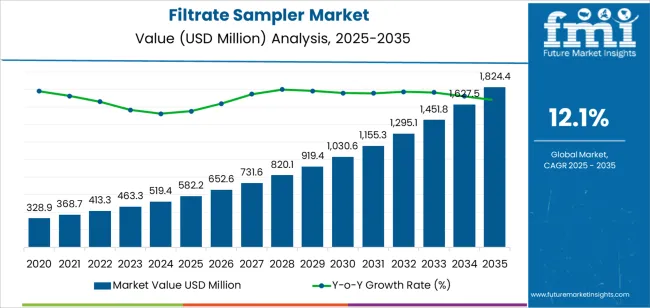

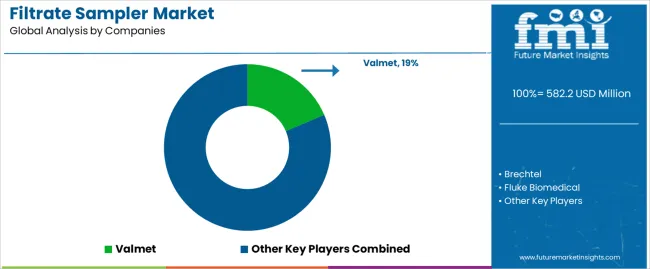

The global filtrate sampler market is valued at USD 582.2 million in 2025 and is set to reach USD 1,824.5 million by 2035, recording an absolute increase of USD 1,242.3 million over the forecast period. This translates into a total growth of 213.4%, with the market forecast to expand at a compound annual growth rate (CAGR) of 12.1% between 2025 and 2035. The overall market size is expected to grow by approximately 3.1X during the same period, supported by increasing quality control requirements, growing demand for precision sampling equipment, and rising regulatory compliance standards across pharmaceutical, laboratory, and industrial production applications.

The global filtrate sampler market represents a specialized segment within the analytical instrumentation and process control industry, driven by the critical need for accurate sample collection and contamination-free analysis procedures. These precision devices operate through advanced sampling mechanisms, providing controlled sample extraction and automated collection capabilities for various liquid filtration processes including pharmaceutical solutions, industrial effluents, and laboratory test materials. The sampling mechanism enables precise volume control and automated timing sequences, making these devices particularly suitable for quality-sensitive applications and processes requiring strict contamination control protocols.

The market encompasses various sampling configurations, capacity ranges, and specialized designs tailored for specific analytical requirements. Modern filtrate samplers incorporate advanced valve systems, integrated sensors, and enhanced collection mechanisms that can operate efficiently across variable process conditions while maintaining sample integrity over extended collection periods. The integration of automated controls, remote monitoring capabilities, and data logging features has further enhanced the value proposition of these sampling systems among laboratory managers and quality control professionals seeking operational precision and regulatory compliance.

Market dynamics are significantly influenced by stringent quality control regulations, particularly in pharmaceutical manufacturing, laboratory testing, and industrial process monitoring where sample accuracy and traceability are paramount. The pharmaceutical sector's increasing emphasis on good manufacturing practices, analytical method validation, and process monitoring has created substantial demand for high-performance sampling solutions in filtration systems, batch processing, and quality control laboratories. The growing trend toward automated laboratory systems and data integrity requirements has amplified the need for intelligent sampling devices capable of integration with laboratory information management systems and quality assurance networks.

Consumer purchasing patterns show a marked preference for modular sampling systems that combine precision collection capabilities with versatile installation options, multiple capacity configurations, and comprehensive data recording features for diverse analytical applications. The market has witnessed significant technological advancement in valve design, collection algorithm development, and communication interface systems, making these devices more suitable for demanding analytical environments, extended operational cycles, and compliance-critical applications.

Between 2025 and 2030, the filtrate sampler market is projected to expand from USD 582.2 million to USD 919.4 million, resulting in a value increase of USD 337.2 million, which represents 27.1% of the total forecast growth for the decade. This phase of development will be shaped by increasing regulatory compliance adoption, rising demand for automated sampling solutions, and growing availability of advanced precision collection systems across pharmaceutical facilities and industrial testing applications.

Between 2030 and 2035, the market is forecast to grow from USD 919.4 million to USD 1,824.5 million, adding another USD 905.1 million, which constitutes 72.9% of the overall ten-year expansion. This period is expected to be characterized by the advancement of IoT-enabled sampling monitoring systems, the development of precision-optimized collection controllers for large-scale applications, and the expansion of automated sampling networks across diverse analytical and quality control applications. The growing emphasis on data integrity and process validation will drive demand for advanced sampler varieties with enhanced diagnostic capabilities, improved collection efficiency characteristics, and superior remote monitoring performance profiles.

Between 2020 and 2024, the filtrate sampler market experienced robust growth, driven by increasing regulatory requirements and growing recognition of automated sampling technology's superior performance in quality-critical applications following extensive industry validation campaigns. The market developed as laboratory managers recognized the advantages of filtrate samplers over manual collection alternatives in contamination-sensitive applications and began seeking specialized solutions designed for precise sample control requirements. Technological advancement in valve technology and collection precision began emphasizing the critical importance of maintaining sample integrity while enhancing operational reliability and improving analytical accuracy across diverse filtration applications.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 582.2 million |

| Forecast Value in (2035F) | USD 1,824.5 million |

| Forecast CAGR (2025 to 2035) | 12.1% |

From 2030 to 2035, the market is forecast to grow from USD 919.4 million to USD 1,824.5 million, adding another USD 905.1 million, which constitutes 72.9% of the overall ten-year expansion. This period is expected to be characterized by the advancement of artificial intelligence integration in sampling control systems, the integration of predictive analytics for optimal collection management, and the development of specialized sampler configurations for high-precision analytical applications. The growing emphasis on process optimization and equipment reliability will drive demand for premium varieties with enhanced collection performance capabilities, improved connectivity options, and superior automated control characteristics.

Between 2020 and 2024, the filtrate sampler market experienced substantial growth, driven by increasing awareness of contamination-related analytical errors and growing recognition of specialized sampling systems' effectiveness in supporting reliable laboratory operations across pharmaceutical facilities and industrial testing applications. The market developed as users recognized the potential for filtrate samplers to deliver analytical advantages while meeting modern requirements for precise sample collection and reliable quality performance. Technological advancement in collection optimization and electronic component development began emphasizing the critical importance of maintaining sample integrity while extending operational life and improving user satisfaction across diverse sampling applications.

Market expansion is being supported by the increasing global emphasis on analytical accuracy and the corresponding shift toward high-performance sampling systems that can provide superior collection control characteristics while meeting user requirements for precision sample handling and cost-effective quality management solutions. Modern laboratory managers are increasingly focused on incorporating sampling systems that can enhance analytical reliability while satisfying demands for consistent, precisely controlled sample collection and optimized contamination prevention practices. Filtrate samplers' proven ability to deliver precision collection excellence, quality assurance benefits, and diverse application possibilities makes them essential components for quality-focused laboratories and compliance-focused analytical professionals.

The growing emphasis on regulatory compliance and analytical method validation is driving demand for high-performance sampling systems that can support distinctive analytical outcomes and comprehensive quality management across pharmaceutical applications, laboratory testing, and premium analytical systems. User preference for sampling solutions that combine functional excellence with contamination prevention is creating opportunities for innovative implementations in both traditional and emerging laboratory automation applications. The rising influence of data integrity requirements and advanced monitoring systems is also contributing to increased adoption of intelligent sampling solutions that can provide authentic analytical benefits and reliable compliance monitoring characteristics.

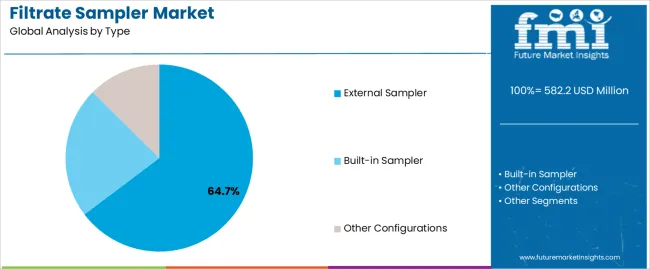

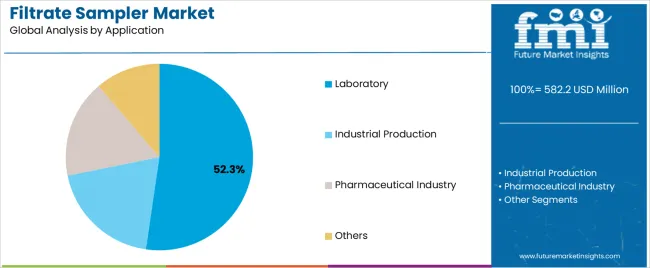

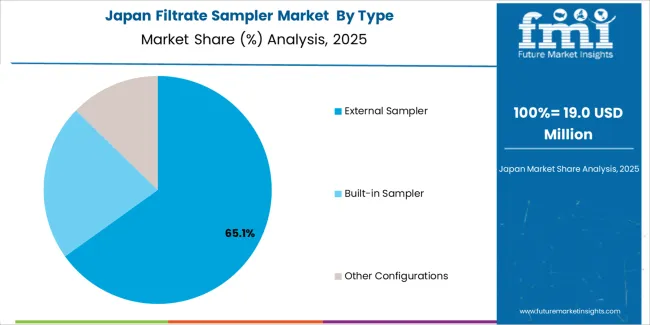

The market is segmented by type, application, capacity range, automation level, and region. By type, the market is divided into external sampler, built-in sampler, and other configurations. Based on application, the market is categorized into laboratory, industrial production, pharmaceutical industry, and others. By capacity range, the market includes low capacity, medium capacity, and high capacity categories. By automation level, the market encompasses manual operation, semi-automated operation, and fully automated operation configurations. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and other regions.

The external sampler segment is projected to account for 64.7% of the filtrate sampler market in 2025, reaffirming its position as the leading type category. Laboratory operators and quality professionals increasingly utilize external systems for their superior installation flexibility characteristics, established accessibility standards, and essential functionality in diverse sampling control applications across multiple analytical sectors. External samplers' proven performance characteristics and established cost-effectiveness directly address user requirements for reliable collection control and optimal operational precision in pharmaceutical and laboratory applications.

This type segment forms the foundation of modern precision sampling performance patterns, as it represents the configuration with the greatest installation versatility and established compatibility across multiple laboratory automation systems. Laboratory investments in advanced sampling technology and quality optimization continue to strengthen adoption among precision-focused users. With quality managers prioritizing contamination prevention and collection reliability, external systems align with both accuracy objectives and operational requirements, making them the central component of comprehensive sampling control strategies.

Laboratory is projected to represent 52.3% of the filtrate sampler market in 2025, underscoring its critical role as the primary application for precision-focused users seeking superior sampling control benefits and enhanced analytical system management credentials. Laboratory users and quality operators prefer laboratory applications for their established analytical requirements, proven precision demand, and ability to maintain exceptional collection accuracy while supporting versatile system coverage during diverse testing activities. Positioned as essential applications for quality-focused laboratory managers, laboratory offerings provide both analytical excellence and contamination prevention advantages.

The segment is supported by continuous improvement in laboratory automation technology and the widespread availability of established analytical standards that enable performance assurance and premium positioning at the facility level. Laboratory users are optimizing sampler selections to support method-specific applications and comprehensive quality assurance strategies. As analytical technology continues to advance and laboratories seek efficient collection methods, laboratory applications will continue to drive market growth while supporting analytical precision and quality optimization strategies.

The filtrate sampler market is advancing rapidly due to increasing regulatory compliance adoption and growing need for automated sampling solutions that emphasize superior collection performance across laboratory segments and quality assurance applications. The market faces challenges, including competition from manual sampling methods, installation complexity considerations, and initial investment cost factors affecting adoption rates. Innovation in precision enhancement and advanced collection control systems continues to influence market development and expansion patterns.

The growing adoption of filtrate samplers with laboratory information system connectivity and automated facility integration is enabling users to develop sampling strategies that provide distinctive traceability benefits while commanding automated operation and enhanced real-time quality analysis characteristics. Laboratory automation applications provide superior analytical consistency while allowing more sophisticated quality optimization features across various pharmaceutical categories. Users are increasingly recognizing the analytical advantages of intelligent sampler positioning for comprehensive quality control outcomes and technology-integrated laboratory management.

Modern filtrate sampler manufacturers are incorporating advanced quality sensors, real-time collection monitoring capabilities, and process analytics systems to enhance analytical precision, improve collection efficiency effectiveness, and meet laboratory demands for intelligent sampling solutions. These systems improve analytical effectiveness while enabling new applications, including continuous quality monitoring programs and automated validation protocols. Advanced analytics integration also allows users to support proactive quality positioning and performance assurance beyond traditional sampling operation requirements.

| Country | CAGR (2025-2035) |

|---|---|

| China | 16.3% |

| India | 15.1% |

| Germany | 13.9% |

| Brazil | 12.7% |

| USA | 11.5% |

| UK | 10.3% |

| Japan | 9.1% |

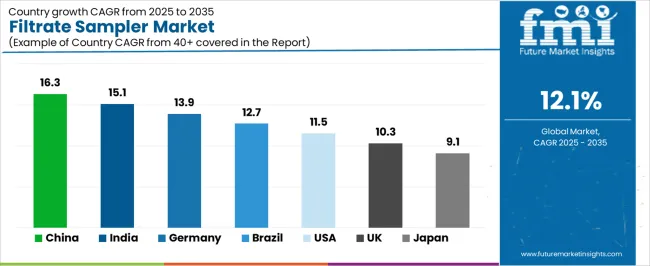

The filtrate sampler market is experiencing exceptional growth globally, with China leading at a 16.3% CAGR through 2035, driven by the expanding pharmaceutical sector, growing laboratory automation requirements, and increasing adoption of advanced quality management systems. India follows at 15.1%, supported by rising industrialization, expanding analytical testing industry, and growing acceptance of precision sampling technologies. Germany shows growth at 13.9%, emphasizing established analytical standards and comprehensive laboratory automation development. Brazil records 12.7%, focusing on pharmaceutical modernization and quality control growth. USA demonstrates 11.5% growth, prioritizing advanced laboratory technologies and analytical optimization.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

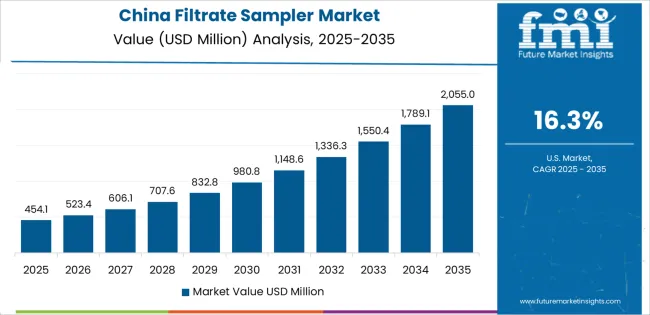

Revenue from filtrate sampler consumption and sales in China is projected to exhibit exceptional growth with a CAGR of 16.3% through 2035, driven by the country's rapidly expanding pharmaceutical sector, favorable government policies toward quality control modernization, and initiatives promoting laboratory automation technologies across major industrial regions. China's position as a global pharmaceutical hub and increasing focus on quality management systems are creating substantial demand for high-quality filtrate samplers in both domestic and export markets. Major analytical equipment companies and laboratory distributors are establishing comprehensive sampling capabilities to serve growing demand and emerging automation opportunities.

Demand for filtrate sampler products in India is expanding at a CAGR of 15.1%, supported by rising industrialization investment, growing quality consciousness, and expanding equipment distributor capabilities. The country's developing laboratory infrastructure and increasing investment in analytical technologies are driving demand for sampling equipment across both traditional and modern laboratory applications. International analytical equipment companies and domestic distributors are establishing comprehensive operational networks to address growing market demand for quality control devices and efficient sampling solutions.

Revenue from filtrate sampler products in Germany is projected to grow at a CAGR of 13.9% through 2035, supported by the country's mature analytical standards, established laboratory automation regulations, and leadership in precision sampling technology. Germany's sophisticated laboratory standards and strong support for advanced quality systems are creating steady demand for both traditional and innovative sampling varieties. Leading analytical equipment manufacturers and specialty distributors are establishing comprehensive operational strategies to serve both domestic markets and growing export opportunities.

Demand for filtrate sampler products in Brazil is expected to expand at a CAGR of 12.7% through 2035, driven by the country's emphasis on pharmaceutical development, laboratory modernization growth, and growing automation distributor capabilities. Brazilian laboratory users and pharmaceutical facilities consistently seek precision-focused equipment that enhances analytical performance and supports modernization excellence for both traditional and modern laboratory applications. The country's position as a Latin American pharmaceutical leader continues to drive innovation in specialized sampling applications and quality control standards.

Revenue from filtrate sampler products in USA is forecasted to grow at a CAGR of 11.5% through 2035, supported by the country's emphasis on laboratory technology advancement, quality control optimization, and advanced analytical system integration requiring efficient sampling solutions. American laboratory users and quality-focused facilities prioritize performance reliability and analytical precision, making specialized filtrate samplers essential components for both traditional and modern laboratory automation applications. The country's comprehensive analytical technology leadership and advancing quality patterns support continued market expansion.

Demand for filtrate sampler products in UK is anticipated to expand at a CAGR of 10.3% through 2035, supported by established laboratory standards, mature analytical markets, and emphasis on quality control across pharmaceutical and industrial sectors. British laboratory users and analytical professionals prioritize quality performance and operational consistency, creating steady demand for premium sampling solutions. The country's comprehensive market maturity and established laboratory practices support continued development in specialized applications.

Revenue from filtrate sampler products in Japan is growing at a CAGR of 9.1% through 2035, supported by the country's emphasis on precision engineering, analytical excellence, and advanced technology integration requiring efficient sampling solutions. Japanese laboratory users and quality-focused facilities prioritize technical performance and engineering precision, making specialized filtrate samplers essential components for both traditional and modern laboratory automation applications. The country's comprehensive engineering leadership and advancing precision patterns support continued market expansion.

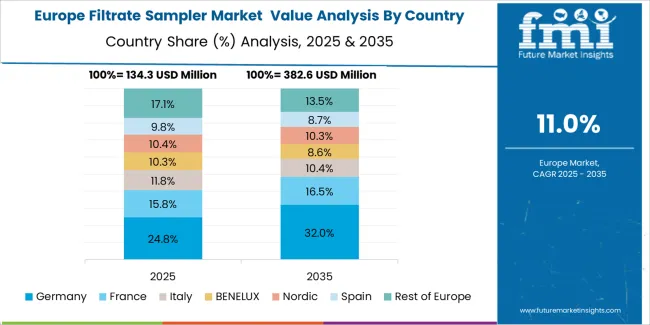

The Europe filtrate sampler market is projected to grow from USD 169.3 million in 2025 to USD 531.4 million by 2035, recording a CAGR of 12.1% over the forecast period. Germany leads the region with a 42.1% share in 2025, moderating slightly to 41.6% by 2035, supported by its strong analytical traditions and demand for premium, precision-manufactured sampling solutions. The United Kingdom follows with 23.7% in 2025, easing to 23.2% by 2035, driven by a mature laboratory market and emphasis on quality control and analytical performance.

France accounts for 16.2% in 2025, rising to 16.7% by 2035, reflecting steady adoption of laboratory automation technologies and quality optimization. Italy holds 9.4% in 2025, expanding to 10.1% by 2035 as pharmaceutical modernization and specialty analytical applications grow. Spain contributes 4.8% in 2025, growing to 5.1% by 2035, supported by expanding laboratory development and quality awareness modernization. The Nordic countries rise from 2.3% in 2025 to 2.4% by 2035 on the back of strong quality consciousness and advanced analytical methodologies. BENELUX remains at 1.5% share across both 2025 and 2035, reflecting mature, precision-focused laboratory markets.

The filtrate sampler market is characterized by competition among established analytical equipment manufacturers, specialized sampling companies, and integrated laboratory solution providers. Companies are investing in advanced collection technologies, specialized precision engineering, product innovation capabilities, and comprehensive distribution networks to deliver consistent, high-quality, and reliable sampling systems. Innovation in collection precision optimization, automated control advancement, and quality-focused product development is central to strengthening market position and customer satisfaction.

Valmet leads the market with 18.6% share with a strong focus on sampling technology innovation and comprehensive analytical solutions, offering laboratory and industrial systems with emphasis on performance excellence and engineering heritage. Brechtel provides integrated quality automation with a focus on laboratory market applications and precision control networks. Fluke Biomedical delivers comprehensive sampling technology solutions with a focus on pharmaceutical positioning and analytical efficiency. Hach Filtrax specializes in comprehensive sampling systems with an emphasis on quality applications. Parker Hannifin focuses on comprehensive analytical equipment with advanced design and premium positioning capabilities.

The success of filtrate samplers in meeting laboratory automation demands, quality control requirements, and analytical integration will not only enhance laboratory performance outcomes but also strengthen global analytical technology manufacturing capabilities. It will consolidate emerging regions' positions as hubs for efficient sampling equipment production and align advanced economies with comprehensive automation systems. This calls for a concerted effort by all stakeholders -- governments, industry bodies, manufacturers, distributors, and investors. Each can be a crucial enabler in preparing the market for its next phase of growth.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How Distributors and Laboratory Equipment Players Could Strengthen the Ecosystem?

How Manufacturers Could Navigate the Shift?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 582.2 million |

| Type | External Sampler, Built-in Sampler, Other Configurations |

| Application | Laboratory, Industrial Production, Pharmaceutical Industry, Others |

| Capacity Range | Low Capacity, Medium Capacity, High Capacity |

| Automation Level | Manual Operation, Semi-Automated Operation, Fully Automated Operation |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, Other Regions |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Valmet, Brechtel, Fluke Biomedical, Hach Filtrax, Parker Hannifin, and other leading filtrate sampler companies |

| Additional Attributes | Dollar sales by type, application, capacity range, automation level, and region; regional demand trends, competitive landscape, technological advancements in sampling engineering, precision optimization initiatives, quality enhancement programs, and premium product development strategies |

The global filtrate sampler market is estimated to be valued at USD 582.2 million in 2025.

The market size for the filtrate sampler market is projected to reach USD 1,824.4 million by 2035.

The filtrate sampler market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in filtrate sampler market are external sampler , built-in sampler and other configurations.

In terms of application, laboratory segment to command 52.3% share in the filtrate sampler market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Autosampler Vials Market Size and Share Forecast Outlook 2025 to 2035

Autosampler Market Size and Share Forecast Outlook 2025 to 2035

Breath Samplers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA