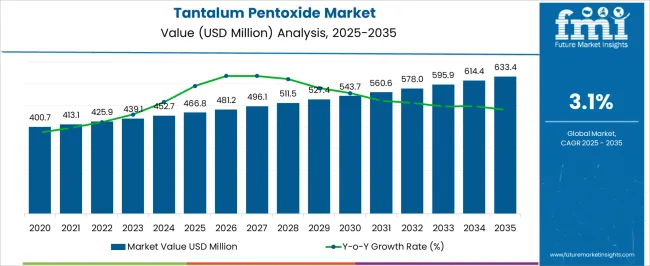

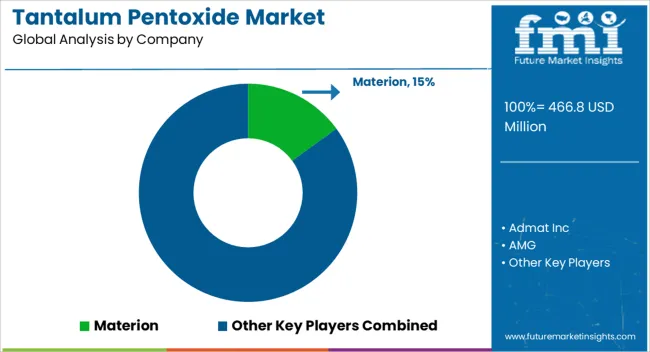

The tantalum pentoxide market is projected to grow from USD 466.8 million in 2025 to USD 633.4 million in 2035, reflecting a CAGR of 3.1%. This represents an absolute dollar opportunity of USD 166.6 million over the decade. The market is expected to expand steadily, reaching USD 481.2 million in 2026, USD 511.5 million in 2029, USD 543.7 million in 2031, and USD 614.4 million in 2034. The consistent growth trajectory underscores rising demand in electronics, capacitors, and specialty materials, providing manufacturers and investors with opportunities to capture incremental revenue and strengthen their market position throughout the forecast period.

From an absolute dollar perspective, annual incremental growth begins at around USD 13–14 million in the early years and rises to approximately USD 19–20 million in the later stages, culminating in USD 166.6 million by 2035. Intermediate values, such as USD 452.7 million in 2025, USD 527.4 million in 2030, and USD 595.9 million in 2033, illustrate steady expansion and predictable growth phases.

| Metric | Value |

|---|---|

| Tantalum Pentoxide Market Estimated Value in (2025 E) | USD 466.8 million |

| Tantalum Pentoxide Market Forecast Value in (2035 F) | USD 633.4 million |

| Forecast CAGR (2025 to 2035) | 3.1% |

Between 2025 and 2027, the market rises from USD 466.8 million to USD 481.2 million, marking the early growth phase where moderate adoption and steady demand drive incremental revenue. Another important breakpoint occurs around 2029–2031, as the market expands from USD 511.5 million to USD 543.7 million, reflecting a period of faster expansion and higher absolute dollar growth. These stages are critical for manufacturers and investors to align production, secure supply chains, and capture revenue during periods of rising market demand.

A major breakpoint is observed between 2033 and 2035, when the market increases from USD 614.4 million to USD 633.4 million, representing the largest absolute dollar growth in the later stage of the decade. Intermediate years, such as 2030–2032, show steady expansion from USD 527.4 million to USD 595.9 million, acting as bridging periods that sustain momentum.

The demand is strongly influenced by the continuous growth of the electronics industry, particularly in capacitors, thin-film coatings, and high-refractive-index glass manufacturing. Increasing application of tantalum pentoxide in miniaturized and high-performance electronics is supporting market growth.

Furthermore, advancements in consumer electronics, automotive electronics, and telecommunications infrastructure are creating new avenues for the material’s utilization. Investments in semiconductor manufacturing and the push towards higher efficiency and durability in electronic devices are expected to maintain positive momentum in the market.

The rising need for reliable dielectric materials in capacitors and the growing adoption of tantalum pentoxide in emerging applications such as photovoltaic cells further contribute to market expansion. The market outlook remains favorable due to the material’s unique chemical and physical properties that cater to the evolving needs of the electronics sector.

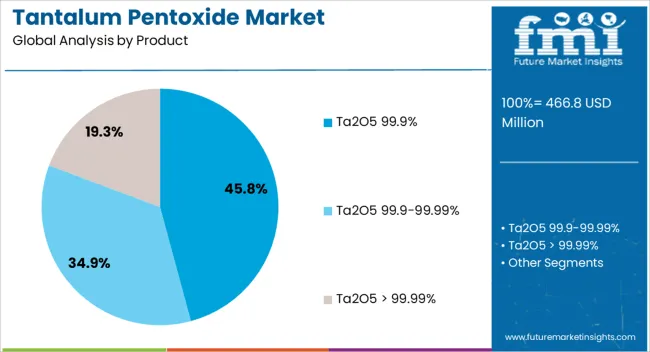

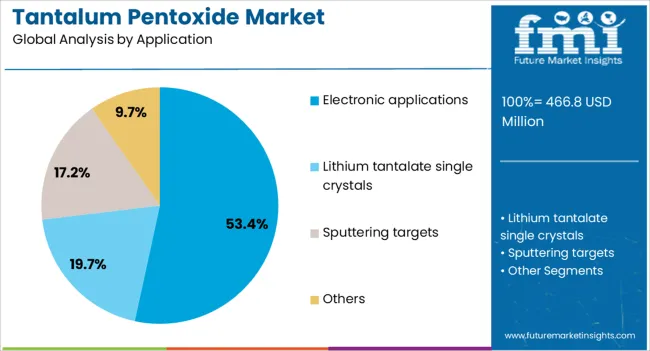

The tantalum pentoxide market is segmented by product, application, and geographic regions. By product, tantalum pentoxide market is divided into Ta2O5 99.9%, Ta2O5 99.9-99.99%, and Ta2O5 > 99.99%. In terms of application, tantalum pentoxide market is classified into Electronic applications, Lithium tantalate single crystals, Sputtering targets, and Others. Regionally, the tantalum pentoxide industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The product segment comprising Ta2O5 99.9% is projected to hold 45.8% of the Tantalum Pentoxide market revenue share in 2025, marking it as the dominant product category. This prevalence is due to the high purity of this grade, which ensures the superior electrical and optical performance required in sensitive electronic applications.

The purity level allows for enhanced dielectric properties, making it highly suitable for use in multilayer ceramic capacitors and thin-film coatings. The segment’s growth has been supported by increasing demand from electronics manufacturers prioritizing quality and reliability.

Additionally, the consistent supply and established processing techniques for Ta2O5 99.9% reinforce its market position. The capacity of this product grade to meet stringent industry standards while enabling miniaturization and efficiency improvements in electronic components continues to underpin its leadership in the market.

The electronic applications segment is expected to account for 53.4% of the total revenue share of the Tantalum Pentoxide market in 2025, positioning it as the leading application area. This dominance is attributed to the widespread use of tantalum pentoxide in the production of capacitors and other critical electronic components.

The material’s excellent dielectric constant, thermal stability, and corrosion resistance make it indispensable for high-performance electronic devices. Growth in consumer electronics, telecommunications, automotive electronics, and industrial electronics has driven demand within this segment.

Furthermore, the increasing trend toward compact and energy-efficient devices has reinforced the need for tantalum pentoxide in electronic applications. The segment’s expansion is further supported by the ongoing development of next-generation electronics and the integration of tantalum pentoxide in emerging technologies, ensuring its continued prominence in the market.

The tantalum pentoxide market is expanding as demand for high-performance electronic components and optical applications increases. Tantalum pentoxide (Ta₂O₅) is widely used in capacitors, thin-film coatings, and optical materials due to its high dielectric constant, thermal stability, and chemical resistance. Growing adoption in consumer electronics, automotive electronics, aerospace components, and energy storage systems supports market growth.

Manufacturers offering high-purity, fine-particle, and nano-structured tantalum pentoxide gain a competitive advantage. Technological trends include integration into multilayer ceramic capacitors (MLCCs), high-performance capacitors for electric vehicles, and anti-reflective or high-index optical coatings. Rising investments in 5G, IoT, and next-generation electronic devices further enhance the role of tantalum pentoxide as a critical material in high-performance and miniaturized electronic systems.

Market growth is restrained by high raw material costs and limited tantalum availability. Tantalum ores are concentrated in a few regions, and extraction involves complex, energy-intensive processes. Price volatility, ethical sourcing concerns, and geopolitical risks further impact supply reliability. Manufacturing tantalum pentoxide with high purity and controlled particle size adds operational costs.

Regulatory compliance regarding conflict minerals and environmental guidelines also increases complexity and cost. These factors make it challenging for small- and medium-scale manufacturers to adopt tantalum pentoxide extensively. Until supply chains are diversified and cost-effective production methods are implemented, the market may remain concentrated among high-end electronics, aerospace, and industrial applications where performance benefits justify higher costs.

Technological advancements are shaping trends in the tantalum pentoxide market. Innovations include nano-structured tantalum pentoxide powders, high-purity formulations, and improved thin-film deposition techniques for capacitors, optical coatings, and dielectric layers. Integration into multilayer ceramic capacitors (MLCCs) and energy-efficient electronic devices enhances miniaturization and performance. In optical applications, tantalum pentoxide is used in high-index coatings for lenses, mirrors, and anti-reflective surfaces. Emerging uses in lithium-ion batteries, photonics, and high-frequency electronic devices expand its applicability. These trends highlight the growing importance of material science, precision manufacturing, and innovative processing techniques in expanding tantalum pentoxide’s role across high-performance electronics, optics, and energy storage industries.

Opportunities in the tantalum pentoxide market are driven by increasing adoption of consumer electronics, electric vehicles, and renewable energy storage systems. The proliferation of smartphones, wearables, and IoT devices creates demand for miniaturized, high-performance capacitors using tantalum pentoxide. Electric vehicles and hybrid cars require reliable, high-capacitance components for power management, boosting material demand. Expanding solar, energy storage, and aerospace applications further enhance market potential. Manufacturers providing high-purity, scalable, and customizable tantalum pentoxide products can capture market share. Additionally, collaborations with capacitor, optical, and battery manufacturers create opportunities for tailored formulations and innovative applications in high-performance electronic and energy systems.

Market growth is restrained by intense competition, regulatory challenges, and environmental concerns. Global and regional suppliers compete on purity, particle size, and cost, pressuring margins. Strict regulations regarding conflict minerals, ethical sourcing, and environmental impact impose operational and reporting requirements on manufacturers. Handling tantalum ores and processing chemicals safely is critical to avoid environmental contamination. Additionally, recycling and end-of-life disposal of tantalum-containing components pose challenges. Until companies ensure sustainable sourcing, regulatory alignment, and environmentally responsible manufacturing, market adoption may remain concentrated in high-value applications such as aerospace, electronics, and advanced energy storage, where performance outweighs cost and complexity.

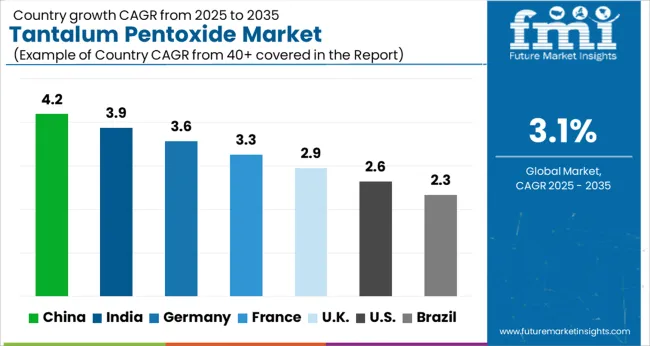

| Country | CAGR |

|---|---|

| China | 4.2% |

| India | 3.9% |

| Germany | 3.6% |

| France | 3.3% |

| UK | 2.9% |

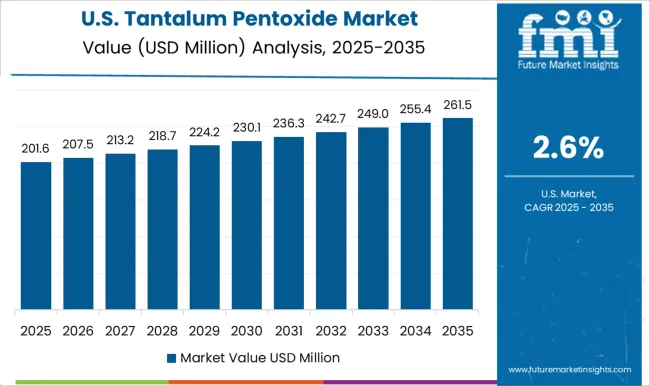

| USA | 2.6% |

| Brazil | 2.3% |

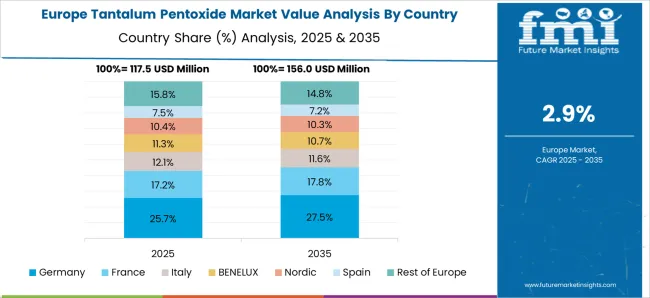

The global tantalum pentoxide market was projected to grow at a 3.1% CAGR through 2035, driven by demand in electronics, ceramics, and capacitor manufacturing applications. Among BRICS nations, China recorded 4.2% growth as large-scale production and processing facilities were commissioned and compliance with industrial and material quality standards was enforced, while India at 3.9% growth saw expansion of manufacturing units to meet rising regional demand. In the OECD region, Germany at 3.6% maintained substantial output under strict industrial and safety regulations, while the United Kingdom at 2.9% relied on moderate-scale operations for electronic and industrial applications. The USA, expanding at 2.6%, remained a mature market with steady demand across electronics, ceramics, and capacitor segments, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The tantalum pentoxide market in China is growing at a CAGR of 4.2% due to rising demand from electronic components, capacitors, and optical devices. Manufacturers are using tantalum pentoxide for high performance capacitors, dielectric applications, and advanced optical coatings due to its high dielectric constant and stability. Growth is supported by expanding electronics manufacturing, increasing industrial applications, and rising adoption of miniaturized electronic devices. Suppliers provide high purity tantalum pentoxide powders and processed materials suitable for industrial and electronic applications. Distribution through chemical suppliers, electronics manufacturers, and online platforms ensures accessibility. Adoption is further driven by demand for reliable, efficient, and high quality dielectric materials in capacitors and optical components. China remains a leading market due to large electronics production, industrial investment, and growing demand for advanced materials in consumer electronics and industrial sectors.

India is witnessing growth at a CAGR of 3.9% in the tantalum pentoxide market due to rising demand for electronic components, capacitors, and optical coatings. Manufacturers adopt tantalum pentoxide for high dielectric constant applications, optical films, and miniaturized electronic devices. Growth is supported by expanding electronics production, industrial modernization, and increasing industrial applications. Suppliers provide processed tantalum pentoxide powders and high purity materials to meet industrial and electronic requirements. Distribution through chemical suppliers, electronics manufacturers, and industrial distributors ensures availability across manufacturing hubs. Adoption is further driven by the need for high quality and reliable dielectric materials in capacitors and advanced electronics. India’s electronics and industrial sectors make it a key market for tantalum pentoxide, supported by growing domestic production capabilities and investment in high performance materials.

Germany is growing at a CAGR of 3.6% in the tantalum pentoxide market due to demand from electronic, capacitor, and optical device manufacturers. Tantalum pentoxide is used for high performance capacitors, optical coatings, and dielectric applications. Suppliers provide high purity powders and processed materials with stable properties suitable for industrial and electronics production. Growth is supported by advanced electronics manufacturing, precision engineering, and adoption of high quality materials. Distribution through chemical suppliers, industrial distributors, and electronics manufacturers ensures product availability for domestic and export markets. Adoption is further driven by the need for reliable, efficient, and high performance materials in electronic and optical applications. Germany’s focus on precision engineering, electronics manufacturing, and industrial quality standards makes it a key market for tantalum pentoxide in Europe.

The United Kingdom market is expanding at a CAGR of 2.9% due to rising adoption of tantalum pentoxide in electronics, capacitors, and optical devices. Manufacturers use it for high dielectric constant applications, optical coatings, and miniaturized electronics. Suppliers provide high purity and processed powders to meet industrial and electronics manufacturing requirements. Growth is supported by electronics production, industrial modernization, and demand for reliable materials in advanced applications. Distribution through chemical suppliers, industrial partners, and electronics manufacturers ensures availability across manufacturing sectors. Adoption is further driven by the need for efficient, high quality, and stable materials for capacitors and optical components. The United Kingdom continues to see moderate growth due to its electronics and industrial applications requiring high performance materials.

The United States market is growing at a CAGR of 2.6% due to increasing use of tantalum pentoxide in electronic components, capacitors, and optical devices. Manufacturers adopt it for high dielectric constant applications, optical coatings, and miniaturized electronic devices. Suppliers provide high purity and processed powders suitable for electronics and industrial applications. Growth is supported by advanced electronics production, industrial modernization, and demand for reliable and high quality dielectric materials. Distribution through chemical suppliers, electronics manufacturers, and industrial distributors ensures accessibility across production regions. Adoption is further driven by the need for efficient, stable, and high performance materials for capacitors, optical components, and electronic applications. The United States continues to see steady demand as electronics and industrial sectors increasingly require high quality tantalum pentoxide.

The tantalum pentoxide market is primarily supplied by Materion, Admat Inc, AMG, F&X Electro-Materials, Jiujiang Tanbre, KING-TAN Tantalum, Lorad Chemical Corporation, Mitsui Kinzoku, MPIL, and Nanoshel. Product materials are presented with high purity grades suitable for electronics, capacitors, optical coatings, and ceramic applications. Brochures detail chemical composition, particle size distribution, melting point, and dielectric properties. Handling, storage guidelines, and safety measures are also emphasized to maintain material integrity and regulatory compliance. Competition is largely defined by purity levels, particle uniformity, and supply reliability. Materion and Mitsui Kinzoku focus on ultra-high purity powders for electronic capacitors and thin-film applications.

AMG and Admat are observed to emphasize custom particle sizes and morphologies for specialty ceramic and optical coatings (observed industry pattern). KING-TAN and F&X Electro-Materials target cost-effective bulk production, while Lorad Chemical and Nanoshel offer tailored nanostructured powders for advanced functional materials. Supply chain partnerships and long-term contracts with capacitor manufacturers influence market share and positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 466.8 Million |

| Product | Ta2O5 99.9%, Ta2O5 99.9-99.99%, and Ta2O5 > 99.99% |

| Application | Electronic applications, Lithium tantalate single crystals, Sputtering targets, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Materion, Admat Inc, AMG, F&X Electro-Materials, Jiujiang Tanbre, KING-TAN Tantalum, Lorad Chemical Corporation, Mitsui Kinzoku, MPIL, and Nanoshel |

| Additional Attributes | Dollar sales vary by connector type, including board-to-board, wire-to-board, and coaxial connectors; by application, such as consumer electronics, automotive, industrial equipment, and telecommunications; by end-use industry, spanning electronics manufacturing, automotive, and industrial automation; by region, led by Asia-Pacific, North America, and Europe. Growth is driven by rising electronics production, miniaturization, and demand for reliable interconnect solutions. |

The global tantalum pentoxide market is estimated to be valued at USD 466.8 million in 2025.

The market size for the tantalum pentoxide market is projected to reach USD 633.4 million by 2035.

The tantalum pentoxide market is expected to grow at a 3.1% CAGR between 2025 and 2035.

The key product types in tantalum pentoxide market are ta2o5 99.9%, ta2o5 99.9-99.99% and ta2o5 > 99.99%.

In terms of application, electronic applications segment to command 53.4% share in the tantalum pentoxide market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tantalum and Niobium Material Market Size and Share Forecast Outlook 2025 to 2035

Tantalum Carbide Market Size and Share Forecast Outlook 2025 to 2035

Tantalum Market

Niobium pentoxide Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA