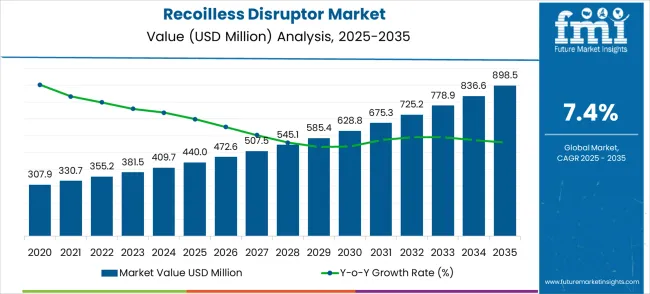

The global recoilless disruptor market is likely to grow from USD 440.0 million in 2025 to approximately USD 898.5 million by 2035, recording an absolute increase of USD 458.5 million over the forecast period. This translates into a total growth of 104.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.4% between 2025 and 2035. The overall market size is expected to grow by nearly 2.04X during the same period, supported by increasing global security threats, growing demand for advanced explosive ordnance disposal equipment, and rising requirements for precise bomb disposal technologies across diverse military, law enforcement, and security applications in the global defense and security industries.

Between 2025 and 2030, the recoilless disruptor market is projected to expand from USD 440.0 million to USD 585.4 million, resulting in a value increase of USD 145.4 million, which represents 31.7% of the total forecast growth for the decade. This phase of development will be shaped by increasing global security concerns, rising adoption of advanced explosive ordnance disposal technologies in military operations, and growing utilization in counter-terrorism activities, bomb squad operations, and security force applications. Defense equipment manufacturers and security technology companies are expanding their disruptor capabilities to address the growing preference for precise and safe explosive neutralization solutions in modern security operations.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 440.0 million |

| Forecast Value in (2035F) | USD 898.5 million |

| Forecast CAGR (2025 to 2035) | 7.4% |

The recoilless disruptor market is segmented into defense and military applications (45%), law enforcement and bomb disposal units (28%), counter-terrorism and homeland security (15%), critical infrastructure protection (7%), and specialized research or training applications (5%). Defense and military adoption dominates due to the need for safe, high-impact solutions to neutralize explosives and hazardous devices. Law enforcement and bomb disposal units rely on disruptors for rapid threat mitigation in urban environments. Counter-terrorism and homeland security operations deploy them for tactical scenarios and protective measures. Critical infrastructure, including airports, power plants, and government buildings, uses recoilless disruptors to safeguard against explosive threats. Specialized research and training applications focus on testing and personnel preparedness.

Key trends include lightweight materials, modular designs, and improved accuracy in threat neutralization. Manufacturers are innovating with enhanced recoil control, portable systems, and remote operation capabilities. Adoption is expanding in military modernization programs, urban security initiatives, and bomb disposal operations. Collaborations between equipment providers and defense or security agencies enable customized, reliable, and high-performance solutions, driving global market growth.

The recoilless disruptor market presents significant growth opportunities as global security threats intensify and counter-terrorism capabilities become increasingly critical for military and law enforcement agencies worldwide. With the market projected to expand from USD 440.0 million in 2025 to USD 898.5 million by 2035 at a 7.4% CAGR, defense contractors and security technology providers are positioned to capitalize on rising defense spending, evolving explosive threats, and the imperative for precision explosive ordnance disposal capabilities across diverse operational environments.

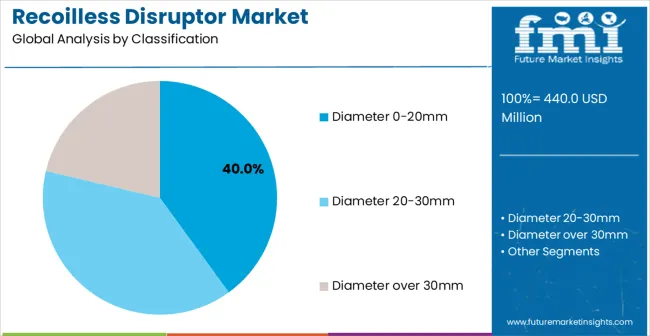

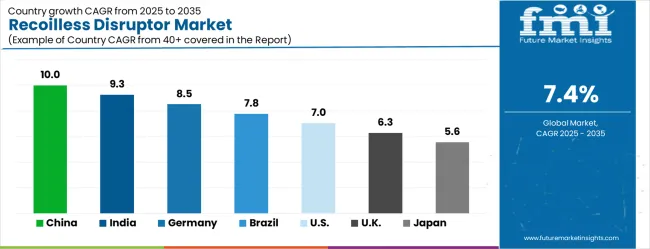

The convergence of asymmetric warfare challenges, urban security requirements, and technological advancement in targeting systems creates sustained market expansion opportunities. Geographic growth differentials are particularly pronounced in China (10.0% CAGR) and India (9.3% CAGR), where defense modernization programs and increasing security concerns drive substantial procurement. Technology advancement pathways around precision guidance, enhanced safety features, and specialized threat response offer differentiation opportunities, while diameter 0-20mm systems dominate current demand due to operational versatility.

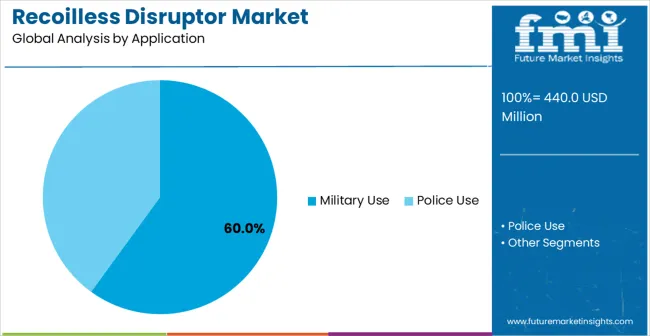

Military use applications lead market revenue, indicating established foundations for battlefield and security operations, while police use represents expanding civilian security applications. Counter-terrorism requirements and critical infrastructure protection drive sustained procurement, while operator safety and precision targeting demands fuel technological advancement across threat neutralization scenarios.

Market expansion is being supported by the increasing global security threats and terrorism concerns, and the corresponding shift toward advanced explosive ordnance disposal technologies that can provide superior precision and safety while meeting operational requirements for effective threat neutralization. Modern military forces and law enforcement agencies are increasingly focused on incorporating advanced disruptor systems to enhance operational capabilities while satisfying demands for operator safety, precision targeting, and reliable threat neutralization. Recoilless disruptor technology's proven ability to deliver superior accuracy, operational flexibility, and enhanced safety margins makes it an essential tool for explosive ordnance disposal, counter-terrorism operations, and security force applications.

The growing focus on urban security and critical infrastructure protection is driving demand for high-quality disruptor systems that can support rapid response capabilities and maintain superior operational effectiveness across airport security, government facility protection, and public event security applications. Security forces' preference for equipment that combines precision targeting with operational safety is creating opportunities for innovative disruptor implementations in both traditional military and emerging civilian security applications. The rising influence of asymmetric warfare and sophisticated explosive threats is also contributing to increased adoption of advanced disruptor systems that can provide reliable performance against evolving security challenges.

The recoilless disruptor market is expanding with increasing adoption in defense and security operations. Disruptors with diameters of 20–30 mm dominate the segment, accounting for approximately 50% of the market share, offering optimal balance between portability, projectile velocity (up to 90 m/s), and target neutralization effectiveness. In terms of application, military use leads with about 60% of the market, reflecting demand for rapid, accurate, and safe explosive ordinance disposal and breaching operations. Growth is driven by rising defense budgets, modernization of military equipment, and the need for lightweight, high-performance disruptors suitable for tactical operations.

Disruptors with diameters of 20–30 mm account for approximately 50% of the market, making them the most widely adopted size. These devices provide projectile velocities of 80–90 m/s and can neutralize explosive devices from distances up to 10 meters. Key manufacturers include Chemring, L3Harris, NAMMO, and Med-Eng. This size range balances portability for field operators with sufficient kinetic impact to safely disable explosive threats. Their compact design allows rapid deployment in urban and tactical environments, making them the preferred choice for EOD teams.

Military use accounts for approximately 60% of the application segment, making it the largest market for recoilless disruptors. These devices are deployed in explosive ordinance disposal, tactical breaching, and urban combat operations. Leading suppliers such as Chemring, L3Harris, NAMMO, and Med-Eng provide models optimized for precision, safety, and portability under extreme conditions. Segment growth is fueled by modernization of military EOD units, increasing global defense spending, and the rising need for lightweight, effective tools for counter-IED and tactical operations.

The recoilless disruptor market is advancing steadily due to increasing global security threats and growing demand for advanced explosive ordnance disposal technologies that focus on precision and safety across military operations, counter-terrorism activities, and law enforcement applications. The market faces challenges, including stringent regulatory requirements for defense equipment, high development costs for advanced systems, and the specialized nature of operator training requirements. Innovation in targeting systems and precision technologies continues to influence market development and expansion patterns.

The growing adoption of recoilless disruptors in counter-terrorism operations and urban security applications is enabling security forces to achieve precise threat neutralization that provides enhanced operational safety while supporting rapid response capabilities and effective threat management. Counter-terrorism applications provide exceptional precision requirements while allowing more sophisticated threat assessment across various urban environments and security scenarios. Security agencies are increasingly recognizing the competitive advantages of advanced disruptor technology for homeland security operations and critical infrastructure protection.

Modern recoilless disruptor manufacturers are incorporating laser targeting systems, ballistic computers, and precision guidance technologies to enhance accuracy, improve operational effectiveness, and meet demands for reliable threat neutralization in complex operational environments. These technologies improve targeting precision while enabling new applications, including standoff operations and enhanced operator safety protocols. Advanced system integration also allows manufacturers to support premium market positioning and operational excellence beyond traditional explosive ordnance disposal equipment.

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| Brazil | 7.8% |

| USA | 7.0% |

| UK | 6.3% |

| Japan | 5.6% |

The recoilless disruptor market is experiencing robust growth globally, with China leading at a 10.0% CAGR through 2035, driven by increasing defense spending, growing security concerns, and rising investment in advanced military technologies and counter-terrorism capabilities. India follows at 9.3%, supported by expanding defense modernization programs, increasing security threats, and growing demand for sophisticated explosive ordnance disposal equipment.

Germany shows growth at 8.5%, prioritizing precision engineering excellence and defense technology export development. Brazil records 7.8%, focusing on internal security enhancement and counter-terrorism capability development. The USA demonstrates 7.0% growth, prioritizing homeland security and military operational effectiveness. The UK exhibits 6.3% growth, supported by its established defense technology heritage and security force modernization. Japan shows 5.6% growth, prioritizing technological innovation and security infrastructure enhancement.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The recoilless disruptors market in China is projected to exhibit exceptional growth with a CAGR of 10.0% through 2035, driven by rapidly expanding defense spending and increasing focus on modernizing military explosive ordnance disposal capabilities across People's Liberation Army units and specialized security forces. The country's growing focus on counter-terrorism preparedness and border security is creating substantial demand for advanced disruptor systems in both military and security applications. Major defense manufacturers and technology companies are establishing comprehensive development and production capabilities to serve both domestic security requirements and export markets.

The recoilless disruptors market in India is expanding at a CAGR of 9.3%, supported by comprehensive defense modernization programs, increasing security threats along borders and in urban areas, and growing investment in advanced explosive ordnance disposal technologies across military and paramilitary forces. The country's expanding security infrastructure and rising counter-terrorism requirements are driving demand for sophisticated disruptor solutions across both military and civilian security applications. International defense companies and domestic manufacturers are establishing comprehensive production and service capabilities to address growing market demand for advanced security equipment.

The recoilless disruptors market in Germany is projected to grow at a CAGR of 8.5% through 2035, driven by the country's leadership in defense technology development, precision engineering excellence, and strong export capabilities in military and security equipment markets. Germany's sophisticated defense industry and commitment to technological innovation are creating substantial demand for high-precision disruptor systems across both domestic security forces and international export applications. Leading defense manufacturers and technology suppliers are establishing comprehensive development strategies to serve both German security requirements and European export markets.

Demand of recoilless disruptors in Brazil is projected to grow at a CAGR of 7.8% through 2035, supported by the country's expanding internal security requirements, growing counter-terrorism capabilities, and increasing investment in specialized security equipment for major events and urban security operations. Brazilian security forces are increasingly adopting advanced disruptor technologies to enhance threat response capabilities and improve operational safety standards. The country's strategic security challenges continue to drive innovation in explosive ordnance disposal applications and equipment adoption.

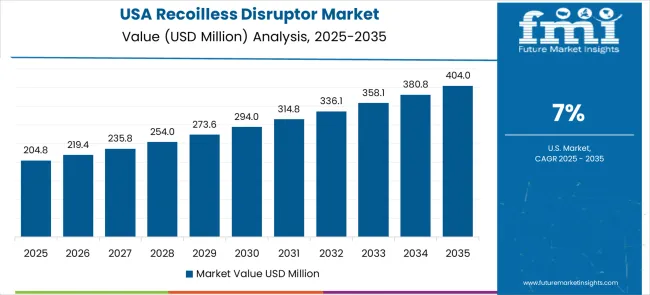

The recoilless disruptors industry in the United States is projected to grow at a CAGR of 7.0% through 2035, supported by the country's comprehensive homeland security infrastructure, advanced military operational requirements, and leadership in defense technology development and security equipment innovation. American military and security forces prioritize operational effectiveness, safety, and technological advancement, making advanced disruptor systems essential equipment for both military operations and domestic security applications. The country's extensive defense research and development capabilities support continued market development and technology advancement.

The recoilless disruptors market in the United Kingdom is projected to grow at a CAGR of 6.3% through 2035, supported by the country's established defense technology heritage, comprehensive security force capabilities, and traditional leadership in military equipment development and explosive ordnance disposal expertise. UK security forces' focus on operational excellence and safety creates steady demand for advanced disruptor systems across both military and civilian security applications. The country's expertise in defense technology drives consistent adoption of precision security equipment.

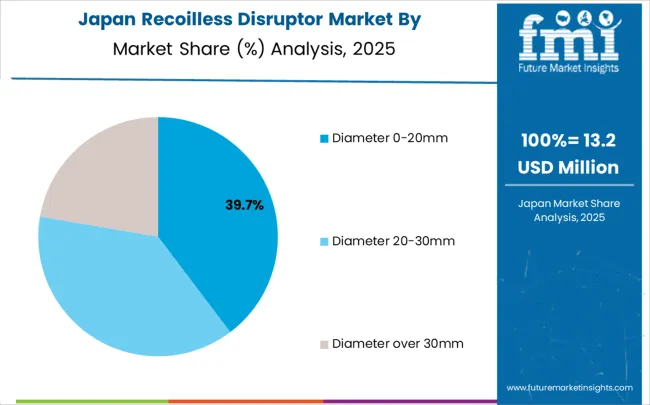

The demand of recoilless disruptors in Japan is projected to grow at a CAGR of 5.6% through 2035, supported by the country's commitment to technological innovation, growing security infrastructure requirements, and focus on advanced defense technology development and precision engineering capabilities. Japan's security sector continues to prioritize innovation and technological excellence while working to enhance security capabilities through advanced equipment development and precision manufacturing expertise.

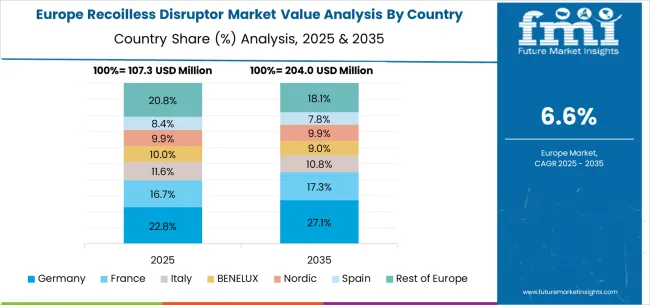

The recoilless disruptor market in Europe is projected to grow from USD 158.7 million in 2025 to USD 324.1 million by 2035, registering a CAGR of 7.4% over the forecast period. Germany is expected to maintain its leadership position with a 31.2% market share in 2025, declining slightly to 30.7% by 2035, supported by its advanced defense technology sector, precision engineering excellence, and comprehensive export capabilities serving European and international security markets.

The United Kingdom follows with a 24.8% share in 2025, projected to reach 24.5% by 2035, driven by established defense technology heritage, comprehensive security force capabilities, and strong military equipment development traditions. France holds a 19.4% share in 2025, expected to maintain 19.6% by 2035, supported by a strong defense industry and growing investment in counter-terrorism technologies. Italy commands a 12.1% share in 2025, projected to reach 12.4% by 2035, while Spain accounts for 7.3% in 2025, expected to reach 7.6% by 2035.

The Netherlands maintains a 2.1% share in 2025, growing to 2.2% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to hold 3.1% in 2025, growing to 3.0% by 2035, attributed to mixed growth patterns with increasing adoption of advanced security technologies in some Eastern European markets balanced by specialized market requirements in smaller Western European countries implementing security modernization programs.

The recoilless disruptor market is characterized by competition among specialized defense equipment manufacturers, advanced security technology providers, and integrated military systems suppliers. Companies are investing in precision targeting technologies, advanced projectile design, safety enhancement systems, and comprehensive training programs to deliver consistent, high-performance, and operationally reliable disruptor solutions. Innovation in guidance systems, targeting accuracy, and operator safety features is central to strengthening market position and operational effectiveness.

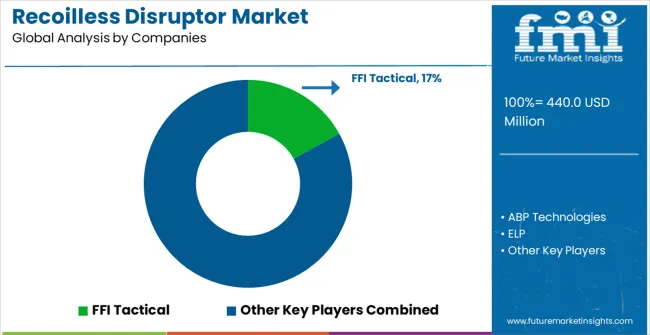

FFI Tactical leads the market with a strong focus on tactical equipment innovation and comprehensive explosive ordnance disposal solutions, offering advanced disruptor systems with focus on precision targeting and operational safety. ABP Technologies provides specialized defense equipment capabilities with a focus on precision engineering and military application expertise. ELP delivers advanced security technology solutions with a focus on operational effectiveness and safety enhancement. DSE International specializes in defense and security equipment with prioritizing on international market development and technical excellence. EPE focuses on explosive ordnance disposal equipment with prioritizing on precision targeting and operational reliability. Sarkar Tactical prioritizing on tactical security solutions with a focus on specialized applications and technical support.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 440.0 million |

| Disruptor Diameter | Diameter 0-20mm, Diameter 20-30mm, Diameter over 30mm |

| Application | Military Use, Police Use |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | FFI Tactical, ABP Technologies, ELP, DSE International, EPE, Sarkar Tactical, NIC Instruments, Chemring Technology, Richmond Defense Systems, and Al Efah Technologies |

| Additional Attributes | Dollar sales by disruptor diameter and application, regional demand trends, competitive landscape, technological advancements in targeting systems, precision enhancement programs, safety improvement initiatives, and specialized security application strategies |

The global recoilless disruptor market is estimated to be valued at USD 440.0 million in 2025.

The market size for the recoilless disruptor market is projected to reach USD 898.5 million by 2035.

The recoilless disruptor market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in recoilless disruptor market are diameter 0-20mm, diameter 20-30mm and diameter over 30mm.

In terms of application, military use segment to command 60.0% share in the recoilless disruptor market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA