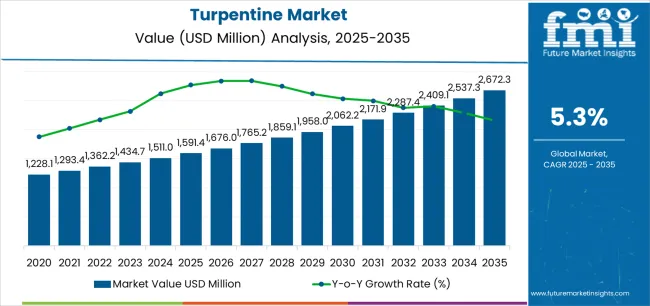

The Turpentine Market is estimated to be valued at USD 1591.4 million in 2025 and is projected to reach USD 2672.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period.

The turpentine market is experiencing consistent growth, supported by increasing demand from fragrance, pharmaceutical, and industrial sectors. Derived primarily from pine resin and wood distillation processes, turpentine serves as a vital raw material in the production of solvents, resins, and aromatic compounds. The current market dynamics are driven by rising consumption of natural and bio-based chemicals amid sustainability trends.

Manufacturers are focusing on improving extraction efficiency and developing higher-purity derivatives to meet industrial and cosmetic-grade standards. Global growth in the paints, coatings, and adhesives industries also contributes to rising utilization.

Additionally, the expanding use of natural ingredients in perfumes and personal care formulations has strengthened demand. With continued emphasis on renewable feedstocks and cleaner chemical production, the turpentine market is expected to maintain its upward trajectory in the coming years.

| Metric | Value |

|---|---|

| Turpentine Market Estimated Value in (2025 E) | USD 1591.4 million |

| Turpentine Market Forecast Value in (2035 F) | USD 2672.3 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

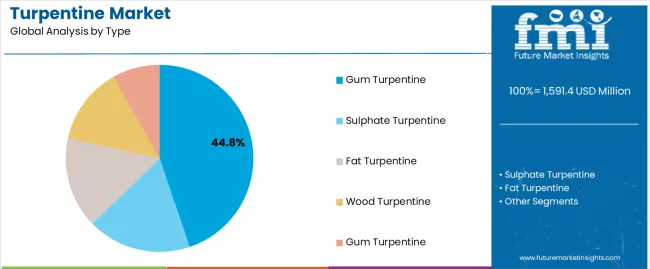

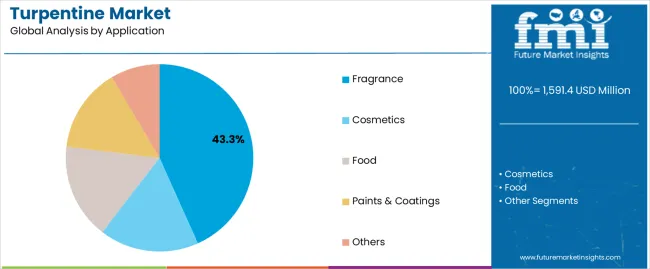

The market is segmented by Type and Application and region. By Type, the market is divided into Gum Turpentine, Sulphate Turpentine, Fat Turpentine, Wood Turpentine, and Gum Turpentine. In terms of Application, the market is classified into Fragrance, Cosmetics, Food, Paints & Coatings, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The gum turpentine segment holds approximately 44.8% share in the type category, driven by its high purity and suitability for various chemical conversion processes. Extracted directly from the resin of pine trees, gum turpentine is preferred in applications requiring natural, high-grade raw materials.

The segment benefits from increasing availability of resin tapping operations across major producing regions and the growing use of bio-based intermediates. Its role as a precursor for fragrance compounds, solvents, and synthetic resins underpins strong industrial demand.

Continuous innovation in distillation and purification technologies has improved yield efficiency, supporting competitive pricing. With rising global preference for sustainable and non-petroleum-based inputs, the gum turpentine segment is expected to remain the dominant contributor to overall market revenue.

The fragrance segment leads the application category, accounting for approximately 43.3% share of the turpentine market. This leadership is attributed to turpentine’s use as a natural source for aroma chemicals such as pinene and limonene, which serve as key ingredients in perfumes, cosmetics, and cleaning products.

Demand is reinforced by the growing consumer inclination toward plant-derived and eco-friendly fragrances. The segment’s growth is further supported by the resurgence of the natural perfumery industry and expansion of green personal care product lines.

Manufacturers are leveraging advanced refining processes to ensure odor consistency and purity, aligning with high-end fragrance standards. With global fragrance consumption increasing across lifestyle and household categories, the fragrance segment is poised to maintain a leading position in the turpentine market.

This section provides detailed insights into specific categories in the turpentine industry. While gum turpentine marks dominance with a commanding 44.80% share in 2025, the fragrance application segment is poised for a significant rise.

| Product Type | Gum Turpentine |

|---|---|

| Market Share in 2025 | 44.80% |

| By Application | Fragrance |

|---|---|

| Market Share in 2025 | 43.30% |

| Historical CAGR | 4.20% |

|---|---|

| Forecast CAGR | 5.60% |

The historical CAGR of 4.20% reflects steady but moderate growth in the turpentine market. Factors contributing to this growth include the traditional applications in industries like paint, varnish, and resin production. However, challenges such as environmental concerns and the emergence of alternative solvents curtailed rapid expansion.

The forecast CAGR of 5.60% suggests an optimistic trajectory for the turpentine industry. Anticipated factors driving this growth include the expanding bio-based solvent trend, exploration of turpentine's medicinal properties, and a resurgence in artistic applications. However, challenges like market saturation and the need for sustainable practices must be navigated for sustained success.

A significant trend is the growing preference for bio-based solvents, positioning turpentine as a sustainable alternative. Industries, especially in paints and coatings, are increasingly shifting toward eco-friendly options. The demand for turpentine rises as it aligns with the global push for sustainable and environmentally friendly solvents, driving adoption across various applications.

Turpentine is increasingly becoming part of cosmetic formulations, particularly in skincare products, as companies collaborate to harness its natural properties for skin benefits. Collaborations between turpentine suppliers and cosmetic brands lead to the development of innovative products, capitalizing on the potential of turpentine in the beauty and personal care industry.

In woodworking, there's a resurgence of using turpentine for preserving and finishing wood, aligning with a preference for traditional craftsmanship and heritage techniques. The heritage-focused trend creates a niche market for turpentine in woodworking communities, where artisans value its historical significance and craftsmanship.

Turpentine is explored as a component in sustainable packaging materials, contributing to the development of eco-friendly packaging solutions for various products. The integration of turpentine in sustainable packaging aligns with circular economy principles, offering an innovative approach to reducing the environmental footprint of packaging materials.

One of the latest trends in the turpentine industry involves experimenting with turpentine's aromatic properties as a natural flavor enhancer in the food and beverage industry, especially in craft beverages. Turpentine's distinctive aroma is explored for its potential to add unique flavor notes, creating a niche market for artisanal beverages and culinary applications.

The section analyzes the turpentine market across key countries, including the United States, Germany, China, India, and Australia. The section provides insights into the key factors driving the demand, adoption, and sales of turpentine in these countries.

| Countries | CAGR |

|---|---|

| United States | 4.5% |

| Germany | 3.3% |

| China | 7.4% |

| India | 8.7% |

| Australia | 6.6% |

The market for turpentine in the United States is anticipated to rise at a CAGR of 4.5% through 2035.

Sales of turpentine in Germany are projected to rise at a CAGR of 3.3% through 2035.

China turpentine market is likely to witness expansion at a CAGR of 7.4% through 2035.

The turpentine market in India is projected to rise at a CAGR of 8.7% through 2035.

The demand for turpentine in Australia is expected to rise at a CAGR of 6.6% through 2035.

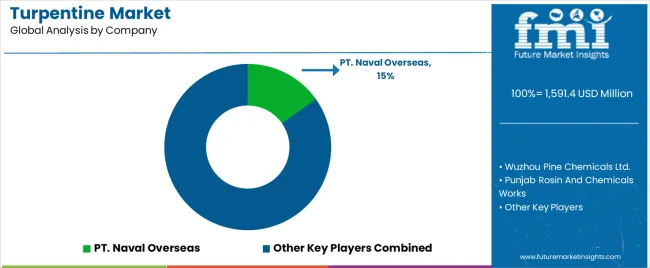

The turpentine industry is witnessing intensified competition as key players vie for market share and explore innovative strategies to gain a competitive edge. Established companies are focusing on enhancing their production capacities, ensuring a consistent supply chain, and maintaining high-quality standards to strengthen their market position.

The robust demand for turpentine across various applications, including paints, fragrances, and pharmaceuticals, is driving players to optimize production processes and explore sustainable sourcing practices. Companies are also investing in research and development to innovate new turpentine-based products, meeting the evolving demands of end-users.

The emphasis on sustainable practices and the increasing popularity of natural ingredients are shaping the competitive dynamics. Moreover, strategic collaborations and partnerships are emerging as significant trends, allowing companies to expand their product portfolios and geographical reach.

Recent Developments in the Turpentine Market

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 1,506.98 million |

| CAGR (2025 to 2035) | 5.60% |

| Base Year for Estimation | 2025 |

| Historical Period | 2020 to 2025 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and kilotons for volume |

| Product Types Analyzed (Segment 1) | Fat Turpentine, Sulphate Turpentine, Wood Turpentine, Gum Turpentine |

| Applications Analyzed (Segment 2) | Cosmetics, Fragrance, Food, Paints & Coatings, Others |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Turpentine Market | PT. Naval Overseas, Wuzhou Pine Chemicals Ltd., Punjab Rosin and Chemicals Works, Wuzhou Sun Shine Forestry & Chemicals Co., Forestar Chemical Co., Ltd., Deqing Yinlong Industrial Co., Ltd., Deqing Jiyuan Synthetic Resin Co., Ltd., Resin Chemicals Co., Ltd, CV. Indonesia Pinus, Guilin Songquan Forest Chemical Co., Ltd., EURO-YSER, Vinhconship Group |

| Additional Attributes | Dollar sales by product category (gum, sulphate, wood), Fragrance and cosmetic industry adoption, Sustainable and natural solvent demand trends, Paint and coating industry influence in emerging economies, Regional growth in pine chemical supply chains |

| Customization and Pricing | Customization and Pricing Available on Request |

The global turpentine market is estimated to be valued at USD 1,591.4 million in 2025.

The market size for the turpentine market is projected to reach USD 2,672.3 million by 2035.

The turpentine market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in turpentine market are gum turpentine, sulphate turpentine, fat turpentine, wood turpentine and gum turpentine.

In terms of application, fragrance segment to command 43.3% share in the turpentine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gum Turpentine Oil Market Growth - Trends & Forecast 2025 to 2035

Crude Sulfate Turpentine Market Analysis by Product Type, Source, Processing Method, Application, and Region through 2035

India Retail Mineral Turpentine Oil Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA