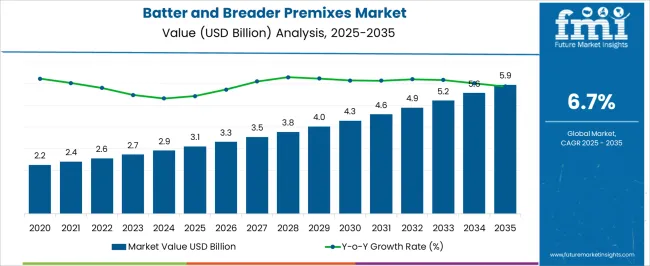

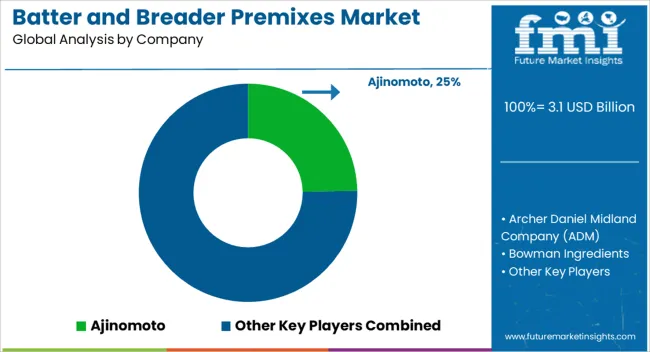

The batter and breader premixes market is estimated to be valued at USD 3.1 billion in 2025 and is projected to reach USD 5.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. The chart indicates consistent expansion in batter and breader premixes, with value rising from 3.1 billion in 2025 to 5.9 billion by 2035 at a 6.7 percent CAGR. Pre 2025 context shows steady gains from 2.2 billion in 2020 to 2.9 billion in 2024, signaling durable demand entering the forecast window. YoY growth tracks in a narrow band and flattens slightly after 2029, which suggests a maturing yet dependable category.

The step up from 3.8 in 2028 to 4.9 in 2032 highlights the period of strongest compounding, helped by foodservice recovery, freezer aisle rotation, and private label expansion. Value mixes benefit from texture systems that enhance adhesion, crunch, and hold time during hot line and air fryer cooking. Regional upside is implied for Asia and the Middle East, where QSR footprints are widening. Risks remain tied to edible oil and wheat price volatility, energy costs in frying operations, and labeling constraints on phosphate or allergen inputs. Suppliers with gluten-free options, clean flavors, and turnkey coating systems should capture share. Retail snacking formats and convenience meals provide incremental volume tailwinds.

| Metric | Value |

|---|---|

| Batter and Breader Premixes Market Estimated Value in (2025 E) | USD 3.1 billion |

| Batter and Breader Premixes Market Forecast Value in (2035 F) | USD 5.9 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The batter and breader premixes market is expanding steadily due to the rising popularity of convenience foods, growing consumption of ready-to-cook meat products, and the global surge in fast food service establishments. Evolving consumer preferences for crispy texture, enhanced flavor, and visual appeal in fried and coated foods are driving demand for customized coating solutions.

Manufacturers are innovating with clean label ingredients, gluten-free formulations, and fortified premixes to cater to health-conscious consumers and evolving dietary patterns. Regulatory focus on food quality and safety has further reinforced the adoption of standardized batter and breader formulations across food processing and hospitality sectors.

The market outlook remains promising as quick-service restaurants and retail brands scale up their product lines with regionally flavored and texture-optimized coating systems tailored to local palates and cooking methods.

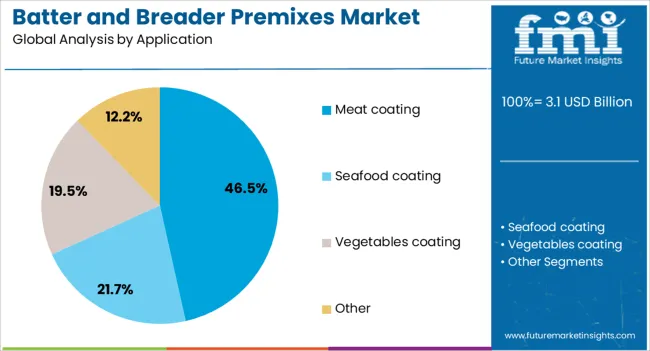

The batter and breader premixes market is segmented by product, application, and geographic regions. By product, the batter and breader premixes market is divided into Batter Type. In terms of application, the batter and breader premixes market is classified into Meat coating, Seafood coating, Vegetables coating, and Other. Regionally, the batter and breader premixes industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The batter type segment is expected to hold a significant share in the product category, contributing prominently to the market due to its widespread use in achieving uniform texture and flavor retention during cooking. Batter premixes are preferred for their ability to form a moisture barrier, prevent oil absorption, and deliver a crispy exterior across various cooking methods.

The segment's prominence is reinforced by rising demand in quick service restaurants, frozen food producers, and industrial kitchens aiming for consistency in coating quality. Continuous innovations in batter formulations, such as gluten-free and tempura-style options, are further enhancing its market appeal.

As a result, batter type remains a dominant product choice in the batter and breader premixes market.

The meat coating application segment is projected to represent 46.50% of total market revenue by 2025, positioning it as the leading application area. This dominance is driven by the growing demand for high-protein meals with enhanced texture and flavor, especially in poultry, seafood, and red meat categories.

Consumers increasingly favor coated meat products for their convenience, taste, and indulgent mouthfeel. Meat processors and quick service restaurants rely on premixes to deliver consistent breading performance, minimize oil uptake, and preserve juiciness.

The expansion of frozen meat offerings and the introduction of globally inspired flavors are further accelerating adoption. With continued innovation and rising protein consumption, meat coating remains the most prominent application within this market.

Demand for batter and breader premixes has been propelled by QSR expansion, frozen meal penetration, and air fryer usage. Processors prefer turnkey predust, batter, and breader systems that standardize adhesion, pickup, color, and crunch while lifting yield. Growth is tempered by commodity volatility, fryer oil management, allergen controls, and energy pressure. Adoption is shifting toward gluten free, rice or pulse based platforms, air fry optimized coatings, and functional starch and fiber systems that extend hold time.

Frozen meals and retail snacks expand use of premixes that standardize adhesion, pickup, color, and crunch. Air fryer adoption encourages low oil pickup systems and rapid browning with stable crumb size. Export momentum in poultry and seafood supports higher yield predust, batter, and breader sets tuned for moisture retention. Private label and co manufacturing prefer turnkey blends that simplify sourcing and audits. Clean label goals move formulas toward rice, corn, and pulse flours with simple declarations. Global rollouts by QSR brands require local flavor maps, consistent bite, and hold time on hot lines, which premix platforms deliver reliably with reheat quality.

Commodity volatility in wheat, corn, rice, edible oils, and spices complicates pricing and contracts. Energy and labor costs raise conversion costs, discouraging premium coatings when margins tighten. Allergen management for gluten, milk, and egg requires segregation, cleaning, and longer changeovers that limit throughput. Acrylamide targets, sodium reduction, and fryer oil management increase reformulation cycles and validation time. Equipment constraints create variability, as batter viscosity, pickup, and crumb adhesion can drift with line speed. Label requirements restrict phosphates, artificial colors, and certain emulsifiers in key channels. Private label bidding pressures dilute differentiation, while in-house mixing by large processors competes with commercial premixes. Export rules and differing additive lists add documentation load, extending lead times for global rollouts and trial schedules.

Air fry optimized coatings with controlled oil pickup, fast color, and resilient crunch are scaling across retail and foodservice. Gluten-free platforms based on rice, tapioca, and pulse flours improve adhesion while keeping simple labels. Functional starches, fibers, and enzymes manage moisture migration, extend hold time, and support reheat quality. Flavor roadmaps diversify toward hot and spicy, Korean style, peri peri, and herb profiles adapted to regional palates. Coatings tailored for plant-based proteins focus on surface binding, juiciness, and color stability during oven or fryer cycles. Data-driven QA monitors crumb size distribution, pickup, cook yield, and texture using inline sensors. Manufacturers expand turnkey offerings, linking pre-dust, batter, breader, and oil programs with training, audit support, and commercialization.

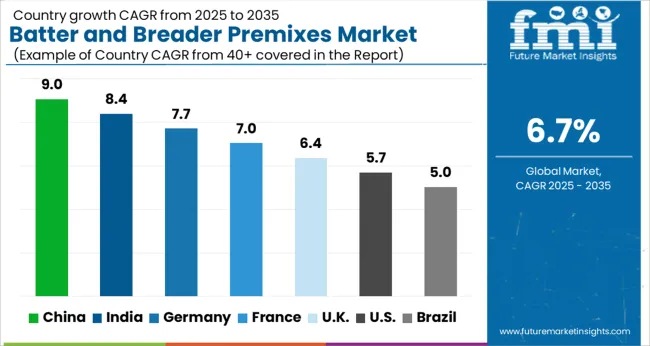

The batter and breader premixes market is projected to grow at a global CAGR of 6.7% from 2025 to 2035, driven by increasing demand for convenient, ready-to-use food products in both commercial and residential sectors. China leads the market with 9.0%, bolstered by its strong food processing industry and rising consumption of fried foods. India follows closely at 8.4%, driven by growth in the foodservice sector and changing consumer preferences. Developed markets like Germany, the UK, and the USA show steady growth, fueled by innovation in food products and the rising popularity of convenience foods. The analysis spans over 40+ countries, with the leading markets shown below.

The batter and breader premixes market in China is projected to grow at a CAGR of 9.0% through 2035. The country’s expansive food processing industry and increasing adoption of fast food, especially fried food, are driving demand. China’s growing middle class, urbanization, and changing consumer lifestyles contribute to a rising preference for convenience and ready-to-use food products. The foodservice sector, particularly quick-service restaurants (QSRs), is a major factor in the increased consumption of batter and breader premixes. Domestic manufacturers have ramped up production capabilities, catering to both the domestic and export markets. The innovation of new flavors and formulations also supports the market's growth, making premixes more attractive to both businesses and consumers.

India is expected to grow at a CAGR of 8.4% through 2035 in the batter and breader premixes market. The growing urban population, the expansion of quick-service restaurants, and rising disposable incomes contribute to the demand for convenient food products. The changing food preferences towards ready-to-eat and processed foods in urban households have spurred the adoption of batter and breader premixes. The expansion of retail channels and the rise of e-commerce platforms in India have made premixes more accessible to a broader consumer base. The increasing popularity of fried snacks and processed foods among Indian consumers is further driving the market growth, coupled with local manufacturers innovating flavors and formulations to cater to regional tastes.

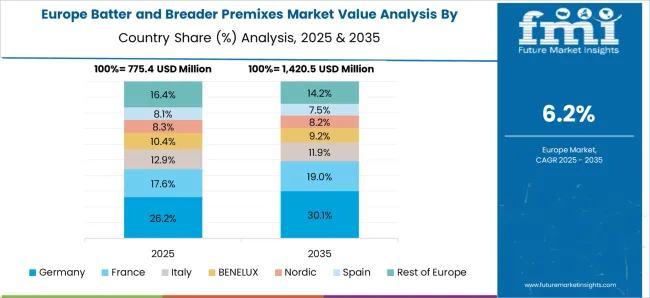

Germany is projected to grow at a CAGR of 7.7% through 2035 in the batter and breader premixes market. As one of Europe’s leaders in food production and processing, Germany benefits from a strong foodservice industry, particularly in quick-service restaurants and the growing popularity of frozen foods. The rising demand for convenience foods, especially in urban areas, is also driving the consumption of premixes. Furthermore, increasing awareness of food quality, innovation in flavor profiles, and a demand for clean-label products are shaping the market. Germany’s focus on food safety and quality standards further boosts the demand for premium and trusted batter and breader premixes, catering to both the retail and foodservice sectors.

The batter and breader premixes market in the United Kingdom is projected to grow at a CAGR of 6.4% through 2035. As consumer demand for convenience and high-quality fast food rises, the UK foodservice industry is turning to ready-to-use products like batter and breader premixes to enhance operational efficiency. The increasing popularity of fried foods, particularly in the takeaway and QSR sectors, contributes to market expansion. The UK also sees growth due to rising consumer interest in premium and innovative food products, including gluten-free and clean-label premixes. The country’s evolving retail landscape, including the rapid expansion of e-commerce, plays a significant role in driving the availability and consumption of batter and breader premixes.

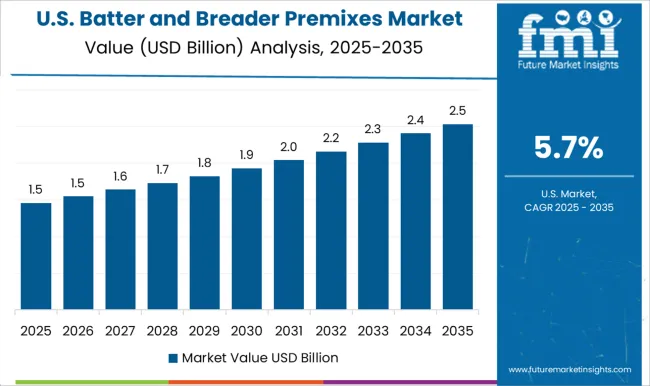

The USA batter and breader premixes market is expected to grow at a CAGR of 5.7% through 2035. The expansion of the foodservice sector, particularly quick-service restaurants and fast-casual dining, is a primary driver of this growth. The increasing preference for convenience foods, especially in the form of ready-to-use cooking products, is propelling the demand for batter and breader premixes. Premium product innovations, such as gluten-free and organic variants, are gaining popularity in the USA market, driving further growth. The rise of e-commerce platforms and the expansion of retail outlets offering convenient meal solutions have made premixes more accessible to a broader range of consumers.

The batter and breader premixes landscape has been led by specialists supplying coating systems and turnkey mixes to processors, QSR, and retail. Ajinomoto offers tempura and coating solutions across foodservice and frozen categories. Archer Daniels Midland Company ADM supports custom blends and bases, leveraging flours, starches, and proteins for coating performance. Bowman Ingredients, part of Solina, supplies batters, breaders, and crumbs for global processors. Breading and Coating Ltd focuses on fried chicken and peri peri style coating mixes for foodservice. House Autry provides branded breading and batter mixes with a strong presence in Southern-style applications. Ingredion delivers starch and texture systems tailored for batters and breadings to improve adhesion, crunch, and hold.

Kerry Group supplies comprehensive coatings through its foodservice brands and plant network. Louisiana Fish Fry serves seafood and fry mixes across retail and foodservice. McCormick offers established coating lines for seafood and fried items. Newly Weds Foods remains a premier global purveyor of customized batters and batters. T. Hasegawa contributes flavor systems for coating concepts, while Tate and Lyle provide functional starches and fibers that upgrade fry performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.1 Billion |

| Product | Batter Type |

| Application | Meat coating, Seafood coating, Vegetables coating, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ajinomoto, Archer Daniel Midland Company (ADM), Bowman Ingredients, Breading & Coating, House Autry, Ingredion, Kerry Group, Louisiana Fish Fry, McCormick, Newly Weds Foods, T. Hasegawa, and Tate & Lyle |

| Additional Attributes | Dollar sales by product type (batter premixes, breader premixes, gluten-free premixes, clean-label premixes) and end-use segments (foodservice, retail, snack food manufacturers, frozen food products). Demand dynamics are driven by the increasing popularity of convenience foods, the rise in demand for gluten-free and healthy food options, and the growing trend of fast food and quick-service restaurants. Regional trends show strong growth in North America and Europe, where consumer demand for quick and easy meal solutions is high, while Asia-Pacific is expanding rapidly due to urbanization and the increasing popularity of Western-style fast foods. Innovation trends focus on enhancing flavor, texture, and oil absorption, and developing natural, functional ingredients to cater to changing consumer preferences. |

The global batter and breader premixes market is estimated to be valued at USD 3.1 billion in 2025.

The market size for the batter and breader premixes market is projected to reach USD 5.9 billion by 2035.

The batter and breader premixes market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in batter and breader premixes market are batter type, _adhesion batter, _tempura batter, _beer batter, _thick batter, _customized batter, _crumbs & flakes, _flour & starch, _pulses, _blends and _other.

In terms of application, meat coating segment to command 46.5% share in the batter and breader premixes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Battery Operated Light Market Forecast and Outlook 2025 to 2035

Battery Voltage Recorder Market Size and Share Forecast Outlook 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Battery Technology Market Size and Share Forecast Outlook 2025 to 2035

Battery Electric Vehicle (BEV) Market Size and Share Forecast Outlook 2025 to 2035

Battery Separator Paper Market Size and Share Forecast Outlook 2025 to 2035

Battery Cyclers Market Size and Share Forecast Outlook 2025 to 2035

Battery Voltage Supervisor Market Size and Share Forecast Outlook 2025 to 2035

Battery Platforms Market Analysis Size and Share Forecast Outlook 2025 to 2035

Battery Management System Market Report – Growth & Forecast 2025-2035

Battery Binders Market Size and Share Forecast Outlook 2025 to 2035

Battery Materials Recycling Market Size and Share Forecast Outlook 2025 to 2035

Battery Packaging Material Market Size and Share Forecast Outlook 2025 to 2035

Battery Energy Storage System Industry Analysis by Battery Type, Connection Type, Ownership, Energy Capacity, Storage System, Application, and Region through 2025 to 2035

Battery Materials Market: Growth, Trends, and Future Opportunities

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Battery Testing Equipment Market Growth – Trends & Forecast 2025 to 2035

Battery Swapping Charging Infrastructure Market Trends and Forecast 2025 to 2035

Battery Leasing Service Market Analysis & Forecast by Business Model, Battery Type, Vehicle Type, and Region Through 2025 to 2035

Batter Mixer Machines Market Analysis by Product Capacity, Application, and Region 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA