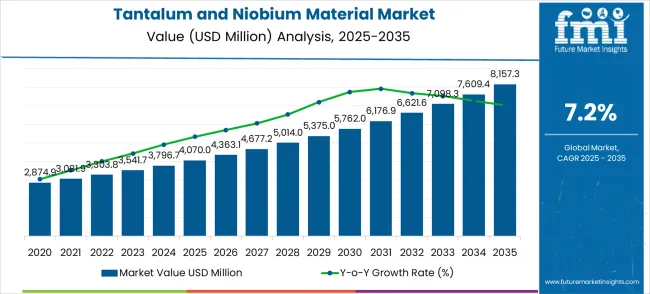

The tantalum and niobium material market is projected to expand from USD 4,070.0 million in 2025 to USD 8,157.3 million by 2035, reflecting a steady CAGR of 7.2%. The first half of the decade witnesses accelerated momentum building, with market value climbing from USD 4,363.1 million in 2026 to USD 6,176.9 million by 2030. This initial phase reflects growing electronics industry sophistication and increasing precision requirements across high-performance technology manufacturing sectors.

The latter half demonstrates high-growth dynamics, propelling the market from USD 6,621.6 million in 2031 to reach USD 8,157.3 million by 2035. Dollar additions during 2030-2035 outpace the earlier period, with annual increments averaging USD 396.1 million compared to USD 526.7 million in the first phase. This progression represents a 100.4% total value increase over the forecast decade.

Market maturation factors include expanding electronics production volumes, aerospace industry precision demands, and medical device manufacturing sophistication. The 7.2% compound annual growth rate positions participants to capitalize on USD 4,087.3 million in additional market value creation. This trajectory signals robust opportunities for technology innovators, supply chain developers, and end-user solution providers across the global industrial landscape.

Market expansion unfolds through two distinct growth periods with different competitive characteristics for each phase. The 2025-2030 foundation period delivers USD 2,106.9 million in value additions, representing 51.8% growth from the baseline. Market dynamics during this phase center on technology standardization, supply chain establishment, and end-user adoption acceleration across electronics and aerospace manufacturing sectors.

The 2030-2035 acceleration period generates USD 1,980.4 million in incremental value, reflecting 32.1% growth from the 2030 position. This phase exhibits mature market characteristics with enhanced competition, product differentiation strategies, and geographic expansion initiatives. Dollar contributions shift from foundational infrastructure development to market share optimization and technological advancement in ultra-high purity grades.

| Metric | Value |

|---|---|

| Market Value (2025) → | USD 4,070.0 million |

| Market Forecast (2035) | USD 8,157.3 million |

| Growth Rate | 7.2% CAGR |

| Leading Material Type | Tantalum |

| Primary Application | Electronics |

Competitive landscape evolution progresses from early market development to established player positioning. The first period prioritizes market education and adoption barriers reduction within traditional electronics applications. The second period witnesses intensified competition for premium market segments and geographical territory expansion. Market maturation factors include standardized purity requirements, automated production integration capabilities, and cross-industry application development across electronics, aerospace, and medical device sectors.

Market expansion rests on four fundamental shifts driving industrial demand acceleration: 1. Electronics Industry Revolution: Advanced semiconductor manufacturing demands enhanced capacitor performance for miniaturized electronic devices. 5G infrastructure deployment requires consistent high-frequency component reliability to meet next-generation communication standards. Consumer electronics manufacturing necessitates precise electrical properties for battery management systems and power efficiency optimization. 2. Aerospace Sector Advancement: Aircraft manufacturing integrates tantalum and niobium alloys with advanced jet engine production systems. Space exploration initiatives enable precise temperature resistance and corrosion protection capabilities. Defense applications require consistent material performance for specialized equipment and automated processing functions. 3. Medical Device Innovation: Surgical implant manufacturing facilities integrate biocompatible tantalum materials with advanced medical device production systems. Digital healthcare enables precise tissue integration control and biocompatibility assurance capabilities. Medical imaging initiatives require consistent radiopacity properties for automated diagnostic functions. 4. Industrial Manufacturing Excellence: High-temperature processing applications reduce operational complexity while improving corrosion resistance properties. Manufacturing cost optimization increases profitability and process reliability measures. Processing efficiency improvements decrease material waste through enhanced utilization procedures.

The growth faces headwinds from supply chain concentration risks and complex extraction requirements. Traditional alternative materials maintain cost advantages for less demanding applications. Technical complexity creates adoption barriers for smaller manufacturing environments without specialized processing capabilities.

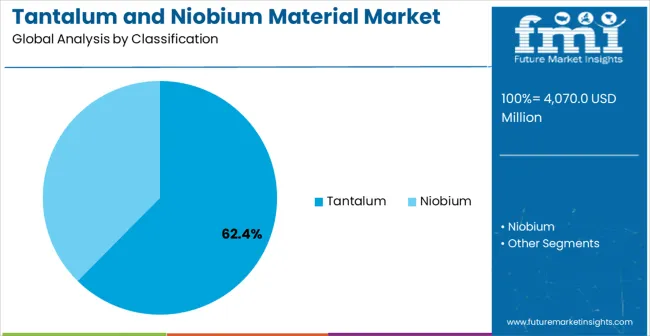

Primary Classification: The market segments by material type into tantalum materials and niobium materials, representing the progression from widely used high-performance materials toward specialized compositions tailored for advanced functional and structural applications across diverse industries.

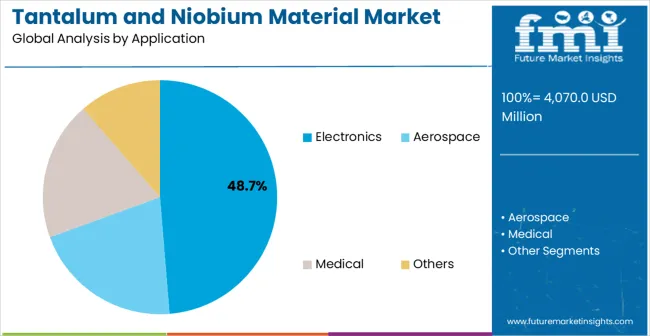

Secondary Breakdown: Application segmentation divides the market into electronics, aerospace, medical, and others, reflecting varied material performance requirements, precision needs, and industry-specific demands. Electronics leads due to high conductivity and durability needs, aerospace focuses on precision and high-strength applications, medical addresses biocompatibility requirements, while other segments cover diverse industrial use cases requiring tailored material properties.

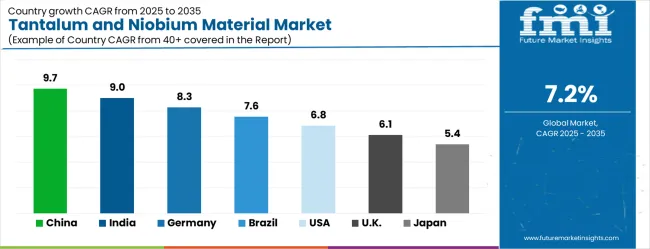

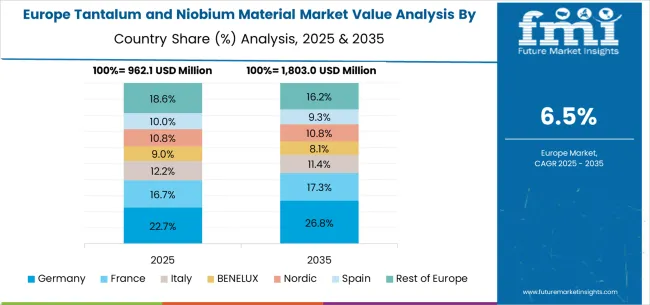

Geographic Segmentation: Regional market distribution spans Asia Pacific, Europe, North America, and Latin America, each demonstrating distinct growth patterns driven by technological advancements and industrial expansion. Asia Pacific leads with China and India exhibiting robust growth rates, Europe benefits from Germany’s advanced material applications, North America maintains steady expansion led by the USA, and Latin America achieves growth supported by Brazil’s expanding adoption of advanced material solutions.

Market Position: Tantalum materials establish clear market leadership through superior electrical properties and corrosion resistance benefits. High-purity tantalum systems eliminate performance limitations in demanding electronic applications. Consistent composition capabilities enable precise capacitor performance where standard alternatives cannot achieve required specifications.

Value Drivers: Advanced processing technology improvements enhance particle uniformity and reduce contamination risks. Digital quality control integration provides real-time composition verification and batch consistency monitoring. Specialized manufacturing capabilities accommodate multiple application requirements within single production configurations for operational efficiency.

Competitive Advantages: Tantalum systems offer enhanced electrical stability compared to standard alternatives requiring frequent replacement cycles. Superior corrosion resistance increases service life through reduced degradation rates in harsh environments. Premium pricing justification occurs through total cost of ownership advantages and performance reliability benefits.

Market Challenges: Complex processing requirements increase manufacturing costs compared to alternative materials. Supply chain concentration creates availability vulnerabilities for specialized applications requiring consistent supply. Limited mining locations demand sophisticated logistics and technical expertise not available in all production facilities.

Strategic Market Importance: Electronics manufacturing represents the primary demand driver for high-performance capacitor applications across global production facilities. Smartphone production, automotive electronics, and consumer device applications require precise electrical properties for operational efficiency. Quality control standards mandate consistent material performance for production optimization and device reliability.

Market Dynamics Q&A:

Business Logic: Electronics production facilities prioritize component reliability and performance consistency, making tantalum materials essential for meeting production targets. Cost justification occurs through reduced failure rates and enhanced device performance. Component protection requirements demand consistent electrical stability for operational continuity.

Forward-looking Implications: Electric vehicle development initiatives create new application requirements for advanced battery management systems. Advanced consumer electronics manufacturing demands enhanced miniaturization capabilities for specialized processing conditions. Global electronics production growth sustains market demand across emerging manufacturing regions with expanding technological infrastructure.

The market is primarily driven by increasing demand from industries requiring superior electrical performance and corrosion resistance. Applications in advanced electronics, aerospace components, and medical devices necessitate materials that maintain structural integrity under extreme conditions, making tantalum and niobium attractive solutions. The integration of advanced manufacturing processes into industrial operations further prioritizes the need for precise material properties and strict chemical composition control, ensuring consistent performance. The stringent quality regulations across electronics and medical sectors encourage the use of biocompatible and high-reliability materials that reduce operational risks and improve product longevity. Tantalum and niobium's compliance with international certification standards also makes them preferred choices for critical applications, where documented material properties are essential for safety and performance, creating a stable demand pipeline globally.

Despite advantages, the tantalum and niobium material market faces several growth inhibitors. Supply chain concentration in specific geographic regions creates availability risks and price volatility, discouraging adoption in cost-sensitive operations and smaller manufacturing units. The extraction and processing operations are complex, requiring specialized equipment, environmental compliance, and stringent safety protocols, which are not universally available. Limited availability of high-grade ore deposits further constrains large-scale production capacity expansion. The technical complexity involved in handling and processing these materials necessitates skilled operators and advanced manufacturing protocols, adding to operational overheads. These challenges collectively slow market penetration, particularly in emerging regions or price-sensitive sectors, restraining overall market growth despite rising industrial demand.

The market is evolving rapidly, driven by technological innovations and eco-friendly initiatives. Nanotechnology integration allows precise control over particle size and surface properties, enhancing performance for specialized applications such as high-performance capacitors, aerospace alloys, and medical implants. Automation in processing is another trend that reduces manufacturing costs, improves product uniformity, and minimizes human error. Eco-friendly and responsible sourcing initiatives are gaining traction, prompting the development of ethical supply chain practices that ensure conflict-free material sourcing. There is increasing demand for customizable alloys and compounds tailored to specific industrial requirements, offering operational flexibility while maintaining performance standards.

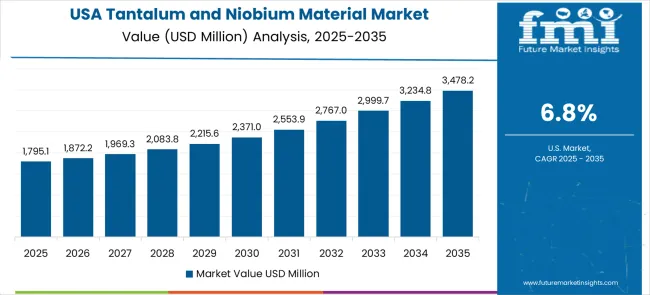

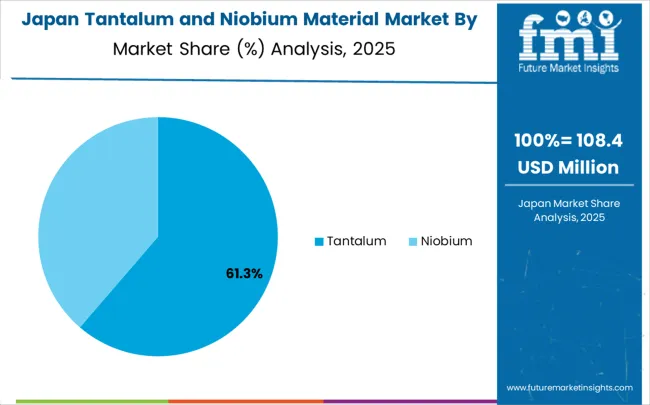

Global market dynamics reveal distinct performance tiers reflecting regional manufacturing capabilities and industrial development levels. Growth Leaders including China (9.7% market share) and India (9.0% share) demonstrate expanding electronics production ecosystems with advanced material adoption, while Germany (8.3% share) represents European manufacturing excellence in precision applications. Steady Performers such as Brazil (7.6% share) and the United States (6.8% share) show consistent demand growth aligned with industrial modernization and electronics sector requirements. Mature Markets including the United Kingdom (6.1% share) and Japan (5.4% share) display established market participation reflecting advanced technology integration and specialized application focus.

Regional synthesis indicates Asia Pacific dominance through electronics manufacturing concentration and export production requirements. European markets prioritize quality standards and precision aerospace applications. North American demand reflects industrial innovation adoption and advanced medical device development initiatives.

| Country | Market Share (%) |

|---|---|

| China | 9.7 |

| India | 9.0 |

| Germany | 8.3 |

| Brazil | 7.6 |

| USA | 6.8 |

| UK | 6.1 |

| Japan | 5.4 |

China establishes market leadership through electronics manufacturing sector dominance across consumer electronics, telecommunications equipment, and automotive electronics manufacturing facilities. A 9.7% market share reflects extensive production capacity and export-oriented electronics manufacturing requirements driving consistent demand for high-performance capacitor materials. Growth metrics demonstrate comprehensive industrial modernization supported by government technology development initiatives and stringent quality improvement mandates across manufacturing sectors.

Market dynamics center on 5G infrastructure expansion creating new high-performance electronic component requirements for enhanced connectivity and substantial network capacity targets. State-owned enterprise modernization programs drive widespread adoption of advanced materials for operational efficiency improvement and international competitiveness. Export market demands necessitate strict international quality standard adherence through extensively documented performance specifications and certification processes.

Manufacturing concentration in major electronics producing regions creates significant demand density for high-performance electronic materials and specialized applications. Industrial development policies specifically include advanced materials requirements for comprehensive technology upgrading initiatives. Foreign technology transfer partnerships bring international quality standards requiring tantalum applications and technical expertise development.

Strategic Market Indicators:

India demonstrates robust growth potential through rapidly expanding electronics manufacturing capabilities and comprehensive government promotion of domestic production initiatives under various technology development programs. A 9.0% market share reflects increasing industrial sophistication and widespread quality standard adoption across manufacturing sectors. Electronics sector growth under government initiatives creates consistent demand for high-performance capacitor materials across both large-scale production facilities and specialized component manufacturers.

Automotive electronics sector expansion drives significant secondary demand through stringent component quality requirements for precision automotive systems and assembly operations. Government quality certification mandates actively promote high-performance material adoption for enhanced safety compliance and international standard adherence. Major infrastructure development projects substantially increase telecommunications equipment production volumes requiring advanced electronic applications and specialized component protection systems.

Market activity centers on comprehensive technology transfer agreements bringing international electronics manufacturing standards and best practices to domestic production facilities. Foreign direct investment in electronics operations introduces advanced material requirements for improved operational efficiency and competitive advantage. Skill development initiatives include extensive training programs for advanced materials application techniques and quality control procedures.

Germany maintains an 8.3% market share through exceptional engineering excellence and established precision manufacturing traditions across diverse industrial sectors. The nation's sustained market demand is supported by an established industrial base with advanced aerospace capabilities and specialty electronics production expertise, where automotive electronics sector requirements create consistent demand for high-performance materials across precision component manufacturing and specialized systems. Industrial equipment manufacturing requires extensively certified material specifications for strict export compliance and international quality standards adherence, while aerospace engineering services utilize premium materials for advanced prototype development and comprehensive testing applications. Quality standard development significantly influences global manufacturing practices requiring advanced material adoption and technical innovation. Advanced manufacturing research initiatives continuously develop innovative applications for tantalum and niobium materials across emerging industrial sectors, with export market leadership necessitating comprehensive quality documentation supporting international sales and regulatory compliance. The electronics supplier network requires consistent material performance for precision manufacturing and assembly operations.

Brazil represents a significant emerging market with 7.6% market share through comprehensive industrial development initiatives and electronics sector expansion across domestic and regional markets. The market reflects increasing manufacturing sophistication and quality standard adoption driven by government policies promoting domestic electronics production capabilities, while mining industry leadership creates consistent supply advantages for raw material processing across integrated facilities and specialty material production operations. Automotive electronics manufacturing growth drives primary market demand through domestic production expansion and regional export requirements for Latin American markets, with aerospace industry development creating substantial opportunities for precision alloy applications and high-performance material solutions. Infrastructure development significantly increases telecommunications equipment production volumes requiring quality electronic components and advanced material systems. Market development benefits from abundant natural resources supporting domestic processing capabilities and strategic geographic positioning for regional market access, while infrastructure projects support manufacturing sector growth requiring precision electronics capabilities.

The United States demonstrates steady growth with a 6.8% market share through comprehensive technology innovation leadership and strategic advanced manufacturing initiatives bringing production capabilities to domestic facilities. The market reflects an established industrial base with significant aerospace sector strength and advanced electronics manufacturing capabilities, where defense electronics sector modernization creates substantial demand for advanced materials and high-performance electronic components meeting stringent military requirements. Aerospace industry leadership requires precision tantalum applications for critical aircraft component manufacturing and specialized high-temperature aerospace systems, while medical device manufacturing maintains consistent demand for biocompatible materials supporting advanced implant procedures and medical electronics applications. Technology innovation adoption creates connectivity requirements for electronic component integration with sophisticated manufacturing execution systems. Manufacturing competitiveness initiatives encourage substantial investment in advanced materials technologies and processing capabilities, with space exploration programs requiring extensively certified materials supporting comprehensive mission-critical applications and regulatory adherence. Aerospace sector leadership drives specialized precision applications, defense electronics maintain consistent demand for certified materials, medical device innovation creates opportunities for biocompatible materials, and space exploration programs increase requirements for mission-critical specialized applications, establishing the United States as a leading technology innovation hub for advanced materials development.

The United Kingdom demonstrates market stability with a 6.1% market share through comprehensive advanced manufacturing modernization and strategic technology sector initiatives across key industries. The established manufacturing base prioritizes quality standards and precision aerospace applications, where aerospace sector strength creates substantial demand for precision tantalum applications in critical aircraft systems and high-performance jet engine components. Financial technology sector requires precision electronic components for advanced payment processing systems and secure transaction hardware meeting stringent security standards, while advanced manufacturing research initiatives continuously develop innovative applications for specialty alloys and high-performance electronic materials. Medical device manufacturing maintains strict quality standard requirements for export markets and international competitiveness. Post-Brexit trade considerations create significant opportunities for domestic advanced materials processing growth requiring precision manufacturing capabilities and specialty material solutions, with government industrial strategy initiatives actively supporting advanced manufacturing technology adoption and innovation development. Strategic technology sector policies prioritize domestic capability development and advanced material technology investment.

Japan maintains technological leadership with a 5.4% market share through exceptional precision manufacturing excellence and comprehensive quality standard development across diverse industrial sectors. The mature market features established advanced electronics adoption across industries and sophisticated manufacturing capabilities, where electronics industry leadership creates consistent demand for advanced capacitor technologies and high-performance tantalum materials meeting strict quality requirements. Industrial robotics manufacturing requires precision materials for component production and comprehensive testing applications ensuring reliable performance, while automotive electronics industry utilizes specialized tantalum applications for advanced vehicle systems and precision manufacturing processes. Quality management system development significantly influences global manufacturing practices and technology adoption standards. Manufacturing technology exports include precision electronic component requirements for international production facilities and technology transfer programs, with research initiatives continuously advancing material processing and application technologies. Supplier network development creates substantial opportunities for precision material integration and advanced electronic applications.

Market structure reflects moderate concentration with established global players maintaining significant market positions while regional competitors serve specialized segments. Competition style prioritizes technological differentiation, purity level advancement, and supply chain integration expansion. Industry dynamics favor companies combining production innovation with comprehensive technical service offerings.

The tantalum and niobium material market is anchored by global leaders such as Global Advanced Metals (GAM) and CBMM, which dominate due to their expansive product portfolios, global distribution strength, and advanced refining capabilities. These companies have invested heavily in R&D, enabling them to pioneer new purity levels, enhanced alloys, and application-specific solutions for industries ranging from electronics to aerospace. Their ability to leverage economies of scale, coupled with long-standing customer relationships, creates significant barriers to entry for smaller players. These Tier 1 leaders not only shape pricing dynamics but also set global benchmarks for quality and technical expertise.

A second competitive tier is represented by JX Advanced Metals and Niobec, firms that focus on specific application areas or advanced alloy markets. Unlike global leaders with wide product breadth, these companies prioritize depth through niche technologies, such as high-purity tantalum for semiconductor use or niobium-based alloys for high-strength steel. Their key strengths lie in technical service, customer co-development programs, and specialized manufacturing expertise. This positioning allows them to build strong relationships with clients requiring tailored solutions. By innovating in advanced processing and metallurgy, Tier 2 companies carve out defensible niches where quality and customization matter more than scale.

The third tier includes CMOC Group, ULBA Metallurgical Plant, and Advanced Metallurgical Group (AMG), which primarily serve local or regional markets while addressing specialized applications. These competitors often succeed in price-sensitive segments, where cost competitiveness and flexibility in customization are critical. Their localized service capabilities provide quick response to customer needs, while their ability to adjust formulations and supply volumes makes them attractive in smaller but vital application areas such as medical devices, niche electronics, and specialty alloys. While less dominant globally, Tier 3 players contribute to supply diversity and balance within the broader tantalum and niobium ecosystem.

The tantalum and niobium material market is central to advanced manufacturing excellence, electronics industry innovation, aerospace sector advancement, and high-technology industrial applications. With increasing demands for performance reliability, environmental compliance, and superior electrical properties, the sector faces pressure to balance supply chain security, material purity levels, and eco-friendly mining practices. Coordinated action from governments, industry bodies, OEMs/technology players, suppliers, and investors is essential to transition toward environmentally sustainable, technologically advanced, and globally competitive tantalum and niobium material systems.

How Governments Could Spur Local Production and Adoption?

| Item | Value |

|---|---|

| Quantitative Units | USD 4,070.0 million |

| Material Type | Tantalum, Niobium |

| Application | Electronics, Aerospace, Medical, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, China, Japan, South Korea, India, ASEAN, Australia, New Zealand, Brazil, Chile, Kingdom of Saudi Arabia, GCC Countries, Turkey, South Africa |

| Key Companies Profiled | Global Advanced Metals, JX Advanced Metals, Metallurgical Products, CBMM, Niobec, CMOC Group, ULBA Metallurgical Plant, Advanced Metallurgical Group, Mitsubishi Materials, Ningxia Orient Tantalum Industry, Guangdong Rising Rare Metals |

The global tantalum and niobium material market is estimated to be valued at USD 4,070.0 million in 2025.

The market size for the tantalum and niobium material market is projected to reach USD 8,157.3 million by 2035.

The tantalum and niobium material market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in tantalum and niobium material market are tantalum and niobium.

In terms of application, electronics segment to command 48.7% share in the tantalum and niobium material market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA