Edtech Market Size and Share Forecast Outlook 2025 to 2035

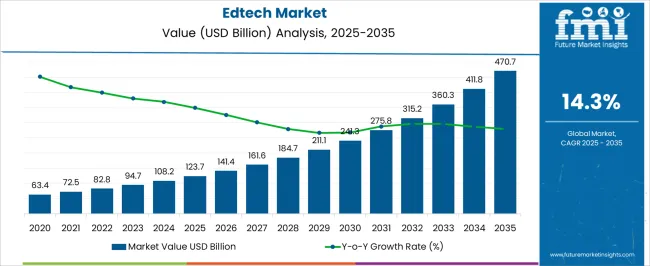

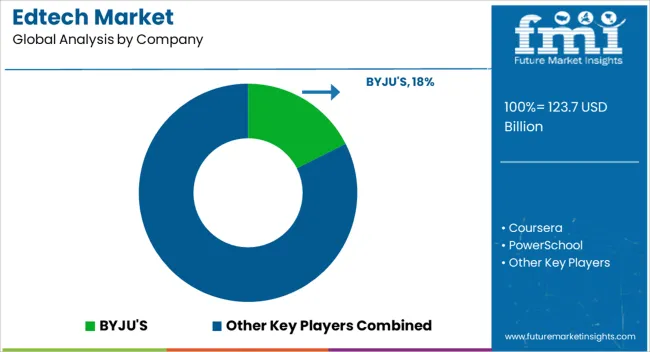

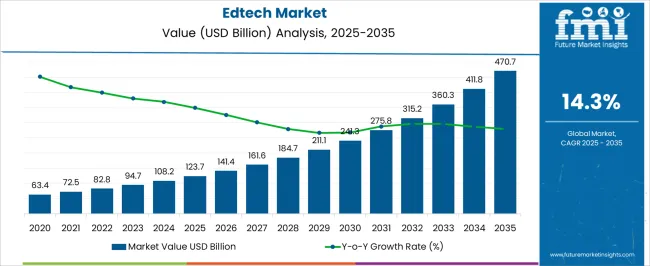

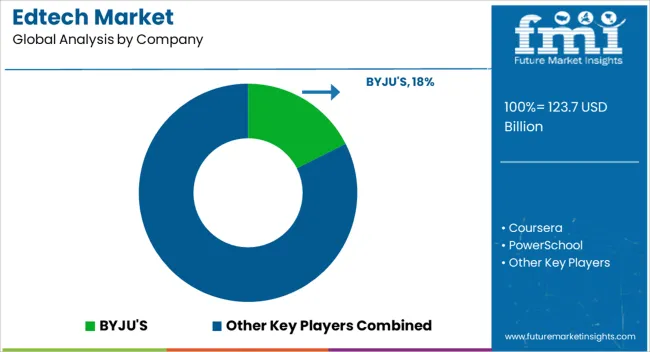

The Edtech Market is estimated to be valued at USD 123.7 billion in 2025 and is projected to reach USD 470.7 billion by 2035, registering a compound annual growth rate (CAGR) of 14.3% over the forecast period.

Quick Stats for Edtech Market

- Edtech Market Industry Value (2025): USD 123.7 billion

- Edtech Market Forecast Value (2035): USD 470.7 billion

- Edtech Market Forecast CAGR: 14.3%

- Leading Segment in Edtech Market in 2025: Software (46.8%)

- Key Growth Region in Edtech Market: North America, Asia-Pacific, Europe

- Top Key Players in Edtech Market: BYJU's, Coursera, PowerSchool, Udemy, Yuanfudao, VIPKid, 17zuoye, 2U, Genshuixue, iTutorGroup, Civitas Learning, Newsela, Instructure, Guild Education, Dreambox Learning, Duolingo, Knewton, Zuoyebang, HuJiang, Age of Learning, Stride, Udacity, Blackboard, Chegg

| Metric |

Value |

| Edtech Market Estimated Value in (2025 E) |

USD 123.7 billion |

| Edtech Market Forecast Value in (2035 F) |

USD 470.7 billion |

| Forecast CAGR (2025 to 2035) |

14.3% |

Pillars of Progress in the Edtech Sphere

- One major factor is the growing integration of technology into educational processes to improve administrative efficiency and learning results. The use of digital tools for administrative, teaching, learning, and assessment purposes falls under this category.

- The globalization of education has allowed Edtech businesses to expand their product and service offerings worldwide. The edtech platforms that let people learn languages, collaborate across cultural boundaries, and access global educational resources are becoming increasingly popular.

- The edtech market is expanding due to government spending, laws, and programs that support digital learning, close the digital gap, and enhance academic results. This covers financing for Edtech companies, collaborations with educational institutions, and innovation-friendly regulatory regimes.

- Personalized learning experiences catered to each student's requirements and learning preferences are becoming increasingly important. There is a demand for edtech solutions that provide data analytics for individualized insights, AI-driven content recommendations, and adaptive learning.

| Attributes |

Details |

| Market Value for 2020 |

USD 58.67 billion |

| Market Value for 2025 |

USD 95.13 billion |

| Market CAGR from 2020 to 2025 |

12.8% |

Deterrents to the Progress of EdTech Solutions

- In the edtech market, quick technological improvements result in shorter product lifetimes. Widespread adoption of edtech is likely to be inhibited by educational institutions' reluctance to invest in solutions that could quickly become outdated.

- Teachers and educators often receive the necessary training to use EdTech effectively. The effective integration of technology into the classroom is hampered by a lack of resources and training programs, which has the potential to reduce the technology's overall influence on learning outcomes.

- The widespread adoption of EdTech solutions is likely to stymie disparities in access to technology and the Internet among various demographic groups and geographical areas. Due to a lack of appropriate devices and dependable internet connectivity, students in economically deprived locations are likely to have limited access to online learning materials.

Category-wise Outlook

The segmented market analysis of EdTech is included in the following subsection. Based on comprehensive studies, the hardware sector is leading the component category, and the academic institution segment is commanding the end-user category.

Hardware's Key Position in Driving Edtech Innovation

| Attributes |

Hardware |

| Market Share (2025) |

42.8% |

- Reliability in hardware is a top priority for educational institutions to maximize learning results and improve student engagement.

- Digital content and interactive experiences have the potential to be delivered more easily due to hardware, which powers the infrastructure of educational technology.

- Complete edtech solutions are ensured by robust hardware ecosystems that provide smooth integration with software and services.

- The scalability and versatility of hardware improvements allow them to meet the changing needs of pedagogy in varied educational situations.

Academic Institutions Shape Education Technology Adoption

| Attributes |

Academic Institution |

| Market Share (2025) |

45.0% |

- The demand for cutting-edge educational technology solutions is constant because academic institutions prioritize innovation and ongoing learning.

- Strong demand exists for flexible Edtech platforms due to the academic institutions sector's ongoing struggles with remote learning and student engagement.

- Establishments are eager to invest in Edtech solutions that improve student achievement and instructional effectiveness because they prioritize academic institutions' excellence and student outcomes.

- In the larger Edtech landscape, academic institutions play a crucial role as early adopters, setting standards and influencing trends essential to the market's expansion and innovation.

Country-wise Analysis

The edtech market can be observed in the subsequent tables, which focus on the leading economies in Germany, Japan, China, the United States, Australia, and New Zealand. A comprehensive evaluation demonstrates that Australia and New Zealand have enormous opportunities.

Australia and New Zealand's Push for Equal Market Opportunities of Edtech

| Country |

Australia and New Zealand |

| CAGR (2025 to 2035) |

22.7% |

- Due to their geographical isolation and remoteness, Australia and New Zealand have seen a rapid uptake of online learning platforms, developing a robust Edtech ecosystem.

- Edtech solutions that integrate experiential and nature-based learning methodologies with Australia's cultural emphasis on outdoor education.

- The Edtech industry in New Zealand is distinguished by a cooperative approach, where collaborations between educational institutions and industry participants fuel innovation.

Edtech Credibility in Japan's Educational Landscape

| Nation |

Japan |

| CAGR (2025 to 2035) |

17.8% |

- The widespread adoption of Edtech solutions, which emphasize improving academic and personal development, indicates the cultural significance put on education.

- Japan's aging population influences Edtech trends since there is an increasing need for edtech platforms and solutions for lifelong learning that accommodate various age groups.

- Adaptive learning technologies and AI-driven personalized education are becoming prevalent in line with Japan's goal of individualized education.

Edtech Trends in China's Education System

| Nation |

China |

| CAGR (2025 to 2035) |

13.5% |

- The government's encouragement of technology businesses and educational institutions to collaborate indicates its support for Edtech innovation and helps drive its growth.

- A popular trend in China's Edtech industry is the combination of artificial intelligence (AI) with adaptive learning technology, which increases the efficacy of online learning.

- The Edtech market in China is defined by a preference for mobile learning solutions, consistent with smartphones' pervasive usage in education.

Data Privacy Emphasis Shapes Edtech Solutions in Germany

| Nation |

Germany |

| CAGR (2025 to 2035) |

12.4% |

- The development of Edtech solutions, with an emphasis on safeguarding student information, is influenced by the German focus on data privacy and security.

- Germany has a robust apprenticeship and vocational education system, so a large part of the Edtech industry is focused on skills- and vocational-based learning.

- Edtech solutions that promote language acquisition and intercultural understanding in Germany indicate the country's cultural respect for multilingualism.

Diverse Solutions Shaping the United States Edtech Market

| Nation |

United States |

| CAGR (2025 to 2035) |

11.2% |

- Edtech solutions for reskilling and upskilling workers in the United States are growing rapidly due to an emphasis on professional development and lifetime learning.

- A strong entrepreneurial spirit influences the United States Edtech landscape, and entrepreneurs are essential in bringing new ideas to the classroom.

- In the United States Edtech industry, accessibility and cost are important factors that influence programs to close the digital divide and ensure equal access to education.

Competitive Analysis

Key edtech vendors in the competitive landscape are advancing innovation and influencing the direction of education. Leading edtech manufacturers providing a wide range of global solutions to learners include Chegg, Coursera, and Blackboard Inc.

Plaetzi, PlelQ, and Digital House, each contributing their methods to meet different educational demands. Through their edtech platforms, Agenda Edu and UOL improve accessibility and engagement. Crehana and Smart Technologies broaden the selection with their specialist services and tools.

Important roles are played by EdX, Microsoft, and Oracle Corporation, which use their technology know-how to revolutionize education. Notable edtech providers that offer specialized services and solutions are Hurix Digital and E-Zest Solutions Ltd.

Conventional learning environments are revolutionized by Touch IT Technologies and Promethan World's unique classroom solutions. SIMA E-learning broadens the scope of educational opportunities by incorporating a global perspective.

These producers work together and compete to shape the Edtech industry. Their combined efforts open the door for a more promising future for education by promoting creativity, accessibility, and diversity in the field.

These major edtech vendors continue to be at the forefront, influencing millions of people's educational experiences as the market expands and changes.

Notable Advancements and Breakthroughs

| Company |

Details |

| Baims |

Baims, a Kuwaiti EdTech company, purchased Egyptian online tutoring startup Orcas in January 2025. Through the acquisition, Baims hopes to become more well-known and increase its services by adding individualized one-on-one teaching and pre-recorded courses. |

| EchoPollTM |

The EdTech SaaS platforms EchoPollTM for interactive polling, ExamViewTM with expanded assessment features, and EchoVideoTM with improved editing tools and accessibility were announced by Echo360 in April 2025. With a focus on interaction, these releases seek to revolutionize the educational process and solidify Echo360's leadership in the EdTech space. |

| Finnish Global Education Solutions Oy |

Finnish Global Education Solutions Oy and Indian ed-tech platform Stones2Milestones joined in November 2025. The cooperation intends to concentrate on developing cutting-edge technological solutions for wider worldwide application and integrating the Finnish learning paradigm into Indian schools, with an emphasis on teacher professional development. |

| Teachmint Technologies Pvt. Ltd. |

An online software for teachers and students called Teachmint Technologies Pvt. Ltd. purchased MyClassCampus, an ERP platform for educational institutions, in January 2025. |

| BYJU'S |

To improve consistency in online learning for instructors and students alike, BYJU'S, an EdTech startup offering online tuition, teamed up with Google LLC in June 2024. Due to this collaboration, educational establishments can now provide students with a customized digital classroom management platform. |

Pivotal Edtech Providers

- Coursera

- PowerSchool

- Udemy

- Yuanfudao

- VIPKid

- 17zuoye

- 2U

- Genshuixue

- iTutorGroup

- Civitas Learning

- Newsela

- Instructure

- Guild Education

- Dreambox Learning

- Duolingo

- Knewton

- Zuoyebang

- HuJiang

- Age of Learning

- Stride

- Udacity

- Blackboard

- BYJU'S

- Chegg

Key Coverage in Edtech Market Report

- Education Technology Market Trends

- Opportunity for the EdTech Market in Australia and New Zealand

- Market Potential of Education Technology in Japan

- Competitive Landscape of Key Edtech Providers

- Strategic Roadmaps for Edtech Vendors with Focus on Teachmint Technologies Pvt. Ltd., BYJU'S, and Others.

Report Scope - Edtech Market

| Report Attributes |

Details |

| Current Total Market Size (2025) |

USD 123.7 billion |

| Projected Market Size (2035) |

USD 470.7 billion |

| CAGR (2025 to 2035) |

14.3% |

| Base Year for Estimation |

2025 |

| Historical Period |

2020 to 2025 |

| Forecast Period |

2025 to 2035 |

| Quantitative Units |

Revenue in USD billion |

| Product Types Analyzed (Segment 1) |

Hardware, Software, Content |

| Applications Analyzed (Segment 2) |

Preschool, K-12, Higher Education, Others |

| Regions Covered |

North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered |

United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, South Africa |

| Key Players Influencing the EdTech Market |

Google for Education; Microsoft Education; Coursera; Blackboard Inc.; Pearson; Udemy; Khan Academy; Byju’s; Duolingo; EdX (2U Inc.) |

| Additional Attributes |

Market segmentation by product type and application; analysis of consumer preferences for digital learning tools; regulatory landscape overview; impact of technological advancements on market growth; regional market trends and growth opportunities |

| Customization & Pricing |

Available upon Request. |

Key Segments

By Component:

- Hardware

- Interactive White Board

- AR/VR Devices

- Projectors

- Webcasting Devices

- Others

- Software

- Learning Management System Platform

- Virtual Classroom Software

- Others

- Services

- Managed Learning Services

- Professional Services

- Learning and Content Management

- Consulting

- Integration and Implementation

- Support and Maintenance

By End User:

- Government Organization

- Academic Institution

- K-12

- College Universities

- Enterprises

- Others

By Region:

- North America

- Latin America

- Europe

- East Asia

- South Asia and Pacific

- Middle East and Africa

Frequently Asked Questions

How big is the edtech market in 2025?

The global edtech market is estimated to be valued at USD 123.7 billion in 2025.

What will be the size of edtech market in 2035?

The market size for the edtech market is projected to reach USD 470.7 billion by 2035.

How much will be the edtech market growth between 2025 and 2035?

The edtech market is expected to grow at a 14.3% CAGR between 2025 and 2035.

What are the key product types in the edtech market?

The key product types in edtech market are software, _learning management system platform, _virtual classroom software, _others, hardware, _interactive white board, _ar/vr devices, _projectors, _webcasting devices, _others, services, _managed learning services and _professional services.

Which end user segment to contribute significant share in the edtech market in 2025?

In terms of end user, academic institution segment to command 53.4% share in the edtech market in 2025.