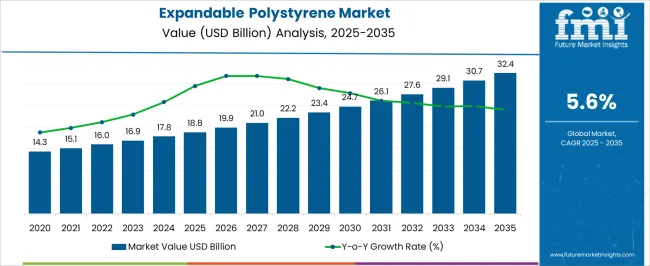

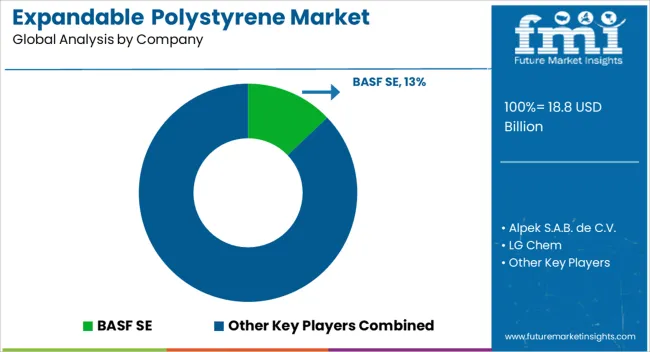

The Expandable Polystyrene Market is estimated to be valued at USD 18.8 billion in 2025 and is projected to reach USD 32.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Expandable Polystyrene Market Estimated Value in (2025 E) | USD 18.8 billion |

| Expandable Polystyrene Market Forecast Value in (2035 F) | USD 32.4 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The expandable polystyrene market is experiencing consistent growth, driven by its versatility, lightweight properties, and cost-effectiveness across multiple industries. Its increasing adoption is being supported by strong demand in packaging, construction, and insulation applications, where performance, thermal stability, and ease of processing are critical. Rising e-commerce activities and global logistics expansion are accelerating the use of expandable polystyrene in protective packaging for electronics, consumer goods, and perishable products.

In addition, improvements in polymer processing technologies are enhancing product quality, dimensional stability, and recyclability, which further supports its deployment in diverse applications. Regulatory initiatives emphasizing material efficiency, sustainability, and lightweight construction are also shaping market dynamics.

The combination of durability, low density, and thermal insulation characteristics is increasing preference among manufacturers and end users seeking cost-effective solutions that reduce transportation and operational costs As industries continue to optimize packaging and insulation processes, the market is expected to grow steadily, with manufacturers focusing on innovative grades and applications to address evolving industry requirements.

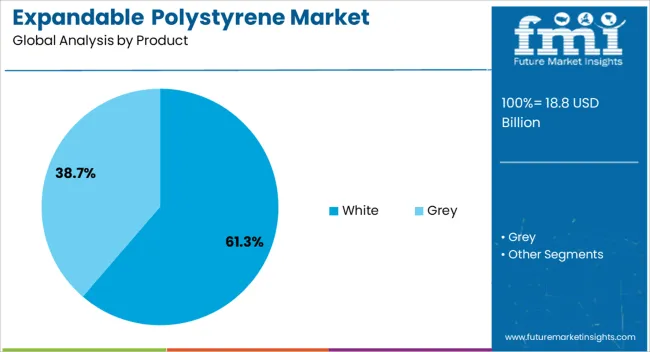

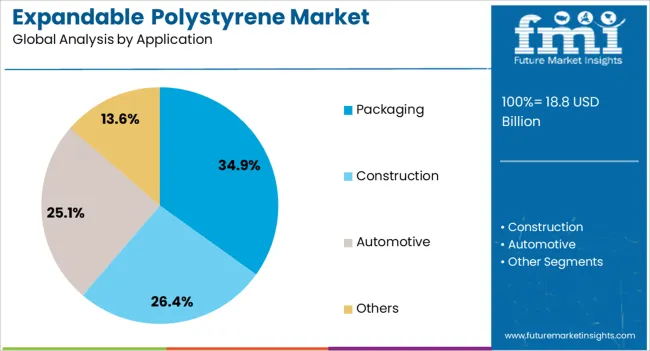

The expandable polystyrene market is segmented by product, application, and geographic regions. By product, expandable polystyrene market is divided into White and Grey. In terms of application, expandable polystyrene market is classified into Packaging, Construction, Automotive, and Others. Regionally, the expandable polystyrene industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The white product segment is projected to hold 61.3% of the expandable polystyrene market revenue share in 2025, positioning it as the leading product type. This dominance is being supported by its broad compatibility with diverse applications, high availability, and cost-effectiveness. Its lightweight nature, combined with excellent cushioning and impact resistance, makes it a preferred choice for packaging sensitive and fragile items.

The high visibility and purity of white expandable polystyrene also enable efficient processing for molding, cutting, and shaping, allowing manufacturers to produce customized products at scale. Consistent material performance and adaptability to both industrial and commercial processes have reinforced adoption in multiple sectors. The widespread use of white grades in protective packaging, insulation panels, and construction materials ensures steady demand.

Furthermore, the ease of sourcing and established manufacturing infrastructure for white expandable polystyrene contribute to its sustained market leadership Continued focus on high-performance, eco-friendly variants is expected to further strengthen its position as the dominant product type.

The packaging application segment is anticipated to account for 34.9% of the expandable polystyrene market revenue share in 2025, establishing it as the leading application area. Its growth is being driven by the need for cost-efficient, lightweight, and protective materials for transporting fragile and high-value goods. Expandable polystyrene’s excellent cushioning and thermal insulation properties ensure product safety during shipping and handling, which is critical for electronics, food, and consumer products.

Rising e-commerce activity and global logistics expansion are further accelerating demand, particularly in regions with high shipment volumes and export-oriented manufacturing. The material’s adaptability for custom molding and its ability to reduce transportation costs through low density are reinforcing its preference in packaging applications.

Growing awareness of packaging efficiency and product protection standards is driving broader adoption among manufacturers and supply chain operators As companies continue to optimize packaging solutions for performance, cost, and sustainability, expandable polystyrene is expected to maintain its leadership position in the packaging segment globally.

Expandable polystyrene (EPS) is a thermoplastic resin that contains an expanding agent. It is used in various applications ranging from food packaging to electrical coatings and medical supplies. It is environment-friendly as it does not involve any halogen during its production process.

The global expandable polystyrene market is growing at an exponential rate as it caters to the demand of various industry verticals through sustainable development. Expandable polystyrene has an added advantage over moulded pulp. Moulded pulp, though recyclable, requires a certain amount of natural gas in the drying process, and it naturally weighs more, resulting into increased packaging and transportation cost.

On the other hand, EPS meets most of the sustainable packaging criteria. It emits less greenhouse gases when compared to moulded pulp.

Taking these benefits into account, governments as well as companies are shifting the packaging market towards the expandable polystyrene segment. The global expandable polystyrene market had witnessed 1.5X times growth in between 2000 and 2010.

Building & construction, and packaging are the two important end-use segment market for expandable polystyrene. Together, they contribute 95% market share of the global expandable polystyrene market. The rise in the demand for processed foods is increasing the expandable polystyrene demands in the food & beverages industry.

In terms of revenue, this industry accounts for the largest market share in the global expandable polystyrene market. The next potential segment is building & construction. With major market economies such as China, India and GCC witnessing a major surge in infrastructure investment, the expandable polystyrene market is set to grow at an accelerated pace.

Expandable polystyrene has been the prime choice for the construction of green buildings. It enhances the durability of buildings, and finds its application in insulating closed cavity walls and floor insulation. These major economies will see a surge in infrastructure investment in the coming decades. It is because of this added advantage that market is set to proliferate at an exponential rate. Another profitable segment is the electronics domain.

Capacitors and electronic components are the main portions of electronics application segment that will push the expandable polystyrene market vertically upward at a CAGR of 4.5% between 2025 and 2025. Refrigerators, microwaves, electrical coatings are the major application for EPS in the electronics segment.

Geographically, the APAC market stands to be the global leader in production and consumption in the EPS market. Almost half of the total global production happens in the APAC region, and 45% of it is consumed in global emerging economies such as India and China. In the APAC region, China will be the most preferred destination primarily due to the rising demand of packaging in the food & beverages, and electronics industry.

China and India are the global leaders in maritime trade. This will boost the packaging industry. China alone accounts for 37% of the global EPS market in terms of volume. As China has a strong hold in the electronics segment and is a major exporter of electronic devices, the EPS market is set to flourish in China.

India, along with Malaysia and Philippines, will be the next major market for EPS primarily due to heavy infrastructure investment across various industry verticals. Europe followed by Latin America and North America are the other potential markets for EPS.

North America has reached its saturation point in global EPS market and therefore its market growth will be stagnant in coming few years. While Europe will witness a surge in the market due to the rising demand of pharmaceutical industries, Latin America will be a preferred destination mainly due to infrastructure investment.

BASF SE, Nova Chemicals Corporation, Synthos S.A, Owens Corning, and INEOS Styrenics are some of the leading manufacturers of EPS.

The global EPS market is set to grow at a moderate CAGR in the coming years. China, Europe, Brazil and India will be the major preferred destinations for the EPS market. Low weight, durability, moisture resistance, thermal efficiency, shock absorption, versatility and ease of use are some characteristics of EPS which are tempting various industry verticals to shift base to EPS.

Though the EPS market is promising, major restraining factors are the availability of high performance substitutes including polypropylene and polyethylene.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types, technology and applications.

The expandable polystyrene market is expected to flourish over the forecast period owing to the beneficial properties of expandable polystyrene. The material is excellent for the packaging of heavy and flimsy products like household goods and consumer electronics. The material further supports proper transportation and ensures effective scratch protection while handling such products, thereby boosting the expandable polystyrene market size in the coming years. This material is not affected by moisture, is non-toxic, and does not sully over time. Thus, the overall market is being driven by environmental benefits associated with the usage of expandable polystyrene.

The primary uses of expandable polystyrene are packaging, insulation, etc. Going forward, the numerous expandable polystyrene uses can be seen in various industries, such as construction, automotive, HVAC, packaging, consumer products, horticulture, aerospace, and pharmaceuticals. The extensive application spectrum of expandable polystyrene in the construction industry to insulate floors, roofs, walls or infill for mass civil engineering projects. The expandable polystyrene (EPS) market by product type is being led by white EPS, whereas grey EPS is anticipated to witness rapid growth in the forecast period. This growth could be attributed to the high consumption rate of grey EPS in the construction and building industry.

The market for expandable polystyrene is expected to be led by the Asia Pacific region. This can be ascribed to the rising demand for the material from the domestic market and increasing disposable incomes in the region. Additionally, the easy procurement of low-cost labour and accessibility and economical raw materials in the region are increasing the production of expandable polystyrene (EPS), thus bolstering foreign investments in the APAC region. Going forward, the expandable polystyrene market size is expected to thrive over the course of the forecast period of 2025-2035, aided by the rising government proposals to better public infrastructure and increasing cash-intensive commercial and other non-residential construction.

The EPS market is predicted to propel over the coming years, led by collaborations, acquisitions, and new developments in the market. For instance, in 2025, Atlas Roofing procured ACH Foam Technologies, which is a leading company manufacturing moulded polystyrene solutions in facilities spanning North America. With this acquisition, the company is expected to enjoy an enhanced product portfolio and bolster its position in the North America market. Similarly, BEWiSynbra acquired Ruukin EPS, which is a Finnish producer of insulation material, in January 2025. With this acquisition, the company aimed to gather coverage in Finland and consequently offer insulation material and related packaging solutions made of EPS.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts, and industry participants across the value chain.

The report provides an in-depth analysis of parent market trends, macro-economic indicators and governing factors, along with market attractiveness within the segments. The report also maps the qualitative impact of various market factors on market segments and various geographies.

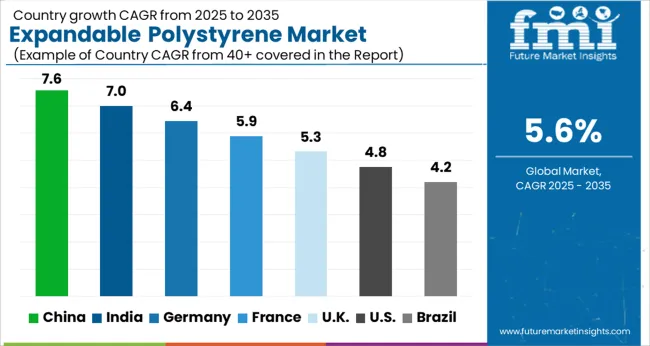

| Country | CAGR |

|---|---|

| China | 7.6% |

| India | 7.0% |

| Germany | 6.4% |

| France | 5.9% |

| UK | 5.3% |

| USA | 4.8% |

| Brazil | 4.2% |

The Expandable Polystyrene Market is expected to register a CAGR of 5.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.6%, followed by India at 7.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.2%, yet still underscores a broadly positive trajectory for the global Expandable Polystyrene Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.4%. The USA Expandable Polystyrene Market is estimated to be valued at USD 6.8 billion in 2025 and is anticipated to reach a valuation of USD 10.8 billion by 2035. Sales are projected to rise at a CAGR of 4.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 942.8 million and USD 478.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.8 Billion |

| Product | White and Grey |

| Application | Packaging, Construction, Automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Alpek S.A.B. de C.V., LG Chem, KANEKA CORPORATION, SIBUR, SUNPOR, Synthos, TotalEnergies, Supreme Petrochem Ltd, NOVA Chemicals, Epsilyte LLC, Ravago, Knauf Industries, Versalis S.p.A., SABIC, and Taita Chemical Co., Ltd. |

The global expandable polystyrene market is estimated to be valued at USD 18.8 billion in 2025.

The market size for the expandable polystyrene market is projected to reach USD 32.4 billion by 2035.

The expandable polystyrene market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in expandable polystyrene market are white and grey.

In terms of application, packaging segment to command 34.9% share in the expandable polystyrene market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Expandable Microspheres Market Size and Share Forecast Outlook 2025 to 2035

Thermoexpandable Polymer Microsphere Market Size and Share Forecast Outlook 2025 to 2035

Polystyrene Films Market Size and Share Forecast Outlook 2025 to 2035

Polystyrene Packaging Market Analysis - Size & Growth Forecast 2025 to 2035

Extruded Polystyrene Market Size and Share Forecast Outlook 2025 to 2035

Expanded Polystyrene for Packaging Market Insights – Growth & Forecast 2025 to 2035

Expanded Polystyrene Market

Specialty Polystyrene Resin Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA