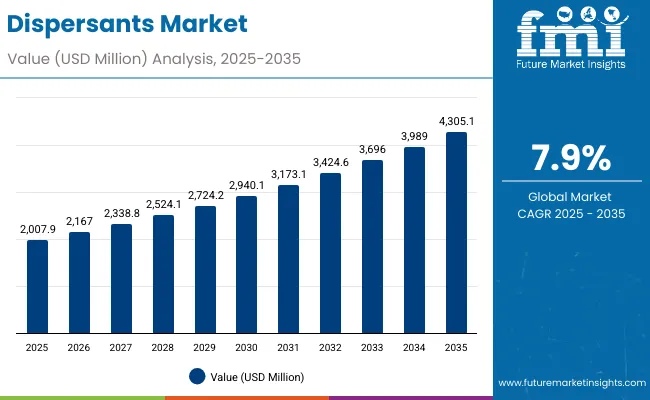

The Dispersants Market is expected to record a valuation of USD 2,007.9 million in 2025 and USD 4,305.1 million in 2035, with an increase of USD 2,297.2 million, which equals a growth of ~193% over the decade. The overall expansion represents a CAGR of 7.9% and a 2X increase in market size.

Dispersants Market Key Takeaways

| Metric | Value |

|---|---|

| Dispersants Market Estimated Value in (2025E) | USD 2,007.9 million |

| Dispersants Market Forecast Value in (2035F) | USD 4,305.1 million |

| Forecast CAGR (2025 to 2035) | 7.9% |

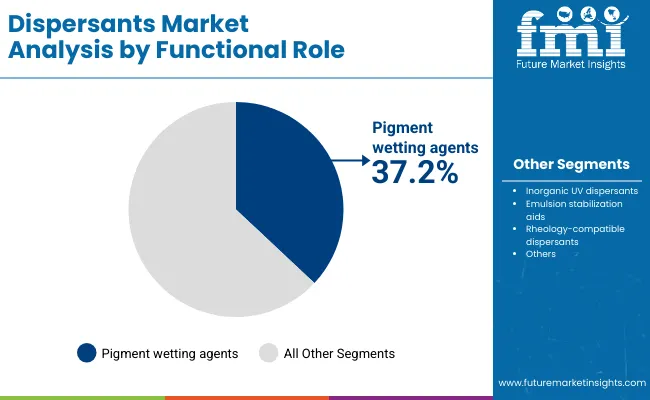

During the first five-year period from 2025 to 2030, the market increases from USD 2,007.9 million to USD 2,724.2 million, adding USD 716.3 million, which accounts for 31% of the total decade growth. This phase records steady adoption across color cosmetics, sunscreens, and hair care formulations, supported by consumer demand for multifunctional beauty products and stricter UV-protection regulations. Pigment wetting agents dominate this period with a 37.2% share in 2025, while polymeric dispersants hold leadership within the chemistry segment.

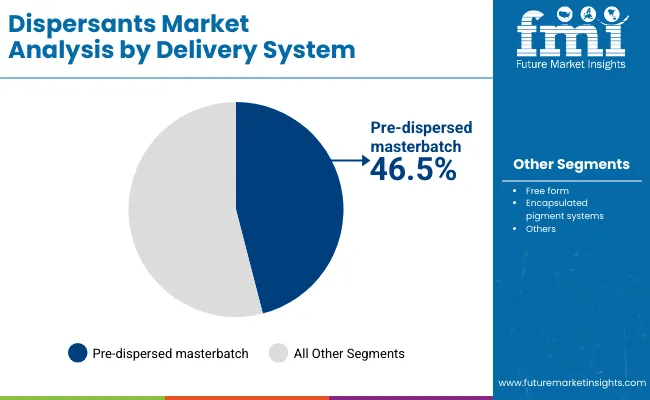

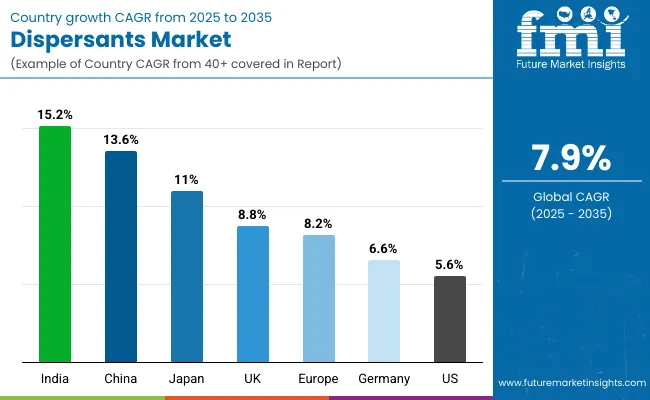

The second half from 2030 to 2035 contributes USD 1,565 million, equal to 68% of total growth, as the market jumps from USD 2,724.2 million to USD 4,305.1 million. This acceleration is powered by innovation in pre-dispersed masterbatches, encapsulated pigment systems, and rheology-compatible dispersants, alongside the expansion of digital manufacturing and sustainable ingredient sourcing. By the end of the decade, pre-dispersed masterbatch systems gain greater traction with a 46.5%+ share, while Asia, particularly China (CAGR 13.6%) and India (CAGR 15.2%), drives the majority of incremental growth.

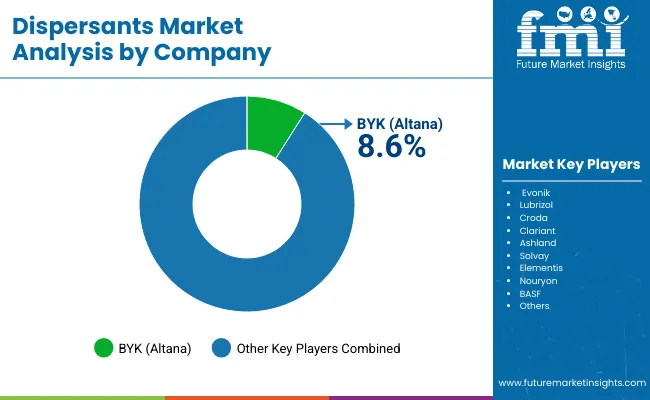

From 2020 to 2024, the Dispersants Market expanded steadily, driven by demand in color cosmetics, sunscreens (TiO₂/ZnO), and hair colorants. Growth was underpinned by formulation innovation and regulatory compliance in UV protection. Competitive dynamics were dominated by specialty chemical manufacturers, with leading players such as BASF, Lubrizol, and BYK (Altana) holding strong positions through diversified dispersant portfolios. Differentiation centered on formulation stability, pigment compatibility, and cost-performance balance, while niche innovators advanced in nonionic/anionic surfactants and hybrid dispersant packages. Service-oriented models were minimal, with most companies competing through material innovation and B2B supply agreements.

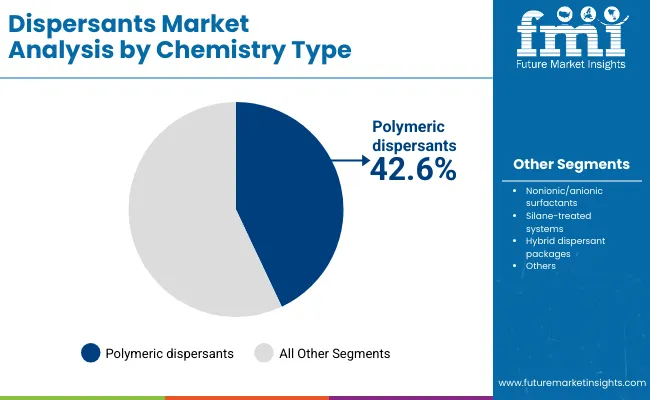

Demand for dispersants will rise to USD 2,007.9 million in 2025 and nearly double to USD 4,305.1 million by 2035. The revenue mix will increasingly reflect the growth of pre-dispersed masterbatch systems (46.5% share in 2025) and polymeric dispersants (42.6% share in 2025). Traditional leaders face intensifying competition from eco-friendly and high-performance dispersant developers, with sustainability and regulatory compliance becoming major differentiators. Emerging entrants focusing on encapsulated pigment systems, hybrid chemistry, and digital manufacturing integration are gaining share. The competitive advantage is shifting from basic dispersant supply toward end-use performance guarantees, sustainable sourcing, and multifunctional dispersant packages designed for next-gen cosmetics and personal care.

The dispersants market is witnessing robust growth due to increasing use in color cosmetics, sunscreens, and hair color formulations. These applications require dispersants to stabilize pigments, improve texture, and enhance uniformity, especially with complex ingredients like TiO₂ and ZnO. Consumer preference for multifunctional products with UV protection, anti-aging, and long-lasting performance is accelerating demand for high-performance dispersants. This trend is particularly evident in Asia-Pacific markets such as China and India, where rising middle-class income is boosting premium beauty consumption.

Innovation in polymeric dispersants, hybrid dispersant packages, and eco-friendly chemistry is significantly driving market expansion. Brands are increasingly adopting pre-dispersed masterbatch and encapsulated pigment systems to achieve better formulation stability while meeting regulatory standards and clean-label expectations. The shift toward sustainable, bio-based dispersants is also creating new revenue streams, as both cosmetic manufacturers and end consumers prioritize environmentally safe products. These technological and sustainability-driven advancements are positioning dispersants as essential enablers of performance and compliance in next-generation formulations.

The Dispersants Market is segmented by functional role, chemistry type, delivery system, physical form, application, end use, and geography. Functional roles include pigment wetting agents, inorganic UV dispersants, emulsion stabilization aids, and rheology-compatible dispersants. By chemistry, the market covers polymeric dispersants, nonionic/anionic surfactants, silane-treated systems, and hybrid dispersant packages.

Delivery systems are classified into free form, pre-dispersed masterbatch, and encapsulated pigment systems, while physical forms comprise liquid concentrates, pastes/dispersions, and powders. Applications span color cosmetics, sunscreens (TiO₂/ZnO), hair colorants, and skin tints/BB/CC bases. End uses are primarily concentrated in color cosmetics, sun care, and hair color. Regionally, the market scope extends across North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa, with China and India emerging as the fastest-growing markets.

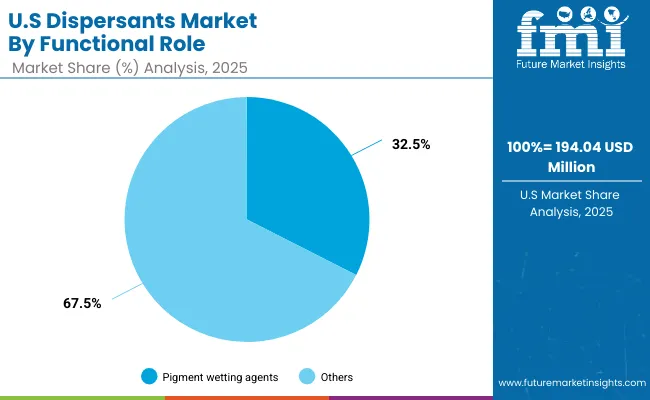

| Functional Role | Value Share% 2025 |

|---|---|

| Pigment wetting agents | 37.2% |

| Others | 62.8% |

The pigment wetting agents segment is projected to contribute 37.2% of the Dispersants Market revenue in 2025, maintaining its lead as the dominant functional role category. This growth is driven by rising demand in color cosmetics, sunscreens, and skin tint formulations, where dispersants are essential for uniform pigment distribution and product stability. Pigment wetting agents enhance coverage, texture, and durability, making them critical for high-performance formulations across the beauty and personal care industry.

The segment’s momentum is further supported by the shift toward nano-scale pigment technologies and hybrid dispersant systems that improve compatibility with complex formulations. As cosmetic brands emphasize long-lasting, multifunctional, and eco-compliant products, pigment wetting agents are expected to remain the backbone of dispersant applications throughout the forecast period.

| Chemistry Type | Value Share% 2025 |

|---|---|

| Polymeric dispersants | 42.6% |

| Others | 57.4% |

The polymeric dispersants segment is forecasted to hold 42.6% of the market share in 2025, driven by its superior ability to stabilize pigments, prevent flocculation, and ensure consistent dispersion in complex formulations. These dispersants are highly favored in color cosmetics, sunscreens, and hair colorants due to their efficiency in maintaining uniform particle size distribution and enhancing product performance.

Their versatility, compatibility with multiple solvent systems, and strong performance across a wide pH range have facilitated widespread adoption in cosmetic and personal care applications. The segment’s growth is further supported by ongoing innovations in polymer engineering, enabling dispersants that deliver better rheology control, reduced dosage requirements, and improved sustainability profiles. As demand for high-performance and eco-friendly formulations accelerates, polymeric dispersants are expected to retain their leadership in the chemistry type segment throughout the forecast period.

| Delivery System | Value Share% 2025 |

|---|---|

| Pre-dispersed masterbatch | 46.5% |

| Others | 53.5% |

The pre-dispersed masterbatch segment is projected to account for 46.5% of the Dispersants Market revenue in 2025, making it one of the most prominent delivery systems. Pre-dispersed masterbatches are increasingly favored by formulators as they simplify processing, ensure consistency, and reduce time-to-market by eliminating the need for on-site dispersion. Their ability to provide high pigment loadings, excellent stability, and improved compatibility with diverse cosmetic bases has fueled their adoption in color cosmetics, sunscreens, and tinted skincare products.

Growth in this segment is further driven by rising demand for ready-to-use, scalable solutions that support uniform performance across global supply chains. Additionally, advancements in encapsulation and rheology-compatible dispersants are boosting the performance of pre-dispersed systems, enabling enhanced durability and clean-label compliance. Given their efficiency and formulation reliability, pre-dispersed masterbatches are expected to expand their role as a cornerstone in dispersant delivery systems.

Rising Demand in Cosmetics and Personal Care

The dispersants market is expanding rapidly due to the increasing use of high-performance formulations in color cosmetics, sunscreens, and hair colorants. Dispersants ensure uniform pigment distribution, improve texture, and enhance product durability, which is critical as consumer preferences shift toward multifunctional and long-lasting products. With growing awareness of UV protection and natural finishes, dispersants are becoming essential in formulations containing TiO₂ and ZnO. Demand from fast-growing markets like China and India, coupled with premiumization in developed economies, is driving consistent adoption across global cosmetic and personal care segments.

Advancements in Polymeric and Hybrid Dispersant Systems

Technological advancements in polymeric dispersants, hybrid chemistry, and pre-dispersed masterbatch systems are fueling market growth. These systems provide superior rheology control, enhanced pigment compatibility, and reduced dosage requirements, enabling formulators to achieve higher efficiency and cost savings. Innovations in bio-based and eco-friendly dispersants are also creating new growth opportunities, especially as regulatory bodies push for sustainable and clean-label products. Hybrid dispersant packages combining multiple functionalities are gaining traction, allowing manufacturers to deliver customized solutions. This innovation-driven expansion is positioning dispersants as a critical enabler for next-generation formulations in the beauty and personal care industry.

High Regulatory and Compliance Burden

A significant restraint for the dispersants market is the increasing stringency of cosmetic and chemical regulations across global markets. Ingredients used in dispersants must meet strict safety, sustainability, and environmental standards, which often requires costly reformulation and compliance testing. Regulations such as REACH in Europe and FDA oversight in the USA limit the use of certain synthetic dispersants, driving up production costs. Additionally, global brands face challenges in aligning formulations across multiple regulatory regimes, slowing product launches. These compliance pressures can limit the adoption of innovative dispersants, especially for smaller and mid-tier suppliers.

Shift Toward Sustainable and Bio-based Dispersants

A major trend reshaping the dispersants market is the transition toward sustainable, bio-based, and clean-label dispersant systems. With consumers increasingly prioritizing eco-friendly and safe beauty products, manufacturers are investing in dispersants derived from renewable raw materials and green chemistry processes. Encapsulated pigment systems and biodegradable dispersants are emerging as popular choices, aligning with brand commitments to reduce environmental impact. This trend is further reinforced by the growing demand for vegan, natural, and dermatologically tested claims. As sustainability becomes a key differentiator in the cosmetics and personal care market, bio-based dispersants are expected to capture a rising share of new formulations.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 13.6% |

| USA | 5.6% |

| India | 15.2% |

| UK | 8.8% |

| Germany | 6.6% |

| Japan | 11.0% |

The global Dispersants Market demonstrates distinct regional growth patterns, strongly influenced by cosmetic consumption, regulatory frameworks, and technological innovation in formulation chemistry. Asia-Pacific emerges as the fastest-growing region, led by India (15.2%) and China (13.6%), driven by a booming middle class, rising spending on beauty and sun care, and government-supported initiatives for safer cosmetic formulations. China’s growth is supported by large-scale manufacturing of color cosmetics and tightening standards for UV filters that necessitate advanced dispersant systems. India’s surge is underpinned by urbanization and rising demand for hair colorants and multifunctional cosmetics.

Europe maintains steady growth, with the UK at 8.8% and Germany at 6.6%, supported by strict EU regulations requiring high-performance dispersants in sunscreens and tinted skincare. Increasing demand for clean-label and eco-certified formulations drives innovation in polymeric and hybrid dispersants across European brands.

Japan (11.0%) reflects strong consumer preference for high-quality sun protection and BB/CC creams, with dispersants enabling stable formulations of ZnO/TiO₂. North America shows moderate expansion, with the USA at 5.6%, reflecting a mature but innovation-driven market where hybrid dispersants and encapsulated pigment systems are adopted to meet evolving preferences for natural, dermatologist-tested, and multifunctional products. Growth is more consumer-driven, influenced by demand for sustainability and product performance differentiation.

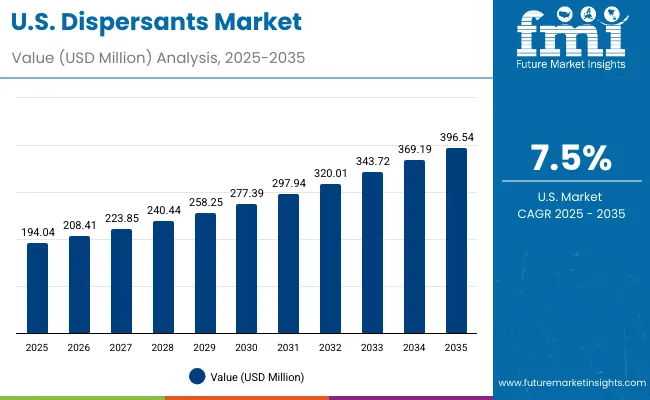

| Year | USA Dispersants Market (USD Million) |

|---|---|

| 2025 | 194.04 |

| 2026 | 208.41 |

| 2027 | 223.85 |

| 2028 | 240.44 |

| 2029 | 258.25 |

| 2030 | 277.39 |

| 2031 | 297.94 |

| 2032 | 320.01 |

| 2033 | 343.72 |

| 2034 | 369.19 |

| 2035 | 396.54 |

The Dispersants Market in the United States is projected to grow at a CAGR of 7.5% from 2025 to 2035, supported by steady demand in color cosmetics, sunscreens, and hair color formulations. Growth is anchored by consumer demand for multifunctional beauty products with UV protection, anti-aging, and natural finish claims. USA formulators are investing in polymeric dispersants and pre-dispersed masterbatches to improve formulation stability and reduce production cycles. Rising interest in eco-friendly, clean-label, and dermatologist-tested dispersants is creating opportunities for innovation.

The Dispersants Market in the United Kingdom is expected to grow at a CAGR of 8.8% between 2025 and 2035, supported by increasing applications in color cosmetics, sun care, and hair colorants. UK-based cosmetic brands are accelerating the adoption of polymeric dispersants and hybrid systems to improve pigment stability, enhance product texture, and comply with stringent EU and UK cosmetic regulations. Demand is particularly strong in sunscreens and skin tints, where dispersants enable uniform dispersion of TiO₂ and ZnO.

Government emphasis on sustainable formulations and industry collaborations with research institutes are pushing innovation in eco-friendly and clean-label dispersants. Growth is further supported by consumer demand for premium, multifunctional, and vegan-certified beauty products.

India is witnessing rapid growth in the Dispersants Market, which is forecast to expand at a CAGR of 15.2% through 2035. The expansion is driven by rising consumer demand for affordable yet high-performance cosmetics, sunscreens, and hair colorants, particularly in urban and tier-2 cities. Local and multinational brands are increasingly using polymeric dispersants and pre-dispersed masterbatches to ensure better pigment stability, uniform coverage, and compatibility with tropical climates.

Educational institutions and research centers are also investing in cosmetic formulation R&D, integrating dispersant technologies into curriculum and pilot projects. Public awareness of UV protection, skin safety, and sustainability is spurring demand for dispersants in ZnO/TiO₂-based sunscreens. With India’s beauty and personal care industry expanding at double-digit rates, dispersants are becoming critical to product differentiation and export-oriented production.

The Dispersants Market in China is expected to grow at a CAGR of 13.6%, the highest among leading economies. This momentum is driven by strong demand in color cosmetics, sunscreens, and BB/CC creams, where dispersants are essential for stabilizing TiO₂ and ZnO pigments and ensuring long-lasting product performance. China’s large-scale beauty manufacturing ecosystem and regulatory emphasis on UV protection and clean-label compliance are accelerating adoption of polymeric and hybrid dispersant systems.

Local manufacturers are increasingly competitive, offering cost-effective dispersant solutions that align with global standards while serving domestic mass-market brands. Rising consumer preference for premium, multifunctional, and skin-safe formulations is also pushing international players to expand dispersant investments in the region.

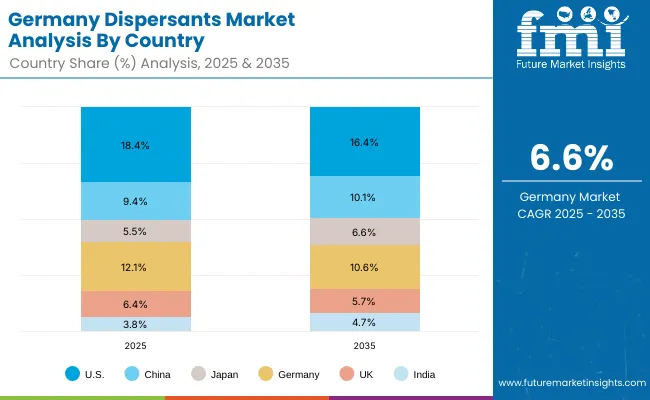

| Countries | 2025 Share (%) |

|---|---|

| USA | 18.4% |

| China | 9.4% |

| Japan | 5.5% |

| Germany | 12.1% |

| UK | 6.4% |

| India | 3.8% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 16.4% |

| China | 10.1% |

| Japan | 6.6% |

| Germany | 10.6% |

| UK | 5.7% |

| India | 4.7% |

The Dispersants Market in Germany is projected to grow at a CAGR of 6.6%, supported by the country’s strong cosmetics and personal care industry and strict EU compliance standards. German brands are focusing on sunscreens and tinted skincare, where dispersants play a critical role in stabilizing inorganic UV filters such as TiO₂ and ZnO. In addition, dispersants are increasingly adopted in hair colorants and premium skincare formulations, helping achieve uniform pigment distribution and improved product longevity.

Germany’s leadership in sustainable and eco-certified formulations is further boosting demand for polymeric dispersants, hybrid packages, and bio-based systems that comply with EU clean-label and environmental requirements. The emphasis on safe, dermatologically tested, and vegan-certified products is creating opportunities for suppliers specializing in next-generation dispersants.

| USA By Functional Role | Value Share% 2025 |

|---|---|

| Pigment wetting agents | 32.5% |

| Others | 67.5% |

The Dispersants Market in the United States is projected to reach USD 194.04 million in 2025, expanding steadily at a CAGR of 5.6% through 2035. Pigment wetting agents dominate with a 32.5% share, underscoring their critical role in color cosmetics, sunscreens, and tinted skincare products. Demand is rising as USA consumers increasingly prioritize UV protection, long-lasting wear, and multifunctional beauty products.

The USA market is also seeing a strong pivot toward eco-friendly and clean-label dispersants, supported by both regulatory oversight and consumer expectations. Polymeric dispersants and pre-dispersed masterbatches are gaining traction as brands seek better formulation stability, faster production cycles, and enhanced performance across diverse product lines.

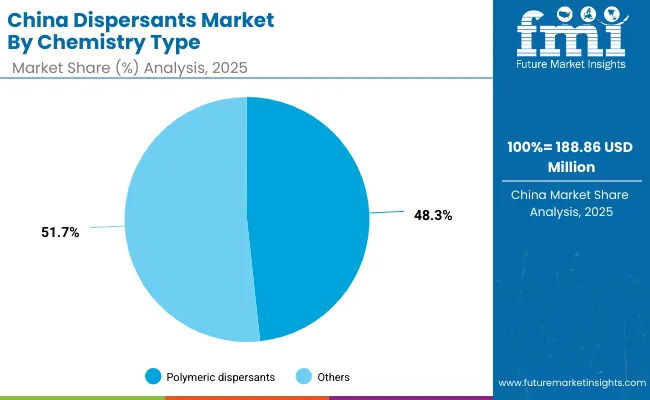

| China By Chemistry Type | Value Share% 2025 |

|---|---|

| Polymeric dispersants | 48.3% |

| Others | 51.7% |

The Dispersants Market in China is valued at USD 188.86 million in 2025, with polymeric dispersants leading at 48.3%. The dominance of polymeric systems reflects China’s fast-expanding color cosmetics and sunscreen segments, where dispersants are essential for stabilizing pigments and improving product texture. With rising awareness of UV protection and skin health, demand for advanced dispersant systems in formulations containing TiO₂ and ZnO is accelerating.

Significant opportunities exist in bio-based and hybrid dispersant systems, as Chinese consumers increasingly prefer eco-friendly, vegan, and clean-label products. Domestic brands are also leveraging cost-effective dispersant packages to compete with international players, while premium global brands focus on polymeric dispersants to deliver multifunctional, high-performance formulations.

The Dispersants Market is moderately fragmented, with global chemical leaders, mid-sized innovators, and specialized regional suppliers competing across cosmetics, sun care, and hair color applications. Leading multinationals such as BASF, BYK (Altana), Lubrizol, and Evonik hold significant shares through broad dispersant portfolios that address pigment stability, rheology control, and multifunctional formulation needs. Their strategies increasingly emphasize sustainable chemistry, bio-based dispersants, and hybrid packages designed for eco-friendly and high-performance formulations.

Mid-sized players including Croda, Clariant, Ashland, and Elementis are highly active in cosmetic dispersants, focusing on pre-dispersed masterbatch systems and specialty blends tailored for sun care and tinted skincare. These companies are accelerating adoption by aligning with clean-label, vegan, and dermatologist-tested claims, making them highly relevant for premium product launches. Specialized providers such as Solvay and Nouryon focus on niche dispersant technologies, including silane-treated systems and encapsulated pigment dispersions, delivering performance advantages in high-value formulations. Their strength lies in application-specific innovation and regulatory compliance, especially in markets like Europe and Asia where safety and sustainability standards are stringent.

Competitive differentiation is shifting from cost and performance alone to ecosystem strength, where suppliers provide not only dispersants but also formulation support, regulatory expertise, and co-innovation with cosmetic brands. This integrated approach is helping leaders secure long-term partnerships with global personal care companies.

Key Developments in Dispersants Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,007.9 Million |

| Functional Role | Pigment wetting agents, Inorganic UV dispersants, Emulsion stabilization aids, Rheology-compatible dispersants |

| Chemistry Type | Polymeric dispersants, Nonionic/anionic surfactants, Silane-treated systems, Hybrid dispersant packages |

| Delivery System | Free form, Pre-dispersed masterbatch, Encapsulated pigment systems |

| Physical Form | Liquid concentrate, Paste/dispersion, Powder |

| Application | Color cosmetics, Sunscreens (TiO₂/ZnO), Hair colorants, Skin tint/BB/CC bases |

| End Use | Color cosmetics, Sun care, Hair color |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, BYK (Altana), Evonik, Lubrizol, Croda, Clariant, Ashland, Solvay, Elementis, Nouryon |

| Additional Attributes | Dollar sales by functional role and chemistry type, adoption trends in sunscreens, color cosmetics, and hair colorants, rising demand for pre-dispersed masterbatch and polymeric dispersants, sector-specific growth in personal care, dermatology, and premium skincare, revenue segmentation by delivery system and physical form, integration with clean-label, vegan, and bio-based formulations, regional trends influenced by regulatory compliance and sustainability mandates, and innovations in hybrid dispersant packages and encapsulated pigment systems. |

The global Dispersants Market is estimated to be valued at USD 2,007.9 million in 2025.

The market size for the Dispersants Market is projected to reach USD 4,305.1 million by 2035.

The Dispersants Market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key functional roles in the Dispersants Market are pigment wetting agents, inorganic UV dispersants, emulsion stabilization aids, and rheology-compatible dispersants.

In terms of chemistry type, polymeric dispersants are expected to command a significant share of 42.6% in 2025, supported by their superior pigment stabilization and wide applicability in cosmetics and sun care formulations.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Organic Dispersants Market

Antiscalants and Dispersants Market Analysis by Product, End-use, and Region 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA