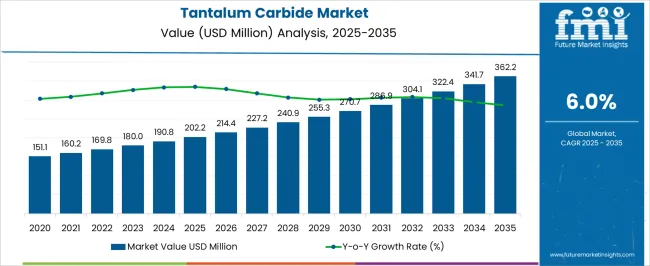

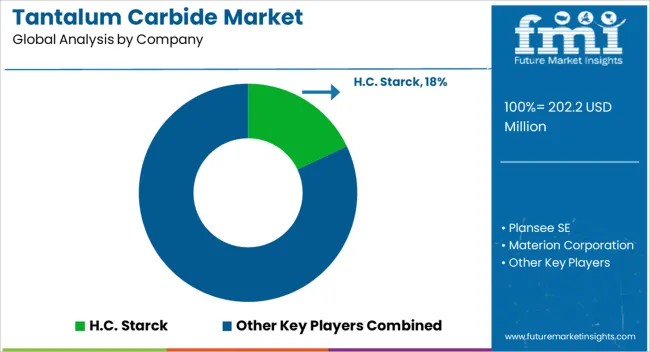

The tantalum carbide market is estimated to be valued at USD 202.2 million in 2025 and is projected to reach USD 362.2 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

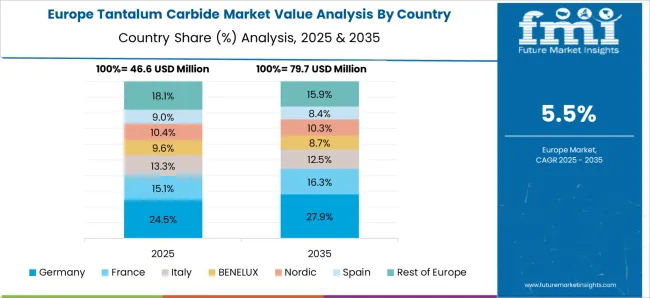

Asia-Pacific is expected to dominate growth due to the concentration of manufacturing hubs and expanding applications in cutting tools, electronics, and chemical processing equipment. The region benefits from lower production costs, proximity to raw material sources, and supportive government initiatives promoting advanced materials, which accelerates adoption across automotive, aerospace, and heavy machinery sectors. Europe shows moderate growth, constrained by stringent environmental and workplace regulations that influence production processes and material handling. While Europe maintains high technological standards and advanced manufacturing capabilities, the higher operational costs and regulatory compliance requirements temper overall market expansion.

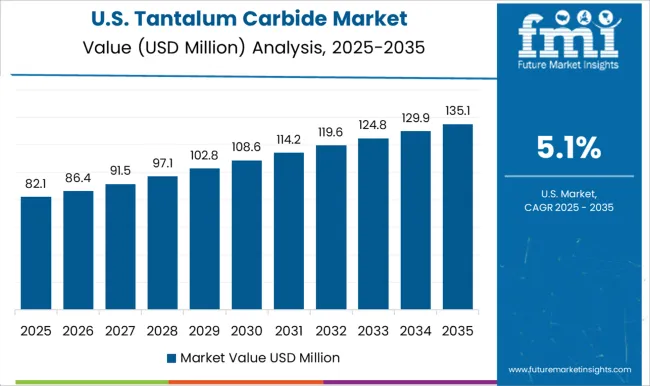

North America demonstrates steady growth but at a relatively slower pace, as demand is influenced by established industrial players with gradual modernization of manufacturing units and incremental adoption of tantalum carbide components in aerospace and defense applications. These regional imbalances also reflect differences in investment trends, supply chain efficiencies, and R&D focus areas. Asia-Pacific’s rapid expansion is reinforced by high-capacity production facilities and localized supply chains, whereas Europe and North America prioritize precision, quality, and compliance. Consequently, Asia-Pacific is poised to capture a larger market share over the forecast period, with Europe and North America maintaining strategic, niche positions in high-value applications.

| Metric | Value |

|---|---|

| Tantalum Carbide Market Estimated Value in (2025 E) | USD 202.2 million |

| Tantalum Carbide Market Forecast Value in (2035 F) | USD 362.2 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The tantalum carbide market is regarded as a high performance niche segment within advanced materials and industrial applications. It is estimated to hold 3.2% of the refractory materials market, driven by its extremely high melting point and hardness. Within advanced ceramics, a 2.7% share is observed, reflecting use in high temperature structural components. Metal cutting and tooling applications account for 4.1%, supported by carbide tipped tools, dies, and inserts. Aerospace and defense materials contribute 1.8%, where high temperature and corrosion resistant properties are critical. Wear resistant coatings and composites hold 2.5%, highlighting its role in extending component life in industrial machinery. Recent industry trends are influenced by the development of ultra-high temperature ceramics, powder metallurgy innovations, and composite carbide materials.

Groundbreaking advancements include nano structured tantalum carbide for improved toughness, hybrid carbide composites combining tantalum and hafnium carbides, and additive manufacturing for complex shapes. Key players are forming partnerships with aerospace and defense companies to optimize material performance for hypersonic and rocket engine applications. Strategic initiatives include scaling production through optimized sintering processes, reducing impurities for performance consistency, and expanding research in coating technologies. These developments are positioning tantalum carbide as a critical material for extreme environment applications across multiple industries.

The market is experiencing sustained expansion, driven by its exceptional hardness, high melting point, and superior thermal conductivity, which have made it a critical material in high-performance applications. Industries such as aerospace, electronics, defense, and advanced manufacturing are increasingly integrating tantalum carbide into tools, coatings, and structural components that require extreme durability under harsh operating conditions.

Technological advancements in powder metallurgy and ceramic composites are enabling the production of higher purity and more uniform grades, thereby enhancing performance characteristics. Rising investment in additive manufacturing and precision machining has also supported wider adoption, as tantalum carbide offers compatibility with modern manufacturing techniques.

Demand is further strengthened by its use in cutting tools and wear-resistant components, where material performance directly impacts operational efficiency The market outlook remains positive, with increased focus on lightweight yet strong materials, sustained research into high-temperature ceramics, and the strategic expansion of production capacity to meet the requirements of advanced engineering sectors worldwide.

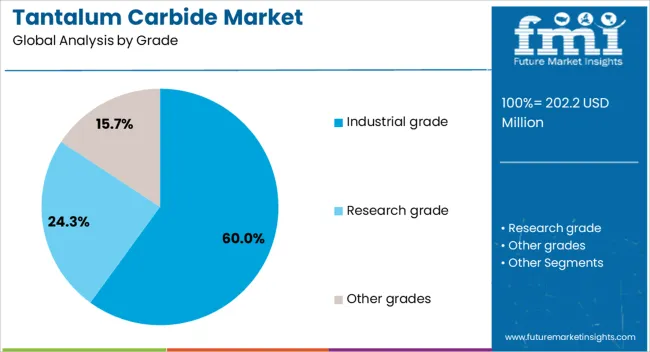

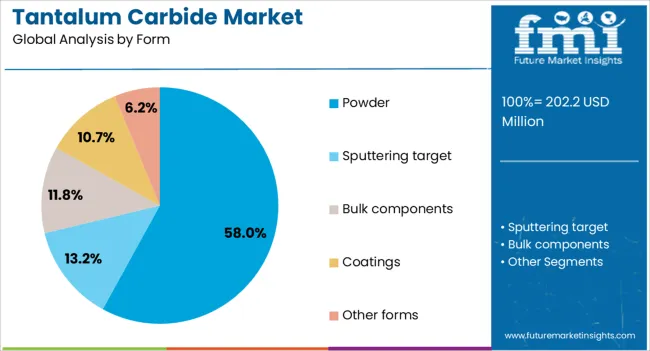

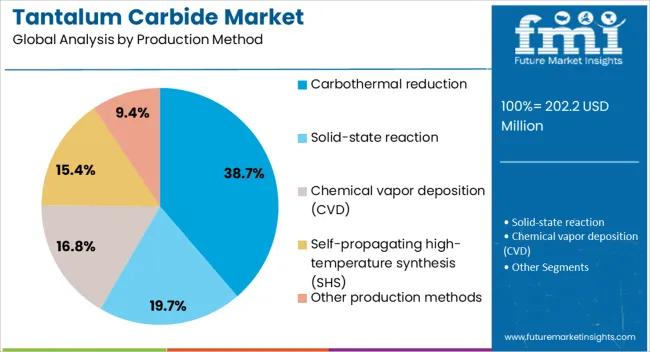

The tantalum carbide market is segmented by grade, form, production method, application, end use industry, and geographic regions. By grade, tantalum carbide market is divided into industrial grade, research grade, and other grades. In terms of form, tantalum carbide market is classified into powder, sputtering target, bulk components, coatings, and other forms. Based on production method, tantalum carbide market is segmented into carbothermal reduction, solid-state reaction, chemical vapor deposition (CVD), self-propagating high-temperature synthesis (SHS), and other production methods. By application, tantalum carbide market is segmented into cutting tools & wear-resistant components, high-temperature components, cemented carbides, electronics & semiconductor, coatings, chemical processing equipment, and other applications. By end use industry, tantalum carbide market is segmented into metal processing & metalworking, aerospace & defense, mining & construction, electronics & semiconductor, chemical & petrochemical, energy & power generation, research & academia, and other end-use industries. Regionally, the tantalum carbide industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The industrial grade segment is projected to hold 60% of the tantalum carbide market revenue share in 2025, making it the leading grade category. Growth in this segment has been supported by the extensive use of industrial grade tantalum carbide in manufacturing cutting tools, wear parts, and protective coatings. Its cost-effectiveness compared to higher purity grades has positioned it as the preferred choice for large-scale industrial applications where extreme hardness and high-temperature resistance are essential. Industrial grade material has been widely adopted in sectors such as metalworking, mining, and heavy machinery production due to its ability to enhance equipment lifespan and maintain performance under abrasive conditions. The versatility of industrial grade tantalum carbide, combined with its compatibility with existing manufacturing processes, has also facilitated its broader integration Continuous improvements in refining and processing techniques have ensured consistent quality and reliability, enabling this segment to maintain its dominant position in the market.

The powder form segment is anticipated to command 58% of the market revenue share in 2025, making it the most prominent form type. This dominance has been driven by the suitability of powder form for advanced manufacturing methods such as powder metallurgy, additive manufacturing, and coating applications. Powdered tantalum carbide offers greater flexibility in shaping, blending, and sintering processes, allowing for the production of complex geometries and customized components. The fine particle size and controlled distribution enhance densification and mechanical performance in the final product. Industries requiring precision and high performance, including aerospace and electronics, have increasingly relied on powder form to meet stringent material specifications. Moreover, the powder form facilitates uniform dispersion in composite materials, improving wear resistance and thermal stability The combination of processing versatility and compatibility with cutting-edge fabrication techniques has firmly established the powder form as the preferred choice for high-value industrial applications.

The carbothermal reduction segment is expected to account for 38.70% of the market revenue share in 2025, making it the leading production method. Its growth has been supported by the method’s cost efficiency and scalability in producing high-quality tantalum carbide on an industrial scale. This process enables the use of readily available raw materials, such as tantalum pentoxide and carbon sources, under controlled high-temperature conditions to achieve consistent composition and performance. The method’s adaptability to various furnace technologies and its ability to produce material with excellent hardness and purity have made it widely adopted in both traditional and emerging applications. Carbothermal reduction also allows for better control over particle size and morphology, which is critical in powder processing and advanced manufacturing As industries continue to seek cost-effective yet high-performance materials, the established reliability and production efficiency of carbothermal reduction have ensured its continued leadership in the market.

The market has grown steadily due to its critical applications in aerospace, tooling, cutting, and refractory industries. Tantalum carbide is valued for its exceptional hardness, high melting point, corrosion resistance, and chemical stability, making it suitable for extreme operational environments. Demand has been driven by the need for wear resistant coatings, high temperature components, and precision cutting tools in manufacturing sectors. The market has been reinforced by investments in advanced material research, growing adoption in automotive and industrial tooling, and rising production in regions with abundant tantalum and carbide processing capabilities.

Tantalum carbide has been widely deployed in industries requiring extreme durability under high temperature and abrasive conditions. Its high melting point, thermal conductivity, and hardness allow components such as cutting tools, nozzles, dies, and refractory inserts to maintain structural integrity in harsh environments. The material’s chemical inertness ensures resistance against oxidation and corrosion during metallurgical, chemical, and aerospace applications. Tungsten carbide composites often incorporate tantalum carbide to improve hardness and toughness. These attributes make tantalum carbide ideal for applications where conventional metals or ceramics fail, reinforcing its adoption in precision machining, metal cutting, and high temperature processing equipment.

The aerospace and defense industries have been significant consumers of tantalum carbide due to its ability to withstand extreme thermal and mechanical stress. Components such as turbine blades, rocket nozzles, and heat shields incorporate tantalum carbide to maintain performance at high altitudes and during high velocity operations. Military applications have included armor piercing projectiles, refractory components, and high wear resistance parts. Material selection has been driven by performance under dynamic stress, weight considerations, and reliability in critical operations. Expansion of commercial and military aerospace fleets has fueled ongoing demand for tantalum carbide components designed to meet rigorous safety and performance standards.

Industrial and precision tooling sectors have relied on tantalum carbide for cutting, drilling, milling, and forming operations. Its hardness and wear resistance have extended tool life and reduced downtime, increasing operational efficiency. Composite carbides incorporating tantalum carbide have been applied to metalworking, mining, and ceramics processing, where abrasive resistance and thermal stability are critical. Custom grades and particle sizes have been developed to optimize performance for specific manufacturing processes. Demand for high precision tools in automotive, electronics, and industrial machinery manufacturing has further reinforced the importance of tantalum carbide in maintaining productivity and reducing replacement costs.

Advances in powder metallurgy, sintering, and coating technologies have improved the quality, consistency, and performance of tantalum carbide products. High purity powders, nano composites, and advanced coatings have been developed to enhance hardness, fracture toughness, and oxidation resistance. Research in hybrid carbide blends and additive manufacturing techniques has expanded design flexibility and application potential. Process optimizations have reduced production costs, enhanced density, and minimized defects, making tantalum carbide components more accessible for diverse industrial applications. These innovations have allowed manufacturers to cater to evolving aerospace, tooling, and chemical processing demands while maintaining reliability, performance, and operational safety in extreme conditions.

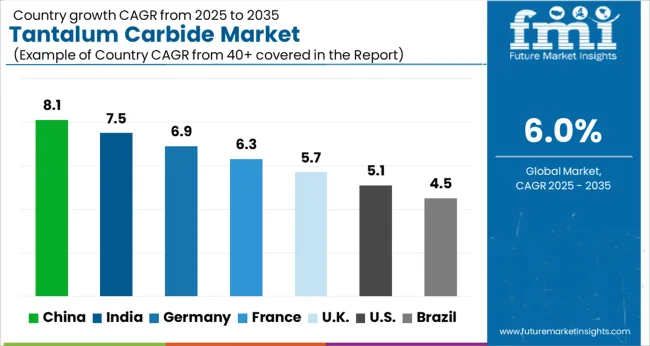

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

China led the market with a forecast CAGR of 8.1%, supported by extensive industrial applications in aerospace, cutting tools, and electronics. India followed at 7.5%, driven by growing adoption in high-performance manufacturing and expanding domestic production capacities. Germany recorded 6.9%, leveraging advanced material processing technologies and strong R&D in carbide applications. The United Kingdom grew at 5.7%, supported by innovation in specialized industrial components. The United States registered 5.1%, where steady demand in tooling and aerospace sectors sustained market growth. Together, these countries represent a diverse landscape of production, technological advancement, and market expansion in tantalum carbide. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expected to expand at a CAGR of 8.1% in the market, driven by rising demand from aerospace, automotive, and tool manufacturing industries. The material’s superior hardness, thermal stability, and chemical resistance make it ideal for cutting, drilling, and coating applications. Industrial growth and increasing investments in precision manufacturing are contributing to higher consumption. Research and development activities by local manufacturers aim to improve material performance and cost-efficiency. Growing adoption in advanced tooling and electronics sectors further supports market expansion. China offers significant growth opportunities for tantalum carbide, fueled by industrial modernization, increasing demand for high-performance materials, and technological advancements in production methods.

India is projected to register a CAGR of 7.5% in the market, supported by growing industrialization and expansion of automotive and aerospace sectors. The material’s high melting point, hardness, and resistance to wear make it preferred for high-performance applications. Domestic manufacturers are introducing tailored carbide grades for cutting and coating tools. Government initiatives promoting industrial modernization and “Make in India” programs encourage adoption of advanced materials. Increasing infrastructure development and investments in manufacturing technologies further contribute to market growth. India presents promising prospects for tantalum carbide consumption, driven by industrial demand, material innovation, and expansion in high-precision applications.

Germany is witnessing a CAGR of 6.9% in the market, influenced by strong automotive, mechanical engineering, and tool manufacturing industries. The material’s wear resistance and chemical stability make it highly suitable for precision tooling, machining, and electronics applications. Manufacturers emphasize quality, reliability, and specialized grades for high-end applications. Adoption is also supported by Germany’s focus on industrial automation and technological innovation. Research collaborations between material suppliers and end-users aim to improve performance and efficiency. Germany provides a stable growth environment for tantalum carbide, driven by industrial expertise, high-quality production standards, and demand from precision manufacturing sectors.

The United Kingdom is growing at a CAGR of 5.7% in the market, supported by demand from precision tooling, aerospace, and electronics industries. The material’s hardness, heat resistance, and durability are critical for high-performance applications. R&D efforts aim to improve efficiency, extend tool life, and optimize production techniques. Industry partnerships and technological advancements enhance market adoption. The UK presents stable growth prospects for tantalum carbide, driven by innovation, industrial requirements, and increasing use in high-performance and specialized applications.

The United States is expanding at a CAGR of 5.1% in the market, influenced by aerospace, defense, and automotive applications. The material’s wear resistance, thermal stability, and versatility make it suitable for cutting tools, coatings, and electronic components. Companies focus on innovations in powder metallurgy, coating technologies, and performance optimization to meet industrial requirements. The US market shows steady growth potential for tantalum carbide, supported by demand for advanced materials, industrial innovation, and high-performance application requirements.

The market is characterized by specialized manufacturers supplying high-performance materials for cutting tools, wear-resistant coatings, and advanced industrial applications. H.C. Starck is a major player, providing high-purity tantalum carbide powders with tailored particle sizes for precision applications in aerospace, electronics, and tooling industries. Plansee SE contributes through its expertise in powder metallurgy, offering advanced carbide solutions that enhance hardness, thermal stability, and chemical resistance for industrial components. Materion Corporation emphasizes consistency and quality, supplying tantalum carbide powders and compounds for both industrial and research applications worldwide.

Stanford Advanced Materials and Inframat Corporation focus on producing custom-grade tantalum carbide materials for research, prototyping, and niche high-tech applications, ensuring flexibility in particle morphology and composition. Toyo Tanso Co., Ltd. and Tokai Carbon Co., Ltd. leverage decades of experience in refractory materials and carbon-based composites to produce tantalum carbide components with high durability and precision. Momentive Technologies and Edgetech Industries LLC provide specialty carbides tailored to specific chemical, thermal, and mechanical requirements. A range of other manufacturers and suppliers support the market by catering to smaller-scale, regional, and customized demands, collectively strengthening the global supply chain for this high-value material.

| Item | Value |

|---|---|

| Quantitative Units | USD 202.2 million |

| Grade | Industrial grade, Research grade, and Other grades |

| Form | Powder, Sputtering target, Bulk components, Coatings, and Other forms |

| Production Method | Carbothermal reduction, Solid-state reaction, Chemical vapor deposition (CVD), Self-propagating high-temperature synthesis (SHS), and Other production methods |

| Application | Cutting tools & wear-resistant components, High-temperature components, Cemented carbides, Electronics & semiconductor, Coatings, Chemical processing equipment, and Other applications |

| End Use Industry | Metal processing & metalworking, Aerospace & defense, Mining & construction, Electronics & semiconductor, Chemical & petrochemical, Energy & power generation, Research & academia, and Other end-use industries |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | H.C. Starck, Plansee SE, Materion Corporation, Stanford Advanced Materials, Inframat Corporation, Toyo Tanso Co., Ltd., Momentive Technologies, Tokai Carbon Co., Ltd., Edgetech Industries LLC, and Other manufacturers / suppliers |

| Additional Attributes | Dollar sales by material grade and application, demand dynamics across aerospace, defense, and industrial tooling sectors, regional trends in advanced ceramic adoption, innovation in hardness, thermal stability, and wear resistance, environmental impact of production and waste management, and emerging use cases in cutting tools, high-temperature components, and protective coatings. |

The global tantalum carbide market is estimated to be valued at USD 202.2 million in 2025.

The market size for the tantalum carbide market is projected to reach USD 362.2 million by 2035.

The tantalum carbide market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in tantalum carbide market are industrial grade, _high-purity grade, _99% purity, _99.5% purity, _99.9% purity, _other high-purity grades, research grade and other grades.

In terms of form, powder segment to command 58.0% share in the tantalum carbide market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tantalum and Niobium Material Market Size and Share Forecast Outlook 2025 to 2035

Tantalum Pentoxide Market Size and Share Forecast Outlook 2025 to 2035

Tantalum Market

Carbide Tools Market Growth - Trends & Forecast 2025 to 2035

Boron Carbide Market Analysis & Trends 2025 to 2035

Silicon Carbide (SiC) Coating Market Size and Share Forecast Outlook 2025 to 2035

Hafnium Carbide Market Size and Share Forecast Outlook 2025 to 2035

Silicon Carbide Market Size and Share Forecast Outlook 2025 to 2035

Tungsten Carbide Market

2D Transition Metal Carbides Nitrides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA