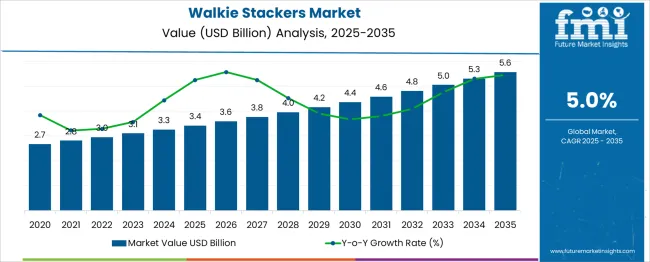

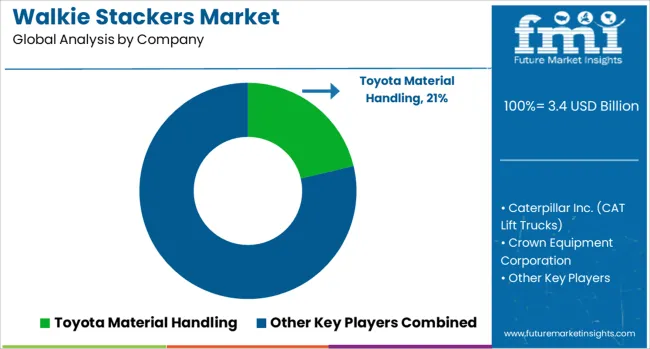

The Walkie Stackers Market is estimated to be valued at USD 3.4 billion in 2025 and is projected to reach USD 5.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Walkie Stackers Market Estimated Value in (2025 E) | USD 3.4 billion |

| Walkie Stackers Market Forecast Value in (2035 F) | USD 5.6 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The walkie stackers market is experiencing steady growth due to increasing automation and material handling demands across warehouses and manufacturing facilities. Industry trends show a preference for equipment that enhances operational efficiency and safety in confined spaces.

The rise in e-commerce and retail distribution centers has driven the need for compact yet capable stackers suitable for narrow aisles. Technological improvements have led to the development of electric-powered walkie stackers that offer quieter operation and lower emissions compared to traditional fuel-powered models.

Additionally, businesses are focusing on cost-effective solutions that reduce labor intensity while maintaining high load handling capabilities. The market outlook remains favorable as modernization of supply chains and adoption of eco-friendly equipment continue. Growth is expected to be led by the walkie reach stacker product, medium-duty load capacity, and electric power sources favored for their efficiency and environmental benefits.

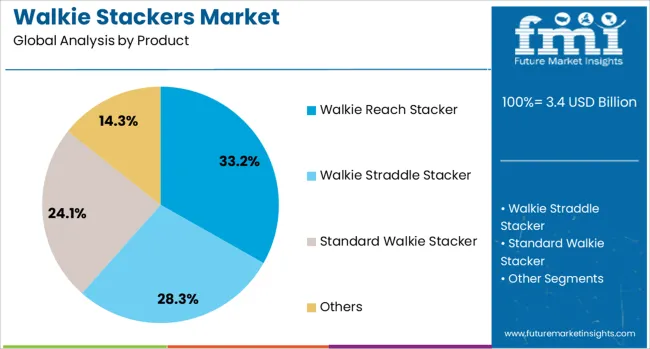

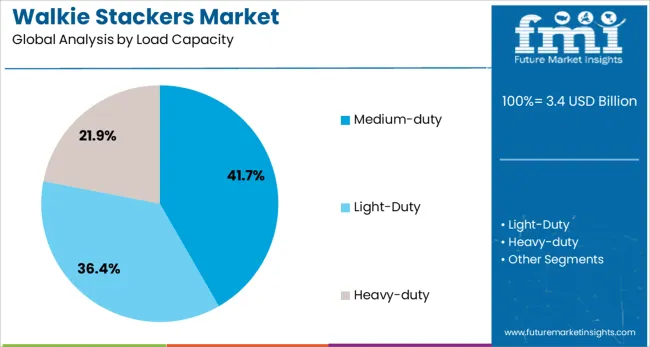

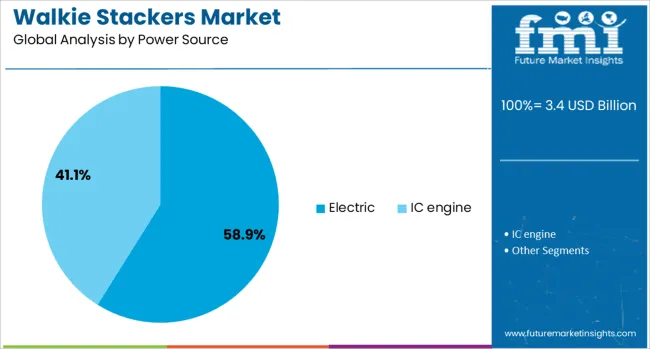

The walkie stackers market is segmented by product, load capacity, power source, and end users and geographic regions. The walkie stackers market is divided into Walkie Reach Stacker, Walkie Straddle Stacker, Standard Walkie Stacker, and Others. In terms of load capacity, the walkie stackers market is classified into Medium-duty, Light-Duty, and Heavy-duty. Based on the power source, the walkie stackers market is segmented into Electric and IC engine. The end users of the walkie stackers market are segmented into Warehouse & logistics, Manufacturing, Construction, Retail, and Others. Regionally, the walkie stackers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The walkie reach stacker segment is expected to hold 33.2% of the market revenue in 2025, making it the leading product type. This segment’s growth has been driven by its ability to combine reach functionality with compact design, making it ideal for warehouses with narrow aisles.

Operators have favored walkie reach stackers for their versatility in stacking and retrieving loads at various heights. The segment benefits from innovations improving maneuverability and operator comfort, leading to increased productivity.

As warehouses continue to optimize space and workflow, walkie reach stackers are expected to remain a popular choice.

The medium-duty load capacity segment is projected to account for 41.7% of market revenue in 2025, establishing itself as the most utilized capacity range. This capacity offers a balance between strength and maneuverability, suiting a wide variety of warehouse and industrial applications.

Medium-duty stackers handle moderate weights efficiently while enabling operators to work safely within confined environments. Demand for medium-duty equipment has been boosted by the need to manage diverse inventory sizes without excessive power requirements.

As businesses seek adaptable solutions for varied operational demands, this segment is expected to sustain its leading position.

The electric power source segment is projected to represent 58.9% of the walkie stackers market revenue in 2025, maintaining its dominance. Growth in this segment has been propelled by increasing awareness of environmental regulations and the operational advantages of electric stackers.

Electric walkie stackers offer quieter operation, zero emissions, and lower maintenance costs compared to fuel-powered alternatives. Warehouses and distribution centers are increasingly adopting electric equipment to comply with sustainability goals and improve indoor air quality.

Advances in battery technology have enhanced run times and charging efficiency, further encouraging market adoption. As companies continue to prioritize green logistics and energy-efficient operations, electric walkie stackers are expected to retain their market leadership.

Walkie stackers are increasingly adopted in warehousing, retail, and production settings due to ergonomic design and compact footprint. In 2024, global unit shipments rose about 12 %, notably in Asia‑Pacific and North America. Preference is shifting toward electric stackers with lithium‑ion batteries, now accounting for 33 % of new orders. Key use cases include narrow aisle rack operations, order-picking zones, and mezzanine support. OEMs now partner with distribution centers to bundle stackers with predictive maintenance services and integrated onboard diagnostics, reducing equipment downtime. Enhanced lift controls and operator-friendly interfaces improve usability and worker safety in busy logistics environments.

Companies are moving toward electric walkie stackers to lower manual strain and improve throughput. Lithium‑ion models cut battery changeovers by 40 % and reduce energy costs by 18 % compared to lead-acid units. Operators report up to 14 % faster cycle times thanks to smooth acceleration and precision lift control. Integrated displays now provide lift height feedback, battery state-of-charge, and fault alerts in real time. Safety features like speed-limiting in corners and automatic braking in lift zones are present in 52 % of new models. OEMs offer ergonomic handle designs to reduce wrist fatigue and optional stability sensors that prevent rolling on uneven floors. These enhancements support adoption in high-density fulfilment and retail replenishment workflows.

Despite efficiency gains, adoption is slowed by high upfront cost, support complexities, and infrastructure needs. Walkie stackers with lithium batteries cost 15-20 % more than conventional models, increasing purchase cycles for smaller operators. Lack of standardized battery charging and docking units lengthens deployment by 2-3 days during handover. In markets without lithium service networks, battery replacements can take up to 10 weeks. Users report 9 % higher incidents of lift motor control faults in retrofit units lacking OEM calibration. Training on new control interfaces takes on average 2.5 days, reducing productivity during handoff. Costly diagnostic tools and infrequent local dealership support in secondary regions contribute to downtime up to 11 % longer in month one.

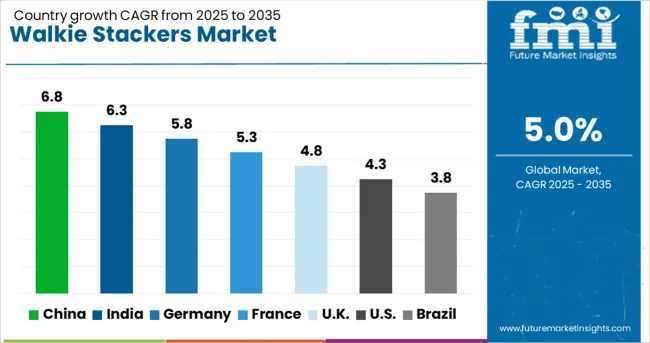

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

Global walkie stackers market demand is expected to grow at a 5% CAGR from 2025 to 2035. Among the profiled countries, Germany leads with 5.8%, translating to a +16% premium over the global average, supported by its warehouse automation upgrades and electric equipment adoption. France shows 5.3% (+6%) amid modest fleet replacement cycles. The United Kingdom aligns slightly below the global rate at 4.8% (–4%) as industrial expansion remains mixed. United States follows with 4.3% (–14%) where smaller warehouse operations continue using legacy lift systems. Brazil records 3.8%, marking a –24% difference, constrained by capital expenditure cycles and slower industrial expansion. Growth spread reflects equipment electrification trends, e-commerce logistics needs, and warehouse automation strategies across regions. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

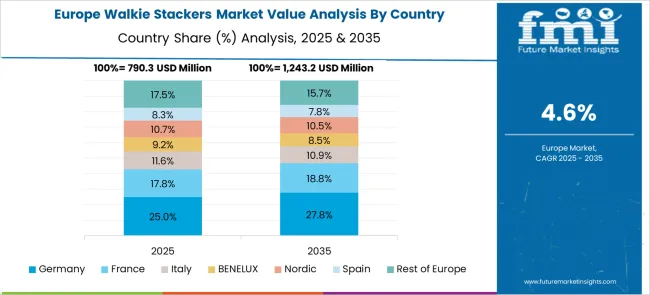

Germany's walkie stacker market is projected to grow at 5.8% CAGR. Food logistics, auto-parts distribution, and pharmaceutical storage are driving demand for AC-powered stackers with regenerative braking and variable-speed control. Facilities in Bavaria and North Rhine-Westphalia are prioritizing narrow-aisle stackers for efficient mid-rise racking. Three-shift fulfillment centers are adopting models with battery-swapping capabilities to reduce downtime. Manufacturers are targeting quieter gear assemblies and redundant braking systems for multi-pallet workflows in high-frequency operations.

France is expected to grow at 5.3% CAGR through 2035. Demand is centered in logistics corridors such as Île-de-France, Auvergne-Rhône-Alpes, and Hauts-de-France. Warehouses are selecting lithium-ion walkie stackers for charging efficiency and stable thermal performance. Dual-motor traction units with programmable lift functions are gaining adoption in retail and textile distribution hubs. Custom fork widths are being added for facilities managing mixed-load pallets and varying platform dimensions.

The UK market is forecast to grow at 4.8% CAGR. West Midlands and Greater London are leading demand where semi-automated walkie stackers are integrated into hybrid fleets. Short-mast electric stackers are favored for mezzanine zones in multi-level warehouse layouts. Models with adjustable tillers and onboard diagnostics are being procured for ergonomic customization. Medium-scale fulfillment centers are using walkie stackers for case picking and shelf restocking in compact vertical environments.

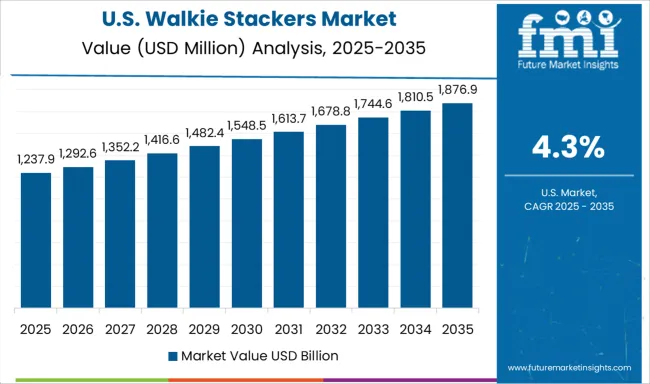

The United States is expected to grow at 4.3% CAGR. Facilities in Texas, Illinois, and Georgia are transitioning to stackers equipped with brushless DC motors and regenerative braking to minimize maintenance. E-commerce centers are sourcing maneuverable stackers with lift capacities under 2 tons. Cold-chain warehouses are specifying stainless steel stackers with enclosed electronics and insulated wiring to withstand frost-prone zones. Applications include multi-load pallet staging and stock movement in temperature-sensitive environments.

Brazil's walkie stacker market is forecast at 3.8% CAGR. In São Paulo and Porto Alegre, older internal combustion lift trucks are being replaced with compact electric walkie stackers. Budget-driven operators are selecting fixed-mast designs with analog lift controls and minimal onboard electronics. Agro-distribution and beverage logistics hubs are using these units for one to two shifts per day. Local assemblers are scaling production of simplified models without digital telemetry to match entry-level procurement criteria.

The walkie stackers market is characterized by strong competition among global material handling leaders, with Toyota Material Handling holding a dominant market share through its reliable electric models and ergonomic designs. Major players like Crown Equipment Corporation, Hyster-Yale Group, and Jungheinrich AG compete with advanced AC drive systems, lithium-ion battery options, and integrated warehouse connectivity solutions. Emerging competitors such as Doosan Industrial Vehicle and SANY Group are gaining market traction with cost-effective, high-capacity alternatives.

Market growth is primarily driven by rapid e-commerce warehouse expansion and the industry-wide transition toward electric-powered equipment for indoor operations. Manufacturers are focusing on enhanced operator comfort features, smart fleet management through IoT-enabled tracking, and sustainable power solutions using fast-charging lithium-ion technology. The sector is seeing increased demand for space-saving narrow-aisle models and versatile hybrid walkie/rider configurations to maximize efficiency in modern distribution centers, while the shift from gas to electric power continues to accelerate due to environmental regulations and energy efficiency requirements.

In March 2024, Jungheinrich launches the lithium-ion walkie stacker EJC 1i series. At LogiMAT 2024 in Stuttgart, Jungheinrich introduced the EJC 1i series of pedestrian stackers powered by 100% lithium-ion batteries. These trucks deliver faster lift/lower speeds, significantly improved residual load capacity (up to +250 kg), and a compact design tailored for SMEs and tight storage spaces.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.4 Billion |

| Product | Walkie Reach Stacker, Walkie Straddle Stacker, Standard Walkie Stacker, and Others |

| Load Capacity | Medium-duty, Light-Duty, and Heavy-duty |

| Power Source | Electric and IC engine |

| End Users | Warehouse & logistics, Manufacturing, Construction, Retail, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Toyota Material Handling, Caterpillar Inc. (CAT Lift Trucks), Crown Equipment Corporation, Doosan Industrial Vehicle America Corp., Hyster-Yale Group, Inc., Jungheinrich AG, Linde Material Handling, MITSUBISHI LOGISNEXT CO.,LTD., Nissan Forklift Corporation, and SANY Group |

| Additional Attributes | Dollar sales by lift height and end-use facility type, growing demand in warehouse automation and last-mile fulfillment hubs, stable usage in retail backrooms and light manufacturing units, advancements in lithium-ion batteries and ergonomic tiller heads improve maneuverability and operational uptime |

The global walkie stackers market is estimated to be valued at USD 3.4 billion in 2025.

The market size for the walkie stackers market is projected to reach USD 5.6 billion by 2035.

The walkie stackers market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in walkie stackers market are walkie reach stacker, _electric, _ic engine, walkie straddle stacker, _electric, _ic engine, standard walkie stacker, _electric, _ic engine, others, _electric and _ic engine.

In terms of load capacity, medium-duty segment to command 41.7% share in the walkie stackers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Walkie Talkie Market Size and Share Forecast Outlook 2025 to 2035

Industrial Stackers Market Forecast and Analysis by Type, End- Use Industry & Region 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA