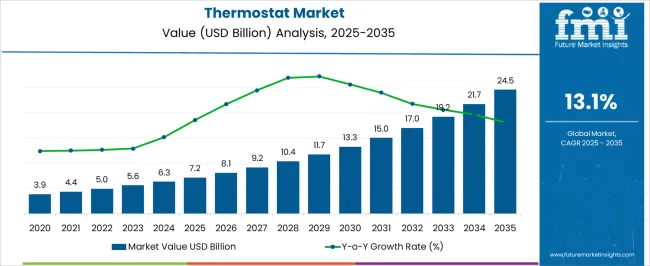

The thermostat market is projected to grow from USD 7.2 billion in 2025 to USD 24.5 billion by 2035, representing a CAGR of 13.1%. This expansion yields an absolute dollar opportunity of USD 17.3 billion over the decade. Demand is supported by residential, commercial, and industrial upgrades where precise temperature control and energy management are priorities. Companies can capture share by strengthening distribution, ensuring compatibility across HVAC systems, and offering reliable after-sales support. Early positioning with clear value propositions, competitive pricing, and service coverage helps vendors build durable pipelines with contractors, facility managers, and retailers, translating pipeline wins into recurring replacement and retrofit revenue.

During the forecast period, the USD 17.3 billion opportunity reflects a sustained shift toward connected controls and broader adoption of programmable devices. By 2035, revenues will increasingly come from replacements, multi-site rollouts, and integration with building management platforms. The 13.1% CAGR signals room for scale: manufacturers that optimize supply chains, secure channel partners, and streamline installation will convert elevated order volumes into margin gains. Targeted outreach to utilities, OEM HVAC partners, and property portfolios can accelerate uptake. Clear documentation, interoperability, and warranty policies further reduce buyer friction, helping vendors unlock the full absolute growth potential embedded in the market outlook.

| Metric | Value |

|---|---|

| Thermostat Market Estimated Value in (2025 E) | USD 7.2 billion |

| Thermostat Market Forecast Value in (2035 F) | USD 24.5 billion |

| Forecast CAGR (2025 to 2035) | 13.1% |

The thermostat market is undergoing rapid modernization driven by the global focus on energy efficiency, smart home integration, and government mandates for sustainable heating and cooling systems. With advancements in IoT and wireless connectivity, consumers are increasingly adopting thermostats that provide remote access, learning capabilities, and integration with smart ecosystems.

Demand is further supported by rising energy costs and the need for predictive, responsive temperature control in both residential and commercial environments. Manufacturers are innovating with AI-based algorithms, cloud compatibility, and sleek interfaces to enhance user experience.

As buildings adopt greener practices, thermostats are emerging as crucial nodes in energy management systems.

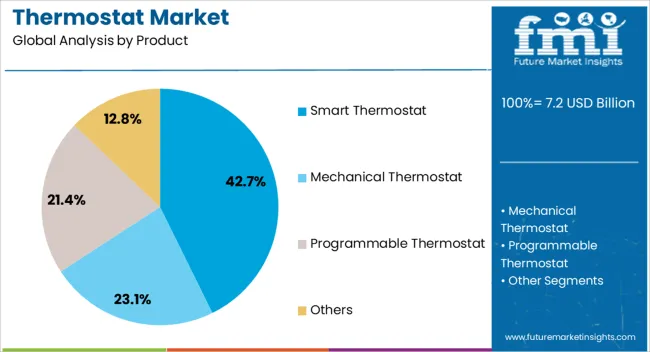

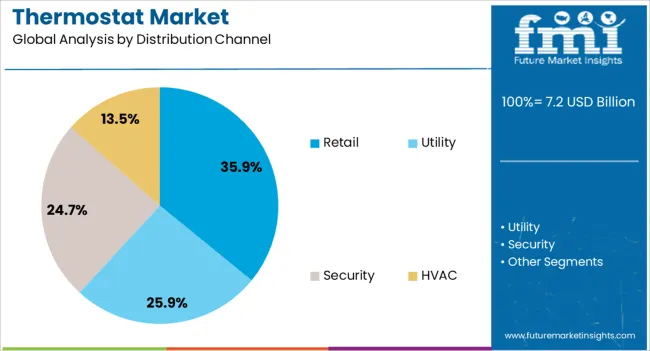

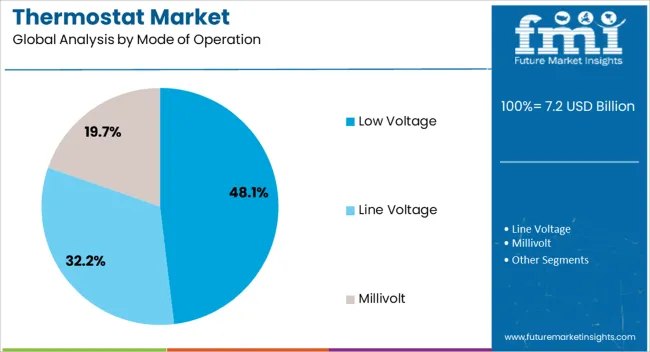

The thermostat market is segmented by product, distribution channel, mode of operation, application, and geographic regions. By product, thermostat market is divided into Smart Thermostat, Mechanical Thermostat, Programmable Thermostat, and Others. In terms of distribution channel, thermostat market is classified into Retail, Utility, Security, and HVAC. Based on mode of operation, thermostat market is segmented into Low Voltage, Line Voltage, and Millivolt. By application, thermostat market is segmented into Residential, Commercial, Educational Institutes, Office Buildings, Retail, Hospitals, Others, and Industrial. Regionally, the thermostat industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Smart thermostats are projected to lead the market with a 42.70% share in 2025. This dominance is attributed to their ability to offer real-time monitoring, remote access, and learning-based temperature adjustments.

As smart homes and connected appliances become mainstream, consumers are opting for solutions that reduce energy bills without compromising comfort. Smart thermostats also contribute to grid stability by integrating with demand response programs.

With increasing compatibility with voice assistants and platforms like Google Home and Amazon Alexa, adoption is growing across both developed and emerging economies. Utility rebates and energy certifications are further accelerating their market traction.

Retail is set to dominate the distribution landscape with a 35.90% share by 2025. This leadership is due to the wide availability of thermostats through online and offline retail outlets, offering consumers ease of comparison, self-installation kits, and promotional bundles.

The growing DIY trend, especially in developed markets, has fueled retail-based purchases of smart and programmable thermostats. Additionally, e-commerce platforms provide tailored recommendations, customer reviews, and attractive discounts, expanding market reach to tech-savvy homeowners.

Retailers are also collaborating with manufacturers to provide in-store guidance and after-sales support, improving conversion rates and customer satisfaction.

Low voltage thermostats are forecast to capture 48.10% of the total market share in 2025, making them the leading mode of operation. These thermostats are widely used in HVAC systems for residential and light commercial applications, offering compatibility with a broad range of heating and cooling equipment.

Their safety, energy efficiency, and ease of installation make them a preferred choice for both consumers and contractors. The increasing demand for smart and programmable variants has further expanded the application of low voltage models.

Their adaptability to zoning systems and multi-stage operations supports energy-saving strategies, especially in regions with fluctuating climates and stringent efficiency standards.

The thermostat market is growing as smart home adoption, energy efficiency goals, and climate control needs accelerate worldwide. Thermostats are widely used in residential, commercial, and industrial applications to regulate heating, ventilation, and air conditioning (HVAC) systems. Rising consumer demand for convenience, remote monitoring, and integration with smart home ecosystems is fueling adoption.

Connected thermostats with Wi-Fi, voice control, and AI-enabled learning features are gaining popularity. Government initiatives promoting energy conservation and stricter building efficiency codes further drive demand. Leading companies are innovating with adaptive learning algorithms, smartphone apps, and interoperability with platforms like Google Home and Amazon Alexa. As sustainability and automation converge, the thermostat market is positioned for sustained expansion across developed and emerging regions.

Adoption of thermostats faces challenges due to high upfront installation costs and compatibility concerns with legacy HVAC systems. Smart and programmable thermostats require professional setup in some cases, which increases expenses for homeowners and small businesses. Older heating or cooling systems may not support advanced thermostat models, limiting penetration in retrofit applications. Additionally, consumer hesitation related to cybersecurity risks and data privacy in connected devices poses barriers. Manufacturers are addressing these issues by offering affordable, user-friendly models, universal compatibility features, and stronger security protocols. Educating consumers on energy savings and long-term cost benefits is also key to overcoming initial adoption barriers and improving market penetration.

Key market trends revolve around integration with IoT platforms, artificial intelligence, and advanced energy management systems. Smart thermostats now feature learning algorithms that automatically adjust temperature based on user behavior, occupancy patterns, and weather conditions. Connectivity with home automation ecosystems enables seamless control through smartphones, voice assistants, and centralized hubs. Utilities and energy providers are partnering with thermostat manufacturers to deploy demand-response programs that optimize grid usage. These trends highlight the growing role of thermostats in smart homes and connected commercial buildings, transforming them from simple temperature regulators into integral components of energy-efficient, automated environments worldwide.

Opportunities in the thermostat market are driven by rising demand for energy-efficient solutions and the rapid adoption of smart home technologies. Consumers and businesses are increasingly seeking devices that lower utility bills, reduce carbon footprints, and enhance comfort. Expansion of connected infrastructure in both residential and commercial buildings is creating opportunities for thermostats with advanced features like zonal temperature control and predictive maintenance alerts. Emerging markets present strong growth potential as urbanization and disposable incomes rise. Manufacturers that focus on affordability, user experience, and integration with broader building automation systems can capture expanding opportunities in global thermostat adoption.

The thermostat market faces restraints from intense competition, evolving regulations, and the need for constant innovation. Numerous global and regional players compete on price, design, and features, leading to margin pressures. Regulatory standards for energy efficiency, safety, and data privacy create compliance challenges for manufacturers, especially in international markets with diverse requirements. Frequent technological advancements also demand continuous R&D investment, raising costs for smaller players. Additionally, fragmented consumer awareness in developing regions slows adoption of advanced thermostats. To overcome these restraints, companies must focus on differentiation through innovation, compliance readiness, and effective consumer education about the benefits of modern thermostat technologies.

| Country | CAGR |

|---|---|

| China | 17.7% |

| India | 16.4% |

| Germany | 15.1% |

| France | 13.8% |

| UK | 12.4% |

| USA | 11.1% |

| Brazil | 9.8% |

The global thermostat market has been projected to expand at a CAGR of 13.1% through 2035, driven by smart home automation, energy efficiency regulations, and integration with HVAC systems. In the BRICS region, China has been recorded with 17.7% growth, where manufacturing of smart thermostats, programmable units, and IoT-enabled devices has been carried out by companies such as Huawei, Xiaomi, and regional HVAC system suppliers. India has been observed at 16.4%, supported by adoption in both residential and commercial buildings as well as rising deployment in smart city projects. Within the OECD region, Germany has been measured at 15.1%, where industrial and residential thermostat applications have been extensively commercialized under EU energy directives. The United Kingdom has been noted at 12.4%, driven by government incentives for energy efficiency and retrofitting of heating systems. The USA has been recorded at 11.1%, where companies including Honeywell, Emerson, and Johnson Controls have been expanding product portfolios for both home automation and industrial HVAC systems. This dataset provides coverage across 40+ countries; the top five markets are highlighted here.

The thermostat market in China is advancing at a CAGR of 17.7%, supported by rapid adoption of smart home technologies, building automation, and energy efficiency initiatives. Technology providers, HVAC manufacturers, and IoT solution vendors are collaborating to deliver advanced thermostats with remote monitoring and AI-based temperature control. Government programs promoting green buildings and energy savings are boosting adoption in residential complexes, commercial offices, and industrial facilities. Pilot deployments in smart city projects are showcasing benefits such as reduced energy consumption, operational efficiency, and enhanced user comfort. Partnerships between device manufacturers, telecom operators, and energy utilities are expected to strengthen China’s leadership in the thermostat market.

Thermostat Market Growth in India

The thermostat market in India is growing at a CAGR of 16.4%, driven by rising demand for smart HVAC systems, energy savings, and increased awareness of climate control technologies. Service providers and HVAC manufacturers are supplying advanced thermostats for residential buildings, office complexes, and industrial applications. Government programs promoting sustainable building practices, energy-efficient appliances, and smart city infrastructure are creating favorable conditions for adoption. Pilot projects in large IT parks and residential smart homes demonstrate significant reductions in energy costs and improved indoor comfort. Collaborations between technology companies, real estate developers, and energy utilities continue to accelerate the adoption of thermostat solutions in the Indian market.

Thermostat Market Expansion in Germany

The thermostat market in Germany is recording a CAGR of 15.1%, underpinned by strict energy efficiency regulations, growing adoption of smart home devices, and demand for sustainable building systems. Technology providers and HVAC companies are integrating intelligent thermostats into commercial offices, residential apartments, and industrial facilities. Government incentives supporting energy-efficient retrofitting and renewable integration have encouraged widespread adoption. Pilot deployments in green building projects demonstrate reductions in operational costs and improvements in energy management. Collaborations between thermostat providers, construction companies, and IoT solution developers are advancing digital control systems, cloud monitoring, and automation platforms in Germany.

Thermostat Market Developments in the United Kingdom

The thermostat market in the United Kingdom is expanding at a CAGR of 12.4%, influenced by rising demand for energy-efficient heating solutions, smart home integration, and building automation. Service providers and HVAC manufacturers are delivering programmable and connected thermostats for residential homes, commercial buildings, and public facilities. Government initiatives promoting energy savings, climate-conscious living, and smart infrastructure accelerate adoption. Pilot projects in office spaces and residential communities showcase improved indoor climate management and energy reduction. Collaborations between thermostat providers, telecom operators, and home automation companies continue to drive growth in the UK market.

Thermostat Market Insights in the United States

The thermostat market in the United States is growing at a CAGR of 11.1%, led by strong demand for smart thermostats, connected home devices, and energy management solutions. Technology providers, HVAC manufacturers, and IoT companies are supplying advanced products with features like geofencing, learning algorithms, and mobile app integration. Federal and state-level programs promoting energy efficiency, sustainability, and green building certifications support adoption. Pilot deployments in residential homes and commercial buildings highlight reduced energy costs and improved HVAC performance. Collaborations between thermostat manufacturers, utility companies, and smart home ecosystem players are expected to accelerate adoption across diverse sectors in the USA market.

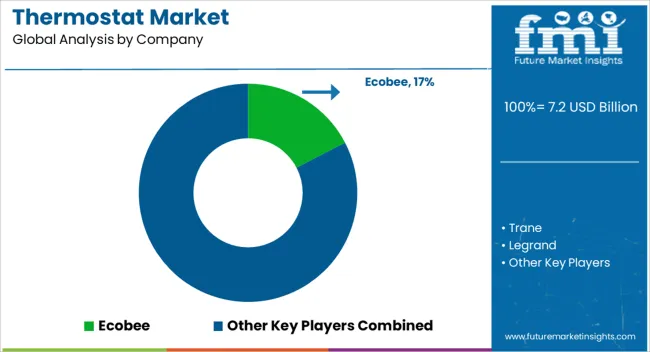

Ecobee, Trane, and Legrand supply connected and programmable thermostats, with brochures detailing features such as voice assistant compatibility, zoned control, and wireless connectivity. Schneider Electric and Nortek Global HVAC emphasize integration with building management systems, providing documentation that highlights energy scheduling, centralized control, and modular installation requirements. The Radio Thermostat Company of America and COMPUTIME LIMITED present OEM and white-label thermostat solutions, with datasheets covering communication protocols, calibration accuracy, and product certifications. Johnson Controls and Danfoss focus on commercial and industrial applications, with brochures showcasing compatibility with HVAC chillers, multi-zone systems, and BACnet or Modbus communication standards.

Carrier Corporation, Emerson Electric, and Sensata Technologies position their products for both residential and commercial markets, supported by technical manuals on load management, wiring configurations, and control logic. Trafag and Venstar Inc. highlight precision control for specialized environments, while tado GmbH and Lennox International Inc. offer smart-home-compatible thermostats with mobile app support, weather adaptation features, and remote management capabilities. Competitive strategies emphasize connectivity, reliability, and product differentiation across residential, commercial, and industrial use cases. Companies invest in platform ecosystems where thermostats interact with HVAC systems, sensors, and building automation platforms. Integration with smart speakers, mobile applications, and cloud-based monitoring is frequently noted in marketing and technical literature. Product development cycles focus on user interface design, predictive temperature control, and wireless communication stability.

Differentiation is achieved through open protocol support, self-learning algorithms, and precision calibration, allowing vendors to target corporate buyers, facility managers, and homeowners alike. Brochure content consistently underlines installation flexibility, system compatibility, and demonstrated efficiency improvements backed by technical performance data. Datasheets and brochures are structured to support technical evaluation, procurement, and installation planning. Ecobee, Trane, and Legrand highlight smart-home integration, touchscreens, and cloud platforms. Schneider Electric, Nortek Global HVAC, and Johnson Controls brochures provide detailed wiring diagrams, communication protocol support, and integration with enterprise-level HVAC controls.

Carrier, Emerson, and Sensata materials emphasize control accuracy, reliability metrics, and testing standards. Trafag and Venstar Inc. datasheets detail industrial-grade durability, vibration resistance, and environmental compliance. tado GmbH and Lennox International literature focuses on consumer usability, app dashboards, and predictive heating adjustments. Most technical brochures include schematics, connectivity tables, and compatibility charts to support installers, engineers, and procurement specialists. These materials are positioned as critical decision-making tools, ensuring clarity on functionality, installation costs, and long-term efficiency outcomes.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.2 Billion |

| Product | Smart Thermostat, Mechanical Thermostat, Programmable Thermostat, and Others |

| Distribution Channel | Retail, Utility, Security, and HVAC |

| Mode of Operation | Low Voltage, Line Voltage, and Millivolt |

| Application | Residential, Commercial, Educational Institutes, Office Buildings, Retail, Hospitals, Others, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ecobee, Trane, Legrand, Schneider Electric, Nortek Global HVAC, Radio Thermostat Company of America, COMPUTIME LIMITED, Johnson Controls, Danfoss, Carrier Corporation, Emerson Electric Co, Sensata Technologies, Inc, Trafag, Venstar Inc, tado GmbH, and Lennox International Inc |

| Additional Attributes |

The thermostat market is projected to grow from USD 7.2 billion in 2025 to USD 24.5 billion by 2035, representing a CAGR of 13.1%. This expansion yields an absolute dollar opportunity of USD 17.3 billion over the decade. Demand is supported by residential, commercial, and industrial upgrades where precise temperature control and energy management are priorities. Companies can capture share by strengthening distribution, ensuring compatibility across HVAC systems, and offering reliable after-sales support. Early positioning with clear value propositions, competitive pricing, and service coverage helps vendors build durable pipelines with contractors, facility managers, and retailers, translating pipeline wins into recurring replacement and retrofit revenue. Across the forecast horizon, the USD 17.3 billion opportunity reflects a sustained shift toward connected controls and broader adoption of programmable devices. By 2035, revenues will increasingly come from replacements, multi-site rollouts, and integration with building management platforms. The 13.1% CAGR signals room for scale: manufacturers that optimize supply chains, secure channel partners, and streamline installation will convert elevated order volumes into margin gains. Targeted outreach to utilities, OEM HVAC partners, and property portfolios can accelerate uptake. Clear documentation, interoperability, and warranty policies further reduce buyer friction, helping vendors unlock the full absolute growth potential embedded in the market outlook. |

The global thermostat market is estimated to be valued at USD 7.2 billion in 2025.

The market size for the thermostat market is projected to reach USD 24.5 billion by 2035.

The thermostat market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in thermostat market are smart thermostat, mechanical thermostat, programmable thermostat and others.

In terms of distribution channel, retail segment to command 35.9% share in the thermostat market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thermostatic Radiator Valves Market Size and Share Forecast Outlook 2025 to 2035

Thermostatic Mixing Valve Market Size and Share Forecast Outlook 2025 to 2035

Smart Thermostat Market Analysis by Services, Solution, and Region Through 2035

Automotive Thermostat Market

Wi-Fi Smart Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Low Vibration Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA