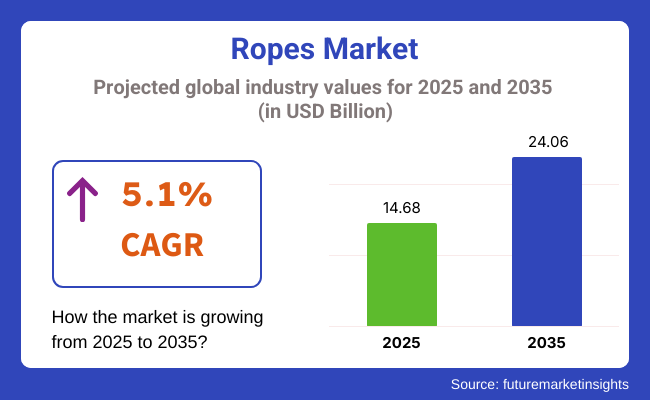

The industry size was valued at USD 14.68 billion in 2025 and is expected to grow at a 5.1% CAGR from 2025 to 2035. The industry is expected to reach USD 24.06 billion by 2035. A major key driver of this growth is the steady rise in maritime activity and infrastructure development, which continue to demand high-performance rope solutions across industrial, marine, recreational, and safety applications.

Advanced construction and utility sectors increasingly demand heavy-duty lifting, rigging, and load management cables due to urban development, mining, and energy projects of large scale. The advent of synthetic fiber cables with greater strength-to-weight ratios, corrosion resistance, and improved longevity has drastically pushed the replacement of conventional steel wire cables in key applications.

Also, marine and offshore sectors continue to be core centers of demand, where mooring, towing, and anchoring systems rely on dependable, high-tensile cables. With the development of renewable energy installations, especially offshore wind farms, rope producers are experiencing growing needs for advanced fiber cables with better fatigue resistance and environmental tolerance, creating new niches in the segment.

Sports and leisure applications are also fueling growth. Climbing, sailing, and adventure travel are pushing the development of lightweight, wear-resistant cables for safety and dynamic performance. These needs have led players to make significant investments in material science, including hybrid fibers, UV protection coatings, and intelligent ropes that can measure stress and use over time.

Throughout the forecast, expansion will be driven by investments in predictive maintenance and automation technologies, which aid in monitoring rope lifespan and performance in mission-critical applications. Rope solutions based on regional safety standards, environmental resistance, and particular tensile loads will establish competitive edge as end-users become more demanding in terms of both reliability and lifecycle efficiency.

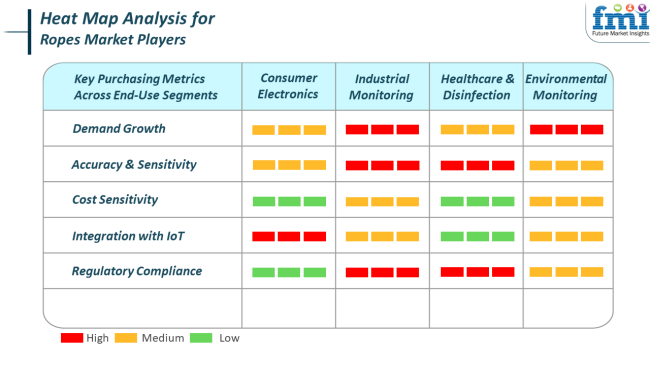

The industrial monitoring applications drive the majority of demand for precision-engineered solutions. These segments require cables with proven tensile properties, environmental durability, and regulatory compliance, particularly in energy, utilities, and transportation systems. As industries become mechanized, smart ropes with embedded sensors are gaining traction.

The consumer uses-like sporting gear and personal protection gear-are more focused on lightweight and appearance but require performance stability under dynamic load. In healthcare and disinfection uses, ropes are used in mobility assist devices and sterilizable systems for facilities and must have hypoallergenic coating and antimicrobial treatments.

Environmental protection and surveillance operations increasingly use cables in extreme terrain and conditions in inaccessible locations, with emphasis on maximizing strength-to-weight ratios and environmentally friendly manufacturing. On all ends of applications, the purchasing decision is made based on a combination of material performance, compliance with safety standards, and compatibility with existing facilities or equipment.

One of the most important risks faced by the industry is volatility in raw material costs, especially for synthetic fiber raw materials like polypropylene, nylon, and aramid, which are petroleum-derived. Price volatility can compress margins and disrupt long-term supply contracts, especially with producers that are not backward integrated or have multiple procurement policies.

Product failure liability for safety-critical applications is also a point of concern. Rope products utilized in high-load or risk-intensive situations need quality and traceability standards. Failure, particularly in construction, offshore, or recreation uses, can result in significant reputational damage as well as liability to lawsuits; hence, quality checks and certification are a requirement.

Finally, there is increasing regulatory and environmental pressure on producers to reduce microplastic loss and improve the biodegradability of synthetic ropes. As sustainability becomes a norm of purchasing, companies that fail to innovate in green formulations or circular production models stand to be excluded from green-led projects and public procurement.

There was steady growth between 2020 and 2024, with rising demand in industries such as construction, marine, oil and gas, and logistics. Growing infrastructure projects, increasing maritime activity, and offshore drilling operations resulted in a higher demand for durable, long-lasting ropes.More stringent safety and efficiency requirements in industrial applications also triggered demand for special rope solutions.

During the forecast period, the industry will be propelled by several key trends. The introduction of new materials, such as ultra-high molecular weight polyethylene (UHMWPE) fibers, into rope manufacturing will improve strength-to-weight ratios and toughness, meeting expectations for high-performance applications.

Further, the use of synthetic ropes will also expand based on their greater resistance to the environment and lower maintenance requirements. The increased focus on sustainability will also create opportunities for innovation in sustainable rope materials and processes, which will be in line with global environmental targets.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Maritime expansion, industrial safety, and infrastructure development | New material adoption, synthetic ropes, and sustainability drivers |

| Designing long-life and high-performance ropes for various applications | Addition of UHMWPE fibers, green materials, and smart rope technologies |

| Opting for reliable and cost-effective rope solutions | Demand for light, strong, and environmentally friendly rope products |

| Growth in emerging region s and industrialized economic hubs | Growth in renewable energy sectors and remote infrastructure projects |

| Initial developments toward sustainable practices in rope manufacturing | Mass adoption of sustainable materials and manufacturing processes |

| Limited use of technology in applications for ropes | Increased integration of smart technologies and digital monitoring systems into ropes |

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 5.6% |

| UK | 4.7% |

| France | 4.5% |

| Germany | 4.9% |

| Italy | 4.3% |

| South Korea | 5.0% |

| Japan | 4.4% |

| China | 6.3% |

| Australia-New Zealand | 4.6% |

The USA is anticipated to witness growth at 5.6% CAGR over the analysis period. The USA is on the threshold of strong growth, driven by growing sectors including construction, oil & gas, marine, and defense. Continued investment in infrastructure upgrading and offshore energy exploration is elevating demand for high-tensile, corrosion-resistant steel and synthetic cables.

In addition, the growing popularity of adventure sports and leisure activities like climbing, sailing, and boating is generating additional consumer demand for performance- and safety-oriented rope solutions. Technological advancements in materials like HMPE (High Modulus Polyethylene) and aramid fibers are revolutionizing the strength-to-weight ratio and durability of cables, which is drawing broad industrial acceptance.

The defense industry is also an important contributor. Heavy cables are used in parachuting, rescue operations, and logistics. Developing safety standards and strict standards in various sectors ensures that there is a continued demand for certified and state-of-the-art rope products. Moreover, increasing domestic manufacturing and product customization in accordance with the needs of the sector is likely to maintain the United States as a global leader in the industry.

The UK will grow at 4.7% CAGR during the forecast period. The UK is influenced by well-established maritime, construction, and industrial logistic industries. Maritime safety focus and naval industry development in the nation guarantee steady demand for marine-grade ropes, especially in ports, offshore platforms, and shipyards. The growth of renewable energy projects, especially offshore wind farms, also supports ropes for use in anchoring, mooring, and cable-laying applications.

Furthermore, urban redevelopment projects and a focus on high-rise construction are stimulating the need for lifting and hoisting solutions using durable synthetic and steel wire ropes. The industrial shift towards sustainability is driving interest in recyclable materials and eco-friendly production processes.

Domestic rope manufacturers and specialized suppliers continue to innovate by offering lightweight, high-strength products tailored for various commercial uses. As regulations become more stringent and industry-specific standards change, the UK is poised for steady, innovation-led growth through 2035.

France will grow at 4.5% CAGR over the study period. The country is driven by its robust aerospace, construction, and maritime industries. As the nation invests in infrastructure and transportation improvements, such as bridge reconstruction and urban smart city growth, demand for safe lifting and load-carrying systems utilizing high-tech ropes has grown. The marine industry along the Atlantic and Mediterranean shores also requires reliable ropes for offshore operations, fishing, and docking on a constant basis.

The climbing and sports industry also provides growth as France continues to encourage outdoor sports and mountain tourism. The country's rope producers are embracing new performance and safety standards, particularly in heavy-duty machinery and industrial crane applications.

The emphasis on carbon neutrality and sustainable production is driving innovation in recyclable and biodegradable materials. France's engagement in EU-wide safety standards and environmental regulations guarantees that the industry has a robust basis for sustainable growth throughout the forecast period.

Germany is anticipated to exhibit 4.9% CAGR growth within the study duration. Being one of the best industrial powerhouses in Europe, Germany provides the ideal setting for the development of the ropes business, especially among industries like engineering, automotive, manufacturing, and heavy machinery industries. The use of automation in material handling and logistics has witnessed the need for high break strength and high precision-performing towing ropes and lifting ropes. The growth of smart cities and energy infrastructure, including windmills and rail systems, is propelling higher consumption of metal and synthetic wire ropes.

Germany's expansive agriculture and forestry industries also fuel the need for long-lasting, weather-resistant ropes. Germany's manufacturing industry focuses on quality, precision, and sustainability and consequently employs high-performance, environmentally friendly materials. Local suppliers are capable of catering to domestic markets and regional markets, having strong distribution networks and export partnerships backing them.

Italy will grow at 4.3% CAGR over the study period. Heritage industries like marine transport, construction, and craft production influence the sector in Italy. The nation's extensive coastline sustains a robust maritime economy that consistently demands ropes for mooring, lifting, and netting uses. In addition, infrastructure rehabilitation and seismic-resistant building practices are fueling demand for construction-grade ropes with high safety profiles.

The Italian market is also supplemented by tourism and sport, where climbing, sailing, and other leisure rope applications are high. Italian manufacturers concentrate on product design and functionality, tending to balance strength with appearance. As there is a growing trend towards environmentally friendly products, rope manufacturers are moving towards recyclable polymers and greener production methods. Growth is also forecast in niche areas like theater rigging, rescue, and manufacturing automation, spurring diversification in product development and distribution.

The South Korean market is forecast to grow at 5.0% CAGR over the study period. South Korea is increasing in line with industrial expansion in shipbuilding, construction, and energy industries. The nation's leadership in shipping and offshore engineering globally requires extensive saltwater-resistant and abrasion-resistant marine rope consumption.

The growth of urban infrastructure development and vertical construction tendencies has raised the demand for hoisting, lifting, and fall protection system ropes that are applied in safety rope usage.

Also, South Korea's government-impelled compliance with safety measures and technology spending is driving the innovation of rope material and performance. High-end synthetic ropes that are UV-resistant and feature smart monitoring are making their way into the marketplace, particularly in industries such as defense and rescue services. The sports and recreation industry, including indoor climbing gyms and outdoor adventure parks, is also adding to higher use.

Japan is projected to grow at 4.4% CAGR throughout the study. Japan is closely associated with its high-end manufacturing, maritime, and construction industries. Owing to the natural disaster risk faced by Japan, construction operations demand stringent safety features, such as certified load-bearing and lifting cables. Apart from this, Japan's fishing industry is still one of the biggest in the world, underpinning constant demand for long-lasting marine cables used in hostile operating conditions.

It is also a big user of advanced synthetic materials of high performance used in engineering purposes, including ultra-high molecular weight polyethylene (UHMWPE) and Kevlar, providing for lightweight but very durable rope use. Japan's emphasis on technological advancement and the quality of products is causing ropes to be incorporated into automation and high-precision logistic systems.

In addition, an aging population has contributed to the development of rescue and elderly care systems in which rope-based safety equipment is crucial. Sustainability factors are becoming increasingly significant, leading to more use of bio-based rope materials.

Chinais anticipated to expand at 6.3% CAGR over the forecast period. China is one of the fastest-growing markets in the world, driven by enormous industrialization, infrastructure growth, and oceanic expansion. The Belt and Road Initiative and the development of high-speed rail are the most important drivers of the demand for ropes in civil engineering usage. Concurrently, the shipping business and port expansion projects of China continue to use enormous quantities of marine ropes.

In the domestic industrial market, ropes find widespread application in mining, construction, oil & gas, and agriculture, driving varied product demands. Domestic producers are increasing production capacities and shifting towards high-performance synthetic variants for both domestic and export markets.

Sports and leisure markets are also growing at a fast pace, and government support for fitness and tourism is driving increased usage of climbing and adventure gear. With a developing safety compliance environment and a robust e-commerce platform for industrial products, China is likely to continue to lead innovation.

The Australia-New Zealand region will grow at 4.6% CAGR throughout the study. Resource-intensive industries like mining, agriculture, marine services, and construction dominate Australia and New Zealand. These industries require abrasion-resistant, UV-stable, and water-resistant variants, ensuring performance and material stability as major buying criteria. Synthetic and high-grade steel wire options are extensively used for lifting, hoisting, and anchoring operations across both nations.

The increasing renewable energy and offshore wind industry is opening new avenues for high-technology tensioning and mooring ropes. Furthermore, outdoor recreation, such as rock climbing, sailing, and camping, is prevalent in both nations, leading to consistent consumer demand.

Compliance with workplace safety and load management regulations is rigorously enforced, leading to ongoing investment in certified rope solutions. Local and foreign manufacturers enjoy a strong distribution network and a high level of awareness of safety protocols.

By product, the segmentation is into synthetic and steel wire ropes, with synthetic representing 40% and steel wire acquiring 35% in 2025.

Industrial applications of synthetic ropes have increased notably owing to their excellent strength-to-weight ratio and corrosion resistance, as well as the high flexibility they provide. Therefore, they are preferred in offshore oil and gas operations, marine applications, and recreational sports, where lightweight yet durable solutions are a necessity. Innovations in this segment have been chiefly spearheaded by manufacturers like Teufelberger and Samson Rope Technologies, which have created products designed to survive in extreme conditions.

The advancement in demand is being triggered by their emerging ability to replace traditional steel counterparts in such applications where lightweight and corrosion resistance are necessary inputs. Handling and maintenance have become much easier with synthetic options than with steel, making them preferred for a wide range of industrial and recreational activities.

Meanwhile, steel wire ropes remain the mainstay in industries like construction, mining, and industrial machinery, where heavy-duty performance and load-bearing capacity come to the fore. Steel wire ropes are highly regarded for their durability and their capability of handling heaps and heavy-duty applications.

WireCo WorldGroup, Usha Martin, etc., are considered leading players in the steel wire rope market, and their products comply with the high standards imposed by these industries. Even with the increasing adoption of synthetic ropes, steel wire ropes are now indispensable in critical high-load applications.

By the year 2025, the industry is likely to show a wide split between industrial and commercial end-users, putting the industrial application at the forefront with 45%, followed by commercial applications with approximately 35% of the overall share.

The requirement will mostly be demand-driven in industries like construction, mining, offshore oil and gas, and heavy-duty machinery. Such sectors use options with properties of high durability and high performance under adverse conditions; for instance, WireCo WorldGroup and Teufelberger produce custom solutions for these industries, from steel wire for very heavy loads to synthetic types for lightweight, corrosion-resistant applications.

The industrial user will, therefore, rely mainly on these tools because of their load-bearing capacity and ability to survive rougher environments; the demand for strong and trustworthy variants will be greater as industries move towards automation, supporting the ever-expanding infrastructure projects across the globe.

Commercial end-users will always be a vital factor in growth, and this includes shipping, entertainment, and recreational activities. Such applications use ropes for nonindustrial purposes, such as mooring and docking in shipping or rigging and staging in the entertainment industry.

Rope manufacturers such as Samson Rope Technologies and New England Ropes develop ropes for commercial use, focusing on strength and reliability in recreational sports, including rock climbing, marine activity, and beyond. With the increasing popularity of outdoor and adventure sports, commercial applications will make a sizable contribution to the industry.

The industrial sector dominates with a greater share owing to heavy demand for heavy-duty ropes. In contrast, steady growth of the commercial sector is anticipated with increasing demand for ropes in recreational and specialized commercial applications.

Industrial strength and the power of technical innovationare exemplified by robust players such as Bridon-Bekaert, TEUFELBERGER, WireCo WorldGroup, Yale Cordage, and Marlow Ropes. They focus on high-performance rope solutions and application areas that include maritime, industrial, energy, and rescue-type areas. Synthetic fiber rope innovation and improvement in durability are mainly focused on customer customization for special industries.

Bridon-Bekaert has an anchoring industrial legacy with strong value products, especially in mining and offshore applications. TEUFELBERGER continued to lead in lightweight, high-strength fiber rope innovations, with a strong emphasis on climbing, arborist, and industrial markets. WireCo Worldwide has increased its manufacturing and services footprint throughout the world while also diversifying its portfolio, including both wire and synthetic ropes.

Yale Cordage has made other significant advances in advanced synthetic rope technologies and has a strong presence in the defense and utility markets. Meanwhile, Marlow Ropes is recognized for its commitment to sustainability and innovation development in the marine and renewable energy sectors, such as offshore wind projects.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Bridon-Bekaert | 18-22% |

| TEUFELBERGER | 14-18% |

| WireCo WorldGroup, Inc. | 12-16% |

| Yale Cordage | 10-14% |

| Marlow Ropes | 8-12% |

| Other Players | 24-30% |

| Company Name | Offerings & Activities |

|---|---|

| Bridon-Bekaert | Specializes in mining, oil & gas, and offshore ropes with high fatigue resistance. |

| TEUFELBERGER | Produces synthetic and hybrid ropes for climbing, safety, and marine use. |

| WireCo WorldGroup, Inc. | It offers a wide range of ropes for the industrial, crane, and construction industrie s. |

| Yale Cordage | Known for synthetic rope solutions in the military , electrical utilities, and rescue operations. |

| Marlow Ropes | Focuses on marine, defense, and renewable energy applications with eco-friendly designs. |

Key Company Insights

Bridon-Bekaert (18-22%)

A key leader in high-strength steel and synthetic ropes, strong in heavy industry and offshore use.

TEUFELBERGER (14-18%)

Lightweight synthetic rope innovator with a global stronghold in climbing, arborist, and industrial rope systems.

WireCo WorldGroup (12-16%)

A diversified global supplier with robust production and a balanced product mix of synthetic and steel rope products.

Yale Cordage (10-14%)

Synthetic rope development technology leader for safety-critical applications such as defense and utilities.

Marlow Ropes (8-12%)

Catching pace in eco-innovation through biodegradable and recyclable ocean rope products.

The segmentation is into Synthetic, Steel Wire, Cotton, and Others.

The segmentation is into Industrial, Commercial, and Residential end-users.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and Middle East and Africa.

The ropes market is projected to be valued at USD 14.68 billion in 2025, with steady growth driven by the increasing demand for both synthetic and steel wire ropes.

The industry size is expected to reach USD 24.06 billion by 2035, reflecting a strong demand for ropes across various industries such as construction, marine, and industrial applications.

China is expected to experience notable growth with a 6.3% CAGR, driven by expanding industrial applications and infrastructure projects.

The increasing use in industries like construction, mining, oil and gas, shipping, and sports fuels the demand. Technological advancements in synthetic ropes and their superior durability are also contributing to sales growth.

Key players in the ropes market include Bridon-Bekaert, TEUFELBERGER, WireCo WorldGroup, Inc., Yale Cordage, Marlow Ropes, MAGENTO, INC. (English Braids Ltd.), Cortland Limited, Southern Ropes, van Beelen Group BV, and Dynamica Ropes.

Table 1: Global Market Value (US$ billion) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (meters) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ billion) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (meters) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ billion) Forecast by End-Users, 2018 to 2033

Table 6: Global Market Volume (meters) Forecast by End-Users, 2018 to 2033

Table 7: North America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (meters) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ billion) Forecast by Product, 2018 to 2033

Table 10: North America Market Volume (meters) Forecast by Product, 2018 to 2033

Table 11: North America Market Value (US$ billion) Forecast by End-Users, 2018 to 2033

Table 12: North America Market Volume (meters) Forecast by End-Users, 2018 to 2033

Table 13: Latin America Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (meters) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ billion) Forecast by Product, 2018 to 2033

Table 16: Latin America Market Volume (meters) Forecast by Product, 2018 to 2033

Table 17: Latin America Market Value (US$ billion) Forecast by End-Users, 2018 to 2033

Table 18: Latin America Market Volume (meters) Forecast by End-Users, 2018 to 2033

Table 19: Western EuRopes Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 20: Western EuRopes Market Volume (meters) Forecast by Country, 2018 to 2033

Table 21: Western EuRopes Market Value (US$ billion) Forecast by Product, 2018 to 2033

Table 22: Western EuRopes Market Volume (meters) Forecast by Product, 2018 to 2033

Table 23: Western EuRopes Market Value (US$ billion) Forecast by End-Users, 2018 to 2033

Table 24: Western EuRopes Market Volume (meters) Forecast by End-Users, 2018 to 2033

Table 25: Eastern EuRopes Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 26: Eastern EuRopes Market Volume (meters) Forecast by Country, 2018 to 2033

Table 27: Eastern EuRopes Market Value (US$ billion) Forecast by Product, 2018 to 2033

Table 28: Eastern EuRopes Market Volume (meters) Forecast by Product, 2018 to 2033

Table 29: Eastern EuRopes Market Value (US$ billion) Forecast by End-Users, 2018 to 2033

Table 30: Eastern EuRopes Market Volume (meters) Forecast by End-Users, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (meters) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ billion) Forecast by Product, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (meters) Forecast by Product, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ billion) Forecast by End-Users, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (meters) Forecast by End-Users, 2018 to 2033

Table 37: East Asia Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (meters) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ billion) Forecast by Product, 2018 to 2033

Table 40: East Asia Market Volume (meters) Forecast by Product, 2018 to 2033

Table 41: East Asia Market Value (US$ billion) Forecast by End-Users, 2018 to 2033

Table 42: East Asia Market Volume (meters) Forecast by End-Users, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ billion) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (meters) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ billion) Forecast by Product, 2018 to 2033

Table 46: Middle East and Africa Market Volume (meters) Forecast by Product, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ billion) Forecast by End-Users, 2018 to 2033

Table 48: Middle East and Africa Market Volume (meters) Forecast by End-Users, 2018 to 2033

Figure 1: Global Market Value (US$ billion) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ billion) by End-Users, 2023 to 2033

Figure 3: Global Market Value (US$ billion) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ billion) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (meters) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ billion) Analysis by Product, 2018 to 2033

Figure 9: Global Market Volume (meters) Analysis by Product, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 12: Global Market Value (US$ billion) Analysis by End-Users, 2018 to 2033

Figure 13: Global Market Volume (meters) Analysis by End-Users, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Users, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Users, 2023 to 2033

Figure 16: Global Market Attractiveness by Product, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Users, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ billion) by Product, 2023 to 2033

Figure 20: North America Market Value (US$ billion) by End-Users, 2023 to 2033

Figure 21: North America Market Value (US$ billion) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (meters) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ billion) Analysis by Product, 2018 to 2033

Figure 27: North America Market Volume (meters) Analysis by Product, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 30: North America Market Value (US$ billion) Analysis by End-Users, 2018 to 2033

Figure 31: North America Market Volume (meters) Analysis by End-Users, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Users, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Users, 2023 to 2033

Figure 34: North America Market Attractiveness by Product, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Users, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ billion) by Product, 2023 to 2033

Figure 38: Latin America Market Value (US$ billion) by End-Users, 2023 to 2033

Figure 39: Latin America Market Value (US$ billion) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (meters) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ billion) Analysis by Product, 2018 to 2033

Figure 45: Latin America Market Volume (meters) Analysis by Product, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 48: Latin America Market Value (US$ billion) Analysis by End-Users, 2018 to 2033

Figure 49: Latin America Market Volume (meters) Analysis by End-Users, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Users, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Users, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Users, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western EuRopes Market Value (US$ billion) by Product, 2023 to 2033

Figure 56: Western EuRopes Market Value (US$ billion) by End-Users, 2023 to 2033

Figure 57: Western EuRopes Market Value (US$ billion) by Country, 2023 to 2033

Figure 58: Western EuRopes Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 59: Western EuRopes Market Volume (meters) Analysis by Country, 2018 to 2033

Figure 60: Western EuRopes Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western EuRopes Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western EuRopes Market Value (US$ billion) Analysis by Product, 2018 to 2033

Figure 63: Western EuRopes Market Volume (meters) Analysis by Product, 2018 to 2033

Figure 64: Western EuRopes Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 65: Western EuRopes Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 66: Western EuRopes Market Value (US$ billion) Analysis by End-Users, 2018 to 2033

Figure 67: Western EuRopes Market Volume (meters) Analysis by End-Users, 2018 to 2033

Figure 68: Western EuRopes Market Value Share (%) and BPS Analysis by End-Users, 2023 to 2033

Figure 69: Western EuRopes Market Y-o-Y Growth (%) Projections by End-Users, 2023 to 2033

Figure 70: Western EuRopes Market Attractiveness by Product, 2023 to 2033

Figure 71: Western EuRopes Market Attractiveness by End-Users, 2023 to 2033

Figure 72: Western EuRopes Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern EuRopes Market Value (US$ billion) by Product, 2023 to 2033

Figure 74: Eastern EuRopes Market Value (US$ billion) by End-Users, 2023 to 2033

Figure 75: Eastern EuRopes Market Value (US$ billion) by Country, 2023 to 2033

Figure 76: Eastern EuRopes Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 77: Eastern EuRopes Market Volume (meters) Analysis by Country, 2018 to 2033

Figure 78: Eastern EuRopes Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern EuRopes Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern EuRopes Market Value (US$ billion) Analysis by Product, 2018 to 2033

Figure 81: Eastern EuRopes Market Volume (meters) Analysis by Product, 2018 to 2033

Figure 82: Eastern EuRopes Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 83: Eastern EuRopes Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 84: Eastern EuRopes Market Value (US$ billion) Analysis by End-Users, 2018 to 2033

Figure 85: Eastern EuRopes Market Volume (meters) Analysis by End-Users, 2018 to 2033

Figure 86: Eastern EuRopes Market Value Share (%) and BPS Analysis by End-Users, 2023 to 2033

Figure 87: Eastern EuRopes Market Y-o-Y Growth (%) Projections by End-Users, 2023 to 2033

Figure 88: Eastern EuRopes Market Attractiveness by Product, 2023 to 2033

Figure 89: Eastern EuRopes Market Attractiveness by End-Users, 2023 to 2033

Figure 90: Eastern EuRopes Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ billion) by Product, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ billion) by End-Users, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ billion) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (meters) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ billion) Analysis by Product, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (meters) Analysis by Product, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ billion) Analysis by End-Users, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (meters) Analysis by End-Users, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Users, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Users, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-Users, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ billion) by Product, 2023 to 2033

Figure 110: East Asia Market Value (US$ billion) by End-Users, 2023 to 2033

Figure 111: East Asia Market Value (US$ billion) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (meters) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ billion) Analysis by Product, 2018 to 2033

Figure 117: East Asia Market Volume (meters) Analysis by Product, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 120: East Asia Market Value (US$ billion) Analysis by End-Users, 2018 to 2033

Figure 121: East Asia Market Volume (meters) Analysis by End-Users, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-Users, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-Users, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-Users, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ billion) by Product, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ billion) by End-Users, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ billion) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ billion) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (meters) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ billion) Analysis by Product, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (meters) Analysis by Product, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ billion) Analysis by End-Users, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (meters) Analysis by End-Users, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Users, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Users, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-Users, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

China Elevator Ropes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA