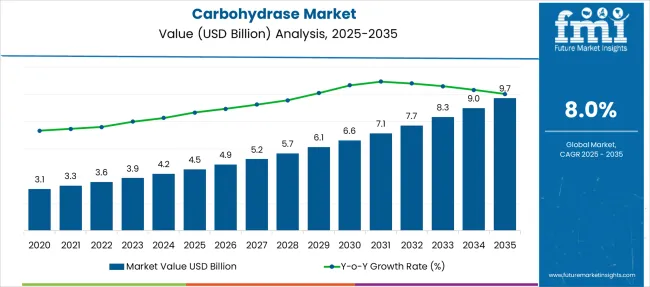

The Carbohydrase Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 9.7 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

| Metric | Value |

|---|---|

| Carbohydrase Market Estimated Value in (2025 E) | USD 4.5 billion |

| Carbohydrase Market Forecast Value in (2035 F) | USD 9.7 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The carbohydrase market is experiencing consistent growth driven by increased demand for functional food ingredients, clean label formulations, and efficient biocatalysts across various industrial processes. Carbohydrases, primarily used to break down complex carbohydrates into simple sugars, are gaining traction in food and beverage manufacturing, biofuel production, and animal feed enhancement.

As consumer awareness rises around digestive health and nutrient absorption, manufacturers are increasingly incorporating enzyme solutions that enhance product quality and functional performance. Advancements in enzyme engineering and fermentation technologies have also enabled the production of more stable and cost effective carbohydrases.

Additionally, the adoption of sustainable processing practices is encouraging the replacement of synthetic additives with bio derived enzyme solutions. The outlook remains strong as industrial applications diversify and innovation in microbial enzyme production continues to reduce costs and improve scalability across global markets.

The carbohydrase market is segmented by source, type, application, and distribution channel and geographic regions. The source of the carbohydrase market is divided into Microbial, Plant, and Animal. In terms of the type, the carbohydrase market is classified into Alpha-amylase, Beta-glucanase, Cellulase, and Others. Based on the application, the carbohydrase market is segmented into Animal Feed, Pharmaceutical, and Others. The distribution channel of the carbohydrase market is segmented into Online and Offline. Regionally, the carbohydrase industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

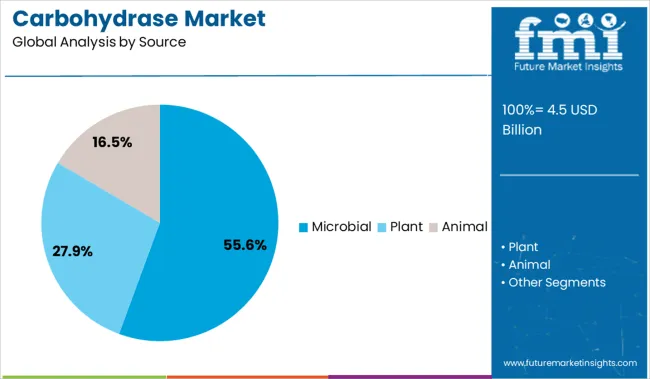

The microbial segment is projected to account for 55.60 percent of total market revenue by 2025 under the source category, positioning it as the leading contributor. This dominance is driven by the efficiency, scalability, and cost effectiveness of microbial fermentation for enzyme production.

Microbial sources, including bacteria and fungi, offer rapid growth cycles, genetic adaptability, and high enzyme yield, making them ideal for large scale industrial applications. Their compatibility with food grade production standards and ability to function under varied pH and temperature conditions have further enhanced their utility.

As manufacturers aim to reduce dependency on animal based enzymes and seek sustainable production methods, the microbial source continues to lead due to its versatility, regulatory compliance, and broad application potential.

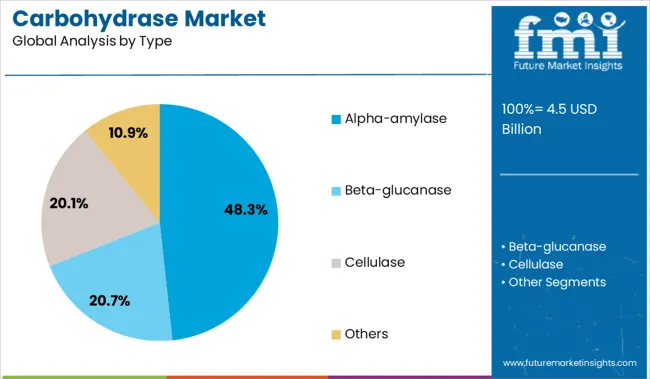

The alpha amylase segment is expected to represent 48.30 percent of market revenue by 2025 within the type category, making it the most significant enzyme variant. This is attributed to its critical role in starch hydrolysis and its widespread application across industries such as baking, brewing, textiles, and bioethanol.

Alpha amylase improves process efficiency by breaking down starches into fermentable sugars, enhancing texture, shelf life, and fermentation control. Its ability to operate across a range of pH levels and processing conditions further increases its appeal in industrial processing.

As the demand for processed and convenience foods grows alongside industrial biofuel production, the utility of alpha amylase continues to drive its market leadership.

The food and beverage segment is projected to hold 46.10 percent of total revenue by 2025 within the application category, positioning it as the dominant end use sector. This leadership is driven by increasing consumer demand for enhanced product quality, improved shelf life, and cleaner ingredient labels.

Carbohydrases are widely used to improve sweetness, dough handling, and flavor profiles in processed foods, baked goods, and beverages. The enzymes contribute to cost reduction and energy efficiency in production while aligning with the shift toward non-synthetic ingredients.

With the growing popularity of functional foods and the need for efficient carbohydrate processing, the food and beverage sector continues to be the largest and most dynamic application area for carbohydrase integration.

Demand for carbohydrase is accelerating across baking, animal feed, and bioethanol production. Sales of multi-enzyme blends are increasing due to improved digestion efficiency and energy yield. Manufacturers are prioritizing thermostable formulations to meet high-performance industrial requirements.

Demand for carbohydrase in animal feed applications grew 19% in 2025, especially in poultry and swine segments. Feed producers in Brazil and India adopted tailored carbohydrase blends to improve starch digestibility and reduce undigested nutrients, cutting feed costs by up to 8%. Trials using xylanase-amylase combinations demonstrated 14% better feed conversion ratios (FCR) in broilers. Thermostable variants capable of withstanding pelleting at 85°C captured more than 33% of new installations. Leading producers began offering pH-flexible enzyme systems optimized for gut microbiota modulation. This shift toward nutrient unlocking under varied digestive conditions is reshaping B2B enzyme procurement strategies in the feed sector.

Sales of carbohydrase for bakery applications rose 23% in 2025, as clean label and shelf-life extension became key purchasing criteria. European bakeries integrated maltogenic amylases to replace chemical softeners, improving crumb resilience while reducing ingredient declarations. In frozen dough and par-baked breads, liquid carbohydrase additions enabled 17% longer freeze-thaw cycles without texture loss. Artisan bread makers in North America adopted fungal-derived carbohydrase to reduce added sugars, aligning with low-GI formulation trends. Plant-based dessert manufacturers also utilized glucoamylase to enhance sweetness from natural starches. This clean processing shift is expanding demand for enzyme systems compatible with organic and additive-free certification.

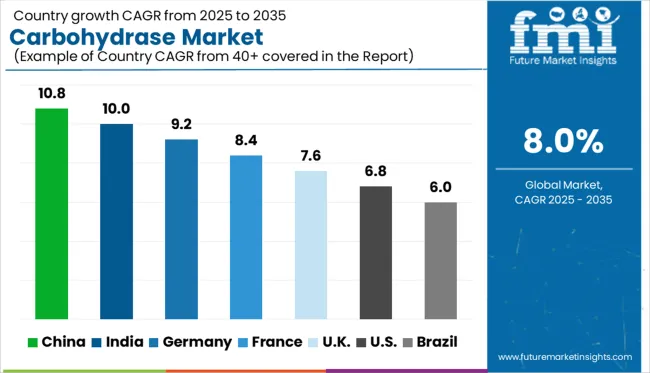

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

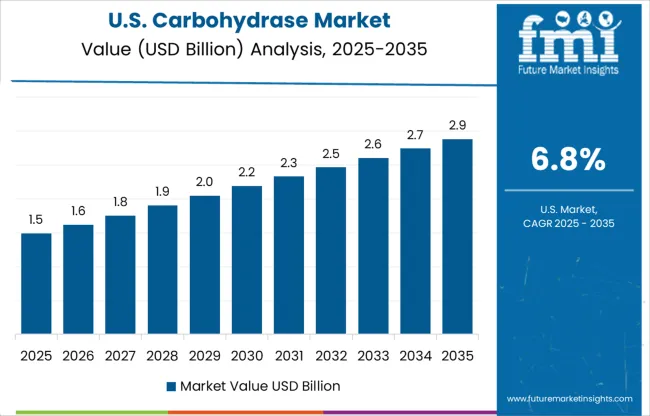

| USA | 6.8% |

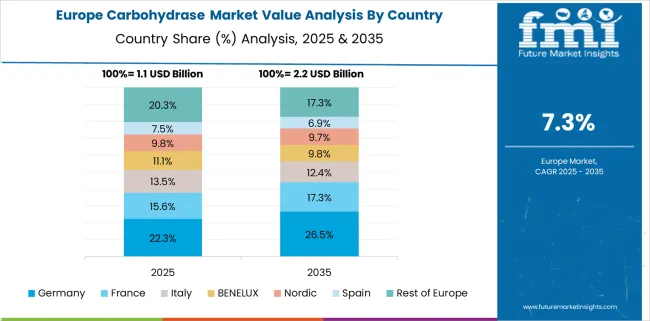

| Brazil | 6.0% |

The global carbohydrase market is expected to expand at a CAGR of 8.0% from 2025 to 2035. China (BRICS) leads with a notable CAGR of 10.8%, outperforming the global average by 2.8 percentage points, supported by high demand in food processing and rapidly scaling animal feed applications. India (BRICS) follows with 10.0% (+2.0 pp), driven by the growth of the packaged food industry and increasing adoption of enzyme-based processing in brewing and textiles. Among OECD countries, Germany shows a CAGR of 9.2% (+1.2 pp), fueled by innovation in enzyme engineering and uptake in dairy and bakery sectors. The UK trails slightly at 7.6% (–0.4 pp), maintaining stable demand in nutraceuticals and infant food. The United States lags at 6.8% (–1.2 pp), due to regulatory complexities and a slower transition toward enzyme-based formulations. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to lead the carbohydrase market with a CAGR of 10.8% between 2025 and 2035, supported by extensive use in animal feed and industrial food processing. Between 2020 and 2024, demand was largely concentrated in poultry and swine feed applications. Moving forward, usage is expected to grow in starch processing and functional foods, aligned with consumer preferences for gut-friendly products.

India’s carbohydrase market is expected to grow at a CAGR of 10.0% from 2025 to 2035, driven by rapid expansion in food & beverage manufacturing and cost-effective enzyme technologies. In 2020–2024, bakeries and breweries dominated the adoption landscape. Over the next decade, packaged food firms and dairy processors are anticipated to increase usage to improve product consistency and digestibility.

Germany is forecast to grow at a CAGR of 9.2% through 2035, supported by demand for clean-label and reduced-sugar food formulations. Between 2020 and 2024, adoption was concentrated in baked goods and brewing industries. Moving forward, pharmaceutical and nutraceutical applications are expected to emerge as strong contributors to revenue growth.

The UK market is anticipated to register a CAGR of 7.6% from 2025 to 2035, with rising demand for enzyme-based solutions across vegan and functional foods. During 2020–2024, demand was primarily driven by artisanal and organic food brands. In the coming decade, broader incorporation across mainstream food producers is expected as enzyme-based solutions reduce processing costs and enhance product profiles.

The USA carbohydrase market is projected to grow at a CAGR of 6.8% between 2025 and 2035, as demand rises in bioethanol production and health-driven food categories. From 2020 to 2024, adoption was primarily focused in grain-based industries and beverage fermentation. Looking forward, the market is expected to diversify into functional ingredients and dietary supplements.

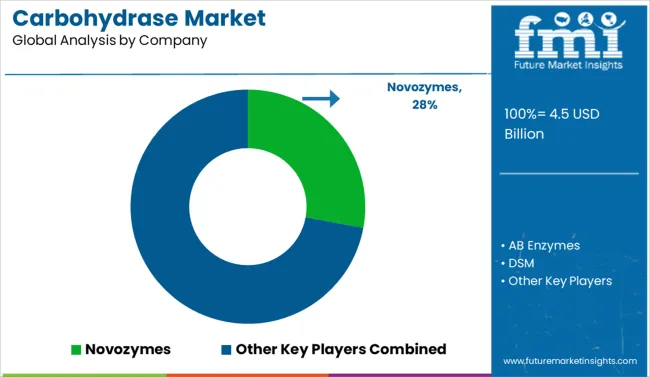

Sales of carbohydrase enzymes are projected to expand steadily through 2025, driven by increased applications in baking, animal feed, and bioethanol. Novozymes dominates the global market with a significant share, underpinned by its extensive carbohydrase portfolio and aggressive positioning in grain processing and feed enzyme blends. AB Enzymes and DSM are key players in the European segment, especially for high-performance amylases and xylanases. DuPont and Amano Enzymes maintain strong positions in North America and Asia respectively, with differentiated offerings in the brewing and textile sectors. Chr. Hansen and Kerry Ingredients are expanding in food-grade carbohydrase solutions. Emerging players like Biocatalysts Ltd. and Green Enzymes are investing in microbial strain engineering, while BioAg and Biome BioSciences are gaining traction in sustainable bioprocessing applications.

In August 2024, AB Enzymes entered a strategic partnership to provide specialized carbohydrate-processing solutions for the pulp and paper industry in Asia, driving regional adoption of its VERON® Polarum enzyme series.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 Billion |

| Source | Microbial, Plant, and Animal |

| Type | Alpha-amylase, Beta-glucanase, Cellulase, and Others |

| Application | Animal Feed, Pharmaceutical, and Others |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Novozymes, AB Enzymes, DSM, DuPont, Amano Enzymes, Chr. Hansen, Kerry Ingredients, Rochem, Biocatalysts Ltd., Genencor International, BBI Enzymes, BioAg (Novozymes), Green Enzymes, Biome BioSciences, and MicroPharm Ltd |

| Additional Attributes | Dollar sales by enzyme type (e.g. amylase, cellulase) and application segment (food & beverage, animal feed, pharma), demand dynamics across conventional versus microbial sources, regional adoption trends (APAC, North America, Europe), innovation in enzyme cocktails and biotech engineering, sustainability impact of substrate sourcing, and emerging uses in biofuels and functional foods. |

The global carbohydrase market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the carbohydrase market is projected to reach USD 9.7 billion by 2035.

The carbohydrase market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in carbohydrase market are microbial, plant and animal.

In terms of type, alpha-amylase segment to command 48.3% share in the carbohydrase market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Feed Carbohydrase Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA