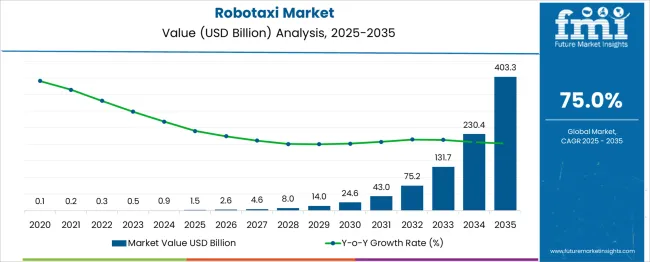

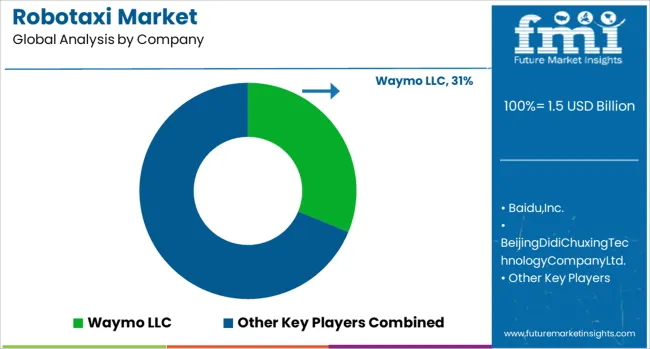

The Robotaxi Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 403.3 billion by 2035, registering a compound annual growth rate (CAGR) of 75.0% over the forecast period. This trajectory reflects an exceptionally high CAGR exceeding 70%, positioning this sector among the fastest-expanding segments in autonomous mobility.

The market remains in its nascent phase during the early years, with incremental gains limited to USD 0.1 billion annually between 2021 and 2022, and reaching just USD 0.5 billion by 2024, indicating a prolonged gestation period where regulatory approval, infrastructure integration, and pilot testing dominate activities. However, the acceleration phase emerges post-2025, driven by commercialization of Level 4 autonomous systems, advancements in AI-based navigation, and safety validation. From 2026 to 2030, the market experiences explosive scaling, adding USD 12.5 billion, which accounts for approximately 90% of total decade growth, underscoring a back-loaded adoption curve. By 2028, the market size will exceed USD 8.0 billion, marking a near 16-fold increase compared to 2024, supported by cost optimization through fleet sharing and strategic partnerships between automotive OEMs and mobility service providers.

The underlying growth catalysts include rising demand for on-demand mobility, integration with ride-hailing ecosystems, and operational cost reductions achieved through the synergy of electrification and automation. Capital inflow from technology giants and transportation innovators is accelerating deployment in urban corridors with high commuter density. These factors collectively indicate that the period from 2026 onward will be the most critical for market capture, scalability investments, and technology differentiation strategies. The current outlook positions robotaxis as a transformational component in future mobility ecosystems, reshaping both passenger transport economics and urban traffic models.

| Metric | Value |

|---|---|

| Robotaxi Market Estimated Value in (2025 E) | USD 1.5 billion |

| Robotaxi Market Forecast Value in (2035 F) | USD 403.3 billion |

| Forecast CAGR (2025 to 2035) | 75.0% |

Governments and private enterprises are increasingly investing in pilot programs, regulatory frameworks, and smart mobility infrastructures to accelerate the deployment of autonomous ride-hailing fleets. Technological progress in LIDAR, real-time mapping, and AI-powered navigation is enabling safe and scalable robotaxi operations in densely populated urban areas.

The increasing focus on decarbonization and congestion reduction is further supporting the shift toward autonomous electric mobility. Major automakers and mobility-as-a-service (MaaS) providers are forming strategic alliances to commercialize Level 4 autonomous vehicles that can adapt to complex traffic scenarios.

Public trust in autonomous technology is improving due to rigorous safety validation, while lower operating costs and efficient fleet utilization are boosting investor confidence in robotaxi deployments. Over the coming years, demand is expected to rise sharply in metropolitan regions where technological readiness, regulatory support, and urban mobility needs align to support high-frequency, driverless transportation services.

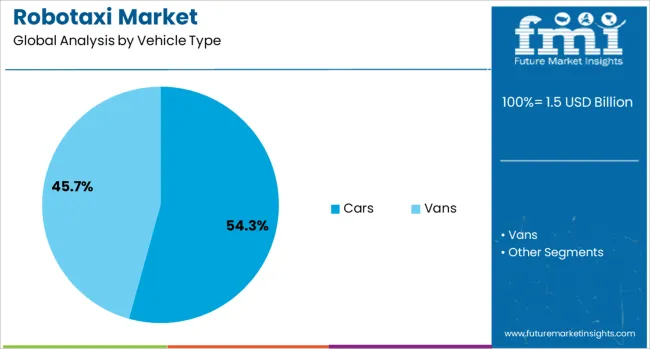

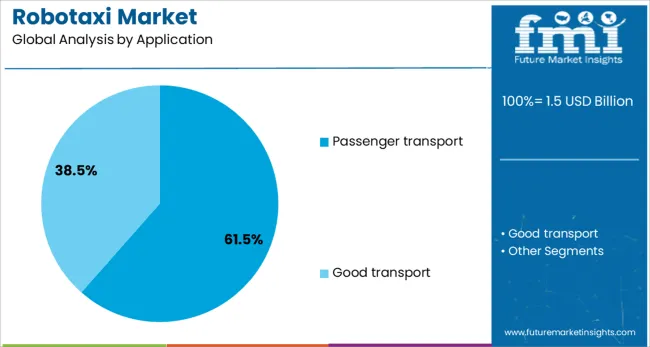

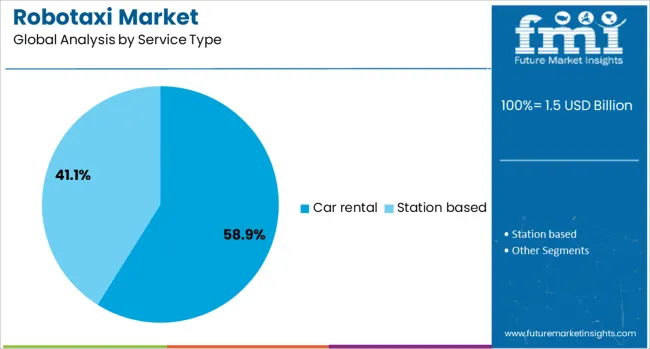

The robotaxi market is segmented by vehicle type, application, service type, end use, and geographic regions. The vehicle type of the robotaxi market is divided into Cars and Vans. In terms of the application, the robotaxi market is classified into Passenger transport and goods transport. Based on the service type, the robotaxi market is segmented into Car rental station-based. The end use of the robotaxi market is segmented into Shared mobility and Corporate fleet.

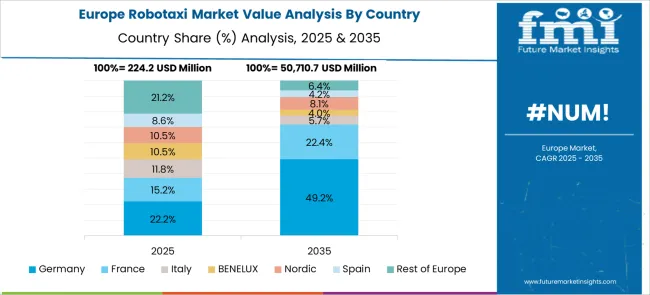

Regionally, the robotaxi industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cars segment is projected to capture 54.3% of the total revenue share in the robotaxi market in 2025, establishing itself as the leading vehicle type. This growth is being driven by the scalability, operational efficiency, and regulatory feasibility of deploying autonomous cars in urban and suburban environments. Cars are better suited to current infrastructure compared to larger vehicle types and are being prioritized by OEMs for early-stage robotaxi fleet rollouts due to their favorable size, maneuverability, and passenger comfort.

The ability to integrate advanced driver-assistance systems, over-the-air software updates, and modular sensor arrays into car platforms has made them more adaptable to evolving autonomous standards. Additionally, their energy-efficient configurations and lower ownership costs align with sustainable fleet management goals.

Commercial viability has been further enhanced through partnerships with technology companies focused on AI vision, route optimization, and real-time fleet analytics. As city governments adopt autonomous transportation pilots, cars are emerging as the preferred format due to their agility and widespread user acceptance.

Passenger transport is expected to represent 61.5% of the robotaxi market’s total revenue share in 2025, reflecting strong demand for autonomous mobility solutions in urban centers. The dominance of this segment is being fueled by the growing demand for on-demand ride services and the need to address driver shortages across global cities. Robotaxis configured for passenger movement are being actively integrated into public transit strategies, offering a cost-effective, scalable alternative to traditional human-driven ride-hailing services.

The advancement of software-defined control systems and fleet orchestration platforms has enabled real-time routing, demand prediction, and passenger experience personalization, enhancing service reliability. Rising urban congestion, consumer preference for contactless mobility, and growing trust in autonomous safety protocols have also contributed to accelerated deployment in the passenger transport segment.

Furthermore, supportive regulatory environments in technology-forward cities are encouraging commercial trials and revenue-generating models. As automation continues to reshape commuter behavior, passenger transport remains at the forefront of robotaxi deployment strategies.

The car rental segment is forecast to account for 58.9% of the total revenue share in the robotaxi market by 2025, establishing it as the leading service type. The growth of this segment is being influenced by the integration of autonomous vehicles into fleet-based rental business models, enabling users to access mobility solutions without long-term ownership commitments. Car rental firms are actively investing in autonomous vehicle technologies to expand their offerings, improve fleet utilization, and reduce operational overhead by minimizing human driver dependency.

The ability to deploy robotaxis on flexible, short-term rental models has found strong traction in both business travel and leisure markets, especially in tech-forward urban regions. Software-defined scheduling, predictive maintenance, and AI-powered vehicle allocation systems are enabling real-time optimization of rental operations.

In parallel, insurance frameworks and liability models tailored to autonomous rentals are gaining regulatory clarity, supporting broader commercial adoption. As convenience and autonomy converge, car rental is emerging as a pivotal channel for introducing robotaxis into mainstream transportation systems.

Robotaxi growth is being supported by regulatory approvals, fleet integration strategies, and partnerships with ride-hailing operators. AI-driven optimization, electrification, and in-vehicle monetization are creating operational efficiency and new revenue opportunities for autonomous mobility services.

Robotaxi adoption has been influenced by regulatory approvals in major economies and structured deployment strategies by mobility service operators. Fleet integration programs are being prioritized by transportation companies to optimize operational efficiency and reduce reliance on human drivers. Autonomous driving technology has reached a stage where Level 4 systems are being tested in controlled environments, enabling incremental scaling of services. Partnerships between automakers and ride-hailing platforms have provided a foundation for market penetration. Safety compliance remains an important determinant for regional expansion, as authorities evaluate autonomous mobility frameworks. Economic incentives for reducing driver costs and improving fleet utilization are positioning robotaxi services as an attractive alternative in metropolitan and suburban areas with high commuter density.

The introduction of artificial intelligence in route optimization and predictive analytics has transformed the operational economics of robotaxi services. Algorithms are being applied for real-time decision-making, enabling vehicles to respond to variable traffic conditions and maximize trip efficiency. Electrification of robotaxi fleets is accelerating due to reduced maintenance requirements and compatibility with autonomous platforms. Charging infrastructure expansion is being incentivized in regions promoting zero-emission transport solutions, which enhances adoption feasibility. Strategic alliances between technology providers and automotive OEMs are shaping competitive advantages through software-driven differentiation. The ability to monetize in-vehicle services such as infotainment and targeted advertising is creating revenue diversification beyond passenger fares, reinforcing the long-term viability of the robotaxi business model.

The robotaxi market is witnessing significant traction as cities and mobility operators integrate autonomous fleets into shared transport ecosystems. Demand is accelerating due to the need for cost-optimized, driverless solutions that can enhance efficiency in ride-hailing and point-to-point transportation. Pilot programs launched in the United States, Europe, and Asia are validating operational models, with governments framing supportive regulations for deployment. The integration of AI-based navigation systems and LiDAR sensors has enhanced route accuracy and passenger safety, increasing confidence in these services. Companies are also leveraging connected platforms for real-time fleet management, ensuring optimal utilization of vehicles and reducing idle times, which contributes to higher profitability for service providers operating at scale.

The transition toward electric mobility is influencing the configuration of robotaxi fleets, as operators prioritize vehicles with zero-emission profiles to comply with regional emission targets and reduce operating costs. The integration of fast-charging technologies and battery-swapping solutions is emerging as a critical enabler for fleet efficiency. Automakers and technology companies are collaborating to develop modular platforms optimized for autonomous ride-sharing, reducing design complexities while improving energy performance. This synergy between automation and electrification creates a dual advantage for market players, combining lower maintenance costs with enhanced operational range, positioning robotaxis as a transformative solution in the evolving mobility landscape.

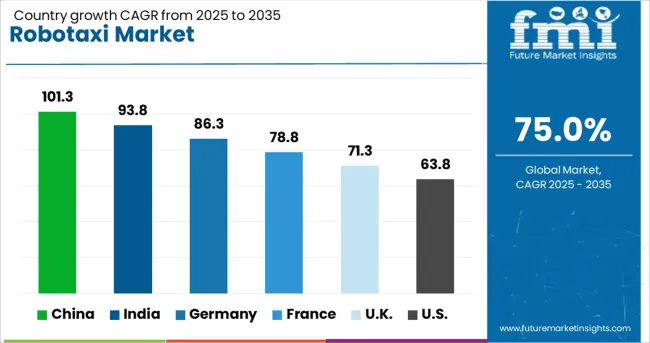

| Country | CAGR |

|---|---|

| China | 101.3% |

| India | 93.8% |

| Germany | 86.3% |

| France | 78.8% |

| UK | 71.3% |

| USA | 63.8% |

The robotaxi industry, projected to expand at a global CAGR of 75% from 2025 to 2035, is experiencing significant momentum in key markets. China is leading adoption with a CAGR of 101.3%, driven by aggressive pilot programs, rapid electrification, and strong government-backed smart mobility initiatives. India follows with a CAGR of 93.8%, supported by large-scale ride-hailing integration and cost-focused strategies that favor autonomous fleet deployment in densely populated corridors. Germany, with an 86.3% CAGR, is advancing through regulatory flexibility and integration of premium automotive brands into autonomous networks. Moderate but substantial growth is evident in the United Kingdom at 71.3%, aided by technology partnerships and urban mobility programs. The United States, with a CAGR of 63.8%, is concentrating on AI-enabled platforms and collaborations between tech giants and automotive OEMs. Emerging economies and established automotive hubs are shaping a competitive global landscape, with Asia-Pacific leading in scale and innovation potential. The report provides an in-depth evaluation of 40+ countries, and the top five markets have been highlighted as a reference.

China recorded the most aggressive performance in robotaxi adoption during 2020 to 2024 with an estimated CAGR near 58%, driven by regulatory flexibility and investments in autonomous vehicle testing zones. This growth has accelerated from 2025 to 2035, reaching 101.3%, as smart city programs and electrification synergy strengthen deployment models. Subsidies for Level 4 platforms and integration with shared mobility networks have amplified operational scale. Strategic alliances between domestic automakers and AI developers have created localized ecosystems that reduce technology adoption barriers. The market shift highlights China’s ability to combine hardware capacity with high-density urban demand to outpace other regions globally.

India displayed an early-stage CAGR of nearly 44% between 2020 and 2024, driven by pilot deployments and regulatory experiments in metropolitan hubs. For 2025 to 2035, CAGR has surged to 93.8%, supported by cost optimization in shared mobility and robust partnerships between automakers and technology startups. Infrastructure developments such as EV charging corridors and 5G networks have reduced connectivity constraints, strengthening the foundation for autonomous taxi adoption. Local companies are pursuing hybrid business models combining subscription and per-ride billing for affordability. These transitions are placing India as a key hub for scaling low-cost robotaxi solutions.

Germany achieved an estimated CAGR of about 39% from 2020 to 2024 through controlled pilot operations supported by automotive giants. This momentum will advance significantly to 86.3% from 2025 to 2035 as the government strengthens autonomous mobility frameworks and automakers accelerate integration of self-driving technologies in premium fleets. Strong R&D investment and expansion of mobility-as-a-service models have enhanced the commercial feasibility of robotaxis across major cities. Legislative measures allowing Level 4 systems on designated roads have provided a clear roadmap for large-scale service introduction by the next decade.

The UK registered a CAGR of nearly 27% from 2020 to 2024 as pilot projects and controlled trials dominated early adoption phases. For 2025 to 2035, CAGR has risen significantly to 71.3%, attributed to improved legal frameworks, availability of AI-based navigation systems, and partnerships with major ride-hailing platforms. Integration of electrified fleets and charging infrastructure development across city clusters has created scalability for autonomous mobility services. Strategic alliances with global technology providers and emphasis on safety compliance are setting the stage for a high-performance ecosystem.

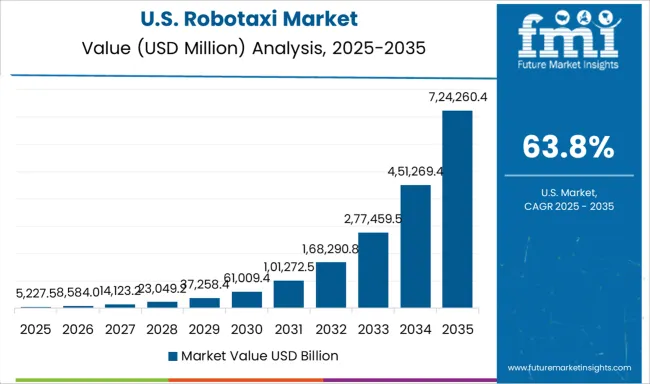

The United States delivered an approximate CAGR of 25% from 2020 to 2024 as companies focused on controlled operational zones and data validation. From 2025 to 2035, this figure advances to 63.8%, fueled by collaborations between leading tech companies and automotive OEMs to develop AI-centric robotaxi models. Enhanced adoption of EV fleets combined with predictive route optimization tools is improving economic viability. Federal and state-level incentives for zero-emission autonomous transportation have accelerated long-term investment strategies. These developments ensure a progressive expansion of autonomous ride-hailing services across key urban corridors.

The global robotaxi market is dominated by companies leveraging AI-driven platforms, electrified fleets, and advanced automation to establish leadership in shared autonomous mobility. Waymo LLC stands out with its Waymo One service, integrating proprietary LiDAR, radar, and AI-based navigation for real-time decision-making, while focusing on ride-hailing partnerships to accelerate user adoption. Baidu Inc. is aggressively expanding its Apollo Go service across Chinese cities, prioritizing regulatory compliance and electrification strategies to meet local emission mandates. Cruise LLC, supported by General Motors, has advanced Level 4 autonomy through extensive testing in U.S. urban centers, emphasizing safety redundancy and software refinement for large-scale commercialization.

Beijing Didi Chuxing Technology Company Ltd. explores hybrid deployment models blending autonomous and human-assisted rides to optimize service flexibility during transition phases. AutoX and Pony.ai are scaling operations in Asia-Pacific, leveraging AI-based decision systems and cost-efficient fleet architectures. Aurora Innovation and Zoox, an Amazon-backed entity, are investing in purpose-built vehicles for autonomous ride-hailing, emphasizing design optimization for passenger comfort and energy efficiency. Mobileye focuses on hardware-software integration through its camera-centric approach, while Tesla Inc. is pushing semi-autonomous features to gradually transition toward full autonomy. Collectively, these companies are aligning strategies around safety compliance, AI scalability, and fleet electrification, positioning robotaxis as a transformative solution in future urban and intercity transportation ecosystems worldwide.

In January 2024, Cruise LLC (General Motors-backed), an internal corporate investigation blamed leadership failures for Cruise’s DMV suspension. GM announced restructuring plans.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Vehicle Type | Cars and Vans |

| Application | Passenger transport and Good transport |

| Service Type | Car rental and Station based |

| End Use | Shared mobility and Corporate fleet |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Waymo LLC, Baidu,Inc., BeijingDidiChuxingTechnologyCompanyLtd., and CruiseLLC |

| Additional Attributes | Dollar sales by region, share of autonomous fleet operators, competitive landscape, regulatory frameworks, adoption rate in ride-hailing, EV integration trends, AI-driven navigation systems, and growth projections for 2025–2035. |

The global robotaxi market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the robotaxi market is projected to reach USD 403.3 billion by 2035.

The robotaxi market is expected to grow at a 75.0% CAGR between 2025 and 2035.

The key product types in robotaxi market are cars and vans.

In terms of application, passenger transport segment to command 61.5% share in the robotaxi market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA