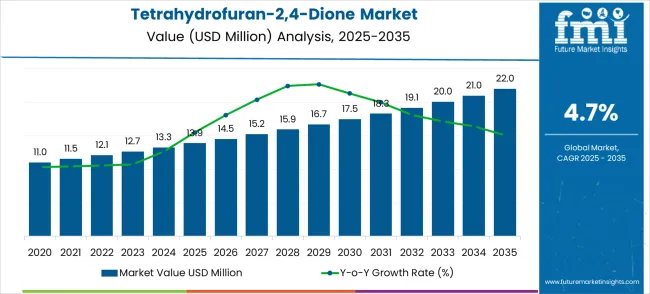

The global tetrahydrofuran-2,4-dione market is projected to reach USD 22.0 million by 2035, recording an absolute increase of USD 8.1 million over the forecast period. The market is valued at USD 13.9 million in 2025 and is set to rise at a CAGR of 4.7% during the assessment period. The overall market size is expected to grow by nearly 1.58X during the same period, supported by increasing demand for specialized chemical intermediates in pharmaceutical synthesis and advanced organic chemistry applications. Growth faces constraints from limited production capacity and high purification costs for pharmaceutical-grade materials.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 13.9 million |

| Market Forecast Value (2035) | USD 22.0 million |

| Forecast CAGR (2025-2035) | 4.7% |

Between 2025 and 2030, the tetrahydrofuran-2,4-dione market is projected to expand from USD 13.9 million to USD 17.5 million, resulting in a value increase of USD 3.6 million, which represents 44.3% of the total forecast growth for the decade. This phase of growth will be shaped by rising demand for pharmaceutical intermediates, product innovation in synthesis methodologies and purification technologies, and expanding research applications. Companies are establishing competitive positions through investment in specialized manufacturing capabilities, premium quality positioning, and strategic market expansion across pharmaceutical companies, chemical distributors, and emerging biotechnology firms.

From 2030 to 2035, the market is forecast to grow from USD 17.5 million to USD 22.0 million, adding another USD 4.5 million, which constitutes 55.7% of the overall ten-year expansion. This period is expected to be characterized by expansion of advanced applications including custom synthesis projects and specialized intermediates tailored for specific pharmaceutical targets, strategic collaborations between chemical manufacturers and pharmaceutical companies, and quality differentiation with pharmaceutical-grade compliance. The growing emphasis on drug development complexity and specialized chemical requirements will drive demand for high-purity tetrahydrofuran-2,4-dione across diverse pharmaceutical synthesis applications.

Market expansion stems from tetrahydrofuran-2,4-dione's critical role as a specialized building block in pharmaceutical synthesis, reducing development time and synthesis complexity for drug manufacturers. Pharmaceutical companies increasingly require reliable access to high-purity cyclic anhydrides for complex molecule construction, particularly in oncology and central nervous system drug development. Chemical research institutions demand consistent quality materials for academic research programs, while biotechnology companies seek specialized intermediates for novel therapeutic development. Asia Pacific markets drive consumption through expanding pharmaceutical manufacturing capabilities, while North American and European demand centers on research applications and custom synthesis projects. Production scalability limitations and regulatory approval requirements for pharmaceutical-grade specifications constrain rapid market expansion.

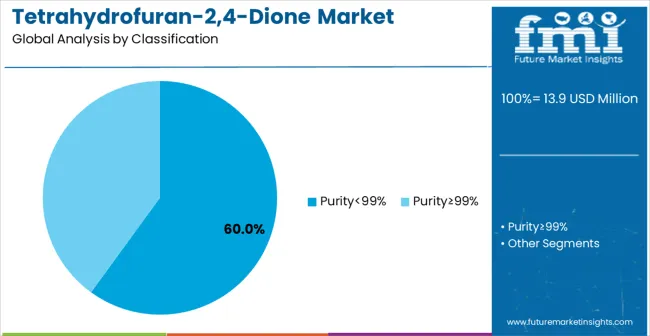

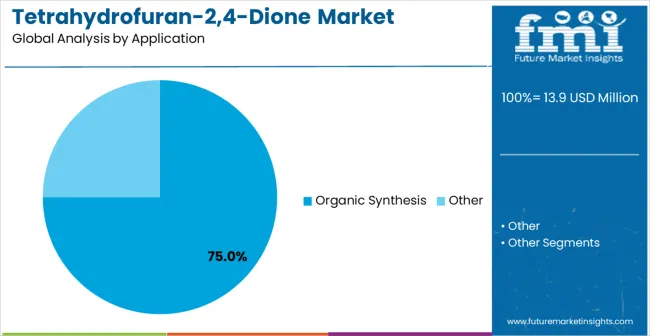

The market is segmented by purity grade, application, and region. By purity grade, the market is divided into Purity<99%, Purity≥99%, and pharmaceutical grade materials. By application, the market is categorized into organic synthesis, pharmaceutical intermediates, and research applications. Regionally, the market is divided into North America, Latin America, Europe, East Asia, South Asia & Pacific, and Middle East & Africa.

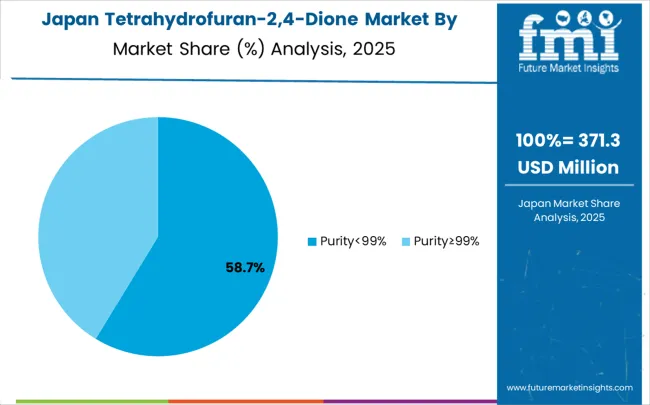

The Purity ≥99% grade is projected to account for approximately 60% of the tetrahydrofuran-2,4-dione market in 2025, reflecting the high demand for ultra-pure materials across pharmaceutical and academic research applications. This segment is primarily driven by pharmaceutical industry requirements for high-purity starting materials that ensure optimal reaction outcomes, reproducible synthetic yields, and regulatory compliance. Impurities in intermediate chemicals can significantly affect the efficacy, stability, and safety of downstream drug formulations, making high-purity grades essential for active pharmaceutical ingredient (API) production. Additionally, research institutions and academic laboratories require consistent material quality to achieve reproducible experimental results in synthesis studies, ensuring that published data meets rigorous peer-reviewed standards. The high value of this segment is also reflected in premium pricing strategies, which account for the specialized manufacturing processes, advanced purification methods, and extensive analytical quality control measures necessary to maintain batch-to-batch consistency. Manufacturing facilities catering to this segment often utilize cleanroom environments, automated monitoring systems, and multi-step purification technologies to comply with International Council for Harmonisation (ICH) guidelines and other global pharmaceutical standards.

Key Highlights:

The organic synthesis segment is expected to represent approximately 75% of tetrahydrofuran-2,4-dione demand in 2025. This dominance is attributed to the compound’s role as a critical cyclic anhydride building block in complex organic synthesis, including pharmaceutical intermediate preparation and academic research applications. Tetrahydrofuran-2,4-dione provides fundamental chemical reactivity that enables the creation of heterocyclic compounds, advanced materials, and novel therapeutic agents. Growth in this segment is supported by the expansion of pharmaceutical pipelines requiring specialized building blocks, increasing complexity in drug discovery synthetic routes, and rising demand for custom synthesis solutions in biotechnology development programs. Consistent quality and high-purity standards are essential for pharmaceutical companies to ensure regulatory compliance, while research institutions rely on reproducible materials for academic publications and methodology development. Biotechnology firms utilize this compound for the development of novel therapeutic compounds, ensuring precise chemical reactions and predictable synthesis outcomes essential for clinical trial preparations. The organic synthesis segment emphasizes supply chain reliability, analytical documentation, and technical support to meet stringent pharmaceutical and research requirements.

Key Highlights:

The tetrahydrofuran-2,4-dione market is primarily driven by the expanding pharmaceutical industry, which increasingly relies on specialized chemical intermediates for complex drug synthesis programs. These intermediates play a critical role in reducing development timelines, improving synthetic efficiency, and ensuring reproducible outcomes in active pharmaceutical ingredient (API) production. Pharmaceutical companies demand high-purity reagents to achieve predictable yields and meet stringent regulatory compliance requirements. Similarly, research institutions drive market growth through consistent procurement of high-purity tetrahydrofuran-2,4-dione for academic synthesis programs, often aligned with publication cycles and grant funding availability. The biotechnology sector also contributes to demand growth, as companies require custom synthesis capabilities and specialized building blocks for novel therapeutic compound development. Collectively, these drivers are closely linked to pharmaceutical development success rates, academic research outputs, and clinical trial progression, all of which depend on reliable and high-quality chemical intermediates.

Market growth, however, is tempered by several restraints. Manufacturing scale limitations constrain production capacity for pharmaceutical-grade specifications, often creating supply bottlenecks during periods of high demand. Regulatory approval complexity for pharmaceutical-grade materials increases compliance costs and delays market entry for new suppliers. Volatility in raw material costs can impact pricing stability, while limited facilities capable of producing consistent high-purity intermediates create significant barriers to entry for smaller manufacturers. Additionally, extensive analytical testing and regulatory compliance requirements for pharmaceutical applications demand robust quality documentation infrastructure, further excluding smaller or less technologically advanced producers from participating effectively in the market.

Key trends shaping the market include the rapid growth of pharmaceutical manufacturing in the Asia Pacific region, creating concentrated demand centers for high-purity intermediates. Technological innovations such as continuous flow synthesis and automated purification systems are being adopted to enhance production efficiency, reduce costs, and maintain consistent product quality. Pharmaceutical companies increasingly prioritize suppliers offering comprehensive quality documentation and technical support services. Emerging trends in personalized medicine and complex therapeutic targets are expected to drive demand for highly specialized intermediates, while generic drug competition could exert price pressures on these materials. Economic fluctuations affecting research funding may also influence academic procurement and slow pharmaceutical development programs requiring tetrahydrofuran-2,4-dione.

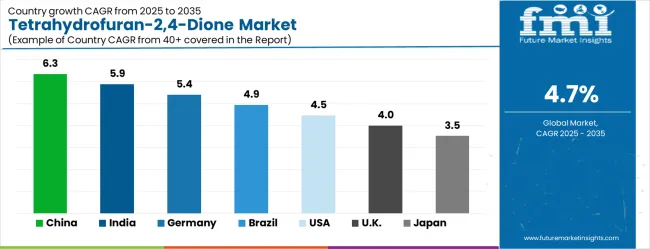

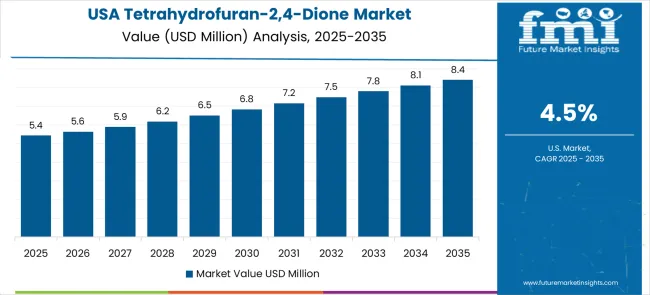

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| Brazil | 4.9% |

| USA | 4.5% |

| UK | 4.0% |

| Japan | 3.5% |

The tetrahydrofuran-2,4-dione market is gathering pace worldwide, with China taking the lead thanks to pharmaceutical manufacturing expansion and chemical industry modernization. Close behind, India benefits from growing pharmaceutical research capabilities and competitive production costs, positioning itself as a strategic growth hub. Germany shows steady advancement, where pharmaceutical industry expertise strengthens its role in the regional supply chain. Brazil is sharpening focus on chemical intermediate production and pharmaceutical manufacturing, signaling ambition to capture niche opportunities. Meanwhile, the United States stands out for its research institution demand, and the United Kingdom and Japan continue to record consistent progress. Together, China and India anchor the global expansion story, while the rest build stability and diversity into the market's growth path.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

China demonstrates strong potential with chemical synthesis expertise and pharmaceutical manufacturing expansion. Revenue growth of 6.3% through 2035 stems from government pharmaceutical industry development programs, chemical manufacturing modernization initiatives, and expanding domestic research capabilities, especially in Beijing, Shanghai, and Guangzhou. Pharmaceutical companies are adopting specialized chemical intermediates for drug development programs while leveraging competitive manufacturing cost advantages and established supply chain infrastructure. Chemical distributors expand production capacity and export capabilities while government policies support chemical industry development through tax incentives and regulatory streamlining. Major pharmaceutical manufacturing zones in Beijing, Shanghai, and Guangzhou report increased procurement of specialized chemical intermediates during 2023-2024 expansion cycles. Chemical manufacturers invest in pharmaceutical-grade production facilities to serve both domestic pharmaceutical companies and international export markets. Research institutions collaborate with chemical producers to develop specialized synthesis methodologies and quality control standards.

In Mumbai and Hyderabad, adoption of specialized chemical intermediates is accelerating among pharmaceutical manufacturers focusing on generic drug development and research institution partnerships. Pharmaceutical companies require high-purity materials for drug synthesis programs while research institutions demand consistent quality reagents for academic studies and publication requirements. Chemical manufacturers establish production facilities to serve domestic pharmaceutical demand while developing export capabilities for international markets. The country's pharmaceutical industry expansion supports 5.9% growth through 2035, linking directly to government pharmaceutical manufacturing incentives, competitive production cost advantages, and skilled chemistry workforce availability. Major pharmaceutical companies in Mumbai, Hyderabad, and Bangalore utilize tetrahydrofuran-2,4-dione for complex generic drug synthesis programs while research institutions require materials meeting international publication standards. Chemical distributors develop specialized supply networks serving both pharmaceutical manufacturing clusters and academic research institutions across major metropolitan areas.

German pharmaceutical research institute partnerships demonstrate measurable increases in specialized intermediate procurement during 2023-2024 research cycles, reflecting academic program expansion and industry collaboration growth. Pharmaceutical companies in Frankfurt, Munich, and Hamburg utilize tetrahydrofuran-2,4-dione for complex drug synthesis programs while chemical manufacturers maintain pharmaceutical-grade production capabilities and European Union regulatory compliance. Research institutions require consistent quality materials for academic publications and industry collaboration projects, creating stable demand patterns supported by government research funding and university-industry partnership programs. Chemical distributors serve both domestic pharmaceutical companies and European export markets through established supply networks and regulatory expertise. Manufacturing facilities focus on pharmaceutical-grade production standards while maintaining comprehensive quality documentation for regulatory compliance. Growth reaches 5.4% through 2035.

Brazil's pharmaceutical sector expansion creates growing demand for specialized chemical intermediates among manufacturers seeking to reduce import dependencies and establish domestic supply chains. Pharmaceutical companies in São Paulo and Rio de Janeiro require high-purity intermediates for generic drug production while chemical manufacturers invest in production capacity upgrades and quality system improvements. Import substitution policies encourage domestic chemical production while pharmaceutical industry development programs support manufacturing infrastructure investments. The challenge involves achieving pharmaceutical-grade quality specifications while maintaining competitive pricing against established international suppliers and meeting regulatory compliance requirements. Research institutions collaborate with chemical manufacturers to develop local synthesis capabilities and quality standards. Growth patterns indicate 4.9% expansion through 2035, driven by government pharmaceutical industry support and domestic market development.

The United States leads pharmaceutical research applications based on academic institution demand and biotechnology company requirements for specialized chemical intermediates. CAGR 4.5% through 2035 reflects cost-per-outcome compression under compliance and reliability constraints through pharmaceutical development program efficiency and research institution budget optimization while maintaining quality standards. Pharmaceutical companies adopt specialized intermediates for drug discovery programs requiring regulatory compliance and consistent quality specifications while biotechnology firms utilize materials for novel therapeutic development. Chemical distributors expand academic institution supply networks and biotechnology company service capabilities through specialized distribution channels and technical support programs. Boston, San Francisco, and Research Triangle Park pharmaceutical research clusters report increased procurement of specialized chemical intermediates for oncology drug development programs and academic research initiatives. Research institutions require materials meeting publication standards while maintaining competitive procurement costs.

The UK market represents medium growth potential based on research institution requirements and pharmaceutical company development programs concentrated in Cambridge, Oxford, and London metropolitan areas. Academic institutions utilize specialized intermediates for organic chemistry research while pharmaceutical companies require high-purity materials for drug synthesis programs and regulatory compliance. The scenario indicates steady demand growth supported by research funding stability and pharmaceutical industry presence, though economic constraints may limit research spending expansion and affect procurement patterns. Chemical suppliers focus on academic market penetration while maintaining pharmaceutical-grade quality standards and comprehensive technical support services. Research institutions collaborate with chemical manufacturers to develop specialized synthesis methodologies and quality control standards. Market dynamics suggest consistent progress in specialized chemical applications supported by government research funding and university-industry partnership programs.

Japan's pharmaceutical companies and research institutions maintain consistent demand for high-purity tetrahydrofuran-2,4-dione in specialized synthesis applications across Tokyo, Osaka, and Yokohama research centers. Chemical manufacturers serve domestic pharmaceutical industry requirements while maintaining quality standards exceeding international specifications for research institution supply and pharmaceutical applications. The market benefits from established pharmaceutical industry presence and research institution stability, creating predictable demand patterns for specialized chemical intermediates supported by government research funding and industry collaboration programs. Manufacturing facilities emphasize quality excellence and comprehensive technical support services while maintaining regulatory compliance for pharmaceutical applications. Consumer acceptance requires extensive quality documentation and scientific validation through established research programs. Growth reaches 3.5% through 2035, reflecting mature market conditions with stable pharmaceutical company requirements and consistent research institution procurement patterns supported by academic funding stability.

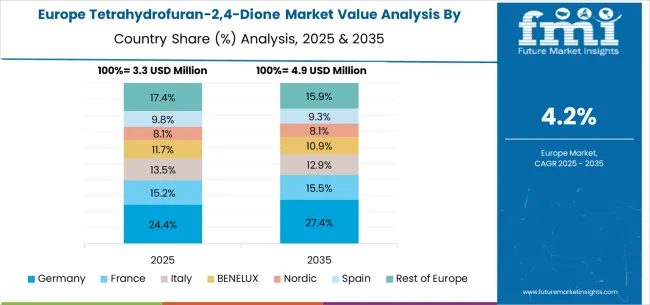

The European tetrahydrofuran-2,4-dione market demonstrates specialized development across pharmaceutical research centers and chemical manufacturing hubs. Germany leads through pharmaceutical industry expertise and research institution demand, while the UK maintains strong academic research applications. France contributes through pharmaceutical company requirements and chemical manufacturing capabilities, with companies focusing on high-purity intermediate production. Italy and Spain show steady growth in pharmaceutical applications, particularly for generic drug manufacturing requiring specialized building blocks. BENELUX countries contribute through chemical distribution networks and pharmaceutical industry support, while Eastern European markets develop production capabilities for cost-effective chemical intermediate manufacturing. The region emphasizes pharmaceutical-grade quality standards and research institution supply requirements.

The tetrahydrofuran-2,4-dione market operates with moderate concentration, featuring approximately 6–10 meaningful global players. Competition primarily focuses on quality differentiation, pharmaceutical-grade certifications, and technical support capabilities rather than price-based strategies. Market leaders include Guangzhou Sunton Biotechnology, Tokyo Chemical Industry Co., Ltd. (TCI Chemicals), and HBCChem, Inc., which maintain competitive advantages through specialized synthesis expertise, pharmaceutical-grade manufacturing capabilities, and established relationships with major pharmaceutical customers. These companies benefit from economies of scale in production, comprehensive quality control systems, and technical support services that create high switching costs for customers requiring consistent quality and regulatory compliance.

Challengers in the market, such as Aladdin Scientific, Alfa Chemistry, Simson Pharma Limited, Shandong SanYoung Industry Co., Ltd., Ark Pharm, Inc., and SynQuest Laboratories, compete through specialized application focus, regional market expertise, and flexible manufacturing capabilities. These companies typically serve niche applications, custom synthesis requirements, or specific geographic markets while building capabilities to expand their market reach. Growth strategies across both leaders and challengers include capacity expansion, quality improvements, and partnership development with pharmaceutical and biotechnology companies. Competition dynamics are driven by advancements in synthesis technology, quality certification programs, and strengthened pharmaceutical industry relationships. Market evolution trends indicate gradual consolidation among smaller players, while established manufacturers continue to expand production capacity and pharmaceutical-grade certifications. Customer retention heavily depends on quality consistency, regulatory documentation, and technical support that ensures smooth integration into pharmaceutical development programs.

Competition dynamics involve technology advancement in synthesis methods, quality certification development, and pharmaceutical industry relationship building. Market evolution trends suggest continued consolidation among smaller players while established manufacturers expand production capacity and pharmaceutical-grade certifications through strategic investments and regulatory compliance improvements. Customer retention depends heavily on quality consistency, technical support capabilities, and regulatory documentation standards that support pharmaceutical development programs.

Tetrahydrofuran-2,4-dione (glutaric anhydride) serves as a versatile cyclic anhydride building block in specialized organic synthesis, particularly for pharmaceutical intermediates, polymer modifications, and fine chemical manufacturing. With a market valued at USD 13.9 million growing to USD 22.0 million at 4.7% annually, this specialty chemical benefits from expanding pharmaceutical development activities and increasing demand for complex synthetic intermediates. The market's advancement requires coordinated efforts across chemical manufacturers, analytical service providers, synthetic chemistry innovators, and targeted investment in high-purity production capabilities.

How Governments Could Support Specialty Chemical Innovation?

How Industry Bodies Could Advance Market Standards?

How Chemical Technology Providers Could Strengthen the Ecosystem?

How Suppliers Could Optimize Market Position?

How Investors Could Accelerate Market Growth?

| Item | Value |

|---|---|

| Quantitative Units | USD 22 million |

| Purity Grade | Purity<99%, Purity≥99%, Pharmaceutical Grade |

| Application | Organic Synthesis, Pharmaceutical Intermediates, Research Applications |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil |

| Key Companies Profiled | Caihe Biotech, Tianmen Hengchang Chemical, Fangde New Materials, Jlight Chemicals Company, Guangzhou Sunton Biotechnology, Tokyo Chemical Industry Co., Ltd. (TCI Chemicals), HBCChem, Inc., Aladdin Scientific, Alfa Chemistry, Simson Pharma Limited, Shandong SanYoung Industry Co., Ltd., Ark Pharm, Inc., SynQuest Laboratories |

| Additional Attributes | Dollar sales by purity grade and application segments, regional consumption trends across North America, Europe, and Asia-Pacific, competitive landscape with specialized chemical manufacturers and pharmaceutical suppliers, adoption patterns for pharmaceutical-grade versus industrial-grade applications, integration with pharmaceutical development programs and research institution requirements, innovations in synthesis methodologies and purification technologies, and development of specialized applications with enhanced purity specifications for drug discovery and pharmaceutical manufacturing processes. |

The global tetrahydrofuran-2,4-dione market is estimated to be valued at USD 13.9 million in 2025.

The market size for the tetrahydrofuran-2,4-dione market is projected to reach USD 22.0 million by 2035.

The tetrahydrofuran-2,4-dione market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in tetrahydrofuran-2,4-dione market are purity<99% and purity≥99%.

In terms of application, organic synthesis segment to command 75.0% share in the tetrahydrofuran-2,4-dione market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA