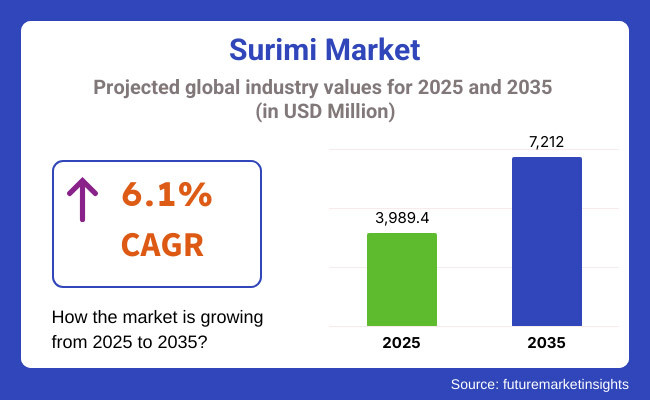

World surimi market value was USD 3,572.7 million in 2023. Surimi consumption registered 6.3% year-on-year growth in 2024 and hence forecasted the world market to be USD 3,989.4 million by 2025. 2025 to 2035 as the forecasting time frame taken, overall sales would have a 6.1% CAGR and achieve the market value of USD 7,212 million by 2035.

Overconsumption of seafood foods, particularly imitation crab meat, is most likely the best way to describe how the surimi market has evolved. Surimi foods offer a cheap alternative to regular seafood but with similar taste and texture. Surimi foods are thus utilized in gigantic volumes by food categories including sushi, salads, and seafood.

part from this, surimi is gaining popularity in those markets where seafood consumption is increasing because it can be stored for a longer time, it is easy to handle, and it is cheap. Ready-to-eat foods and convenient foods have also increased the demand for surimi products because they require less preparation.

Increased health consciousness of consumers has been driving demand for low-calorie and low-fat, high-protein foods in the recent past. Surimi is low-calorie and low-fat, high-protein food and can be positioned quite easily in line with such health and wellness trends.

Surimi is also highly promoted as a green seafood product due to the fact that it is produced from white fish, which is a resource that is less environmentally degrading in its nature than other processes of seafood production. Increased focus on sustainable sourcing and green production processes in the surimi sector is allowing brands to connect with consumers who are ever more environmentally conscious of the effects of their food shopping.

Surimi market has also been driven by innovation in products, with manufacturers constantly developing new shapes, textures, and flavor profiles for surimi in a bid to keep up with evolving consumers' demands. Surimi market is also increasing in the Asian-Pacific and Latin American emerging markets, where rising disposable income and growing interest in international foodstuffs are driving demand for seafood products.

The following table is a comparative analysis of the six-month difference in CAGR between the base year (2024) and the actual year (2025) of the global surimi market. The analysis shows a very high level of variation in performance and provides trends for realization of revenue and thus helps the stakeholders determine in which direction growth would be moving over a period of a year. H1 = July to Dec, first half year. H2 = Jan to June, second half.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 5.6% |

| H2 (2024 to 2034) | 5.8% |

| H1 (2025 to 2035) | 5.9% |

| H2 (2025 to 2035) | 6.1% |

The firm will grow at the rate of CAGR 5.9% in the first half (H1) of the time span 2025 to 2035, and subsequently the increased rate of 6.1% in the second half (H2) of the same duration. Reaching the following period, H1 2025 to H2 2035, CAGR will be 5.9% for the first half and extremely high at 6.1% for the second half. The industry grew 20 BPS in the first half (H1), while the company gained 30 BPS in the second half (H2).

Surimi industry will continue to grow, driven by innovation in products and continued focus on value and convenience. As the market grows, firms will increasingly focus on how to merchandise differentiation and capture a greater share of the growing consumer market interested in seafood alternatives.

Tier 1 Multinationals - Controls Surimi Production and Export All over the Globe Tier 1 is controlled by the multinationals, who control surimi production and export all over the globe. They possess value-added processing technology bargaining power, green supply chain practices, and effective global supply chains.

Thai Union Group, Thai Union is an international network of seafood processors and a global surimi industry leader producing high-quality surimi paste and added-value seafood for global market leaders. Thai Union focuses on sustainability, state-of-the-art processing technology, and worldwide distribution and becomes an Asian quality supplier to Asia, Europe, and North America. Trident Seafoods is a top surimi processor and exporter of surimi.

Tier 2 Regional Powerhouses - This sector comprises firms with established regional reach with domain-focused markets and growth market reach in the form of value-added surimi products and innovation. Viciunai Group,

Viciunai Group is the largest European surimi producer that makes a variety of surimi items ranging from imitation shrimp to crab sticks and fish cakes. The company has leadership positions in the European foodservice and retail markets, as well as in its expanding base of distribution within Eastern Europe and Asia Pacific.

Tier 3 Emerging Players and Niche Innovators - This level includes small but expanding firms that produce value-added surimi product lines, alternative foods, and sustainable seafood practices. These firms are selling to health food consumers, seafood alternatives for vegetarians, and the home market. Ocean's Halo (USA), enjoying red-carpet status as a veggie seafood choice, Ocean's Halo is breaking into the plant-based surimi segment with plant-based fish and crab sticks.

Highlighting sustainable, non-GMO ingredients, the company is targeting the challenger alternative seafood space. PT Sekar Bumi Tbk (Indonesia) New Southeast Asia surimi player, PT Sekar Bumi is a frozen seafood food producer such as surimi-based fish cakes, crab sticks, and dumplings.

Growing Demand for Clean Label and Natural Surimi Products

Shift: Consumers of seafood are becoming more ingredient-aware and actively looking for clean-label, lower-processed seafood. Surimi products have artificial preservatives, phosphates, and flavor enhancers such as MSG, which are now considered negative by health-aware consumers. In Europe and North America, 74% of the consumers buying seafood buy them from products that do not contain artificial additives, leading to a 19% sales boost of clean-label seafood over the past two years.

Strategic Response: To fight clean-label demand attacks, Trans-Ocean Products introduced Simply Surimi®, artificial flavor-, MSG-, and gluten-free surimi derived from wild Alaska Pollock, which recorded 23% sales increases in large USA retail chains. Viciunai Group introduced phosphate-free surimi sticks, and its European customers increased by 17% over a span of one year. Kanika Foods introduced sea salt- and plant-based extracts-flavored surimi alternative, expanding its Asia distribution by 12%.

Increase in Demand for Plant-Based & Hybrid Surimi Alternatives

Shift: Flexitarian and plant-based diets are influencing the demand for seafood alternatives, such as plant-based surimi. Consumers are looking for sustainable, ethical, and health-driven alternatives, resulting in 28% annual growth for the plant-based seafood alternative market. Overfishing and allergens of traditional surimi also fuel the trend.

Strategic Response: Leading brands are launching new plant-based and hybrid surimi products to respond to this upcoming market. New Wave Foods launched a mung bean- and seaweed protein-based surimi alternative with retail partnerships that expanded its market coverage by 31%.

Nestlé Garden Gourmet launched a plant-based crab alternative product into the European market, before launching it elsewhere, with sales boosted by 14%. OmniFoods, on the other hand, launched an algae plant-based alternative surimi product, which then retailed in over 2,500 stores in Asia within half a year.

Trend Towards Premium and Functional Surimi Products

Shift: Today's consumers are seeking greater protein, omega-3 value, and functionality from seafood. Surimi itself is seen as processed and unhealthy and is propelling premiumization trends. Among consumers in recent surveys, 46% pay a premium for greater nutritional value, especially North America, Europe, and Japan.

Strategic Response: The manufacturers are launching premium surimi with greater functional ingredients to take advantage of demand. Thai Union brought DHA- and omega-3-fortified surimi into Japan and recorded 18% greater sales in the half-year. SeaPak introduced a protein-backed surimi alternative with additional 30% fish, driving frozen seafood advancement of 11%.

Nippon Suisan Kaisha subsequently developed collagen-fortified surimi snack foods with the aim of targeting a new consumer segment of health benefit and age-related healthcare-oriented consumers and gaining East Asian market share by 22%.

Ready-to-Eat (RTE) and Snackable Surimi Products

Shift: Trend here is high-protein snacking among working professionals, women, and men, and health-oriented fitness enthusiasts. As 73% of global consumers snack on a daily basis, surimi players are grabbing the trend and launching RTE formats

Strategic Response: Surimi players are making a move to RTE and snackable formats in order to tap into this trend. Louis Kemp expanded its portfolio of products with surimi cheese and cracker snack packs, propelling sales 21% higher in North America.

Japan's Maruha Nichiro introduced surimi-based protein bars, and one such product attained spectacular success in the sports nutrition category with sales up by 16%. Viciunai introduced single-serve-size packaging of surimi sticks, successful in gaining entry into leading convenience European chains with the retail geography coverage area boosted by 14%.

Sustainable and Ethical Surimi Demands

Shift: Seafood consumers increasingly care about sustainability and socially responsible purchasing, and global seafood buyers now demand products that have eco-labels like MSC (Marine Stewardship Council) in 67%, and three-year sales growth has been 20% in sustainable seafood.

Strategic Response: Major surimi manufacturers are guaranteeing sustainable harvesting and alternative materials. Trident Seafoods has started to purchase only MSC-certified Alaska Pollock to use in surimi, and it has pushed 12% more sustainable customer purchases.

Pacific Seafood launched a carbon-neutral surimi brand with an estimated carbon offset through investment in ocean conservation efforts and secured premium North American retail shelf space. Nissui developed a plant-reduced surimi product from algae and kelp that reduced fish dependency by 30% and persuaded environmentally aware consumers and recorded a 19% sales boost in Japan.

The following table shows the estimated growth rate of the Surimi market through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 5.1% |

| Germany | 7.5% |

| China | 6.8% |

| Japan | 8.2% |

| India | 5.4% |

A rising number of health-conscious consumers are choosing higher protein and lower fat seafood substitutes, which continues to fuel demand for surimi in the USA In fact, surimi has a wide range of applications in fast food, sushi manufacturing, and packaged food as imitation crab meat, fish-based snacks, and seafood analogs.

In addition, the shifting consumer preferences for functional seafood products and protein-fortified alternatives are driving demand for surimi-based meat substitutes, high-protein snacks, and processed frozen seafood items. Overall, USA market is also being helped by improvements in fish processing techniques that enhance texture, flavor and shelf life.

Getting adequate protein and cardio-protective benefits from lean seafood as per government-backed nutrition recommendations has also been influencing high private investment in surimi-based food formulations, fortified seafood and value-added fish protein alternatives.

The surimi market in Germany is growing steadily, aided by EU regulations on sustainable fishing, a growing demand for processed seafood, and an increase in consumer awareness of high-protein diets. Surimi premiumization is fueled by the increasing popularity of flexitarian diets, meal replacements based on seafood and ready-to-cook or eat seafood products.

German manufacturers are developing low-sodium surimi formulations, offering wild-caught fish-based products, and developing protein-enhanced seafood analogs to meet fresh demand as consumers increasingly seek clean-label, responsibly sourced seafood.

China’s surimi market is expanding extremely fast owing to growing disposable income, high demand for processed seafood, and expansion of QSRs(chain restaurants) who include seafood. Gains in surimi-based dumplings, seafood sausages, and ready-to-eat imitation crab products are contributing to growing demand for high-protein, low-cost surimi formulations.

Initiatives by the Chinese government-backed seafood industry are driving manufacturers to expand mass-scale surimi manufacture, frozen seafood distribution and superior species fish protein processing to meet the increasing consumer base.

The surimi market in Japan is supported by the country’s well-established tradition of fish-based culinary culture, with increasing demand for high-end surimi applications, as well as innovations in fish-protein texturing technologies. Authentic, high-grade surimi is favored by Japanese consumers for sushi, tempura fish cakes and processed seafood snacks.

Increasing preferences for premium-grade, natural-flavor, and texture-enhanced surimi products driven by Japan's ability to produce enzyme-assisted fish protein and high-moisture surimi formulations are contributing toward the demand for surimi products across the globe.

The Indian surimi market is growing as a result of increased seafood processing capacity, fish exports, and domestic demand for high-protein and low-cost seafood options. Surimi is increasingly being used in fish patties, frozen seafood products, and quick-service seafood meals.

With a supportive government approach towards seafood processing, and export-oriented seafood products, Indian manufacturers are putting money into effective fish protein extraction processes, frozen surimi products, and value added seafood innovations.

| Segment | Value Share (2025) |

|---|---|

| Processed Surimi Seafood (By Application) | 70.8% |

Due to high demand for imitation crab, fish balls, and surimi-based seafood snacks, the processed surimi seafood segment holds the largest market share. Because of their convenience factor, low carbohydrate content, high protein level and mild taste, ready-to-eat surimi seafood is in demand as it can be used for a broad variety of culinary applications. The rising popularity of sushi, seafood salads, and frozen seafood meals have also led to increasing demand for surimi-based products in retail and foodservice.

With the increasing demand for processed seafood alternatives, product developers are especially focused on targeting high-stability high texture and low sodium surimi products to the discerning health market. Innovations in surimi processing, including plant-based binding agents and omega-3 enrichment as examples, are also on the rise.

Expected to account for 70.8% value share in 2025, this segment is slated for dynamic growth in Asia-Pacific as well as North America as the processed seafood market and quick-service seafood chains catch on like wildfire. With manufacturers continuing to develop premium, sustainably sourced, and allergen-friendly surimi products, the market is primed for continued innovation and growth.

| Segment | Value Share (2025) |

|---|---|

| Functional Foods, High-Protein Snacks & Meat Alternatives (By Application) | 29.2% |

SurimiDerived Foods Market IncludesProtein Enrichment SnackSurimisurimi snack, Functional Seafood Foods, SurimiBased Meal Replacers, Seafood Analogs, Surimi Spiral Snacks, HighProtein Snacks. But health-conscious and fit consumers have pushed manufacturers to develop over-arching surimi products combining premium surimi formulations, human health benefits and the properties of surimi that facilitate and improve production.

Also, the energy-dense diet trends of surimi-enriched functional foods and seafood protein have increased the demand. And as companies seek shelf-stable, low-calorie, seafood-derived high-protein products, demand for surimi-based fish protein isolates and functional seafood blends will grow. In addition, innovations in texturization and flavor-enhancing technologies are making surimi an even more appealing sustainable alternative to traditional seafood and meat products.

The segment is predicted to seize a 29.2% value share by 2025, with demand particularly high in Europe and North America, where high-protein seafood substitutes are heavy on trend. Consumer demand for sustainable, clean-label and minimally processed seafood items is growing, and this will push the surimi market toward the constant development and a stable growth.

Others involved in the surimi industry are competing intensely for a share of surimi production and consumption; key players are centered on the extraction of high-quality fish protein, seafood alternative meats, and diversifying functional seafood applications. The surimi processing companies are investing toward sustainable surimi production, clean-label seafood, and surimi processing innovations.

The industry is dominated by major players including Maruha Nichiro, Thai Union Group, Nippon Suisan Kaisha (Nissui), Trident Seafoods, Viciunai Group known for their prowess in seafood processing, high-quality surimi extraction, and an extensive distribution network worldwide. Many companies are also building their Asia-Pacific and European production plants to meet the growing demand for premium and processed surimi seafood.

Important strategies include collaborations with seafood processors, investment in enzyme-treated surimi proteins and high-moisture, low-sodium surimi formulations. Manufacturers are also focusing more on sustainable seafood sourcing and environmentally friendly surimi processing methods.

For instance

The market includes fish surimi, derived from species such as Alaska Pollock, Atlantic Cod, Tilapia, Black Bass, and others. Additionally, meat surimi is sourced from pork and beef.

Surimi products are available in various forms, including fresh (whole, fillet), processed, canned, and frozen (whole, fillet), catering to different industry needs and consumer preferences.

Distribution takes place through direct sales and indirect sales, including modern trade, convenience stores, specialty food stores, wholesale stores, discount stores, online retail, and other retail formats.

Surimi is widely used across multiple industries, including the food industry, pharmaceutical industry, animal feed, pet food, food service, and retail.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global surimi industry is projected to reach USD 3,989.4 million in 2025.

Key players include Maruha Nichiro, Thai Union Group, Nippon Suisan Kaisha (Nissui), Trident Seafoods, and Viciunai Group.

Asia-Pacific is expected to dominate due to high demand for processed seafood and surimi-based meat analogs.

The industry is forecasted to grow at a CAGR of 6.1% from 2025 to 2035.

Figure 1: Global Market Value (US$ Million) by Species, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Species, 2023 to 2033

Figure 27: Global Market Attractiveness by Form, 2023 to 2033

Figure 28: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Species, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Species, 2023 to 2033

Figure 57: North America Market Attractiveness by Form, 2023 to 2033

Figure 58: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Species, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Species, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Species, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Europe Market Attractiveness by Species, 2023 to 2033

Figure 118: Europe Market Attractiveness by Form, 2023 to 2033

Figure 118: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 122: East Asia Market Value (US$ Million) by Species, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 123: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 131: East Asia Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 133: East Asia Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 135: East Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 138: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 139: East Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 142: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: East Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Species, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Form, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ Million) by Species, 2023 to 2033

Figure 152: South Asia Market Value (US$ Million) by Form, 2023 to 2033

Figure 153: South Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 154: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 161: South Asia Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 164: South Asia Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 165: South Asia Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 168: South Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 169: South Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 180: South Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 181: South Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 182: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 183: South Asia Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 184: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 185: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 186: South Asia Market Attractiveness by Species, 2023 to 2033

Figure 187: South Asia Market Attractiveness by Form, 2023 to 2033

Figure 188: South Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 189: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ Million) by Species, 2023 to 2033

Figure 182: Oceania Market Value (US$ Million) by Form, 2023 to 2033

Figure 183: Oceania Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 184: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 191: Oceania Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 194: Oceania Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 195: Oceania Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 198: Oceania Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 199: Oceania Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 202: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: Oceania Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Species, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Form, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Sales Channel, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 220: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 221: Middle East and Africa Market Value (US$ Million) by Species, 2023 to 2033

Figure 222: Middle East and Africa Market Value (US$ Million) by Form, 2023 to 2033

Figure 223: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 225: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 226: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 227: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 228: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 229: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 230: Middle East and Africa Market Value (US$ Million) Analysis by Species, 2018 to 2033

Figure 231: Middle East and Africa Market Volume (MT) Analysis by Species, 2018 to 2033

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by Species, 2023 to 2033

Figure 233: Middle East and Africa Market Y-o-Y Growth (%) Projections by Species, 2023 to 2033

Figure 234: Middle East and Africa Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 235: Middle East and Africa Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 236: Middle East and Africa Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 237: Middle East and Africa Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 238: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 239: Middle East and Africa Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 233: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Species, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Form, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Species, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Species, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Species, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Species, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 44: East Asia Market Volume (MT) Forecast by Species, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 46: East Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: East Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 51: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 54: South Asia Market Volume (MT) Forecast by Species, 2018 to 2033

Table 55: South Asia Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 56: South Asia Market Volume (MT) Forecast by Form, 2018 to 2033

Table 57: South Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 58: South Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 59: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: South Asia Market Volume (MT) Forecast by Application, 2018 to 2033

Table 61: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: Oceania Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 64: Oceania Market Volume (MT) Forecast by Species, 2018 to 2033

Table 65: Oceania Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 66: Oceania Market Volume (MT) Forecast by Form, 2018 to 2033

Table 67: Oceania Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 68: Oceania Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 69: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: Oceania Market Volume (MT) Forecast by Application, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Species, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Species, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Form, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by Application, 2018 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA