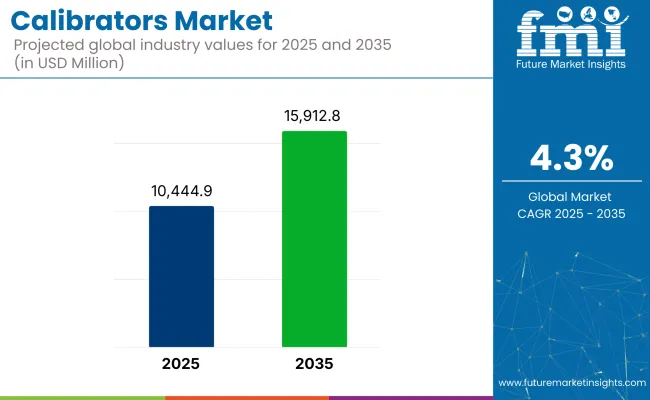

The global calibrators market is poised for steady expansion between 2025 and 2035, driven by increasing demand for precision measurement across industries, technological advancements in calibration devices, and stringent regulatory requirements for quality assurance. The market is projected to reach USD 10,444.9 million in 2025 and grow to USD 15,912.8 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

Calibrators have been in demand in industries seeking a higher degree of precision, instructing manufacturing, healthcare, and aerospace, and are essential devices that ensure measurement devices are exact. Market growth is driven by the adoption of automation and smart factory initiatives. The growing focus on multi-function and digital calibrators, the growing penetration of wireless connectivity and a rise in demand for portable calibration solutions is driving a lot of the innovation in the sector.

Growing stringent regulations and guaranteed error free application, for many industries such as aerospace & defence, food & beverage, automotive, electronics, oil & gas etc., along with focus on quality control, regulatory compliance and reducing operational downtime, have been driving demand for advanced calibrators in application. Also, data logging as well as IoT compatible calibration solutions are benefitting from cloud based technology and increase in industrial applications calling for precision.

Growing demand for precision measurement in various industries, including manufacturing, healthcare, aerospace, introduction of strict regulatory requirements for quality assurance are anticipated to drive the calibrators market demand during the forecast period. Rising adoption automation, smart factory, industry 4.0 driving need for sophisticated calibration solutions.

Furthermore, increasing adoption of multifunction and digital calibrators, growing development of wireless connectivity and tremendous demand for portable calibration equipment are some other factors fuelling the market growth as well.

A number of manufacturers are employing materials that are gritty, resistant to corrosion, and stable in temperature when producing calibrators to improve product life and efficiency. On the other hand, cloud data logging and IoT based calibration solutions are driving accuracy and efficiency at an individual application level across industries.

North America continues to be a significant market for calibrators, facilitated by the growing usage of industrial automation, health care, and aerospace. The stringent regulatory framework of the region, such as ISO and ANSI calibration standards, is fueling the demand for accurate measurement solutions. Rise of smart factories in the USA and Canada is expected to promote demand for automatic and multi-functional calibration devices.

Additionally, wireless and remote calibration technologies are being explored for their ability to streamline the calibration process without sacrificing precision, particularly in sectors like oil & gas, manufacturing, and defense. Importantly, the calibrators market from government investments in quality assurance and industrial optimization is expected to witness a sustained growth in the North America region.

Europe’s calibrators market is expanding due to strict quality control regulations and the region’s strong emphasis on precision manufacturing. The market in Germany is led by countries like France and the UK where high accuracy of measurement instruments is critical in industries like automotive, pharmaceutical, and aerospace.

Regulatory policies in the EU aimed at environmental sustainability and energy efficiency are driving the manufacturers to create innovative calibrators that consume lower energy and longer calibration intervals. Market growth is further propelled by the increasing adoption of Industry 4.0 and the growing demand for automated calibration solutions, with organizations seeking to incorporate smart monitoring and remote calibration into their operations for improved efficiency.

The Asia-Pacific region is experiencing rapid growth in the calibrators market, driven by expanding industrialization, increasing healthcare investments, and strong demand from the electronics and semiconductor industries. China, Japan, South Korea, and India are among the nations taking the lead in the development of automated calibration equipment. Smart manufacturing and the adoption of Industry 4.0 in the region are fuelling the demand for precise calibrators that provide real-time data analytics.

Furthermore, due to these factors, the demand for portable and multi-function calibrators is increasing significantly across various industries such as power generation, automotive manufacturing, and medical device production, thus making Asia-Pacific as a vital growth area.

The Middle East & Africa (MEA) calibrators market continues to witness minor growth due to the expanding industrial sector in the region, along with rising oil & gas exploration, as well as increasing power plants and medical diagnostics. Industries, such as Saudi Arabia, UAE, and South Africa; investing in industrial quality control systems for precise calibration solutions.

As focus on infrastructure development and process automation increases, MEA is anticipated to witness a growing adoption of advanced calibration technologies. Furthermore, the growing regulatory compliance in sectors like pharmaceuticals and environmental monitoring is propelling the market growth.

Challenges

High Cost of Advanced Calibration Equipment

High cost of advanced multi-function & digital calibration systems is expected to hamper growth of the calibrators market over the forecast period. Industries that require calibrators of high precision, like aerospace and medical devices, often encounter budgetary restrictions due to costly equipment purchase and upkeep.

Frequent calibration and certification compliance add to operational costs as well. Manufacturers are working on reducing cost-effective automated calibration solutions with longer calibration time intervals and increasing the durability to meet this concern.

Integration with IoT and Smart Technologies

Automated, cloud-connected solutions are transforming legacy calibration processes, necessitating significant infrastructure overhauls. Some industries still use legacy systems that cannot interface with modern digital calibrators, resulting in slower adoption rates. To address this, manufacturers are heavily investing into hybrid calibration models that interconnect traditional and smart calibration systems.

Opportunities

Advancements in Portable and Multi-Function Calibrators

The demand for portable, multi-function calibrators is creating significant opportunities in the market. Technological developments in lightweight, wireless calibrated are improving utilization in area operations.

On-site testing and maintenance of equipment is witnessing a rise in the demand for compact, battery operated calibrators across sectors including oil & gas, power generation, and One of the key factors driving demand for portable calibration systems is the growing focus on equipment maintenance. The combination of AI with advanced calibration algorithms helps enhance accuracy and avoid human errors while expanding the market prospects.

Rising Demand in Healthcare and Pharmaceutical Industries

The demand for high accuracy calibrators is being driven by the increasing use of precision instruments in the healthcare sector. Imaging systems, diagnostic devices, laboratory instruments, and other medical devices must frequently be calibrated due to strict regulatory standards.

I think with telemedicine replacing face-to-face consultations, and healthcare providers looking to adopt specially calibrated automated diagnostic tools, the need for remote patient monitoring and digital healthcare enterprise solutions will only explode. Pharmaceutical organizations are also focusing on premium calibration systems to ensure strict compliance with GMP.

Between 2020 and 2024, the calibrators market experienced steady growth, driven by the rising demand for high-precision measurement tools, as well as stringent regulatory standards and automation acceptance. The demand for accurate calibration solutions was still driven by fall out industries like aerospace, manufacturing, healthcare, etc.

Related sectors like aerospace, manufacturing, and healthcare that need reliable calibration solutions, also sustained the demand. Digital calibration software, cloud based data logging systems and related technologies also increased efficiencies and compliance.

Looking ahead to 2025 to 2035, the market is expected to evolve with the emergence of AI-integrated calibration solutions, real-time monitoring, and self-diagnostic calibrators. Blockchain-based calibration records will help to increase traceability, alongside advanced nano-sensor-based calibration technologies which will set new standards in accuracy. Moreover, environmentally sustainable and energy-efficient calibration solutions will also find their way as industries strive for sustainability and optimization of operational expenses.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Demand from Industrial & Healthcare Segments | Growing integration of digital calibrators in industrial automation & healthcare domains |

| Shift Toward Smart & IoT-Connected Calibration | Overview of cloud-based calibration data logging and automated calibration solutions. |

| Material Innovations for Durability & Efficiency | Stainless steel and polymer-coated calibrators for enhanced durability. |

| Automated Calibration & Remote Monitoring | Expansion of remote calibration solutions supported with wireless connectivity. |

| Regulatory Compliance & Standardization | Increasing demand for certified calibration solutions due to stringent regulatory frameworks. |

| Growth in Aerospace & Automotive Segments | Growing application of calibrators in precision manufacturing and quality assurance. |

| Market Shift | 2025 to 2035 |

|---|---|

| Demand from Industrial & Healthcare Segments | In biomedical and industrial applications, the expansion of AI-based calibration solutions and real-time monitoring. |

| Shift Toward Smart & IoT-Connected Calibration | Broad adoption of blockchain-based calibration records and nano-sensor-enabled calibration systems. |

| Material Innovations for Durability & Efficiency | The use of advanced nano-materials and self-lubricating coatings to prolong calibration intervals. |

| Automated Calibration & Remote Monitoring | Next-gen AI-powered self-diagnostic calibrators with real-time analytics. |

| Regulatory Compliance & Standardization | Blockchain and digital twin-based calibration system enables improved traceability and compliance. |

| Growth in Aerospace & Automotive Segments | Increasing focus of ultra-high-precision calibrators in autonomous vehicles and aerospace engineering. |

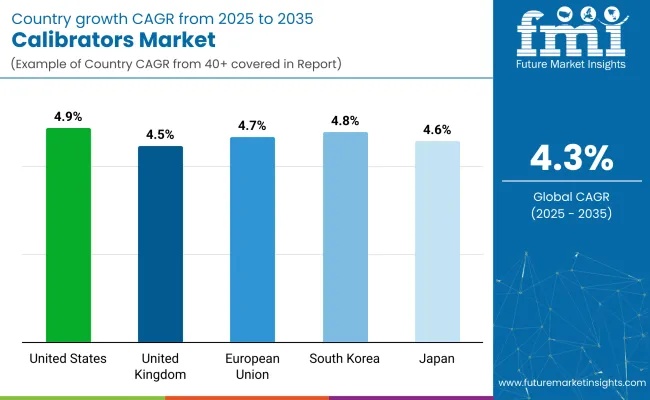

The United States calibrators market is anticipated to grow at a significant CAGR during the forecast period owing to the growing industrial automation, regulatory focus on quality control, advancement in technology of precision measurement. Increased demand of the high accuracy calibrators in automotive, aerospace, healthcare, and manufacturing domains is fuelling market growth. In addition, the rise in the number of smart factories is also, with the introduction of IoT based calibration systems, driving the demand for automated and remote calibration solutions.

Also, strict government regulation mandating the compliance of the organizations to international standards is pushing the organizations to spend on advanced calibration technologies offering maximum quality in products along with operational efficiency.

Key Market Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.9% |

The United Kingdom calibrators market is being propelled by the rise in adoption of digital calibration tools, the increasing investment in high-precision industries, and an increase in government regulations enforcing stringent calibration standards, among others, due to the moderate growth during the period under consideration. The move toward Industry 4.0 and growing use of automated manufacturing also are increasing demand for advanced calibration solutions.

The UK’s robust pharmaceutical and medical device industry is also dependent on high precision calibration equipment to comply with regulatory processes. Expansion of the renewable energy sector, including wind and solar, is generating new business avenues for calibrators used in power generation and distribution applications.

Key Market Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.5% |

The European Union calibrators market is witnessing steady growth, fueled by rising industrial automation, increasing adoption of smart metrology solutions, and stringent environmental and safety regulations. Demand for digital and IoT-enabled calibrators is arising with the European Union's focus energy efficiency and precision manufacturing.

Germany, France, and Italy are lucrative markets, backed by substantial investments in high-accuracy measurement solutions for aerospace, automotive, and healthcare sectors. With the development of smart grid technology and electric vehicle manufacturing, the demand for the precise calibration of power systems and electric battery technologies is anticipated to increase.

Key Market Drivers

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.7% |

Japan’s calibrators market is growing at a steady pace, driven by its strong presence in advanced manufacturing, precision engineering, and automation. Being a major hub of robotics and semiconductor production, has a significant need for ultra-precise calibrators in electronics testing and quality control applications. The increasing popularity of electric and hybrid vehicles is also driving demand for calibration equipment utilized in automotive research and development (R&D) and production. Moreover, with Japan's growing healthcare industry and increasing emphasis on high-tech micro-medical devices, the constant calibration standards for regulatory purpose require accuracy.

Key Market Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

The South Korea calibrators market is expanding due to its leadership in semiconductor manufacturing, electric vehicles, and advanced industrial automation. Increase in digital and connected calibrators demand is propelled by the country's fast-paced acceptance of AI-powered metrology and real-time monitoring solutions. In addition, the precision calibration tools are consequently required to develop and manufacture battery-electric vehicles (BEVs) in South Korea. The market is also broadening as the company invests in high-performance computing, telecommunications and aerospace, which require ever more stringent calibration systems.

Key Market Drivers

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

The AC calibrators segment holds a major share in the calibrators market owing to the high utilization of these calibrators across several industries for calibration of voltage, current, and frequency. Electrical calibrators are essential devices that help in keeping the electrical instruments functional, well calibrated, accurate, and reliable in factories, manufacturing plants as well as in power distribution networks. With their capacity to produce stable and high-precision AC signals, they play a pivotal role in automation, electrical testing, and metrology industries.

The increasing implementation of industrial automation, as well as the strict calibration norms for machines and electrical systems, are driving the need for AC calibrators. Moreover, improved calibration technology with multi-function features and digital interfaces help improve efficiency and reduce human error in industrial applications. The rise of smart manufacturing and movement toward Industry 4.0 will present increasing demand for high-precision AC calibrators.

Handheld calibrators are widely used in process industries and laboratory settings, offering portability and ease of use for field calibration. These devices are used in a number of process control applications within the process industry specializing in the production of chemicals, pharmaceuticals & food products (including sugar and dairy), where ensuring the accuracy of the sensors, transmitters & control system makes up a significant part of the process. They are sought after for onsite troubleshooting and verification due to their small and multi-functional nature.

Handheld calibrators are widely used in laboratories for accurate measurements during research and quality control applications. Stringent requirement of product quality, accuracy of research and research compliance with international testing standards and product is fuelling the demand of these calibrators in the forecast period. The shift towards real-time monitoring and digital calibration solution would lead to greater traction of handheld calibrators with continued development of connectivity and data logging features.

AC calibrators are prominently used in the industrial sector, which is one of the primary end-use segments, thus paving way for growth of the market as more industries moving towards automation and digitalization requires high precision calibration systems. Heavy electrical components, panels, and power grids are dependent on these calibrators to ensure performance and secure operation. The proliferation of industrial automation and smart grid technology has increased the demand for high precision AC calibrators that can perform in harsh environments.

Moreover, national and international industry standards and government regulations for energy efficiency and equipment safety are creating a solid foundation for calibration solutions. Automated AC calibrators with remote monitoring and cloud-based calibration management are increasingly being deployed by industrial players to optimize their operations and reduce downtime. The growing requirements for the AC calibrator in the industrial segment as the automation is taking a center stage are anticipated to promote growth in the market used for AF calibration.

The electrical & electronics sector is another dominant end-use segment for calibrators, particularly single-phase calibrators, which play a crucial role in testing and calibrating consumer electronics, circuit boards, and electrical components. The consumer trend towards ever-increasing numbers of smart devices, IoT-enabled appliances and energy efficient electrical systems is fuelling demand for improved accuracy and reliability in calibration solutions.

As a result of the advancements in various industries, manufacturers operating in this domain are looking forward to investing in sophisticated calibration systems to ensure the accuracy involved in production processes and adherence to the international standards, such as ISO and IEC.

In the era of rapid miniaturization in electronic component technology and a parallel increase of performance and reliability, new design features including automation and digital communication are evolving into crucial functions implemented in a modern single-phase calibrator. This segment will continue to grow owing to the rapid expansion of the consumer electronics market and innovations in semiconductor technology.

The global calibrators market has been witnessing serious growth with businesses giving more preference on operating with higher accuracy and reliability. Calibrations assist in providing the tools to the instruments to provide accurate readings, minimize mistakes and it is also plays a significant role in making part of the regulations. Furthermore, the growing number of automated system applications and demand for strict quality assurance standards across various organizations is acting as a fuel for the market growth.

Some of the major factors driving the market growth are the increasing adoption of digital and multifunction calibrators, IoT-based remote monitoring solutions and technological advancements, as well as the expansion of applications in renewable energy. This pressing need for high precision at the same time contact, -tenacious and easy to use calibrators is encouraging increasingly inventive production for leading makers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Fluke Corporation | 12-15% |

| WIKA Instrument, LP | 9-12% |

| AMETEK Inc. | 8-11% |

| Additel Corporation | 6-9% |

| Beamex Oy Ab | 5-8% |

| Other Companies (combined) | 50-60% |

| Company Name | Key Offerings/Activities |

|---|---|

| Fluke Corporation | Industry leader in electrical, pressure, and temperature calibrators, featuring advanced automation capabilities. |

| WIKA Instrument, LP | Specializes in high-precision pressure calibrators and digital calibration solutions. |

| AMETEK Inc. | Manufactures multifunctional process calibrators for industrial and laboratory applications. |

| Additel Corporation | Creates portable high precision calibration tools with built-in data logging. |

| Beamex Oy Ab | Provides cloud-based automated calibration systems to help streamline processes. |

Key Company Insights

Fluke Corporation

Fluke Corporation is a world leader in electronic test tools and software, with customers in the aerospace, energy, and other manufacturing industries. Automated testing, data logging, and advanced diagnostics all benefit the company’s precision electrical and temperature calibrators with improved reliability. Fluke is investing in Internet of Things (IoT) enabled products that offer remote calibration management, which can drive up operational efficiency as well as minimize downtime.

WIKA Instrument, LP

WIKA is a premier manufacturer of pressure and temperature calibration equipment, known for its high-accuracy instruments. Its temperature calibration solutions serve many industrial applications in oil and gas, pharmaceutical, and power generation. The company is developing digital calibration technology, maintaining compliance with rigorous industry standards while improving ease of use.

AMETEK Inc.

AMETEK offers a wide range of high performance calibration tools, such as multifunction calibrators, for industrial process control. The company designs and manufacturers durable, portable, and easy-to-use calibrators that deliver accurate measurement in the most demanding environments. AMETEK builds its product portfolio around wireless and cloud-enabled calibration solutions for more efficient operations.

Additel Corporation

Additel manufactures portable and high-accuracy calibration devices, which includes integrated data logging along with innovative digital and pressure calibrators. It’s simple and low-weight design makes company use it easy in several industries. Additel is focusing on automation and cloud-based calibration management to improve dependability.

Beamex Oy Ab

Beamex is one of the top providers of calibration software and equipment with its automated calibration solution. It offers multifunction calibrators, and calibration management systems integrated with industrial automation platforms. Data quality plays a critical role in all measurements, and companies should prioritize cloud-based calibration management systems through digital transformation to monitor changes to their products and remain compliant in real-time monitoring.

AC, DC, Single Phase, Three Phase, Handheld, Stationary

Industrial, Electrical & Electronics, Process Industry/Process Control, Power Industry, Auxiliary Manufacturing, Laboratory

North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Middle East & Africa

The global calibrators market is projected to reach USD 10,444.9 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.3% over the forecast period.

By 2035, the calibrators market is expected to reach USD 15,912.8 million.

The electrical calibrators segment is expected to dominate due to the increasing adoption in industries such as aerospace, healthcare, and manufacturing, along with advancements in digital calibration technology.

Key players in the calibrators market include Fluke Corporation, WIKA Instrument, LP, AMETEK Inc., Additel Corporation, and Beamex Oy Ab.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Signal Calibrators Market

Multifunction Calibrators Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA