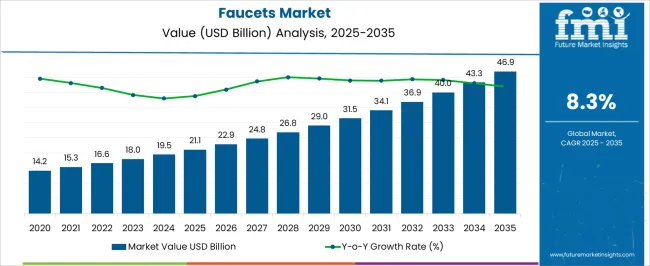

The faucets market is projected to reach USD 21.1 billion in 2025 and is anticipated to expand to USD 46.9 billion by 2035, growing at a CAGR of 8.3%. A breakpoint analysis of this trajectory highlights the key phases where demand shifts between steady expansion and accelerated growth. From 2025 to 2027, the market advances from USD 21.1 billion to USD 22.9 billion, driven mainly by residential remodeling activity and steady adoption of premium faucets in urban housing projects.

Between 2028 and 2031, the market crosses USD 29.0 billion, reflecting a sharper acceleration fueled by large-scale commercial developments, hotel renovations, and institutional construction projects that favor advanced water-saving faucets. This period is identified as a critical breakpoint, marking the transition from replacement-driven demand to innovation-led installations. By 2032, demand stabilizes briefly as replacement cycles dominate in mature regions, with the market reaching USD 36.9 billion. Beyond 2033, the trajectory resumes an upward climb toward USD 46.9 billion by 2035, as emerging economies boost installations through infrastructure projects, coupled with rising consumer spending on branded and design-focused faucets.

The breakpoint analysis reveals that while early growth is renovation-focused, mid-period expansion is construction-led, and later momentum is carried by emerging markets and replacement cycles, ensuring balanced but dynamic long-term growth.

| Metric | Value |

|---|---|

| Faucets Market Estimated Value in (2025 E) | USD 21.1 billion |

| Faucets Market Forecast Value in (2035 F) | USD 46.9 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The faucets market is shaped by five interconnected parent markets, each contributing differently to demand and expansion. The residential construction and remodeling market holds the largest share at 38%, as households increasingly adopt premium, water-efficient, and design-focused faucets in kitchens and bathrooms. The commercial real estate and hospitality market contributes 25%, with hotels, offices, malls, and institutional facilities installing advanced faucet systems to enhance functionality, aesthetics, and hygiene standards.

The plumbing and sanitary fittings industry accounts for 15%, as faucets serve as a key component within integrated water delivery and utility networks, ensuring compliance with safety and efficiency codes. The retail and distribution channel market holds a 12% share, driven by specialty stores, DIY retailers, and e-commerce platforms that influence product accessibility and consumer choice.

The industrial and public infrastructure market represents 10%, where airports, railway stations, schools, and healthcare facilities deploy durable faucets designed for heavy usage and strict maintenance requirements. Residential, commercial, and plumbing sectors account for 78% of overall demand, emphasizing how home renovations, hospitality expansions, and industry compliance shape the primary drivers, while retail networks and public projects provide incremental opportunities for consistent global growth in the faucet industry.

The faucets market is experiencing sustained expansion driven by rising urbanization, increasing residential construction activities, and a growing emphasis on water conservation technologies. Consumer demand is shifting toward ergonomic designs, smart water control features, and aesthetically aligned products that enhance both utility and interior design.

Technological advancements such as touchless operation, temperature control, and water flow optimization are accelerating innovation within the sector. Government initiatives promoting water efficiency standards and green building certifications are further supporting product modernization.

With lifestyle upgrades and infrastructure development continuing across emerging and developed regions, the faucets market is expected to grow steadily, shaped by evolving consumer preferences and regulatory momentum toward eco friendly and efficient fixtures.

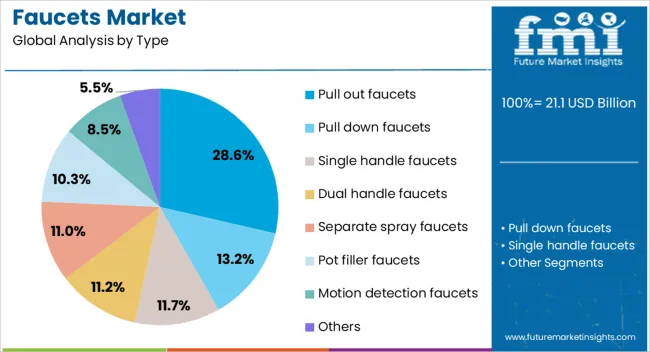

The faucets market is segmented by type, application, end use, and geographic regions. By type, faucets market is divided into Pull out faucets, Pull down faucets, Single handle faucets, Dual handle faucets, Separate spray faucets, Pot filler faucets, Motion detection faucets, and Others. In terms of application, faucets market is classified into Kitchen, Bathroom, and Others. Based on end use, faucets market is segmented into Residential and Commercial. Regionally, the faucets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pull out faucets segment is projected to contribute 28.60% of the overall market revenue by 2025, emerging as the leading product type. This growth is attributed to the versatility and functional flexibility these faucets offer in residential and commercial kitchens.

The ability to direct water flow with precision, ease of cleaning large cookware, and user friendly design make them an attractive choice for modern kitchens. Manufacturers are increasingly integrating pull out systems with sleek aesthetics and water saving technologies, aligning with both convenience and sustainability trends.

Their adaptability across contemporary kitchen layouts and rising popularity in urban households have further elevated demand, establishing pull out faucets as the dominant type in the market.

The faucets market is shaped by residential remodeling, commercial construction, consumer preference for design, and regulatory standards. Together, these dynamics highlight durability, efficiency, and aesthetics as key growth drivers.

The faucets market is witnessing consistent momentum from residential construction and remodeling activities worldwide. Homeowners are increasingly investing in premium fixtures that combine aesthetics with long-term durability. Kitchen and bathroom upgrades remain the primary drivers, where faucets are chosen not only for water delivery but also as statement pieces enhancing interior design. Demand is supported by the rising middle-class segment seeking branded products that balance cost and performance. Refurbishment of older homes further fuels adoption, as buyers replace outdated fixtures with modern, efficient models. This dynamic highlights how the faucets industry benefits from both new housing starts and the continuous cycle of renovation projects in developed and emerging markets alike.

Commercial infrastructure development across hospitality, retail, and institutional sectors is a significant factor influencing faucet demand. Hotels and resorts favor advanced designs to meet guest expectations for comfort and luxury, while malls and office complexes require durable, high-traffic fixtures. Institutions such as schools, hospitals, and airports prioritize reliable, easy-to-maintain faucets that meet strict hygiene and operational standards. This segment’s growth is closely tied to global construction activity, where large projects often drive bulk procurement of faucets. Manufacturers offering a wide product portfolio across price ranges stand to benefit. The trend demonstrates that commercial applications will continue to provide a stable and lucrative share of the faucet market’s revenue base.

Consumers are placing greater emphasis on faucets that deliver not only functionality but also design value. Aesthetic appeal, ergonomic features, and ease of operation are shaping purchase decisions across residential and commercial segments. Smart finishes, minimalistic designs, and touch-based controls are gaining popularity among style-conscious buyers. Beyond appearance, consumers also demand durability, corrosion resistance, and consistent performance, ensuring that faucets contribute to both practicality and visual appeal. This focus on blending style with everyday utility positions faucets as lifestyle products rather than just plumbing fixtures. Manufacturers competing on customization, finish variety, and unique design innovations are capturing greater consumer attention in both developed and emerging markets.

The faucet industry is increasingly influenced by regulatory requirements and efficiency guidelines related to water use. Many regions are mandating flow rate limits and performance certifications, compelling manufacturers to adapt product designs to meet compliance. Buyers in residential, commercial, and institutional sectors are responding by prioritizing faucets that provide efficiency without compromising user experience. Certification labels and government-backed efficiency programs enhance consumer trust, driving adoption of compliant models. This regulatory-driven trend encourages manufacturers to invest in testing, certification, and product differentiation through documented performance. The focus on compliance and efficiency ensures that faucets remain relevant in markets where environmental considerations and standards are critical for product acceptance.

| Country | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

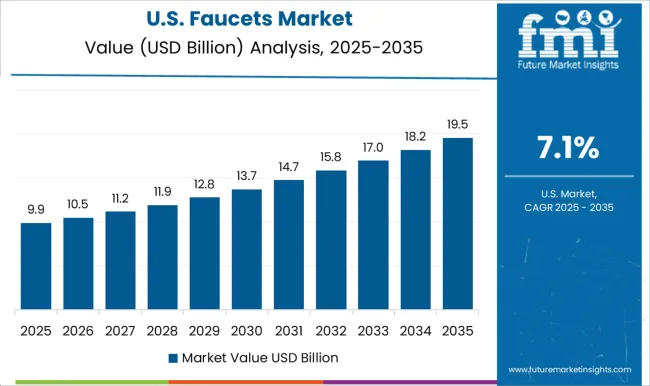

| USA | 7.1% |

| Brazil | 6.2% |

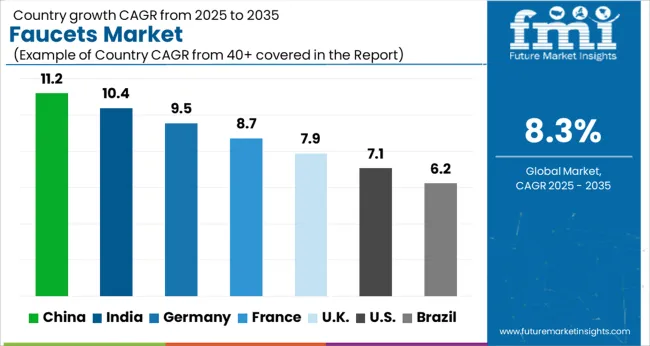

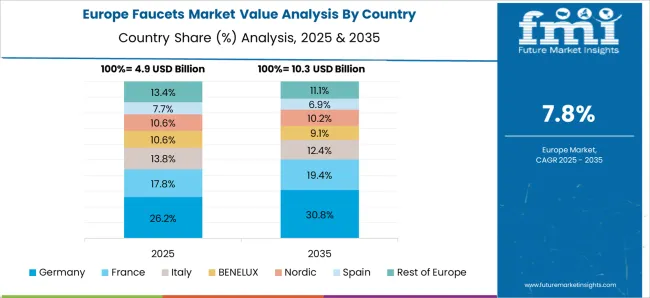

The global faucets market is projected to grow at a CAGR of 8.3% from 2025 to 2035. China leads at 11.2%, followed by India at 10.4% and Germany at 9.5%, while France records 8.7%, the UK posts 7.9%, and the USA trails at 7.1%. Growth in Asia, particularly China and India, is driven by large-scale residential projects, rising consumer demand for premium kitchen and bathroom fittings, and infrastructure investments. Germany and France emphasize regulatory compliance, efficient water use, and design-led adoption in both residential and commercial spaces. The UK and USA show steady but slower growth as demand is shaped by remodeling cycles, hospitality upgrades, and institutional procurement. Asia demonstrates the strongest expansion, while Europe and North America sustain demand through regulatory adherence, lifestyle-driven design, and long-term replacement trends. The analysis spans over 40+ countries, with the leading markets shown below.

The faucets market in China is projected to grow at a CAGR of 11.2% from 2025 to 2035. Expansion is being powered by large residential projects, steady urban housing upgrades, and premiumization in kitchens and bathrooms. Developers have specified water efficient, long life cartridges and finish options that withstand hard water. Tier 2 and Tier 3 cities are witnessing rapid installation across mid scale apartments and townships, which has supported volume gains for domestic brands. Hotels, malls, and transport hubs are adding commercial grade fittings with vandal resistant features and metered flow. In this view, China is expected to maintain leadership as distributors deepen coverage in building clusters and as OEM partnerships secure stable component supply over the forecast horizon.

The faucets market in India is expected to expand at a CAGR of 10.4% from 2025 to 2035. Demand has been supported by new housing starts, affordable housing schemes, and consistent renovation cycles in metros and tiered cities. Builders prefer standardized SKUs for faster fit outs, while homeowners opt for single lever mixers and concealed diverters for clean aesthetics. Hospitality and healthcare projects require durable, easy service designs that meet local plumbing codes. Organized retail and e commerce channels have widened access, improving brand discovery and price transparency. It is assessed that steady localization of valves, aerators, and cartridges will improve cost control and after sales reliability, keeping India on a firm growth path through 2035.

The faucets market in Germany is projected to grow at a CAGR of 9.5% from 2025 to 2035. Adoption has been driven by stringent water efficiency norms, meticulous building standards, and preference for high durability metals and coatings. Replacement of aging fittings in multifamily housing continues to generate stable demand. Commercial projects specify thermostatic and touch free models for hygiene and maintenance control. Distributors and installers value documented performance, noise class ratings, and spare part continuity over long service windows. It is believed that certified products with recyclable materials and verifiable life cycle data will gain share, while design led ranges support premium segments across kitchens and wellness bathrooms.

The faucets market in the UK is anticipated to advance at a CAGR of 7.9% from 2025 to 2035. Activity in refurbishments, student housing, and build to rent schemes sustains consistent orders. Specifiers prioritize WRAS approved products, reliable cartridge performance, and finishes that handle coastal moisture. Public sector frameworks evaluate whole life cost, vandal resistance, and ease of retrofit on legacy pipework. Merchant channels and DIY retail continue to drive homeowner upgrades, with rising interest in pull out kitchen mixers and compact basin taps for small footprints. In an opinionated view, documented water savings and straightforward maintenance will remain decisive in bids, supporting measured yet durable growth through 2035.

The faucets market in the USA is projected to grow at a CAGR of 7.1% from 2025 to 2035. Demand stems from remodeling of kitchens and baths, steady single family construction, and upgrades in hospitality and healthcare facilities. Buyers evaluate ADA compliance, lead content rules, and performance under hard water. Big box retail and pro channels shape assortment, while e commerce accelerates premium discovery. Builders favor quick install systems and universal rough in valves to simplify labor. It is judged that warranty strength, service networks, and reliable spares will remain core differentiators. Premium growth is expected from matte and PVD finishes, while multi family projects sustain volume for standardized chrome sets.

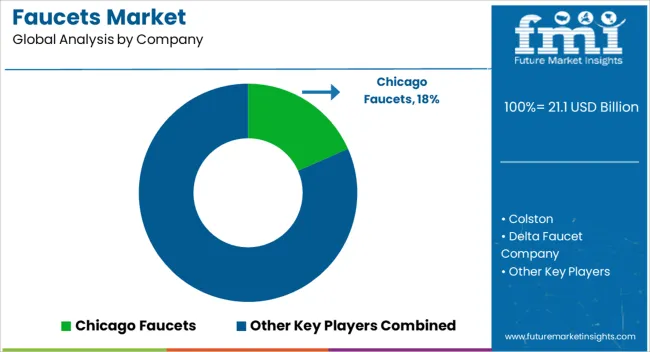

The faucets market is defined by the presence of global sanitary ware brands, regional plumbing fixture manufacturers, and specialized luxury design firms. Leading players such as Kohler, Moen, LIXIL Group, Hansgrohe, and Delta Faucet Company hold strong market positions with extensive product portfolios spanning kitchen, bathroom, and commercial faucets. Competitive differentiation is driven by design aesthetics, material quality, water efficiency, ease of installation, and smart functionality integration such as touchless operation and temperature control.

Regional manufacturers, particularly from Asia-Pacific, compete by offering cost-effective solutions and quick turnaround for large residential and commercial projects, while European brands focus on premium styling, advanced cartridge technology, and brand heritage. Distribution networks through home improvement retailers, plumbing wholesalers, and e-commerce platforms significantly influence market reach. Strategic collaborations with builders, architects, and hospitality chains also shape brand visibility and preference.

Innovation in ceramic disc valves, anti-scald technology, and lead-free construction has become crucial for compliance and differentiation. Firms that blend strong design capabilities, reliable performance, and widespread distribution are best positioned to secure market share in the evolving faucets market.

| Item | Value |

|---|---|

| Quantitative Units | USD 21.1 Billion |

| Type | Pull out faucets, Pull down faucets, Single handle faucets, Dual handle faucets, Separate spray faucets, Pot filler faucets, Motion detection faucets, and Others |

| Application | Kitchen, Bathroom, and Others |

| End Use | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Chicago Faucets, Colston, Delta Faucet Company, Gerber Plumbing Fixtures, Grohe America Inc, Hansgrohe, Jaquar, Kohler Co., Lixil Group, Masco Corporation, Moen Incorporated, Roca Bathroom Products Pvt. Ltd. (Parryware), Roca Sanitario S.A, Signature Hardware, and Sloan |

| Additional Attributes | Dollar sales by product type, share by application (residential, commercial, institutional), regional growth hotspots, pricing benchmarks, consumer design preferences, regulatory impact, and distribution channel performance. |

The global faucets market is estimated to be valued at USD 21.1 billion in 2025.

The market size for the faucets market is projected to reach USD 46.9 billion by 2035.

The faucets market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in faucets market are pull out faucets, pull down faucets, single handle faucets, dual handle faucets, separate spray faucets, pot filler faucets, motion detection faucets and others.

In terms of application, kitchen segment to command 45.3% share in the faucets market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bar and Prep Faucets Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA