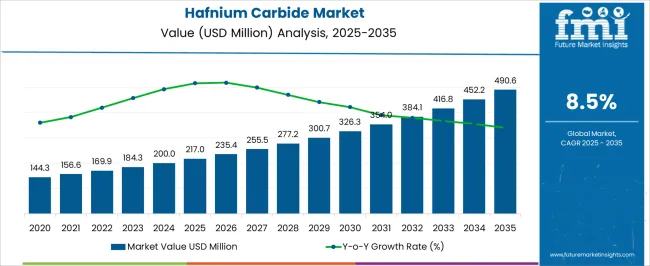

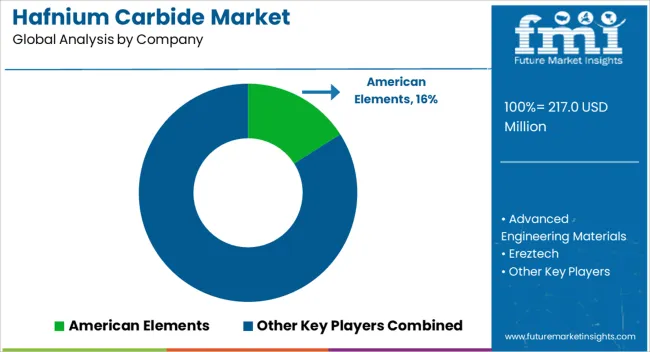

The hafnium carbide market is estimated to be valued at USD 217.0 million in 2025 and is projected to reach USD 490.6 million by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

Hafnium is a rare transition metal, often extracted as a by-product of zirconium refining, which makes raw material availability and purification one of the largest cost components. The integration of hafnium with carbon through high-temperature carbothermal reduction involves energy-intensive processes, driving up production expenditures. Equipment durability, handling of extreme conditions, and compliance with purity standards further increase manufacturing costs. Within the value chain, upstream activities such as mining and separation hold significant influence due to supply scarcity and high concentration of production in limited geographies. Midstream processes include powder synthesis, densification, and composite integration, where innovations in sintering and additive manufacturing are gradually lowering costs.

Downstream, the value is captured through applications in aerospace thermal shielding, nuclear reactors, and high-temperature electronics, sectors that demand ultra-reliable materials and justify premium pricing. The cost-to-value dynamic shows that while production expenses remain high, the strategic importance of hafnium carbide in enabling next-generation aerospace propulsion and nuclear safety creates strong long-term value capture potential. Continuous efficiency improvements in processing will be pivotal in enhancing affordability and sustaining broader adoption across industries.

| Metric | Value |

|---|---|

| Hafnium Carbide Market Estimated Value in (2025 E) | USD 217.0 million |

| Hafnium Carbide Market Forecast Value in (2035 F) | USD 490.6 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

The hafnium carbide market is assessed as a specialized segment within advanced materials, supported by its extreme temperature tolerance and high hardness. It accounts for around 2.4% of advanced ceramics due to its role in thermal protection systems. In aerospace and defense materials, a 1.9% share is calculated, driven by hypersonic vehicle programs and rocket nozzle liners. Within refractory materials, the share is 3.1%, as demand for ultra-high-temperature ceramics strengthens. The electronic components materials sector contributes 1.2%, where hafnium carbide is studied for microelectronics. In high performance coatings, 1.6% is attributed, with applications in surface protection for turbines and reactors.

Recent industry trends show momentum in hypersonic flight research and nuclear technologies, pushing hafnium carbide into experimental thermal shields and coatings. Breakthroughs include additive manufacturing for dense carbide structures, nanostructured composites for crack resistance, and hybrid materials combining hafnium carbide with tantalum carbide for ultra-high stability. Key players are pursuing partnerships with defense agencies, aerospace primes, and research labs to develop scalable fabrication. Strategies involve investment in powder metallurgy, hot pressing, and chemical vapor deposition techniques. The market is shaped by innovation in extreme environment materials, where reliability, manufacturability, and integration into advanced systems are seen as decisive factors.

The market is experiencing significant growth, driven by its exceptional thermal stability, hardness, and high melting point, which make it suitable for extreme environment applications. Demand is being supported by advancements in aerospace and defense technologies, where materials capable of withstanding ultra-high temperatures are increasingly required.

The ability of hafnium carbide to maintain structural integrity under severe thermal and mechanical stress has positioned it as a critical component in next-generation propulsion systems, thermal protection structures, and cutting-edge manufacturing processes. Growing investments in hypersonic aircraft development, space exploration programs, and advanced industrial coatings are expanding its adoption globally.

Innovations in powder processing and high-purity material production are further enhancing performance characteristics, enabling broader usage across high-precision industries With continuous improvements in manufacturing efficiency and increasing availability of high-grade hafnium carbide, the market is poised for sustained growth as industries demand superior performance materials to meet evolving technological challenges.

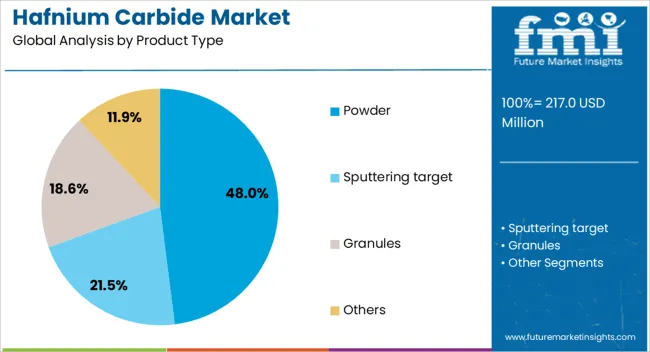

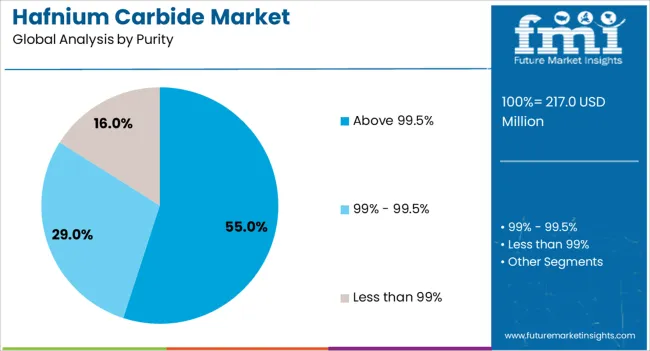

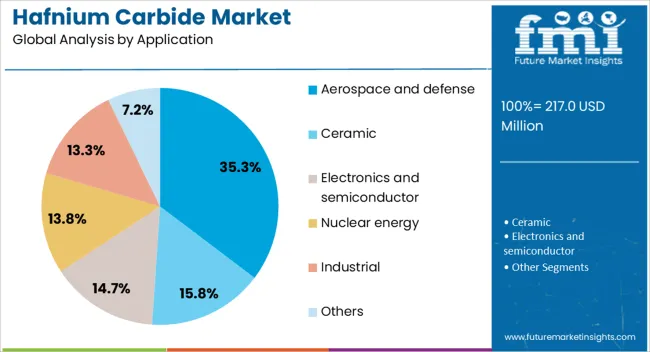

The hafnium carbide market is segmented by product type, purity, application, and geographic regions. By product type, hafnium carbide market is divided into powder, sputtering target, granules, and others. In terms of purity, hafnium carbide market is classified into above 99.5%, 99% - 99.5%, and less than 99%. Based on application, hafnium carbide market is segmented into aerospace and defense, ceramic, electronics and semiconductor, nuclear energy, industrial, and others. Regionally, the hafnium carbide industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The powder product type segment is anticipated to hold 48% of the market revenue share in 2025, making it the leading product form. This dominance is attributed to the versatility and ease of integration of hafnium carbide powder in various manufacturing processes, including additive manufacturing, coating applications, and sintering.

The fine particle size of the powder allows for precise material deposition and improved densification, which is critical in producing components with high mechanical strength and thermal resistance. Powder form is particularly advantageous for producing complex geometries and customized components required in advanced engineering applications.

The segment’s leadership is reinforced by its compatibility with both traditional and emerging fabrication techniques, enabling manufacturers to achieve consistent quality and performance As demand increases for high-performance components in aerospace, defense, and industrial sectors, hafnium carbide powder is expected to remain the preferred form, offering both flexibility in processing and superior end-product characteristics.

The above 99.5% purity segment is projected to account for 55% of the market revenue share in 2025, positioning it as the dominant purity grade. This high level of purity ensures superior thermal conductivity, oxidation resistance, and structural stability, which are essential for mission-critical applications.

Industries such as aerospace, defense, and energy demand the highest material specifications to guarantee performance in extreme operational environments. High-purity hafnium carbide offers reduced impurities that could otherwise compromise material integrity, thereby enhancing the lifespan and reliability of components.

The segment’s growth is supported by advancements in refining and synthesis techniques that have improved cost efficiency while maintaining exceptional quality standards As technological applications push the boundaries of temperature and pressure resistance, demand for above 99.5% purity material is set to strengthen, ensuring this segment retains its leading market position.

The aerospace and defense application segment is expected to command 35.30% of the market revenue share in 2025, making it the leading application area. This dominance is driven by the increasing need for ultra-high-temperature materials capable of withstanding extreme thermal and mechanical stresses encountered in advanced propulsion systems, thermal shielding, and hypersonic flight vehicles.

Hafnium carbide’s exceptional hardness, oxidation resistance, and ability to maintain structural integrity at temperatures exceeding 3900°C make it indispensable in these sectors. The segment’s growth is being supported by significant investments in space exploration, missile defense systems, and next-generation aircraft technologies.

Additionally, its application in protective coatings for turbine blades, rocket nozzles, and heat shields is expanding as defense and aerospace manufacturers seek materials that enhance performance and safety The continuous push for higher operational efficiency, speed, and durability ensures that aerospace and defense will remain the primary consumer of hafnium carbide in the foreseeable future.

The market has been influenced by its exceptional thermal and mechanical properties, making it highly suitable for advanced aerospace, defense, and electronics applications. Known for its ultra-high melting point, strong hardness, and resistance to oxidation, hafnium carbide has gained recognition in cutting tools, coatings, nuclear reactors, and hypersonic vehicle systems. The demand has been observed across specialized industries where conventional materials fail to perform under extreme conditions. Continuous research and industrial collaborations have been fostering new application areas, expanding its commercial significance worldwide.

The aerospace and defense sector has been one of the primary demand centers for hafnium carbide due to its capability to withstand extreme thermal environments. Hypersonic vehicles, rocket nozzles, and thermal protection systems have relied on materials capable of enduring temperatures beyond the limits of traditional ceramics. Hafnium carbide has been integrated into composite structures to provide thermal stability and durability during re-entry and propulsion phases. Its ability to resist thermal shock and oxidation has positioned it as an essential material in next-generation aerospace technology. This influence has created a strong link between defense budgets, space exploration programs, and market growth.

Hafnium carbide has been adopted in the electronics and semiconductor industry for specialized applications requiring conductive and high-temperature stable materials. Thin films of hafnium carbide have been investigated for use in microelectronics, plasma-facing components, and protective coatings for critical semiconductor equipment. Its high hardness and chemical resistance have made it suitable for applications in emerging transistor technologies and advanced chip fabrication. As the semiconductor sector has been witnessing constant miniaturization and performance enhancements, hafnium carbide has been positioned as a key enabler in extending component durability and efficiency under rigorous operational conditions. This sector has provided consistent growth opportunities for market expansion.

Extensive research in material science has played a central role in expanding the application scope of hafnium carbide. University research groups and industrial R&D units have focused on developing composites and coatings that integrate hafnium carbide with other ultra-high temperature ceramics. The objective has been to improve processability, reduce brittleness, and enhance oxidation resistance. Such innovations have facilitated its use not only in aerospace and defense but also in industrial tooling, energy systems, and protective manufacturing equipment. Patents filed across multiple regions have highlighted the growing interest of material engineers in developing scalable processing methods. These advancements have reinforced the long-term relevance of hafnium carbide in high-performance industries.

Despite its advantages, the hafnium carbide market has been constrained by supply chain limitations and high production costs. Hafnium is a byproduct of zirconium processing, making its availability dependent on nuclear and zirconium industries. This indirect supply route has created fluctuations in pricing and availability. Processing hafnium carbide at a commercial scale has also required advanced equipment and high costs, limiting accessibility for smaller industries. Dependence on a few producers and restricted global availability have intensified challenges. These supply dynamics have emphasized the need for recycling, substitution research, and improved extraction methods to ensure stable future growth for the market.

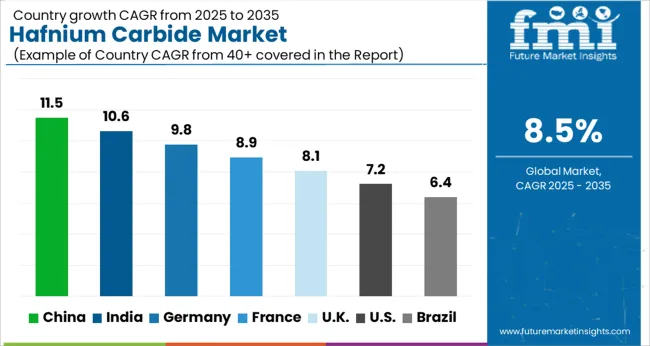

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

| China | 16.1% |

| India | 14.9% |

| Germany | 13.7% |

| France | 12.5% |

| UK | 11.3% |

| USA | 10.1% |

| Brazil | 8.9% |

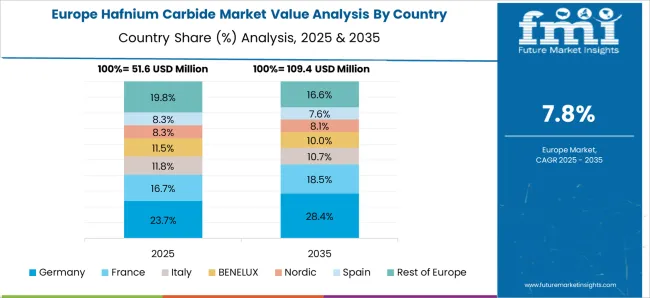

The market is projected to grow at a CAGR of 8.5% from 2025 to 2035, supported by its rising demand in aerospace, defense, nuclear reactors, and high-temperature resistant materials. China, recording an 11.5% CAGR, dominates with large-scale production capacities and state-backed R&D in advanced ceramics and thermal shielding. India follows at 10.6%, benefitting from increasing investments in defense and space exploration programs. Germany, growing at 9.8%, is focusing on technological innovation in high-performance coatings and superalloys. The UK, at 8.1%, is scaling applications in research and defense manufacturing, while the USA, at 7.2%, leverages aerospace and nuclear advancements to strengthen market presence. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to rise at a CAGR of 11.5%, supported by its extensive demand in aerospace, defense, and industrial applications. Hafnium carbide is highly valued for its exceptional melting point, strength, and thermal stability, making it suitable for next-generation aerospace components, hypersonic vehicles, and high-temperature furnace linings. China’s growing investment in advanced material sciences and defense technology programs further drives domestic production and usage. Continuous research and partnerships with global material suppliers strengthen the country’s role as a leading hub for hafnium carbide innovation.

India is expected to expand at a CAGR of 10.6%, driven by the nation’s increasing focus on indigenous defense production, aerospace development, and advanced research in thermal-resistant materials. Hafnium carbide is being evaluated for integration in rocket nozzles, gas turbines, and high-performance coatings to meet defense and space requirements. Expanding collaborations between research institutions and private industries are also facilitating growth. Although production volumes are currently lower compared to major economies, India’s investments in material technology are expected to strengthen its global position.

Germany’s market is forecast to grow at a CAGR of 9.8%, supported by its established aerospace sector and expertise in advanced ceramics and material engineering. The high-performance characteristics of hafnium carbide, including resistance to thermal shock and superior hardness, are fostering its adoption in specialized aerospace and industrial uses. German industries are integrating hafnium carbide into turbine blades, hypersonic propulsion components, and refractory linings. Government-backed R&D programs in high-temperature materials are further boosting innovation, ensuring Germany’s position as a significant consumer and innovator in the European market.

The market in the United Kingdom is expected to advance at a CAGR of 8.1%, influenced by the country’s focus on aerospace innovation, defense advancements, and research in ultra-high-temperature ceramics. Hafnium carbide is being adopted in areas such as propulsion systems, protective coatings, and industrial furnace linings. Growing partnerships between universities, research institutes, and defense contractors are playing a vital role in promoting its applications. Although domestic production capacity remains limited, the UK is investing in collaborations to strengthen access to critical materials like hafnium carbide.

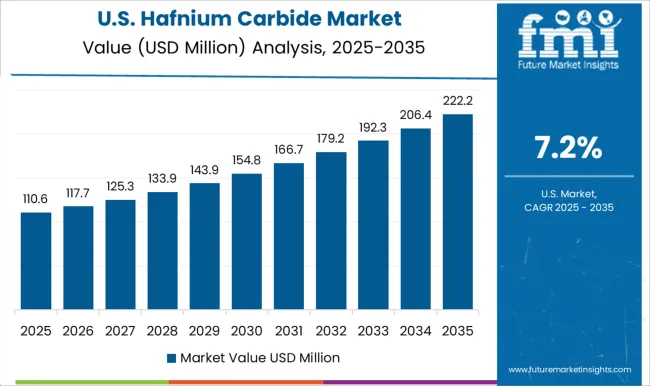

The market in the United States is projected to rise at a CAGR of 7.2%, largely supported by advanced aerospace, defense, and industrial manufacturing applications. Hafnium carbide’s extreme heat tolerance makes it vital for hypersonic vehicle development, next-generation turbine engines, and protective aerospace coatings. The United States continues to invest heavily in defense R&D programs, ensuring strong demand for ultra-high-temperature materials. Private industry players, research labs, and government agencies are increasingly aligned in developing scalable hafnium carbide applications, reinforcing the nation’s dominance in advanced material technologies.

The market is shaped by a limited group of specialized companies that focus on supplying ultra-high temperature ceramics for aerospace, defense, and advanced industrial applications. American Elements has positioned itself as a prominent global supplier, offering hafnium carbide powders for research institutions and commercial end users across different industries. Its strong distribution channels and wide material portfolio provide flexibility for clients working on next-generation thermal barrier coatings and high-performance components. Advanced Engineering Materials is also a notable player, catering to aerospace engineering firms and laboratories with high-purity hafnium carbide solutions. Their expertise in producing uniform powders and custom grades strengthens the role of hafnium carbide in high-heat environments. Ereztech has built recognition by emphasizing custom synthesis and specialty chemicals, serving as a reliable partner for companies involved in R&D and niche applications. Its ability to tailor hafnium carbide materials for experimental use adds diversity to the competitive landscape.

Hunan Huawei Jingcheng Material Technology represents an important participant from China, with capacity for scaled manufacturing and export-oriented strategies that contribute to regional competition. Merck, leveraging its global presence in specialty chemicals and advanced materials, supports innovation by supplying research-grade hafnium carbide. The company’s reputation for quality and strong relationships with research institutes and industrial users make it an influential force. Collectively, these companies focus on purity levels, particle size control, and customization, as these parameters determine performance under extreme operating conditions. Their activities highlight a market driven by innovation, limited supply chains, and specialized customer demand.

| Item | Value |

|---|---|

| Quantitative Units | USD 217.0 Million |

| Product Type | Powder, Sputtering target, Granules, and Others |

| Purity | Above 99.5%, 99% - 99.5%, and Less than 99% |

| Application | Aerospace and defense, Ceramic, Electronics and semiconductor, Nuclear energy, Industrial, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | American Elements, Advanced Engineering Materials, Ereztech, Hunan Huawei Jingcheng Material Technology, and Merck |

| Additional Attributes | Dollar sales by material grade and application, demand dynamics across aerospace, defense, and industrial sectors, regional trends in advanced ceramic adoption, innovation in ultra-high temperature resistance and durability, environmental impact of production and waste management, and emerging use cases in hypersonic vehicles and thermal protection systems. |

The global hafnium carbide market is estimated to be valued at USD 217.0 million in 2025.

The market size for the hafnium carbide market is projected to reach USD 490.6 million by 2035.

The hafnium carbide market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in hafnium carbide market are powder, sputtering target, granules and others.

In terms of purity, above 99.5% segment to command 55.0% share in the hafnium carbide market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbide Tools Market Growth - Trends & Forecast 2025 to 2035

Boron Carbide Market Analysis & Trends 2025 to 2035

Silicon Carbide (SiC) Coating Market Size and Share Forecast Outlook 2025 to 2035

Silicon Carbide Market Size and Share Forecast Outlook 2025 to 2035

Tantalum Carbide Market Size and Share Forecast Outlook 2025 to 2035

Tungsten Carbide Market

2D Transition Metal Carbides Nitrides Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA