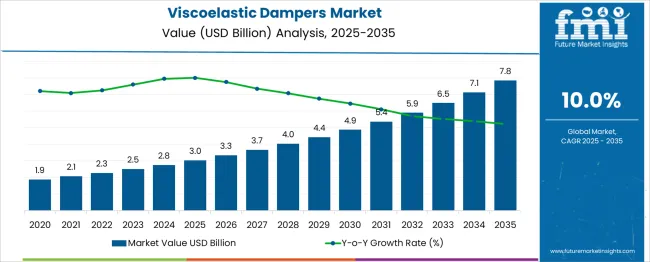

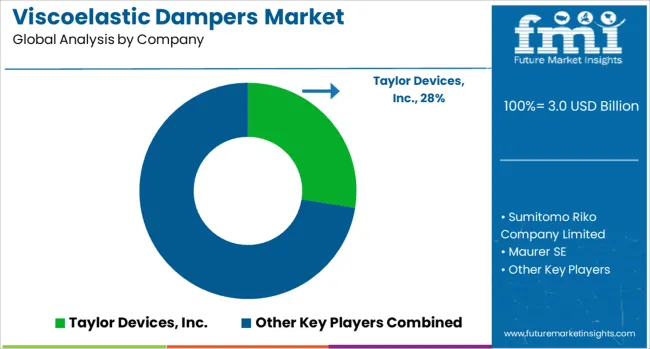

The Viscoelastic Dampers Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 7.8 billion by 2035, registering a compound annual growth rate (CAGR) of 10.0% over the forecast period.

| Metric | Value |

|---|---|

| Viscoelastic Dampers Market Estimated Value in (2025 E) | USD 3.0 billion |

| Viscoelastic Dampers Market Forecast Value in (2035 F) | USD 7.8 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

Enhanced safety regulations and the push for resilient infrastructure have prompted the adoption of advanced damping technologies. Polymer-based viscoelastic dampers are increasingly preferred for their ability to absorb energy and reduce structural vibrations in buildings and bridges.

Growing investments in urban development and infrastructure modernization have expanded applications, especially in earthquake-prone regions. Technological improvements in polymer materials have improved damper performance, durability, and ease of installation.

As infrastructure projects continue to evolve with a focus on longevity and occupant comfort, the market outlook remains positive. Segment growth is anticipated to be driven by polymer-based dampers, applications in building and construction, and use by the construction and infrastructure industry.

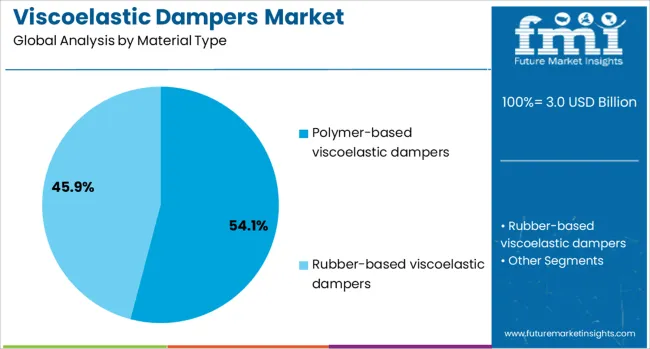

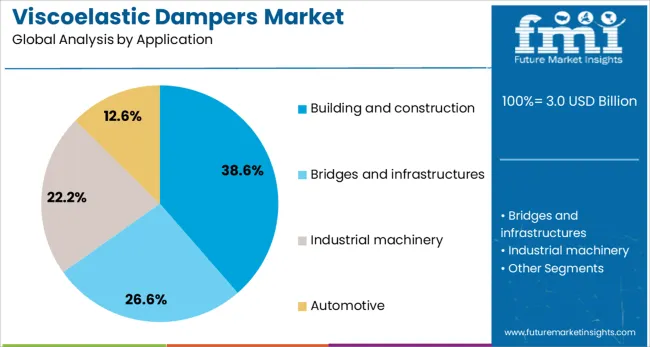

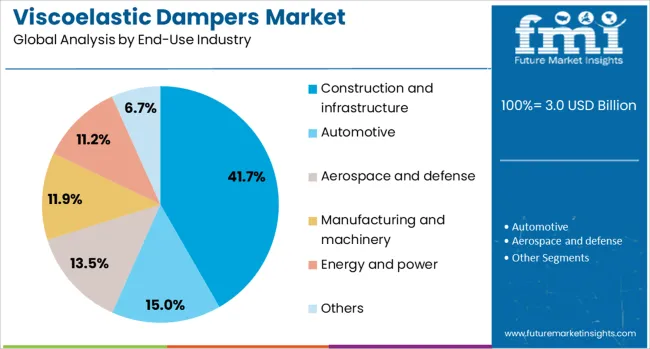

The viscoelastic dampers market is segmented by material type, application, and end-use industry and geographic regions. By material type of the viscoelastic dampers market is divided into Polymer-based viscoelastic dampers and Rubber-based viscoelastic dampers. In terms of application of the viscoelastic dampers market is classified into Building and construction, Bridges and infrastructures, Industrial machinery, Automotive, and Others. Based on end-use industry of the viscoelastic dampers market is segmented into Construction and infrastructure, Automotive, Aerospace and defense, Manufacturing and machinery, Energy and power, and Others. Regionally, the viscoelastic dampers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polymer-based viscoelastic dampers segment is projected to hold 54.1% of the market revenue in 2025, reflecting its leading position in material types. Growth has been fueled by the polymers’ superior energy dissipation characteristics and flexibility under dynamic loads. These dampers provide efficient vibration control while maintaining structural integrity, making them suitable for a range of building applications.

The ease of customization and compatibility with various structural designs has enhanced their adoption. Environmental resistance and long service life further contribute to preference for polymer-based dampers.

As infrastructure demands continue to require effective vibration mitigation solutions, this segment is expected to maintain its dominance.

The building and construction segment is expected to account for 38.6% of the market revenue in 2025, securing its place as the primary application area. This growth is linked to the need for vibration control in high-rise buildings, commercial complexes, and residential projects. Structural engineers and architects have increasingly specified viscoelastic dampers to enhance building safety against wind loads and seismic activities.

Regulations mandating vibration control measures have also supported wider adoption. The segment benefits from ongoing urbanization and infrastructure expansion, with an emphasis on sustainable and resilient construction practices.

As buildings become more complex and taller, the application of viscoelastic dampers is projected to increase.

The construction and infrastructure industry segment is projected to contribute 41.7% of the market revenue in 2025, reflecting its leading role as an end user. Demand has been driven by extensive infrastructure projects including bridges, tunnels, and public facilities that require vibration mitigation for structural safety and longevity.

Investments in upgrading existing infrastructure and developing new projects have supported the adoption of viscoelastic dampers. The industry’s focus on durability, safety compliance, and occupant comfort continues to drive demand for advanced damping technologies.

With increasing government spending on infrastructure worldwide, this segment is expected to sustain its market leadership.

Viscoelastic dampers are gaining traction for enhancing structural safety in seismic and non-seismic applications, driven by regulatory compliance and demand for vibration control. Their expanded use across infrastructure, power, and industrial sectors highlights versatility and long-term reliability.

The adoption of viscoelastic dampers has been driven by increasing emphasis on structural safety during seismic events. Their role in dissipating vibration energy and reducing building sway under dynamic loads has gained prominence across commercial complexes, high-rise buildings, and bridges. Government codes promoting earthquake-resistant construction have reinforced the integration of these dampers into new projects. Market participants have been observed prioritizing tailored solutions for retrofitting older structures. Construction firms prefer viscoelastic dampers for long-term reliability and minimal maintenance requirements compared to conventional damping systems. The combination of performance efficiency and regulatory compliance has positioned these dampers as a preferred choice for urban and industrial applications seeking improved vibration mitigation solutions.

The usage of viscoelastic dampers is not confined to earthquake-prone regions, as adoption is rising across sectors that require vibration control in sensitive environments. Power generation facilities, manufacturing units, and transportation infrastructure have increasingly incorporated these systems to safeguard operational integrity. Advanced material formulations have enhanced temperature resistance and load-bearing capabilities, enabling their use in extreme climatic conditions. Suppliers are developing modular configurations that reduce installation time, addressing contractor concerns regarding cost and complexity. Industry experts view this trend as a response to growing awareness of operational safety and structural longevity. These factors indicate that viscoelastic dampers are evolving from niche seismic components into versatile solutions addressing a broad range of engineering challenges.

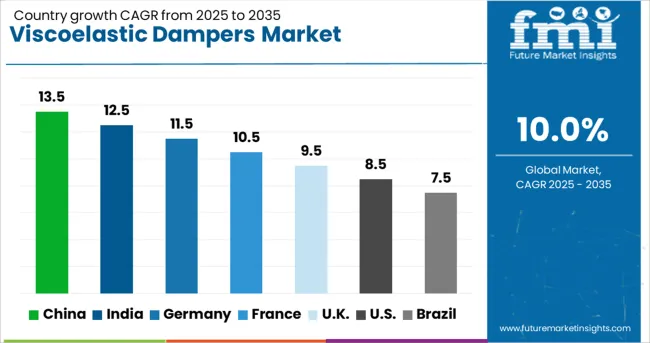

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

The viscoelastic dampers market, projected to grow at a global CAGR of 10.0% from 2025 to 2035, is demonstrating significant growth variations across major economies. China is leading with a 13.5% CAGR, driven by extensive infrastructure development and stringent building safety regulations. India follows with a 12.5% CAGR, supported by rising investments in earthquake-resistant construction and retrofitting initiatives across high-density cities. Germany is reporting an 11.5% CAGR, reflecting a strong focus on advanced structural solutions for both commercial and industrial applications. The United Kingdom is experiencing a 9.5% CAGR, primarily influenced by modernization projects and demand for vibration control in transport infrastructure. The United States is showing an 8.5% CAGR, where growth is being supported by retrofitting programs and adoption in energy and manufacturing facilities. High-growth momentum is being observed in Asia, while OECD nations maintain steady performance through regulatory compliance and technological adoption. The analysis includes over 40 countries, with the top five presented as a reference.

The CAGR in the United Kingdom moved from about 7.4% during 2020–2024 to 9.5% for 2025-2035, indicating stronger momentum compared to the previous phase. This acceleration is linked to increased retrofitting of aging structures, greater compliance with Eurocode standards, and demand from transport infrastructure upgrades. Government-backed programs for seismic resilience in critical facilities like hospitals and rail systems have significantly boosted adoption. Rising awareness among contractors regarding the lifecycle benefits of viscoelastic dampers over conventional devices also played a vital role. Additionally, energy sector facilities started adopting these dampers to ensure vibration safety for turbines and pipelines, which expanded the market footprint beyond residential and commercial spaces.

The CAGR in China increased from nearly 10.2% in 2020-2024 to 13.5% between 2025 and 2035, driven by the aggressive implementation of seismic safety regulations across urban clusters and industrial corridors. Expanding metro and high-speed rail projects demanded vibration control components for tunnel and elevated track structures, creating a strong pipeline for dampers. The domestic construction sector, influenced by frequent seismic activity in western provinces, began to adopt advanced damping technologies at scale. Policy reforms linked to smart city frameworks prioritized building codes mandating dampers for high-rise construction. This adoption extended beyond new builds to cover retrofitting in Tier 2 and Tier 3 cities.

The viscoelastic dampers market in India is projected to grow at a CAGR of 12.5% through 2035, supported by strong demand from seismic-prone zones and retrofitting initiatives for government buildings. Public infrastructure investments under highway, metro, and smart transit corridors introduced guidelines encouraging advanced vibration mitigation solutions. Construction firms integrated dampers in premium residential complexes as urban high-rise projects multiplied. Industry professionals have highlighted India's shift toward localized manufacturing, which has reduced dependency on imports and improved cost competitiveness. These developments created favorable conditions for long-term adoption of viscoelastic dampers across infrastructure, industrial plants, and energy facilities.

Germany is forecast to grow at an 11.5% CAGR, propelled by advanced engineering standards in industrial facilities, high-speed rail systems, and smart commercial structures. Adoption of viscoelastic dampers is increasing in logistics hubs and energy plants, where precision and safety are critical. Compliance with Eurocode regulations ensures integration of damping systems into design frameworks for earthquake resilience and vibration mitigation. German manufacturers lead in developing high-performance dampers compatible with modular construction and prefabricated components. Strong emphasis on research-driven innovation supports advanced viscoelastic compounds offering enhanced fatigue resistance, crucial for large-scale bridges and transportation infrastructure.

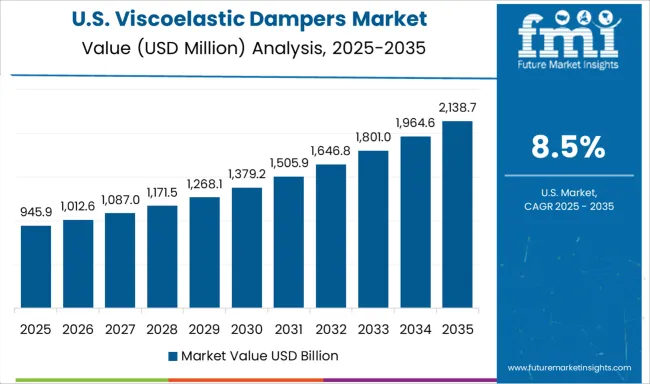

The United States is expected to grow at an 8.5% CAGR, with adoption driven by retrofitting programs in seismic zones and modernization of industrial facilities. Infrastructure upgrades under federal stimulus plans stimulate demand for damping systems in bridges, energy plants, and manufacturing hubs. Advanced viscoelastic dampers are gaining traction in high-value sectors, including aerospace facilities and data centers, where vibration control is critical. OEMs focus on developing dampers with integrated health monitoring systems, enabling predictive maintenance. The presence of stringent building codes across states ensures consistent demand from large contractors and EPC firms engaged in commercial and transport infrastructure projects.

In the viscoelastic dampers market, leading manufacturers are prioritizing high-performance vibration control systems tailored for seismic safety and industrial stability. Taylor Devices, Inc. is advancing damper designs integrated with structural engineering solutions for bridges and high-rise projects, while Sumitomo Riko Company Limited focuses on polymer-based damping materials optimized for thermal durability and long-term energy dissipation. Maurer SE has positioned itself as a specialist in bridge and transport infrastructure dampers, developing modular products to support retrofitting needs. FIP Industriale and Freyssinet are expanding adoption across critical infrastructure by offering customizable viscoelastic systems for tunnels, metro stations, and industrial complexes. Kawakin Holdings Group emphasizes precision-engineered dampers for seismic zones, incorporating advanced elastomeric compounds for maximum vibration control. Trelleborg AB is leveraging its expertise in engineered polymers to create dampers suitable for offshore energy installations and heavy-load structures, ensuring resilience against operational stresses.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 Billion |

| Material Type | Polymer-based viscoelastic dampers and Rubber-based viscoelastic dampers |

| Application | Building and construction, Bridges and infrastructures, Industrial machinery, Automotive, and Others |

| End-Use Industry | Construction and infrastructure, Automotive, Aerospace and defense, Manufacturing and machinery, Energy and power, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Taylor Devices, Inc., Sumitomo Riko Company Limited, Maurer SE, FIP Industriale, Freyssinet, Kawakin Holdings Group, and Trelleborg AB |

| Additional Attributes | Dollar sales, share, regional demand distribution, competitive positioning, pricing benchmarks, adoption trends in retrofitting vs. new builds, material innovations, regulatory impacts, and growth opportunities in energy, transportation, and infrastructure projects. |

The global viscoelastic dampers market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the viscoelastic dampers market is projected to reach USD 7.8 billion by 2035.

The viscoelastic dampers market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in viscoelastic dampers market are polymer-based viscoelastic dampers and rubber-based viscoelastic dampers.

In terms of application, building and construction segment to command 38.6% share in the viscoelastic dampers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Door Dampers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA