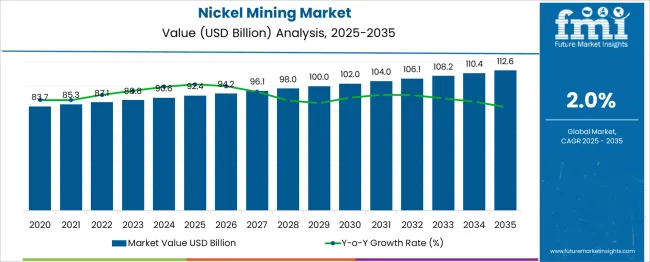

The global nickel mining market is likely to grow from USD 92.38 billion in 2025 to approximately USD 112.6 billion by 2035, recording an absolute increase of USD 20.2 billion over the forecast period. This translates into a total growth of 21.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 2% between 2025 and 2035. The market size is expected to grow by nearly 1.22X during the same period, supported by increasing demand from stainless steel production, growing electric vehicle battery requirements, and expanding applications in non-ferrous alloys across industrial sectors.

Between 2025 and 2030, the nickel mining market is projected to expand from USD 92.3 billion to USD 102 billion, resulting in a value increase of USD 9.6 billion, which represents 47.6% of the total forecast growth for the decade. This phase of growth will be shaped by accelerating demand from the electric vehicle sector, increasing stainless steel production in emerging markets, and growing investments in green mining technologies. Mining companies are expanding their production capacities and implementing advanced extraction techniques to meet the rising global demand for high-purity nickel products.

| Metric | Value |

| Estimated Value in (2025E) | USD 92.3 billion |

| Forecast Value in (2035F) | USD 112.6 billion |

| Forecast CAGR (2025 to 2035) | 2% |

From 2030 to 2035, the market is forecast to grow from USD 102 billion to USD 112.6 billion, adding another USD 10.6 billion, which constitutes 52.4% of the ten-year expansion. This period is expected to be characterized by technological advancements in nickel extraction and processing, implementation of environmentally friendly mining practices, and development of high-grade nickel products for battery applications. The growing adoption of electric vehicles and renewable energy storage systems will drive demand for battery-grade nickel sulfate and other specialized nickel products.

Between 2020 and 2025, the nickel mining market experienced steady expansion, driven by recovering industrial activity post-pandemic and increasing focus on energy transition technologies. The market developed as mining companies recognized the strategic importance of nickel in the global shift toward electrification. Government policies supporting electric vehicle adoption and clean energy infrastructure began emphasizing the critical role of nickel in battery chemistries and energy storage solutions.

Market expansion is being supported by the accelerating global transition to electric vehicles and the corresponding demand for nickel-rich battery chemistries. Modern battery manufacturers are increasingly focused on nickel-intensive cathode materials that offer higher energy density and improved vehicle range. Nickel's essential role in lithium-ion batteries, particularly in NMC (nickel-manganese-cobalt) and NCA (nickel-cobalt-aluminum) formulations, makes it a critical component in the electrification of transportation systems worldwide.

The steady demand from the stainless steel industry continues to provide a stable foundation for nickel market growth. Stainless steel production, which accounts for approximately 70% of global nickel consumption, remains robust due to infrastructure development, urbanization trends, and industrial expansion in emerging economies. The growing emphasis on corrosion-resistant materials in construction, automotive, and chemical processing industries is driving consistent demand for nickel-containing stainless steel grades across diverse applications.

The market is segmented by end use and region. By end use, the market is divided into stainless steel, non-ferrous alloys, batteries, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The stainless steel end use is projected to account for 70.0% of the nickel mining market in 2025, reaffirming its position as the primary consumption driver for nickel products globally. The construction and infrastructure sectors increasingly demand austenitic stainless steels containing 8-12% nickel for their superior corrosion resistance, durability, and aesthetic properties. Major infrastructure projects, urban development initiatives, and industrial facility expansions across emerging economies continue to drive substantial nickel consumption through stainless steel production.

This segment forms the backbone of nickel demand, supported by the material's indispensable role in modern construction, automotive manufacturing, and industrial equipment production. The growing focus on green building materials and lifecycle cost optimization reinforces stainless steel's competitive advantages. With urbanization trends accelerating globally and infrastructure modernization programs expanding, stainless steel production ensures constant nickel demand. Its broad application spectrum across industries guarantees continued dominance, making it the central pillar of nickel mining market stability.

The nickel mining market is advancing steadily due to increasing demand from electric vehicle battery production. The market faces challenges including environmental regulations, mining complexity in laterite deposits, and price volatility influenced by supply-demand imbalances. Innovation in extraction technologies and ethical mining practices continue to influence production efficiency and market development patterns.

The implementation of advanced extraction technologies is enabling more efficient recovery of nickel from low-grade ores and complex laterite deposits. High-pressure acid leaching (HPAL) technologies and improved hydrometallurgical processes are reducing production costs while minimizing environmental impact. These technological improvements are particularly crucial as the industry shifts toward processing more challenging ore bodies to meet growing global demand.

Mining companies are increasingly adopting green practices to reduce carbon emissions, water consumption, and ecological impact of nickel extraction operations. Implementation of renewable energy in mining operations, development of tailings management systems, and habitat restoration programs are becoming standard practices. These initiatives respond to stakeholder demands for responsible sourcing while ensuring long-term operational viability and social license to operate.

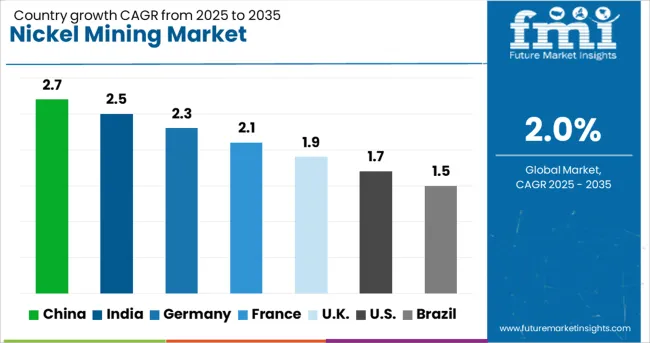

| Country | CAGR (2025-2035) |

| China | 2.7% |

| India | 2.5% |

| Germany | 2.3% |

| France | 2.1% |

| UK | 1.9% |

| USA | 1.7% |

| Brazil | 1.5% |

The nickel mining market is experiencing steady growth globally, with China leading at a 2.7% CAGR through 2035, driven by massive stainless steel production capacity, rapid electric vehicle adoption, and extensive infrastructure development programs. India follows at 2.5%, supported by expanding manufacturing sector, urbanization initiatives, and growing automotive industry. Germany shows growth at 2.3%, emphasizing high-value applications in automotive and industrial equipment. France records 2.1%, focusing on aerospace and energy sector requirements. The UK demonstrates 1.9% growth, prioritizing specialized industrial applications. The USA shows 1.7% growth, balancing domestic consumption with strategic supply chain considerations.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from nickel mining products in China is projected to exhibit steady growth with a CAGR of 2.7% through 2035, driven by the country's position as the world's largest stainless steel producer and rapidly expanding electric vehicle market. The nation's extensive manufacturing base and infrastructure development programs create consistent demand for nickel across multiple applications. Major domestic and international mining companies are establishing processing facilities and supply partnerships to serve China's substantial nickel requirements.

Revenue from nickel mining products in India is expanding at a CAGR of 2.5%, supported by rapid industrialization, infrastructure development, and growing stainless steel production capacity. The country's expanding automotive sector and increasing focus on renewable energy infrastructure are driving demand for nickel-containing materials. Domestic stainless steel producers and battery manufacturers are establishing supply chains to secure consistent nickel product availability.

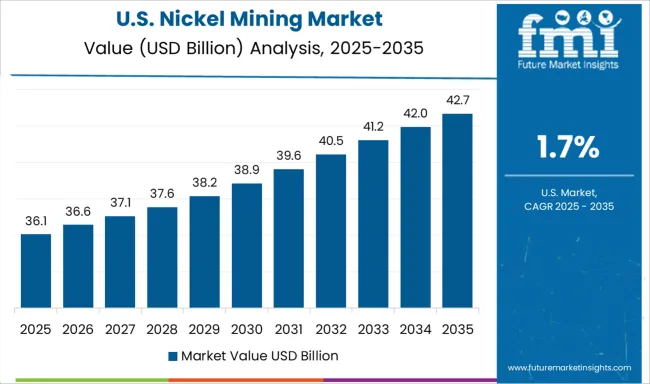

Demand for nickel mining products in the USA is projected to grow at a CAGR of 1.7%, supported by domestic manufacturing requirements and strategic considerations for critical mineral supply chains. American industries prioritize secure nickel supply for aerospace, defense, and emerging battery manufacturing sectors. The market is characterized by emphasis on supply chain resilience and partnerships with allied nations for nickel sourcing.

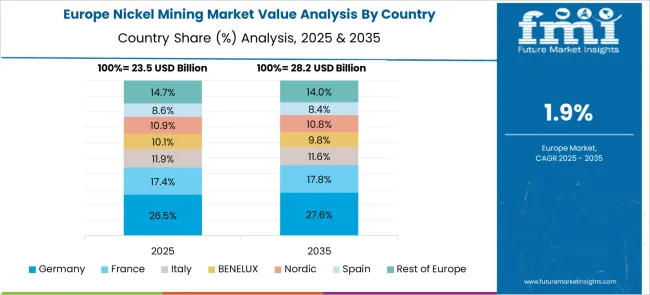

Revenue from nickel mining products in Germany is projected to grow at a CAGR of 2.3% through 2035, driven by the country's advanced manufacturing capabilities, automotive industry transformation, and chemical processing sector requirements. German industries consistently demand high-quality nickel products for precision engineering applications and specialized alloy production.

Revenue from nickel mining products in the UK is projected to grow at a CAGR of 1.9% through 2035, supported by offshore energy sector requirements, chemical processing industries, and emerging clean technology applications. British industries value high-performance materials for challenging operational environments.

Revenue from nickel mining products in France is projected to grow at a CAGR of 2.1% through 2035, supported by the country's prominent aerospace industry, nuclear energy sector, and industrial manufacturing base. French industries prioritize high-performance nickel alloys for critical applications requiring exceptional material properties.

Revenue from nickel mining products in Brazil is projected to grow at a CAGR of 1.5% through 2035, supported by domestic industrial development, mining sector expansion, and growing manufacturing capabilities. Brazilian industries benefit from domestic nickel resources while developing downstream processing capabilities.

The nickel mining market is characterized by competition among major multinational mining corporations, state-owned enterprises, and specialized nickel producers. Companies are investing in green mining technologies, processing facility expansions, strategic partnerships, and vertical integration strategies to secure market position and meet evolving customer requirements. Production efficiency, environmental compliance, and supply chain reliability are central to maintaining competitive advantages in the global nickel market.

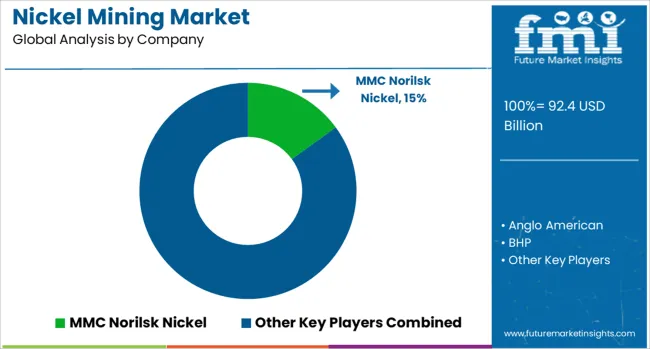

MMC Norilsk Nickel (Norilsk Nickel), Russia-based, leads the market with 15.0% global production share, offering comprehensive nickel and palladium production with integrated mining and refining operations. Vale S.A., Brazil, provides extensive nickel production capacity with focus on both sulfide and laterite ore processing. Glencore, Switzerland, delivers diversified nickel production through global mining assets and trading operations. BHP, Australia, focuses on high-grade nickel sulfide production with emphasis on battery-grade products. Anglo American and Eramet, operating globally, provide specialized nickel production with focus on green mining practices and value-added products.

Jinchuan Group International Resources Co. Ltd., China, emphasizes integrated nickel production serving domestic and international markets. Sherritt International Corporation, Canada, specializes in laterite ore processing with advanced hydrometallurgical capabilities. Sumitomo Metal Mining Co., Ltd., Japan, provides high-purity nickel products with focus on battery materials and specialized applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 92.38 Billion |

| End Use | Stainless Steel, Non-Ferrous Alloys, Batteries, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | MMC Norilsk Nickel, Anglo American, BHP, Eramet, Glencore, Jinchuan Group International Resources Co. Ltd., Norilsk Nickel, Sherritt International Corporation, Sumitomo Metal Mining Co., Ltd., and Vale S.A. |

| Additional Attributes | Production volume by ore type (sulfide vs. laterite), regional supply-demand dynamics, competitive landscape analysis, pricing trends and market volatility factors, green initiatives and carbon footprint reduction strategies, technological innovations in extraction and processing methods |

End Use:

Region:

The global nickel mining market is estimated to be valued at USD 92.4 billion in 2025.

The market size for the nickel mining market is projected to reach USD 112.6 billion by 2035.

The nickel mining market is expected to grow at a 2.0% CAGR between 2025 and 2035.

The key product types in nickel mining market are stainless steel, non-ferrous alloys, batteries and others.

In terms of , segment to command 0.0% share in the nickel mining market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nickel Sulfate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Superalloy Market Size and Share Forecast Outlook 2025 to 2035

Nickel Niobium Market Size and Share Forecast Outlook 2025 to 2035

Nickel Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Acetate Market Size and Share Forecast Outlook 2025 to 2035

Nickel Cobalt Manganese (NCM) Market Trend Analysis Based on Product, End-Use, and Region 2025 to 2035

Nickel Cobalt Aluminium Market Trend Analysis Based on Purity, End Use, and Region 2025 to 2035

Nickel Nitrate Hexahydrate Market

Nickel Alloy Market

Aluminum-Nickel Catalyst Market Size and Share Forecast Outlook 2025 to 2035

Mining Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Mining Remanufacturing Component Market Forecast Outlook 2025 to 2035

Mining Hose Market Size and Share Forecast Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Mining Tester Market Size and Share Forecast Outlook 2025 to 2035

Mining Pneumatic Saw Market Size and Share Forecast Outlook 2025 to 2035

Mining Drilling Service Market Size and Share Forecast Outlook 2025 to 2035

Mining Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Mining Shovel Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA