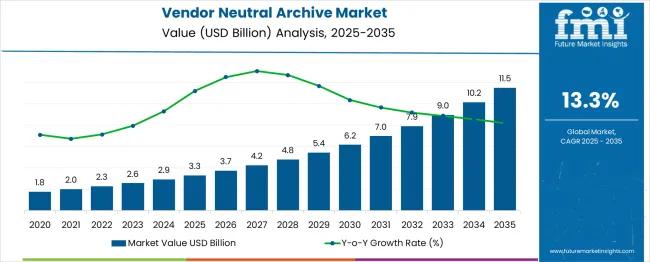

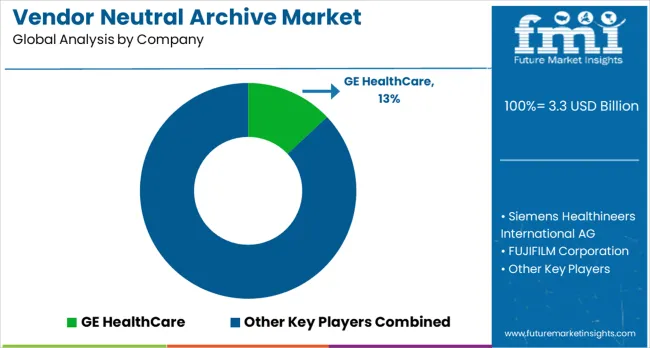

The global vendor neutral archive (VNA) market is expected to increase from USD 3.3 billion in 2025 to USD 11.5 billion by 2035, reflecting a 13.3% CAGR and generating an absolute dollar opportunity of USD 8.2 billion. Expansion is fueled by growing demand for centralized medical imaging storage, rising healthcare digitization, and regulatory requirements for secure patient data management. Adoption is further supported by cloud integration, interoperability solutions, and the need to streamline data access across multi-departmental hospital networks.

Quick Stats for Vendor Neutral Archive Market

Elasticity of growth against macroeconomic indicators reveals how the market responds to shifts in healthcare spending, infrastructure development, and policy initiatives. In periods of GDP expansion and increased healthcare investment, adoption accelerates as hospitals and diagnostic centers allocate larger budgets to IT modernization. During tighter fiscal conditions, demand shows resilience due to regulatory compliance pressures, the need to reduce operational inefficiencies, and long-term cost savings associated with centralized archives.

Rising government focus on electronic health records and digital transformation strengthens market elasticity, while technological progress in AI-driven archiving and cybersecurity ensures adoption even in fluctuating economic cycles. The VNA market demonstrates strong responsiveness to macroeconomic drivers, with long-term expansion shaped by healthcare modernization and digital recordkeeping mandates worldwide.

| Metric | Value |

| Market Value (2025) | USD 3.3 billion |

| Forecast Market Value (2035) | USD 11.5 billion |

| Forecast CAGR (2025–2035) | 13.3% |

Recent developments in the vendor neutral archive market focus on interoperability, scalability, and integration with advanced technologies. AI-driven image recognition, automated indexing, and workflow optimization are improving diagnostic accuracy and operational efficiency. Cloud-based VNAs are expanding adoption by offering flexible deployment and cost efficiency. Integration with electronic health records and telehealth platforms is enhancing accessibility and collaboration.

Data security innovations, including encryption and compliance frameworks, are addressing regulatory requirements. Partnerships between healthcare providers and IT companies are accelerating deployment.

The vendor neutral archive (VNA) market is driven by five primary parent markets with specific shares. Healthcare IT leads with 38%, as hospitals and clinics adopt VNAs to centralize imaging data and streamline interoperability. Medical imaging contributes 26%, driven by radiology, cardiology, and oncology departments requiring efficient storage and access.

Cloud computing accounts for 14%, supporting scalable storage and remote accessibility for healthcare providers. Enterprise data management accounts for 12% of the market, leveraging VNAs for standardized archiving across healthcare networks. Research and academic institutions hold 10%, using VNAs to support clinical studies and collaborative projects. These sectors collectively shape global demand for VNA solutions.

Market expansion is being supported by the exponential growth in medical imaging data volumes and the corresponding need for scalable, vendor-agnostic storage solutions across healthcare organizations. Modern healthcare facilities generate massive amounts of imaging data from multiple modalities and require efficient archiving systems that enable seamless data sharing and long-term retention. VNA solutions provide standardized DICOM storage capabilities that eliminate vendor lock-in and enable cost-effective data management strategies.

The growing focus on healthcare interoperability and data analytics is driving demand for comprehensive imaging data management platforms from healthcare providers. Regulatory requirements for data retention and sharing are establishing standards that favor vendor-neutral storage solutions capable of supporting multiple imaging vendors and clinical workflows. Healthcare organizations are implementing VNA systems to enable enterprise imaging initiatives and support artificial intelligence applications requiring large imaging datasets.

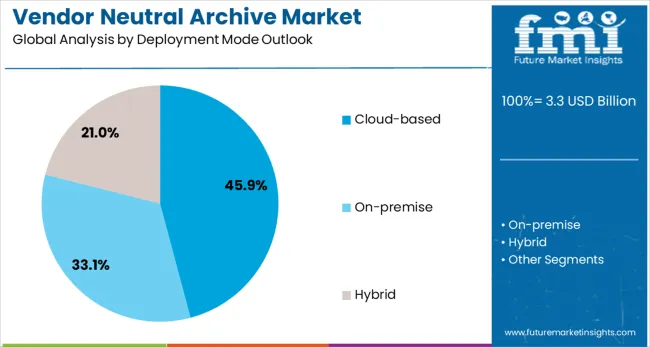

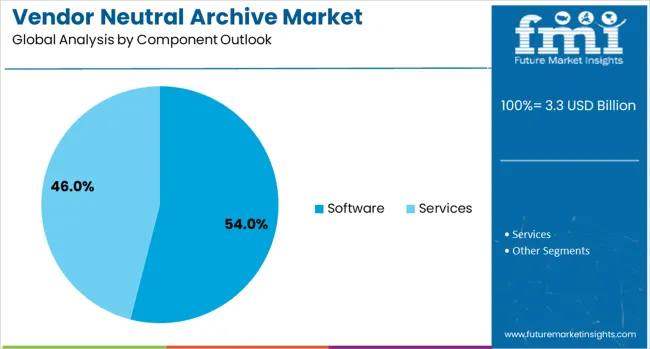

The market is segmented by imaging modalities outlook, deployment mode outlook, component outlook, end-use outlook, application outlook, and region. By imaging modalities outlook, the market is divided into Radiology, Cardiology, Pathology, Endoscopy, Mammography, and Others. Based on deployment mode outlook, the market is categorized into Cloud-based, On-premise, and Hybrid. In terms of component outlook, the market is segmented into Software and Services.

By end-use outlook, the market is classified into Hospitals and Diagnostic Imaging Centres. Based on application outlook, the market is divided into Clinical Imaging and Non-Clinical Data Management. Regionally, the market is divided into key countries including China, India, Germany, France, United Kingdom, United States, and Brazil.

Radiology is projected to account for 48% of the vendor neutral archive market in 2025. This leading share is supported by the high volume of radiological imaging studies and the critical need for long-term storage and retrieval capabilities in radiology departments. Radiology VNA implementations enable consolidation of CT, MRI, X-ray, and ultrasound data from multiple vendors while maintaining DICOM compliance and clinical workflow integration. The segment benefits from established radiology information systems and comprehensive image management requirements.

Cloud-based deployment is expected to represent 46% of VNA implementation demand in 2025. This significant share reflects the growing adoption of cloud infrastructure for medical imaging storage and the cost advantages of scalable cloud-based archiving solutions. Cloud VNA implementations provide elastic storage capacity, disaster recovery capabilities, and reduced infrastructure maintenance requirements for healthcare organizations. The segment benefits from increasing healthcare cloud adoption and regulatory acceptance of cloud-based medical data storage.

Software components are projected to contribute 54% of the market in 2025, representing the core VNA platform technologies that enable imaging data management and workflow integration. Software components include image storage engines, DICOM services, workflow orchestration, and user interface applications that form the foundation of VNA implementations. The segment encompasses vendor-neutral storage software, integration middleware, and clinical viewing applications that enable comprehensive imaging data management.

Hospitals are estimated to hold 61% of the market share in 2025. This dominance reflects the large-scale imaging data management requirements of hospital systems and the complex multi-vendor imaging environments typical in acute care facilities. Hospital VNA implementations support enterprise imaging initiatives, enable data sharing across departments, and provide foundation infrastructure for artificial intelligence applications. The segment includes academic medical centres, community hospitals, and integrated health systems with comprehensive imaging requirements.

The vendor neutral archive market is advancing rapidly due to increasing medical imaging volumes and growing recognition of vendor-neutral storage benefits. The market faces challenges including data migration complexity, integration requirements with existing systems, and varying regulatory compliance across different regions. Cloud adoption trends and artificial intelligence integration continue to influence platform development and deployment strategies.

The incorporation of AI-powered image analysis and automated workflow optimization is transforming VNA platforms from passive storage systems into active clinical decision support tools. Advanced analytics capabilities enable automated image quality assessment, clinical finding detection, and workflow prioritization that improve radiologist efficiency and diagnostic accuracy. AI integration also supports predictive analytics and population health management initiatives that leverage comprehensive imaging datasets.

Modern VNA implementations are evolving beyond radiology to support enterprise-wide imaging initiatives that consolidate data from cardiology, pathology, endoscopy, and other clinical departments. Multi-departmental VNA platforms provide unified imaging data management across diverse clinical workflows while maintaining specialty-specific viewing and reporting capabilities. Enterprise imaging initiatives enable comprehensive patient imaging histories and support coordinated care delivery across multiple clinical specialties.

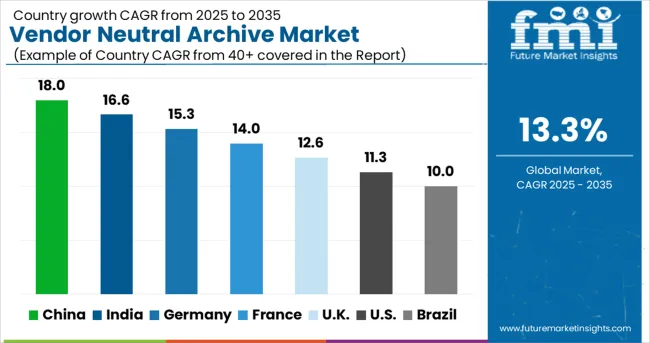

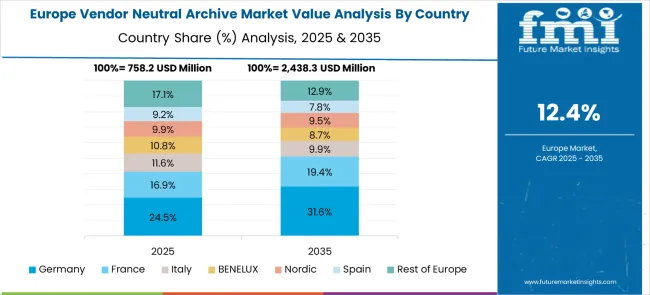

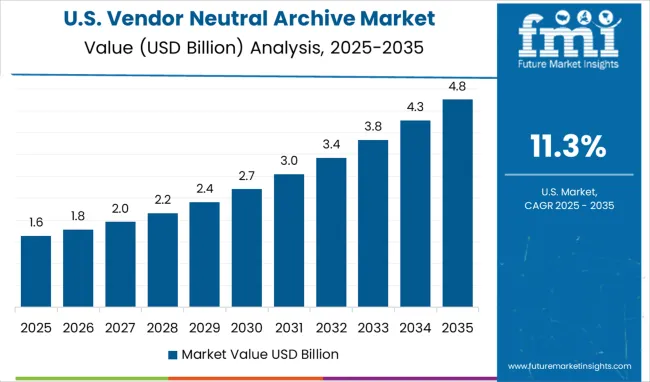

The global vendor neutral archive market is projected to grow from USD 3.3 billion in 2025 to USD 11.5 billion by 2035, recording a CAGR of 13.3%. China, at 17.9%, leads BRICS peers, supported by rapid digitization of hospitals and state-driven health IT reforms. India follows with 16.6%, where healthcare digitization, rising imaging volumes, and private sector adoption accelerate growth. Germany, at 15.3%, shows OECD-driven momentum, underpinned by compliance requirements and strong radiology networks. France expands at 14%, reflecting OECD investment in data security and cross-hospital interoperability. The United Kingdom, with 12.6%, advances through NHS digital transformation initiatives and centralized image archiving. The United States, at 11.3%, remains below global growth as a mature OECD market, yet innovation in cloud-based VNA sustains demand. Brazil records 10%, driven by BRICS-linked healthcare modernization and imaging expansion. ASEAN economies also emerge as growth pockets with improving hospital IT adoption.

This report includes insights on 40+ countries; the top markets are shown here for reference.

| Country | CAGR (2025-2035) |

| China | 17.9% |

| India | 16.6% |

| Germany | 15.3% |

| France | 14 % |

| United Kingdom | 12.6% |

| United States | 11.3% |

| Brazil | 10% |

The vendor neutral archive market in China is projected to exhibit the highest growth rate with a CAGR of 17.9% through 2035, driven by extensive healthcare digitization programs and massive investments in medical imaging infrastructure across urban and rural healthcare networks. The country's expanding hospital systems and government healthcare modernization initiatives are creating unprecedented demand for scalable imaging data management solutions. Major healthcare technology companies are establishing comprehensive VNA platforms to support China's growing medical imaging requirements and interoperability objectives.

Demand for vendor neutral archive solutions in India is expanding at a CAGR of 16.6%, supported by rapid healthcare infrastructure development and increasing adoption of digital medical imaging technologies across both private and public healthcare sectors. The country's growing medical tourism industry and expanding diagnostic imaging capabilities are driving demand for enterprise-grade VNA solutions. Healthcare organizations are implementing comprehensive imaging data management systems to support quality improvement initiatives and clinical research programs.

Demand for vendor neutral archive solutions in Germany is projected to grow at a CAGR of 15.3%, supported by the country's focus on advanced healthcare technology integration and comprehensive medical data management strategies. German healthcare systems are implementing sophisticated VNA platforms that support artificial intelligence applications, clinical research initiatives, and population health management programs. The market is characterized by focus on data security, clinical workflow optimization, and integration with existing healthcare information systems.

The vendor neutral archive market in France is growing at a CAGR of 14 %, driven by implementation of national healthcare digitization strategies and growing adoption of enterprise imaging platforms across regional healthcare networks. The country's established healthcare system is expanding VNA capabilities to support telemedicine initiatives, clinical collaboration, and comprehensive patient care coordination. Healthcare facilities are investing in cloud-based imaging solutions to improve data accessibility and reduce infrastructure maintenance requirements.

Growth Assessment of Vendor Neutral Archive Market in the United Kingdom Demand for vendor neutral archive market in the United Kingdom is expanding at a CAGR of 12.6%, driven by NHS digitization initiatives and increasing focus on healthcare interoperability across integrated care systems. British healthcare organizations are implementing comprehensive VNA platforms to support population health management, clinical pathway optimization, and regional care coordination. The market benefits from standardized implementation approaches and clinical evidence development that demonstrate VNA value in improving healthcare outcomes.

Demand for vendor neutral archive solutions in the United States is expanding at a CAGR of 11.3%, driven by healthcare system consolidation and increasing attention on value-based care delivery models. American healthcare organizations are establishing comprehensive VNA platforms that integrate artificial intelligence capabilities, advanced analytics, and clinical decision support systems. The market benefits from mature healthcare IT infrastructure and established reimbursement models that support advanced imaging technologies.

The vendor neutral archive solutions market in Brazil is growing at a CAGR of 10.0%, driven by healthcare infrastructure modernization and increasing adoption of digital medical imaging technologies across public and private healthcare sectors. The country's expanding medical imaging capabilities and growing popularity on healthcare quality improvement are creating demand for comprehensive VNA solutions. Healthcare organizations are implementing cloud-based imaging platforms to improve data management efficiency and support clinical workflow optimization.

The vendor neutral archive market is shaped by healthcare IT providers, medical imaging leaders, and enterprise data management firms delivering advanced storage and interoperability solutions. GE HealthCare and Siemens Healthineers International AG support this market with imaging informatics platforms and enterprise data integration systems. FUJIFILM Corporation and Koninklijke Philips N.V. provide enterprise imaging solutions that streamline medical image archiving and clinical workflow management. IBM Watson Health, now operating as Merative, strengthens this space with cloud-based healthcare analytics and interoperable data management systems. Hyland Healthcare contributes with content services and imaging platforms designed for health systems of varying scale.

Sectra AB and Agfa HealthCare offer enterprise imaging systems and vendor neutral archives focused on radiology, cardiology, and pathology workflows. Carestream Health and BridgeHead Software provide scalable solutions for data archiving and hospital information system integration. Canon Medical Systems enhances this market with diagnostic imaging platforms linked to enterprise archiving solutions, while Novarad delivers PACS and VNA systems designed to improve interoperability across healthcare environments. Dell Technologies supports healthcare providers with enterprise data storage and infrastructure tailored for medical imaging archives.

Change Healthcare plays a key role by offering interoperability solutions and cloud-enabled platforms for imaging data exchange. Dicom Systems, Inc. provides middleware and integration engines that support vendor neutral archiving. Intelerad and RamSoft further contribute with enterprise imaging and PACS platforms designed to improve clinical workflows and patient care coordination. Collectively, these organizations enable healthcare providers to manage large volumes of medical imaging data with improved accessibility, security, and compliance. Their efforts strengthen healthcare systems by ensuring clinical data can be archived, retrieved, and shared across diverse platforms without vendor restrictions, supporting more connected and efficient patient care delivery.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.3 billion |

| Imaging Modalities Outlook | Radiology, Cardiology, Pathology, Endoscopy, Mammography, Others |

| Deployment Mode Outlook | Cloud-based, On-premise, Hybrid |

| Component Outlook | Software, Services |

| End Use Outlook | Hospitals, Diagnostic Imaging Centers |

| Application Outlook | Clinical Imaging, Non-clinical Data Management |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, France, United Kingdom, United States, Brazil |

| Key Companies Profiled | GE HealthCare, Siemens Healthineers International AG, FUJIFILM Corporation, Koninklijke Philips N.V., IBM Watson Health (Merative), Hyland Healthcare, Sectra AB, Agfa HealthCare, Carestream Health, BridgeHead Software, Canon Medical Systems, Novarad, Dell Technologies, Change Healthcare, Dicom Systems Inc., Intelerad, RamSoft |

| Additional Attributes | Dollar sales by imaging modalities outlook, deployment mode outlook, component outlook, end use outlook, and application outlook, regional demand trends across key markets, competitive landscape with established healthcare IT providers and specialized VNA vendors, healthcare provider preferences for cloud versus on-premise deployment models, integration with artificial intelligence and advanced analytics platforms, innovations in enterprise imaging and multi-departmental workflow solutions, and adoption of comprehensive VNA platforms with embedded clinical decision support and population health management capabilities for enhanced healthcare delivery outcomes. |

Radiology

North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global vendor neutral archive market is estimated to be valued at USD 3.3 billion in 2025.

The market size for the vendor neutral archive market is projected to reach USD 11.5 billion by 2035.

The vendor neutral archive market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in vendor neutral archive market are radiology, cardiology, pathology, endoscopy, mammography and others.

In terms of deployment mode outlook, cloud-based segment to command 45.9% share in the vendor neutral archive market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Street Vendors Market Size and Share Forecast Outlook 2025 to 2035

Odor-Neutralizing Sachets Market Size and Share Forecast Outlook 2025 to 2035

Odor-Neutralizer Injectors Market Size and Share Forecast Outlook 2025 to 2035

Extra Neutral Alcohol (ENA) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Freeze Neutralising Kit Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Buffering & Neutralizing Agents Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA