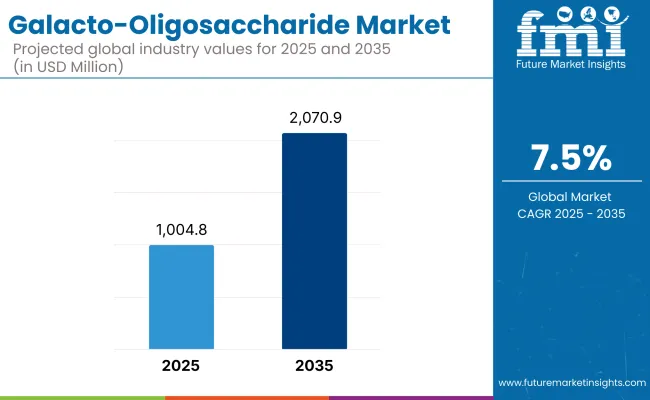

The galacto-oligosaccharide market is estimated to be valued at USD 1,004.8 million by 2025 and is projected to expand to USD 2,070.9 million by 2035, progressing at a CAGR of 7.5% during the forecast period.

| Attributes | Description |

|---|---|

| Estimated Global Galacto-Oligosaccharide Industry Size (2025E) | USD 1,004.8 million |

| Projected Global Galacto-Oligosaccharide Industry Value (2035F) | USD 2,070.9 million |

| Value-based CAGR (2025 to 2035) | 7.5% |

The market is increasingly positioned at the intersection of gut health science, functional food innovation, and early-life nutrition strategy. Among global regions, the United States is anticipated to dominate consumption, while China is expected to exhibit the fastest growth through 2035, underpinned by evolving infant nutrition regulations and rising awareness around microbiome health.

The upward trajectory of this market is influenced by a shift toward prebiotic-enriched formulations in infant formula, dairy, beverages, and dietary supplements. A strong body of scientific literature supporting the role of GOS in fostering beneficial gut flora and improving digestive and immune health has catalyzed demand.

Manufacturers are actively pursuing R&D in synbiotic formulations and exploring dairy- and plant-based GOS sources. However, growth is moderated by high production costs, the complexity of enzymatic synthesis, and regulatory divergence across regions. Clean-label expectations and product traceability continue to shape product development, while formulators seek stability and efficacy across delivery formats.

Between 2025 and 2035, the GOS market is expected to evolve into a cornerstone of microbiome-targeted functional nutrition. With expanding penetration in adult and senior health categories, the application base is forecasted to broaden beyond infant formula.

Players are likely to intensify innovation in synergistic formulations with probiotics, expand into personalized nutrition solutions, and invest in advanced delivery formats. Regulatory harmonization and supply chain transparency will remain key to unlocking full-scale adoption in mainstream health and wellness platforms.

The following table compares the difference in the CAGR values over the six-month period for the base year 2024 and the current year 2025 for Galacto-Oligosaccharide industry worldwide.

This analysis shows the important changes in performance and the revenue earning practices and hence adds greater understanding of the annual growth pattern of the Global Galacto-Oligosaccharide industry. The first half of the year or H1 is from January to June, while the second half or H2 is from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 5.9% (2024 to 2034) |

| H2 | 6.4% (2024 to 2034) |

| H1 | 6.5% (2025 to 2035) |

| H2 | 7.0% (2025 to 2035) |

From the year 2023 to 2033, the industry is expected to grow at a rate of 5.9% in the first half, and then increase slightly more to 6.4% in the second half of the decade.

Moreover, in the H1 2024 to H2 2034 period, the CAGR is expected to rise to 6.5% in the first half and then be able to remain rather high at 7.0% in the second half. In the first half, the sector experienced a 45 BPS increase whereas the sector recorded a drop of 20 BPS in the second half.

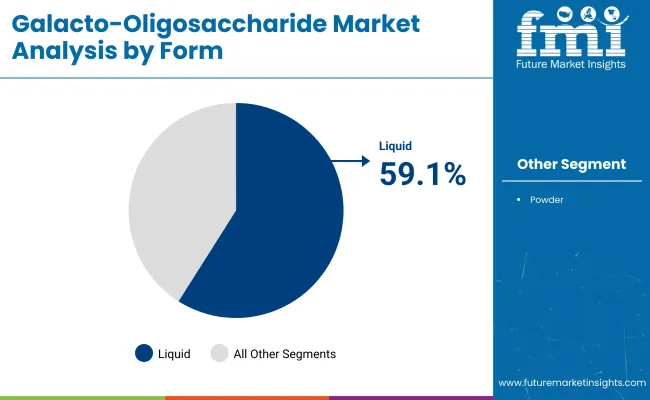

The liquid form of galacto-oligosaccharide (GOS) is anticipated to command a 59.1% market share in 2025, maintaining its lead in alignment with the overall market CAGR of 7.5% through 2035. Its continued dominance is underpinned by formulation convenience, especially in high-growth segments like infant nutrition, dairy-based functional beverages, and early-stage dietary supplements.

Liquid GOS has emerged as the preferred format due to its superior solubility, processing compatibility, and ease of dosing in both industrial and clinical nutrition settings. In infant formula, where formulation precision and shelf-life stability are critical, liquid GOS offers manufacturers a scalable solution with consistent prebiotic efficacy. Similarly, in dairy applications-including yogurt and milk-based beverages-it ensures smooth integration without compromising product texture or flavor.

However, its growth trajectory is not without constraints. High moisture content affects transportation and shelf stability in certain markets, especially those lacking advanced cold chain infrastructure. Additionally, as clean-label expectations rise, manufacturers are reevaluating ingredient processing footprints-fueling interest in concentrated liquid forms and hybrid delivery systems.

Looking ahead, strategic investments in enzymatic yield optimization and multi-format flexibility will be essential. Liquid GOS is poised to remain the industry’s gateway to microbiome innovation, but its success will depend on adaptive formulation strategies and regional infrastructure compatibility.

With a projected market share of 59.1% in 2025, the liquid form of galacto-oligosaccharide (GOS) continues to anchor the segment’s dominance and is expected to expand steadily in line with the broader market CAGR of 7.5% through 2035. This leadership position reflects the format’s proven functional versatility and its critical role in delivering microbiota-enhancing benefits in both infant and adult nutritional systems.

Liquid GOS has earned strategic relevance in product categories where precision prebiotic delivery and high solubility are required-particularly in infant formula, medical nutrition, and functional dairy. Its ease of incorporation, reduced processing steps, and compatibility with thermal and enzymatic stability parameters offer distinct advantages to formulators. Furthermore, the liquid format supports product uniformity in high-throughput manufacturing environments, a key advantage in scaling commercial applications.

However, supply-side factors such as cost of enzymatic hydrolysis and regional storage limitations present logistical hurdles. Manufacturers are countering these with advancements in concentrated liquid variants and encapsulation technologies.

Increasing regulatory clarity around GOS claims in China, Southeast Asia, and Latin America is also expected to accelerate adoption. As consumer demand for gut health intensifies, liquid GOS will remain the preferred vehicle for mass-market applications, provided it evolves with cleaner profiles and platform-neutral integration capabilities.

Surge in demand for fortified products targeting specific health benefits

The increasing consumer focus on health and wellness has led to a surge in demand for fortified food and beverage products designed to offer specific health benefits. Galacto-Oligosaccharide (GOS) has emerged as a sought-after ingredient in this category due to its proven prebiotic properties.

Fortified products enriched with GOS cater to diverse health needs, including gut health, immunity support, and improved digestion. Consumers are increasingly drawn to functional foods like yogurts, plant-based dairy alternatives, and snack bars that deliver not only nutrition but also targeted health benefits.

Additionally, dietary supplements containing GOS are gaining traction among individuals looking to address specific issues, such as constipation, bloating, or weakened immunity. This trend is particularly pronounced in aging populations and urban consumers who prioritize preventive healthcare.

Manufacturers are leveraging GOS's versatility to create products that resonate with health-conscious buyers. For example, GOS-enriched beverages and meal replacements are marketed as solutions for improving gut health and enhancing overall well-being.

The surge in fortified product demand is further fueled by advancements in food technology, which make it easier to incorporate GOS into a wide range of applications. This trend underscores the growing role of GOS in the functional food and beverage industry, driving its demand across globe.

GOS's similarity to human milk oligosaccharides (HMOs) drives its use in infant formula

Galacto-Oligosaccharide (GOS) has gained prominence in the infant formula industry due to its structural and functional similarity to human milk oligosaccharides (HMOs). HMOs are critical components of breast milk that promote the growth of beneficial gut bacteria, support immune development, and enhance nutrient absorption in infants. GOS effectively mimics these benefits, making it a key ingredient in premium infant formula products.

With rising global birth rates and an increasing number of working mothers seeking high-quality alternatives to breastfeeding, the demand for fortified infant formula continues to grow. GOS-enriched formulas provide a solution that closely replicates the natural benefits of breast milk, reassuring parents about their infants' nutritional and developmental needs.

Moreover, ongoing research into the gut microbiome has highlighted the importance of prebiotics like GOS in establishing a healthy gut flora early in life. These findings have driven regulatory approvals and encouraged manufacturers to prioritize GOS in their formulations.

The infant nutrition premix industry growth, particularly in emerging economies, is a significant factor driving the demand for GOS. Its inclusion in infant formula not only ensures industry differentiation but also underscores its role as an essential ingredient in addressing the nutritional needs of newborns and infants.

Rising cases of irritable bowel syndrome (IBS) and other digestive issues

The increasing prevalence of digestive disorders, such as irritable bowel syndrome (IBS), constipation, and bloating, has significantly boosted the demand for Galacto-Oligosaccharide (GOS). IBS, a condition affecting millions globally, is often linked to imbalances in the gut microbiome.

As a prebiotic, GOS promotes the growth of beneficial gut bacteria, such as Bifidobacteria and Lactobacilli, which play a crucial role in restoring gut health and alleviating digestive discomfort.

Consumers struggling with digestive issues are turning to functional foods and dietary supplements that include GOS as a key ingredient. GOS's ability to enhance stool consistency, reduce bloating, and improve gut motility has been well-documented, making it an appealing solution for individuals seeking non-pharmaceutical options to manage their symptoms.

This trend is particularly strong among younger consumers and health-conscious populations, who are increasingly prioritizing gut health as part of their overall wellness goals. The integration of GOS into products such as yogurts, plant-based dairy, and beverages further expands its accessibility and appeal.

With healthcare providers and nutritionists emphasizing the role of prebiotics in managing digestive disorders, the demand for GOS is expected to grow. This rise highlights GOS's role as a natural and effective solution for addressing the global burden of digestive health issues.

Between 2019 and 2023, the Galacto-oligosaccharide (GOS) industry saw notable growth, driven by increasing awareness about gut health and the rising demand for natural, plant-based prebiotics. As consumers became more health-conscious, GOS gained popularity in functional foods, dairy alternatives, and dietary supplements, particularly among those seeking lactose-free and vegan options.

Major food companies incorporated GOS into their offerings to cater to the growing demand for digestive health products. Despite challenges like high production costs and ingredient sourcing, the industry continued to expand.

From 2024 through 2034, the GOS industry is expected to grow further, fuelled by advancements in production technology, which will improve product quality and reduce costs.

The focus on sustainability, eco-friendly packaging, and strategic partnerships will also drive innovation and reach. As e-commerce platforms continue to grow, GOS will become an essential ingredient in global wellness and functional food trends, making it a key player in the market for digestive health and prebiotic products.

Tier 1 players in the global Galacto-oligosaccharide (GOS) industry are recognized as dominant forces that capture a significant share, thanks to their strong research and development capabilities.

These companies are leaders in the industry due to their comprehensive product portfolios and vast distribution networks. They leverage their expertise to innovate and offer high-quality GOS products that are used in a wide range of applications, including functional foods, beverages, and dietary supplements.

Tier 2 players are regional or domestic companies with specialized GOS offerings that cater to specific consumer needs. These companies have managed to capture significant share by focusing on unique product formulations or targeting specific dietary trends.

For example, companies in India or Southeast Asia may offer GOS in lactose-free or plant-based dairy products to address regional preferences. These players often thrive in their local markets by tailoring products to meet consumer demand for digestive health and wellness.

Tier 3 players are smaller companies that operate within limited geographic regions, providing niche solutions or customized offerings to cater to local consumer needs.

These firms may not have extensive research capabilities, but they play a crucial role by offering specialized GOS-based products, such as artisanal supplements or region-specific functional foods. Despite their smaller scale, Tier 3 companies are valued for their agility in responding to consumer trends and offering personalized customer experiences, which contribute to the GOS industry growth at a local level.

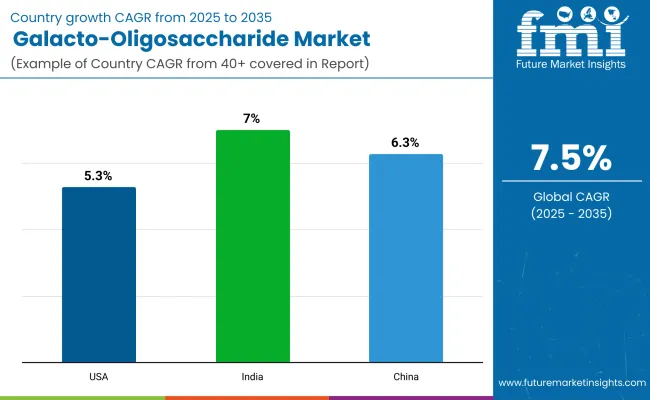

The following table shows the estimated growth rates of the key territories. USA, India and China are set to exhibit a significant growth rate of 5.3%, 7.0%, and 6.3%, respectively, through 2035

| Countries | CAGR 2025 to 2035 |

|---|---|

| USA | 5.3% |

| India | 7.0% |

| China | 6.3% |

The increasing demand for vegan and lactose-free products in the USA is contributing to the expansion of the Galacto-oligosaccharides (GOS) industry, particularly as manufacturers develop non-dairy alternatives. Lactose intolerance affects a significant portion of the population, prompting many consumers to seek plant-based options that do not compromise their digestive health.

Non-dairy GOS, derived from plant-based sources, offer a prebiotic fiber that supports gut health, mimicking the beneficial effects of traditional dairy-based GOS. This innovation is meeting the needs of vegan consumers, who often face challenges in obtaining prebiotics, a crucial component for digestive wellness.

As more food and beverage companies aim to provide functional and inclusive products, non-dairy GOS is being incorporated into plant-based dairy alternatives, beverages, snacks, and supplements.

These developments are helping to fill a gap in the sector, enabling lactose-intolerant and vegan consumers to enjoy the digestive health benefits of GOS without the need for dairy-based ingredients. The rise in health-conscious choices and awareness of gut health is further fuelling this growth, positioning non-dairy GOS as a key ingredient in products that cater to these evolving consumer preferences.

The growing penetration of Galacto-oligosaccharides (GOS) into the animal nutrition sector is becoming a key driver of market growth in China. With the increasing demand for high-quality animal feed, especially in the livestock and poultry industries, GOS is being recognized for its potential to enhance animal health and productivity.

GOS serves as a prebiotic that supports the gut microbiome, improving digestion, nutrient absorption, and overall immune function in animals. In China, where animal farming plays a crucial role in the agricultural sector, integrating GOS into animal feed is seen as an effective solution to boost animal performance while also promoting sustainable farming practices.

As awareness about the importance of gut health in livestock grows, GOS is increasingly being incorporated into animal nutrition products such as feed additives, pet food, and aquaculture feeds.

Additionally, the rise in demand for high-quality protein sources and the focus on reducing antibiotic usage in animal farming further fuel the adoption of GOS, as it helps enhance the overall health of animals naturally. This trend is driving the growth of the GOS in China, with a growing emphasis on animal health and productivity across various sectors within the country’s thriving agricultural industry.

In India, the growing preference for minimally processed, natural prebiotics is significantly driving the Galacto-oligosaccharides (GOS) industry. As consumers become more health-conscious, there is a noticeable shift towards products that offer natural health benefits without artificial additives or excessive processing.

GOS, known for its prebiotic properties, aligns with this demand as it is derived from natural sources like lactose, making it an attractive option for those seeking digestive health benefits.

The Indian industry, with its increasing awareness about gut health and overall wellness, is witnessing a rise in the consumption of GOS in functional foods, beverages, and dietary supplements.

As people seek to enhance their digestive systems and boost immunity naturally, GOS is emerging as a key ingredient in products like dairy alternatives, snacks, and health supplements. This preference for natural, minimally processed ingredients is fuelling the growth of the GOS in India, driving demand for functional, gut-friendly products.

The competition outlook for Galacto-oligosaccharides (GOS) is increasingly dynamic, driven by the growing demand for prebiotics and functional ingredients in the food, beverage, and health industries. Key players in the GOS industry include global companies specializing in ingredients for dietary supplements, infant nutrition, and dairy products.

These companies are leveraging advanced production technologies to offer GOS in various forms, such as powder and liquid, to meet diverse consumer needs. The industry is characterized by the presence of both large multinational corporations and smaller, specialized suppliers.

Leading manufacturers are focused on expanding their product portfolios, improving the quality and functionality of GOS, and tapping into new regional markets.

Additionally, innovation in production techniques, such as enzymatic synthesis, is helping companies reduce costs and improve scalability. As consumer awareness of gut health increases, competition in the GOS sector is expected to intensify, with companies investing in R&D to stay competitive and meet evolving consumer demands.

As per primary function, the industry is categorized into Prebiotic and Sweetener

By form the industry is categorised into liquid/syrup and powder.

As per Concentration, the industry is segregated into 57% and less, 70%, and 90% and More

By end-use application, the industry is segregated into food processing, beverage processing, baking food and confectionary, snacks, dairy & dairy blends, animal feed, dietary supplements, cosmetic & personal care, and infant food.

The industry is valued at USD 1,004.8 million in 2025.

It is forecasted to reach USD 2,070.9 million by 2035.

The industry is anticipated to grow at a CAGR of 7.5% during this period.

Prebiotic Function are projected to lead the market with a 82.6% share in 2025.

Asia Pacific, particularly India, is expected to be the key growth region with a projected growth rate of 7.0%.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA