The bread crumbs market demonstrates strong industry growth potential from 2025 to 2035 because of food service requirements and civilian cooking trends alongside a changing preference for convenient food products. Dried breadcrumbs act as vital ingredients which improve the texture and deliver excellent crispness features to fried and baked food products across different culinary traditions.

Manufacturers now focus on creating new formulations because consumers want products that align with health-oriented and gluten-free and organic demands. Bread crumb demand rises significantly because ready-to-cook and frozen food producers use them as coating substances and binding agents.

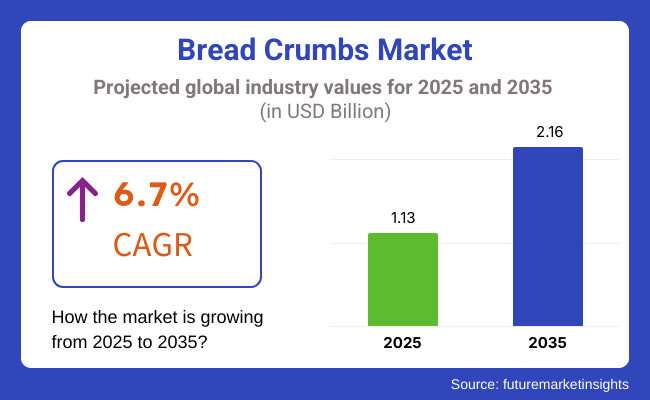

Bread crumb sales will expand from the 2025 evaluation amount of USD 1.13 Billion to USD 2.16 Billion in 2035 at a predicted annual growth rate of 6.7%. Market expansion results from rising consumer demand for premium food ingredients together with improved bread crumb production and major food brands enhancing their product ranges.

The entry of plant-based and allergen-free bread crumb products meets the needs of health-conscious consumers thus expanding market growth opportunities. The market benefits from advances in packaging methods which increase product availability and distribution duration.

North America holds the largest market share of bread crumbs due to the unrelenting demand from fast food companies, frozen food manufacturers, and home bakers.The United States and Canada have developed an increasingly sophisticated palate for panko-style bread crumbs, essential for crispy coatings for fried foods.

Whole wheat, gluten-free, and organic bread crumb consumers are being driven by health-conscious consumers. Moreover, the growing penetration of private-label as well as specialty food brands in supermarkets is contributing to increasing product availability and market penetration throughout the region.

The bread crumbs market in Europe is growing at a steady pace owing to high demand from the bakery, processed food, and restaurant segments. Manufacturers are introducing healthy and fortified bread crumb; countries including Germany,France, and the UK are at the forefront of product innovation.

Alternative bread crumbs made from legumes and whole grains are also gaining traction, driven by growing interest in plant-based and flexitarian diets. In addition, strict food safety for ingredients and clean-label trends have transformed the attention of producers toward minimal additives and preservatives, which has helped build consumer confidence in bread crumb products.

Asia-Pacific is likely to witness the maximum growth of the bread crumbs market on the back of increasing food service industries,rising disposable income and changing dietary habits. Asian countries like China, Japan, South Korea, and India are consuming bread crumbs, as this ingredient is used in regional and western food preparations.

Japanese cuisine has an ever-growing presence around the world, making panko bread crumbs even more highly desired. In addition, the quick-service restaurant and processed food sectors are expanding in quick successions demand for growing set of bread crumbs in the area. Further expanding the market growth is a result of government initiatives that promote food processing and export-oriented food products.

Challenge

Volatility of Prices in Raw Materials

One of the major factors affecting bread crumbs market is the increasing fluctuation in price of raw materials required for bread crumbs processing including wheat flour, corn flour, etc. Disruptions in global supply chains, fluctuating weather and geopolitical tensions have caused uneven wheat production and price volatility. And inflationary pressures in transportation, labour and packaging cost have further created market uncertainty.

One way to combat this difficulty is for the manufacturers to diversify suppliers, develop long-term supplier contracts, and look for alternate grain based material. Precision agriculture and smart farming techniques can stabilize grain production and reducing dependence on volatile global markets. Moreover, effective inventory management and predictive demand forecasting can help alleviate financial risks arising from price volatility.

Opportunity

Increasing Demand for Gluten-Free and Health-Oriented Varieties

There is a clear transition among consumers to prefer health ingredients driving the demand towards gluten-free, whole grains, and fortified bread crumbs. Innovation in the bread crumbs space has been driven by the increasing prevalence of gluten intolerance and the rise in awareness of celiac disease as well as the growing inclination of consumers toward healthy consumption. They have branched into products made with alternative flours like rice, quinoa, almond and chickpea.

The clean-label trend has also prompted brands to minimize the use of artificial additives and preservatives and excessive sodium in their bread crumb formulations. Functional bread crumbs infused with protein, fiber and vitamins are popular among health-conscious consumers. This trend is providing manufacturers with an opportunity to launch premium, organic, and allergen-free bread crumb offerings while taking advantage of the growing retail and foodservice demand.

| Market Shift | 2020 to 2024 |

|---|---|

| Ingredient Innovation | The options for gluten-free and alternative flour bread crumbs were few, in a market dominated by traditional wheat-based options. |

| Health & Nutrition Trends | Clearly growing demand for low-sodium and clean-label products, but limited options available to fortify them. |

| Sustainability Practices | Reducing food waste by using up surplus bread and bakery products by turning them into crumbs. |

| Foodservice & Retail Growth | Most of the sales demand for the short term overall will be driven by those foodservice-specific applications within coatings, batters, and fried food preparation. |

| Technological Advancements | Limited automation in bread crumb production, with manual processes still prevalent in some regions. |

| Consumer Preferences | Preference for traditional, fine-textured bread crumbs in Western cuisines. |

| Regulatory Landscape | Compliance with food safety and labelling regulations, but minimal focus on fortification standards. |

| Market Shift | 2025 to 2035 |

|---|---|

| Ingredient Innovation | Various Usage of Alternate Grains & Plan Based Ingredients of Specliased Diets |

| Health & Nutrition Trends | Rising inclination towards high protein, fiber-enriched, and fortified bread crumbs with functional health benefits. |

| Sustainability Practices | Broadening the scope of circular economy initiatives such as upcycled raw materials, sustainable packaging and carbon-neutral manufacturing. |

| Foodservice & Retail Growth | Rising demand from home cooks meal package provider’s ready-to-cook segment, diversifying retailer’s product offerings. |

| Technological Advancements | Increased use of AI-driven production optimization, automated quality control, and precision ingredient blending. |

| Consumer Preferences | Expansion of global flavours, including panko, herb-seasoned, and ethnic-inspired bread crumb varieties. |

| Regulatory Landscape | Stricter regulatory oversight on nutritional claims, allergen disclosures, and sustainable sourcing certifications. |

The USA bread crumbs market is growing steadily, driven by the increasing consumer demand for convenience food and ready-to-cook meal solutions. Similar trending of breadcrumbs in the foodservice industry involving-driven by casual and fast food is also fuelling market growth.

The rise in demand for gluten-free and whole grain variants in the bread crumbs market is also a response to the health-conscious population. Market growth is being driven forward by the need for exotic flavours and improved texture in fried and baked food coatings.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.0% |

Crispy bread coatings for home-cooked meals and restaurateur food, homeowners are increasingly turning to the UK’s bread crumbs market.

A movement toward healthier options, including whole-wheat and panko-style bread crumbs, is emerging. Growing plant-based and vegan meal preps, in turn, are further adding to the demand for alternative bread crumb formulations. Moreover, growing penetration of ready-to-eat meal kits and pre-seasoned coatings are aiding the growth of the market.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

The EU bread crumbs market is growing, with high demand in Germany, France, and Italy for retail and foodservice.

The increasing trend of artisan bread crumbs and organic variants adding to market growth. Manufacturers are developing preservative-free and additive-free bread crumbs in response to strict EU food regulations and the growing consumer preference for clean-label ingredients. In addition, the growth of plant-based and flexitarian diets also drive the growth of the market.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.7% |

Japan is one of the fastest growing markets in the global bread crumbs sector, where panko bread crumbs are widely preferred in preparation of traditional fried dishes such as tempura and ton katsu.

The growing popularity of Japanese food in the global marketplace is also driving demand for panko exports. Moreover, rising innovation in gluten-free and low carb bread crumb alternatives has made them attractive to health conscientious customers. The increased traction of premium and seasoned bread crumbs in domestic cooking and commercial kitchens is another factor that is facilitating growth in the market.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.3% |

The sales of South Korea’s popular flour-based powdery seasoning called bread crumbs are on the rise, in part because a growing number of people in the country are influenced by Western and Japanese cuisines in their home cooking and restaurant dining. Sales are being driven by the demand for crispy coatings on fried chicken, seafood, and snack foods.

The growing range of seasoned and flavoured bread crumbs creates more opportunities for culinary experimentation for consumers. Moreover, the growing e-commerce platforms and meal delivery services are expected to increase the demand for ready-to-use bread crumb products.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.9% |

Panko bread crumbs and meat, poultry & seafood segments are in dominating share in the bread crumbs market, owing to the increasing requirement of food manufacturers, home cooks and professional chefs for premium quality, textures and crispy coating solutions. Essential to the processed food brands, QSRs, and gourmet food producers, these bread crumb nutshells help make it possible to achieve balance crunchiness, moisture retention, and aesthetics in the "food you see."

The flows in culinary trends toward light, crispier coatings, and the impact of global cuisines on food preparation techniques, have led manufacturers to improve bread crumb formulations, ensure product versatility, and find applications with new protein-based or plant-based foods.

Demand for Light, Crisp, and Airy Food Textures Fuels Panko Bread Crumbs Market Growth

Panko bread crumbs offer better crunch, more absorption, and versatile uses.

Out of these, panko bread crumbs segment has gained immense popularity with remarkable crispiness, better aeration and great moisture absorption for fried, baked and pan cooked food, thereby making it one of the most popular kinds of bread crumbs available in the food business.

Panko differs from traditional bread crumbs in its more open, flaky structure, larger surface area, and lower density, producing a lighter, crunchier coating with less oil absorption for several culinary uses.

Adoption driven by premium panko bread crumb demand, with characteristics including coarser grind consistency, higher heat resistance, and gluten-free options. Panko bread crumbs are preferred by over 65% of commercial kitchens and food processing facilities, as they provide longer texture and crunch, making this segment significantly more profitable in terms of demand.

Growing availability of international flavours in the mainstream food markets have woven around Japanese, Korean, and Southeast Asian cuisines, which in turn would continue to hike up market demand, establishing enhanced alignment for panko style coatings in Western and fusion food recipes.

Further enhancing adoption is the incorporation of next-generation panko bread crumb formulations, which include infusion with plant-based protein, non-GMO production methods, and AI-assisted texture optimization to ensure functionality for the health-conscious consumer and specialty dietary needs.

Accordingly, specific tailored solutions for panko bread crumb, such as using high-stability coatings, improving binding characteristics, or the ability to have multi-textured layers, are another factor that have catalysed the market growth; facilitating adaptive validation with the emergence of novel food preparation methods.

However, this market segment is expected to see a negative impact in the coming years due to the high production costs and the limited availability of these specialty products in mass-market retail chains as well as changing consumer demands for alternative coatings, thereby reducing the growth of the segment.

Still, the panko bread crumbs is poised to witness steady stream of growth globally, as comparable innovations in AI-assisted formulation improvements, next-generation fortification of key ingredients, and biodegradable packaging for an extended shelf life continue to make for improved cost-economics, especially regarding sustainability and worldwide market expansion.

Panko Bread Crumbs: A Favorited in Fried Cuisine, Gourmet Bread-Coating, and Healthier Selections

The panko bread crumbs segment has seen wide adoption, especially in QSRs, frozen food brands, and fine dining restaurants; where industries look at replacing traditional bread crumb coatings with more airier/ lighter/crispier coatings. In contrast with the traditional plain or seasoned bread crumbs, panko types enhance food texture, which provides better adherence, and frying efficiency, which allows better consistency and consumer satisfaction.

This demand for next-generation panko bread crumb solutions, which include oil-reduction capacity, high-heat stability as well as amino acids and organic components, has driven adoption. With pasta, fried food, tempura, and coated frozen food products, over 70 % on account of studies, it is figure do not conquer yet of tremendous demand for this type of product segment, use of panko bread lowered crumbs as company as things preparation a name food for all consumer demand.

In the case of plant-based meat alternatives, panko-based coatings are increasingly being expanded in varieties, such as gluten-free, whole-wheat, and high-protein, thereby strengthening the scope of market adoption, thereby ensuring greater inclusivity for dietary-conscious consumers.

Advanced smart coating technologies, with predictive frying performance assessment, optimized starch adhesion, and AI-based texture normalization, have even facilitated wider adoption, delivering improved food production efficiency and product quality control.

The high availability of raw materials combined with increasing demand for gluten-free formulations is supporting market expansion, especially for gluten-free panko crumbs, but simultaneously exposing the industry to challenges including increasing cost of raw materials and demand for alternative coating options. But transformative developments in enzyme-altered bread crumb refinement, AI-enabled sensory texture analysis, and block chain-enabled traceability for sourcing high-quality panko bread crumbs is optimizing product consistency, sustainability and international provenance, while ensuring further growth of panko bread crumbs on a global scale.

The meat, poultry & seafood segment of the bread crumbs market is one of the leading end-use categories, which, in turn, allow food manufacturers, frozen meal brands, and meat processing companies to improve the taste, texture, and stability of a wide variety of protein-based food products. Unlike coatings that need flour or batter, bread crumbs are better in providing a crunchy layer which ensures better moisture retention and adhesion making breaded proteins more appealing in flavour and building an extended shelf life.

Adoption has surged due to high-performance consumer grade bread crumb coatings with characteristics such as uniform particle sizes, oil resistance, and binding properties. According to a latest study, more than 65% of frozen and ready-to-eat (RTE) breaded meat and seafood products contain specialized bread crumbs to enhance texture and the longevity of freshness, factoring in robust demand throughout this segment.

Bread crumbs find broader applications in non-conventional protein processing, backed by market growth fuelled by demand for plant-based and alternatives proteins, such as breaded plant-based chicken, seafood substitutes, and hybrid protein coatings.

The integration of AI-powered formulation advancements, such as predictive frying analytics, moisture-locked bread crumb coatings, and gluten-free coating alternatives, has further propelled adoption, guaranteeing better product durability and enhancing the consumer experience.

It has led to the development of customized protein breading solutions, including spice-infused blends, extended fry-stability properties, enriched nutrient profiles, all of which have optimized market growth, enhancing better market adaptability and functional aspects in various meat processing industries worldwide.

While the meat, poultry & seafood segment, which dominates the market, has a lot to gain from the advantages of using such coatings in terms of coating adherence, product shelf life, and optimizing texture in protein applications, factors such as stringent regulatory compliance to allergen labelling, variable costs for ingredient sourcing, and changing consumer preferences towards alternative protein coatings all hinder its growth.

Yet, as novel efficiencies harnessing AI for coating uniformity classification, enzyme-altered protein breading applications are hitched with sustainable packaging materials for longer undergo exist, the cost-effectivity, formulation versatility and range of consumer accessibility will aid sustained market expansion for inclusion based coating solutions in meat, poultry & seafood applications globally

Meat, Poultry & Seafood Industry Increasing Use of Bread Crumbs across Frozen Meals, Coatings for Processed Meats and QSR Menus

The meat, poultry & seafood segment has witnessed a major adoption since bread crumb is widely utilized across frozen food processors, fastening restaurant chains, and gourmet meal industries to induce puff pastries, keep juiciness and increase product stability in fried foods. Subsequently, bread crumbs offer a delightful crunch that is distinct from a basic coating of flour or unseasoned batter and help to retain its texture through frying, baking, and air-frying-an experience consumers demand and leads to higher repeat purchase.

Contribution towards this might be the rising preference for gluten-free formulations and protein-enhanced breading, and pre-seasoned variants available for direct application has led to an increased adoption. Benefits are leading to more than 70% of frozen meat and poultry goods utilizing specialized bread crumbs coverings that are contributed to meat, to improve the appeal of consumers as well as supply texture stability, assisting durable growth for this division.

While offering benefits in terms of improved efficiency of meat coating, reduced inconsistencies in cooking, and enhanced product crispiness, the meat, poultry & seafood segment must grapple with pressures from increasing ingredient costs, inconsistent global food safety regulations, and the continued rise in demand for meat-substitutes and other plant-based protein alternatives.

However, various new innovations like enzyme-treated bread crumbs, AI-driven coating performance analysis and biodegradable food packaging are enhancing cost-effectiveness, sustainability and consistency of the product, which in turn makes it likely for bread crumbs to witness further demand in meat, poultry & seafood applications across the globe.

Industry Overview

The bread crumb market continues to expand moderately because the food industry requires more celiac products for processed foods and ready-to-cook meals as well as restaurant chains. Consumers apply bread crumbs to multiple food applications because these amendments provide both coating functionality and textural modification and thickening behaviour.

The market grows because fast-service restaurants continue their expansion while demand for convenience food keeps increasing and producers launch innovative product types including organic and gluten-free bread crumbs. The leading bread crumb manufacturers dedicate efforts to improve product texture along with taste quality and longevity and adopt sustainable and clean-label components during manufacturing process.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Newly Weds Foods | 18-22% |

| McCormick & Company, Inc. | 15-19% |

| Pinnacle Foods Inc. (Conagra Brands) | 12-16% |

| Gonnella Baking Co. | 9-13% |

| George Weston Foods Ltd. | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Newly Weds Foods | Specializes in custom-formulated bread crumbs for industrial food production and restaurant applications. |

| McCormick & Company, Inc. | Produces seasoned and plain bread crumbs with a strong retail presence in global markets. |

| Pinnacle Foods Inc. (Conagra Brands) | Offers high-quality bread crumbs under various brand names, including gluten-free and organic options. |

| Gonnella Baking Co. | Focuses on traditional and specialty bread crumb products for commercial food processors and bakeries. |

| George Weston Foods Ltd. | Provides bakery-based food ingredients, including panko and fine-milled bread crumbs. |

Key Company Insights

Newly Weds Foods (18-22%)

Newly Weds Foods, a leading industrial bread crumbs supplier, provides food manufacturers, QSRs, and large-scale foodservice operators with tailored formulations.

McCormick & Company, Inc. (15-19%)

A major player in the retail space, McCormick makes seasoned and unseasoned bread crumbs under popular brands for home chefs and restaurants.

Pinnacle Foods Inc. (Conagra Brands) (12-16%)

Pinnacle Foods under Conagra Brands-The Company offers a variety of bread crumbs, including organic and gluten-free choices, to cater to changing consumer demands.

Gonnella Baking Co. (9-13%)

Gonnella produces fresh regular and specialty traditional toasted bread crumbs for high volume foodservice operators.

George Weston Foods Ltd (7-11%)

George Weston Foods has a full range of industrial and retail bakery products which include panko and finely milled bread crumbs.

Other Important Players (30-40% Combined)

There are also a few other companies that play in the bread crumbs space, hitting innovative formulations and/or sustainable source of ingredients. Notable players include:

The overall market size for Bread Crumbs Market was USD 1.13 Billion in 2025.

The Bread Crumbs Market expected to reach USD 2.16 Billion in 2035.

The demand for the bread crumbs market will grow due to increasing consumption of processed and convenience foods, rising demand for ready-to-cook meal solutions, expanding fast-food industry, and growing adoption of bread crumbs in bakery, meat, and seafood applications for texture enhancement.

The top 5 countries which drives the development of Bread Crumbs Market are USA, UK, Europe Union, Japan and South Korea.

Panko Bread Crumbs and Meat, Poultry & Seafood lead market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 36: Western Europe Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 38: Western Europe Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Western Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 46: Eastern Europe Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 48: Eastern Europe Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 66: East Asia Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 68: East Asia Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 70: East Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Flavor, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Flavor, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Application, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by End-Use Application, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Flavor, 2023 to 2033

Figure 28: Global Market Attractiveness by End-Use Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Flavor, 2023 to 2033

Figure 58: North America Market Attractiveness by End-Use Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Flavor, 2023 to 2033

Figure 88: Latin America Market Attractiveness by End-Use Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 105: Western Europe Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 109: Western Europe Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Flavor, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by End-Use Application, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 135: Eastern Europe Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 139: Eastern Europe Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Flavor, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by End-Use Application, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Flavor, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by End-Use Application, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 195: East Asia Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 199: East Asia Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: East Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Flavor, 2023 to 2033

Figure 208: East Asia Market Attractiveness by End-Use Application, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Flavor, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by End-Use Application, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Flavor, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (MT) Analysis by Flavor, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Flavor, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Flavor, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Application, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (MT) Analysis by End-Use Application, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Application, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Application, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Flavor, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by End-Use Application, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breadcrumbs Market Size and Share Forecast Outlook 2025 to 2035

Bread Emulsifier Market Analysis by Source, Product Type and Application Through 2035

Bread Preservatives Market Insights – Trends & Forecast 2025 to 2035

Bread Improvers Market Outlook - Growth, Demand & Forecast 2024 to 2034

Bread Dough Improver Market

Bread Premix Market

Breadnut Market

Gingerbread Market Size and Share Forecast Outlook 2025 to 2035

Banana Bread Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premix Bread Flour Market Growth - Trends & Applications 2025 to 2035

Lentil Bread Market Analysis by Source, Type, Product Type, Distribution Channel and Region Through 2035

Ezekiel Bread Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Packaged Bread Market Trends - Shelf-Stable Bakery Innovations 2025 to 2035

Market Leaders & Share in the Tortilla Bread Industry

Par-Baked Bread Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Batter and Breader Premixes Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Bread Market

North America Par Baked Bread Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA