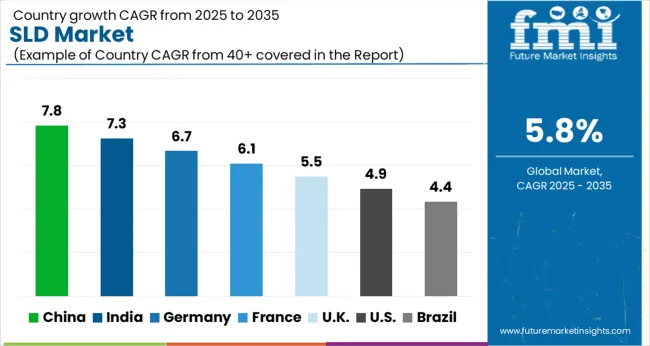

The SLD Market is estimated to be valued at USD 82.8 billion in 2025 and is projected to reach USD 145.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| SLD Market Estimated Value in (2025 E) | USD 82.8 billion |

| SLD Market Forecast Value in (2035 F) | USD 145.5 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The SLD market is witnessing steady expansion as digital systems become more integrated across consumer electronics, automotive, industrial automation, and telecommunications. Standard logic devices continue to serve as foundational elements for low-latency signal processing, interfacing, and level shifting functions.

Growing adoption of embedded systems, sensor fusion modules, and complex SoC architectures has amplified demand for compact, energy-efficient, and high-speed logic gates and drivers. Additionally, widespread efforts toward miniaturization and the integration of fail-safe control systems in mission-critical environments are encouraging manufacturers to invest in robust logic circuits with high switching accuracy and reliability.

With the rollout of AI workloads and edge computing, demand for specialized buffer and transceiver configurations is expected to grow, particularly in high-frequency environments. Continued emphasis on product lifecycle optimization, packaging innovation, and RoHS-compliant manufacturing processes will further define the competitive landscape of the global SLD market.

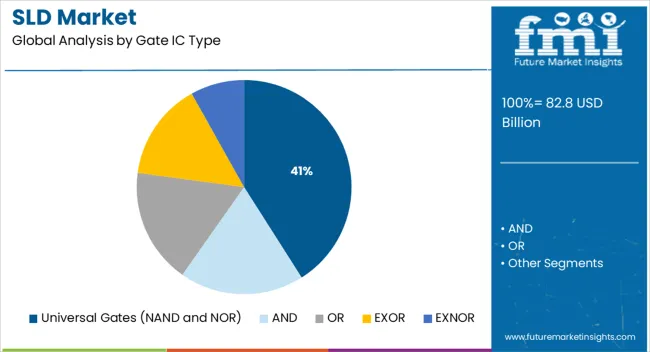

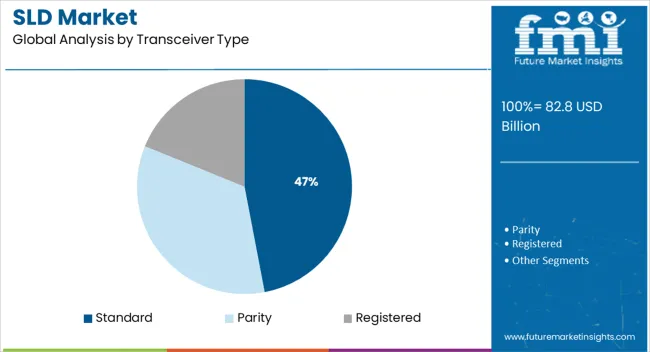

The market is segmented by Gate IC Type, Buffer/Driver Type, Transceiver Type, Flip-Flop/Latches Type, Switches and Multiplexer Type, and Registers Type and region. By Gate IC Type, the market is divided into Universal Gates (NAND and NOR), AND, OR, EXOR, and EXNOR. In terms of Buffer/Driver Type, the market is classified into Inverting and Non-inverting. Based on Transceiver Type, the market is segmented into Standard, Parity, and Registered. By Flip-Flop/Latches Type, the market is divided into D flip flop, SR flip flop, JK flip flop, and T flip flop. By Switches and Multiplexer Type, the market is segmented into Analog, Buffered, and Protocol Specific. By Registers Type, the market is segmented into Storage Registers and Shift Registers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Universal gates, primarily NAND and NOR, are projected to contribute 41.0% of the total SLD market revenue in 2025, making them the leading gate IC type segment. Their dominance is being driven by their versatility in constructing any digital logic function, which has made them essential building blocks in both combinational and sequential logic designs.

The ability of these gates to reduce circuit complexity and lower chip count has resulted in widespread integration into microcontrollers, digital signal processors, and programmable logic devices. Their superior switching performance, minimal propagation delay, and cost-effectiveness have further solidified their role in compact electronic modules.

As miniaturization and multi-functionality remain central to device innovation, NAND and NOR gates continue to serve as the foundation for logic design efficiency in mass-produced electronics.

The inverting buffer/driver segment is anticipated to account for 58.0% of the market revenue in 2025, making it the dominant category within buffer/driver types. This segment’s strength stems from its critical role in ensuring signal integrity by reversing logic levels while amplifying voltage or current to drive high-capacitance loads.

Inverting drivers are commonly utilized in timing-sensitive digital applications, where precise edge timing and minimized signal degradation are essential. Their integration into clock distribution, data bus management, and level-shifting applications has made them indispensable in high-density printed circuit board (PCB) layouts.

Enhanced noise immunity, along with compatibility with low-voltage logic families such as LVTTL and CMOS, has expanded their utility in modern electronic design. With rising demand for high-speed interconnects in consumer and industrial applications, inverting drivers are expected to maintain their lead due to their robustness and compact design efficiency.

Standard transceivers are projected to hold 47.0% of the overall market share in 2025, positioning them as the leading transceiver type in the SLD landscape. This dominance is attributed to their core role in bidirectional communication between logic blocks, especially in systems requiring high-speed data exchange and isolation.

Standard transceivers provide robust performance in managing voltage level mismatches and reducing signal reflections in bus-based systems. Their ability to support multiple I/O standards and configurable direction control has made them highly suitable for applications in memory interfacing, peripheral connectivity, and serial communications.

As demand grows for modular hardware platforms with seamless plug-and-play logic compatibility, standard transceivers continue to offer the flexibility and performance balance needed for scalable digital infrastructure. Their wide availability and proven reliability have further ensured their continued preference in both legacy and next-generation electronic designs.

As per the SLD Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, the market value of the SLD Market increased at around 6.4% CAGR. During the forecast period, the market is projected to grow at a CAGR of 5.8%.

Due to its growing application areas, the electronic component business has enjoyed rapid expansion in recent years. Consumer electronics items such as cell phones, DVDs, TVs, and so on, as well as workplace automation equipment such as printers and PCs, have all contributed considerably to this expansion.

This rapid expansion has prompted many firms in such sectors to establish new manufacturing facilities and increase production capacity in recent years. Furthermore, continuous technological improvements are likely to broaden the areas of application for standard logic devices, propelling the global standard logic devices (SLD) market forward during the projected period. ?

Standard logic devices & packaging have emerged as critical frameworks for facilitating the creation of extended lifetime goods and supporting the large lead times experienced by manufacturers in general. New alliances and partnerships have emerged throughout the years to fulfill the growing need for standard logic devices across semiconductor makers.

A variety of conventional 5400/7400 logic family types are in high demand, supporting the market for standard logic devices. The growing adoption of integrated circuits (ICs) can be attributed to advantages such as ease of use and quick availability. However, the sophisticated functionality of items throughout the standard logic devices (SLD) industry must be improved. The fixed functionality of ordinary logic devices makes complex features difficult to implement. Several chips must also be placed on the printed circuit board. The goods are available off the shelf.

The growing demand for logic devices that are registered-based, has boosted the expansion of the standard logic devices industry. The market is enhanced by advancements in plastic and ceramic packaging. DIP, PLCC, SOIC, PGA, BGA, & QFP are some of the popular packaging possibilities. The fast speed of digitization is a fundamental driver of the market for standard logic devices.

Rising disposable household income levels, a fast-rising population, and increased urbanization contribute to the demand for standard and sophisticated consumer electronics gadgets. For effective and suitable operation, ICs are found in a variety of electronic equipment, including cell phones, washing machines, televisions, and refrigerators.

Several top consumer electronics manufacturers, like Samsung, Apple, and Huawei, are investing heavily in releasing new gadgets to meet rising customer demand for sophisticated devices, therefore sustaining the global standard logic devices industry development.

During the projected period, Asia-Pacific held the largest share of the global SLD Market. The increased need for automation technologies in industrial applications and the automotive industry is one of the primary factors for the growth of the standard logic devices industry in this region. Automation has simplified industrial operations, while the need for driver assistance technologies has continuously increased in the vehicle sector.

The increasing use of driver assistance technology in luxury vehicles has resulted in a substantial industry trickle-down impact, pushing requirements from the standard logic devices industry across the automotive industry. As a result, the growing ultra-high-net-worth demographics in the Asia Pacific, as well as the Middle East, will be critical for the worldwide standard logic devices industry in the subsequent years.

The market in China is expected to account for the largest market of USD 145.5 Billion by the end of 2035 with an expected CAGR of 6.3% by the end of 2035.

The availability of lower-cost trained labor, suitable climatic conditions, government incentives, solid power, and water infrastructures, logistics and transportation services, and appealing investment conditions all contribute to the growth of this region's standard logic device industry. These industries provide substantial contributions to the production of standard logic ICs & devices.

The Transceiver Type segment is forecasted to grow at the highest CAGR of around 5.6% from 2025 to 2035. The primary function of a transceiver is to broadcast and receive signals. The transceiver is a component of a network interface in local area networks. The development and expanding need for wireless technologies to establish quick connections between devices is likely to drive the demand for Standard Logic Devices in the future years. Wireless communication semiconductors include Bluetooth transceivers, GPS receivers, and other devices.

The Analog segment is forecasted to grow at the highest CAGR of around 5.2% from 2025 to 2035. Switches & multiplexers are high-performance, low-cost topologies with low resistance, quicker switching, lower voltage supply, and smaller surface-mount packaging. Analog switches and multiplexers come in a broad range of configurations to fit practically any application, including multi-channel data collection systems, instrumentation, and video switching, among others.

The variable frequency of switches and multiplexers above standard electro-mechanical switches provides better signals and decreases the noise ratio. Traditional electromechanical switches have unidirectional current flow, whereas coupled switches & multiplexers create bi-gate networks which are more suited for solid state switches.

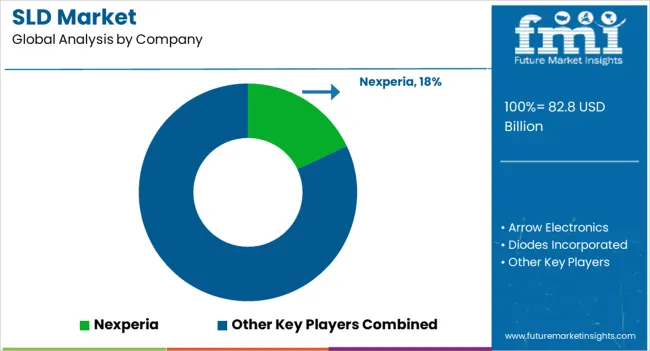

Numerous companies are emphasizing organic growth techniques such as new releases, product approvals, and others such as copyrights and events. Acquisitions, partnerships, and collaborations were among the inorganic growth tactics observed in the industry. Some of the recent market developments include:

Similarly, recent developments related to companies' SLD Market have been tracked by the team at Future Market Insights, which are available in the full report.

The global SLD market is estimated to be valued at USD 82.8 billion in 2025.

The market size for the SLD market is projected to reach USD 145.5 billion by 2035.

The SLD market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in SLD market are universal gates (nand and nor), and, or, exor and exnor.

In terms of buffer/driver type, inverting segment to command 58.0% share in the SLD market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA