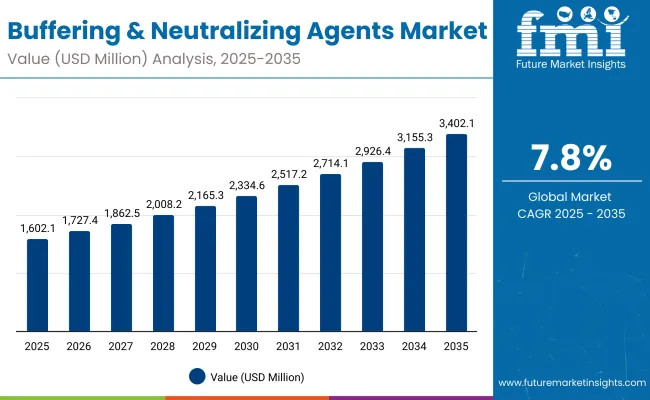

The Buffering & Neutralizing Agents Market is expected to record a valuation of USD 1,602.1 million in 2025 and USD 3,402.1 million in 2035, with an increase of USD 1,800.0 million, which equals a growth of 112% over the decade. The overall expansion represents a CAGR of 7.8% and more than a 2X increase in market size.

Buffering & Neutralizing Agents Market Key Takeaways

| Metric | Value |

|---|---|

| Buffering & Neutralizing Agents Market Estimated Value in (2025E) | USD 1,602.1 million |

| Buffering & Neutralizing Agents Market Forecast Value in (2035F) | USD 3,402.1 million |

| Forecast CAGR (2025 to 2035) | 7.8% |

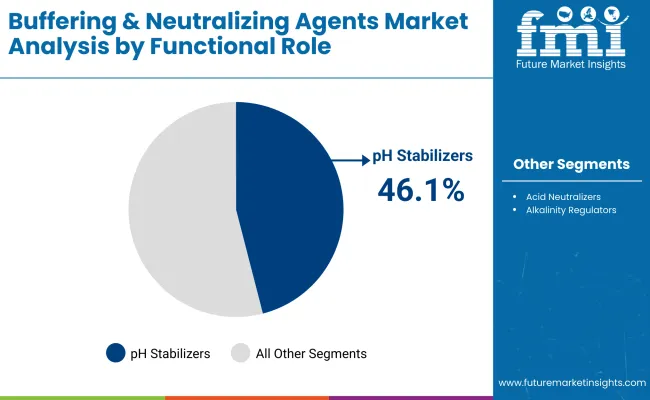

During the first five-year period from 2025 to 2030, the market increases from USD 1,602.1 million to USD 2,334.6 million, adding USD 732.5 million, which accounts for about 41% of the total decade growth. This phase records steady adoption of buffering and neutralizing agents in personal care manufacturing, haircare products, and skin cleansers, driven by the need to stabilize pH and enhance formulation performance. pH stabilizers dominate this period with more than 46% share in 2025, reflecting their critical role in maintaining cosmetic product safety and efficacy.

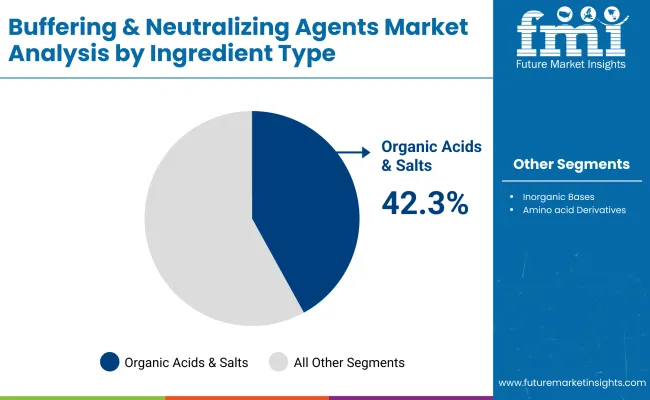

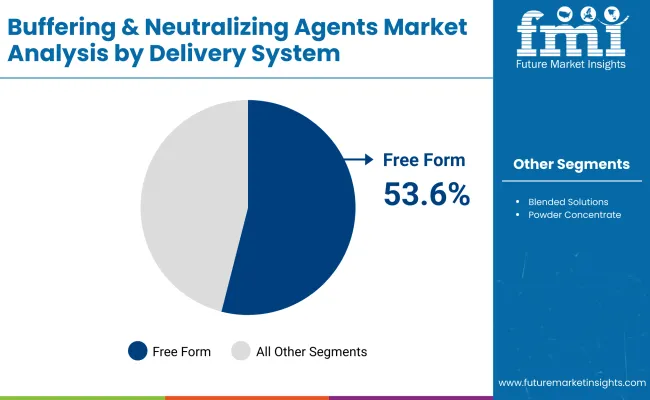

The second half from 2030 to 2035 contributes USD 1,067.5 million, equal to 59% of total growth, as the market jumps from USD 2,334.6 million to USD 3,402.1 million. This acceleration is powered by strong demand in dermocosmetic formulations, color cosmetics, and bath products, where multifunctional buffering systems and amino acid derivatives are increasingly adopted. By the end of the decade, organic acids & salts retain a leading role with a 42.3% share in 2025, while free-form delivery systems capture over 53% of the market. Rapidly expanding Asian markets, led by China (CAGR 13.7%) and India (CAGR 15.4%), further accelerate global demand in this phase.

From 2020 to 2024, the Buffering & Neutralizing Agents Market expanded steadily, supported by rising demand in personal care and cosmetic formulations. Growth during this period was driven by the adoption of basic buffering systems such as inorganic bases and organic salts, with companies focusing on supply reliability and cost competitiveness.

Multinationals like BASF, Solvay, and Clariant dominated supply, controlling nearly 70% of the market through integrated raw material sourcing and distribution networks. Competitive differentiation relied heavily on product consistency, safety certifications, and regulatory compliance, while specialized derivatives such as amino acid-based agents were still niche and contributed less than 10% of total value.

Looking forward to 2025 and beyond, market value will reach USD 1,602.1 million in 2025, and the revenue mix will evolve toward specialized and multifunctional agents. Demand for amino acid derivatives and blended formulations will accelerate, particularly in dermocosmetic applications and premium skincare lines, where consumers demand pH stability with additional moisturizing and soothing benefits.

Traditional chemical leaders face increasing competition from bio-based and clean-label innovators, who are introducing organic-certified, COSMOS/NATRUE-compliant buffering systems. The competitive advantage is shifting from scale and commodity pricing to portfolio innovation, sustainability, and end-user partnerships with cosmetic brands.

The Buffering & Neutralizing Agents Market is experiencing robust growth due to their critical role in stabilizing pH-sensitive dermocosmetic formulations. Dermatology-led cosmetic products, particularly for sensitive skin, acne-prone skin, and post-treatment care, rely heavily on buffering agents to maintain stability and ensure clinical efficacy. As the consumer base for dermocosmetics expands across Asia-Pacific and Europe, demand for advanced amino acid derivatives and organic-certified buffering systems is accelerating beyond basic neutralizers.

Growth is also driven by the surge in multifunctional products such as 2-in-1 cleansers, hybrid toners, and hair treatment solutions that require precise pH balancing to deliver multiple benefits. These agents not only neutralize but also enhance compatibility with active ingredients like niacinamide, AHAs, and hyaluronic acid, preventing instability and irritation. This compatibility-driven demand is pushing companies to adopt tailored buffering solutions that fit clean-label, fragrance-free, and dermatologist-tested claims.

The Buffering & Neutralizing Agents Market is segmented by functional role (pH stabilizers, acid neutralizers, alkalinity regulators), ingredient type (organic acids & salts, inorganic bases, amino acid derivatives), delivery system (free form, blended solutions, powder concentrate), and physical form (solution/concentrate, powder, granules).

Applications include skin cleansers & toners, hair treatments, color cosmetics, and bath products, serving end-use industries such as personal care manufacturing, haircare, and dermocosmetic formulations. Regionally, the market spans North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with China and India emerging as the fastest-growing markets due to rising adoption of clean-label and multifunctional cosmetic products.

| Functional Role | Value Share % 2025 |

|---|---|

| pH stabilizers | 46.1% |

| Others | 53.9% |

The pH stabilizers segment is projected to contribute 46.1% of the Buffering & Neutralizing Agents Market revenue in 2025, maintaining its lead as the dominant functional role. This dominance is supported by rising demand in personal care manufacturing, cleansers, and dermocosmetic formulations, where consistent pH balance is critical to ensure stability, skin compatibility, and active ingredient performance.

Growth is further reinforced by the shift toward fragrance-free, dermatologist-tested, and sensitive-skin safe products, where stabilizers play a central role in reducing irritation risks. As brands increasingly invest in hybrid formulations and multifunctional personal care solutions, the reliance on pH stabilizers is expected to expand, cementing their position as the backbone of buffering and neutralizing applications.

| Ingredient Type | Value Share % 2025 |

|---|---|

| Organic acids & salts | 42.3% |

| Others | 57.7% |

The organic acids & salts segment is forecasted to hold 42.3% of the market share in 2025, driven by their versatility in maintaining formulation stability across skin cleansers, toners, and bath products. These ingredients are favored for their ability to deliver consistent buffering capacity while aligning with clean-label, vegan, and COSMOS/NATRUE-certified standards, making them highly attractive to both formulators and consumers.

Their broad compatibility with active ingredients such as niacinamide, AHAs, and hyaluronic acid has reinforced their adoption in multifunctional and sensitive-skin formulations. The segment’s growth is further bolstered by rising consumer preference for organic-certified personal care products, where natural and safe ingredient positioning provides a competitive edge. As cosmetic brands intensify their focus on sustainability and transparency, organic acids & salts are expected to retain leadership within the ingredient landscape throughout the forecast period.

| Delivery System | Value Share % 2025 |

|---|---|

| Free form | 53.6% |

| Others | 46.4% |

The free form delivery system is projected to account for 53.6% of the Buffering & Neutralizing Agents Market revenue in 2025, establishing it as the leading format. Free form agents are preferred for their ease of incorporation across diverse cosmetic formulations, from skin cleansers and toners to hair treatments and bath products, without requiring pre-blended solutions.

Their flexibility allows formulators to precisely adjust pH balance and neutralizing capacity, ensuring better compatibility with actives like AHAs, retinoids, and amino acid derivatives. Additionally, free form systems align well with R&D-driven customization, enabling manufacturers to innovate with multifunctional and clean-label products. Given their cost-effectiveness, adaptability, and growing use in both mass-market and premium dermocosmetic lines, free form delivery systems are expected to maintain leadership throughout the forecast period.

Rising Demand for Sensitive-Skin and Dermocosmetic Products

A major growth driver for the Buffering & Neutralizing Agents Market is the surge in demand for sensitive-skin and dermocosmetic formulations. Consumers are increasingly choosing fragrance-free, dermatologist-tested, and pH-balanced products to address issues like acne, rosacea, and barrier damage. Buffering agents are essential in stabilizing these formulations, ensuring safety and efficacy while preventing irritation caused by fluctuating acidity.

Global brands are reformulating their product lines with gentle stabilizers, while new entrants are introducing bio-based and amino acid derivatives, fueling steady adoption across both premium and mass-market segments.

Multifunctional Role in Hybrid Personal Care Products

The growth of multifunctional personal care products is driving wider adoption of buffering and neutralizing agents. Hybrid formats such as cleanser-toner combinations, treatment shampoos, and 2-in-1 bath products require pH control not only for stability but also for optimizing the performance of actives like niacinamide, AHAs, and peptides.

Buffering systems ensure product integrity when multiple ingredients interact, expanding their relevance beyond basic neutralization. As consumer expectations shift toward convenience-driven, multifunctional formulations, buffering agents provide manufacturers the technical backbone to innovate, differentiate, and maintain consistent quality, making this segment critical for long-term growth.

Regulatory Scrutiny on Ingredient Safety and Claims

A key restraint is the tightening of global regulatory frameworks governing cosmetic ingredients. Agencies in the EU, USA, and Asia-Pacific are implementing stricter compliance for pH ranges, ingredient labeling, and safety testing. Buffering and neutralizing agents must now meet higher thresholds for biocompatibility, clean-label certification, and environmental safety.

This increases costs for manufacturers, particularly smaller firms lacking regulatory expertise. Additionally, marketing claims such as “natural,” “vegan,” or “dermatologist-approved” demand evidence-backed validation, creating barriers for rapid product launches. Such scrutiny slows down innovation pipelines and raises entry costs, limiting agility in highly competitive markets.

Shift Toward Bio-Based and Clean-Label Buffering Agents

A defining trend in the Buffering & Neutralizing Agents Market is the pivot toward bio-based, organic-certified, and clean-label solutions. Consumers increasingly prefer products with recognizable, plant-derived components, pushing formulators to replace synthetic neutralizers with organic acids, salts, and amino acid derivatives.

This trend is amplified by certification demands such as COSMOS, ECOCERT, and NATRUE, which influence purchasing decisions, especially in Europe and Asia-Pacific. Brands are also embedding sustainability narratives, such as sourcing buffering agents from upcycled agricultural by-products. This evolution reflects a broader shift where functionality must align with transparency, eco-responsibility, and consumer trust.

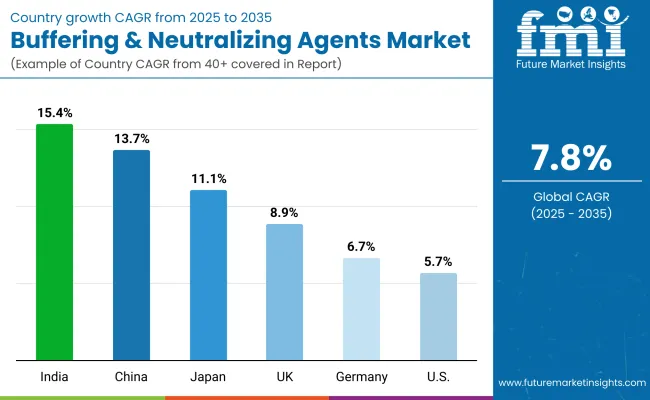

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 13.7% |

| USA | 5.7% |

| India | 15.4% |

| UK | 8.9% |

| Germany | 6.7% |

| Japan | 11.1% |

The global Buffering & Neutralizing Agents Market demonstrates strong country-level variations in adoption, shaped by cosmetic industry maturity, regulatory frameworks, and consumer preferences.

Asia-Pacific emerges as the fastest-growing region, anchored by India at 15.4% CAGR and China at 13.7% CAGR. Growth in India is propelled by rising consumption of affordable mass-market personal care products and increasing demand for dermocosmetics among urban consumers, while China benefits from premium skincare, hybrid formulations, and government-backed support for clean-label compliance. Japan records an 11.1% CAGR, reflecting the popularity of dermocosmetic formulations, multifunctional bath products, and pH-sensitive hair treatments, driven by high consumer awareness of skin health.

In Europe, the UK (8.9%) and Germany (6.7%) maintain steady growth due to stringent safety and labeling regulations that enforce pH balance and ingredient transparency, fostering the adoption of buffering agents in both mass retail and premium cosmetic lines.

The USA shows moderate expansion at 5.7% CAGR, reflecting its mature personal care industry where buffering agents are already widely integrated. Growth here is sustained by rising consumer demand for dermatologist-tested and fragrance-free formulations, with innovation centered on amino acid derivatives and bio-based stabilizers rather than baseline neutralizers.

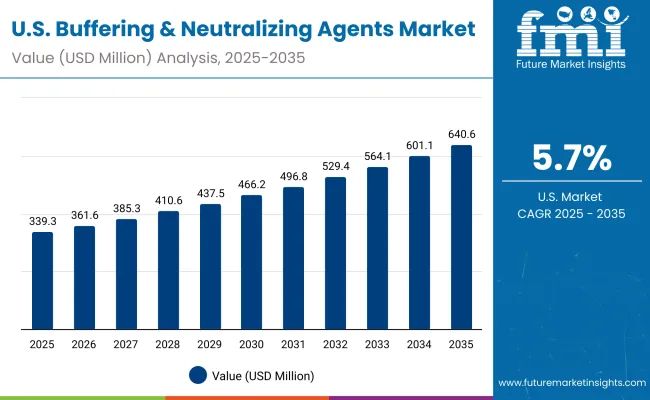

| Year | USA Buffering & Neutralizing Agents Market (USD Million) |

|---|---|

| 2025 | 339.38 |

| 2026 | 361.64 |

| 2027 | 385.36 |

| 2028 | 410.63 |

| 2029 | 437.57 |

| 2030 | 466.27 |

| 2031 | 496.85 |

| 2032 | 529.44 |

| 2033 | 564.17 |

| 2034 | 601.17 |

| 2035 | 640.60 |

The Buffering & Neutralizing Agents Market in the United States is projected to grow at a CAGR of 5.7% from 2025 to 2035, supported by rising demand for dermatologist-tested skincare, pH-stable hair treatments, and clean-label cosmetic formulations. Growth is reinforced by the shift toward fragrance-free and sensitive-skin safe products, which require reliable pH stabilization.

The Buffering & Neutralizing Agents Market in the United Kingdom is expected to grow at a CAGR of 8.9% from 2025 to 2035, supported by expanding demand in personal care, dermocosmetic, and haircare formulations. UK consumers are increasingly shifting toward pH-balanced, dermatologist-approved, and sensitive-skin safe products, boosting adoption of stabilizers and neutralizers across cleansers, toners, and bath care products.

Premium beauty brands are incorporating organic acids, amino acid derivatives, and clean-label buffering systems to comply with stringent EU and UK cosmetic regulations. Growth is further supported by sustainability initiatives, private-label expansion in retail, and innovation partnerships with R&D institutions.

India is witnessing rapid growth in the Buffering & Neutralizing Agents Market, which is forecast to expand at a CAGR of 15.4% through 2035. This momentum is driven by the booming personal care and cosmetics industry, rising disposable incomes, and growing urban demand for affordable yet effective skincare and haircare solutions.

Tier-2 and tier-3 cities are emerging as strong demand hubs, where MSMEs and local brands are actively adopting buffering agents to create cost-effective, stable, and pH-balanced products. Increasing awareness of dermocosmetic formulations, natural claims, and clean-label standards is further fueling adoption.

The Buffering & Neutralizing Agents Market in China is expected to grow at a CAGR of 13.7%, the highest among leading economies. This growth is fueled by the country’s rapidly expanding cosmetics and personal care industry, coupled with strong consumer demand for premium skincare and haircare products.

International and domestic brands are actively formulating with organic acids, amino acid derivatives, and blended buffering systems to stabilize high-performance formulations. China’s regulatory framework supporting clean-label, vegan, and COSMOS-compliant products is accelerating adoption, while consumers’ increasing awareness of pH balance in daily routines is driving widespread market expansion.

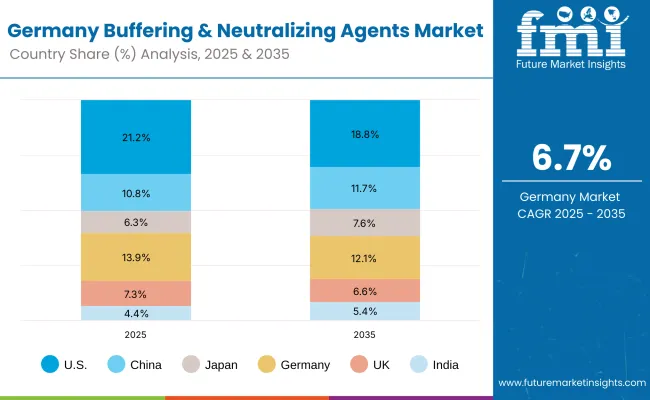

| Country | 2025 Share (%) |

|---|---|

| USA | 21.2% |

| China | 10.8% |

| Japan | 6.3% |

| Germany | 13.9% |

| UK | 7.3% |

| India | 4.4% |

| Country | 2035 Share (%) |

|---|---|

| USA | 18.8% |

| China | 11.7% |

| Japan | 7.6% |

| Germany | 12.1% |

| UK | 6.6% |

| India | 5.4% |

The Buffering & Neutralizing Agents Market in Germany is projected to grow at a CAGR of 6.7%, supported by the country’s advanced cosmetic manufacturing sector and stringent EU regulatory environment. German personal care brands prioritize formulation stability, product safety, and compliance with clean-label and sustainability requirements, creating strong demand for buffering systems.

The shift toward vegan, organic-certified, and dermatologist-tested formulations has increased reliance on organic acids, amino acid derivatives, and multifunctional stabilizers. Furthermore, Germany’s position as a hub for premium skincare and haircare exports enhances the role of buffering agents in ensuring consistent quality and long shelf-life.

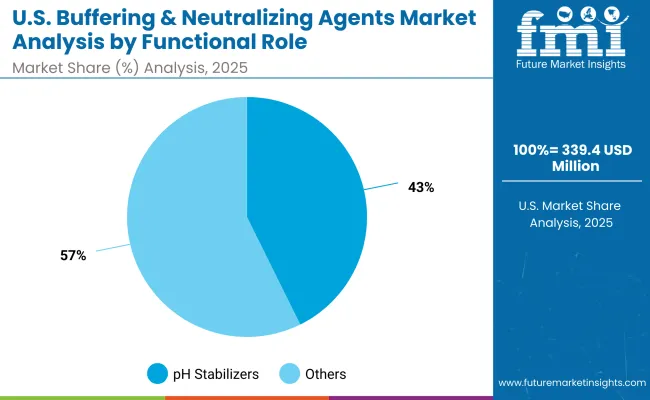

| USA By Functional Role | Value Share % 2025 |

|---|---|

| pH stabilizers | 42.7% |

| Others | 57.3% |

The Buffering & Neutralizing Agents Market in the United States is projected at USD 339.4 million in 2025, expanding at a CAGR of 5.7% through 2035. Growth is primarily driven by strong consumer demand for dermatologist-tested skincare, pH-stable hair treatments, and bath care products. The USA market reflects a higher preference for fragrance-free, sensitive-skin safe, and clean-label claims, where buffering agents play a critical role in maintaining product safety and stability.

While pH stabilizers lead with a 42.7% share in 2025, the market is witnessing a gradual rise in amino acid derivatives and organic acid-based systems, particularly in premium and dermocosmetic segments. Innovation is reinforced by FDA-regulated safety frameworks and the push toward vegan, organic-certified formulations in both mass and premium beauty categories.

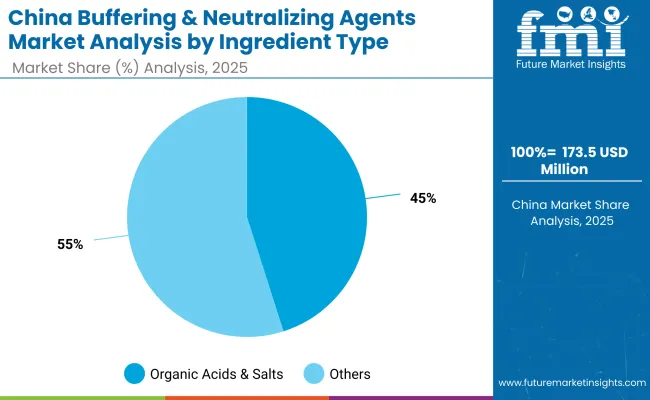

| China By Ingredient Type | Value Share % 2025 |

|---|---|

| Organic acids & salts | 45.1% |

| Others | 54.9% |

The Buffering & Neutralizing Agents Market in China is valued at USD 173.5 million in 2025, with organic acids & salts leading at 45.1%, followed by other ingredient types at 54.9%. The dominance of organic acids and salts reflects their suitability for premium skincare, color cosmetics, and bath care formulations, where consumer preference is shifting toward clean-label and naturally positioned products.

Their compatibility with dermocosmetic actives, multifunctional claims, and COSMOS-certified formulations makes them highly attractive to both international and domestic cosmetic brands.

This advantage positions organic acids & salts as an essential input for China’s growing premium and sensitive-skin skincare segment, which demands strict pH stability and minimal irritation risk. Amino acid derivatives are also emerging as high-potential alternatives, offering multifunctional benefits like moisturization and skin-soothing properties.

As Chinese consumers continue prioritizing safety, natural ingredients, and product transparency, the opportunity for bio-based buffering systems will expand significantly, supported by regulatory alignment with clean beauty standards.

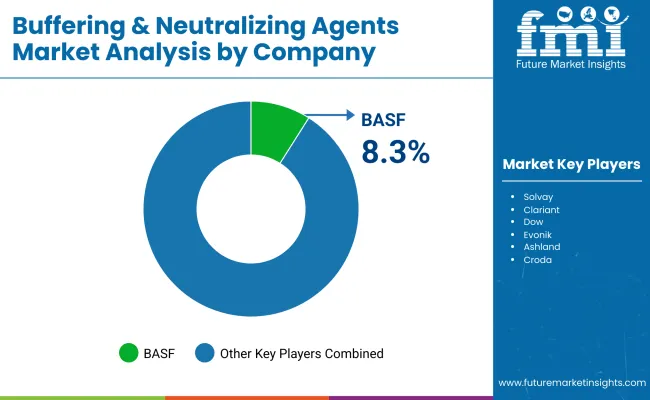

| Company | Global Value Share 2025 |

|---|---|

| BASF | 8.3% |

| Others | 91.7% |

The Buffering & Neutralizing Agents Market is moderately fragmented, with multinational chemical companies, specialty ingredient suppliers, and distribution-focused firms competing across diverse cosmetic and personal care applications.

Global leaders such as BASF, Solvay, Clariant, Dow, and Evonik dominate the market through integrated production capabilities, strong R&D pipelines, and partnerships with global personal care brands. Their strategies emphasize portfolio diversification into organic acids, amino acid derivatives, and multifunctional stabilizers, aligned with clean-label and dermocosmetic trends.

Mid-sized players including Ashland, Croda, and Lubrizol focus on innovation-driven formulations, leveraging expertise in specialty ingredients and bio-based derivatives. These companies are strengthening their positions by offering tailored buffering systems for sensitive-skin products, premium haircare, and multifunctional bath products.

Distribution and service-oriented providers such as DSM-Firmenich and Brenntag play a key role in expanding accessibility, especially in emerging Asia-Pacific markets. Their strength lies in global supply networks, technical support, and regional customization, helping smaller and local brands formulate compliant and stable products.

Competitive differentiation is increasingly shifting away from commodity neutralizers toward specialized, multifunctional, and certified ingredients that deliver pH stability while supporting claims such as vegan, organic, fragrance-free, and dermatologist-tested.

Key Developments in Buffering & Neutralizing Agents Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,602.1 Million |

| Functional Role | pH stabilizers, Acid neutralizers, Alkalinity regulators |

| Ingredient Type | Organic acids & salts, Inorganic bases, Amino acid derivatives |

| Delivery System | Free form, Blended solutions, Powder concentrate |

| Physical Form | Solution/concentrate, Powder, Granules |

| Application | Skin cleansers & toners, Hair treatments, Color cosmetics, Bath products |

| End Use | Personal care manufacturing, Haircare products, Dermocosmetic formulations |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Solvay, Clariant , Dow, Evonik , Ashland, Croda , Lubrizol, DSM- Firmenich , Brenntag |

| Additional Attributes | Dollar sales led by pH stabilizers and organic acids & salts, with strong adoption in dermocosmetics , premium skincare, and haircare. Growth is driven by clean-label and bio-based demand, particularly amino acid derivatives, and reinforced by free form delivery systems. Asia-Pacific’s clean beauty momentum and Europe’s strict regulations shape regional trends, while innovations in encapsulation and upcycled sourcing highlight the link between sustainability and performance. |

The global Buffering & Neutralizing Agents Market is estimated to be valued at USD 1,602.1 million in 2025.

The market size for the Buffering & Neutralizing Agents Market is projected to reach USD 3,402.1 million by 2035.

The Buffering & Neutralizing Agents Market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in the Buffering & Neutralizing Agents Market are pH stabilizers, acid neutralizers, and alkalinity regulators.

In terms of functional role, the pH stabilizers segment is expected to command a 46.1% share of the Buffering & Neutralizing Agents Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

R & D Cloud Collaboration Market Size and Share Forecast Outlook 2025 to 2035

US & Canada Sports & Athletic Insoles Market Trends - Growth & Forecast 2024 to 2034

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

ADC & DAC In Quantum Computing Market Size and Share Forecast Outlook 2025 to 2035

LTE & 5G for Critical Communications Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Electrification Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Carbon Capture and Storage Market Size and Share Forecast Outlook 2025 to 2035

Cap and Closure Market Trends - Growth & Demand 2025-2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Data Management Software Market Size and Share Forecast Outlook 2025 to 2035

Oil & Gas Analytics Market Growth – Trends & Forecast 2025 to 2035

USA & Canada Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

The USA & Canada OTC Pet Nutritional Supplements Market Analysis by Growth, Trends and Forecast from 2025 to 2035

USA & Canada Cat Litter Market Growth, Demand, and Forecast 2025 to 2035

Oil & Gas Terminal Automation Market Growth – Trends & Forecast 2025-2035

USA & Canada Portable Air Conditioner Market Growth – Trends & Forecast 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA