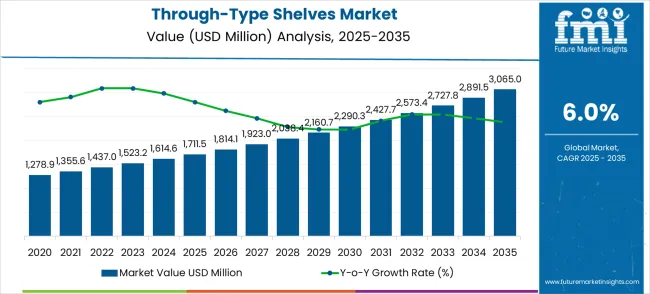

The through-type shelves market is forecasted to move from USD 1,711.5 million in 2025 to USD 3,065.0 million by 2035, progressing at a CAGR of 6.0%. This trajectory reflects a multiplication factor of nearly 1.8X within a ten-year span, showcasing how incremental demand builds steadily into long-term value. The curve begins with moderate expansion driven by warehousing, logistics, and retail industries where storage optimization remains a critical requirement. Increasing e-commerce penetration accelerates early adoption as distribution hubs demand flexible and durable shelving solutions. This initial phase demonstrates a strong foundation for consistent compounding growth.

Over the foresting period, the value accumulation curve steepens as advanced materials, modular designs, and automated storage solutions become integrated into industrial and commercial operations. Growth is not uniform, with distinct inflection points arising during cycles of investment in logistics infrastructure and warehouse expansion. The second half of the forecast period captures higher returns from emerging economies where industrialization and organized retail drive adoption. By 2035, the market illustrates how steady CAGR progression, combined with technology-driven upgrades, can generate substantial long-term value.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,711.5 million |

| Forecast Value in (2035F) | USD 3,065.0 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

Key industry trends include modular and adjustable shelf designs, the use of corrosion-resistant materials, and integration with automated storage systems. Manufacturers are introducing ergonomic and high-load capacity structures to serve varied industrial and commercial needs. Growing focus on space efficiency, operational flexibility, and compliance with hygiene and safety standards continues to push market adoption globally. The market is distributed across retail display solutions (33%), warehouse and logistics storage (28%), food and beverage storage systems (18%), pharmaceuticals and healthcare inventory management (12%), and specialty applications including libraries and archives (9%).

Retail display leads the adoption of durable and modular shelving as brands demand improved product visibility and enhanced consumer engagement. Warehousing and logistics rely on through-type shelves for space optimization, inventory efficiency, and easy accessibility. Food and beverage facilities adopt these systems for hygienic and organized storage, while pharmaceuticals require precision and compliance with storage standards. Specialty uses cover organized document and material management.

The through-type shelves market represents a high-growth warehousing segment driven by e-commerce expansion, supply chain optimization demands, and warehouse automation adoption. With the global market growing from USD 1,711.5 million in 2025 to USD 3,065.0 million by 2035 at a robust 6.0% CAGR, strategic opportunities emerge through automation integration, specialized applications, and geographic expansion in rapidly digitizing economies. Food and beverage applications commanding USD 635.8 million in 2025, unidirectional arrangements' operational efficiency, and China's exceptional 8.1% growth rate reflect the critical role of high-density storage solutions in modern distribution operations.

The market benefits from converging trends, including omnichannel fulfillment requirements, cold chain logistics expansion, and smart warehouse technology adoption. The dominance of unidirectional arrangements demonstrates a preference for simplified inventory management and efficient FIFO rotation, while expanding applications across cold storage and specialized sectors signals diversification beyond traditional dry goods storage.

Market expansion is being supported by the increasing global demand for efficient warehouse storage solutions and the corresponding need for high-density storage systems that can maximize space utilization while maintaining easy access and inventory rotation across various distribution applications. Modern warehouse operators and logistics providers are increasingly focused on implementing storage solutions that can optimize space efficiency, improve inventory management, and provide consistent access to stored products across different storage environments. Through-type shelves' proven ability to deliver high-density storage, enhanced accessibility, and operational efficiency make them essential components for contemporary warehouse management and distribution center operations.

Warehouse operators' preference for storage systems that combine space efficiency with operational flexibility and automation compatibility is creating opportunities for innovative shelving implementations. The rising influence of e-commerce growth and omnichannel distribution requirements is also contributing to increased adoption of through-type shelves that can provide efficient storage solutions without compromising accessibility or operational workflow.

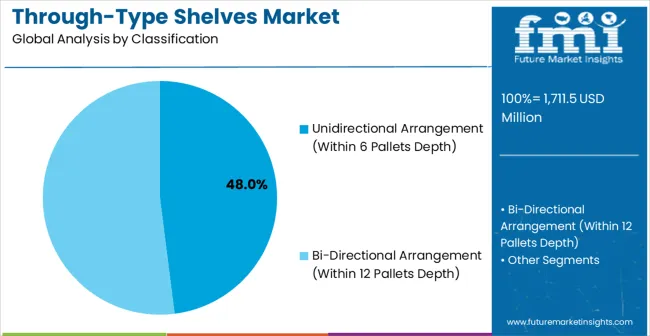

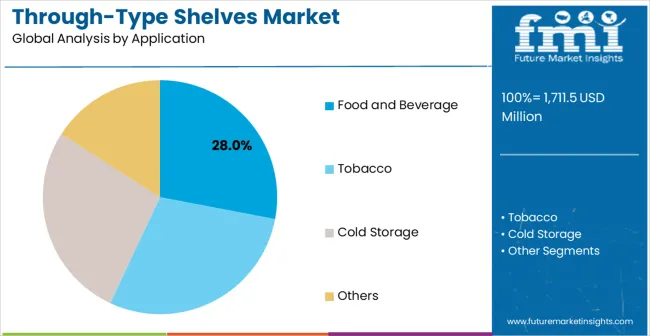

The through-type shelves market is advancing as industries adopt high-density storage solutions to optimize warehouse efficiency. Unidirectional arrangement within 6 pallets depth dominates the arrangement type segment with about 48% of the market share, as it maximizes space utilization while simplifying inventory management. On the application side, food and beverage leads with around 28% of the market, reflecting the sector’s high demand for organized and temperature-controlled storage.

Unidirectional arrangement shelves within 6 pallets depth account for approximately 48% of the arrangement type segment, making them the most widely used configuration. These shelves are designed to optimize space efficiency while maintaining accessibility, typically offering load capacities of 800–1,200 kg per pallet. Manufacturers such as Mecalux, Jungheinrich, SSI Schäfer, and Daifuku supply systems tailored for industrial warehouses. Their structured arrangement supports inventory accuracy, reduces retrieval times, and improves throughput in large-scale facilities, particularly where FIFO (First-In-First-Out) operations are not required.

The food and beverage sector represents about 28% of the application segment, making it the largest user of through-type shelving systems. These shelves are essential for storing perishable goods, packaged food, and beverages under controlled conditions, ensuring product integrity. Key providers include Mecalux, Jungheinrich, SSI Schäfer, and Daifuku, who design shelving solutions compatible with cold storage and high turnover environments. Growth is supported by rising consumption of packaged food, the expansion of refrigerated supply chains, and the sector’s reliance on structured storage to meet regulatory and quality standards.

The through-type shelves market is advancing rapidly due to increasing demand for efficient warehouse storage solutions and growing adoption of high-density storage systems that provide enhanced space utilization and inventory management capabilities across diverse distribution applications. The market faces challenges, including high initial installation costs, complexity of warehouse layout integration, and the need for specialized material handling equipment. Innovation in automation technologies and smart storage systems continues to influence product development and market expansion patterns.

The growing adoption of e-commerce platforms and omnichannel distribution strategies is driving demand for through-type shelves that can support diverse product handling requirements, rapid order fulfillment, and flexible storage configurations in modern distribution centers. Advanced e-commerce operations require specialized storage solutions while enabling more efficient order processing and inventory management across various product categories and distribution channels. Manufacturers are increasingly recognizing the competitive advantages of e-commerce-compatible shelving capabilities for market expansion and operational efficiency.

Modern through-type shelves producers are incorporating automation compatibility features and smart storage technologies to enable automated material handling, real-time inventory tracking, and enhanced operational intelligence for warehouse and distribution applications. These technologies improve storage efficiency while enabling new applications, including automated inventory management and predictive storage optimization. Advanced automation integration also allows warehouse operators to support sophisticated logistics strategies and operational efficiency beyond traditional storage capabilities.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| Brazil | 6.3% |

| USA | 5.7% |

| UK | 5.1% |

| Japan | 4.5% |

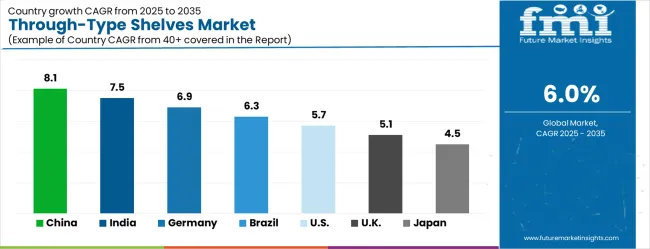

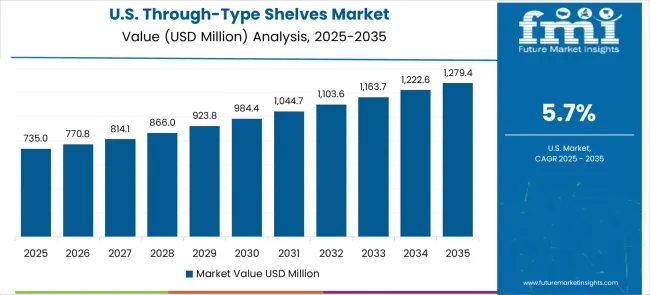

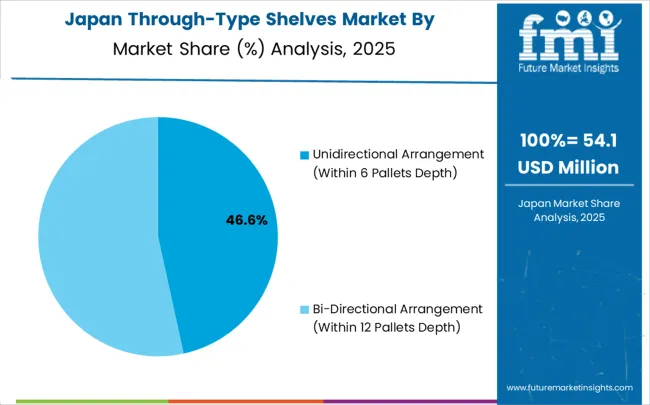

The through-type shelves market is experiencing strong growth globally, with China leading at an 8.1% CAGR through 2035, driven by the expanding e-commerce sector, growing manufacturing activity, and significant investment in logistics infrastructure development. India follows at 7.5%, supported by rapid retail sector growth, increasing warehouse modernization, and growing prioritizing on supply chain efficiency improvement. Germany shows growth at 6.9%, prioritizing technological innovation and advanced warehouse automation solutions. Brazil records 6.3%, focusing on retail sector expansion and distribution infrastructure modernization. The USA demonstrates 5.7% growth, driven by e-commerce growth and warehouse automation adoption. The UK exhibits 5.1% growth, supported by retail sector modernization and logistics infrastructure improvement. Japan shows 4.5% growth, prioritizing precision manufacturing and advanced storage technologies.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

China is projected to grow at a CAGR of 8.1% between 2025 and 2035, which is expected to be the fastest among the listed countries. Rising demand from large-scale warehouses, e-commerce distribution centers, and manufacturing facilities is fueling expansion. Manufacturers are focusing on producing heavy-duty through-type shelves that can support automated systems such as conveyors and robotic pickers. Investments in smart logistics hubs are increasing, with strong support from both domestic enterprises and regional governments. Competitive strategies are centered on scalability, modular design, and integration with warehouse management software, with players such as Jiangsu NOVA Logistics and Nanjing Kingmore contributing to innovation. China is positioning itself as a global supplier of advanced storage systems, supported by cost-efficient manufacturing and a growing logistics network.

India is expected to expand at a CAGR of 7.5% during 2025 to 2035, driven by logistics sector modernization and rising requirements from retail and third-party warehousing companies. The growth is supported by rising storage optimization needs in fast-growing industrial clusters. Manufacturers are focusing on sturdy, low-maintenance through-type shelves that cater to medium and large warehouse operators. Demand is expanding from industries such as automotive, FMCG, and electronics, which rely heavily on efficient pallet racking and high-density storage. Domestic manufacturers are adopting modular designs that reduce installation time and allow expansion as storage needs grow. Local players such as Godrej Storage Solutions and Nilkamal are actively introducing tailored products to capture market share, while international suppliers are forming joint ventures to meet Indian warehouse demands.

Germany is projected to grow at a CAGR of 6.9% from 2025 to 2035, with strong demand from advanced manufacturing and high-precision logistics operations. Adoption of through-type shelves is supported by the rise of automated warehouses integrated with robotics and IoT-enabled systems. German companies focus on energy efficiency, space utilization, and safety standards in storage infrastructure. Engineering-focused shelf designs are being widely implemented to support industrial and automotive supply chains. Key suppliers are leveraging research and development to integrate shelves with smart sensors for real-time inventory management. Players such as SSI Schäfer and Jungheinrich are leading innovation, providing customized solutions tailored for industrial clients seeking flexibility and automation compatibility in their warehouse systems.

Brazil is forecasted to grow at a CAGR of 6.3% between 2025 and 2035, supported by increased investment in retail distribution, food processing, and industrial storage facilities. Companies are adopting through-type shelves to maximize storage density and streamline warehouse operations. The market is influenced by a need for cost-effective storage structures that can perform reliably in varied environmental conditions. Domestic logistics firms are partnering with international suppliers to modernize existing warehouses and expand capacity. Through-type shelves are particularly in demand in metropolitan regions where real estate costs are rising, making space optimization critical. Local manufacturers such as Metalúrgica Vanzin, along with global players, are focusing on hybrid designs that balance durability with affordability for small and mid-sized warehouses.

The United States is projected to grow at a CAGR of 5.7% through 2035, reflecting steady demand from established warehouse and distribution sectors. Growth is supported by automation in e-commerce and large-scale logistics facilities that require durable, high-capacity through-type shelves. USA companies focus on shelves compatible with automated guided vehicles, conveyor systems, and robotic pickers. Modular designs that allow quick assembly and reconfiguration are increasingly preferred. Firms such as Interlake Mecalux and Steel King are introducing heavy-duty designs engineered for safety and adaptability. The focus is on optimizing order fulfillment speed and inventory accuracy, with technology integration becoming a competitive differentiator in this market.

The United Kingdom is forecasted to grow at a CAGR of 5.1% between 2025 and 2035, driven by increasing adoption of automated warehousing and retail distribution centers. Demand is concentrated in metropolitan hubs where efficient storage is critical to support rapid fulfillment requirements. Companies are implementing through-type shelves that are optimized for compact spaces and compatible with mechanized storage solutions. Modular and lightweight materials are being prioritized to reduce installation costs and enhance adaptability. Collaboration between local warehouse developers and international storage equipment providers is expanding product availability. Prominent suppliers such as BITO Storage Systems and Link 51 are active in this market, delivering specialized designs for e-commerce and industrial clients.

Japan is expected to grow at a CAGR of 4.5% from 2025 to 2035, reflecting steady but slower growth compared to other key countries. The demand is influenced by the need for space-efficient storage solutions in densely populated regions. Through-type shelves are increasingly integrated with automation systems in manufacturing plants and logistics centers. Japanese companies emphasize precision engineering, durability, and safety standards in shelf design. Players are innovating by combining high-strength materials with compact modular structures suited for small and medium warehouses. Leading companies such as Daifuku and Okamura are enhancing through-type shelf solutions by incorporating smart inventory systems and compatibility with automated material handling equipment.

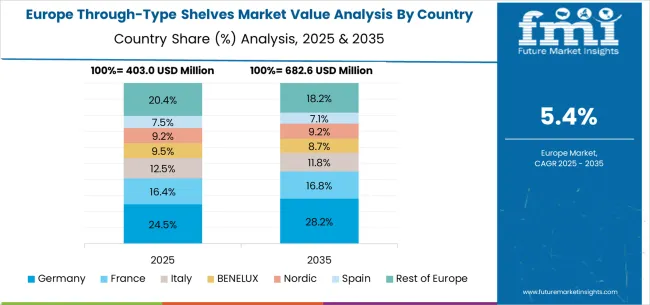

The through-type shelves market in Europe is projected to grow from USD 397.6 million in 2025 to USD 712.3 million by 2035, registering a CAGR of 6.0% over the forecast period. Germany is expected to maintain its leadership position with a 31.4% market share in 2025, moderating slightly to 31.1% by 2035, supported by its strong logistics infrastructure, advanced warehouse automation capabilities, and comprehensive distribution networks serving major European markets.

The United Kingdom follows with a 22.8% share in 2025, projected to reach 23.0% by 2035, driven by robust retail sector modernization, established e-commerce infrastructure, and strong demand for efficient storage solutions across distribution and manufacturing applications. France holds an 18.1% share in 2025, rising to 18.3% by 2035, supported by retail infrastructure development and increasing adoption of warehouse automation technologies in distribution operations. Italy records 12.9% in 2025, inching to 13.0% by 2035, with growth underpinned by logistics infrastructure improvement and increasing emphasis on supply chain efficiency in retail and manufacturing sectors. Spain contributes 8.7% in 2025, moving to 8.8% by 2035, supported by expanding retail activities and distribution infrastructure development programs. The Netherlands maintains a 2.9% share in 2025, growing to 3.0% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, Belgium, Switzerland, and Austria, is anticipated to gain momentum, expanding its collective share from 3.2% to 2.8% by 2035, attributed to increasing adoption of advanced storage technologies in Nordic countries and growing retail activities across Eastern European markets implementing infrastructure modernization programs.

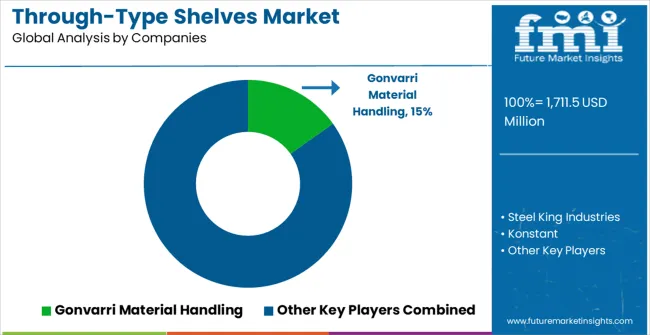

The through-type shelves market is characterized by competition among established storage equipment manufacturers, specialized warehouse solution providers, and integrated material handling system companies. Companies are investing in advanced storage technology research, automation compatibility enhancement, precision manufacturing improvements, and comprehensive product portfolios to deliver consistent, high-performance, and reliable storage solutions. Innovation in storage design, automation integration, and smart warehouse technologies is central to strengthening market position and competitive advantage.

Gonvarri Material Handling leads the market with a strong market share, offering comprehensive storage solutions with a focus on advanced engineering and warehouse optimization capabilities. Steel King Industries provides specialized storage equipment with an emphasis on industrial applications and high-density storage systems. Konstant delivers innovative storage technologies with a focus on automated warehouse solutions and material handling integration. Apex Warehouse Systems specializes in comprehensive warehouse solutions with emphasis on storage efficiency and operational optimization. Frazier focuses on advanced storage systems and specialized engineering solutions for demanding warehouse applications. REB Storage Systems International offers comprehensive storage products with emphasis on retail and distribution sectors.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,711.5 million |

| Arrangement Type | Unidirectional Arrangement (Within 6 Pallets Depth), Bi-Directional Arrangement (Within 12 Pallets Depth) |

| Application | Food and Beverage, Tobacco, Cold Storage, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Gonvarri Material Handling, Steel King Industries, Konstant, Apex Warehouse Systems, Frazier, and REB Storage Systems International |

| Additional Attributes | Dollar sales by arrangement type and application category, regional demand trends, competitive landscape, technological advancements in storage systems, automation integration innovation, smart warehouse development, and operational optimization |

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global through-type shelves market is estimated to be valued at USD 1,711.5 million in 2025.

The market size for the through-type shelves market is projected to reach USD 3,065.0 million by 2035.

The through-type shelves market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in through-type shelves market are unidirectional arrangement (within 6 pallets depth) and bi-directional arrangement (within 12 pallets depth).

In terms of application, food and beverage segment to command 28.0% share in the through-type shelves market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart Shelves Market

Cat Window Perches & Wall Shelves Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA