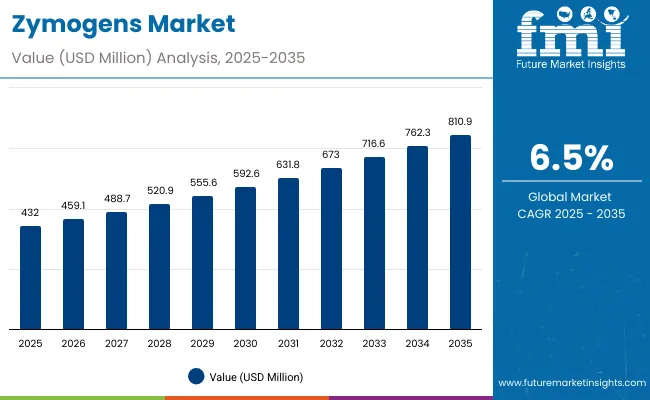

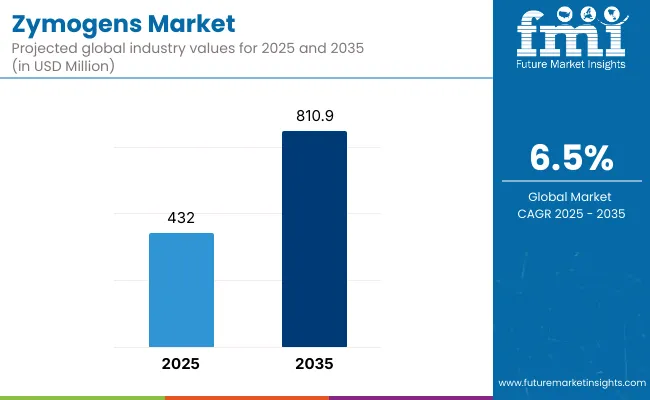

The Zymogens Market is projected to be valued at USD 432.0 million in 2025, rising to USD 810.9 million by 2035. This expansion reflects a USD 378.9 million increase, equivalent to nearly a 1.9X growth in size over the decade. The trajectory represents a compound annual growth rate (CAGR) of 6.5%, indicating steady yet resilient advancement across healthcare, industrial, and research-driven applications.

Zymogens Market Key Takeaways

| Metric | Value |

|---|---|

| Zymogens Estimated Value in (2025E) | USD 432.0 million |

| Zymogens Forecast Value in (2035F) | USD 810.9 million |

| Forecast CAGR (2025 to 2035) | 6.5% |

During the first five-year period from 2025 to 2030, the market is expected to expand from USD 432.0 million to approximately USD 592.6 million, adding USD 160.6 million. This phase accounts for 42% of total decade growth, highlighting early adoption across pharmaceutical and biologics applications. Growing recognition of zymogens’ ability to enhance precision and reduce variability in enzyme activation is anticipated to reinforce their inclusion in biologics pipelines and diagnostic innovations.

In the second half of the forecast period (2030–2035), the market is expected to grow from USD 592.6 million to 810.9 million, contributing USD 218.3 million, equal to 58% of decade expansion. This acceleration will likely be driven by intensified integration in bioprocessing, synthetic biology, and food biotechnology. The convergence of advanced protein engineering, regulatory alignment, and cross-industry collaborations is expected to position zymogens as critical enablers of scalable innovation, thereby ensuring long-term sustainability of market momentum.

From 2020 to 2024, the Zymogens Market expanded from niche enzyme applications into broader integration across pharmaceuticals, diagnostics, and industrial biotechnology. Growth during this period was primarily supported by pharmaceutical adoption, with biologics and diagnostics accounting for nearly half of revenue. Global leaders such as Merck KGaA and Thermo Fisher Scientific reinforced their dominance through biologics-focused enzyme solutions, while Novonesis and Amano Enzyme Inc. expanded industrial and food biotechnology portfolios.

Competitive differentiation relied on enzyme stability, precision in controlled activation, and scalability of recombinant production platforms. Service-led models were limited but gradually emerged in contract research and biotech collaborations. By 2025, demand is projected to reach USD 432.0 million, with the revenue mix shifting toward high-growth applications in research institutions and industrial biotech. Competitive advantage is increasingly being defined not only by enzyme portfolios but also by recombinant innovation, academic-industry partnerships, and region-specific adoption strategies. Emerging players emphasizing customization, molecular engineering, and application-specific zymogen solutions are expected to gain market share, challenging established leaders to innovate beyond traditional enzyme platforms.

Growth in the Zymogens Market is being propelled by the rising adoption of controlled enzyme activation mechanisms across healthcare, biotechnology, and industrial applications. Demand is being reinforced by the increasing reliance on zymogens for precise regulation in biologics manufacturing, where stability and reduced off-target effects are being prioritized. The potential of zymogens to minimize side reactions and enhance therapeutic efficiency is being recognized as a transformative driver for their integration into next-generation drug development.

Pharmaceutical and diagnostics companies are increasingly channeling investments into zymogen-based research, with recombinant and microbial-derived sources being advanced for scalability and cost-effectiveness. Academic institutions and research organizations are contributing to this momentum through deeper exploration of zymogen activation pathways, supporting innovations in both therapeutic and diagnostic use cases. Expansion into industrial biotechnology and food processing is also being facilitated, where controlled enzymatic activity is being leveraged for improved process yields and product consistency.

Future growth is expected to be sustained through advancements in recombinant expression systems, enabling high-purity and tailored zymogen variants for commercial applications. With regulatory frameworks becoming more accommodating to biotechnology innovations, the Zymogens Market is being positioned as a critical enabler of precision-driven enzyme technologies across multiple high-value industries.

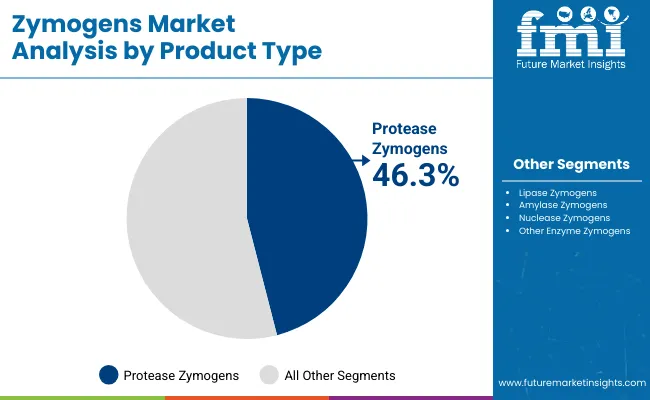

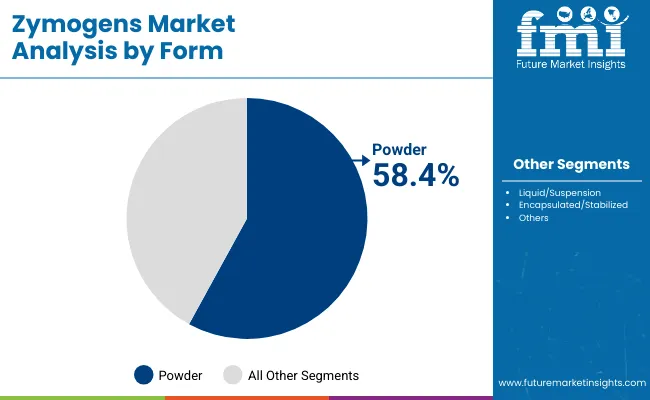

The Zymogens Market is segmented by product type, end-use application, and form, each highlighting unique drivers of adoption and innovation. Product type segmentation encompasses protease, lipase, amylase, nuclease, and other enzyme zymogens, reflecting the diversity of enzymatic functions being integrated across industries. End-use applications span pharmaceuticals & biologics, diagnostics & research, food & beverage processing, industrial biotech, and academic institutions, showcasing the broad reach of zymogen technology. Form segmentation includes powders, liquid/suspension, and encapsulated/stabilized formats, representing the different delivery mechanisms shaping commercial adoption. Each segment reflects distinct growth dynamics influenced by technological innovation, regulatory support, and industry-specific demand patterns. The outlook suggests that traditional strongholds will continue to anchor revenue, while faster-growing niches are expected to create new opportunities for strategic expansion and cross-industry collaborations.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Protease Zymogens | 46.3% |

| Lipase Zymogens | 19.2% |

Protease Zymogens are projected to command the largest share at 46.3% in 2025, maintaining their central role in the market. Their dominance is being reinforced by widespread application in pharmaceuticals, where controlled protease activity underpins drug development and therapeutic stability. Growth is also being supported by industrial processes that rely on protease zymogens for enhanced efficiency in bioprocessing and protein engineering. While this segment leads in scale, higher growth rates are being observed in nuclease and other zymogen classes, indicating a gradual diversification of demand. Continuous innovation in enzyme engineering and recombinant production methods is expected to reinforce the competitive strength of protease zymogens, ensuring their sustained relevance across high-value sectors.

| Form | 2025 Share% |

|---|---|

| Powder (lyophilized, spray-dried) | 58.4% |

| Liquid/Suspension | 26.1% |

| Encapsulated/Stabilized | 15.5% |

Powder formulations are projected to account for 58.4% of the Zymogens Market in 2025, securing their lead due to longer shelf life, higher stability, and easier storage. Their dominance is being reinforced by widespread adoption in pharmaceuticals and industrial biotech, where consistent quality is essential. However, faster growth is being recorded in encapsulated and stabilized formats (9.0% CAGR), reflecting advances in delivery mechanisms tailored to research and therapeutic applications. Liquid suspensions are also gaining ground, offering convenience in laboratory and process-scale environments. The sustained leadership of powders underscores their role as the backbone of current commercialization, while innovation-driven forms are expected to gradually reshape the market landscape through enhanced usability and performance optimization.

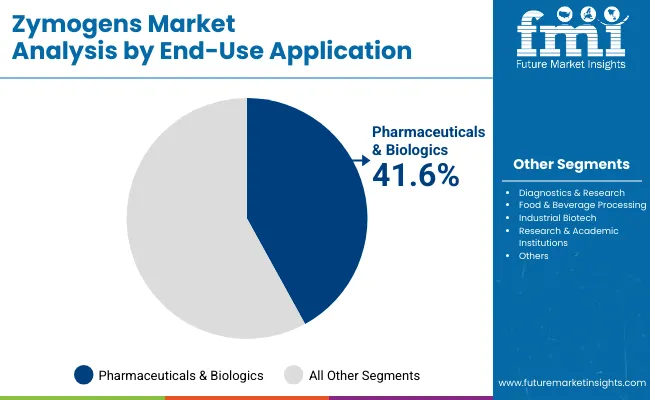

| End-Use Application | 2025 Share% |

|---|---|

| Pharmaceuticals & Biologics | 41.6% |

| Diagnostics & Research | 22.4% |

| Food & Beverage Processing | 14.3% |

Pharmaceuticals & Biologics are projected to lead with a 41.6% share in 2025, reflecting the strategic integration of zymogens into drug pipelines and biologic therapies. Their precision in controlled activation is being leveraged to reduce adverse reactions and improve therapeutic efficacy. Beyond clinical use, demand is being driven by biologics manufacturing, where stability and process consistency are critical. While this segment anchors overall revenue, rapid growth is being seen in research institutions and industrial biotech, signaling expansion into discovery and applied sciences. Over the coming decade, pharmaceuticals are expected to remain the backbone of zymogen adoption, yet cross-sectoral applications will increasingly balance market growth, reinforcing the role of zymogens in shaping both healthcare and industrial innovation.

Although challenges in cost efficiency and scalability persist, the Zymogens Market is being accelerated by rising demand in pharmaceuticals, diagnostics, and industrial biotechnology. Controlled activation properties are being recognized as critical to innovation, enabling precision-driven applications. Parallelly, industry-wide emphasis on novel biotechnologies is being reflected in emerging research pipelines and strategic collaborations, reinforcing long-term growth prospects.

Increasing Role in Biologics and Precision Medicine

Market expansion is being reinforced by the growing adoption of zymogens in biologics and precision medicine. Their controlled activation capacity is being utilized to enhance therapeutic safety, reduce off-target effects, and improve clinical outcomes. As demand for next-generation biologics increases, zymogens are being integrated into advanced pipelines, where scalable recombinant production systems are ensuring commercial viability. Regulatory recognition of their therapeutic value is further solidifying this trajectory, encouraging continued investment.

Advancements in Recombinant Expression and Stabilization

A major trend is being observed in the advancement of recombinant expression systems and stabilization technologies. Recombinant platforms are enabling the production of highly pure, customizable zymogen variants, aligning with pharmaceutical and diagnostic requirements. Simultaneously, innovations in encapsulated and stabilized formats are being prioritized to improve delivery efficiency and shelf life. These advancements are positioning zymogens as adaptable tools across diverse end-use industries, reshaping market competitiveness and long-term adoption pathways.

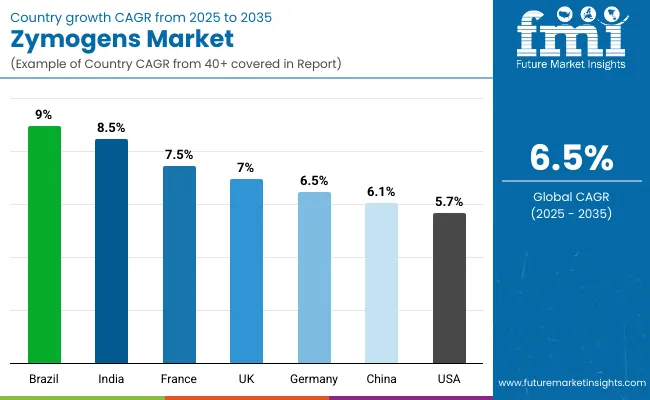

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.1% |

| India | 8.5% |

| Germany | 6.5% |

| France | 7.5% |

| UK | 7.0% |

| USA | 5.7% |

| Brazil | 9.0% |

The global Zymogens Market is being shaped by distinct country-level growth trajectories, reflecting differences in industrial maturity, research capacity, and regulatory alignment. In Asia-Pacific, China is expected to advance at a 6.1% CAGR, supported by large-scale biopharmaceutical production and strong government focus on biotechnology innovation. India is projected to record the fastest regional growth at 8.5% CAGR, as research-driven institutions and contract manufacturing hubs increasingly integrate zymogens into biologics pipelines and diagnostic solutions.

In Europe, Germany is anticipated to expand at 6.5% CAGR, leveraging its established pharmaceutical and industrial biotech sectors. France at 7.5% CAGR and the UK at 7.0% CAGR are being positioned as leading innovation centers, propelled by strong research frameworks and academic-industry collaborations. Regulatory alignment with EU biotechnology standards is expected to further enhance adoption.

In North America, the USA is forecasted to grow at a 5.7% CAGR, reflecting market maturity but also consistent integration of zymogens into drug discovery, diagnostics, and food biotechnology applications. Growth is being driven more by advanced research and high-value biologics development rather than scale-driven production.

Latin America is being led by Brazil at a 9.0% CAGR, signaling rising adoption across food processing and industrial biotech, supported by expanding R&D capabilities and regional manufacturing initiatives.

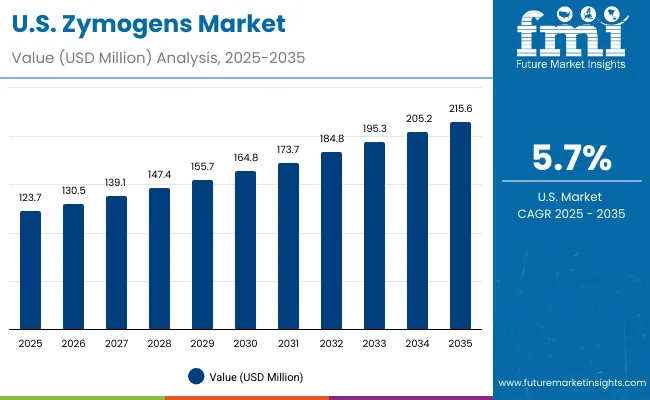

| Year | USA Zymogens Market (USD Million) |

|---|---|

| 2025 | 123.7 |

| 2026 | 130.5 |

| 2027 | 139.1 |

| 2028 | 147.4 |

| 2029 | 155.7 |

| 2030 | 164.8 |

| 2031 | 173.7 |

| 2032 | 184.8 |

| 2033 | 195.3 |

| 2034 | 205.2 |

| 2035 | 215.6 |

The Zymogens Market in the United States is projected to grow from USD 123.7 million in 2025 to USD 215.6 million by 2035, advancing at a CAGR of 5.7%. Growth is being reinforced by continued demand for biologics, diagnostics, and industrial applications, where controlled enzymatic activity is regarded as critical for precision and consistency.

Pharmaceutical adoption is being strengthened through integration into biologic pipelines, while diagnostic laboratories are increasingly employing zymogen-based assays to improve testing accuracy. Food biotechnology and industrial sectors are also expanding their utilization, supported by the efficiency gains offered by zymogen-controlled pathways. The trajectory is expected to be shaped by regulatory harmonization, advancements in recombinant expression, and expanding academic research partnerships.

The Zymogens Market in the United Kingdom is projected to expand at a 7.0% CAGR from 2025 to 2035, supported by a well-established life sciences ecosystem and government-backed biotech initiatives. Growth is being reinforced by the UK’s strong presence in clinical trials and biologics research, where zymogens are being explored to enhance therapeutic precision and reduce variability in drug development. Rising investments through the UK’s Life Sciences Vision strategy are further enabling innovation in enzyme engineering and recombinant production.

In addition, food and beverage innovation is being advanced by zymogen-enabled fermentation technologies, reflecting growing consumer interest in functional nutrition and sustainable protein alternatives. The academic sector is also playing a vital role, with universities and research institutes contributing to early-stage zymogen engineering projects. These dynamics are expected to position the UK as a leading European hub for translational enzyme research, balancing healthcare and industrial adoption.

The Zymogens Market in China is forecasted to grow at a 6.1% CAGR from 2025 to 2035, supported by the country’s expanding biopharmaceutical industry and government-backed biotech initiatives. Large-scale biologics production ecosystems are actively integrating zymogens to enhance stability and process efficiency. Academic institutions are contributing to early-stage innovation, with translational research being prioritized in genomics and molecular biology. Food and beverage sectors are also emerging as growth drivers, reflecting China’s strategic interest in precision fermentation and functional nutrition. Regulatory reforms that streamline approval pathways for biotechnology applications are expected to further reinforce market acceleration.

The Zymogens Market in India is expected to record robust growth at an 8.5% CAGR through 2035, making it one of the fastest-expanding markets globally. Rapid investment in contract research and manufacturing services (CRAMS) is enabling zymogen integration into biologics and biosimilar pipelines. Government initiatives in biotechnology and life sciences are providing strong support, creating fertile ground for academic research and commercial application. Diagnostics laboratories are also expanding adoption, driven by rising healthcare access and a growing focus on precision medicine. In addition, industrial biotech applications, including fermentation and enzyme-controlled processes, are being scaled up to meet export-oriented production demand.

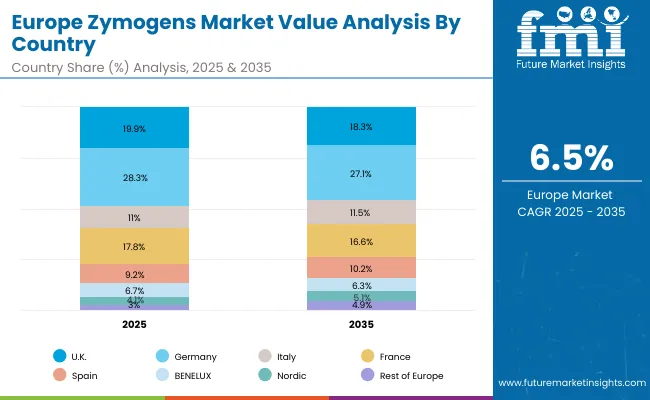

| Country | 2025 |

|---|---|

| UK | 19.9% |

| Germany | 28.3% |

| Italy | 11.0% |

| France | 17.8% |

| Spain | 9.2% |

| BENELUX | 6.7% |

| Nordic | 4.1% |

| Rest of Europe | 3.0% |

| Country | 2035 |

|---|---|

| UK | 18.3% |

| Germany | 27.1% |

| Italy | 11.5% |

| France | 16.6% |

| Spain | 10.2% |

| BENELUX | 6.3% |

| Nordic | 5.1% |

| Rest of Europe | 4.9% |

The Zymogens Market in Germany is projected to expand at a 6.5% CAGR over the forecast period, anchored by its established pharmaceutical, diagnostics, and industrial biotech sectors. German biopharma manufacturers are incorporating zymogens into biologics pipelines, with precision-focused research reinforcing therapeutic innovation. Diagnostics adoption is rising, supported by Europe’s strong emphasis on clinical reliability and regulatory compliance. Industrial biotech utilization is also accelerating, particularly in enzyme-driven fermentation and process optimization. Germany’s role as a research hub is expected to sustain innovation-led growth, with academic and institutional collaborations advancing recombinant and stabilized zymogen formats.

| Product Type | Market Value Share, 2025 |

|---|---|

| Protease Zymogens | 46.3% |

| Lipase Zymogens | 19.2% |

| Amylase Zymogens | 12.7% |

| Nuclease Zymogens | 6.8% |

| Other Enzyme Zymogens | 15.0% |

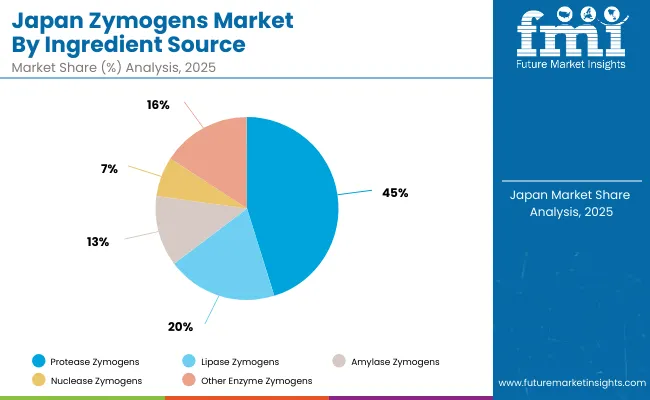

The Zymogens Market in Japan is projected at USD 25.6 million in 2025, with protease zymogens contributing 45.2%, while nuclease zymogens, though smaller in scale, are advancing fastest at a 7.0% CAGR. This dynamic illustrates a dual trajectory anchored by protease-driven applications in pharmaceuticals and biologics, while rapid expansion is being propelled by nucleases in genomics and molecular biology. Rising integration of recombinant expression systems in Japan’s established biotech sector is being reinforced by government funding for precision medicine and regenerative healthcare initiatives.

Beyond healthcare, industrial biotechnology is gradually adopting amylase and lipase zymogens for fermentation and enzyme-controlled processes, strengthening the diversification of use cases. Academic collaborations with global research institutions are further accelerating early-stage development, positioning Japan as a hub for translational science. With precision diagnostics and advanced biologics manufacturing expected to remain national priorities, the outlook suggests that protease dominance will persist, but nucleases and other specialized zymogens will gain rising importance in shaping the country’s innovation-led growth.

| End-Use Application | Market Value Share, 2025 |

|---|---|

| Pharmaceuticals & Biologics | 42.2% |

| Diagnostics & Research | 23.2% |

| Food & Beverage Processing | 14.6% |

| Industrial Biotech | 13.9% |

| Research & Academic Institutions | 6.1% |

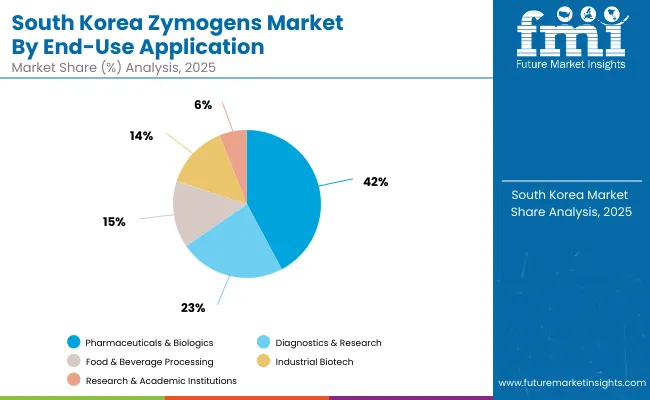

The Zymogens Market in South Korea is projected at USD 13.8 million in 2025, led by pharmaceuticals and biologics with a 42.2% share, supported by the country’s expanding biopharmaceutical ecosystem. Diagnostics and research applications follow closely, with strong government investment in precision medicine and healthcare technology driving adoption. Food and beverage processing represents a significant share, reflecting South Korea’s advanced food technology industry and increasing demand for functional and fermented products.

The fastest growth is being recorded in research and academic institutions (9.4% CAGR) and industrial biotechnology (8.8% CAGR), where early-stage R&D is being reinforced by collaborations with global players. Universities and biotech hubs are accelerating translational studies, focusing on recombinant and stabilized zymogen formats. These initiatives are positioning South Korea as a leading center for next-generation enzyme research in Asia.

With strong policy alignment under national biotech roadmaps and emphasis on digitalized healthcare, zymogens are expected to transition from niche applications into mainstream bioprocessing and diagnostic solutions. This trajectory underscores the dual strength of South Korea—anchoring value through pharmaceuticals while pushing frontier growth in research and industrial applications.

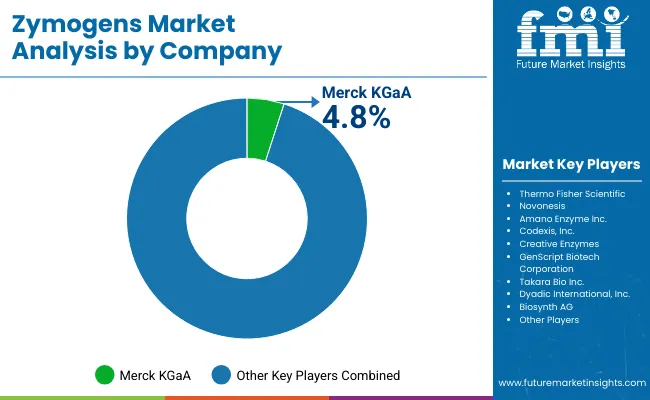

| Company | Global Value Share 2025 |

|---|---|

| Merck KGaA | 4.8% |

| Others | 95.2% |

The Zymogens Market is moderately fragmented, with global leaders, mid-sized innovators, and specialized biotechnology firms competing across healthcare, industrial, and research domains. Global players such as Merck KGaA and Thermo Fisher Scientific are holding significant influence, leveraging strong portfolios in biologics, diagnostics, and life science solutions. Their strategies are being focused on recombinant zymogen development, scalable production platforms, and integration into pharmaceutical pipelines, reinforcing their leadership positions.

Established mid-sized innovators, including Novonesis, Codexis, Inc., and Amano Enzyme Inc., are contributing to accelerated adoption by emphasizing tailored enzymatic solutions for industrial biotechnology, food processing, and emerging therapeutic applications. Their competitive strength is being enhanced through partnerships, contract research services, and a focus on sustainability-driven enzyme innovation.

Specialized biotechnology firms such as GenScript Biotech Corporation, Takara Bio Inc., Dyadic International, Inc., and Biosynth AG are carving niches in academic and clinical research segments. Their differentiation is being built on customization, proprietary enzyme engineering platforms, and regional adaptability rather than global scale.

Competitive differentiation is expected to shift further from volume-driven supply to innovation-led ecosystems, where recombinant engineering, encapsulation technologies, and collaborative R&D partnerships are anticipated to define long-term market leadership.

Key Developments in Zymogens Market

| Item | Value |

|---|---|

| Quantitative Units | USD 432.0 million |

| Product Type | Protease Zymogens, Lipase Zymogens, Amylase Zymogens, Nuclease Zymogens, Other Enzyme Zymogens |

| Source | Animal-Derived, Microbial-Derived (bacterial/fungal), Recombinant (biotech expression systems) |

| Form | Powder (Lyophilized, Spray-Dried), Liquid/Suspension, Encapsulated/Stabilized |

| End-Use Application | Pharmaceuticals & Biologics, Diagnostics & Research, Food & Beverage Processing, Industrial Biotech, Research & Academic Institutions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Merck KGaA, Thermo Fisher Scientific, Novonesis, Amano Enzyme Inc., Codexis, Inc., Creative Enzymes, GenScript Biotech Corporation, Takara Bio Inc., Dyadic International, Inc., Biosynth AG |

| Additional Attributes | Market outlook by product type, source, and end-use application; recombinant and microbial-derived zymogen adoption trends; application expansion in biologics, diagnostics, and food biotechnology; sector-specific opportunities in industrial biotech and academic R&D; regional growth dynamics shaped by policy support, biotech ecosystems, and academic-industry collaborations; innovation in recombinant expression systems, encapsulated formats, and zymogen engineering platforms. |

The global Zymogens is estimated to be valued at USD 432.0 million in 2025.

The market size for the Zymogens is projected to reach USD 810.9 million by 2035.

The Zymogens is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in the Zymogens Market include protease zymogens, lipase zymogens, amylase zymogens, nuclease zymogens, and other enzyme zymogens.

In terms of product type, protease zymogens are projected to command the largest share at 46.3% of the Zymogens Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA