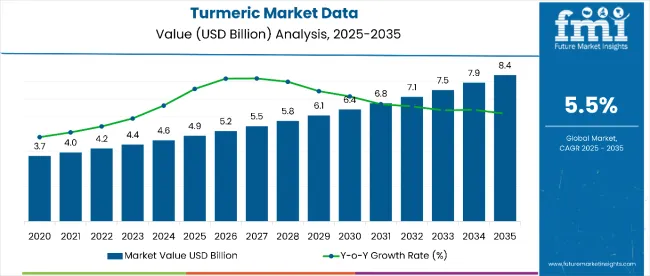

The turmeric market is projected to expand steadily from USD 4.9 billion in 2025 to USD 8.4 billion by 2035, advancing at a CAGR of 5.5%.

| Metric | Value |

|---|---|

| Estimated Value in 2025 (E) | USD 4.9 billion |

| Forecast Value in 2035 (F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

This growth is driven by increasing demand for natural food ingredients, rising incorporation in functional foods and beverages, and growing use in cosmetics and dietary supplements. The market shows a consistent upward trajectory, supported by heightened consumer preference for health-promoting spices, expanding applications in food processing, and the rise of natural and clean-label product trends.

By 2030, the market is forecasted to reach USD 6.4 billion, reflecting steady growth during the first half of the decade. The absolute dollar increase between 2025 and 2035 is expected to be about USD 3.5 billion, indicating robust and sustained expansion. Growth is expected to accelerate in the latter half of the period as processed turmeric formats gain deeper penetration in packaged foods, nutraceuticals, and personal care markets.

Key companies such as Naturex S.A. (Givaudan), Sabinsa Corporation, and Chr. Hansen A/S are strengthening their market positions through investments in advanced extraction technologies and novel product formulations. Their innovation pipelines focus on high-purity curcumin extracts, natural colorants, and turmeric-based wellness products, facilitating greater access to premium and health-conscious consumer segments. Market dynamics will continue to be influenced by quality standards, sustainable agricultural sourcing, and regulatory compliance, all critical factors shaping competitive success globally.

The market holds 38% of the global herbal extracts market, driven by its widespread use in traditional medicine, dietary supplements, and functional foods. It accounts for around 33% of the curcumin-based nutraceuticals segment, supported by growing clinical validation of its anti-inflammatory and antioxidant properties. The market contributes nearly 27% to the natural colorants market, particularly in applications requiring clean-label yellow and orange hues in food and beverages. It holds close to 22% of the digestive health supplements market, where turmeric is essential for gut health and anti-inflammatory formulations. The share in the clean-label ingredients market reaches about 29%, reflecting its strong appeal among consumers seeking natural, plant-based solutions.

The market is undergoing structural change driven by rising demand for botanical extracts in preventive healthcare, sports nutrition, and functional beverages. Advances in extraction technologies, including supercritical CO₂ and water-based methods, have improved bioavailability, purity, and consistency of turmeric formulations. Manufacturers are introducing specialized turmeric extracts with standardized curcumin content, enhanced absorption through nanoemulsions, and synergistic blends with piperine or probiotics, extending usage beyond traditional supplements. Strategic partnerships between herbal extract producers, pharmaceutical companies, and food manufacturers are accelerating turmeric integration across multiple applications. Clean-label positioning, sustainability in sourcing, and clinical research-backed efficacy are reshaping consumer preferences, compelling conventional herbal suppliers to invest in premium, science-driven turmeric innovations.

The turmeric market is expanding due to increasing consumer preference for natural, health-promoting ingredients and rising demand across food, beverage, pharmaceutical, and personal care sectors. Growing awareness of turmeric’s antioxidant, anti-inflammatory, and wellness benefits is driving widespread adoption in functional foods, dietary supplements, and natural cosmetics.

Advances in processing and extraction technologies, including improved curcumin purity and bioavailability, have enhanced product quality and versatility, making turmeric more appealing to diverse consumer segments. The rising trend toward clean-label, organic, and sustainable products is further fueling demand for premium turmeric variants.

The expanding use of turmeric in ethnic and traditional cuisines, as well as its increasing incorporation into snacks, beverages, and nutraceutical formulations, is broadening the market’s reach. Product innovation, including high-potency extracts and value-added turmeric-based offerings, is enabling companies to meet evolving consumer needs and capture premium segments.

As global foodservice, retail, and pharmaceutical industries continue to prioritize natural and functional ingredients, the outlook for the turmeric market remains positive. With producers focusing on quality, traceability, and advanced formulations, turmeric is positioned for strong growth and wider international acceptance.

The market is segmented by variety, product form, end use, distribution channel, nature, and region. By variety, the market is divided into Madras turmeric, Alleppey turmeric, West Indian turmeric, and others (Rajapore, BKK). Based on product form, the market is categorized into whole turmeric, processed turmeric including powder, oleoresin, curcumin, and oil. In terms of end use, the market is segmented into food and beverage processing (processed food products, dairy products, meat, poultry and seafood, confectionery, baked goods, sauces, dressings and condiments, spices and seasoning, beverages, others such as infusions), pharmaceuticals and dietary supplements, cosmetics and personal care, textiles, foodservice/HoReCa, and retail/household.

By distribution channel, the market is divided into hypermarkets/supermarkets, specialty stores, convenience stores, and online retail. Based on nature, the market is bifurcated into organic and conventional. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

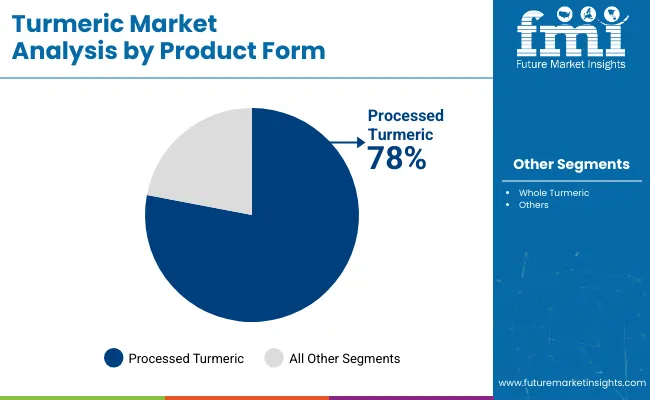

The most lucrative segment within the turmeric market by product form is processed turmeric, with powdered turmeric being the dominant sub-segment. In 2025, processed turmeric commands the largest share, 78% of the total market, driven by its convenience, consistent quality, and multi-industry applicability. Powdered turmeric is highly favored for culinary uses, food processing, and as a base for extracts and supplements due to its ease of handling and extended shelf life. Moreover, technological advancements in processing have improved purity and bioavailability, notably boosting demand for value-added derivatives like curcumin extracts, oleoresin, and turmeric oil.

Curcumin, the bioactive compound, is gaining immense traction in pharmaceuticals and nutraceuticals for its antioxidant and anti-inflammatory benefits, further driving overall segment growth. The increasing consumer focus on natural health-enhancing products sustains robust adoption of processed turmeric forms, particularly in regions like Asia-Pacific and North America. These dynamics position processed turmeric powder as the most economically attractive and strategically important segment.

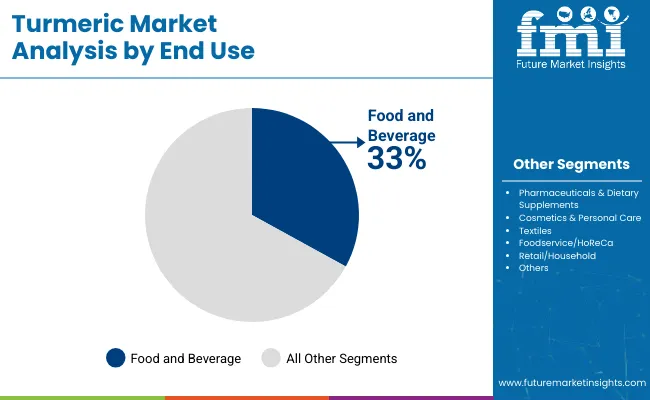

The food and beverage processing category holds the largest share, estimated at around 33% of the turmeric market in 2024-2025, driven by turmeric’s widespread use as a natural colorant, flavor enhancer, and health-boosting ingredient. Its incorporation in diverse products such as sauces, baked goods, snacks, and beverages continues to expand, fueled by growing consumer demand for clean-label and functional foods. Innovations in turmeric extraction and formulation are also enabling food manufacturers to enhance product appeal while delivering added nutritional benefits.

Turmeric is extensively used in processed foods such as sauces, snacks, baked goods, and beverages including the rapidly growing segment of turmeric-based drinks like golden milk and health shots, which are gaining traction worldwide due to their antioxidant and anti-inflammatory properties. Additionally, turmeric’s application in dairy products, confectionery, and seasoning blends further broadens its food industry footprint. The rising consumer preference for natural, clean-label ingredients and functional foods combined with advancements in processing and innovation continues to amplify turmeric’s role within this expansive food and beverage landscape globally.

From 2025 to 2035, rising consumer demand for natural, health-promoting ingredients has driven significant growth in the turmeric market. Increasing preference for organic, high-purity, and value-added turmeric products has led producers to invest in advanced processing technologies and product innovation to meet evolving wellness trends and expand their portfolios.

Growing Consumer Health Awareness Drives Market Growth

A steady rise in consumer focus on clean-label, antioxidant-rich, and anti-inflammatory foods is a primary catalyst for growth. The demand for turmeric in functional foods, dietary supplements, and natural personal care products continues to surge. By 2025, manufacturers are enhancing product quality through improved extraction methods and bioavailability, aligning with consumer expectations for efficacy and purity.

Innovation in Product Development Expands Market Opportunities

Recent innovations, including organic turmeric powders, high-curcumin extracts, oleoresins, and oils, have broadened the market beyond traditional applications. Enhanced nutritional profiles, improved shelf life, and sustainable sourcing practices are creating new opportunities across food, pharmaceutical, cosmetics, and nutraceutical sectors. Producers emphasizing quality certifications and sustainability are gaining competitive advantage, reinforcing long-term growth prospects globally.

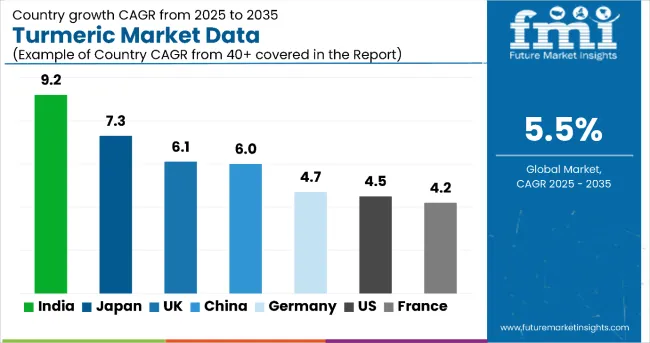

| Countries | CAGR (2025 to 2035) (%) |

|---|---|

| India | 9.2 |

| Japan | 7.3 |

| United Kingdom | 6.1 |

| China | 6.0 |

| Germany | 4.7 |

| United States | 4.5 |

| France | 4.2 |

The market is experiencing robust growth globally, with India leading at a CAGR of 9.2%, reflecting its dominant role as the largest producer and exporter. India's growth is propelled by expansive cultivation, rising organic farming, and strong domestic demand from pharmaceutical and food industries. Japan follows with a solid 7.3% CAGR, driven by increasing consumer preference for natural health products and advancements in curcumin bioavailability for nutraceuticals and functional foods. The United Kingdom exhibits a growth rate of 6.1%, fueled by rising demand for plant-based supplements and government support for natural health products. Both markets capitalize on innovation, regulatory support, and expanding applications in food, supplements, and cosmetics. Germany and France report moderate yet steady growth rates of 4.7% and 4.2%, respectively, aligned with increasing consumer focus on organic and natural products, stringent quality regulations, and broadening retail and e-commerce channels.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from turmeric in India is projected to grow at a CAGR of 9.2%, fueled by its position as the largest producer and exporter. The country’s extensive cultivation areas, particularly in states like Andhra Pradesh and Tamil Nadu, ensure a steady supply of high-quality raw turmeric. Increasing consumer preference for organic and sustainably farmed turmeric is driving adoption of advanced agricultural practices. Government initiatives supporting farmer welfare and export subsidies are strengthening production capabilities. Additionally, investments in modern processing facilities and technological upgrades improve yield and product quality. Expanding domestic demand from pharmaceutical and food industries also bolsters production growth. With strong infrastructure and policy support, India continues to consolidate its leadership in turmeric supply worldwide.

Demand for turmeric in Japan is growing steadily at a CAGR of 7.3%, driven primarily by rising consumer demand for natural health and wellness products. Its strong functional food and nutraceutical industries increasingly incorporate turmeric extracts, especially curcumin, for their antioxidant and anti-inflammatory benefits. Strict quality and safety regulations uphold product standards, encouraging premium market growth. Collaborations between Japanese companies and global suppliers facilitate access to high-purity turmeric ingredients. The foodservice sector also embraces turmeric-infused items, expanding usage. Growing interest in clean-label and organic products among consumers further propels market expansion. Technological innovations aimed at enhancing curcumin bioavailability support Japan’s leading role in turmeric application development.

The UK turmeric revenue is growing at a CAGR of 6.1%, fueled by increasing consumer preference for natural and plant-based health supplements. Turmeric has become a staple in functional foods, beverages, and dietary supplements favored by health-conscious populations. The rise of e-commerce platforms facilitates wider availability of turmeric products, fostering market growth. Regulatory frameworks supporting safe herbal supplement use aid product innovation. The foodservice industry’s incorporation of turmeric into ethnic and fusion cuisines also contributes to demand. Continuous product launches of turmeric-infused snacks and beverages keep consumer interest high. Sustainable sourcing and certification practices are becoming key competitive differentiators for UK market players.

Sales of turmeric in China are expanding at a CAGR of 6.0%, supported by government initiatives promoting traditional medicine and natural health products. Increasing domestic consumption in food, beverage, and pharmaceutical sectors drives production growth. Modernization of turmeric processing technologies improves extract quality and efficiency. Growing exports of turmeric products reinforce manufacturing capabilities. Investments in organic cultivation and quality control systems ensure compliance with international standards. The surge in health-conscious consumers opting for natural ingredients amplifies demand. Additionally, the expansion of turmeric applications into cosmetics and nutraceuticals provides diversified growth avenues for Chinese producers.

Revenue from Germany is projected to grow at a CAGR of 4.7%, driven by strong consumer interest in natural and organic health products. Increasing adoption of turmeric in dietary supplements, functional foods, and cosmetics is fueling demand. The country’s well-established regulatory framework ensures high product standards, which builds consumer trust and supports premium product positioning. Germany’s health-conscious population and rising awareness of turmeric’s benefits accelerate growth in retail and e-commerce channels. The foodservice sector is increasingly incorporating turmeric-infused dishes, offering new growth avenues. Manufacturers are investing in innovative extraction technologies and sustainable sourcing to meet evolving consumer expectations.

The USA turmeric demand grows at a CAGR of 4.5%, propelled by increasing consumer awareness of turmeric’s health benefits and demand for functional foods and dietary supplements. The market benefits from extensive research and development focused on enhancing bioavailability and efficacy of curcumin-based products. Clean-label and organic turmeric variants are popular among health-conscious consumers. Retail chains and online platforms provide broad distribution, facilitating market access. Innovations in turmeric-based beverages, snacks, and personal care products drive consumer interest. The wellness trend and integrative health approaches further foster turmeric adoption. Key industry players invest heavily in marketing and product innovation to maintain growth momentum.

Revenue from turmeric in France is projected to grow at a CAGR of 4.2% over the forecast period, propelled by the increasing inclusion of turmeric in functional and natural health products. French consumers’ growing recognition of turmeric’s antioxidant and anti-inflammatory properties supports demand in supplements and cosmetics. The market benefits from expanding distribution through health stores, pharmacies, and e-commerce platforms. Food and beverage companies are diversifying product offerings with turmeric-infused items, tapping into consumer interest in wellness and clean-label concepts. Sustainability and traceability remain key priorities for producers and consumers alike, driving investment in quality certifications and ethical sourcing.

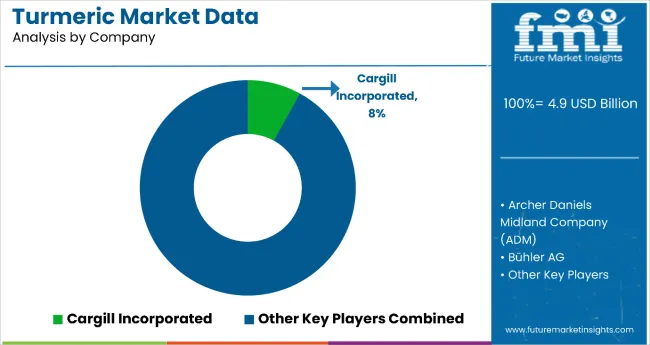

The market is moderately consolidated, with key players differentiating themselves through advanced processing expertise, product innovation, and strategic regional presence. Leading companies such as Naturex S.A. (Givaudan), Sabinsa Corporation, and Chr. Hansen A/S dominate through large-scale extraction capabilities and a diverse product portfolio that includes powdered turmeric, curcumin extracts, oleoresin, and oils catering to food, pharmaceutical, and personal care sectors. Their strengths lie in high-quality raw material sourcing, sophisticated extraction technologies, and extensive global distribution networks.

Companies like McCormick & Company and Archer Daniels Midland (ADM) emphasize cost-efficient production processes and robust supply chain optimization to serve increasing demand for organic, sustainable, and high-purity turmeric products worldwide. Regional players focus on authentic turmeric varieties, local sourcing, and customization to meet niche consumer preferences, particularly in Asia-Pacific and North America.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 4.9 billion |

| Variety | Madras Turmeric, Alleppey Turmeric, West Indian Turmeric, Others (Rajapore, BKK) |

| Product Form | Whole Turmeric, Processed Turmeric (Powder, Oleoresin, Curcumin, Oil) |

| End Use | Food and Beverage Processing (Processed Food Products, Dairy Products, Meat, Poultry and Seafood, Confectionery, Baked Goods, Sauces, Dressings and Condiments, Spices and Seasoning, Beverages, Others such as Infusions |

| Distribution Channel | Hypermarkets/Supermarkets, Specialty Stores, Convenience Stores, Online Retail |

| Nature | Organic, Conventional |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ others |

| Key Companies Profiled | Sales Footprint, Sabinsa Corporation, Vigon International, Inc., Chr., Everest Spices, Biomax Life Sciences Ltd., Sensient Technologies Corporation, ITC Limited, The Archer Daniels Midland Company, Symrise AG, MDH Spices, McCormick & Company, Kancor Ingredients Limited, BOS Natural Flavors (P) Limited, Roha Dyechem Pvt. Ltd., Frutarom Industries Ltd., Kalsec, Inc., DDW The Colour House Corporation, Universal Oleoresins, Ungerer & Company, Hansen A/S |

| Additional Attributes | Dollar sales by variety, product form and application, growing demand for organic and high-purity turmeric products, expansion of applications in food, pharmaceutical and cosmetic sectors, advancements in extraction technology, increasing consumer focus on sustainability, traceability, and product authenticity |

The global turmeric market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the turmeric market is projected to reach USD 8.4 billion by 2035.

The turmeric market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in turmeric market are madras turmeric, alleppey turmeric, west indian turmeric and others (rajapore, bkk, etc.).

In terms of product form, whole turmeric segment to command 39.8% share in the turmeric market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Turmeric-Infused Actives Market Size and Share Forecast Outlook 2025 to 2035

Turmeric Oleoresin Market – Growth & Demand 2025 to 2035

Curcuma Longa (Turmeric) Root Extract Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA