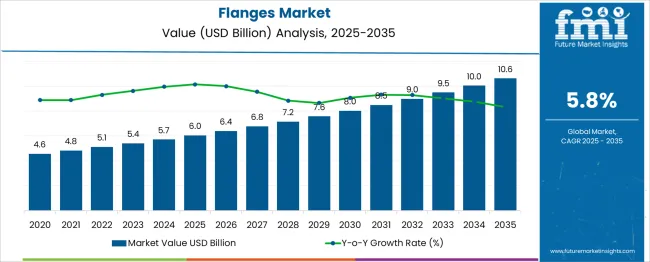

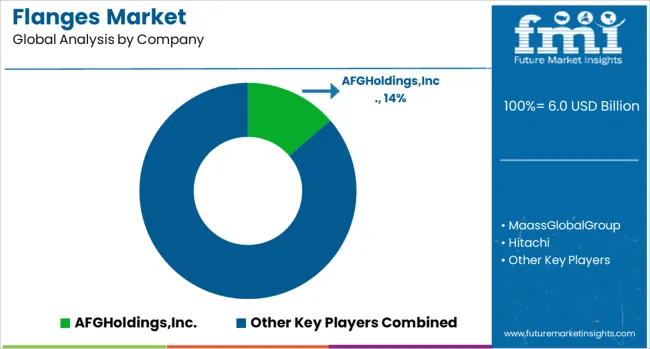

The Flanges Market is estimated to be valued at USD 6.0 billion in 2025 and is projected to reach USD 10.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

The flanges market is positioned as a critical subsegment within multiple parent industries, including oil and gas equipment, pipeline components, petrochemical plant machinery, power generation equipment, and water treatment systems. Among these, the oil and gas equipment segment contributes the largest share, with flanges accounting for nearly 12 % of the total equipment value due to their essential role in pipeline connectivity and pressure sealing applications. In pipeline components, flanges capture an estimated 18 % share, supported by replacement cycles and the requirement for reliable joint integrity in transmission networks. Within petrochemical plant machinery, the share stands close to 10 %, as process piping systems depend on high-pressure flange connections for operational stability.

For power generation equipment, including thermal and nuclear applications, flanges represent around 8 %, attributed to stringent compliance and temperature resistance needs. The water treatment sector contributes a smaller proportion, at approximately 6 %, reflecting moderate adoption in modular setups and municipal projects. This multi-industry penetration emphasizes the strategic importance of flange manufacturers aligning with EPC contractors and OEMs to secure long-term supply contracts. Growth opportunities remain strong in sectors undergoing capacity expansion and energy transition projects. Companies that focus on cost-effective production, superior metallurgical quality, and precision standards will strengthen their footprint in these parent markets, ensuring competitive advantage during forecast years.

| Metric | Value |

|---|---|

| Flanges Market Estimated Value in (2025 E) | USD 6.0 billion |

| Flanges Market Forecast Value in (2035 F) | USD 10.6 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The flanges market is witnessing robust expansion, supported by increased investment in pipeline infrastructure, process industry modernization, and cross-border energy transportation projects. As industrial operations become more complex and demand higher safety standards, flanges have gained strategic importance for ensuring secure, leak-proof connections in high-pressure environments.

The transition toward sustainable energy sources, coupled with the resurgence of oil and gas exploration and refining activities, has reinforced the demand for advanced flange configurations tailored to specific applications. In parallel, the adoption of automation and digital monitoring systems in manufacturing facilities has enhanced the precision requirements for flanged joints, encouraging the uptake of quality-certified components.

Regulatory mandates focusing on emissions reduction and pipeline safety standards have further accelerated the use of durable and corrosion-resistant flange materials. With urbanization and industrialization on the rise in emerging economies, especially in Asia and the Middle East, the market is poised for steady growth driven by long-term infrastructure development and replacement of aging systems.

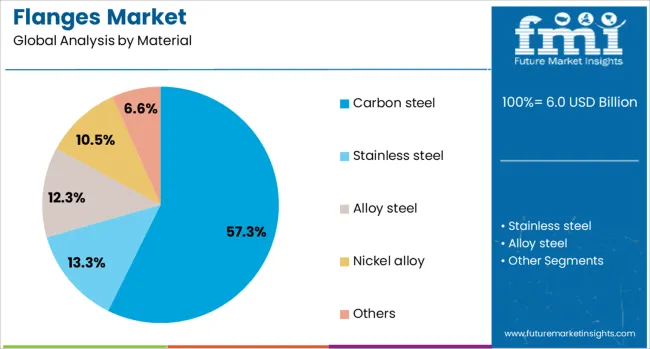

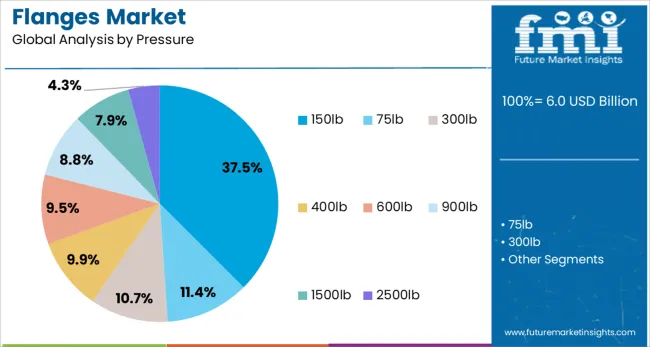

The flanges market is segmented by material, pressure, shape, size, end user and geographic regions. The market for flanges is divided into Carbon steel, Stainless steel, Alloy steel, Nickel alloy, and Others. In terms of pressure, the flanges market is classified into 150lb, 75lb, 300lb, 400lb, 600lb, 900lb, 1500lb, and 2500lb.

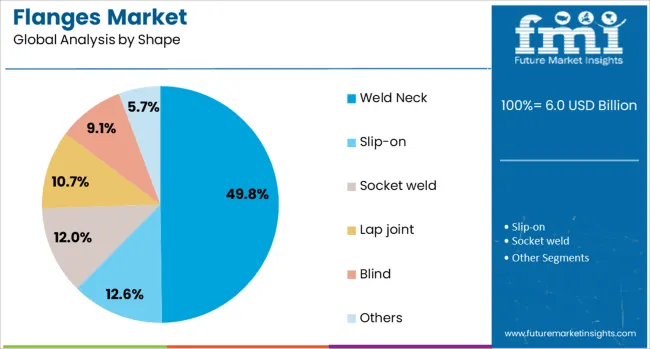

Based on the shape of the flanges, the market is segmented into Weld Neck, Slip-on, Socket weld, Lap joint, Blind, and Others. The flanges market is segmented by size into 0.5 to 12 inches, 13 to 24 inches, and 25 to 60 inches. The end-user market for flanges is segmented into Oil & Gas, Petrochemical, Power Generation, Wastewater Management, Chemical Industry, and Others. Regionally, the flanges industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The carbon steel segment is expected to account for 57.3% of the total revenue share in the flanges market in 2025, making it the leading material type. This segment’s growth has been influenced by its high tensile strength, durability, and affordability, which make carbon steel flanges well suited for high-pressure pipelines and industrial fluid handling systems.

Its widespread adoption across oil and gas, petrochemical, and water treatment industries has been supported by the ability to withstand harsh environmental conditions and corrosive media when appropriately coated. The availability of various grades to match specific pressure and temperature requirements has contributed to increased preference among manufacturers and EPC contractors.

The segment has also benefited from strong domestic production capabilities across key manufacturing regions, which ensures consistent supply and cost competitiveness. As large-scale industrial and energy projects continue to expand, particularly in developing markets, the utilization of carbon steel flanges is anticipated to remain dominant due to their reliability and cost-performance balance.

The 150lb pressure segment is projected to hold 37.5% of the total revenue share in the flanges market in 2025, emerging as the most commonly used pressure rating. This segment’s dominance is attributed to its suitability for low to moderate pressure applications across HVAC, plumbing, general water distribution, and food processing industries.

The ease of availability, standardization, and lower material thickness requirements have resulted in reduced procurement and installation costs, driving adoption across a wide spectrum of commercial and light industrial projects. The compatibility of 150lb-rated flanges with a broad range of piping components and the ability to meet ANSI and ASME compliance standards have further reinforced their usage in globally regulated environments.

Favorable supply chain dynamics and reduced maintenance needs have supported their widespread integration into existing infrastructure networks and utility systems. As utility upgrades and mid-scale industrial developments increase, demand for 150lb flanges is anticipated to remain strong due to their versatility and regulatory alignment.

The weld neck segment is forecast to capture 49.8% of the total revenue share in the flanges market in 2025, establishing itself as the preferred shape across critical applications. This segment’s leadership has been driven by its superior structural integrity, which is achieved through butt-welded connections that provide a smooth stress distribution along the pipe.

Weld neck flanges are favored in high-pressure and high-temperature pipelines, particularly in oil refineries, petrochemical units, and thermal power plants, where failure risks must be minimized. Their performance in cyclic loading and vibration-prone environments has positioned them as essential components in mission-critical piping systems.

The ability to withstand repeated stress cycles and prevent leakage in harsh operating conditions has supported their usage in both onshore and offshore installations. As the demand for safe and efficient fluid transport intensifies, weld neck flanges are expected to remain at the forefront of adoption due to their longevity, operational safety, and compliance with strict industry standards.

Demand for flanges increases alongside global infrastructure development in oil and gas, petrochemical, and power generation sectors. Flanges provide essential secure joints for pipelines, capable of withstanding pressures above 5,000 psi. Use of corrosion-resistant alloys reduces maintenance needs by up to 35%. Digital inspection techniques such as ultrasonic testing improve product quality in over 40% of manufacturing processes. Lightweight composite flanges, weighing 20 to 30% less than steel counterparts, help reduce installation and transport costs. Replacement projects make up roughly a quarter of flange consumption globally.

Expanding Pipeline and Power Infrastructure Investment

Global pipeline infrastructure investments exceed USD 500 billion, supporting steady flange demand. Growing natural gas consumption, expected to increase by over 20% by 2030, requires reliable flange connections designed for pressures up to 6,000 psi. Carbon steel and stainless steel flanges account for approximately 70% of the market share due to their strength and resistance to corrosion. Thermal and nuclear power plants represent 18% of demand. Industry standards mandate defect rates below 0.5%, pushing manufacturers to maintain high quality. Replacement of aging pipelines accounts for about 25% of flange sales, ensuring consistent market activity despite fluctuations in new projects.

Volatile Raw Material Prices and Production Costs

Flange manufacturing involves costly processes like forging and precision machining, making up 35 to 40% of total production expenses. Raw material prices for stainless steel and alloy metals can fluctuate up to 25% annually, leading to pricing volatility. Certification and testing protocols increase lead times by 15 to 20 days. Skilled labor is necessary to ensure correct installation and inspection, adding about USD 2,000 annually in operational costs per facility. Regulatory inconsistencies across regions create challenges for manufacturers, particularly small and mid-sized enterprises, limiting market accessibility due to high compliance costs.

Advanced Materials and IoT-Enabled Monitoring

Lightweight composite flanges reduce installation and transportation costs by up to 30%, equating to savings of USD 500 to USD 1,000 per project. Corrosion-resistant coatings extend operational lifespan by 20 to 30%, especially in offshore and chemical environments. Additive manufacturing accelerates production timelines by approximately 25% and reduces material waste by 15%. IoT-integrated flanges with real-time pressure and temperature monitoring can lower unplanned downtime by 10 to 15%. Growing industrialization in Asia and Africa, with growth rates between 6 and 8%, presents expanding markets for flange suppliers.

Digital Inspection and Sustainable Manufacturing

Over 40% of flange manufacturers use digital inspection technologies like 3D scanning and ultrasonic testing to achieve defect rates below 0.5%. Digitized supply chains have cut lead times by 10 to 15 days. Customized flange orders now represent 35% of demand to satisfy specific pressure and size requirements. Annual use of recycled metals has increased by 12%, aligning production with environmental initiatives. Multi-functional flange designs combining sealing and structural support can reduce installation time by up to 20%. Collaboration between producers and clients enhances compliance with evolving safety regulations, impacting over 70% of industrial projects.

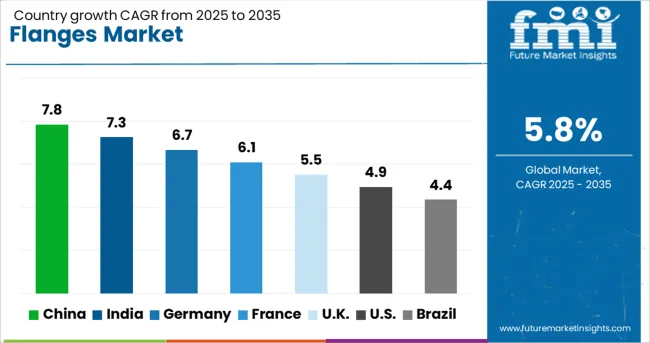

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

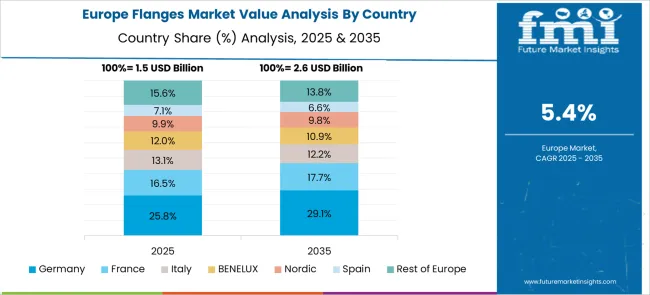

The flanges industry, expected to grow at a global CAGR of 5.8% from 2025 to 2035, is showing varied performance across major economies. A 7.8% CAGR is being recorded in China, a BRICS member, driven by extensive pipeline projects and rapid industrial expansion. India, another BRICS member, is experiencing a 7.3% CAGR, supported by large-scale infrastructure projects and expanding petrochemical facilities. Germany, an OECD member, is showing a 6.7% CAGR due to strong demand from energy systems and precision manufacturing sectors.

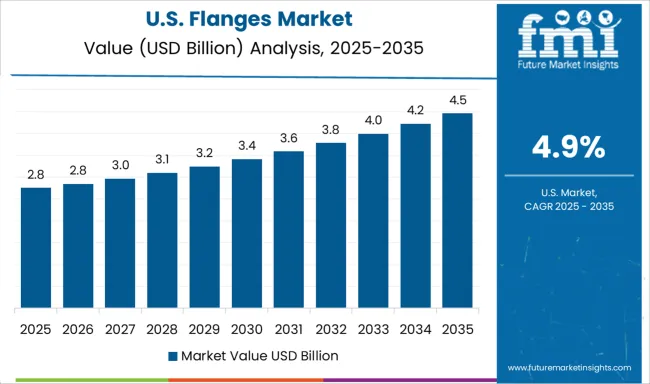

The United Kingdom, also part of the OECD, is witnessing moderate growth at 5.5%, influenced by ongoing maintenance requirements in its energy infrastructure. The United States is growing at 4.9%, with demand concentrated in oil and gas upgrades and power plant maintenance. The report includes a detailed evaluation of over 40 countries, and these top five have been highlighted as key reference points for strategic analysis.

The CAGR of the flanges market in the United Kingdom rose from approximately 4.2% during 2020–2024 to 5.5% for 2025–2035, supported by scheduled maintenance programs and modernization initiatives across energy networks. Growth in the earlier period was comparatively lower due to delayed infrastructure investments and a decline in North Sea exploration activity. Increased investments post-2025 in hydrogen-ready pipeline projects and thermal plant upgrades influenced higher procurement of precision-engineered flanges. Compliance with stringent pressure containment standards and integration of advanced sealing technology for operational safety have been prioritized by operators. This transition has positioned the UK as a mature yet evolving market within industrial energy and utility systems.

The CAGR in Germany increased from around 5.4% during 2020–2024 to 6.7% during 2025–2035, supported by a strong focus on industrial modernization. Growth during the earlier timeframe was steady due to limited investment in large-scale pipeline projects. However, post-2025, demand accelerated as flanges became essential for combined heat and power units and district heating systems. German manufacturers have emphasized compliance with DIN and EN standards, ensuring reliability under high-pressure conditions. Procurement strategies have been influenced by energy transition policies requiring higher material resilience and advanced corrosion protection measures. Industry feedback suggests repeat demand in refineries and chemical plants has created consistent procurement cycles.

The CAGR in China advanced from nearly 6.1% during 2020–2024 to 7.8% for 2025–2035, making it the fastest-growing region. Early growth was moderate due to controlled spending in energy projects and pandemic-induced supply disruptions. Post-2025, substantial investments in pipeline connectivity, LNG infrastructure, and refinery upgrades pushed large-scale flange adoption. Industrial clusters in Jiangsu, Shandong, and Zhejiang witnessed capacity expansions, supported by local forging capabilities. Government-driven energy diversification strategies have encouraged demand for pressure-rated components, including high-integrity flanges for petrochemical and power generation units. Foreign OEM partnerships with Chinese manufacturers have facilitated the adoption of advanced sealing designs.

The CAGR of the flanges market in the United States increased from 3.8% during 2020–2024 to 4.9% for 2025–2035, supported by oil and gas midstream refurbishments and thermal power modernization programs. The earlier phase faced slower growth due to subdued shale output and limited pipeline extensions. However, after 2025, the focus on asset integrity and the revival of LNG export terminals has resulted in consistent procurement of corrosion-resistant flanges. OEMs have shifted toward delivering ANSI-compliant solutions with advanced sealing systems to address reliability issues in complex operating environments. Predictive maintenance integration has influenced a shift toward higher-precision forged flanges.

The CAGR value moved up from approximately 5.6% during 2020–2024 to 7.3% for 2025–2035, supported by a surge in pipeline projects and refinery capacity expansion. The early phase showed gradual progress due to financing constraints and slower EPC project execution. Post-2025, national infrastructure programs accelerated the procurement of industrial flanges, particularly in petrochemicals and power generation. Indigenous forging capabilities have scaled up in Gujarat and Maharashtra, reducing import reliance. High-grade alloy flanges have gained traction in fertilizer and chemical processing sectors due to higher corrosion resistance. Maintenance strategies in thermal plants have driven repeat demand across critical high-pressure applications.

In the flanges industry, leading companies are prioritizing precision engineering, advanced sealing designs, and strict adherence to global standards like ANSI, ASME, and DIN to address complex operational needs across oil and gas, petrochemical, and power sectors. AFG Holdings, Inc., Maass Global Group, and Hitachi have established strong reputations for high-pressure flanges engineered for extreme environments, ensuring system reliability under demanding conditions.

Texas Flange and Kohler Corporation are reinforcing their presence through durable material grades and alloy-based solutions for energy infrastructure and pipeline projects. Piping Technology & Products, Inc., Metalfar S.p.A., and Coastal Flange Inc. focus on delivering custom flanges for offshore drilling, LNG terminals, and subsea installations, emphasizing precision and compliance. Star Pipe Products, Ltd. and Kerkau Manufacturing are scaling production to meet the rising need for large-diameter flanges in industrial and municipal applications.

European players such as Flanschenwerk Bebitz GmbH maintain dominance in corrosion-resistant solutions for chemical and industrial systems. Emerging competitors, including Simtech Process Systems, SSI Technologies, Inc., and Pro-Flange, are targeting niche opportunities through tailored flange configurations for specialized process systems. Additionally, Outokumpu Armetal Stainless Pipe Co., Ltd. leverages its stainless steel expertise to cater to increasing demand in Middle Eastern and Asia-Pacific markets, strengthening supply resilience through regional expansion and product innovation.

In March 2024, Hitachi Energy announced HVDC tech collaboration with Grid United to boost USA power grid capacity

| Item | Value |

|---|---|

| Quantitative Units | USD 6.0 Billion |

| Material | Carbon steel, Stainless steel, Alloy steel, Nickel alloy, and Others |

| Pressure | 150lb, 75lb, 300lb, 400lb, 600lb, 900lb, 1500lb, and 2500lb |

| Shape | Weld Neck, Slip-on, Socket weld, Lap joint, Blind, and Others |

| Size | 0.5 to 12 inches, 13 to 24 inches, and 25 to 60 inches |

| End User | Oil & Gas, Petrochemical, Power Generation, Wastewater Management, Chemical Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AFGHoldings,Inc., MaassGlobalGroup, Hitachi, TexasFlange, KohlerCorporation, PipingTechnology&Products,Inc., MetalfarS.p.A., OCoastalFlangeInc, StarPipeProducts,Ltd., KerkauManufacturing, FlanschenwerkBebitzGmbH, SimtechProcessSystems, SSITechnologies,Inc., Pro-Flange, and utokumpuArmetalStainlessPipeCoLtd. |

| Additional Attributes | Dollar sales, share, regional demand trends, material-grade preferences, industry-specific applications, competitive landscape, pricing benchmarks, procurement cycles, regulatory compliance, capacity expansion opportunities, and growth forecasts for key sectors. |

The global flanges market is estimated to be valued at USD 6.0 billion in 2025.

The market size for the flanges market is projected to reach USD 10.6 billion by 2035.

The flanges market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in flanges market are carbon steel, stainless steel, alloy steel, nickel alloy and others.

In terms of pressure, 150lb segment to command 37.5% share in the flanges market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

High-vacuum Fiber Feedthrough Flanges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA