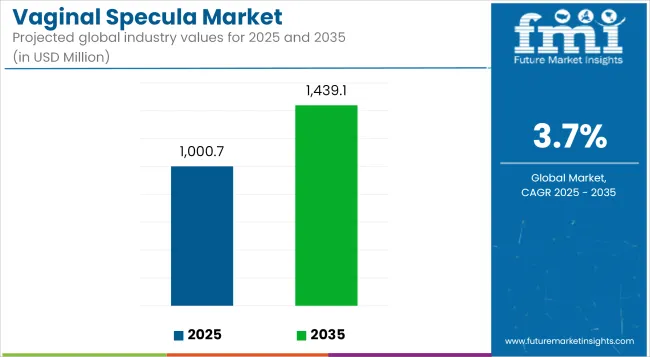

The Vaginal Specula Market is estimated to reach USD 1,000.7 million by 2025. From 2025 to 2035, the market is expected to grow at a CAGR of 3.7%, surpassing USD 1,439.1 million in sales by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,000.7 million |

| Industry Value (2035F) | USD 1,439.1 million |

| CAGR (2025 to 2035) | 3.7% |

The vaginal specula market is undergoing notable expansion, supported by a growing emphasis on women’s health screening programs, preventive gynecological care, and rising procedural volumes across both developed and emerging regions. Increased awareness about early detection of cervical and vaginal conditions has contributed to steady procedural demand in hospitals, ambulatory centers, and physician offices.

Regulatory frameworks have evolved to prioritize patient safety and infection control, which has incentivized the adoption of single-use, sterile instruments. Advancements in polymer engineering have enhanced the performance and ergonomics of disposable specula, reinforcing clinical preference and procurement policies that align with infection prevention protocols.

Healthcare provider investments in colposcopy infrastructure and gynecological examination capabilities have further accelerated the need for reliable and cost-effective specula solutions. Demographic trends indicating higher screening compliance among women in midlife and older age brackets are expected to sustain market momentum. Continued product innovation focusing on patient comfort, ease of use, and material sustainability is anticipated to shape purchasing decisions and drive differentiation in a competitive landscape.

In 2025, disposable specula are anticipated to hold a 33.8% revenue share in the vaginal specula market. This leadership has been driven by their role in mitigating cross-contamination risks and simplifying sterilization workflows. Regulatory guidelines have increasingly favored single-use instruments to support infection prevention initiatives in gynecological practices.

Hospitals and clinics have expressed preference for disposable models due to consistent quality, standardized performance, and reduced reprocessing costs. Advances in medical-grade polymer materials have contributed to improved strength and transparency, reinforcing clinician confidence during examinations.

Procurement policies emphasizing safety and operational efficiency have further accelerated adoption. Collectively, these dynamics have positioned disposable specula as the preferred type for a growing range of routine and diagnostic procedures.

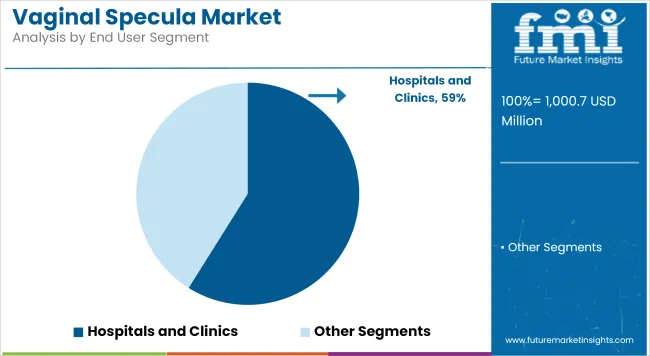

Hospitals and clinics are projected to account for 58.9% of the market share in 2025. This segment’s prominence has been attributed to their central role in cervical cancer screening programs, pelvic exams, and preventive gynecological services. Institutional purchasing strategies have increasingly prioritized bulk procurement of single-use specula to align with infection control policies and minimize turnaround time between procedures.

Clinical guidelines advocating for standardized examination protocols have supported higher procedural volumes in these settings. Additionally, investments in gynecology-focused outpatient infrastructure and dedicated women’s health clinics have bolstered demand. The combination of workflow efficiency, reimbursement alignment, and regulatory compliance has secured hospitals and clinics as the leading end users in the vaginal specula market.

Patient Discomfort and Reusability Concerns

The different market challenges in the vaginal specula relate to patient discomfort, clinician preference, and sterility concerns. Although reusable metal specula are less expensive in the long run, they cause cold sensations and anxiety, which eventually result in noncompliance of patients during pelvic exams.

The disposable plastic variants, on the contrary, face criticism with respect to environmental effects and add to medical waste. Non-standard size availability and wrong insertion technique are other factors that affect diagnostic quality, thus limiting user satisfaction.

There are many health systems in low-resource settings that may not have access to high-quality sterilisable materials or single-use products that can be sustainable, making it hard for this market to penetrate public health and routine gynecological care.

Demand for Patient-Centric, Single-Use, and Eco-Friendly Designs

The vaginal specula market will gradually develop, despite all these drawbacks, because the increasing awareness of women's health, the growing incidence of cervical cancer screening, and the demand for patient’s friendly, hygienic examination instruments are making room for the market.

One-time fabricated specimen from warm-feel plastic, with smoother edges and ergonomic handles, would go a long way toward gaining acceptance in outpatient and mobile health settings. Emerging innovations in biodegradable materials and temperature-neutral coatings are enhancing experiences while fulfilling sustainability goals.

The continuous expansion of gynecological services through telemedicine-supported clinics, urgent care centers, and global women health initiatives globalizes the already burgeoning demand for the best-designed, cost-effective, and environmentally responsible specula.

Meaningful growth continues to propel the vaginal specula market in the United States with high volumes of pelvic exams, cervical cancer screenings, and obstetricgynecologic visits. The USA clinics and hospitals have been moving toward the use of single-use sterile plastic specula to minimize infection hazards, as well as very stringent regulatory hygiene specifications.

There is increasing demand for patient-centered innovations such as self-heating and ergonomically designed specula that ensure comfort and reduce anxiety during the examination.

| Country | CAGR (2025 to 2035) |

|---|---|

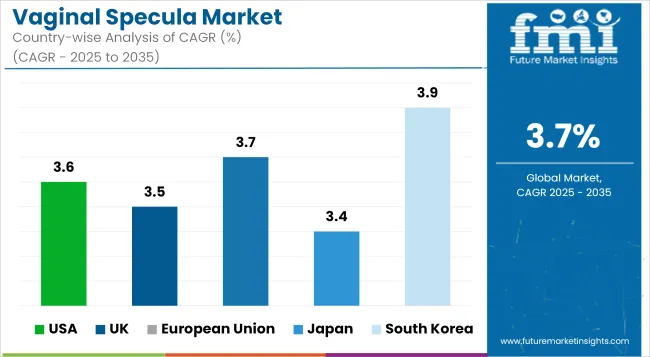

| USA | 3.6% |

Market states that the United Kingdom is footed by NHS-led cervical screening programs and guidance since these have been extending to regularly promote pelvic assessments. Lightweight and disposable vaginal specula are being adopted by British providers across GP surgeries, community clinics, and hospital outpatient departments.

Sustainability and patient comfort are becoming the focus of procurement criteria, resulting in an increased use of recyclable and BPA-free materials.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.5% |

Although a mature market for vaginal specula, the EU can be described as stable, especially in territories like Germany, France, and the Netherlands. Since these countries have public health programs focusing on HPV screening and gynecologic health, there is steady consistent demand for specula in public and private sectors alike.

Manufacturers, therefore, provide CE-marked disposable specula with integrated lighting and greater size availability, with special attention paid to the efficiency of procedure and the experience of patients.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.7% |

Japanese vaginal specula are experiencing moderate growth, which is well supported by government programs for cervical cancer prevention and the increasing population of aging females interested in routine gynecologic care. Japanese facilities prefer compact and low-noise specula that increase patient comfort and examination accuracy.

Interest is also increasing in single-use, sterile types to enhance outpatient flow and infection control.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

As women's health issues become more visible, with a growing number of private clinics operating in the country and with government-supported screening programs, the vaginal specula market in South Korea continues to undergo steady growth. Local manufacturers of South Korea are supplying both plastic and metal vaginal specula, compatible with colposcopes and video-assisted gynecology systems.

The product design and innovation in the domestic market are taking shape on design ergonomics, sterility, and awareness for the patient.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.9% |

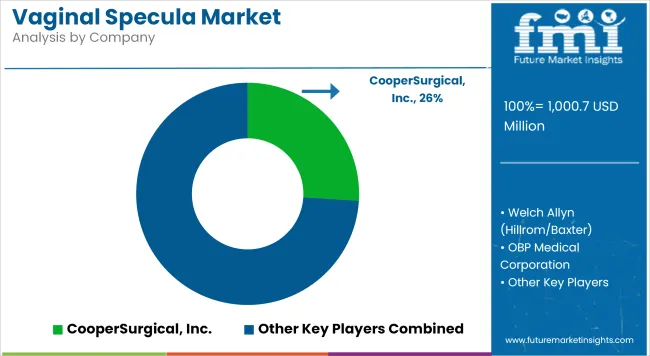

The vaginal specula market is moderately competitive, shaped by demand for patient comfort, infection control, and workflow efficiency in gynecological exams and procedures. Leading companies are focusing on innovations such as single-use disposable specula, integrated illumination, and ergonomic designs to improve visualization and reduce cross-contamination risks.

Strategic partnerships with hospitals, ambulatory surgery centers, and women’s health clinics, along with expanded distribution networks, are central to strengthening market presence. Additionally, growing emphasis on cost-effective disposable solutions and compliance with infection prevention protocols is accelerating the shift away from reusable stainless-steel devices in many regions.

The overall market size for the vaginal specula market was USD 1,000.7 million in 2025.

The vaginal specula market is expected to reach USD 1,439.1 million in 2035.

The increasing awareness of women's health screening, rising number of gynecological examinations, and growing use of disposable specula in hospital-based use fuel the vaginal specula market during the forecast period.

The top 5 countries driving the development of the vaginal specula market are the USA, UK, European Union, Japan, and South Korea.

Disposable specula and hospital-based use lead market growth to command a significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vaginal Exam Specula Market

Vaginal Spetula Market Size and Share Forecast Outlook 2025 to 2035

Vaginal Inserts Market Size and Share Forecast Outlook 2025 to 2035

Vaginal Antifungals Market Size and Share Forecast Outlook 2025 to 2035

Vaginal and Vulval Inflammatory Diseases Treatment Market - Demand & Innovations 2025 to 2035

Vaginal Applicator Market Growth & Health Innovations 2024-2034

Vulvovaginal Candidiasis Treatment Market Size and Share Forecast Outlook 2025 to 2035

At-Home Vaginal pH Test Kit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA