The enameled cookware market is gaining traction as consumers increasingly prioritize aesthetic appeal, durability, and non-reactive cooking surfaces in their kitchenware. Industry press releases and brand announcements have emphasized the growing demand for enamel-coated cast iron and steel products that combine visual elegance with heat retention efficiency.

A rise in home cooking trends, fueled by health-conscious lifestyles and culinary experimentation, has expanded the consumer base for high-performance cookware. Product innovation, including chip-resistant enamel coatings and vibrant finishes, has further elevated the appeal of enameled cookware in both premium and mid-range segments.

Additionally, increased consumer awareness around the long-term safety of non-stick alternatives has encouraged a shift towards enameled surfaces, which do not leach chemicals during high-heat cooking. The market outlook remains positive, supported by retail expansion, cookware brand collaborations with chefs and designers, and growing residential demand. Segmental growth is being led by Pots, driven by their versatility, the Residential application segment due to household adoption trends, and Offline distribution channels where in-store experience influences purchasing decisions.

| Metric | Value |

|---|---|

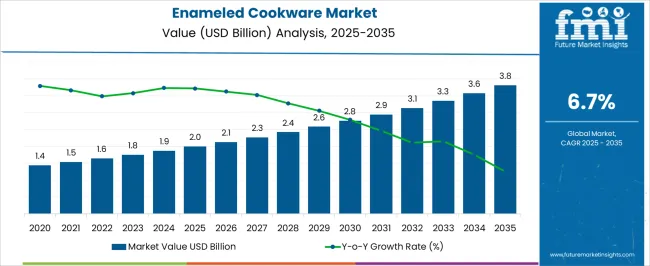

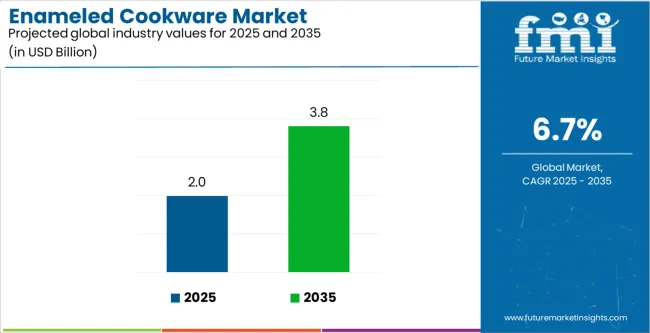

| Enameled Cookware Market Estimated Value in (2025 E) | USD 2.0 billion |

| Enameled Cookware Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

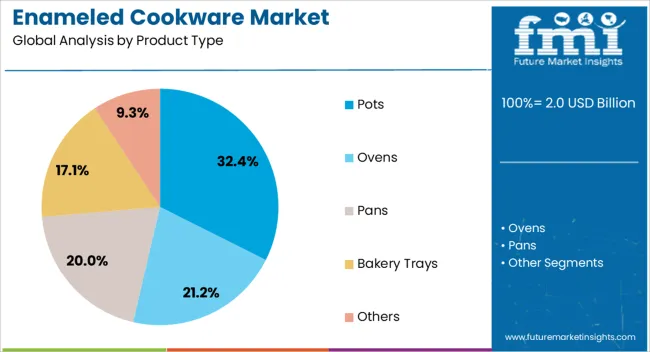

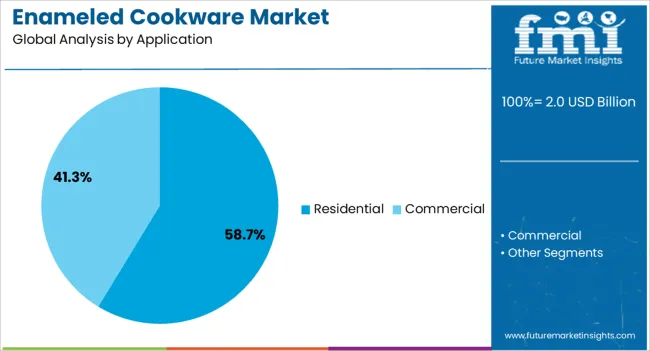

The market is segmented by Product Type, Application, and Distribution Channel and region. By Product Type, the market is divided into Pots, Ovens, Pans, Bakery Trays, and Others. In terms of Application, the market is classified into Residential and Commercial. Based on Distribution Channel, the market is segmented into Offline and Online. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Pots segment is projected to contribute 32.4% of the enameled cookware market revenue in 2025, maintaining its position as the leading product category. Growth in this segment has been attributed to the functional versatility of pots in various cooking styles, including slow-cooking, braising, boiling, and stewing.

Enameled pots have gained popularity for their ability to retain and evenly distribute heat, which enhances cooking efficiency while preserving food texture and flavor. Retail insights have shown consistent consumer preference for enameled Dutch ovens and stock pots, especially in residential kitchens where one-pot meals are increasingly favored.

Furthermore, product development efforts have introduced aesthetically appealing designs and color options, driving the adoption of pots as both functional cookware and countertop decor. With rising consumer investment in kitchen tools that support everyday and occasional cooking needs, the Pots segment is expected to sustain its lead in the product type category.

The Residential segment is projected to account for 58.7% of the enameled cookware market revenue in 2025, reflecting its dominance in end-user adoption. Growth of this segment has been fueled by shifting consumer habits toward home-prepared meals, dietary control, and comfort-driven cooking experiences.

Homeowners have increasingly sought cookware that blends performance with visual appeal, favoring enameled cookware for its easy maintenance, non-reactive surfaces, and compatibility with modern kitchen aesthetics. Consumer lifestyle trends captured in home goods publications have highlighted increased interest in artisanal and premium cookware, particularly among millennials and Gen Z buyers furnishing new homes or upgrading kitchen essentials.

Enameled cookware has also been positioned as a gift-worthy item, supporting demand during seasonal and festive periods. As online content platforms and cooking shows promote home-based culinary experiences, the Residential segment is expected to remain a key driver of market demand.

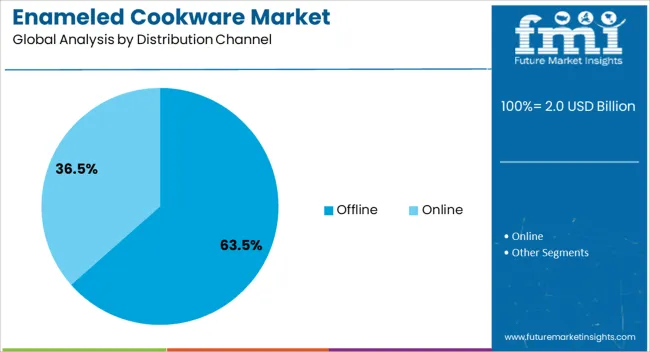

The Offline segment is projected to hold 63.5% of the enameled cookware market revenue in 2025, establishing itself as the leading distribution channel. This segment’s growth has been supported by consumer preferences for tactile shopping experiences where product weight, finish, and quality can be physically assessed.

Cookware brands have reported strong sales through specialty kitchenware stores, department stores, and home improvement outlets, where expert staff and in-store demonstrations influence purchasing decisions. Offline retail formats have also allowed consumers to compare cookware collections side-by-side, aiding decisions on color matching and kitchen compatibility.

Brick-and-mortar stores have offered exclusive collections and bundle deals that incentivize in-person purchases. Additionally, premium and luxury enameled cookware brands have prioritized showroom experiences to reinforce brand positioning and consumer engagement. With continued emphasis on experiential retail and value-added services like product consultations and cookware workshops, the Offline channel is expected to dominate the distribution landscape for enameled cookware.

Aesthetic Adulthood Now Made Possible by New Offerings by Leading Brands

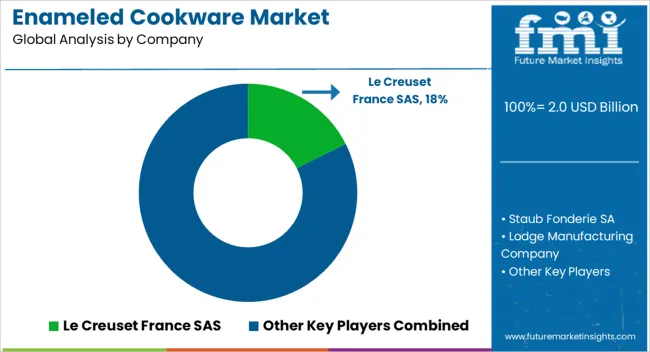

Young people, especially Gen Z, are increasingly investing in quality cookware. This is because certain famed Instagram-friendly brands like Le Creuset, which offer bright-colored pans, pots, and sturdy Dutch ovens, have caught Gen-Zer's interest.

These players are blurring the lines between aesthetically appealing decor and functional cookware. Their popularity among Gen-Zers, relies on their online cottage-core trend, which diverged from Pinterest and found a home in TikTok during the pandemic. Massive following and viewership of these brands’ content is promoting product sales.

The appeal of brands like Le Creuset lies in its reputation as a wise investment for people having the intent to stick with the cooking habit.

Commercial Sector to Contribute to Increasing Sales of Enameled Cooking Vessels

The trend of frequent eating out at hotels, bars, restaurants, and other eating joints is expected to create demand for heat-resistant, durable cookware to cook and maintain appropriate temperatures of food.

Furthermore, the expanding restaurant industry has led restaurant owners to invest in high-quality cookware to ensure quality service and food at their establishments. The shifting mindset of consumers is driving demand for enameled cookware in the commercial sector.

Key Barriers to the Growth of Enameled Cookware Industry

Enameled cookware is priced at a higher end. Thus, creating a barrier for consumers with limited budgets. This is especially seen in emerging economies, where discretionary income is relatively less than in developed countries.

Cookware composed of stainless steel or aluminum is increasingly preferred over enameled cooking vessels due to its lightweight, rust-free, and cost-effectiveness. This is further limiting the scope of enameled cooking vessels.

Global enameled cookware sales rose at a CAGR of 6.5% from 2020 to 2025. Through 2035, the industry is projected to expand at a 6.7% CAGR. Inflating income levels in developing countries and growing health concerns are stimulating the sales of enameled cookware.

The increase in nuclear families, and more recently, the surge in single-person households, is favoring the products’ sales prospects. Moreover, rising renovation and kitchen remodeling projects are motivating consumers to purchase enameled cookware products.

Continuous replacements of traditional cooking accessories with modern, induction-compatible cookware products among eco-conscious consumers, are driving sales. Teflon-coated cookware is now widely known for its toxicity to humans as well as the environment.

Chefs and the general public are turning away from its use in favor of eco-friendly alternatives like ceramic non-stick coating cookware. The popularity of these alternatives is further driven by surging ethical consumerism.

Players are expected to invest in research and development activities to develop cookware products that meet various requirements of consumers. More competition in the enameled cookware industry is predicted to accelerate the release of innovations over the years to follow.

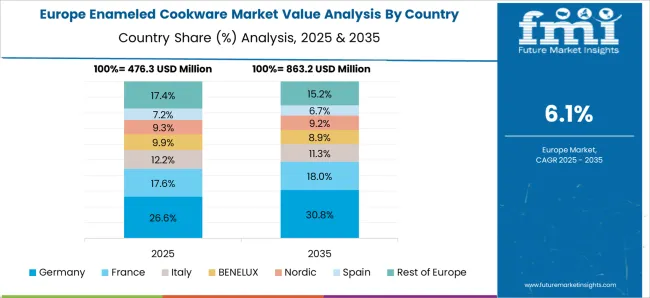

The section below tabulates the growth rates identified across leading markets for enameled cookware. There’s a distinct trend spotted among developed and developing countries. Germany and the United States show moderate sales scope for the product. Meanwhile, developing countries of Asia Pacific exhibit a higher demand for enameled cookware.

| Countries | CAGR 2025 to 2035 |

|---|---|

| The United States | 4.8% |

| Germany | 5.3% |

| China | 8.4% |

| India | 9.6% |

| Australia | 6.2% |

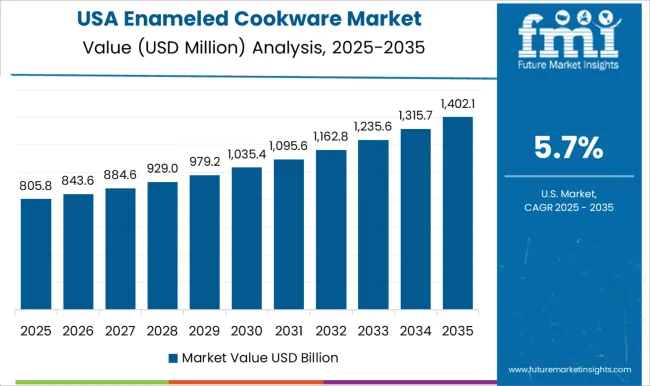

The United States is predicted to witness moderate growth of 4.8% CAGR through 2035. The high acceptability of technologically advanced cookware appliances among American households is fueling product sales.

The industry is pushed forth by the increasing influence of popular chefs and televised programs. These shows feature enameled cookware covered in peppy colors to hook the viewers. In turn, sales of enameled cookware are seeing a surge.

Manufacturers are supported by regional policies that promote the trade of energy-efficient appliances. Higher gains in this industry are motivating stakeholders to raise their stakes in enameled cookware.

Sales of enameled cookware in Germany are predicted to surge ahead at a CAGR of 5.3% over the forecast period. The increasing appeal of classic-looking products among Germans is raising product-related purchases.

Dynamic culinary practices in Germany are also positively influencing the sales of enameled cookware. Consumers are further seen increasing their spending on health-oriented kitchen appliances to cook healthier meals at home.

As creative and cutting-edge items gain interest among Germans, sales of enameled cookware are expected to spur. The latest technology makes meal preparation convenient and fun.

India is expected to accelerate at a CAGR of 9.6% over the estimated period. The surge in home improvement projects across the country is favoring enameled cookware. Consumers in India are inclined to purchase cookware that is easy to clean and maintain. Ease and comfort associated with the use of enameled cookware is thus fueling product demand.

The industry is further stimulated by the running trend of smart kitchens. Householders especially show an inclination for smart kitchens. This, along with growing demand for new, different types of cookware to cook various cuisines is expected to spur industry growth. Rising preference for unique, multi-utility products is further expected to fuel product demand.

This segment offers key insights regarding the top performers in various product categories. In the product segment, pans are expected to acquire a share of 33% in 2025. Based on application, the residential sector is projected to lead with a 61% share in the year 2025.

| Segment | Pans (Product) |

|---|---|

| Value Share (2025) | 33% |

Out of all the enameled cookware, pans are significantly purchased, positioning them as a top product. Pans are expected to record a share of 33% by 2025 end.

Pans are highly demanded to carry out culinary procedures like preparing sauces, brewing stocks, sautéing, frying, grilling, and braising. Growing knowledge about PTFE and PFOA-free non-stick coating is a key trend that is influencing sales of enameled pans.

Influencer marketing has put a spotlight on aesthetically appealing cookware. As enamel pans come in vibrant colors and have a classic appearance, they are gaining popularity over social media channels.

| Segment | Residential (Application) |

|---|---|

| Value Share (2025) | 61% |

Homeowners are the leading consumers of enameled cookware. The residential sector is projected to account for 61% share in 2025.

Householders are increasingly investing in enameled cooking vessels, particularly enameled cast iron, to promote even cooking and lead to effective results in the kitchen. Further, increasing the use of enameled cooking vessels for many purposes like baking, braising, and induction is expanding the segment’s size.

Rising demand for long-lasting kitchenware is also promoting the sales of enameled cooking vessels, which are known for their exceptional durability.

The competitive landscape of the enameled cooking vessels industry is filled with entrants and few established players. Players are offering innovations beyond the conventional Dutch oven. Thus, providing innovative designs like grill pans, fry pans with lids, and casserole dishes to serve the various cooking needs.

Key players in the enameled cookware industry are introducing enameled cooking vessels in vibrant colors and designs. This strategy is expected to raise the appeal of these cookware among design-conscious buyers.

Leading companies are targeting Gen Z and millennials, which digital marketing, as they are showing heightened interest in cooking. To target these demographics, players are selling their enameled cookware offerings on eCommerce platforms and assuming direct-to-consumer models.

Players are further extending warranties and customer service to foster brand loyalty and trust. Industry participants are also developing quality and durable enameled cooking vessels that have been the highlight of their marketing.

Industry Updates

Based on product type, the industry is divided into ovens, pots, pans, bakery trays, and others.

By application, the market is bifurcated into commercial and residential.

The main distribution channels of enameled cooking vessels include offline and online.

The enameled cooking vessels are sold across North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

The global enameled cookware market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the enameled cookware market is projected to reach USD 3.8 billion by 2035.

The enameled cookware market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in enameled cookware market are pots, ovens, pans, bakery trays and others.

In terms of application, residential segment to command 58.7% share in the enameled cookware market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA