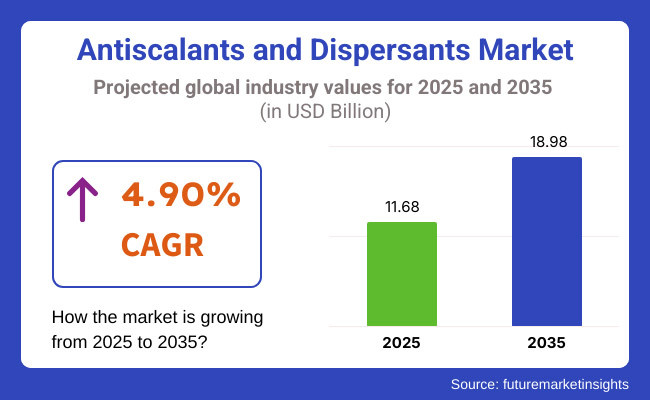

The Antiscalants and Dispersants Market globally is anticipated to reach USD 11.68 billion in 2025. Between 2025 and 2035, the market is forecast to grow at a CAGR of 4.9%, reaching a value of USD 18.98 billion by 2035.

The growth of the Antiscalants and Dispersants industry is fueled by increased industrialization, enhanced applications of water treatment, and regulatory environmental policies.

In 2024, the Antiscalants and Dispersants industry experienced tremendous progress fueled by sustainability and digitalization. Companies aimed to create green formulations with biodegradable and low-toxicity chemicals in response to tough environmental regulations.

The use of intelligent water treatment solutions with AI and IoT enabled industries to track and optimize the use of chemicals in real-time, minimizing waste and enhancing efficiency. Also, sectors like power generation, oil & gas, and mining extended their application of sophisticated antiscalants to avoid scaling and maximize equipment life, facilitating cost-efficient operations.

Moving into the future of 2025, the industry will be witnessing increasing growth on the back of expanding investments in recycling and reuse of water technologies. Increasing concerns related to water shortages will see industries raise their usage of high-performance antiscalants for water quality control and low system downtime.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Consistent industry expansion influenced by industrial upkeep and water treatment requirements. | Faster expansion into pharmaceuticals, agriculture, and high-tech manufacturing. |

| Restricted use of digital equipment; manual dosing and monitoring were the norm. | Monitoring through AI, automated dosing, and IoT integration for optimization. |

| Adherence to current environmental guidelines; gradual change to environmentally friendly alternatives. | Tighter global sustainability regulations driving biodegradable and non-toxic formulations. |

| Gradual advancements in chemical formulations for greater efficiency. | Creation of multifunctional and industry-specific antiscalants and dispersants. |

| Led by Europe and North America, with gradual acceptance among emerging sectors. | Asia-Pacific and the Middle East emerging as growth sectors with industrialization. |

| There is some pressure for green alternatives, but cost issues restricted universal usage. | Industry-wide transition to green chemistry with regulatory and financial incentives. |

| The big chemical companies dominated the industry with little competition. | Increased competition from startups and niche players with customized solutions. |

| High cost of products, unawareness, and compatibility constraints restricted usage. | Efforts to lower costs, improved education, and tailored products increasing demand. |

| Moderate industry growth depending on conventional applications. | Robust growth in water reuse, energy efficiency, and new industrial segments. |

The Antiscalants and Dispersants industry is part of the specialty chemicals business under water treatment chemicals, industrial process chemicals, and performance additives. It is affected by global industrialization, legislation, eco-sustainability trends, and chemical engineering technological developments.

The industry is witnessing substantial change, with growing investments in green chemistry, water security, and industrial efficiency boosting demand for antiscalants and dispersants.

Accelerating urbanization, infrastructure growth, and industrial development—mostly in emerging nations such as India, China, and the Middle East—are fueling the need for effective water management solutions.

Furthermore, growing global efforts in water reuse and desalination are generating robust demand for sophisticated antiscalants to avoid scaling in reverse osmosis (RO) and thermal desalination processes.

Increased energy prices and supply chain interruptions have caused raw material prices to rise, prompting manufacturers to invest in cost-effective, high-performance formulations. Greater integration of AI and IoT into industrial processes is also affecting product demand, with real-time monitoring systems maximizing the use of chemicals, enhancing efficiency and sustainability.

As water scarcity across the world intensifies, industries will increasingly be dependent on advanced antiscalants to avoid scaling in desalination plants, cooling towers, and industrial boilers.

Carbonates and phosphonates among antiscalants will see high uptake as they can effectively manage calcium and magnesium scales in extreme industrial environments.

Sulphates and fluorides will experience consistent growth, especially in chemical processing and municipal water treatment applications where accurate scaling prevention is necessary.

Formulators will emphasize environmentally friendly and biodegradable products, meeting strict regulatory standards in North America and Europe. The dispersant segment will also grow as industries require improved suspension stability and dispersion efficiency.

Silicates will become more prominent in detergents and industrial cleaning agents, providing residue-free applications. Alkali metal esters and phosphates will be important in high-performance oil and gas formulating, facilitating the removal of sludge and maintenance of pipelines.

Cellulose derivatives will start to be increasingly used in the food processing and pharmaceutical industries because of their biodegradability.

The oil and gas industry will lead the industry, with a strong share anticipated at a CAGR of 5.1% during the period 2025 to 2035. The industry will see strong growth owing to growing offshore and shale gas exploration activities, necessitating superior antiscalants and dispersants to avoid equipment scaling and fouling.

As energy firms move towards operational effectiveness and cost optimization, demand for high-performance additives will increase.

The water treatment business will also witness significant growth, as investment in desalination plants, wastewater recycling, and industrial effluent treatment continues to rise.

The detergents and cleaners industry will gain due to consumer choice favoring high-performance and residue-free cleaning agents, resulting in increased demand for silicate-based dispersants and phosphate-based antiscalants.

In the mining sector, dispersants will have a significant function in mineral processing, allowing effective separation of economic minerals and lowering the cost of processing.

The United States will be a key market for antiscalants and dispersants due to the country's fast-paced industrialization, the need for strong water regulations, and continuous advances in oil and gas activities.

The nation's emphasis on the development of water reuse and upgrading infrastructure will immensely drive demand for high-performance antiscalants used in municipal and industrial water treatment processes. Furthermore, growth in shale gas exploration and refining operations will also drive increasing adoption, as energy firms seek to improve operational efficiency and prolong equipment life.

The pharmaceutical and food processing sectors will also fuel demand for dispersants, as high-purity processing solutions are required. As environmental concerns rise, the industry will witness a transition toward environmentally friendly and biodegradable formulations due to federal regulations.

FMI opines that the USA industry will expand at an approximate CAGR of 4.6% from 2025 to 2035, as consistent investments in intelligent water treatment technology and automation dictate future demand.

India's dispersants and antiscalants industry will grow strongly driven by fast urbanization, water scarcity, and accelerated industrialization. The ambitious schemes of the nation, like Jal Jeevan Mission and Smart Cities Programme, will create opportunities for growth in high-tech water treatment chemicals for urban water supply and sewage treatment.

As industries push towards sustainability targets and regulatory requirements, high-performance antiscalant uptake in power plants, textile production, and pharmaceuticals will increase.

India's metal processing and mining industries will also drive demand, with organizations looking for efficient solutions to optimize mineral recovery and minimize processing costs.

India is forecasted to grow at a CAGR of 5.5% during 2025 to 2035, emerging as one of the fastest-growing marketplaces in the industry.

China's industry for antiscalants and dispersants will grow considerably, spurred by industrial expansion, growing desalination activities, and developments in the chemical industry.

With the nation suffering from acute water shortages, the government will concentrate on recycling wastewater and reusing industrial water, leading to greater use of antiscalants in power plants, steel production, and chemical processing.

The oil and gas industry will also be a growth driver, with firms upgrading refining processes with sophisticated scale prevention technologies.

The emphasis on sustainability and minimizing industrial waste in the country will promote innovations in green antiscalants and dispersants, complementing strict environmental regulations.

FMI noted that China's antiscalants and dispersants industry is projected to expand at 4.9% CAGR between 2025 and 2035 and continue to serve as a preeminent regional industry.

The United Kingdom industry for antiscalants and dispersants will expand steadily due to strict water treatment regulations, optimization of industrial processes, and net-zero emissions momentum.

As the nation prioritizes sustainable water management, municipal and industrial wastewater treatment demand for antiscalants will increase.

The North Sea oil and gas industry will continue to be a significant driver, with operators looking for low-cost ways to minimize equipment maintenance and prolong operational life.

The detergents and personal care industry will drive demand for dispersants to ensure high-performance formulations in end products.

Green chemistry and sustainable manufacturing practices will spur innovation in biodegradable dispersants and phosphate-free antiscalants.

The drug and biotech industries will continue to boost industry growth, as they need high-purity chemicals in manufacturing.

The United Kingdom's industry will grow at a CAGR of 4.8% between 2025 and 2035, with growing investment in intelligent water treatment technology forming the future demand.

Germany will be among the most technologically developed sectors for antiscalants and dispersants, fueled by robust industrial growth, R&D-driven innovation, and sustainability-driven regulation.

The nation's established automotive, pharmaceutical, and chemical sectors will drive demand for high-performance dispersants to maximize production processes and maintain product stability.

Germany's emphasis on renewable power will also provide new uses for antiscalants in geothermal facilities and energy storage technology.

With EU’s stringent environmental standards, the industries will quickly transition towards adopting biodegradable, phosphate-free, and low-toxicity formulators.

FMI opines that Germany's sector is expected to expand at a CAGR of 6.2% during the period 2025 to 2035, driven by ongoing improvements in eco-friendly chemical solutions and process automation.

Japan’s industry is set to expand at a 4.3% CAGR, spurred by state-of-the-art technologies in precision engineering, robotics, and water-guzzling industries.

As the nation's infrastructure ages and fears of water pollution grow, expenditures on next-generation wastewater treatment will rise, enhancing demand for proprietary antiscalants. The electronics and semiconductor industry, which utilizes ultra-pure water for the production of chips, will spearhead the implementation of high-performance dispersants for ensuring operational performance.

Japan's auto and hydrogen fuel cell sectors will also drive growth, necessitating tailored scale prevention solutions for cooling and energy systems.

As Japan is committed to net-zero emissions, the sector will see fast-forward development of bio-based and low-carbon footprint chemical formulations to meet green manufacturing guidelines.

FMI expects South Korea’s industry to grow at approximately 5.0% CAGR, driven by the country's swift advance toward technological innovation and industrialization.

Dispersants demand will be boosted by the semiconductor and display panel sectors as accurate cleaning and blemish-free manufacturing become top priority.

Industrial water reuse projects and desalination projects will increasingly promote the use of state-of-the-art antiscalants for ensuring the maximum level of operating efficiency in areas with scarce water resources. The increasing requirement for electric cars (EVs) will also propel dispersant demand in production and battery cooling applications. South Korea's emphasis on green infrastructure and sustainability will result in phosphate-free and bio-degradable options gaining traction, satisfying stringent environmental regulations while still allowing industrial growth.

France's industry for antiscalants and dispersants will be spurred by regulatory compliance on industrial emissions, wastewater treatment, and green chemistry. The wine and agrochemical industries, both significant drivers of the economy, will grow their dependence on dispersants for effective chemical formulations.

France's growth in renewable energy, especially hydropower and nuclear power, will drive demand for high-performance antiscalants to guarantee operational longevity in energy facilities.

With a solid focus on the principles of circular economy, industrial industries will target resource-saving and recyclable chemical products to reduce their footprint on the environment.

FMI opines that France’s industry for antiscalants and dispersants will expand at a CAGR of 4.7% during the forecast period.

Italy’s industry is anticipated to grow at an approximate 4.6% CAGR and will flourish with its rich industrial base, ranging from the pharmaceutical and textile industries to metallurgy and food processing.

Its vibrant fashion and dyeing industries will demand improved dispersant formulations for uniform and high-quality textile outputs.

Italy's chemical and refinery industries will also drive the demand for scale inhibitors, avoiding efficiency losses in heat exchangers and pipelines.

With increasing investments in sustainable urban planning and eco-tourism, municipalities will place emphasis on cost-effective wastewater treatment, with expanded applications of low-toxicity antiscalants.

The marine and desalination projects of the country will also drive the industry, which will ensure the prevention of scaling and fouling in high-salinity settings.

Australia and New Zealand's antiscalant and dispersant industry will see stable growth, spearheaded mainly by desalination, mineral exploitation, and water conservation projects.

Australia's minerals and metal processing sectors, most notably in the extraction of lithium and rare earths, will play a leading role in demand for dispersants to increase the recovery of ores and cut back on process losses.

In the meantime, New Zealand's emerging dairy and farm industries will become more dependent on biodegradable dispersants in order to conserve soil and water quality. The growth of offshore energy projects, such as wind and hydrogen production, will also increase the uptake of specialist antiscalants to maximize equipment lifetime.

FMI opines that the Australia and New Zealand’s antiscalant and dispersant industry will reach a CAGR of 4.4% during 2025 to 2035.

Future Market Insights carried out a comprehensive survey of major industry players, such as manufacturers, suppliers, end-users, and policymakers, to analyze the changing dynamics of the industry for antiscalants and dispersants.

The results show that stakeholders identify regulatory pressure as a chief growth driver with stricter environmental regulations necessitating low-toxicity and phosphate-free products across industries.

A major shift toward high-performance, multi-functional chemicals is another key takeaway from the survey. More than half of the respondents noted that industries are demanding antiscalants with dual-action dispersant properties to enhance process efficiency while reducing overall chemical consumption.

The adoption of bio-based dispersants is also gaining traction, particularly in the agriculture and food processing sectors, where manufacturers seek natural and biodegradable alternatives to meet sustainability targets.

Moreover, supply chain disruptions and volatile raw material prices were also identified by industry leaders as continuing issues, leading businesses to invest in regional production facilities and localized supply chains to maintain stable product supply.

The survey also revealed that the industry is being reshaped by digital transformation. During the forecast period, smart dosing systems and AI-powered monitoring technologies will transform chemical consumption management by offering real-time analysis and automated adjusting mechanisms.

This is notably seen in the oil and gas, semiconductor, and pharmaceutical sectors, where accuracy in scale prevention and dispersion has a direct impact on operational efficiency.

| Country | Government Regulations |

|---|---|

| United States | The USA Environmental Protection Agency (EPA) has strict water treatment regulations that must be complied with under the Clean Water Act. NSF/ANSI 60 certification is a requirement for chemicals employed in drinking water treatment. Sustainability policies encouraging low-toxicity and biodegradable products also impact the industry. |

| India | The Bureau of Indian Standards (BIS) requires quality certifications for water treatment chemicals. Central Pollution Control Board (CPCB) imposes wastewater treatment standards, fuelling the need for environmentally friendly antiscalants. Hazardous Waste Management Rules and environmental assessments are required by companies. |

| China | The Ministry of Ecology and Environment (MEE) regulates the Water Pollution Prevention and Control Law, limiting the application of high-phosphate dispersants. Firms are required to meet the China Compulsory Certification (CCC) for industrial chemicals and follow stringent wastewater discharge standards. |

| Japan | The Japan Water Works Association (JWWA) controls chemicals utilized in water treatment. The Chemical Substances Control Law prohibits hazardous formulations, fostering bio-based products. Stringent wastewater reuse laws propel the usage of high-performance antiscalants. |

| Germany | The German Federal Water Act (WHG) and the REACH regulation necessitate conformity for all industrial chemicals. The Blue Angel certificate for environmentally friendly chemicals is widely pursued by enterprises. |

| United Kingdom | The UK Environment Agency enforces the Water Industry Act, compelling companies to maintain tight effluent discharge regulations. The UK REACH regulation after Brexit mirrors EU standards closely, with a focus on non-toxic and biodegradable formulation. |

| South Korea | The Water Quality and Environment Act is regulated by the Ministry of Environment, limiting the use of harmful chemicals in water treatment. The Korea Eco-Label certification is promoted for environmentally sustainable dispersants. The Chemical Control Act must be complied with. |

| France | The French Code of the Environment governs industrial water consumption, mandating firms to employ certified antiscalants under the European Biocidal Products Regulation (BPR). France also encourages the use of environmentally friendly formulations through tax relief. |

| Italy | Italian laws under EU REACH and national water treatment regulations impose rigorous monitoring of chemical additives. The National Institute of Health (ISS) certifies chemicals for safe application in public water systems. |

| Australia-New Zealand | The Australian Drinking Water Guidelines (ADWG) and the Ministry for Environment of New Zealand implement water safety standards. The chemicals utilized in treatment processes are required to comply with Australian Pesticides and Veterinary Medicines Authority (APVMA) and WaterMark certification standards. |

The industry for antiscalants and dispersants is undergoing revolutionary change, offering immense opportunities for manufacturers, suppliers, and investors. Water reuse and industrial wastewater treatment is one of the key growth streams where industries are moving toward phosphate-free and biodegradable antiscalants because of strict environmental regulations.

The sectors in Europe and North America are driving the trend here, generating demand for environmentally sustainable options that meet regulatory requirements. Further, Middle East, African, and Asia-Pacific emerging sectors provide vast opportunities as their rapid industrialization, urbanization, and infrastructural development drive the demand for effective water treatment solutions.

To take advantage of these opportunities, firms need to expand strategically into regions and decrease their dependency on international supply chains. Having localized manufacturing and distribution centers in high-growth territories such as India, South Korea, and the Middle East will help reduce supply chain disruptions and increase sector penetration.

Firms also need to concentrate on building customized solutions specific to industries such as geothermal power plants, lithium-ion battery fabrication, and precision engineering uses. The increasing use of industry-specific dispersants and antiscalants reinforces the call for customized chemical solutions that can deliver optimized performance in specific end-uses.

The antiscalants and dispersants sector is seeing high competition, with the major firms prioritizing product innovation, strategic alliances, and geographic expansion. Industry leaders like BASF and Dow are majorly investing in R&D to launch high-performance, sustainable solutions. BASF has created high-performance polymer-based antiscalants that work well under harsh water conditions.

Strategic partnerships and acquisitions have emerged as key growth drivers within the sector. For instance, Solenis, which is a water treatment chemicals global leader, has acquired a number of companies in order to build its portfolio and increase its footprint in wastewater treatment.

Likewise, H₂O Innovation has been aggressively supplying its low-carbon-footprint, super-concentrated antiscalants to industrial applications and desalination plants globally. These strategic actions assist businesses in broadening their product and sector reach, addressing increasing demand in industries like water treatment, oil & gas, and mining.

Geographical growth is an area of central interest for large firms as they create regional production and distribution centers. This practice decreases the cost of logistics, guarantees efficiency in supply chains, and enables firms to fulfill localized regulatory compliance. For example, H₂O Innovation has grown its operations to support desalination plants and industrial plants around the world.

Market Share Analysis

| Company | Estimated Market Share (%) |

|---|---|

| BASF SE | 15- 20% |

| Dow Chemical Company | 10- 15% |

| Solenis | 8- 12% |

| Kemira Oyj | 7- 10% |

| Ecolab Inc. | 6- 9% |

| Italmatch Chemicals | 5- 8% |

| H₂O Innovation | 4- 7% |

Antiscalant-(Carbonates, Phosphonates, Sulphates, Fluorides, Others), Dispersant—(Silicates, Alkali Metal Phosphates, Esters, Cellulose Derivatives, Others),

Water Treatment, Detergents & Cleaners, Oil & Gas, Mining, Others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, The Middle East & Africa

The industry is shifting towards eco-friendly, biodegradable formulations and integrating digital monitoring solutions for enhanced efficiency.

Stricter environmental laws are driving companies to innovate with sustainable chemicals while ensuring compliance with wastewater treatment and industrial emission standards.

Water treatment, oil & gas, and mining remain dominant sectors, with growing adoption in pharmaceuticals, food processing, and semiconductor manufacturing.

Companies are focusing on strategic acquisitions, partnerships, and R&D investments to enhance product performance and expand their global reach.

Sustainability is a major driver, with increasing demand for phosphate-free, biodegradable solutions that minimize environmental impact without compromising efficiency.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 & 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 & 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 & 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 & 2033

Table 6: Global Market Volume (Tons) Forecast by End Use, 2018 & 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 & 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 & 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2018 & 2033

Table 12: North America Market Volume (Tons) Forecast by End Use, 2018 & 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 & 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 & 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2018 & 2033

Table 18: Latin America Market Volume (Tons) Forecast by End Use, 2018 & 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 & 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 & 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 & 2033

Table 24: Western Europe Market Volume (Tons) Forecast by End Use, 2018 & 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 & 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 & 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 & 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by End Use, 2018 & 2033

Table 31: East Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 32: East Asia Market Volume (Tons) Forecast by Country, 2018 & 2033

Table 33: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 34: East Asia Market Volume (Tons) Forecast by Product Type, 2018 & 2033

Table 35: East Asia Market Value (US$ Million) Forecast by End Use, 2018 & 2033

Table 36: East Asia Market Volume (Tons) Forecast by End Use, 2018 & 2033

Table 37: South Asia Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 38: South Asia Market Volume (Tons) Forecast by Country, 2018 & 2033

Table 39: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 40: South Asia Market Volume (Tons) Forecast by Product Type, 2018 & 2033

Table 41: South Asia Market Value (US$ Million) Forecast by End Use, 2018 & 2033

Table 42: South Asia Market Volume (Tons) Forecast by End Use, 2018 & 2033

Table 43: MEA Market Value (US$ Million) Forecast by Country, 2018 & 2033

Table 44: MEA Market Volume (Tons) Forecast by Country, 2018 & 2033

Table 45: MEA Market Value (US$ Million) Forecast by Product Type, 2018 & 2033

Table 46: MEA Market Volume (Tons) Forecast by Product Type, 2018 & 2033

Table 47: MEA Market Value (US$ Million) Forecast by End Use, 2018 & 2033

Table 48: MEA Market Volume (Tons) Forecast by End Use, 2018 & 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 & 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 & 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 & 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 & 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 & 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2018 & 2033

Figure 13: Global Market Volume (Tons) Analysis by End Use, 2018 & 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2023 & 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 20: North America Market Value (US$ Million) by End Use, 2023 & 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 & 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 & 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2018 & 2033

Figure 31: North America Market Volume (Tons) Analysis by End Use, 2018 & 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2023 & 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 38: Latin America Market Value (US$ Million) by End Use, 2023 & 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 & 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 & 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2018 & 2033

Figure 49: Latin America Market Volume (Tons) Analysis by End Use, 2018 & 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 & 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2023 & 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 & 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 & 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by End Use, 2018 & 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 & 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2023 & 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 & 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 & 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 & 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by End Use, 2018 & 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 & 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 92: East Asia Market Value (US$ Million) by End Use, 2023 & 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 95: East Asia Market Volume (Tons) Analysis by Country, 2018 & 2033

Figure 96: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 97: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 99: East Asia Market Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 100: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 101: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) Analysis by End Use, 2018 & 2033

Figure 103: East Asia Market Volume (Tons) Analysis by End Use, 2018 & 2033

Figure 104: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 & 2033

Figure 105: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 107: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 108: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 110: South Asia Market Value (US$ Million) by End Use, 2023 & 2033

Figure 111: South Asia Market Value (US$ Million) by Country, 2023 & 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 113: South Asia Market Volume (Tons) Analysis by Country, 2018 & 2033

Figure 114: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 115: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 117: South Asia Market Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 118: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 119: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: South Asia Market Value (US$ Million) Analysis by End Use, 2018 & 2033

Figure 121: South Asia Market Volume (Tons) Analysis by End Use, 2018 & 2033

Figure 122: South Asia Market Value Share (%) and BPS Analysis by End Use, 2023 & 2033

Figure 123: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 124: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 126: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: MEA Market Value (US$ Million) by Product Type, 2023 & 2033

Figure 128: MEA Market Value (US$ Million) by End Use, 2023 & 2033

Figure 129: MEA Market Value (US$ Million) by Country, 2023 & 2033

Figure 130: MEA Market Value (US$ Million) Analysis by Country, 2018 & 2033

Figure 131: MEA Market Volume (Tons) Analysis by Country, 2018 & 2033

Figure 132: MEA Market Value Share (%) and BPS Analysis by Country, 2023 & 2033

Figure 133: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: MEA Market Value (US$ Million) Analysis by Product Type, 2018 & 2033

Figure 135: MEA Market Volume (Tons) Analysis by Product Type, 2018 & 2033

Figure 136: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 & 2033

Figure 137: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: MEA Market Value (US$ Million) Analysis by End Use, 2018 & 2033

Figure 139: MEA Market Volume (Tons) Analysis by End Use, 2018 & 2033

Figure 140: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 & 2033

Figure 141: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 143: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dispersants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Organic Dispersants Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA