The dehydrating breather market is witnessing consistent growth, supported by increasing demand for reliable moisture control solutions in electrical equipment. Breathers play a crucial role in maintaining oil and air quality in transformers and other industrial systems by preventing moisture ingress.

Market expansion is driven by the growing number of power transmission and distribution projects, especially across developing regions experiencing rapid electrification. Rising emphasis on equipment longevity, reduced maintenance costs, and energy efficiency is also contributing to market demand.

Technological enhancements such as self-reactivating desiccants and condition monitoring features are improving performance reliability. With growing investments in renewable energy and grid modernization, the dehydrating breather market is positioned for continued steady growth in the coming years.

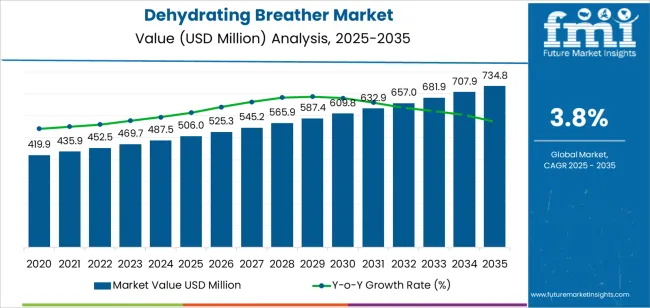

| Metric | Value |

|---|---|

| Dehydrating Breather Market Estimated Value in (2025 E) | USD 506.0 million |

| Dehydrating Breather Market Forecast Value in (2035 F) | USD 734.8 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

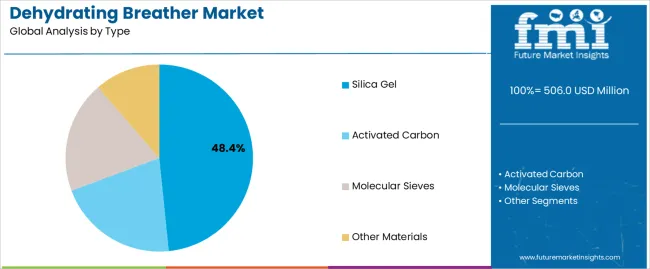

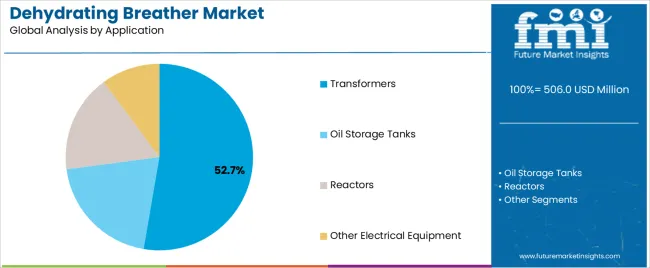

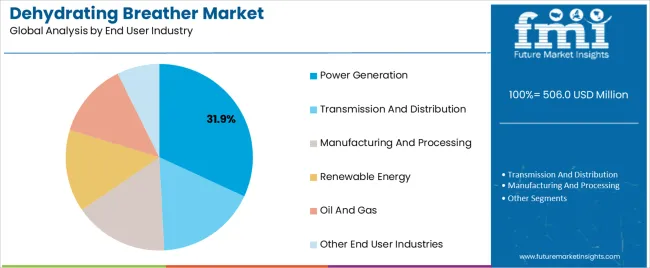

The market is segmented by Type, Application, and End User Industry and region. By Type, the market is divided into Silica Gel, Activated Carbon, Molecular Sieves, and Other Materials. In terms of Application, the market is classified into Transformers, Oil Storage Tanks, Reactors, and Other Electrical Equipment. Based on End User Industry, the market is segmented into Power Generation, Transmission And Distribution, Manufacturing And Processing, Renewable Energy, Oil And Gas, and Other End User Industries. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The silica gel segment holds approximately 48.4% share in the type category, reflecting its widespread use due to high moisture absorption capacity and cost-effectiveness. Silica gel’s ability to maintain low humidity levels and regenerate easily has made it the preferred choice for standard transformer applications.

The segment benefits from its simplicity, wide availability, and proven reliability in protecting oil insulation systems. Continuous demand from utilities and industrial sectors, coupled with low operational costs, reinforces its market dominance.

With growing efforts to improve transformer performance and reduce downtime, silica gel breathers are expected to retain a leading position throughout the forecast period.

The transformers segment dominates the application category with approximately 52.7% share, driven by the critical role of dehydrating breathers in extending transformer lifespan and maintaining dielectric strength of insulating oil. Moisture control is essential in preventing degradation and minimizing the risk of electrical failure.

Widespread deployment of distribution and power transformers in transmission networks supports sustained demand for breathers. Increased focus on grid reliability, coupled with modernization of aging infrastructure, continues to fuel adoption.

With expanding power generation capacity worldwide, the transformers segment is projected to remain the core application area for dehydrating breathers.

The power generation segment represents approximately 31.9% share of the end user industry category, supported by rising investment in conventional and renewable energy facilities. Reliable transformer operation is vital in power plants where consistent voltage management and equipment safety are paramount.

Dehydrating breathers ensure uninterrupted performance by maintaining optimal moisture balance within transformer systems. The segment’s growth is further enhanced by the increasing installation of step-up transformers in solar and wind farms.

With ongoing global energy transition and capacity expansion projects, the power generation segment is expected to sustain its market share over the forecast horizon.

The conventional dehydrating breather market was valued at USD 419.9 million in 2020. Over the following five years, the CAGR for sales of dehydrating breathers was 5.7%. The overall market reached a valuation of USD 506 million in 2025.

According to the global dehydrating breathers strategic business report, the initial outbreak caused supply chain disruptions and temporarily slowed down breather installation and maintenance operations. However, interest in smart dehydrating breathers surged during this period due to a spike in remote monitoring and maintenance solutions.

| Attributes | Details |

|---|---|

| Dehydrating Breather Market Value (2020) | USD 419.9 million |

| Market Revenue (2025) | USD 506 million |

| Market Historical Growth Rate (CAGR 2020 to 2025) | 5.7% CAGR |

As industrialization is rapidly increasing in Asian and Latin American economies, there is a greater need for transformers, resulting in higher sales of dehydrating breathers in many developing markets in these regions.

Vented breather applications for energy security and resilience in diverse industries, including manufacturing, construction, and information technology, are expected to expand within the breather filter market.

Industry-wide efforts to promote environmental sustainability are encouraging the reduction of dust contamination in transformers by employing better desiccant formulations and sealed system breather housings.

Likewise, the adoption of nitrogen-sealed breathers is expected to rise further by eliminating the chance of transformer oil leaks and pollution, thus keeping impurities out.

The section below represents the general trends and opportunities in two other adjacent markets through 2035 for easy comparison. The sales growth in the power transformer market is expected to impact the demand for dehydrating breathers directly.

On the other hand, the robust growth of the transformer monitoring system market hints at the expected technological advancements in the dehydrating breather sector.

Dehydrating Breather Market:

| Attributes | Dehydrating Breather Market |

|---|---|

| CAGR (2025 to 2035) | 3.8% |

| Growth Factor | By limiting moisture intrusion and alleviating energy transmission issues, dehydrating breathers help transformers last longer |

| Market Opportunities | The inclusion and use of wireless monitoring tools with dehydrating breathers allow for real-time evaluation, intervention, and reduction of downtime |

| Market Challenges | The market expansion is anticipated to be hampered by fluctuations in the cost and supply of raw materials used in the making of desiccants |

Power Transformer Market:

| Attributes | Power Transformer Market |

|---|---|

| CAGR (2025 to 2035) | 5% |

| Growth Factor | The fast growth of the power distribution networks in emerging nations with the intention to electrify rural areas rapidly |

| Market Opportunities | There is a rise in the production and sales of low-cost transformers that can be deployed in apartments, small residential, and commercial areas |

| Market Challenges | Strict regulations limiting the use and disposal of transformer oils are being implemented in response to the growing environmental consciousness |

Transformer Monitoring System Market:

| Attributes | Transformer Monitoring System Market |

|---|---|

| CAGR (2025 to 2035) | 8.9% |

| Growth Factor | Transformer monitoring systems have the capacity to offer real-time data for operational safety, maintenance, and dependability |

| Market Opportunities | Growing industrial facilities and manufacturing units require uninterrupted power supply for a range of processes |

| Market Challenges | The higher installation and operation costs of power transformer monitoring systems are anticipated to limit market expansion |

The table below puts together the CAGRs for countries that are expected to witness higher production of dehydrating breathers during the forecast years.

| Regional Market Comparison | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

| Japan | 3.1% |

| United Kingdom | 5.3% |

| South Korea | 5.6 % |

| China | 4.7% |

Demand for dehydrating breathers in the United States is expected to increase at a 4.2% CAGR through 2035. The net worth of the United States market is projected to be around USD 128.2 million by the end of the forecast period.

The dehydrating breather market in the United Kingdom is expected to witness a moderate CAGR of 5.3% from 2025 to 2035. The net worth of the United Kingdom market is forecasted to be USD 734.8 million in 2035.

The demand for dehydrating breathers is likely to surge at a 4.7% CAGR through 2035 due to expanding power transmission and distribution networks. By the end of this forecast period, the net worth of the market in China is forecasted to be USD 113.7 million.

Manufacturing and utilization of dehydrating breathers in Japan are likely to increase at a CAGR of 3.1% through 2035. The overall market share of Japan is projected to be valued at USD 62.7 million by 2035.

With a projected CAGR of 5.6%, the dehydrating breather market in South Korea is expected to expand at a higher rate in the Asia Pacific region. The regional market is further projected to reach a valuation of USD 42.1 million by the end of this forecast period.

The power generation sector is expected to hold a significant market share in 2025, making it the top end user industry category in the dehydrating breather market. Over the projected years, this segment is likely to inflate at a CAGR of 3.3%, according to the market analysis.

| Attributes | Details |

|---|---|

| Top End User Industry Type or Segment | Power Generation |

| Market Segment Growth Rate from 2025 to 2035 | 3.3% CAGR |

| Market Segment Growth Rate from 2020 to 2025 | 5.3% CAGR |

Silica gel is the most commonly used material type in dehydrating breathers, capturing more than 50% of the conventional dehydrating breather market size. This segment is anticipated to expand further with a CAGR of 3.6% between 2025 and 2035.

| Attributes | Details |

|---|---|

| Top Material Type or segment | Silica Gel |

| Market Segment Growth Rate from 2025 to 2035 | 3.6% CAGR |

| Market Segment Growth Rate from 2020 to 2025 | 5.5% CAGR |

Conventional dehydrating breather industry players are enhancing pressure swing adsorption (PSA) cycles to remove moisture more effectively while using less energy. New market players are utilizing 3D printing technology to produce breather housings, resulting in adaptable breather designs with maximum moisture collection and airflow efficiency.

Recent Developments in the Dehydrating Breather Market

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 506.0 million |

| Projected Market Size (2035) | USD 734.8 million |

| Anticipated Growth Rate (2025 to 2035) | 3.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America, Latin America, Europe, Middle East & Africa (MEA), East Asia, South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Material Type, By Application, By End User Industry, and By Region |

| Key Companies Profiled |

|

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global dehydrating breather market is estimated to be valued at USD 506.0 million in 2025.

The market size for the dehydrating breather market is projected to reach USD 734.8 million by 2035.

The dehydrating breather market is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in dehydrating breather market are silica gel, activated carbon, molecular sieves and other materials.

In terms of application, transformers segment to command 52.7% share in the dehydrating breather market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breather Bags Market Size and Share Forecast Outlook 2025 to 2035

Oil Breather Tank Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA