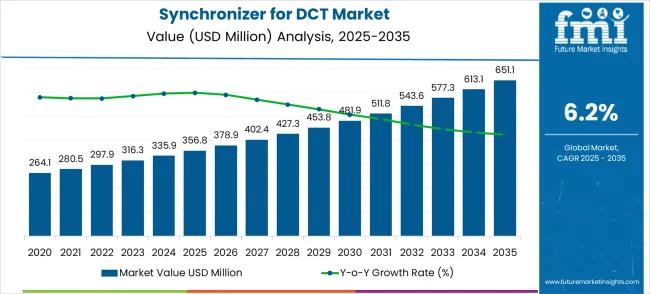

The synchronizer for dual-clutch transmissions (DCT) market is expected to grow steadily from USD 357 million in 2025 to USD 651.1 million by 2035, with a forecast compound annual growth rate (CAGR) of 6.2%. The rising adoption of dual-clutch transmissions in vehicles due to their efficiency, performance, and smoother shifting is driving this market. DCTs are increasingly favored in the automotive industry for their ability to provide faster gear shifts, enhanced fuel efficiency, and reduced emissions compared to traditional manual and automatic transmissions.

As consumer preferences shift toward vehicles with improved fuel economy and enhanced driving performance, the demand for DCT technology and its components, including synchronizers, is anticipated to increase. The growing focus on performance-oriented vehicles and electric vehicle (EV) integration with advanced transmission systems is expected to further elevate the role of synchronizers in automotive engineering.

The increased use of dual-clutch transmissions across a wide range of passenger cars, commercial vehicles, and performance cars is significantly contributing to the growth of the synchronizer market. DCT systems offer substantial advantages in terms of fuel efficiency and driving dynamics, which align with the demand for high-performance vehicles globally. As automotive manufacturers focus on enhancing vehicle performance and reducing carbon footprints, the market for synchronizers used in DCTs is set for substantial expansion.

The shift toward more efficient transmission technologies, especially in premium and electric vehicles, is likely to fuel further growth in this segment. As a result, the synchronizer for dual-clutch transmissions market is poised to experience strong demand, driven by the automotive sector's ongoing evolution toward more efficient and performance-focused solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 357 million |

| Forecast Value in (2035F) | USD 651.1 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

The synchronizer for dual-clutch transmissions (DCT) market holds a significant share of approximately 25% within the automotive transmission market, driven by the increasing demand for DCT systems in modern vehicles. In the dual-clutch transmission market, it commands around 30% of the total share, as synchronizers are critical components for efficient gear shifting. Within the automotive components market, the share is roughly 10%, owing to the widespread use of synchronizers in various automotive systems. In the automotive drivetrain market, it accounts for 8%, reflecting its importance in enhancing performance. In the electric vehicle transmission market, the synchronizer for DCT market holds about 5%, indicating its emerging role in electrified drivetrains. This distribution showcases its integral position across both conventional and electric vehicle sectors.

Market expansion is being supported by the increasing adoption of dual-clutch transmission technology across passenger and commercial vehicle segments and the corresponding demand for advanced synchronizer systems capable of handling complex gear engagement requirements. Modern DCT systems require precise synchronizer components that can manage rapid gear changes, minimize shifting friction, and ensure smooth power delivery under various operating conditions. Advanced synchronizer technologies provide the performance characteristics needed to optimize fuel efficiency, enhance acceleration response, and deliver superior driving dynamics in contemporary automotive applications.

The growing emphasis on automotive fuel efficiency and performance optimization is driving demand for sophisticated synchronizer systems that can support advanced transmission control strategies and reduce energy losses during gear transitions. Consumer preference for responsive transmission performance and smooth shifting characteristics is creating opportunities for innovative synchronizer designs that combine durability with precision engineering. The rising adoption of performance-oriented vehicles and premium automotive segments is also contributing to increased demand for high-quality synchronizer components across different DCT configurations and applications.

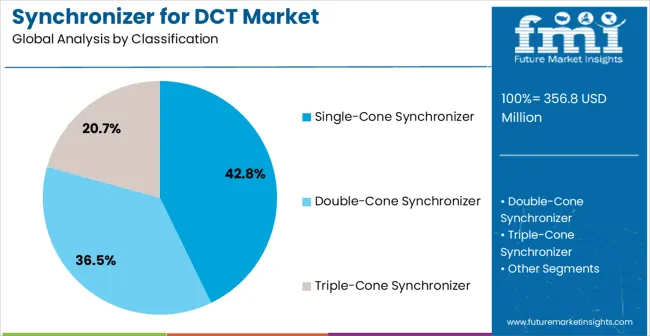

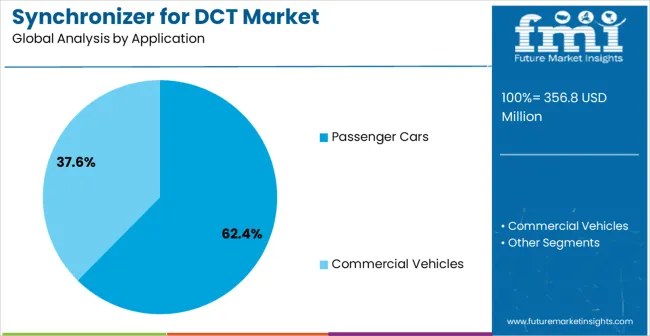

The market is segmented by synchronizer type, vehicle type, and region. By synchronizer type, the market is divided into single-cone synchronizer, double-cone synchronizer, and triple-cone synchronizer. Based on vehicle type, the market is categorized into passenger cars and commercial vehicles. Regionally, the market is divided into North America, Europe, East Asia, Latin America, South Asia & Pacific, and Middle East & Africa.

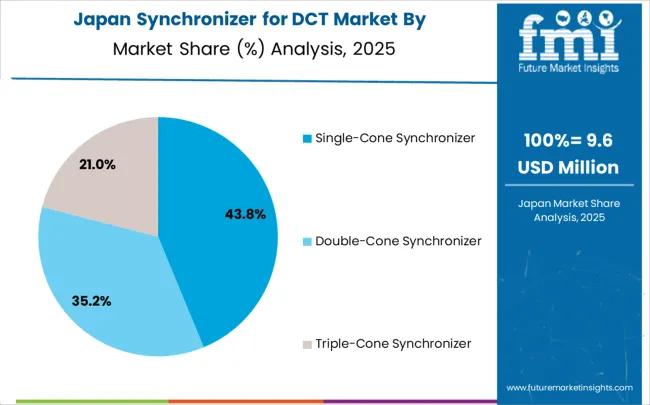

The single-cone synchronizer segment is expected to account for 42.8% of the synchronizer for dual-clutch transmissions (DCT) market in 2025, solidifying its position as the most widely adopted technology. Manufacturers recognize the cost-effectiveness and reliable performance of single-cone synchronizers in standard DCT applications, offering adequate torque capacity, simplified manufacturing, and proven durability for passenger vehicles. This synchronizer type forms the core of volume production DCT systems, providing an economical solution for automotive manufacturers seeking efficient gear synchronization. The segment benefits from industry validation and extensive field testing, reinforcing its adoption. With increasing demand for cost-effective transmission solutions and reliable shifting performance, single-cone synchronizers align with automotive manufacturers' goals of operational efficiency and cost optimization. Their broad compatibility across various DCT configurations ensures continued market dominance.

The passenger cars segment is expected to represent 62.4% of the synchronizer for dual-clutch transmissions (DCT) demand in 2025, highlighting its central role in DCT technology adoption. Automotive manufacturers focus on passenger vehicles due to their high-volume production, accessibility to the consumer market, and potential for economies of scale. DCT systems in passenger cars offer significant performance benefits, such as improved fuel efficiency and better acceleration, along with competitive market advantages. Consumer demand for fuel-efficient vehicles and automatic transmissions continues to rise, while hybrid powertrain integration further increases system complexity, supporting premium synchronizer technologies. As passenger vehicle electrification expands, DCT synchronizer systems will maintain their dominance in the automotive sector, underscoring their importance in modern transmission systems.

The synchronizer for dual-clutch transmissions market is advancing steadily due to increasing DCT adoption in passenger vehicles and growing demand for enhanced transmission performance and fuel efficiency. However, the market faces challenges including complex manufacturing requirements, high precision tolerance demands, and competition from alternative transmission technologies including CVT and advanced automatic transmissions. Innovation in materials technology and advanced manufacturing processes continue to influence product development and market expansion patterns.

The growing adoption of advanced multi-cone synchronizer systems is enabling superior performance characteristics in high-torque DCT applications through enhanced friction surface area and improved heat dissipation capabilities. Triple-cone and advanced double-cone systems equipped with specialized friction materials provide exceptional durability and shifting precision while maintaining compact packaging requirements. These technologies offer enhanced torque capacity and extended service life, particularly beneficial for performance vehicle applications and commercial vehicle DCT systems requiring robust synchronizer solutions.

Modern synchronizer manufacturers are incorporating advanced materials, including carbon fiber composites, lightweight steel alloys, and precision-engineered brass compounds, to optimize synchronizer performance while reducing the overall weight of the transmission. Advanced manufacturing processes enable precise dimensional control, improved surface finishing, and consistent friction characteristics that enhance shifting quality and system reliability. These technologies support the development of compact, efficient synchronizer systems that meet demanding automotive performance requirements while contributing to overall vehicle fuel efficiency improvements.

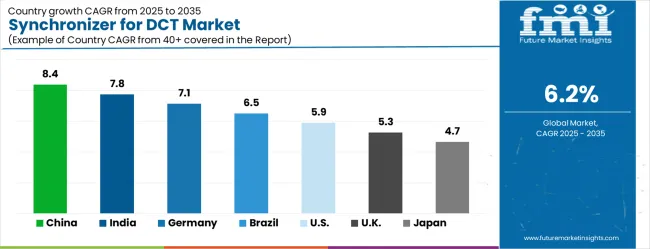

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

| United States | 5.9% |

| United Kingdom | 5.3% |

| Japan | 4.7% |

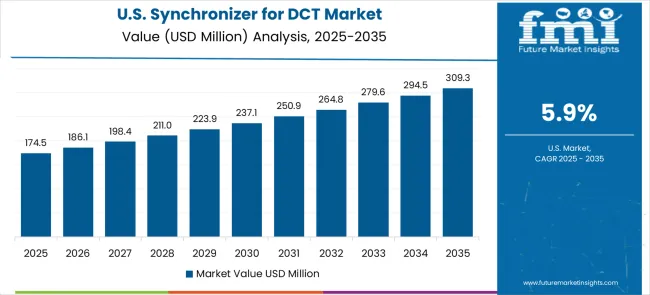

The synchronizer for dual-clutch transmissions market is experiencing strong growth globally, with China leading at 8.4% CAGR through 2035, driven by rapid automotive industry expansion, increasing DCT adoption in passenger vehicles, and growing demand for fuel-efficient transmission systems. India follows at 7.8%, supported by expanding automotive manufacturing capabilities, rising middle-class vehicle ownership, and increasing preference for automatic transmission alternatives. Germany shows robust growth at 7.1%, emphasizing precision engineering excellence and advanced transmission technology development. Brazil records 6.5%, focusing on automotive industry modernization and growing consumer preference for enhanced driving performance. The United States demonstrates 5.9% growth, prioritizing transmission efficiency improvements and performance vehicle segment expansion. The United Kingdom shows 5.3% growth, supported by automotive technology innovation and premium vehicle manufacturing. Japan maintains 4.7% growth, leveraging precision manufacturing expertise and advanced automotive component technology.

The report covers an in-depth analysis of 40+ countries, the top-performing countries are highlighted below.

The synchronizer for dual-clutch transmissions market in China is expected to grow at a CAGR of 8.4%, fueled by the country's large automotive industry and increasing demand for high-performance vehicles. As China continues to be a leader in global vehicle production, the demand for advanced transmission systems like DCT, which offer faster gear shifts and improved fuel efficiency, rises. The growing focus on electric and hybrid vehicles, as well as the increasing interest in performance-oriented cars, further boosts the need for high-quality synchronizers. Additionally, China's investment in smart manufacturing and automation in the automotive sector accelerates the adoption of DCT systems.

The synchronizer for dual-clutch transmissions market in India is projected to grow at a CAGR of 7.8%, driven by the country’s expanding automotive sector and rising demand for fuel-efficient and high-performance vehicles. India’s growing middle class and increasing disposable incomes are contributing to the demand for advanced vehicles with better driving dynamics, such as those equipped with DCT systems. The market is further fueled by government initiatives to promote clean and efficient mobility solutions, including hybrid and electric vehicles. As manufacturers seek to integrate advanced transmission systems in their vehicles, the need for synchronizers increases.

The synchronizer for dual-clutch transmissions market in Germany is expected to grow at a CAGR of 7.1%, driven by the country’s focus on precision engineering and innovation in the automotive sector. Germany’s strong automotive industry, led by manufacturers like Volkswagen, BMW, and Mercedes-Benz, increasingly adopts DCT systems for their superior performance and efficiency. The country’s emphasis on high-performance vehicles and its push toward electric mobility and hybrid vehicles further drives the demand for advanced transmission technologies. Additionally, Germany’s commitment to sustainability and reducing carbon emissions accelerates the use of DCT systems, which contribute to improved fuel efficiency.

The synchronizer for dual-clutch transmissions market in Brazil is projected to grow at a CAGR of 6.5%, driven by the country’s growing automotive industry and increasing consumer demand for high-performance vehicles. As Brazil continues to modernize its vehicle production and integrate more advanced transmission systems, the need for synchronizers in DCT-equipped vehicles rises. Additionally, the Brazilian government’s push for cleaner, more fuel-efficient cars, including hybrid and electric vehicles, further supports the adoption of DCT systems. Brazil’s growing focus on technological advancements in the automotive sector also accelerates the demand for high-quality transmission components like synchronizers.

The synchronizer for dual-clutch transmissions market in the United States is expected to grow at a CAGR of 5.9%, driven by the country’s strong automotive industry and growing consumer demand for advanced, high-performance vehicles. DCT systems, known for their faster gear shifts and improved fuel efficiency, are becoming increasingly popular in both traditional and electric vehicle models. As the USA continues to focus on improving fuel efficiency and reducing emissions, the adoption of DCT systems in passenger vehicles rises. The country’s increasing focus on electric mobility further accelerates the demand for transmission technologies that optimize vehicle performance.

The synchronizer for dual-clutch transmissions market in the United Kingdom is projected to grow at a CAGR of 5.3%, driven by the country’s automotive industry and increasing adoption of electric vehicles. The demand for DCT systems in the UK is primarily fueled by their ability to offer better fuel efficiency and driving performance, which is becoming increasingly important as consumer preferences shift towards high-performance and eco-friendly vehicles. The United Kingdom’s focus on reducing carbon emissions and its strong presence in the global electric vehicle market contribute to the growing adoption of advanced transmission technologies, including DCT systems.

The synchronizer for dual-clutch transmissions market in Japan is expected to grow at a CAGR of 4.7%, driven by Japan’s robust automotive manufacturing sector and its focus on technological innovation. As Japanese automakers, such as Toyota and Honda, continue to lead the market in terms of innovation, the demand for DCT systems, known for their superior performance, grows. Japan’s shift toward electric and hybrid vehicles further accelerates the adoption of DCT systems, as they offer enhanced energy efficiency and faster shifting capabilities. The market is also supported by Japan’s emphasis on sustainability and reducing fuel consumption in vehicles.

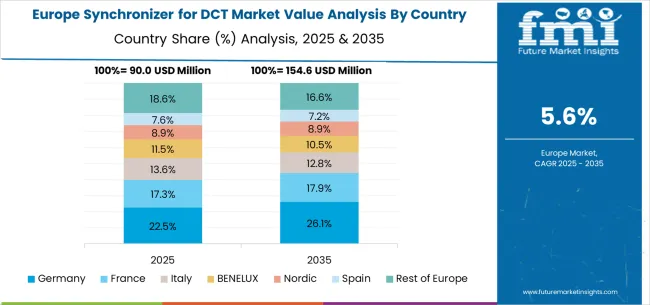

The synchronizer for dual-clutch transmissions market in Europe is projected to grow from USD 89.2 million in 2025 to USD 162.8 million by 2035, registering a CAGR of 6.2% over the forecast period. Germany is expected to maintain its leadership with a 35.8% share in 2025 (USD 31.9 million), supported by its extensive automotive manufacturing base and advanced transmission technology development programs.

France follows with 22.1% market share (USD 19.7 million), driven by strong automotive industry presence and DCT technology adoption in premium vehicle segments. The United Kingdom accounts for 16.4% of European demand (USD 14.6 million), supported by performance vehicle manufacturing and transmission system integration capabilities. Italy represents 11.2% market share (USD 10.0 million), reflecting growing automotive component manufacturing. Spain contributes 8.9% to European market value (USD 7.9 million), while Nordic countries account for 3.8% (USD 3.4 million) and BENELUX region holds 1.8% market share (USD 1.6 million).

The synchronizer for dual-clutch transmissions market is characterized by competition among established automotive component manufacturers, transmission system specialists, and precision engineering companies. Companies are investing in advanced materials research, precision manufacturing technologies, comprehensive testing programs, and technical support services to deliver reliable, durable, and cost-effective synchronizer solutions for DCT applications. Technology innovation, manufacturing excellence, and global supply chain capabilities are central to strengthening product portfolios and market positioning.

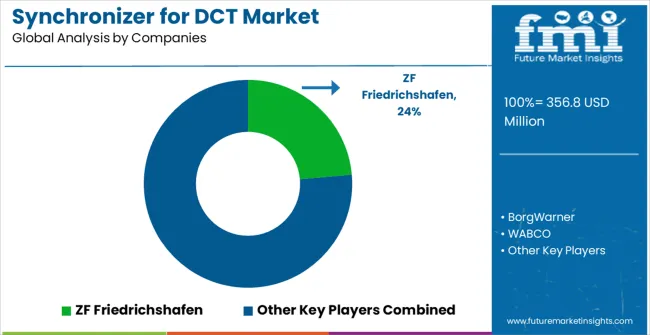

ZF Friedrichshafen, Germany-based, leads the market with comprehensive DCT synchronizer solutions featuring advanced multi-cone technologies and precision engineering designed for various vehicle applications and performance requirements. BorgWarner, USA, provides sophisticated transmission component systems with emphasis on fuel efficiency optimization and performance enhancement. ZF (WABCO legacy business) offers specialized synchronizer technologies designed for commercial vehicle DCT applications with focus on durability and operational reliability. Schaeffler Group, Germany, delivers advanced synchronizer systems with proprietary materials technology and comprehensive technical support services.

Eaton (Eaton Corporation plc), USA, provides transmission component solutions with focus on system integration and performance optimization across diverse automotive applications. Zhejiang Xunda Industry, China, offers cost-effective synchronizer manufacturing with emphasis on volume production capabilities. Haoneng Technology provides specialized component manufacturing with focus on precision engineering and quality control. Oerlikon, Switzerland, delivers advanced materials technology and surface treatment solutions for enhanced synchronizer performance, while Guangyang Bearing and Hoerbiger offer specialized synchronizer technologies and comprehensive manufacturing capabilities across regional and international markets.

Synchronizers for dual-clutch transmissions represent critical components enabling seamless gear shifting in high-performance automotive applications, with the global market valued at $357 million in 2023 and projected to reach $651.1 million by 2030, growing at a 6.2% CAGR. These precision-engineered assemblies synchronize rotational speeds between gears and shafts, ensuring smooth engagement without grinding or wear. Market expansion is driven by increasing DCT adoption in both passenger cars and commercial vehicles, demand for improved fuel efficiency, and growing preference for automated manual transmissions. However, scaling requires coordinated innovation across materials science, manufacturing precision, thermal management, and integration with evolving powertrain architectures.

How Governments Could Accelerate Market Development?

Automotive Industry Policy Support: Implement fuel economy standards and emissions regulations that favor advanced transmission technologies like DCT over conventional automatics. Provide research grants for universities and institutes developing next-generation synchronizer materials and friction technologies.

Manufacturing Excellence Programs: Establish centers of excellence for precision machining and surface treatment technologies essential for synchronizer manufacturing. Offer tax incentives for companies investing in advanced heat treatment facilities, precision grinding equipment, and quality measurement systems.

Supply Chain Localization Initiatives: Support domestic development of specialized steel alloys, carbon-based friction materials, and precision manufacturing capabilities to reduce dependence on imports. Create industrial clusters connecting synchronizer manufacturers with bearing producers, heat treatment specialists, and precision machining companies.

Electric Vehicle Transition Planning: Fund research into synchronizer applications in hybrid powertrains and multi-speed electric vehicle transmissions. Support development of specialized synchronizers for electric axle applications and range extender systems.

Standards and Testing Infrastructure: Establish national testing facilities for transmission component durability, thermal cycling, and noise-vibration-harshness (NVH) evaluation. Develop certification programs ensuring synchronizer quality and performance consistency across suppliers.

How Industry Bodies Could Strengthen Technology Foundations?

Performance Standards Development: Create comprehensive testing protocols for synchronizer engagement force, shift quality, durability under thermal cycling, and friction material wear characteristics. Establish standardized metrics for comparing single-cone, double-cone, and triple-cone synchronizer performance across different applications.

Materials Science Advancement: Coordinate pre-competitive research on advanced friction materials including carbon-carbon composites, ceramic-matrix composites, and nano-structured coatings. Develop material property databases enabling optimal synchronizer design for specific torque and thermal requirements.

Integration Guidelines: Publish best-practice guides for synchronizer integration with DCT architectures, covering gear ratio optimization, shift actuator coordination, and thermal management strategies. Create design tools helping transmission engineers select appropriate synchronizer configurations.

Quality and Reliability Frameworks: Establish failure mode analysis databases documenting common synchronizer wear patterns, root causes, and mitigation strategies. Develop predictive maintenance algorithms for commercial vehicle applications with high-duty cycles.

Market Intelligence and Forecasting: Provide regular analysis of DCT adoption trends across vehicle segments, regional preferences for transmission types, and emerging applications in hybrid and electric powertrains.

How OEMs and Technology Providers Could Drive Innovation?

Advanced Manufacturing Technologies: Invest in precision machining centers capable of achieving sub-micron tolerances on synchronizer cones and friction surfaces. Develop automated assembly systems ensuring consistent press-fit tolerances and friction material bonding quality.

Friction Material Innovation: Advance carbon-fiber reinforced composites and ceramic-matrix materials offering superior thermal stability and wear resistance. Develop gradient friction materials with optimized engagement characteristics across the synchronizer surface.

Thermal Management Solutions: Create advanced heat dissipation designs including integrated cooling channels, thermal barrier coatings, and high-conductivity backing plates. Develop thermal modeling tools predicting synchronizer temperature profiles under various duty cycles.

Smart Synchronization Systems: Integrate position sensors and force feedback systems enabling adaptive synchronization strategies. Develop algorithms optimizing engagement timing and force based on driving conditions, load, and component wear state.

Multi-Speed Electric Applications: Develop specialized synchronizers for multi-speed electric vehicle transmissions, addressing unique challenges like regenerative braking integration and high-rpm operation without engine damping.

How Suppliers Could Navigate Market Evolution?

Product Portfolio Diversification: Offer complete synchronizer families spanning economy single-cone systems for light-duty applications to high-performance triple-cone assemblies for sports cars and heavy commercial vehicles. Develop modular designs allowing customization for specific transmission architectures.

Advanced Materials Integration: Source and process specialized steel alloys with optimized hardness gradients, advanced friction materials with consistent coefficient characteristics, and precision-manufactured components meeting tight geometric tolerances.

Application Engineering Excellence: Provide comprehensive design support including thermal analysis, durability modeling, and shift quality optimization. Develop test capabilities demonstrating synchronizer performance under customer-specific operating conditions.

Global Manufacturing Strategy: Establish regional manufacturing centers near major automotive production hubs while maintaining centralized R&D for advanced material development and testing. Implement consistent quality systems across all production locations.

Lifecycle Support Services: Offer field failure analysis, root-cause investigation, and performance optimization services for existing DCT applications. Develop remanufacturing capabilities extending synchronizer service life in commercial vehicle applications.

How Investors and Financial Partners Could Unlock Market Value?

Advanced Manufacturing Infrastructure: Finance construction of precision manufacturing facilities incorporating state-of-the-art machining centers, automated assembly systems, and advanced quality measurement equipment. Structure investments with performance milestones tied to quality metrics and production efficiency.

Materials Technology Development: Back research initiatives developing breakthrough friction materials, surface treatments, and manufacturing processes. Support joint ventures between synchronizer manufacturers and advanced materials companies.

Market Expansion Opportunities: Finance capacity expansion in high-growth markets like China and India where DCT adoption is accelerating. Support establishment of technical centers providing local engineering support and application development.

Electrification Transition Investment: Fund development of synchronizer technologies for hybrid and electric vehicle applications. Support companies developing integrated solutions combining synchronizers with electric motor controllers and power electronics.

Supply Chain Vertical Integration: Finance strategic acquisitions enabling synchronizer manufacturers to control critical supply chain elements including specialized steel processing, friction material development, and precision manufacturing capabilities. Support partnerships with bearing manufacturers and heat treatment specialists.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 357 million |

| Synchronizer Type | Single-Cone Synchronizer, Double-Cone Synchronizer, Triple-Cone Synchronizer |

| Vehicle Type | Passenger Cars, Commercial Vehicles |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | ZF Friedrichshafen, BorgWarner Inc., ZF(WABCO legacy business), Schaeffler Group, Eaton (Eaton Corporation plc), Zhejiang Xunda Industry Co., Ltd., Haoneng Technology, Oerlikon Group, Guangyang Bearing Co., Ltd., Hoerbiger Holding AG |

| Additional Attributes | Dollar sales by synchronizer type and material composition, regional adoption trends across automotive markets, competitive landscape analysis with established component manufacturers and emerging technology providers, automotive manufacturer preferences for single-cone versus multi-cone synchronizer systems, integration with advanced DCT control systems and hybrid powertrains, innovations in friction materials and lightweight construction techniques, and adoption of precision manufacturing processes with enhanced durability and performance characteristics |

The global synchronizer for dual-clutch transmissions (DCT) market is estimated to be valued at USD 356.8 million in 2025.

The market size for the synchronizer for dual-clutch transmissions (DCT) market is projected to reach USD 651.1 million by 2035.

The synchronizer for dual-clutch transmissions (DCT) market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in synchronizer for dual-clutch transmissions (DCT) market are single-cone synchronizer, double-cone synchronizer and triple-cone synchronizer.

In terms of application, passenger cars segment to command 62.4% share in the synchronizer for dual-clutch transmissions (DCT) market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Heavy-duty Truck AMT Synchronizer Market Size and Share Forecast Outlook 2025 to 2035

Automotive Transmission Synchronizer Assembly Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA