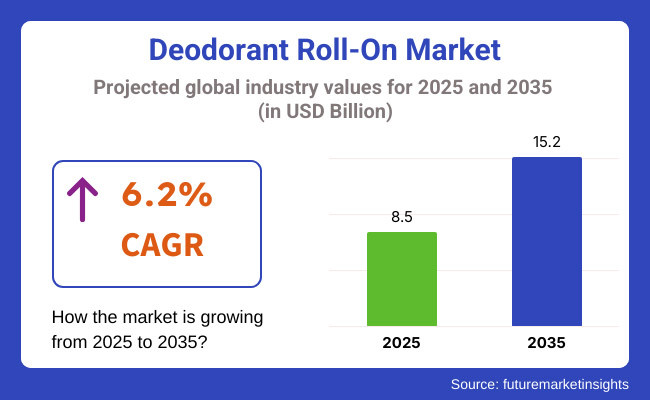

The deodorant roll-on market is projected to experience significant growth between 2025 and 2035, driven by increasing demand for personal hygiene products, natural ingredient formulations, and long-lasting odor protection. The market is expected to expand from USD 8.5 billion in 2025 to USD 15.2 billion by 2035, reflecting a CAGR of 6.2% over the forecast period.

Growing consumer preference for alcohol-free, dermatologically tested, and skin-friendly deodorant roll-on will fuel demand. Also, the rising fashionability of organic and aluminum-free deodorants among health-conscious consumers will drive innovation in the industry. Sustainable packaging, refillable options, and eco-friendly phrasings will further shape the future of the deodorant roll-on market.

North America will remain a dominant market for deodorant roll-on due to a strong culture of particular hygiene, adding demand for natural phrasings, and innovative product launches. Consumers in the United States and Canada are shifting towards aluminium-free, paraben-free, and cruelty-free deodorants, which has led to the expansion of organic and vegan product lines.

Also, the rise of sustainable and refillable deodorant roll-ons will drive further market relinquishment. E-commerce growth and subscription-grounded deodorant models will enhance availability, with leading brands partnering with influencers and dermatologists to strengthen their market position.

Europe will witness steady growth, fuelled by eco-conscious consumer geste and strict regulations on ornamental constituents. Countries similar to Germany, France, and the UK will see an increased demand for natural, alcohol-free, and anti-bacterial deodorant roll - on.

Sustainability will be a major focus, with biodegradable packaging and refillable deodorants gaining fashionability. European consumers prefer mild, dermatologically tested deodorants, pushing brands to introduce hypoallergenic and sensitive-skin-friendly phrasings. Also, the men’s fixing member is expanding, leading to a rise in gender-specific deodorant products.

Asia-Pacific is anticipated to be the fastest-growing region, driven by rising disposable incomes, urbanization, and growing mindfulness of personal hygiene. Countries similar as China, India, and Japan will see a swell in demand for affordable and long-lasting deodorant roll-on, particularly in hot and sticky climates where sweat control is a precedence.

The region’s growing middle-class population is driving demand for decoration, skin-friendly, and natural deodorant roll-on. Original and transnational brands are investing in herbal and Ayurveda deodorant products to cater to indigenous preferences. Also, the rise of e-commerce and social media-driven beauty trends is accelerating market expansion.

Challenges

One of the main challenges in the deodorant roll-on market is competition from indispensable deodorant formats similar to sprays, sticks, and solid deodorants. Some consumers prefer aerosol sprays for quick drying, while others prefer deodorant creams or maquillages for customized application. This competition may impact the deal growth of roll-on in certain markets.

Also, nonsupervisory scrutiny on constituents such as parabens, phthalates, and aluminum composites requires brands to reformulate products to meet safety and environmental norms. Companies must continuously acclimate to evolving regulations and invest in clean-marketing phrasings to maintain consumer trust.

Opportunities

The increasing demand for sustainable deodorant results presents a significant growth opportunity. Consumers are laboriously seeking refillable, biodegradable, and plastic-free deodorant roll-on, encouraging brands to develop eco-friendly packaging and zero-waste practices. Brands that integrate sustainability with long-lasting door protection will gain a competitive edge.

Another crucial occasion lies in the development of functional deodorants that offer added skin benefits, such as miniaturization, soothing parcels, and skin-cheering goods. Probiotic-invested deodorants, vitamin-amended formulas, and sensitive-skin-friendly options will appeal to a growing number of health-conscious consumers looking for more than just odor control.

| Country | United States |

|---|---|

| Population (millions) | USD 345.4 Million |

| Estimated Per Capita Spending (USD) | 18.40 |

| Country | China |

|---|---|

| Population (millions) | USD 1,419.3 Million |

| Estimated Per Capita Spending (USD) | 7.60 |

| Country | United Kingdom |

|---|---|

| Population (millions) | USD 68.3 Million |

| Estimated Per Capita Spending (USD) | 16.90 |

| Country | Germany |

|---|---|

| Population (millions) | USD 84.1 Million |

| Estimated Per Capita Spending (USD) | 15.50 |

| Country | Japan |

|---|---|

| Population (millions) | USD 125.1 Million |

| Estimated Per Capita Spending (USD) | 13.80 |

The USA has a well-established deodorant roll-on the market, driven by particular hygiene mindfulness and strong consumer brand fidelity. Leading brands similar to Dove, Secret, and Old Spice dominate, while natural and aluminium-free phrasings gain traction. E-commerce platforms, supermarkets, and apothecaries contribute to wide product variety.

China’s market is expanding as youngish consumers embrace Western grooming habits and demand for decoration and long-lasting roll-on deodorants grows. Transnational brands like Nivea and Rexona dominate, but original brands are gaining attention with herbal and skin-sensitive phrasings. E-commerce platforms like Tmall and JD.com are crucial deal channels

In the UK, sustainability is a major trend, with an added demand for eco-friendly packaging and aluminum-free roll-on. Unisex and gender-neutral products are popular, and major retailers like Thrills and Superdrug ensure availability. Subscription-grounded grooming services are also impacting copping patterns.

Germany’s market is characterized by demand for dermatologically tested, hypoallergenic, and alcohol-free roll-on deodorants. Organic and vegan-pukka options are gaining fashion ability, particularly among eco-conscious consumers. German brands similar to Nivea and Sebamed lead in invention and market share.

Japan’s deodorant roll-on market thrives on mild, skin-friendly, and sweat-resistant phrasings suitable for sticky climates. Compact and travel-friendly packaging is largely favored. Convenience stores and beauty retailers like Don Quijote play a significant part in product distribution, while transnational brands acclimate their innovations to meet original preferences.

The roll-on deodorant category keeps growing as consumers increasingly demand long-lasting freshness, gentle, skin-friendly ingredients, and sustainability. According to a survey of 300 North American, European, and Asian consumers, there are key trends that are influencing shopping behaviour.

Long-lasting protection is an issue, with 72% of the respondents looking for deodorant roll-ons to last 24 hours or more in odor control. This is most prevalent in North America (75%), with customers looking for dependable sweat and odor protection on a daily basis.

Mild and dermatologically tested products are gaining traction, with 64% of consumers wanting alcohol-free and sensitive-skin-friendly roll-ons. The trend is most prominent in Europe (67%), as hypoallergenic and organic deodorants gain popularity.

Organic and natural ingredients influence purchase, with 58% choosing deodorant roll-ons that use plant-based or aluminum-free formulation. The trend is most prominent in Asia (60%), as herbal and toxin-free offerings go mainstream.

Decision-making is guided by sustainability and innovation in packaging, with 55% of the respondents preferring roll-ons that come in recyclable or refillable packaging. Zero-waste and biodegradable packaging drives market trends, especially in Europe (60%).

Subscription-based models and internet purchases are increasing, with 63% of the respondents willing to purchase deodorant roll-ons from e-commerce portals. In Asia (65%), online sales are increasing based on convenience, availability, and individualized recommendations.

With the growing demand for long-lasting, skin-safe, and environmentally friendly deodorant roll-ons, businesses targeting sustainability, dermatological value, and new formulation technology are set to gain from market expansion.

| Market Shift | 2020 to 2024 |

|---|---|

| Ingredient Innovation | Growth in aluminium-free, paraben-free, and alcohol-free roll-on deodorants. Increased demand for natural and organic ingredients like bamboo charcoal, probiotics, and essential oils for door control. |

| Sustainability & Circular Economy | Brands introduced refillable roll-on deodorants and plastic-free, biodegradable packaging. Increased use of vegan and cruelty-free formulations to align with ethical consumerism. |

| Smart Features & Technological Advancements | Growth of sensitive skin formulations with skin-nourishing ingredients like aloe vera and hyaluronic acid. Development of quick-drying, stain-resistant formulas to prevent marks on clothing. |

| Market Expansion & Consumer Adoption | Increased demand for gender-neutral and unisex deodorant roll-ons. Rise in travel-friendly, mini-sized roll-ons. Growth of direct-to-consumer (DTC) brands selling subscription-based deodorants. |

| Regulatory & Compliance Standards | Stricter global regulations on aluminum salts and artificial fragrances in deodorants. Growth in demand for USDA Organic, ECOCERT, and dermatologist-approved roll-ons. |

| Customization & Personalization | Brands launched AI-powered scent selectors to match fragrances with personal body chemistry. Growth in mix-and-match deodorant bases and scents for custom roll-on experiences. |

| Influencer & Social Media Marketing | Beauty and wellness influencers promoted natural and sustainable deodorant roll-ons on TikTok, Instagram, and YouTube. Brands used interactive social commerce to boost engagement. |

| Consumer Trends & Behavior | Consumers prioritized long-lasting protection, skin sensitivity, and eco-friendly deodorants. Demand increased for fragrance-free, essential oil-based, and sweat-proof roll-ons. |

| Market Shift | 2025 to 2035 |

|---|---|

| Ingredient Innovation | AI-optimized deodorant formulations adapt to individual skin chemistry for longer-lasting odor protection. Lab-grown, bioengineered sweat-absorbing compounds replace synthetic alternatives. Smart roll-on formulas adjust based on temperature and activity level. |

| Sustainability & Circular Economy | Zero-waste deodorant roll-ons dominate the market. Blockchain-backed transparency ensures ethical and sustainable ingredient sourcing. Waterless roll-on deodorants reduce carbon footprint in production and shipping. |

| Smart Features & Technological Advancements | AI-driven sweat analysis apps recommend personalized deodorant roll-ons. pH-balancing and microbiome-friendly deodorants prevent body odor at the source. Temperature-sensitive roll-ons release active ingredients in response to body heat. |

| Market Expansion & Consumer Adoption | Hyper-personalized deodorant roll-ons adapt to climate and activity level. 3D-printed, on-demand deodorant formulations cater to individual preferences. Deodorant-infused skincare hybrids combine sweat protection with skin conditioning. |

| Regulatory & Compliance Standards | The government mandates for full transparency in ingredient labeling. AI-powered compliance tracking ensures adherence to sustainability and safety standards. Standardized carbon footprint labeling on deodorant packaging. |

| Customization & Personalization | 3D-printed, refillable roll-on deodorant pods allow personalized ingredient combinations. Adaptive deodorants with AI-based sweat level detection adjust strength based on humidity and exertion. On-demand, custom fragrance blending tailors scents to user preferences. |

| Influencer & Social Media Marketing | AI-generated virtual influencers promote personalized, smart deodorant solutions. Augmented reality (AR) scent trials let users experience fragrances digitally before purchase. Metaverse-based wellness hubs offer interactive product education and consultations. |

| Consumer Trends & Behavior | Biohacking-inspired deodorant roll-ons integrate AI-driven hydration and pH monitoring. Consumers embrace multi-functional, AI-personalized sweat protection solutions that adapt to skin health, climate, and personal scent preferences. |

The USA deodorant roll-on market is witnessing steady growth, driven by the demand for long-lasting newness, rising preference for aluminium-free and natural formulations, and the expansion of decoration and dermatologist-approved brands. Major players include Dove, Secret, and Native.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

The UK deodorant roll-on market is expanding due to the increasing demand for sustainable and cruelty-free deodorants, rising interest in skin sensitivity, and the influence of decorative particular care brands. Leading brands include Mitchum, Nivea, and Sure.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.2% |

Germany’s deodorant roll-on market is growing, with consumers favoring dermatologist-tested, scent-free, and anti-irritation formulas. Crucial players include Nivea, Sebamed, and Weleda.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.4% |

India’s deodorant roll-on market is witnessing rapid-fire growth, fueled by adding disposable inflows, rising demand for sweat control results, and growing mindfulness of long-lasting newness. Major brands include Nivea, Engage, and Yardley.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.8% |

China’s deodorant roll-on market is expanding significantly, driven by adding disposable inflows, growing demand for decoration and natural deodorants, and strong influence from transnational particular care trends. Crucial players include Rexona, Adidas, and Biotherm.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.0% |

Consumers are increasingly considering deodorant roll-on due to their long-lasting odor protection, ease of operation, and quick absorption. The growing mindfulness of particular hygiene and grooming habits, especially in civic areas, continues to drive market demand. Both men and women prefer roll-on deodorants for their non-sticky texture and dependable sweat control

The market is witnessing a swell in demand for deodorant roll-on formulated with natural and skin-sensitive constituents. Consumers are shifting toward aluminum-free, alcohol-free, and paraben-free variants to avoid skin irritation and long-term health concerns. Brands are incorporating botanical extracts, essential oils, and skin-nutritional factors to feed into this preference.

The rapid-fire expansion of e-commerce platforms has made deodorant roll-on more accessible to consumers worldwide. Online retailers, subscription models, and brand-possessed DTC(direct-to-consumer) websites give a wide range of options, competitive pricing, and individualized recommendations, boosting product relinquishment.

As environmental enterprises grow, manufacturers are fastening on sustainable packaging results similar to recyclable, refillable, and biodegradable roll-on holders. The drive for eco-conscious products aligns with consumer preferences, leading to increased demand for sustainable deodorant roll-on in global markets.

The deodorant roll-on market is witnessing steady growth, driven by consumer demand for long-lasting newness, skin-friendly phrasings, and natural constituents. The rise in mindfulness about particular hygiene, growing preference for aluminum-free and organic deodorants, and advancements in scent technology are crucial for motorists. Companies are fastening on skin- conditioning agents, antibacterial protection, and dermatologically tested formulas to feed to different consumer preferences.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Unilever | 22-26% |

| Procter & Gamble | 16-20% |

| Beiersdorf (Nivea) | 12-16% |

| L’Oréal | 8-12% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Unilever | Market leader with brands like Rexona, Dove, and Axe, offering long-lasting protection and moisturizing roll-ons. Focuses on aluminum-free, 48-hour protection, and eco-friendly packaging. |

| Procter & Gamble | Offers roll-on deodorants under brands like Old Spice and Secret, featuring sweat-activated technology and invisible protection. Expanding into all-natural and gender-neutral formulas. |

| Beiersdorf (Nivea) | Specializes in skin-care-based roll-on deodorants with gentle and nourishing ingredients. Develops alcohol-free, quick-drying, and sensitive skin formulas for daily use. |

| L’Oréal | Targets premium and dermatologist-backed roll-on deodorants with a focus on skincare benefits, offering anti-irritation and extra-fresh formulas under brands like Vichy. |

Strategic Outlook of Key Companies

Unilever (22-26%)

Unilever continues to dominate the deodorant roll-on market with its strong brand portfolio, including Rexona (Sure), Dove, and Axe. The company is innovating in sweat-control technology, developing aluminum-free variants, and investing in sustainable packaging. With a growing focus on plant-based ingredients and cruelty-free certifications, Unilever is enhancing its appeal among eco-conscious consumers.

Procter & Gamble (16-20%)

P&G is strengthening its roll-on deodorant members with inventions in odor-negativing technology, skin-soothing phrasings, and gender-inclusive marketing. The company is expanding its Secret and Old Spice brands with clinical- strength roll- on and non-irritating formulas designed for sensitive skin.

Beiersdorf (Nivea) (12-16%)

Beiersdorf focuses on skin-friendly roll-on deodorants, offering alcohol-free, anti-perspirant, and moisturizing formulas. With an emphasis on dermatological exploration, the company is expanding its Nivea range with organic extracts, anti-stress sweat protection, and scent-free variants.

L’Oréal (8-12%)

L’Oréal is targeting the decoration and dermatological market with high-quality roll-on deodorants, emphasizing anti-irritation and skincare benefits. The company is integrating thermal water-grounded and paraben-free results under brands like Vichy, appealing to health-conscious and luxury consumers.

Other Key Players (30-40% Combined)

Several emerging and established brands contribute to the deodorant roll-on market, offering innovative, natural, and budget-friendly solutions:

Alcohol-Based Roll-Ons, Alcohol-Free Roll-Ons, Antiperspirant Roll-Ons, Natural/Organic Roll-Ons, and Others.

Chemical-Based, Plant-Based, and Hybrid.

Supermarkets/Hypermarkets, Specialty Stores, Pharmacies/Drug Stores, Online, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Deodorant Roll-On industry is projected to witness a CAGR of 6.2% between 2025 and 2035.

The Deodorant Roll-On industry stood at USD 7.5 billion in 2024.

The Deodorant Roll-On industry is anticipated to reach USD 15.2 billion by 2035 end.

Aluminium-free and organic deodorant roll-ons are set to record the highest CAGR of 6.1%, driven by increasing consumer preference for natural and skin-friendly products.

The key players operating in the Deodorant Roll-On industry include Unilever, Procter & Gamble, Beiersdorf, L'Oréal, Henkel, and Reckitt.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sales channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Sales channel, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Sales channel, 2018 to 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: East Asia Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 36: East Asia Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Sales channel, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Sales channel, 2018 to 2033

Table 41: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 44: South Asia Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 45: South Asia Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 46: South Asia Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 47: South Asia Market Value (US$ Million) Forecast by Sales channel, 2018 to 2033

Table 48: South Asia Market Volume (Units) Forecast by Sales channel, 2018 to 2033

Table 49: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Oceania Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Oceania Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 52: Oceania Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 53: Oceania Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 54: Oceania Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 55: Oceania Market Value (US$ Million) Forecast by Sales channel, 2018 to 2033

Table 56: Oceania Market Volume (Units) Forecast by Sales channel, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 62: MEA Market Volume (Units) Forecast by Nature, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Sales channel, 2018 to 2033

Table 64: MEA Market Volume (Units) Forecast by Sales channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Gender, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Sales channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Gender, 2023 to 2033

Figure 22: Global Market Attractiveness by Nature, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Gender, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Sales channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Gender, 2023 to 2033

Figure 46: North America Market Attractiveness by Nature, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Gender, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Sales channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Gender, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Gender, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Sales channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Sales channel, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Sales channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Gender, 2023 to 2033

Figure 94: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 95: Europe Market Attractiveness by Sales channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) by Gender, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 99: East Asia Market Value (US$ Million) by Sales channel, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 106: East Asia Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 107: East Asia Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 108: East Asia Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 110: East Asia Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 111: East Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 112: East Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 113: East Asia Market Value (US$ Million) Analysis by Sales channel, 2018 to 2033

Figure 114: East Asia Market Volume (Units) Analysis by Sales channel, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Sales channel, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Sales channel, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Gender, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Nature, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Sales channel, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia Market Value (US$ Million) by Gender, 2023 to 2033

Figure 122: South Asia Market Value (US$ Million) by Nature, 2023 to 2033

Figure 123: South Asia Market Value (US$ Million) by Sales channel, 2023 to 2033

Figure 124: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 130: South Asia Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 131: South Asia Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 132: South Asia Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 133: South Asia Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 134: South Asia Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 135: South Asia Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 136: South Asia Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 137: South Asia Market Value (US$ Million) Analysis by Sales channel, 2018 to 2033

Figure 138: South Asia Market Volume (Units) Analysis by Sales channel, 2018 to 2033

Figure 139: South Asia Market Value Share (%) and BPS Analysis by Sales channel, 2023 to 2033

Figure 140: South Asia Market Y-o-Y Growth (%) Projections by Sales channel, 2023 to 2033

Figure 141: South Asia Market Attractiveness by Gender, 2023 to 2033

Figure 142: South Asia Market Attractiveness by Nature, 2023 to 2033

Figure 143: South Asia Market Attractiveness by Sales channel, 2023 to 2033

Figure 144: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 145: Oceania Market Value (US$ Million) by Gender, 2023 to 2033

Figure 146: Oceania Market Value (US$ Million) by Nature, 2023 to 2033

Figure 147: Oceania Market Value (US$ Million) by Sales channel, 2023 to 2033

Figure 148: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: Oceania Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 154: Oceania Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 155: Oceania Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 156: Oceania Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 157: Oceania Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 158: Oceania Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 159: Oceania Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 160: Oceania Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 161: Oceania Market Value (US$ Million) Analysis by Sales channel, 2018 to 2033

Figure 162: Oceania Market Volume (Units) Analysis by Sales channel, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Sales channel, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Sales channel, 2023 to 2033

Figure 165: Oceania Market Attractiveness by Gender, 2023 to 2033

Figure 166: Oceania Market Attractiveness by Nature, 2023 to 2033

Figure 167: Oceania Market Attractiveness by Sales channel, 2023 to 2033

Figure 168: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 169: MEA Market Value (US$ Million) by Gender, 2023 to 2033

Figure 170: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 171: MEA Market Value (US$ Million) by Sales channel, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 178: MEA Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 179: MEA Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 180: MEA Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 182: MEA Market Volume (Units) Analysis by Nature, 2018 to 2033

Figure 183: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 184: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) Analysis by Sales channel, 2018 to 2033

Figure 186: MEA Market Volume (Units) Analysis by Sales channel, 2018 to 2033

Figure 187: MEA Market Value Share (%) and BPS Analysis by Sales channel, 2023 to 2033

Figure 188: MEA Market Y-o-Y Growth (%) Projections by Sales channel, 2023 to 2033

Figure 189: MEA Market Attractiveness by Gender, 2023 to 2033

Figure 190: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 191: MEA Market Attractiveness by Sales channel, 2023 to 2033

Figure 192: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Deodorant Stick Market – Trends, Growth & Forecast 2025 to 2035

Deodorant Packaging Market Trends & Industry Forecast 2024-2034

Prebiotic Deodorants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Refillable Deodorants Market Growth, Trends and Forecast from 2025 to 2035

Aluminium-Free Deodorant Market Analysis - Trends, Growth & Forecast 2025 to 2035

Antiperspirants and Deodorants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA