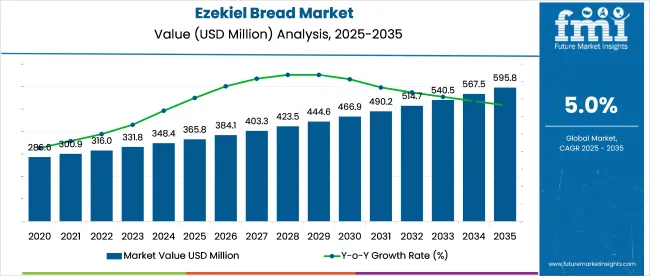

The Ezekiel bread market is projected to expand from USD 365.8 million in 2025 to USD 594.2 million by 2035, registering a CAGR of 5.0% during the forecast period. The market is benefiting from rising consumer preference for sprouted grain-based, low-glycemic, and protein-rich bread alternatives that align with clean-label and whole-food dietary trends.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 365.8 million |

| Projected Industry Value (2035F) | USD 594.2 million |

| Value-based CAGR (2025 to 2035) | 5.0% |

Farmers primarily in the United States and Canada grow wheat, millet, barley, spelt, soybeans, and lentils under non-GMO conditions to meet clean-label certification. These are sprouted and stone-ground in small batches before being cold-pressed into loaves without added sugar or preservatives.

Bakeries operate on batch scheduling due to the perishability of fresh-sprouted mash, often freezing the product immediately after baking to maintain texture and nutrient density. Distribution is centered on frozen logistics, with high footfall seen in natural food stores and subscription-based DTC platforms.

Demand is increasing due to higher protein density and improved digestibility compared to traditional bread. New formulations using chickpeas and flax are being scaled to meet demand from flexitarian consumers and functional food buyers in urban wellness clusters.

As of 2025, the Ezekiel bread market is being positioned as a specialized segment within the broader bakery industry. Around 1-2% of the global whole grain bread market is represented by Ezekiel bread, supported by rising consumer preference for sprouted and high-fiber products.

Within the organic bread category, it contributes approximately 4-6%, as demand grows for minimally processed and non-GMO options. In the functional food market, its share is estimated at 1-2%, driven by the inclusion of complete proteins and natural ingredients. In the clean-label baked goods space, about 3-4% is accounted for by Ezekiel bread. Its presence in the overall packaged bread segment remains niche, capturing close to 0.5-1% globally.

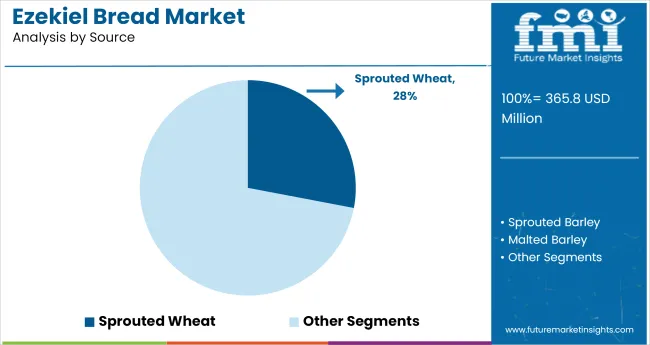

The market is gaining traction due to growing consumer preference for clean-label, nutrient-dense baked goods. Key demand is concentrated in sprouted wheat-based products, organic nature segments, and online retail channels offering better accessibility and convenience.

Sprouted wheat is expected to lead the source category, contributing 28% of the total market by 2025. Its high digestibility, enriched nutrient profile, and lower glycemic index make it a popular ingredient for health-focused consumers. The segment benefits from rising interest in traditional grains with functional health benefits.

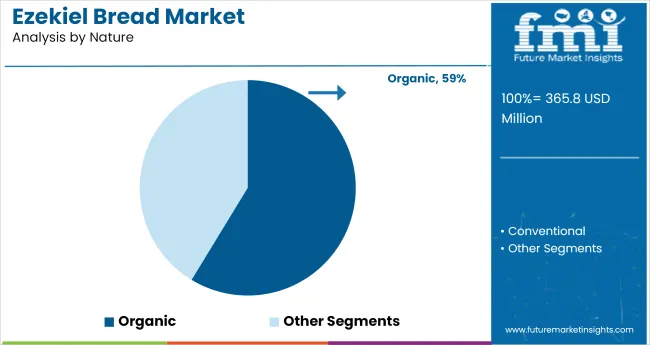

Organic Ezekiel bread is projected to dominate the nature segment, capturing 58.7% of the global market by 2025. Consumers are increasingly choosing organic-certified products that avoid synthetic additives and pesticides. The trend aligns with wider interest in holistic wellness and farm-to-table consumption.

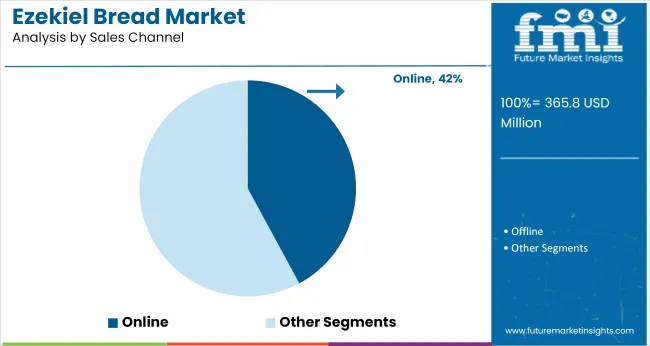

Online platforms are anticipated to account for 42.1% of sales in the market by 2025. E-commerce expansion, especially in health and wellness categories, has made premium bread products more accessible. Direct-to-consumer models and specialty online grocers support further growth.

The market is expanding due to rising demand for clean-label, sprouted grain products in the premium bakery segment. In 2024, global sales exceeded USD 640 million, with North America holding a 56% revenue share. Increased adoption among health-conscious consumers and vegan diets is accelerating retail shelf penetration.

Adoption in Sports Nutrition and Diabetic-Friendly Diets

Due to its low glycemic index and high protein content, Ezekiel bread is increasingly used in meal plans for endurance athletes and diabetic patients. In 2024, dietitians in over 40% of USA wellness clinics recommended sprouted bread options as part of metabolic control regimens. Brands are promoting complete amino acid profiles to target niche nutritional markets.

Production Efficiency and Cold Chain Logistics Impacting Scale-Up

High moisture content and absence of preservatives increase the need for robust cold chain infrastructure. In 2023, over 72% of Ezekiel bread SKUs in the USA were sold frozen. Manufacturers are investing in blast-freezing and modified atmosphere packaging (MAP) to extend shelf life and maintain texture integrity.

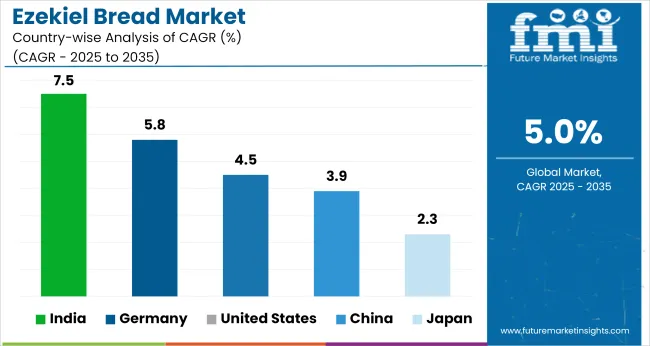

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 7.5% |

| Germany | 5.8% |

| United States | 4.5% |

| China | 3.9% |

| Japan | 2.3% |

Global demand for Ezekiel bread is projected to expand at a 5.0% CAGR between 2025 and 2035. India leads with a growth rate of 7.5%, outpacing the global average by +50%. This rise is backed by rising domestic health-consciousness and increasing urban retail access to sprouted grain products.

Germany follows at 5.8% (+16%), supported by strong demand for organic and minimally processed baked goods. The USA posts a 4.5% CAGR (-10%), a mature market where category penetration is already high. China lags at 3.9% (-22%), hindered by low category awareness and limited shelf presence.

Japan records the slowest growth at 2.3% (-54%), constrained by declining bread consumption and a preference for traditional bakery formats. The contrast in growth patterns suggests BRICS economies like India are shaping the next wave of Ezekiel bread expansion, while mature OECD markets exhibit demand saturation.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

Indian market is forecast to grow at a robust CAGR of 7.5% from 2025 to 2035, driven by rising demand for high-protein and diabetic-friendly baked products. Urban consumers are actively switching to sprouted grain alternatives, greater awareness of glycemic control and gut health. Health food stores and online platforms are expanding their offerings to meet demand from metro regions.

With a projected CAGR of 5.8% from 2025 to 2035, Germany’s Ezekiel bread industry is thriving due to increasing consumer focus on organic and sprouted grain nutrition. Bakers across the country are incorporating ancient grains and seed blends, which appeal to health-aware millennials and vegetarians. Regulatory support for organic certification is also driving adoption.

The market in the United States is anticipated to grow at a CAGR of 4.5% during the forecast period, spurred by greater interest in low-carb and protein-rich dietary patterns. Demand is especially strong among fitness-focused consumers and those following plant-based or paleo diets. Supermarkets and niche health retailers continue to expand shelf space for these products.

China’s market is projected to register a CAGR of 3.9% from 2025 to 2035, supported by the growing urban middle class and their shift toward Westernized health foods. Although still a niche category, Ezekiel bread is gaining visibility in health-conscious urban centers like Shanghai and Beijing. Domestic brands are testing clean-label offerings in limited markets.

Japan is expected to expand at a CAGR of 2.3% from 2025 to 2035, with growth paced by its slowly aging population and conservative bread consumption habits. The small-scale bakeries and natural food cafés in Tokyo and Osaka are introducing sprouted grain bread as a functional wellness item.

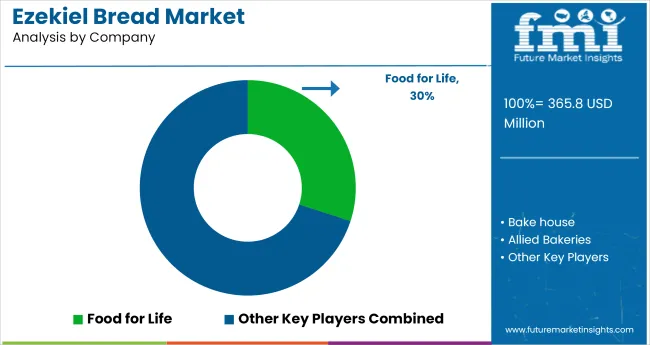

The industry is moderately fragmented, with competition driven by nutritional differentiation, clean-label positioning, and regional distribution strength. Food for Life leads in market share, supported by nationwide USA retail partnerships and a broad sprouted grain product line. Alvarado Street Bakery and Silver Hills Bakery closely compete with strong consumer trust and certified organic claims.

In Canada, ShaSha Bread Co. has carved out a loyal base through probiotic-rich, slow-fermented offerings. In the UK, Allied Bakeries leverages supermarket networks, while Bake House targets niche wellness consumers. Dave’s Killer Bread is rapidly scaling via protein-enriched variants and modern branding. Smaller artisanal brands like Berlin Natural Bakery and Rainbows Health Food contribute to a dynamic, innovation-focused market ecosystem.

Recent Ezekiel Bread Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 365.8 million |

| Projected Market Size (2035) | USD 594.2 million |

| CAGR (2025 to 2035) | 5.0% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for market value |

| Sources Analyzed (Segment 1) | Sprouted Wheat, Sprouted Barley, Malted Barley, Sprouted Millet, Sprouted Spelt, Sprouted Lentils, Sprouted Soybeans |

| Nature Analyzed (Segment 2) | Organic, Conventional |

| Sales Channels Analyzed (Segment 3) | Offline (Supermarkets, Hypermarkets, Department Stores, Convenience Outlets), Online (Brand Websites, E-commerce Platforms) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Food for Life, Bake House, Allied Bakeries, Silver Hills Bakery, Sha Sha Bread Co., Alvarado Street Bakery, Rainbows Health Food, Pepperidge Farm, Panera Bread, Oasis Bread, Berlin Natural Bakery, Dave’s Killer Bread, Other Emerging Players |

| Additional Attributes | Dollar sales by nature and sales channel, growing interest in sprouted grain nutrition, expansion of clean-label bakery offerings, and strong presence in premium health food retail channels. |

Ezekiel bread is produced using a blend of sprouted grains and legumes, including sprouted wheat, sprouted barley, malted barley, sprouted millet, sprouted spelt, sprouted lentils, and sprouted soybeans.

Based on nature, the market is bifurcated into organic and conventional categories to meet varying consumer health and dietary preferences.

In terms of distribution, sales are conducted via offline and online channels. The offline channel comprises supermarkets, hypermarkets, departmental stores, convenience outlets, and other retail formats. The online segment includes brand-owned websites and major e-commerce platforms offering doorstep delivery.

Regionally, the market spans North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, and the Middle East and Africa.

The market is valued at USD 365.8 million in 2025.

The market is forecast to reach USD 594.2 million by 2035.

The market is anticipated to grow at a CAGR of 5.0% from 2025 to 2035.

Organic products dominate with a 58.7% share in 2025.

India is the fastest-growing market, with a projected CAGR of 7.5% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breadcrumbs Market Size and Share Forecast Outlook 2025 to 2035

Bread Emulsifier Market Analysis by Source, Product Type and Application Through 2035

Bread Crumbs Market Growth – Baking & Culinary Trends 2025 to 2035

Bread Preservatives Market Insights – Trends & Forecast 2025 to 2035

Bread Improvers Market Outlook - Growth, Demand & Forecast 2024 to 2034

Bread Dough Improver Market

Bread Premix Market

Breadnut Market

Gingerbread Market Size and Share Forecast Outlook 2025 to 2035

Banana Bread Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Premix Bread Flour Market Growth - Trends & Applications 2025 to 2035

Lentil Bread Market Analysis by Source, Type, Product Type, Distribution Channel and Region Through 2035

Packaged Bread Market Trends - Shelf-Stable Bakery Innovations 2025 to 2035

Market Leaders & Share in the Tortilla Bread Industry

Par-Baked Bread Market Analysis by Product Type, Nature, Flavour Type, Distribution Channel Type, and Processing Type Through 2035

Batter and Breader Premixes Market Size and Share Forecast Outlook 2025 to 2035

Low Calorie Bread Market

North America Par Baked Bread Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA