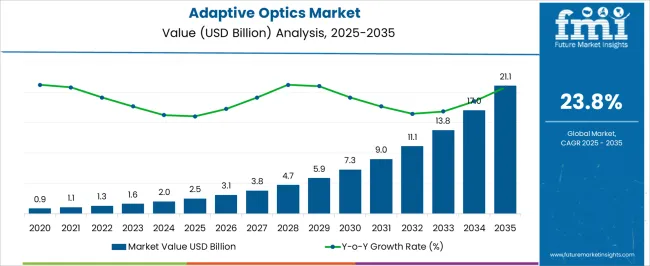

The Adaptive Optics Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 21.1 billion by 2035, registering a compound annual growth rate (CAGR) of 23.8% over the forecast period.

| Metric | Value |

|---|---|

| Adaptive Optics Market Estimated Value in (2025 E) | USD 2.5 billion |

| Adaptive Optics Market Forecast Value in (2035 F) | USD 21.1 billion |

| Forecast CAGR (2025 to 2035) | 23.8% |

The adaptive optics market is experiencing accelerated expansion, fueled by its increasing adoption in imaging, communication, and consumer applications. Industry journals and company announcements have underscored that advancements in wavefront correction technologies have significantly improved optical performance in fields ranging from astronomy to medical imaging. Growing investments in laser communication systems and high-resolution microscopy have enhanced the demand for precision optical components.

Moreover, government-funded research programs in defense and space sciences have strengthened adoption of adaptive optics in surveillance and deep-space exploration. In recent years, the entry of adaptive optics into consumer electronics—particularly in augmented reality (AR) and virtual reality (VR)—has broadened the addressable market.

Press releases and analyst presentations from optical component manufacturers highlight that mass-market demand is shifting adaptive optics from niche research tools into scalable commercial products. Looking forward, technological innovation in compact sensors, deformable mirrors, and AI-assisted wavefront correction is expected to accelerate integration into mainstream applications. Growth momentum is projected to be led by wavefront sensors as core components and the consumer industry as the largest end-user base.

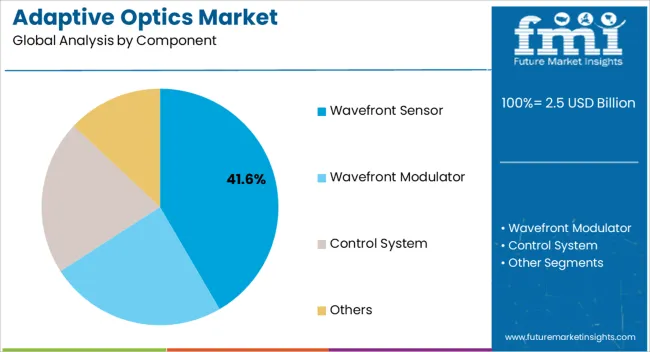

The Wavefront Sensor segment is projected to contribute 41.60% of the adaptive optics market revenue in 2025, positioning it as the leading component. Growth of this segment has been driven by the critical role of sensors in detecting optical distortions and enabling real-time correction. Scientific and engineering publications have emphasized that advancements in Shack-Hartmann and pyramid wavefront sensor designs have enhanced sensitivity and accuracy, supporting widespread deployment in imaging and communication systems.

Moreover, the ability of wavefront sensors to be integrated into compact devices has expanded their utility across research laboratories, medical instruments, and consumer electronics. Manufacturers have also prioritized sensor miniaturization and improved signal processing capabilities, enabling cost-effective solutions for broader applications.

The rising demand for high-resolution displays and imaging technologies has further reinforced the importance of wavefront sensors as indispensable elements of adaptive optics systems. With their proven performance and scalability, the Wavefront Sensor segment is expected to maintain its leadership position in the component landscape.

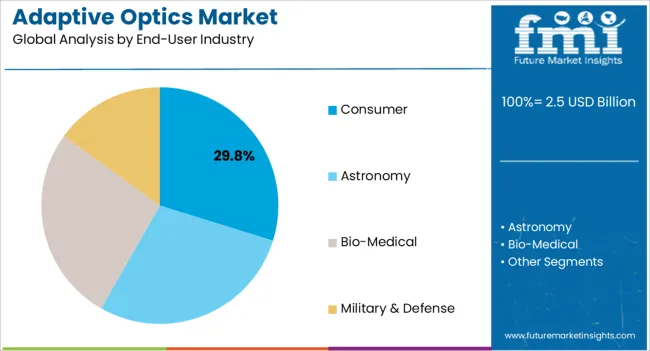

The Consumer segment is projected to account for 29.80% of the adaptive optics market revenue in 2025, making it the largest end-user industry. Expansion of this segment has been driven by the integration of adaptive optics into AR and VR headsets, smartphones, and advanced imaging devices. Consumer electronics companies have increasingly focused on delivering immersive visual experiences, and adaptive optics has been central to achieving higher clarity and reduced visual distortion.

Market updates and technology press releases have highlighted growing investments in head-mounted displays and smartphone cameras, where adaptive optics is being leveraged to enhance user experience. Additionally, the shift toward remote entertainment, digital gaming, and virtual collaboration has accelerated demand for consumer devices embedded with optical correction systems.

Cost reductions in manufacturing and growing availability of miniaturized adaptive optics components have made consumer adoption commercially viable. As consumer demand for immersive, high-quality digital experiences rises, the Consumer segment is expected to sustain its leading role in driving adaptive optics market growth.

According to Future Market Insights’ (FMI’s) latest analysis, the global market for adaptive optics expanded at around 38.9% CAGR historically from 2020 to 2025. Total market size reached about USD 2.5 billion at the end of 2025.

Looking ahead, global adaptive optics demand is expected to rise at a CAGR of 24.9% through 2035. The worldwide adaptive optics industry is set to generate an absolute $ opportunity of USD 13.0 billion during the assessment period.

Growing demand for adaptive optics systems from diverse sectors such as military & defense, communication, industrial manufacturing, and astronomy is expected to drive the target market forward.

Adaptive optics is becoming an ideal technology for countering atmospheric distortions in optical systems. Usage of adaptive optics is helping end users to significantly improve the performance of optical systems.

Technological advancements in optical components such as wavefront sensors, wavefront modulators, and control systems are playing a key role in fostering market development.

Continuous advancements in adaptive optics are widening its applications across several sectors. For instance, it is now being used in defense, communication, and biomedical imaging. High adoption of adaptive optics in these applications is expected to boost the target market.

Rising need for improving performance of surveillance systems and laser weapon systems is another key factor stimulating market growth. Adaptive optics is being increasingly used in modern weapons and defense systems.

Growing prevalence of several eye diseases and adoption in ophthalmology and biomedical imaging is acting as a catalyst triggering adaptive optics system sales.

Adaptive optics is helping ophthalmologists in early disease detection and treatment monitoring by providing high-resolution imaging of eye and other biological structures. It is being used in several medical applications including retinal imaging in combination with optical coherence tomography (OCT).

Adaptive optics technology uses wavefront sensors to sense aberrations of ocular optics and compensate them through deformable mirrors. Thus, it helps to enhance retinal imaging performance.

| Country | United States |

|---|---|

| Projected CAGR (2025 to 2035) | 23.0% |

| Market Value (2035) | USD 21.1 billion |

| Historical CAGR (2020 to 2025) | 35.8% |

| Country | United Kingdom |

|---|---|

| Projected CAGR (2025 to 2035) | 23.9% |

| Market Value (2035) | USD 0.674 billion |

| Historical CAGR (2020 to 2025) | 37.4% |

| Country | China |

|---|---|

| Projected CAGR (2025 to 2035) | 26.0% |

| Market Value (2035) | USD 1.2 billion |

| Historical CAGR (2020 to 2025) | 40.8% |

| Country | Japan |

|---|---|

| Projected CAGR (2025 to 2035) | 221.1% |

| Market Value (2035) | USD 1.1 billion |

| Historical CAGR (2020 to 2025) | 37.9% |

| Country | South Korea |

|---|---|

| Projected CAGR (2025 to 2035) | 25.4% |

| Market Value (2035) | USD 0.586 billion |

| Historical CAGR (2020 to 2025) | 39.8% |

United States Adaptive Optics Market Overview:

According to Future Market Insights (FMI), the United States adaptive optics market value is expected to reach USD 21.1 billion by 2035. It is set to generate an absolute $ growth of about USD 3.8 billion during the assessment period.

Historically, demand for adaptive optics in the United States grew at 35.8% CAGR. Over the projection period, the United States adaptive optics industry is anticipated to thrive at 23.0% CAGR.

Exponential growth of military & defense sector due to increasing government spending and high adoption of advanced weapons & defense systems are key factors driving the United States market.

The United States is the world’s leading country when it comes to military & defense spending. For instance, as per the EXECUTIVEGOV, the United States defense budget & military spending totaled a massive valuation of around USD 2 billion in 2024.

The United States government is constantly looking to provide sophisticated weapons and defense systems to its forces. This has prompted it to invest in technologies such as adaptive optics which in turn is boosting the overall market revenues.

Growing demand from astronomical and biomedical applications is also expected to boost adaptive optics sales revenues in the United States through 2035.

China Adaptive Optics Market Outlook:

China is projected to remain the most lucrative market for adaptive optics during the forecast period. This is attributable to rising adoption of adaptive optics in consumer electronics and industrial manufacturing.

As per Future Market Insights’ (FMI’s) latest analysis, China adaptive optics market is anticipated to progress at 26.0% CAGR over the forecast period in comparison to 40.8% CAGR during the historical period. By 2035, total market size in China is expected to reach USD 1.2 billion.

Adaptive optics is gradually making its way into consumer devices such as smartphone cameras, AR & VR headsets, etc. This widening application in consumer electronics sector is expected to elevate demand for adaptive optic components such as wavefront sensors, wavefront modulators, etc in China.

Similarly, increasing usage in industrial manufacturing is expected to boost China adaptive optics industry during the assessment period.

Today, several China-based companies are incorporating adaptive optics into industrial manufacturing processes to achieve higher precision, increased efficiency, and high-quality products.Top of Form This in turn is set to improve China adaptive optics market share in the global market.

| Top Segment (Component) | Wavefront Sensors |

|---|---|

| Historical CAGR (2020 to 2025) | 38.7% |

| Projected CAGR (2025 to 2035) | 24.8% |

| Top Segment (End-use Industry) | Military and Defense |

|---|---|

| Historical CAGR (2020 to 2025) | 38.4% |

| Projected CAGR (2025 to 2035) | 24.7% |

Based on component, the global adaptive optics industry is segmented into wavefront modulator, wavefront sensor, control system, and others. Among these, demand remains high for wavefront sensors, making it the top revenue-generating segment.

According to Future Market Insights (FMI), wavefront sensor segment grew at a stupendous CAGR of 38.7% during the historical period from 2020 to 2025. For the projection period, wavefront sensor demand is likely to rise at 24.8% CAGR.

Optical devices used for measuring & characterizing the wavefront of light, especially in telescopes, laser systems, and other optical systems are known as wavefront sensors. These devices measure distortions and send commands to deformable mirrors and control systems to counteract the distortions.

Wavefront sensors are gaining immense traction in adaptive optics systems. This is because they can help to correct aberrations and distortions in optical systems caused by factors such as imperfections in optical components and atmospheric turbulence.

Wavefront sensors are widely employed in several adaptive optics applications. For instance, they are used for several laser applications such as laser material processing and laser beam diagnostic for controlling laser beam size and shape to improve accuracy.

Wavefront sensors can significantly enhance the performance of lasers, telescopes, and other optical devices. This is due to their ability to provide feedback to adaptive optics systems so that they can adjust the shape of deformable mirrors and other elements in real-time to compensate for aberrations.

Increasing usage of wavefront sensors in applications such as laser beam control systems and astronomical observations is expected to fuel their demand during the assessment period.

Growing usage of wavefront sensing in microscopy and metrology is another key factor expected to fuel wavefront sensor sales and boost the target market.

As per Future Market Insights’ (FMI) latest report, military and defense end-user sector is expected to hold a dominant share of the global adaptive optics industry through 2035. This is due to rising applications of adaptive optics in military and defense sector.

The military & defense segment witnessed a CAGR of 38.4% during the historical timeframe and for the projection period, it is likely to expand at 24.7% CAGR.

In the military & defense sector, adaptive optics is employed for myriad applications. For instance, it is used for developing sophisticated guidance systems and state-of-the-art defense weapons. Similarly, it is becoming essential in long-range target identification and tracking

Adaptive optics enhances image quality, targeting precision, and tracking accuracy in modern warfare and defense applications by compensating for atmospheric disturbances.

Adaptive optics technology is expected to play a crucial role in military sector by allowing airborne and ground-based laser weapons to reach and neutralize targets at far away distances.

Various efforts are being made to utilize adaptive optics in horizontal path surveillance systems which will further boost the target segment.

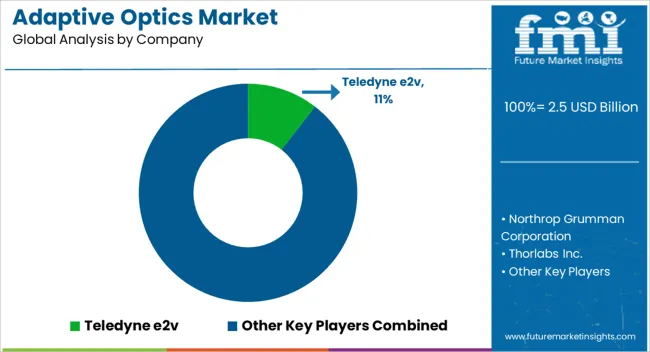

Leading adaptive optics systems manufacturers listed in the report include Northrop Grumman Corporation, Teledyne e2v, Thorlabs Inc., Boston Micromachines Corporation, Adaptica S.R.L., Active Optical Systems LLC, Iris AO, Inc., OKO Technologies, Imagine Optic Sa, and Phasics CORP among others.

These key companies are constantly investing in research & development to advance in adaptive optics. They are implementing a wide variety of strategies to improve their revenues and strengthen their market positions. These strategies include new product launches, mergers, partnerships, facility expansions, alliances, agreements, and acquisitions.

Recent developments:

| Attribute | Details |

|---|---|

| Estimated Market Value (2025) | USD 2.5 billion |

| Projected Market Value (2035) | USD 21.1 billion |

| Anticipated Growth Rate (2025 to 2035) | 23.8% CAGR |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Component, End-user Industry, and Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; and the Middle East & Africa |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, Spain, Nordic, Russia, Poland, China, India, Thailand, Indonesia, Australia and New Zealand, Japan, GCC countries, North Africa, South Africa, and others. |

| Key Companies Profiled | Teledyne e2v; Northrop Grumman Corporation; Thorlabs Inc.; Iris AO, Inc.; Adaptica S.R.L.; Active Optical Systems LLC; OKO Technologies; Imagine Optic Sa; Boston Micromachines Corporation; Phasics CORP |

The global adaptive optics market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the adaptive optics market is projected to reach USD 21.1 billion by 2035.

The adaptive optics market is expected to grow at a 23.8% CAGR between 2025 and 2035.

The key product types in adaptive optics market are wavefront sensor, wavefront modulator, control system and others.

In terms of end-user industry, consumer segment to command 29.8% share in the adaptive optics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adaptive Shapewear Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Stroller Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control and Blind Spot Detection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Adaptive Microemulsions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control System Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Camouflage Materials Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Steering Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Front Lighting Market Growth - Trends & Forecast 2025 to 2035

Adaptive Cruise Control Market - Size, Share, and Forecast 2025 to 2035

Adaptive Authentication Market Insights - Growth & Forecast 2025 to 2035

Adaptive Access Control Market Growth – Trends & Forecast through 2034

Shelf-Adaptive Geometry Packs Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Testing Market Size and Share Forecast Outlook 2025 to 2035

Fiber Optics Market Size and Share Forecast Outlook 2025 to 2035

Advanced Optics Material Market Size and Share Forecast Outlook 2025 to 2035

Demand for Adaptive Shapewear in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Adaptive Shapewear in USA Size and Share Forecast Outlook 2025 to 2035

Automotive Adaptive Lighting Market

Medical Fiber Optics Market Size and Share Forecast Outlook 2025 to 2035

Sapphire Coated Optics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA