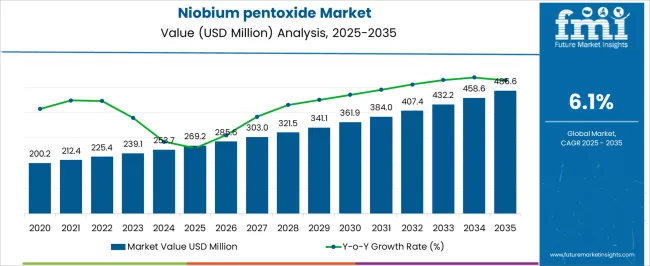

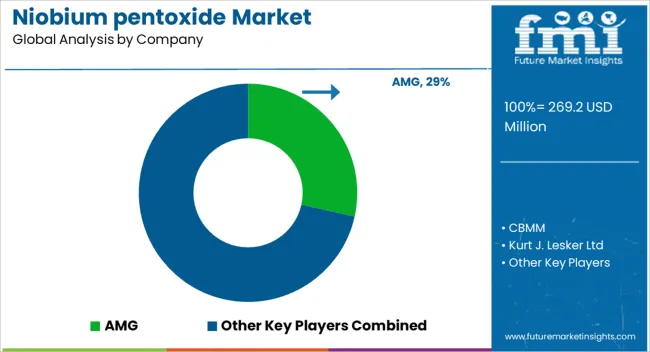

The niobium pentoxide market is estimated to be valued at USD 269.2 million in 2025. It is projected to reach USD 486.6 million by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. Between 2025 and 2030, the market is expected to increase steadily, from USD 269.2 million to USD 361.9 million. This growth is driven by the increasing demand for niobium pentoxide in various high-tech industries, particularly in the production of superalloys, electronics, and energy storage systems.

As the global need for advanced materials in aerospace, electronics, and automotive applications continues to rise, the market for niobium pentoxide is expected to grow at a steady pace, reflecting the increasing reliance on this material for performance-enhancing applications. The demand for niobium pentoxide is further supported by advancements in material science and the expanding use of niobium-based superalloys in the aerospace and defense industries. By 2030, the market is forecast to reach USD 361.9 million, advancing from USD 285.6 million in 2026 and USD 303.0 million in 2027, as niobium pentoxide is increasingly used to produce alloys with superior strength, durability, and resistance to heat.

Additionally, the rise of renewable energy technologies, particularly in energy storage systems and electric vehicles, will create additional opportunities for niobium pentoxide due to its use in enhancing the performance of lithium-ion batteries and fuel cells. These factors position niobium pentoxide as a key material for industries focused on high-performance, energy-efficient solutions.

| Metric | Value |

|---|---|

| Niobium pentoxide Market Estimated Value in (2025 E) | USD 269.2 million |

| Niobium pentoxide Market Forecast Value in (2035 F) | USD 486.6 million |

| Forecast CAGR (2025 to 2035) | 6.1% |

The niobium pentoxide market is experiencing notable growth due to increasing demand in advanced materials, electronics, and green energy sectors. Rising investments in solid acid catalysts, high-performance capacitors, and specialty glass are driving the consumption of high-purity niobium pentoxide across industrial applications.

The compound’s ability to enhance dielectric properties and corrosion resistance makes it highly desirable in both emerging technologies and traditional manufacturing processes. Global shifts toward renewable energy and emission reduction have also accelerated its use in catalysts and battery components.

As the industrial sector seeks high temperature stability and enhanced reactivity in specialty materials, the role of niobium pentoxide is becoming increasingly strategic. The market outlook remains strong, with growing R&D spending and material innovation shaping its adoption trajectory in high-growth sectors worldwide.

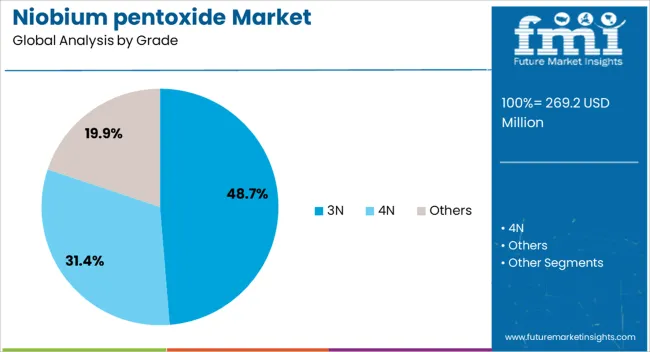

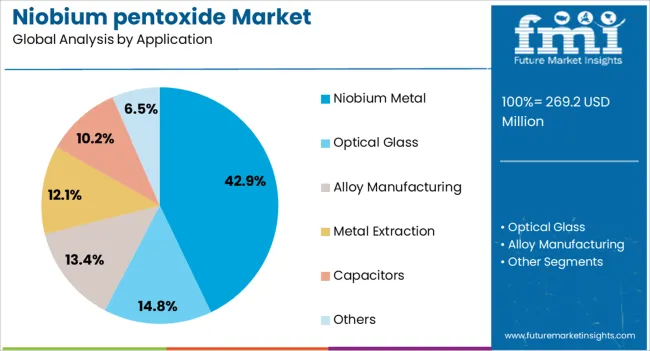

The niobium pentoxide market is segmented by grade, application, end-use industry, and geographic regions. By grade, the niobium pentoxide market is divided into 3N, 4N, and Others. In terms of application, the niobium pentoxide market is classified into Niobium Metal, Optical Glass, Alloy Manufacturing, Metal Extraction, Capacitors, and Others.

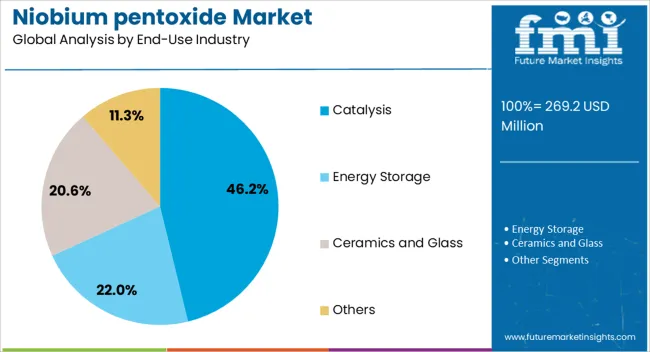

Based on end-use industry, the niobium pentoxide market is segmented into Catalysis, Energy Storage, Ceramics and Glass, and Others. Regionally, the niobium pentoxide industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 3N grade segment is projected to contribute 48.70% of the total market revenue by 2025 within the grade category, establishing it as the leading segment. This dominance is attributed to the high purity requirements across electronic and optical applications, where even trace contaminants can impact performance.

The 3N grade is widely utilized in the manufacturing of capacitors, lithium-ion batteries, and other advanced components that demand consistent chemical and thermal stability. Its use is further supported by the expanding semiconductor industry and innovations in energy storage where purity directly affects efficiency and product lifespan.

The reliability and versatility of 3N grade material have secured its widespread adoption, making it the preferred standard for critical high performance applications.

The niobium metal application segment is expected to hold 42.90% of the overall market revenue by 2025, positioning it as the most significant application category. This is primarily due to the growing demand for niobium alloys in aerospace, superconductors, and medical imaging technologies.

Niobium pentoxide is a critical precursor in the production of high-strength, low-alloy steels and superconducting materials, which are essential for infrastructure, energy, and defense applications. The continued evolution of lightweight and high-strength materials has intensified the use of niobium metal, boosting upstream demand for niobium pentoxide.

The stability and performance enhancements delivered by niobium in demanding environments have reinforced its role in modern metallurgical innovations, sustaining its lead in the application category.

The catalysis segment is projected to represent 46.20% of the total market revenue by 2025 within the end use industry category, making it the dominant segment. The increasing need for efficient and sustainable catalytic processes in chemical manufacturing, petroleum refining, and environmental technologies drives this growth.

Niobium pentoxide is extensively used as a solid acid catalyst due to its thermal stability, surface acidity, and tunable reactivity. These characteristics support cleaner reactions and improved yields, aligning with industry-wide goals for greener chemistry and emission control.

The adoption of niobium pentoxide in desulfurization, biomass conversion, and selective oxidation processes has gained momentum, especially as industries seek cost-effective alternatives to traditional rare earth catalysts. The combination of functional performance and sustainability benefits continues to position catalysis as the leading end-use sector in the niobium pentoxide market.

The niobium pentoxide market is driven by the growing demand for niobium in steel and electronics industries. Opportunities in expanding electronics and superconductors sectors, along with emerging trends toward high-purity niobium pentoxide, are shaping the market. However, challenges such as price volatility and limited supply sources remain significant. By 2025, overcoming these obstacles through more diversified sourcing and cost management strategies will be key for sustained market expansion and securing the material’s position in high-end applications.

The niobium pentoxide market is witnessing significant growth due to the increasing demand for niobium in the steel industry. Niobium is widely used as an alloying element in high-strength, low-alloy steels, which are essential in construction, automotive, and aerospace applications. The need for stronger and more durable materials in these industries is driving the demand for niobium pentoxide. By 2025, the market is expected to continue expanding as the steel industry continues to prioritize high-performance alloys for their production.

Opportunities in the niobium pentoxide market are growing with the expanding use of niobium in the electronics and superconductor markets. Niobium pentoxide is a critical component in the production of superconducting materials, which are used in high-performance electronics, medical imaging systems, and energy-efficient applications. As the demand for energy-efficient and high-capacity electronics rises, the use of niobium in advanced applications is expected to increase. By 2025, the market will see substantial growth due to these expanding sectors.

Emerging trends in the niobium pentoxide market include a shift toward high-purity niobium pentoxide for advanced applications. High-purity niobium is becoming increasingly important in industries such as electronics, where the demand for high-quality, efficient materials is rising. As more industries look for innovative ways to improve the performance of their products, the market for high-purity niobium pentoxide is expected to grow. By 2025, demand for high-purity niobium pentoxide will become more pronounced in high-end applications such as superconductors and advanced electronics.

Despite growth, challenges such as price volatility and limited supply sources persist in the niobium pentoxide market. The price of niobium is heavily influenced by factors such as mining conditions and geopolitical issues, which can cause fluctuations in market prices. Additionally, the market is reliant on a small number of suppliers, which can lead to supply chain disruptions. By 2025, addressing these challenges through diversified supply chains and price stabilization strategies will be crucial for ensuring consistent market growth.

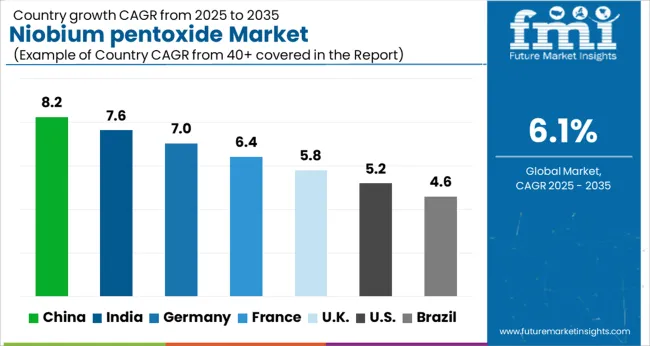

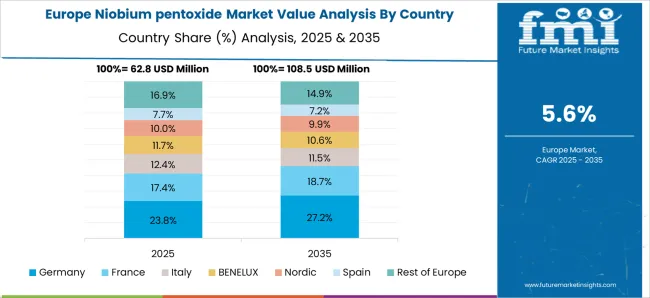

The global niobium pentoxide market is projected to grow at a 6.1% CAGR from 2025 to 2035. China leads with a growth rate of 8.2%, followed by India at 7.6%, and Germany at 7%. The United Kingdom records a growth rate of 5.8%, while the United States shows the slowest growth at 5.2%. These varying growth rates are driven by factors such as increasing demand for niobium pentoxide in high-performance alloys, electronics, and energy storage applications. Emerging markets like China and India are experiencing higher growth due to rapid industrialization, growing infrastructure, and demand for advanced materials, while more mature markets like the USand the UK see steady growth driven by technological advancements and the growing need for energy-efficient solutions and durable alloys in aerospace, automotive, and electronics industries. This report includes insights on 40+ countries; the top markets are shown here for reference.

The niobium pentoxide market in China is growing rapidly, with a projected CAGR of 8.2%. China’s strong industrial base, particularly in sectors like aerospace, automotive, and electronics, is driving significant demand for niobium pentoxide. The country’s rapid urbanization, infrastructure development, and focus on advanced materials for high-performance alloys, batteries, and electronic devices contribute to market growth. China’s increasing investments in the development of energy-efficient solutions, including electric vehicles (EVs) and energy storage technologies, further accelerate the demand for niobium pentoxide. Additionally, government policies supporting industrial growth and material innovation are expected to play a key role in shaping the market landscape.

The niobium pentoxide market in India is projected to grow at a CAGR of 7.6%. India’s rapidly expanding industrial sectors, particularly in aerospace, automotive, and electronics, are fueling the demand for high-performance alloys and materials. The country’s growing investments in infrastructure, combined with increasing demand for energy-efficient materials, further contribute to the market’s growth. India’s increasing focus on sustainable technologies, including electric mobility and energy storage solutions, is driving the adoption of advanced materials like niobium pentoxide. Furthermore, India’s rising demand for consumer electronics and durable materials for manufacturing further accelerates the market’s expansion.

The niobium pentoxide market in Germany is projected to grow at a CAGR of 7%. Germany’s strong demand for high-performance materials in aerospace, automotive, and electronics industries is driving steady growth in the market. The country’s commitment to sustainability, coupled with increasing investments in renewable energy and energy storage solutions, further accelerates the adoption of niobium pentoxide in battery technologies and energy-efficient alloys. Additionally, Germany’s focus on material innovation, technological advancements, and environmental regulations supporting the development of eco-friendly materials are contributing to market expansion.

The niobium pentoxide market in the United Kingdom is projected to grow at a CAGR of 5.8%. The UK’s increasing demand for high-performance alloys in aerospace, automotive, and electronics industries is driving steady demand for niobium pentoxide. The country’s commitment to sustainability, innovation in energy-efficient solutions, and emphasis on green manufacturing practices further accelerate the market’s growth. Additionally, the UK’s efforts to expand its renewable energy infrastructure and promote electric mobility are contributing to the growing demand for niobium pentoxide in energy storage applications and electric vehicle technologies.

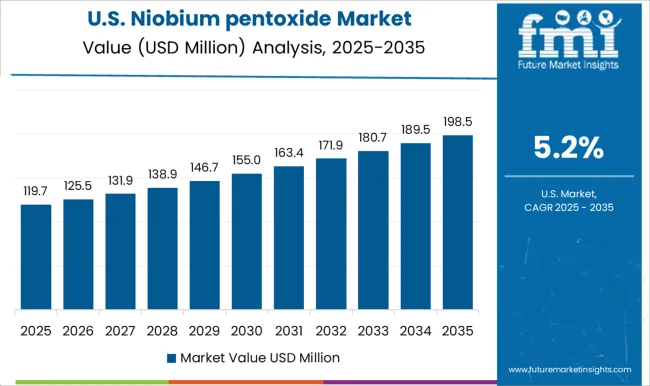

The niobium pentoxide market in the United States is expected to grow at a CAGR of 5.2%. The USA market remains steady, driven by the rising demand for advanced materials in industries like aerospace, automotive, and electronics. The country’s growing focus on energy efficiency, renewable energy technologies, and electric mobility further contributes to the demand for niobium pentoxide. The increasing adoption of niobium-based alloys in battery technologies and energy storage solutions, combined with the USA commitment to reducing carbon emissions and improving sustainability, is expected to accelerate the market growth in the coming years.

The niobium pentoxide market is led by AMG Critical Materials, recognized for its advanced production capabilities and strong supply chain integration. The company maintains a dominant position through its high-quality niobium products used across electronics, aerospace, and energy storage. CBMM also plays a central role, leveraging its position as the world’s largest niobium producer to strengthen the availability of niobium pentoxide for global industries. Merck and Kurt J. Lesker Ltd remain established suppliers, focusing on research-grade and specialty niobium compounds critical for high-performance alloys, superconductors, and thin-film applications.

Emerging participants such as F&X Electro-Materials Limited, Hebei Suoyi Chemicals Co. Ltd, and Taki Chemical Co., Ltd are expanding their footprint by tailoring niobium pentoxide for niche uses including semiconductors, glass coatings, and renewable energy technologies. Their strategies center on enhancing purity levels, refining processing techniques, and developing application-specific grades. Competition is increasingly shaped by differentiation in material quality, vertical integration in supply chains, and long-term contracts with electronics and aerospace manufacturers.

Market expansion is underpinned by growing demand for high-performance materials in electronics, automotive, and energy systems, with niobium alloys gaining traction in aerospace and defense. Advances in alloy formulation, improvements in crystallization processes, and adoption of environmentally responsible extraction practices are expected to define competitive positioning. Together, these factors reinforce the niobium pentoxide market as a strategically important segment of the broader advanced materials landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 269.2 Million |

| Grade | 3N, 4N, and Others |

| Application | Niobium Metal, Optical Glass, Alloy Manufacturing, Metal Extraction, Capacitors, and Others |

| End-Use Industry | Catalysis, Energy Storage, Ceramics and Glass, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AMG, CBMM, Kurt J. Lesker Ltd, Merck, F&X Electromaterials Limited, Hebei Suoyi Chemicals Co. Ltd, King Tan Tantalum Industries Ltd, MPIL, Taki Chemical Co., Ltd, and XIMEI Resources Holding Limited |

| Additional Attributes | Dollar sales by application type and sector, demand dynamics across electronics, aerospace, and energy storage industries, regional trends in niobium pentoxide adoption, innovation in high-performance materials and alloying technologies, impact of regulatory standards on product safety and environmental impact, and emerging use cases in superconductors and advanced battery systems. |

The global niobium pentoxide market is estimated to be valued at USD 269.2 million in 2025.

The market size for the niobium pentoxide market is projected to reach USD 486.6 million by 2035.

The niobium pentoxide market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in niobium pentoxide market are 3n, 4n and others.

In terms of application, niobium metal segment to command 42.9% share in the niobium pentoxide market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nickel Niobium Market Size and Share Forecast Outlook 2025 to 2035

Tantalum and Niobium Material Market Size and Share Forecast Outlook 2025 to 2035

Tantalum Pentoxide Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA