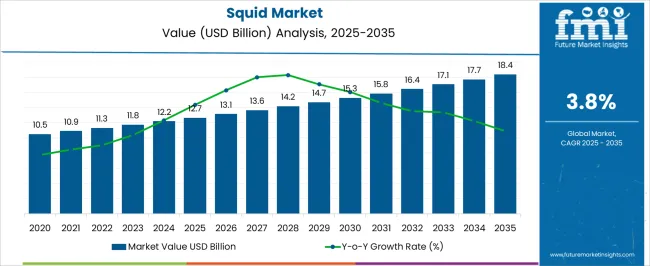

The squid market, valued at USD 12.7 billion in 2025, is expected to grow to USD 18.4 billion by 2035, with a CAGR of 3.8%. The market follows a steady growth trajectory with moderate fluctuations. From 2021 to 2025, the market is projected to grow from USD 10.5 billion to USD 12.7 billion, with annual increments reaching USD 10.9 billion, USD 11.3 billion, USD 11.8 billion, and USD 12.2 billion, respectively. This early period is characterized by stable growth, driven by increasing demand for squid in both fresh and processed forms across global markets, particularly in the Asia-Pacific and North America regions, where squid is a staple ingredient in various cuisines. The market sees gains in this phase due to increasing consumer awareness of the nutritional value of squid, coupled with innovations in squid-based products in food processing industries.

From 2026 to 2030, the market is expected to strengthen further, growing from USD 12.7 billion to USD 15.8 billion, passing through intermediate values of USD 13.1 billion, USD 13.6 billion, USD 14.2 billion, and USD 14.7 billion. During this phase, growth is driven by rising demand for squid as a protein-rich alternative in diets and continued expansion of frozen and ready-to-eat squid products in retail and foodservice. Between 2031 and 2035, the market is projected to reach USD 18.4 billion, advancing from USD 15.3 billion to USD 16.4 billion, USD 17.1 billion, and USD 17.7 billion. This final phase sees continued growth but at a slower pace, reflecting market share stabilization as competition intensifies from alternative seafood sources.

| Metric | Value |

|---|---|

| Squid Market Estimated Value in (2025 E) | USD 12.7 billion |

| Squid Market Forecast Value in (2035 F) | USD 18.4 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The seafood market is the largest contributor, accounting for approximately 45-50% of the squid market share. Squid is a popular seafood item consumed globally, particularly in regions like Asia, Europe, and North America, where it is used in various dishes such as sushi, calamari, and seafood stews. The fisheries and aquaculture market contributes around 20-25%, as squid is a key target species for commercial fishing and aquaculture operations. The demand for squid in this market is driven by its high market value and popularity as a seafood delicacy.

The food processing market holds about 15-18%, as squid is processed into frozen, dried, or canned products, expanding its availability in retail and foodservice sectors. The pet food market adds approximately 8-10%, as squid by-products and other marine-based ingredients are utilized in the production of pet food, particularly in products aimed at enhancing the nutritional value of pet diets.

The marine biology and research market contributes around 5-7%, with squid being a valuable species for scientific research in areas such as marine ecology, behavior, and environmental impact studies.

The squid market is witnessing steady expansion, driven by increasing global seafood consumption and rising awareness of squid’s nutritional value. Growth is supported by efficient supply chains, improved cold storage facilities, and expanding international trade in seafood products. The market benefits from consistent demand across foodservice and retail channels, particularly in regions where squid is a staple protein source.

Demand growth is further influenced by the diversification of product formats, ranging from fresh and frozen to ready-to-eat packaged varieties. Regulatory compliance regarding sustainable fishing practices has become a key driver for premium positioning, as environmentally conscious consumers are influencing purchase trends.

Advances in processing technology and packaging innovation have also extended product shelf life, enabling wider market penetration. Over the forecast period, the squid market is expected to maintain its upward trajectory, underpinned by expanding distribution networks, increased frozen seafood consumption, and a stable supply outlook that supports consistent availability across both domestic and export-oriented markets.

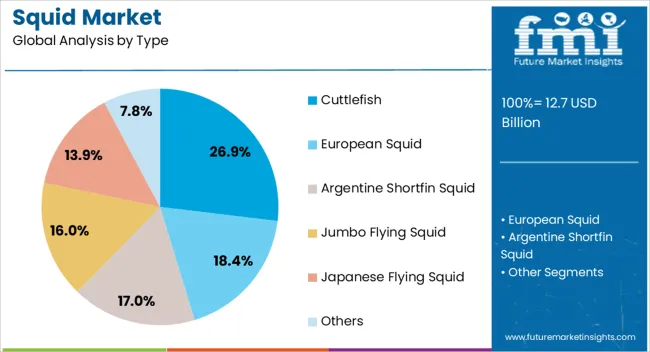

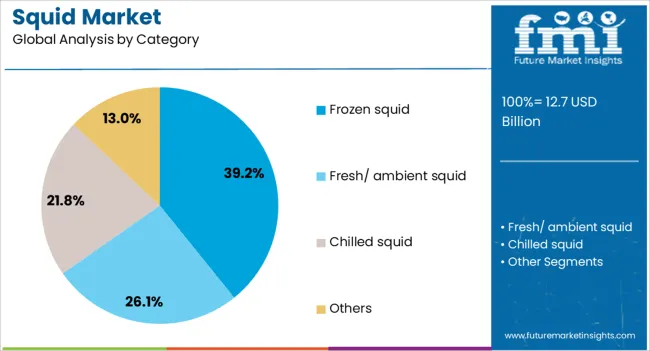

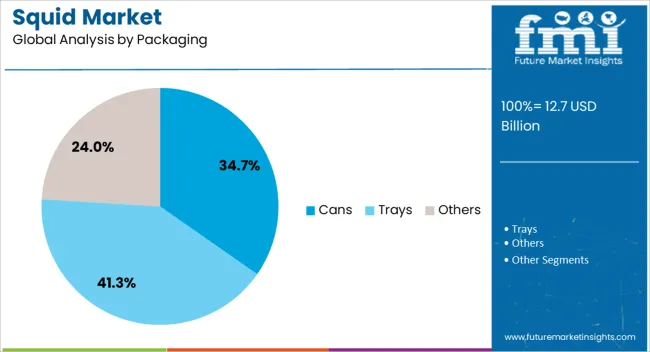

The squid market is segmented by type, category, packaging, distribution channel, and geographic regions. By type, squid market is divided into Cuttlefish, European Squid, Argentine Shortfin Squid, Jumbo Flying Squid, Japanese Flying Squid, and Others. In terms of category, squid market is classified into Frozen squid, Fresh/ ambient squid, Chilled squid, and Others. Based on packaging, squid market is segmented into Cans, Trays, and Others. By distribution channel, squid market is segmented into Food retail and Food service. Regionally, the squid industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cuttlefish segment, representing approximately 26.9% of the squid market by type, has maintained a strong presence due to its high culinary value and demand in both domestic and export markets. This segment’s performance is reinforced by its premium perception, particularly in East Asian and Mediterranean cuisines where cuttlefish is valued for its flavor and texture.

The segment benefits from efficient processing and preservation methods that retain quality during transportation, allowing for competitive participation in international trade. Growth in this segment is also supported by rising consumer interest in diverse seafood options and the popularity of specialty dishes in global gastronomy.

The strong integration of cuttlefish products into foodservice menus, coupled with evolving packaging and preservation techniques, has ensured consistent demand. With stable catch volumes and targeted marketing of its nutritional benefits, the cuttlefish segment is positioned to sustain its share and capture incremental growth from premium seafood consumption trends.

The frozen squid segment dominates the category breakdown, accounting for approximately 39.2% of the market share. This leadership is attributed to the segment’s ability to meet year-round demand, unaffected by seasonal catch fluctuations. The extended shelf life provided by freezing technology allows suppliers to maintain product quality over long distances, facilitating global distribution.

This segment has gained further traction in retail channels, where frozen seafood offers convenience, reduced waste, and consistent availability for consumers. The growing popularity of home cooking and easy-to-prepare seafood products has also reinforced demand for frozen squid. From a supply chain perspective, frozen formats optimize inventory management for wholesalers and foodservice providers, ensuring steady supply without compromising quality.

Technological advancements in quick-freezing methods have preserved texture and taste more effectively, supporting consumer confidence. As demand for reliable and convenient seafood continues to grow, the frozen squid segment is expected to remain the market leader in the category segment.

The cans segment holds a significant 34.7% share in squid market packaging, driven by its convenience, long shelf life, and suitability for ambient storage. Canned squid products cater to markets with limited cold storage infrastructure and appeal strongly to consumers seeking ready-to-use seafood solutions. This packaging format has proven particularly effective for export markets, where transportation and storage conditions necessitate durable, shelf-stable solutions.

The segment benefits from established distribution channels in both retail and institutional sectors, offering versatility in product applications from direct consumption to integration into prepared meals. Advancements in canning technology have improved product quality, retaining nutritional content and flavor integrity. Additionally, canned squid aligns with demand for value-added seafood products, often incorporating seasonings and marinades to enhance appeal.

The segment’s resilience is further supported by its accessibility in remote markets and emergency food supply channels. With sustained global demand for non-perishable, high-protein foods, the cans segment is anticipated to maintain strong growth momentum in the squid market.

The squid market is experiencing steady growth as demand rises in both the seafood and industrial sectors, driven by the increasing popularity of squid as a culinary ingredient and its use in various processed food products. Demand is largely fueled by its nutritional profile, high protein content, and versatility in cuisines globally, especially in Asia and Europe. Challenges in the market include seasonal fluctuations in supply, fishing regulations, and concerns over sustainability practices in squid harvesting. Opportunities exist in the growing trend of sustainable and traceable sourcing, as well as in the development of value-added squid products such as squid ink, dried squid, and squid-based snacks. Trends also indicate a shift toward frozen and ready-to-cook squid products, especially in convenience-focused markets.

The demand for squid is increasing due to its high nutritional value and versatility in cooking, particularly in Asian and Mediterranean cuisines. Squid’s low-calorie, high-protein content, along with its ability to be used in a wide range of culinary applications such as grilled, fried, or used in soups has fueled its popularity in the global seafood market. Its use in processed foods such as ready-to-eat meals, frozen foods, and snacks is expanding. This growing demand from both the culinary and processed food sectors is driving market growth, particularly in regions with established seafood consumption patterns. As consumer preferences shift toward healthy and protein-rich diets, the squid market is poised for continued growth.

The squid market faces several challenges, including supply volatility due to environmental changes and fishing restrictions. Squid availability fluctuates seasonally, and fishing regulations in key production regions can impact market stability. The cost of harvesting, processing, and distributing squid is high, particularly for value-added products such as squid ink and dried squid. Regulatory requirements for food safety and quality assurance, especially for international exports, add to the operational complexity. As concerns about fishing practices increase, there is rising pressure on suppliers to ensure their products meet quality standards and can be traced through the supply chain. Addressing these challenges effectively is critical for maintaining a steady supply of high-quality squid products.

The market presents opportunities for growth in value-added squid products such as squid ink, dried squid, and squid-based snacks. These products cater to a growing demand for unique and healthy snack options, particularly in regions where squid consumption is part of traditional eating habits. The rise in demand for convenience foods is another key driver, with frozen, pre-cooked, and ready-to-eat squid products becoming increasingly popular. As consumers seek quick, nutritious meals, these products are gaining traction, especially in busy markets with health-conscious consumers. Companies focusing on these value-added and convenience-driven products can effectively tap into the expanding consumer base, driving market growth.

The squid market is trending towards an increase in demand for frozen squid, ready-to-eat options, and squid-based snacks. Frozen squid, often pre-cooked or in ready-to-cook formats, is becoming a go-to option for consumers seeking quick, nutritious meal solutions. Additionally, products like dried squid and squid chips are gaining popularity, particularly in snack-conscious markets. These convenience-driven trends are encouraging innovation in processing and packaging methods to enhance product freshness and convenience. As more consumers prefer easy-to-prepare meals and snacks, the demand for such squid-based products is expected to continue growing, opening up new opportunities for market players who can meet these evolving consumer preferences.

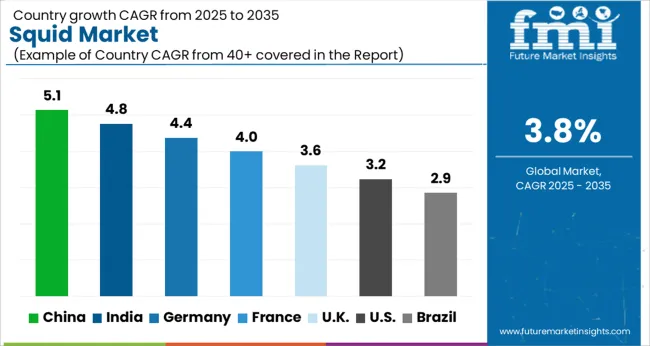

| Country | CAGR |

|---|---|

| China | 5.1% |

| India | 4.8% |

| Germany | 4.4% |

| France | 4.0% |

| UK | 3.6% |

| USA | 3.2% |

| Brazil | 2.9% |

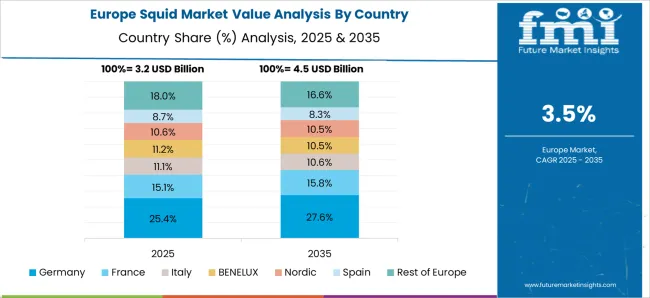

The global squid market is expected to grow at a CAGR of 3.8% from 2025 to 2035, with China leading at 5.1%, followed by India at 4.8% and Germany at 4.4%. The market is driven by rising consumer demand for squid as a healthy protein source and its increasing use in both traditional and international cuisines. The growing awareness of sustainability and the adoption of responsible fishing practices are contributing to the market’s steady growth. As seafood consumption increases globally, particularly in Asia and Europe, the squid market is expected to expand across key regions. The analysis spans over 40+ countries, with the leading markets shown below.

The squid market in China is anticipated to grow at a CAGR of 5.1% from 2025 to 2035, driven by the country’s dominant position in the global seafood industry. As the largest producer and consumer of squid, China continues to see rising domestic consumption, particularly in urban areas where squid is featured in both traditional dishes and modern cuisine. The growing health-conscious population is contributing to the increasing demand for protein-rich, low-fat foods like squid. China’s seafood export industry is booming, with squid being one of the top products shipped to markets in Asia and Europe. The continuous advancements in fishing and aquaculture technologies allow China to improve its squid farming and fishing techniques, ensuring a steady supply to meet both domestic and international demand. The expanding middle class and their willingness to spend on premium food products further enhance the market’s growth.

The squid market in India is projected to grow at a CAGR of 4.8% from 2025 to 2035, driven by the increasing consumption of seafood, especially among health-conscious consumers. As a country with one of the longest coastlines in the world, India benefits from an abundant supply of marine resources, including squid. The growing awareness about the nutritional benefits of seafood, such as squid’s high protein and low-fat content, is fueling demand. Squid is becoming a popular option in both traditional Indian cuisines and global dishes, especially in coastal regions. India’s seafood export industry is experiencing significant growth, particularly in markets across the Middle East, Southeast Asia, and Europe, which contributes to the expansion of the squid market. The adoption of advanced fishing techniques, along with improvements in aquaculture, has also enhanced squid production.

The squid market in Germany is expected to grow at a CAGR of 4.4% from 2025 to 2035, supported by the rising demand for seafood and growing interest in squid in European cuisines. As one of Europe’s largest seafood markets, Germany has seen increasing popularity of squid, especially in frozen and canned forms. The country’s robust seafood trade with other European countries, combined with its increasing awareness of the nutritional value of squid, has contributed to a steady rise in demand. Consumers are increasingly looking for healthy, high-protein alternatives to red meat, and squid fits this requirement perfectly. Germany’s seafood imports are increasing, which helps meet domestic consumption needs. The expanding foodservice industry in the country, which includes both traditional seafood restaurants and modern dining establishments, is driving up squid demand.

The UK squid market is projected to grow at a CAGR of 3.6% from 2025 to 2035, driven by rising consumer interest in seafood, particularly squid. Squid’s high nutritional value, versatility, and inclusion in international cuisines are pushing demand in both households and the foodservice industry. Increasingly, consumers in the UK are opting for protein-rich foods like squid, which are considered healthier alternatives to red meats. The retail availability of squid, especially in supermarkets and online platforms, is enhancing its accessibility to consumers. The growth of squid consumption in restaurants, cafes, and takeaway establishments reflects a shift toward more diverse food options, including Mediterranean and Asian-inspired dishes. With continued consumer interest in healthy, protein-packed foods, the UK market for squid is set for sustained growth over the next decade.

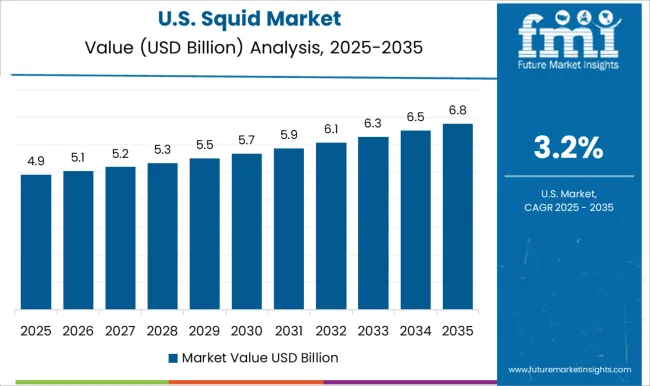

The USA squid market is expected to grow at a CAGR of 3.2% from 2025 to 2035, with increasing consumer awareness of the health benefits of seafood, particularly squid. The demand for squid is being driven by its high protein content, low fat, and versatility in cooking. As consumers become more health-conscious, squid is emerging as a popular option in both home kitchens and restaurants. The rise of international cuisines, including Mediterranean and Asian dishes, is further boosting demand for squid in the USA Additionally, the increasing availability of squid in supermarkets and restaurants is expanding its consumer base. The seafood industry in the USA is also benefitting from stronger trade relationships, which are helping to secure a steady supply of squid for domestic consumption. As the USA continues to explore diverse seafood options, the squid market is poised for steady growth over the forecast period.

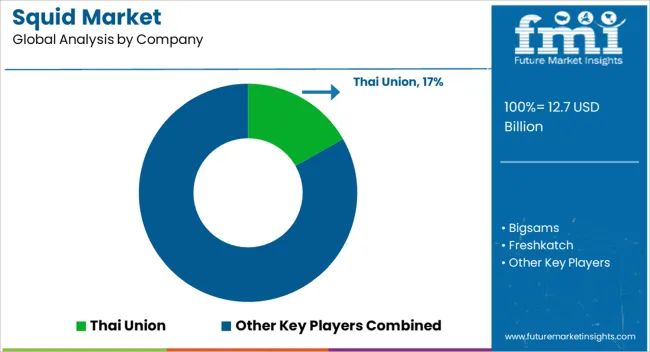

In the squid market, competition is driven by quality, sustainability, and supply chain efficiency. Thai Union is a market leader, offering a wide range of frozen and processed squid products, including value-added items such as calamari and squid rings, to meet the demands of global food retailers and foodservice providers. Bigsams competes by specializing in the supply of fresh and frozen squid to various markets, focusing on high-quality, traceable sourcing from sustainable fisheries.

Freshkatch positions itself as a supplier of premium squid products, with an emphasis on freshness and quality control throughout the supply chain, often targeting restaurants and high-end culinary applications. Holmes and Holt are known for their extensive frozen squid offerings, often specializing in bulk packaging for industrial and commercial use, catering to both domestic and international markets. Lee Fishing competes by providing high-quality squid products sourced from both wild-caught and sustainable fisheries, catering to the growing demand for traceability in the seafood supply chain.

Minh Khue stands out with its competitive pricing strategy, offering both fresh and frozen squid, targeting large-scale distributors and processing companies in the Asia-Pacific region. Pescanova competes globally, with a focus on processed squid products and sustainability certifications, appealing to environmentally-conscious consumers and retailers. Qingdao Seaflying Food and Seafood Pride International provide frozen squid and other seafood, emphasizing processing efficiency and cost-effectiveness in bulk quantities.

Seaquest and Xiamen Taiseng offer competitive pricing on frozen squid, targeting regional and international markets with reliable supply and quality assurance. Strategies in this market revolve around improving product quality, sustainability, and maintaining a steady supply chain. Product brochures highlight squid cuts, value-added products, packaging options, and sustainability certifications, ensuring traceability and quality compliance to meet diverse consumer and industry requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 12.7 Billion |

| Type | Cuttlefish, European Squid, Argentine Shortfin Squid, Jumbo Flying Squid, Japanese Flying Squid, and Others |

| Category | Frozen squid, Fresh/ ambient squid, Chilled squid, and Others |

| Packaging | Cans, Trays, and Others |

| Distribution channel | Food retail and Food service |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Thai Union, Bigsams, Freshkatch, Holmes, Holt, Lee Fishing, Minh Khue, Pescanova, Qingdao Seaflying Food, Seafood Pride International, Seaquest, and Xiamen Taiseng |

| Additional Attributes | Dollar sales by product type (fresh, frozen, canned, dried), processing method (whole, cleaned, cut, ring), and application (retail, foodservice, industrial). Demand dynamics are driven by the growing popularity of squid in global cuisines, sustainable seafood sourcing practices, and increasing seafood consumption. Regional trends indicate strong growth in Asia-Pacific, Europe, and North America, fueled by rising consumer preference for seafood and the expansion of global distribution networks. |

The global squid market is estimated to be valued at USD 12.7 billion in 2025.

The market size for the squid market is projected to reach USD 18.4 billion by 2035.

The squid market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in squid market are cuttlefish, european squid, argentine shortfin squid, jumbo flying squid, japanese flying squid and others.

In terms of category, frozen squid segment to command 39.2% share in the squid market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA