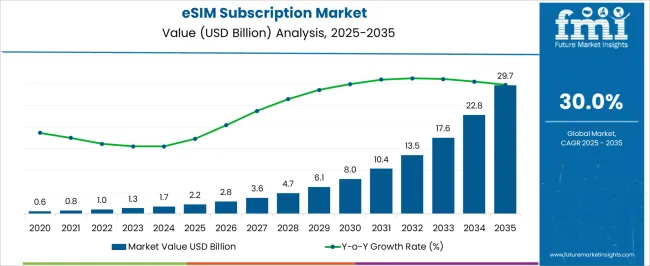

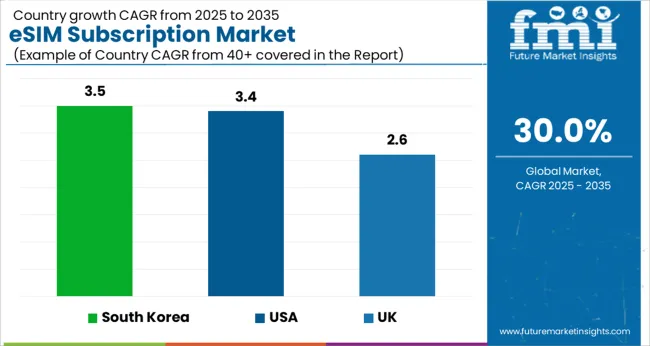

The eSIM Subscription Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 29.7 billion by 2035, registering a compound annual growth rate (CAGR) of 30.0% over the forecast period.

| Metric | Value |

|---|---|

| eSIM Subscription Market Estimated Value in (2025 E) | USD 2.2 billion |

| eSIM Subscription Market Forecast Value in (2035 F) | USD 29.7 billion |

| Forecast CAGR (2025 to 2035) | 30.0% |

The eSIM subscription market is advancing rapidly, driven by the proliferation of connected devices, growing IoT ecosystems, and the rising demand for seamless connectivity across borders. Unlike traditional SIM cards, embedded SIM technology provides enhanced flexibility, remote provisioning, and simplified network switching, which are increasingly valued in dynamic digital environments.

Governments and telecom providers are encouraging eSIM adoption through supportive regulations and infrastructure investments, especially in 5G rollouts. Advancements in device miniaturization and consumer expectations for uninterrupted network access have further propelled the shift toward eSIM integration in consumer electronics, automotive systems, and industrial applications.

With the digital transformation of telecom services and increasing focus on interoperability, the eSIM subscription market is expected to continue expanding across both consumer and enterprise segments, offering opportunities for scalable, secure, and globally connected solutions.

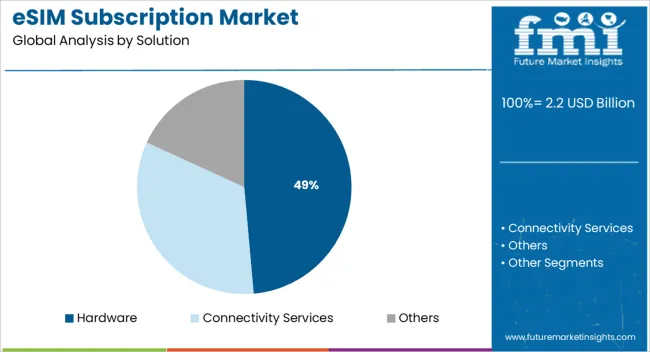

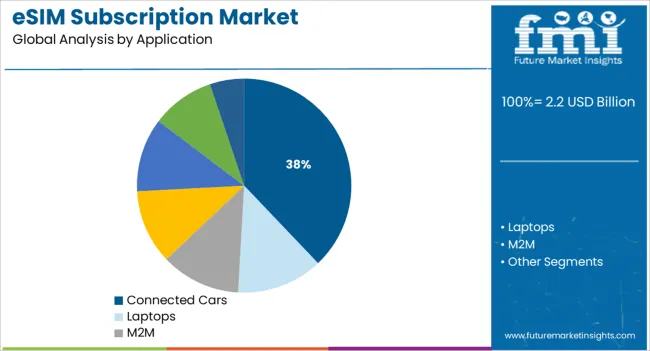

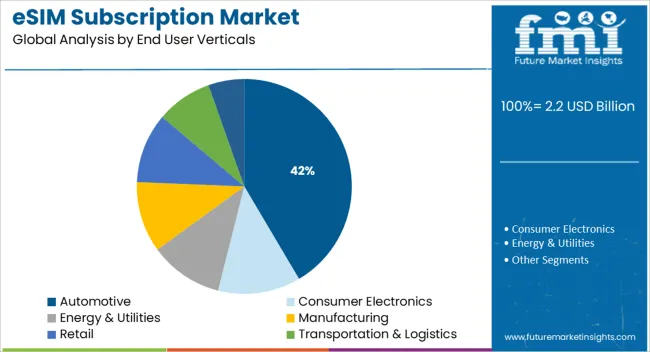

The market is segmented by Solution, Application, and End User Verticals and region. By Solution, the market is divided into Hardware, Connectivity Services, and Others. In terms of Application, the market is classified into Connected Cars, Laptops, M2M, Smartphones, Tablets, Wearables, and Others (Drones, Smart Meters, Smart Grids). Based on End User Verticals, the market is segmented into Automotive, Consumer Electronics, Energy & Utilities, Manufacturing, Retail, Transportation & Logistics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment is expected to account for 48.60% of total revenue by 2025 within the solution category, establishing itself as the dominant component. This is primarily due to the physical integration of embedded SIM chips into devices, which is essential for enabling remote provisioning and network compatibility.

As connected products in mobility, consumer electronics, and industrial applications increasingly rely on non removable SIM components, demand for robust and secure hardware modules has surged. Additionally, manufacturers are prioritizing the integration of tamper resistant designs and enhanced security features within eSIM hardware to meet regulatory and privacy standards.

The growing need for compact, power efficient, and scalable connectivity solutions has firmly positioned hardware as the foundational element in the overall eSIM ecosystem.

The connected cars segment is projected to hold 37.90% of the total application share by 2025, positioning it as the leading area of use. This dominance is driven by the rising deployment of vehicle telematics, in car connectivity features, and over the air software updates.

Automakers are incorporating eSIM technology to support real time diagnostics, navigation systems, infotainment, emergency response, and fleet tracking solutions. The ability to switch networks without changing physical cards enhances global operability, particularly for automotive manufacturers with international distribution.

As mobility innovations progress and smart transportation systems expand, connected cars continue to represent a key driver of eSIM application growth.

The automotive sector is expected to represent 41.50% of total market revenue by 2025 among end user verticals, making it the most dominant vertical. The adoption of eSIM technology in this sector is being driven by the evolution of smart mobility, the growth of electric vehicles, and the rising need for real time connectivity across transport networks.

Automakers are leveraging eSIM solutions to enhance safety features, enable predictive maintenance, and deliver integrated digital services. The integration of eSIM also supports compliance with global regulatory mandates for connected vehicle infrastructure.

As vehicle platforms become more software defined and reliant on data exchange, the automotive vertical continues to lead eSIM implementation, supported by long product life cycles and the increasing complexity of in vehicle systems.

The eSIM business model is intricate and involves a number of partners. Stakeholders must coordinate and collaborate to set standards for economies of scale, connectivity, and IoT technologies, such as M2M interactions and universal cellular networks, in order to integrate embedded SIMs over a wide range of goods successfully.

So many International bodies, such as the European ETSI and the GSMA, are concentrating on developing standards on both technical and operational facets to address this issue that is poised to further augment the market and adoption of eSIM subscriptions.

Mobile Network Operators (MNOs) are also nowadays offering eSIM for international travel to securely regulate end-user cellular subscriptions from a distance.

Additionally, the demand for eSIM subscriptions in the automobile sector following the concept of linked cars is emerging as a new opportunity for the market players. The use of online eSIM in the automotive sector is anticipated to greatly simplify maneuvering and obtaining real-time data ultimately promoting the growth of the eSIM subscription numbers.

Other than that, the growing competition among market leaders in order to provide internet services at a reasonable price, they have begun to spend extensively in the eSIM data-only services category. This, in turn, is projected to further boost the eSIM subscription market opportunities in the coming days.

North America and European Countries are the first to use the eSIM digital technology.

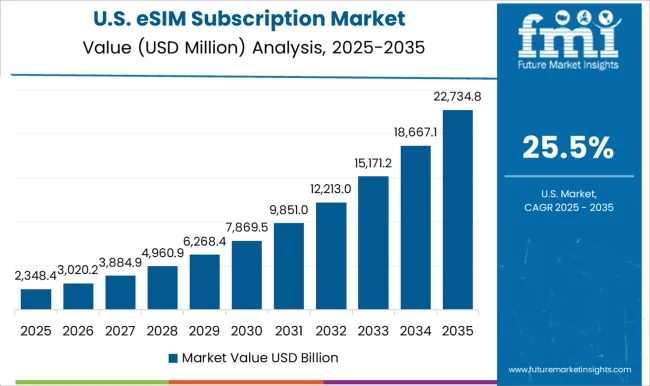

As per the recently released market survey reports, by registering the fastest CAGR in the last decade, the USA eSIM subscription market held the leading position in comparison to other countries. According to the records, it contributes to almost 40% of the global market revenue in the present year 2025. This rise can be attributed to the country's rapid technical improvements and the widespread presence of wireless carriers.

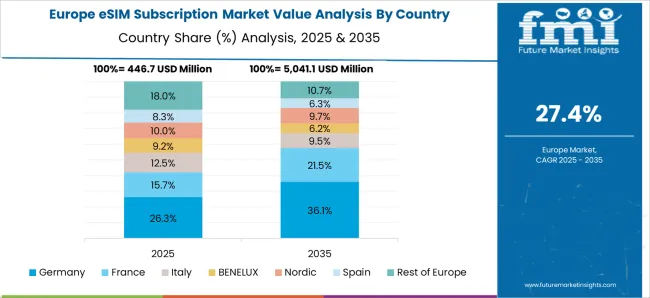

By the virtue of the presence of many significant original equipment manufacturers, including Giesecke & Devrient Mobile Security GmbH, STMicroelectronics, NXP Semiconductors N.V., and others, Europe, with a market value of USD 2,070.3 in 2024, is expected to continue as a leading region for the eSIM subscription.

Moreover, the Eurolink prepaid regional eSIM services are quite popular in European countries constituting a significant portion of the studied market.

The greatest CAGR is anticipated for the eSIM subscription market in APAC mostly between 2025 and 2035. As the rate of smartphone adoption is increasing gradually in this area, and it is clear that three of the top five smartphone user base nations worldwide, including Australia, Singapore, and South Korea, are located in APAC, China's eSIM subscription market would emerge as the top country.

Throughout the projected period, the China eSIM subscription Market is anticipated to register a CAGR of 8.5% and emerge as a lucrative market for global players. Leading smartphone manufacturers in the country like Huawei and OnePlus Electronics have introduced eSIM mobile phones, gaining traction in the eSIM subscription business and establishing eSIM as the standard SIM technology in adjacent countries as well.

In present times, a number of OEMs are creating eSIM solutions and assembling collaborative development teams from across the landscape in nations like China and India in order to forge strong demand for eSIM subscriptions.

The international player IDEMIA has also recently constructed a new facility in India, which is anticipated to enhance the adoption of eSIM for travel purposes by denizens and international tourists.

This country has also witnessed a sharp rise in the use of linked smart gadgets and vehicles in the last two decades. Moreover, with the recent boom in providing digital services by telecom operators, the unlimited data eSIM is getting popular and is anticipated to boost the eSIM subscription market trends and opportunities as a result of all these variables.

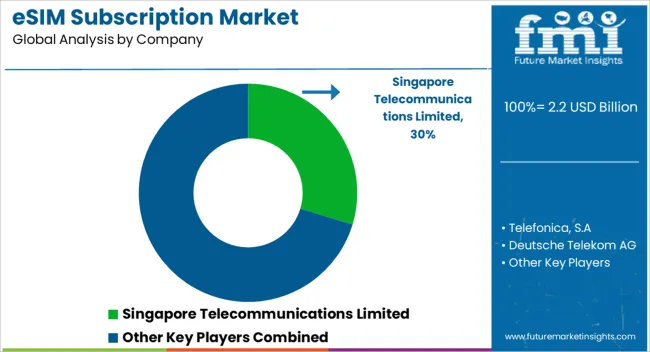

The eSIM subscription market study report by FMI Research indicates that G+D and Thales are at the present years continue to be the leading players in the global market. They also lead in a lot of key metrics, including OS, portability, and privacy that have surfaced as major concerns besides price and service for consumers in the present times.

As per the market survey reports, almost 35% of all eSIM for Samsung watch wearables, as well as over a million eSIM phones and tablets, are enabled by Giesecke+Devrient Mobile Security GmbH.

However, recently entered market participants like IDEMIA have taken the lead and offer extensive eSIM enabling capabilities along with its own embedded secure products of eUICC and iUICC operating systems, as well as by creating products for its users such as automotive, and IoT applications.

Since a lot of businesses are concentrating on the creation of cutting-edge, and economical solutions and technology, it is projected that the rivalry between eSIM subscription market players is anticipated to become even fiercer in the coming days.

Another of the firms advancing the strongest within the eSIM subscription market space is Kigen, which is now placed fourth by the market statistics reports. In particular, it tops the ranking in terms of firmware, adherence & compliance, and privacy protection.

Other than that, Dark horses Truphone, VALID and Oasis Smart SIM, Workz, and RedTea Mobile are some of the new eSIM subscription market participants that are well-positioned too to build on their strengths and compete with the market's top players.

The global esim subscription market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the esim subscription market is projected to reach USD 29.7 billion by 2035.

The esim subscription market is expected to grow at a 30.0% CAGR between 2025 and 2035.

The key product types in esim subscription market are hardware, connectivity services and others.

In terms of application, connected cars segment to command 37.9% share in the esim subscription market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

FeSiMg Nodularizers Market Size and Share Forecast Outlook 2025 to 2035

Rare Earth FeSiMg Nodularizers Market Size and Share Forecast Outlook 2025 to 2035

Subscription Economy Market Size and Share Forecast Outlook 2025 to 2035

Subscription Carwash Services Market Size and Share Forecast Outlook 2025 to 2035

Subscription and Billing Management Market Insights – Forecast 2023-2033

FWA Subscription Market Size and Share Forecast Outlook 2025 to 2035

Wine Subscription Market Analysis by Subscription Model, Wine Type, Price Tier, and Subscription Frequency and Region through 2035

Beauty Subscription Market Growth - Innovations, Trends & Forecast 2025 to 2035

Elder Care Subscription Market Size and Share Forecast Outlook 2025 to 2035

Consumer Cloud Subscription Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA