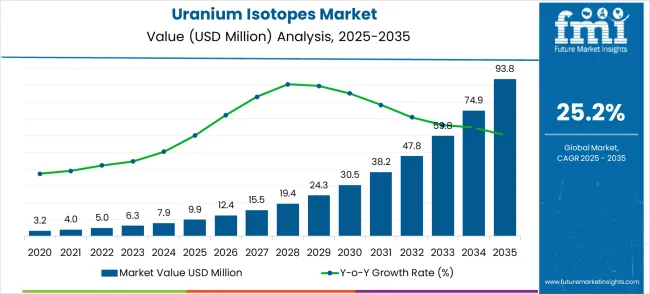

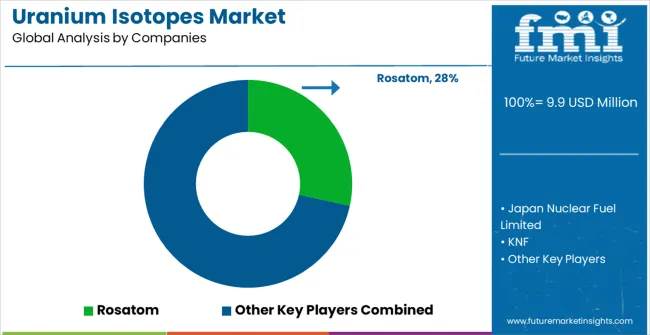

The uranium isotopes market is valued at USD 9.9 million in 2025 and is expected to increase significantly to USD 93.8 million by 2035, with a CAGR of 25.2%. In the initial phase, from 2021 to 2025, the market grows from USD 3.2 million to USD 9.9 million. Annual increments are observed through USD 4.0 million in 2022, USD 5.0 million in 2023, USD 6.3 million in 2024, and USD 7.9 million in 2025. This growth is primarily driven by the increasing applications of uranium isotopes in nuclear energy, scientific research, and defense technologies. Advances in isotope separation and nuclear reactor designs, along with rising energy demands, contribute to steady market expansion.

Between 2026 and 2030, the market accelerates, growing from USD 9.9 million in 2025 to USD 24.3 million by 2030. During this period, the market is expected to reach values of USD 12.4 million in 2026, USD 15.5 million in 2027, and USD 19.4 million in 2028. This growth is attributed to the expansion of nuclear energy projects and the increasing demand for uranium isotopes in the medical and industrial sectors. By 2035, the market is expected to reach USD 93.8 million, with intermediate increments passing through USD 30.5 million in 2029, USD 38.2 million in 2030, and USD 47.8 million in 2031.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 9.9 million |

| Forecast Value in (2035F) | USD 93.8 million |

| Forecast CAGR (2025 to 2035) | 25.2% |

The nuclear energy market is the largest contributor, accounting for approximately 40–45% of the market share. Uranium isotopes, especially Uranium-235, are crucial for nuclear reactors, where they serve as fuel for energy production. The defense and military market plays a significant role, contributing about 20–25%, as uranium isotopes are used in the production of nuclear weapons and military-grade applications.

The mining and extraction market accounts for around 10–12%, as uranium mining and isotope separation are critical to the overall supply chain of uranium-based materials. The research and scientific applications market contributes approximately 5–8%, as Uranium isotopes are used in various scientific studies, including environmental research, physics experiments, and space exploration.

Below is a compact, actionable set of opportunity pathways modeled on the example you gave. Each path describes who wins, why it matters, and a directional revenue-opportunity estimate (based on the report numbers you supplied: global market growing from USD 9.9M (2025) to USD 93.8M (2035), total incremental gain approximately USD 83.9M). These estimates are directional - intended to help prioritize investment and go-to-market focus, not to replace detailed financial modelling.

Uranium Isotopes Market - Executive summary (opportunity framing) The uranium isotopes market is small today but projected to scale rapidly (CAGR 25.2% to 2035). Growth is concentrated in advanced research, defense/military, and specialized medical/scientific uses, with Asia-Pacific (China, India, Japan) leading. Opportunity winners will be those who 1) deliver ultra-high purity and regulatory-compliant supply; 2) provide advanced separation/enrichment and licensing of technology; 3) offer secure, audited logistics and storage; and 4) expand regional supply ecosystems (local processing, domestic supply to defense and research programs).

Why it matters: Report highlights U-234 as the leading uranium type in 2025; research and defense demand premium purity and tight isotopic ratios. Who wins: Specialized producers, quality-focused converters, providers of certificate-of-analysis and chain-of-custody services. Strategic moves: Invest in advanced QA/QC labs, ISO/Nuclear QA certification, packaged purity guarantees for defense & research customers. Estimated revenue pool (directional): USD 18-30 million (share of the 2035 market served by premium, higher-margin products and services).

Why it matters: Defense & military is the dominant application segment in 2025; long-term contracts and secure supply chains lock in recurring revenue. Who wins: Large integrators with regulatory clearances, firms offering audited supply, secure transport, and on-site handling. Strategic moves: Obtain export/control clearances, develop escorted transport & secure warehousing, pursue multi-year SLAs with defense agencies. Estimated revenue pool: USD 20-35 million (contractual, recurring portion of market growth).

Why it matters: Advanced separation technologies are a stated growth driver-licensing or service models scale faster than commodity sales. Who wins: Technology developers, equipment makers, and service providers that can deliver superior isotopic ratios and lower per-unit separation cost. Strategic moves: Offer pilot plants, pay-per-kg processing, licensing deals with national labs and private processors. Estimated revenue pool: USD 8-18 million (equipment sales + recurring service fees/royalties by 2035).

Why it matters: From 2030 to 2035, the report expects stronger growth in medicine and research. These buyers pay for traceability and exact isotopic blends. Who wins: Suppliers that package isotopes for radiochemistry, tracer research, and niche medical procedures, plus partnerships with research institutes. Strategic moves: Co-develop product formats for research labs, provide small-batch, fast-turn deliveries, and enable regulatory dossiers for medical use. Estimated revenue pool: USD 6-12 million.

Why it matters: China and India show the highest CAGRs; regional hubs reduce lead times, compliance friction, and geopolitical risk. Who wins: Local processors, joint ventures with domestic players, logistics partners that can localize handling and storage. Strategic moves: JV with domestic entities in China/India, set up regional QC labs, secure local licenses and government partnerships. Estimated revenue pool: USD 12-22 million (value unlocked by regional capture and reduced import friction).

Why it matters: Stringent regulatory controls and export restrictions are a key restraint; companies that simplify compliance create stickier customer relationships. Who wins: Advisors, compliance-as-a-service firms, audited custodians, and digital identity/chain-of-custody platforms. Strategic moves: Build specialist regulatory teams, offer turnkey export/import bundles, and provide digital traceability (auditable logs). Estimated revenue pool: USD 4–8 million (service fees, premium margins).

Why it matters: Specialized materials and the cost of separation make recovery, recycling and closed-loop solutions attractive, especially for defense and large research facilities. Who wins: Firms that can economically recover valuable isotopes or create low-waste processing lines. Strategic moves: Pilot recovery programs with major customers, license recovery tech, partner with clean-tech investors. Estimated revenue pool: USD 3-7 million.

Why is the Uranium Isotopes Market Growing?

Market expansion is being supported by the increasing global demand for advanced nuclear technologies and the corresponding need for specialized isotopic materials that can support cutting-edge research, strategic defense applications, and scientific breakthrough discoveries across various atomic science and technology fields. Modern research institutions and defense organizations are increasingly focused on implementing isotope solutions that can enable advanced nuclear research, support strategic capabilities, and provide specialized materials for complex scientific investigations. Uranium isotopes' proven ability to deliver precise nuclear properties, enable specialized applications, and support strategic research makes them essential materials for contemporary nuclear science and defense technology programs.

The growing focus on nuclear security and scientific advancement is driving demand for uranium isotopes that can support strategic research, enable defense applications, and facilitate breakthrough scientific discoveries in atomic physics and related fields. Research organizations' preference for isotopic materials that combine purity with specialized nuclear properties and regulatory compliance is creating opportunities for innovative uranium isotope implementations. The rising influence of advanced nuclear technologies and strategic research initiatives is also contributing to increased adoption of uranium isotopes that can provide specialized nuclear capabilities without compromising safety or regulatory requirements.

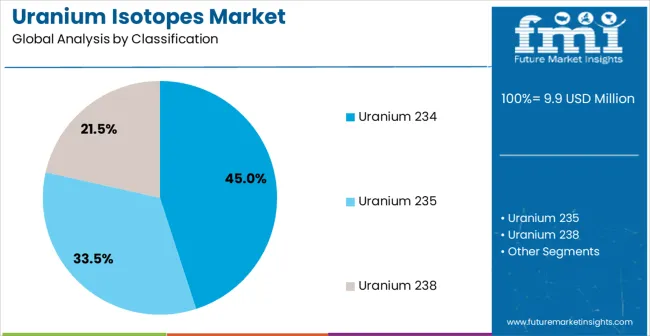

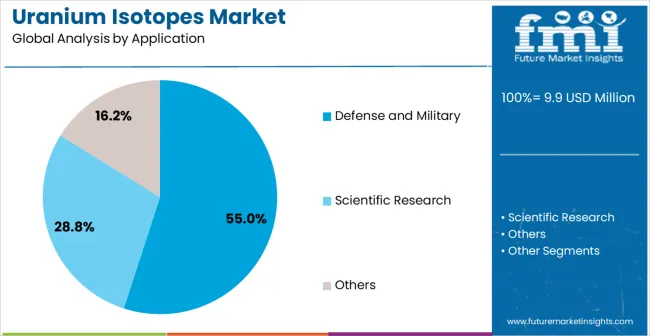

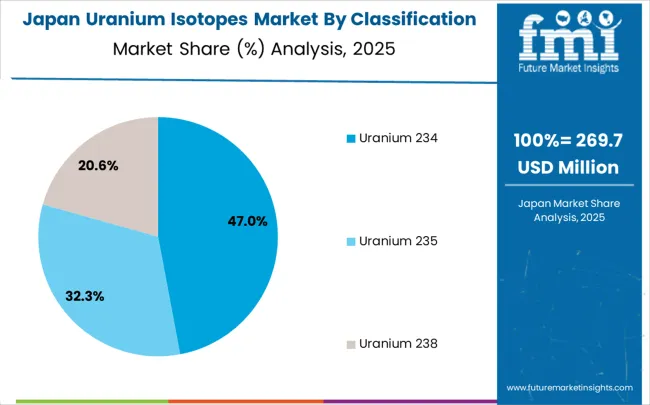

The market is segmented by uranium type, application, and region. By uranium type, the market is divided into uranium-234, uranium-235, and uranium-238. Based on application, the market is categorized into defense and military, scientific research, and others. Regionally, the market is divided into Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa.

The uranium 234 segment is expected to lead the uranium isotopes market in 2025, accounting for 45% of the market share. This segment is favored for its unique nuclear properties, including its decay characteristics that are crucial for advanced scientific research and defense applications. Uranium 234 plays an essential role in nuclear reactors and radiological studies, making it integral to military technology development. Its widespread use in atomic research and strategic defense projects ensures its continued dominance. Research institutions and defense organizations continue to invest in uranium 234 procurement and handling systems, solidifying its position as a key material in modern nuclear strategies.

The defense and military application segment is expected to account for 55% of the uranium isotopes market share in 2025. Uranium isotopes play a key role in strategic defense initiatives, enabling the development of advanced military technologies, including nuclear propulsion systems and sophisticated weapons systems. This segment is driven by ongoing investments in military research and the critical need for isotopic materials that can meet national security requirements. As global defense strategies evolve and new technologies emerge, the demand for uranium isotopes in defense applications continues to grow, further solidifying its dominance in the market.

Integral in the development of next-gen nuclear propulsion systems for defense fleets.

The uranium isotopes market is advancing rapidly due to increasing demand for advanced nuclear technologies and growing adoption of specialized isotopic materials that provide enhanced research capabilities and strategic applications across diverse nuclear science and defense technology fields. The market faces challenges, including stringent regulatory requirements and international controls, high costs associated with isotope separation and purification, and complex handling and storage requirements for radioactive materials. Innovation in isotope separation technologies and advanced nuclear processing continues to influence product development and market expansion patterns.

The increasing use of advanced separation and enrichment technologies is helping nuclear organizations achieve higher isotopic purity, better processing efficiency, and accurate isotopic ratios for specialized research and strategic applications. These advanced systems enhance the quality of isotopes while allowing for more efficient processing, ensuring consistent output across a range of uranium isotopes and their varied applications. Manufacturers are recognizing the competitive edge that advanced separation technologies offer, enabling them to differentiate their research and optimize strategic applications.

Contemporary uranium isotope producers are adopting cutting-edge processing technologies and automated quality assurance systems to boost isotopic purity, ensure regulatory compliance, and provide consistent, high-quality materials for both research and strategic applications. These innovations enhance processing efficiency and enable the development of ultra-pure isotopes and specialized nuclear materials. The integration of advanced processing systems also supports complex research needs and expands capabilities, enabling organizations to go beyond traditional nuclear material applications.

| Country | CAGR (2025-2035) |

|---|---|

| China | 34.0% |

| India | 31.5% |

| Germany | 29.0% |

| Brazil | 26.5% |

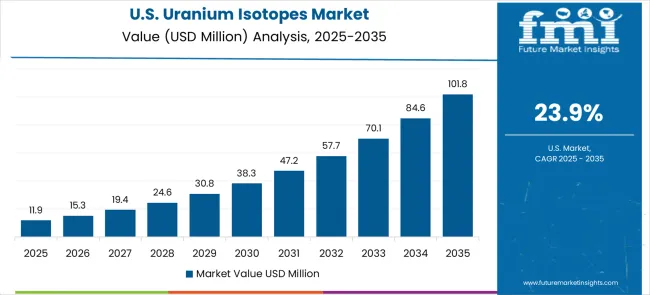

| USA | 23.9% |

| UK | 21.4% |

| Japan | 18.9% |

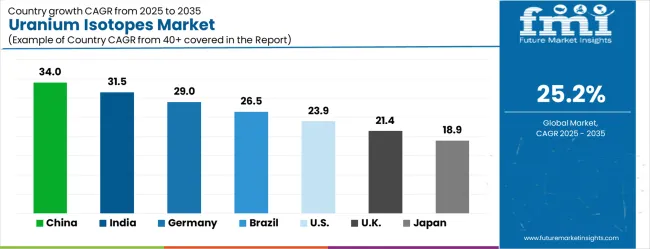

The uranium isotopes market is experiencing exceptional growth globally, with China leading at a 34.0% CAGR through 2035, driven by the expanding nuclear research infrastructure, growing strategic defense programs, and significant investment in advanced nuclear technology development and isotope processing capabilities. India follows at 31.5%, supported by ambitious nuclear research initiatives, increasing defense technology development, and growing investment in atomic science and strategic applications. Germany shows growth at 29.0%, emphasizing advanced nuclear research and scientific excellence in isotope technologies. Brazil records 26.5%, focusing on atomic research expansion and strategic technology development. The USA demonstrates 23.9% growth, supported by an established nuclear research infrastructure and an focus on strategic defense applications. The UK exhibits 21.4% growth, emphasizing nuclear research excellence and advanced isotope applications. Japan shows 18.9% growth, supported by advanced atomic science and specialized research technologies.

The report covers an in-depth analysis of 40+ countries withtop-performing countries highlighted below.

The uranium isotopes market in China is set to grow at a robust CAGR of 34% from 2025 to 2035. The country’s rapid expansion in nuclear power generation, driven by its ambitious energy plans, is a major factor in this growth. With China aiming to diversify its energy mix and reduce dependency on fossil fuels, nuclear energy is becoming an increasingly vital part of the national grid. Uranium isotopes play a key role in nuclear reactors, and as China develops more nuclear plants to meet growing energy demands, the need for uranium isotopes is expanding. The growing investment in uranium mining and processing technologies is strengthening its position as a major player in the global market. The nuclear research facilities are also pushing for increased use of uranium isotopes for advanced technologies, including space exploration and medical applications.

The uranium isotopes market in India is expected to grow at a CAGR of 31.5% from 2025 to 2035. The country’s increasing reliance on nuclear power for its growing energy needs is a key driver behind this significant growth. India is rapidly expanding its nuclear energy infrastructure with several new reactors under development. With the government’s commitment to energy diversification and the ambitious nuclear energy targets, India’s demand for uranium isotopes is expected to rise substantially. India is also investing in uranium exploration and extraction, aiming to reduce dependency on imports and bolster domestic production. The nuclear research sector is pushing for the use of uranium isotopes in medical diagnostics and treatment, especially in cancer therapies. The increasing focus on clean energy and energy security is further driving the demand for uranium isotopes, and India is positioning itself as a significant player in the global uranium market.

Demand for uranium isotopes in Germany is projected to grow at a CAGR of 29.0% from 2025 to 2035. Despite Germany's decision to phase out nuclear power, the country remains a significant player in nuclear research and isotopes applications. Germany has a strong foundation in nuclear technology, with leading research institutions focusing on using uranium isotopes for medical treatments, particularly cancer therapies. Germany is investing in advanced reactor designs and uranium isotope applications for research in space exploration and nuclear fusion energy. While Germany’s nuclear energy generation capacity is set to decline, the demand for uranium isotopes remains high, driven by their essential role in medical and scientific advancements. The focus on technological innovation and research-based applications of uranium isotopes, including new methods for isotope separation, is expected to contribute to market growth.

The uranium isotopes market in Brazil is forecast to grow at a CAGR of 26.5% from 2025 to 2035. Brazil’s growing nuclear power sector, particularly with the expansion of the Angra nuclear power plants, is the primary driver of this demand. With a focus on enhancing energy security, Brazil is seeking to increase its reliance on nuclear energy, which is fueling the need for uranium isotopes. Brazil’s investments in uranium exploration and mining are expected to strengthen its domestic supply and reduce dependence on imports. Uranium isotopes also have growing applications in medical sectors, particularly in imaging and cancer treatment, contributing to market demand. Brazil’s active participation in global nuclear nonproliferation initiatives positions it as an emerging market for uranium isotopes.

The United States’ uranium isotopes market is expected to grow at a CAGR of 23.9% from 2025 to 2035. The USA continues to be one of the largest consumers of uranium isotopes, largely due to its substantial nuclear energy sector. The ongoing demand for uranium isotopes for use in existing reactors, as well as the continued development of next-generation reactors, will drive market growth. Uranium isotopes are vital in medical applications, including cancer treatment and medical imaging, sectors that have shown increased growth over the years. The USA government’s ongoing efforts to bolster domestic uranium production and supply chains, along with its investments in nuclear research, will help maintain the country’s leadership in the global market.

The United Kingdom’s uranium isotopes market is projected to grow at a CAGR of 21.4% from 2025 to 2035. The UK continues to maintain a strong presence in the global nuclear energy sector, which directly impacts the demand for uranium isotopes. Although the country’s reliance on nuclear energy may decrease with ongoing renewable energy initiatives, there remains significant demand for uranium isotopes in research, medical, and industrial applications. The UK is also investing in advanced reactors and exploring new applications for uranium isotopes, particularly in the fields of space exploration and nuclear medicine. The growing focus on reducing carbon emissions and transitioning to low-carbon energy sources will further contribute to the market demand for uranium isotopes.

The uranium isotopes market in Japan is set to expand at a CAGR of 18.9% from 2025 to 2035. Following the Fukushima disaster, Japan has made efforts to restart its nuclear reactors, contributing to a steady demand for uranium isotopes. The country’s reliance on nuclear energy is gradually increasing as it seeks to balance energy security with the need for clean power generation. Uranium isotopes are crucial in both power generation and the medical sectors. In particular, Japan is focusing on the development of new medical treatments using uranium isotopes for cancer therapy, which is driving demand. Japan’s commitment to nuclear research, alongside the growing number of medical and industrial applications, is expected to support market growth in the coming decade.

Commitment to nuclear research and technological advancements

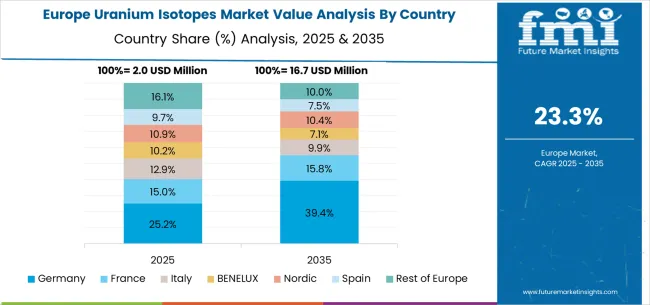

The uranium isotopes market in Europe is projected to grow from USD 3.5 million in 2025 to USD 35.2 million by 2035, registering a CAGR of 26.3% over the forecast period. Germany is expected to maintain its leadership position with a 28.0% market share in 2025, moderating slightly to 27.5% by 2035, supported by its strong nuclear research sector, advanced isotope processing capabilities, and comprehensive scientific research infrastructure serving major European markets.

The United Kingdom follows with 24.0% in 2025, projected to reach 23.8% by 2035, driven by established nuclear research excellence, comprehensive scientific programs, and advanced isotope application capabilities. France holds 20.0% in 2025, rising to 20.2% by 2035, supported by nuclear research leadership and growing adoption of specialized isotope technologies. Italy commands 12.0% in 2025, projected to reach 12.1% by 2035, while Spain accounts for 8.0% in 2025, expected to reach 8.1% by 2035. The Netherlands maintains a 3.5% share in 2025, growing to 3.6% by 2035. The Rest of Europe region, including Nordic countries, Eastern Europe, and other markets, is anticipated to maintain its position, holding its collective share at 4.5% by 2035, attributed to increasing nuclear research modernization and growing isotope technology adoption across emerging research markets implementing advanced atomic standards.

The uranium isotopes market is characterized by competition among established nuclear organizations, specialized isotope producers, and integrated nuclear technology providers. Companies are investing in advanced separation technology research, regulatory compliance, quality assurance, and comprehensive isotope portfolios to deliver pure, reliable, and strategically important uranium isotope solutions. Innovation in separation technologies, purification processes, and specialized nuclear material handling is central to strengthening market position and competitive advantage.

Rosatom leads the market with comprehensive nuclear technology solutions, offering advanced uranium isotope processing with a focus on strategic applications and research support. Japan Nuclear Fuel Limited provides specialized nuclear fuel and isotope services with an focus on quality and regulatory compliance. KNF delivers innovative nuclear processing solutions with a focus on specialized applications and technical excellence. China National Nuclear Corporation specializes in atomic technology and isotope production with focus on strategic capabilities and research support. NIDC focuses on atomic technology development and specialized nuclear material applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 9.9 million |

| Uranium Type | Uranium 234, Uranium 235, Uranium 238 |

| Application | Defense and Military, Scientific Research, Others |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East & Africa |

| Countries Covered | China, India, Germany, Brazil, the United States, the United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Rosatom, Japan Nuclear Fuel Limited, KNF, China National Nuclear Corporation, and NIDC |

| Additional Attributes | Dollar sales by uranium type and application category, regional demand trends, competitive landscape, technological advancements in isotope separation systems, purification technology development, nuclear processing innovation, and strategic application optimization |

Asia Pacific

North America

Europe

Latin America

Middle East & Africa

The global uranium isotopes market is estimated to be valued at USD 9.9 million in 2025.

The market size for the uranium isotopes market is projected to reach USD 93.8 million by 2035.

The uranium isotopes market is expected to grow at a 25.2% CAGR between 2025 and 2035.

The key product types in uranium isotopes market are uranium 234, uranium 235 and uranium 238.

In terms of application, defense and military segment to command 55.0% share in the uranium isotopes market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA