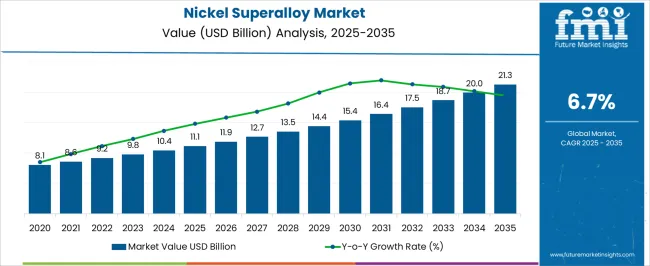

The nickel superalloy market is estimated to be valued at USD 11.1 billion in 2025 and is projected to reach USD 21.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. Nickel superalloys are crucial in sectors such as aerospace, power generation, and automotive, where the need for heat resistance, corrosion resistance, and durability is paramount. As industries focus on operational efficiency and reliability, the demand for nickel-based alloys with superior performance characteristics is expected to grow substantially in the coming years.

The increasing use of nickel superalloys in turbine engines, industrial gas turbines, and high-temperature components will be a key factor in driving market expansion. Their superior mechanical properties make them essential in critical applications, particularly in aerospace and energy sectors, where failure risks are minimized through the use of these alloys. As the global demand for energy continues to rise, coupled with the growth in air travel and defense projects, the nickel superalloy market will see significant long-term benefits.

| Metric | Value |

|---|---|

| Nickel Superalloy Market Estimated Value in (2025 E) | USD 11.1 billion |

| Nickel Superalloy Market Forecast Value in (2035 F) | USD 21.3 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The nickel superalloy market is estimated to hold a notable proportion within its parent markets, representing approximately 7-9% of the metal alloys market, around 10-12% of the aerospace materials market, close to 5-6% of the power generation materials market, about 3-4% of the automotive materials market, and roughly 2-3% of the industrial manufacturing materials market.

The cumulative share across these parent segments is observed in the range of 27-34%, reflecting the strategic role nickel superalloys play in high-performance sectors such as aerospace, energy, and automotive. The market has been influenced by the increasing demand for materials that can withstand extreme temperatures, corrosion, and mechanical stress, especially in critical industries such as aerospace and power generation. Procurement decisions drive adoption focused on performance, durability, and weight reduction, which are essential for applications in turbines, engines, and other high-stress systems.

Market participants have focused on enhancing the chemical composition and manufacturing processes of nickel superalloys to offer superior strength, heat resistance, and fatigue resistance. As a result, the nickel superalloy market has not only captured a substantial share within the aerospace and power generation sectors but has also influenced automotive and industrial manufacturing materials markets, underlining its essential role in improving the efficiency, reliability, and operational life of high-performance systems across multiple industries.

The nickel superalloy market is experiencing stable growth, driven by increasing demand for high-performance materials in industries that require superior mechanical strength, corrosion resistance, and thermal stability. These alloys are being widely adopted in aerospace, energy, automotive, and marine sectors where extreme environmental conditions demand long-lasting and reliable components. Rising production of commercial aircraft, expansion of defense procurement programs, and continuous improvements in turbine technologies are creating favorable conditions for market expansion.

Moreover, the energy sector’s shift toward more efficient gas turbines and next-generation nuclear reactors is accelerating the need for superalloys that can withstand high pressure and temperature without material degradation. Innovation in powder metallurgy, additive manufacturing, and alloy formulation is enabling enhanced product customization, opening new application possibilities.

Manufacturers are focusing on supply chain optimization and advanced processing techniques to meet the growing global demand As technological advancement across core industries continues to rise, the market for nickel superalloys is expected to experience steady growth, driven by their unmatched performance benefits and expanding range of critical applications.

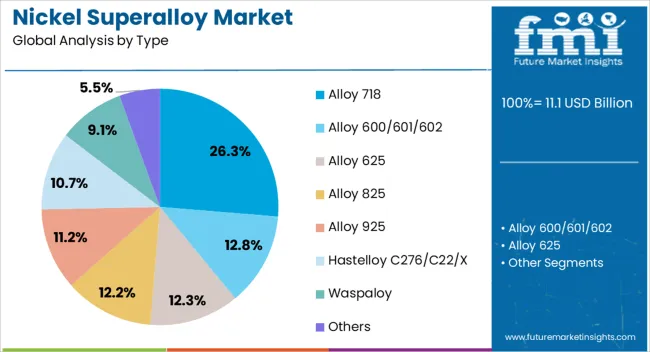

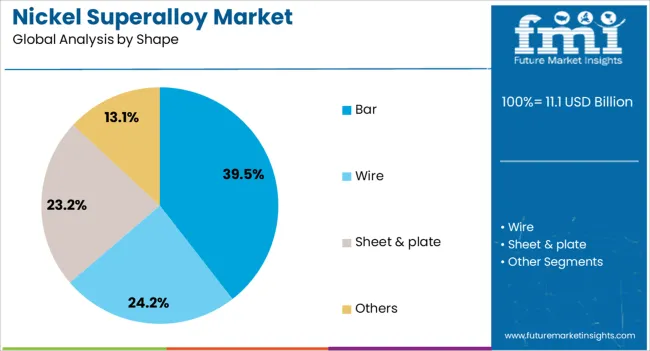

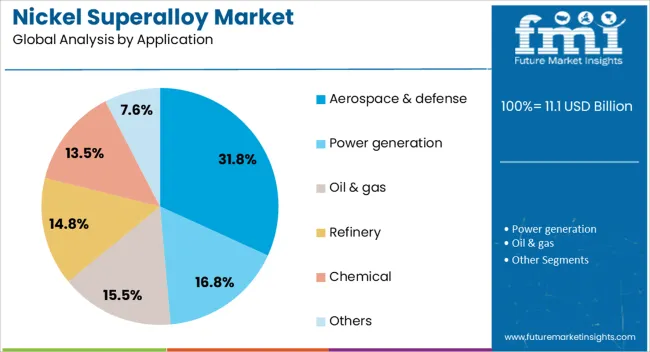

The nickel superalloy market is segmented by type, shape, application, and geographic regions. By type, nickel superalloy market is divided into Alloy 718, Alloy 600/601/602, Alloy 625, Alloy 825, Alloy 925, Hastelloy C276/C22/X, Waspaloy, and Others. In terms of shape, nickel superalloy market is classified into Bar, Wire, Sheet & plate, and Others. Based on application, nickel superalloy market is segmented into Aerospace & defense, Power generation, Oil & gas, Refinery, Chemical, and Others. Regionally, the nickel superalloy industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Alloy 718 segment is projected to hold 26.3% of the nickel superalloy market revenue share in 2025, establishing it as the leading alloy type. This prominence is being driven by the alloy’s exceptional mechanical strength, fatigue resistance, and stability at elevated temperatures, which make it highly suitable for demanding structural and engine components. The alloy’s excellent weldability and corrosion resistance further enhance its appeal across critical applications in aerospace, defense, and industrial gas turbines.

Its composition allows for outstanding creep rupture strength and stress corrosion cracking resistance, essential for performance in aggressive environments. As demand grows for advanced engine and turbine components capable of sustaining peak efficiency under severe thermal and mechanical stress, the use of Alloy 718 is expanding steadily.

Manufacturers are increasingly selecting this alloy due to its proven reliability and cost-effectiveness in production and maintenance Continuous research and innovation aimed at improving Alloy 718 processing and performance are expected to further strengthen its position in the global market.

The bar shape segment is expected to account for 39.5% of the nickel superalloy market revenue share in 2025, making it the dominant product form. This leadership is being supported by its widespread use in the manufacturing of structural and engine components that require precise dimensions, high strength, and ease of machining. Bars are particularly valued for their versatility in forging and machining processes, which are commonly used in the aerospace, automotive, and energy industries.

Their availability in a wide range of diameters and grades allows for tailored applications across complex assemblies. The segment is also benefiting from improvements in metallurgical processes that enhance grain structure, strength, and fatigue resistance in bar-formed components.

As demand rises for high-performance, precision-engineered components in mission-critical systems, the preference for bar-shaped nickel superalloys is expected to increase Strong global production capacities and the consistent supply of bar stock materials further reinforce its leadership position within the shape segment of the market.

The aerospace and defense segment is anticipated to capture 31.8% of the nickel superalloy market revenue share in 2025, positioning it as the leading application area. This dominance is being driven by the increasing demand for fuel-efficient, high-thrust aircraft engines and advanced structural materials in both commercial and military aviation. Nickel superalloys are being widely adopted in jet engines, turbine blades, exhaust systems, and structural airframe components due to their ability to withstand extreme temperatures, stress, and corrosion.

The growing focus on lightweight, high-performance materials in defense systems and the expansion of air fleets globally are accelerating segment growth. Advancements in additive manufacturing and precision casting have enabled more efficient use of superalloys in complex geometries, improving engine efficiency and reducing lifecycle costs.

Compliance with stringent regulatory and performance standards in the aerospace sector has made nickel-based superalloys a material of choice As global air travel rebounds and defense modernization continues, this application segment is expected to remain a key driver of market demand.

The nickel superalloy market is experiencing robust growth, fueled by increasing demand across aerospace, defense, and energy sectors. Opportunities in high-performance applications are driving the demand for these alloys, with a focus on their use in turbine and engine components. However, the market faces challenges such as high production costs and supply chain complexities, especially regarding nickel availability. As industries continue to seek durable, high-performance materials, these challenges will need to be addressed to ensure sustained market growth.

The demand for nickel superalloys is rapidly increasing across sectors such as aerospace, power generation, and automotive due to their exceptional strength and resistance to high temperatures and corrosion. These materials are essential in turbine engines, jet engines, and other high-performance applications where durability and reliability are critical. The growing need for advanced components in these industries is significantly contributing to the market’s expansion, with nickel superalloys being a preferred choice for manufacturing high-performance parts.

The aerospace and defense sectors are expected to drive significant growth in the nickel superalloy market. With the ongoing expansion of air travel and the increase in defense spending globally, the demand for advanced materials that can withstand extreme conditions has surged. Nickel superalloys are increasingly used in engine components, ensuring operational efficiency and safety. This sector's reliance on such materials is anticipated to create lucrative opportunities for market players to cater to rising demand, especially in turbine blades and exhaust systems.

There has been a noticeable shift towards the integration of nickel superalloys in energy generation sectors such as nuclear, gas turbines, and wind energy. These alloys are critical for the construction of power generation equipment, helping to meet the growing demand for energy solutions that provide higher efficiency and reliability. As energy production methods evolve, these materials continue to be a key part of infrastructure, fueling market growth in the renewable and traditional energy sectors alike.

One of the primary challenges facing the nickel superalloy market is the high cost of production. The manufacturing process of these materials requires complex and specialized techniques, driving up prices. Additionally, the volatile supply of nickel, a key raw material, can disrupt production and lead to supply chain challenges. As demand increases, these challenges are expected to put pressure on companies, potentially increasing the cost of end products and limiting accessibility for smaller manufacturers.

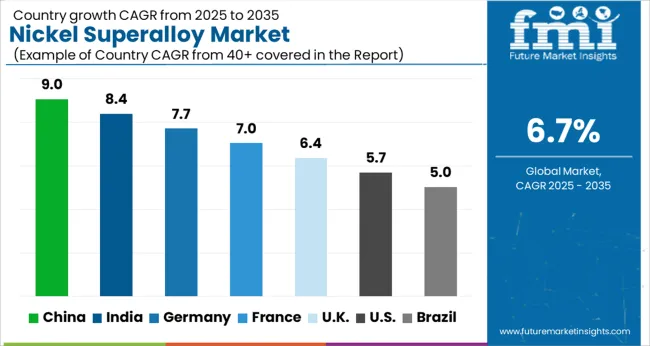

| Country | CAGR |

|---|---|

| China | 9.0% |

| India | 8.4% |

| Germany | 7.7% |

| France | 7.0% |

| UK | 6.4% |

| USA | 5.7% |

| Brazil | 5.0% |

The global nickel superalloy market is projected to grow at a CAGR of 6.7% from 2025 to 2035. China leads with a growth rate of 9%, followed by India at 8.4%, and Germany at 7.7%. The United Kingdom records a growth rate of 6.4%, while the United States shows the slowest growth at 5.7%. The expansion is driven by the rising demand for nickel superalloys in key industries such as aerospace, power generation, and automotive. China and India are benefiting from increasing industrialization, growing manufacturing capabilities, and the expansion of their aerospace and automotive sectors. Meanwhile, developed economies like the USA and the UK focus on upgrading their industrial capabilities and meeting the demand for high-performance alloys for advanced applications. This report includes insights on 40+ countries; the top markets are shown here for reference.

The nickel superalloy market in China is growing at a rate of 9%, driven by the country’s rapid industrialization and increasing demand in aerospace, automotive, and power generation industries. China’s aerospace industry, in particular, is a key consumer of nickel superalloys, with major investments in aircraft manufacturing and defense technologies. The automotive industry in China is also adopting these high-performance alloys to meet the demands for lightweight and fuel-efficient vehicles. China’s growing energy sector is another major contributor to the market, as nickel superalloys are critical for high-temperature applications in power plants. The demand for advanced alloys in these sectors is expected to continue rising as China strengthens its position in global manufacturing and technological advancement.

The nickel superalloy market in India is growing at 8.4%, with key sectors such as aerospace, automotive, and energy leading the way. India’s growing aerospace and defense industries are driving the demand for nickel-based alloys, as they are essential for the production of advanced turbine engines and critical components. The country’s automotive sector, which is increasingly focusing on fuel efficiency and lighter vehicles, is also a significant consumer of these materials. In addition, India’s expanding power generation sector, particularly with a focus on renewable energy, is boosting the adoption of nickel superalloys in high-performance machinery and turbines. India’s strategic investments in industrial development and technological advancement are expected to sustain the growth of the nickel superalloy market.

The nickel superalloy market in Germany is growing at a rate of 7.7%, supported by strong industrial sectors such as aerospace, automotive, and energy. Germany’s aerospace industry is one of the largest in Europe, and the demand for nickel superalloys is driven by the need for high-performance materials in turbine engines, aircraft structures, and defense applications. The automotive sector is increasingly using these alloys to meet emission standards and reduce weight. Additionally, Germany’s advanced energy sector, including power plants and renewable energy initiatives, is driving the adoption of nickel superalloys in turbines and other high-temperature components. Germany’s focus on innovation and high-performance manufacturing ensures continued growth for the market in the coming years.

The nickel superalloy market in the United Kingdom is growing at a rate of 6.4%. The UK has a long-standing aerospace industry that continues to drive demand for high-performance alloys, particularly for engines and other critical components. In the automotive sector, manufacturers are increasingly adopting these alloys to improve fuel efficiency and reduce emissions. The UK’s energy industry, including nuclear and renewable energy projects, is another key market for nickel superalloys. These materials are crucial for high-temperature applications in turbines, reactors, and energy systems. As the UK continues to invest in technological advancements and infrastructure, the demand for nickel superalloys is expected to remain strong.

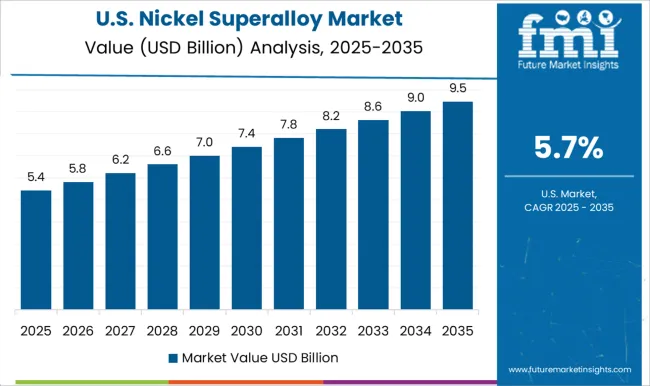

The nickel superalloy market in the United States is growing at a rate of 5.7%, with major industries like aerospace, automotive, and energy driving the demand. The USA aerospace industry is one of the largest consumers of nickel superalloys, particularly in turbine engines, aircraft components, and defense technologies. In the automotive industry, the shift towards lightweight, high-performance vehicles is fueling the demand for these alloys. Additionally, the USA energy sector, especially in nuclear and thermal power plants, requires nickel superalloys for high-temperature applications in turbines and other critical systems. As the USA continues to focus on improving manufacturing capabilities and industrial output, the nickel superalloy market is poised to grow steadily.

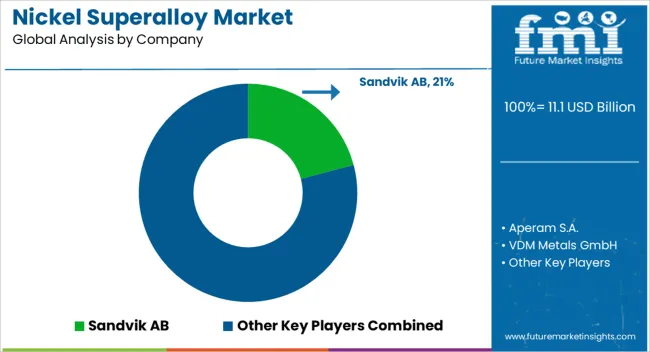

The nickel superalloy market is experiencing strong growth, driven by the increasing demand for high-performance materials in industries such as aerospace, automotive, and energy. Leading companies like Sandvik AB, Aperam S.A., and VDM Metals GmbH are playing a significant role in the production of these specialized alloys, which are known for their exceptional heat resistance, corrosion resistance, and mechanical strength. Sandvik AB, with its expertise in advanced materials and manufacturing processes, supplies high-quality nickel superalloys that are crucial for the aerospace and power generation sectors. Similarly, Aperam S.A. is contributing to the market with its stainless steel and nickel alloys that are designed for demanding environments. VDM Metals GmbH, a major player in the production of high-performance alloys, is known for its development of customized solutions for industries such as chemical processing and aerospace, further expanding the application scope of nickel superalloys. On the other hand, Precision Castparts Corporation, Voestalpine AG, and Allegheny Technologies Incorporated are also key contributors to the nickel superalloy market.

Precision Castparts Corporation offers precision-cast products that are essential in industries requiring extreme strength and high-temperature resistance, including aviation and defense. Voestalpine AG focuses on high-quality metal alloys, including nickel-based superalloys, which are vital in sectors like aerospace, energy, and automotive. Allegheny Technologies Incorporated manufactures nickel superalloys for aerospace applications, emphasizing their role in the production of turbine engines and other high-stress components. Furthermore, Haynes International, Inc. and Rolled Alloys, Inc. provide advanced materials used in gas turbines, heat exchangers, and other critical equipment where durability and resistance to high temperatures are paramount. With continued innovation and increasing industrial demand, these companies are solidifying their positions in the growing nickel superalloy market, catering to the evolving needs of high-performance industries.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.1 Billion |

| Type | Alloy 718, Alloy 600/601/602, Alloy 625, Alloy 825, Alloy 925, Hastelloy C276/C22/X, Waspaloy, and Others |

| Shape | Bar, Wire, Sheet & plate, and Others |

| Application | Aerospace & defense, Power generation, Oil & gas, Refinery, Chemical, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sandvik AB, Aperam S.A., VDM Metals GmbH, Precision Castparts Corporation, Voestalpine AG, Allegheny Technologies Incorporated, Haynes International, Inc., and Rolled Alloys, Inc. |

| Additional Attributes | Dollar sales by alloy type (cast, wrought) and application (aerospace, power generation, automotive, industrial) are key metrics. Trends include rising demand for high-performance materials in extreme conditions, growth in aerospace and defense sectors, and increasing adoption in turbine and engine components. Regional adoption, technological advancements, and material efficiency are driving market growth. |

The global nickel superalloy market is estimated to be valued at USD 11.1 billion in 2025.

The market size for the nickel superalloy market is projected to reach USD 21.3 billion by 2035.

The nickel superalloy market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in nickel superalloy market are alloy 718, alloy 600/601/602, alloy 625, alloy 825, alloy 925, hastelloy c276/c22/x, waspaloy and others.

In terms of shape, bar segment to command 39.5% share in the nickel superalloy market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nickel Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Mining Market Size and Share Forecast Outlook 2025 to 2035

Nickel Niobium Market Size and Share Forecast Outlook 2025 to 2035

Nickel Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Acetate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Cobalt Aluminium Market Trend Analysis Based on Purity, End Use, and Region 2025 to 2035

Nickel Cobalt Manganese (NCM) Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Nickel Nitrate Hexahydrate Market

Nickel Alloy Market

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Superalloys Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA