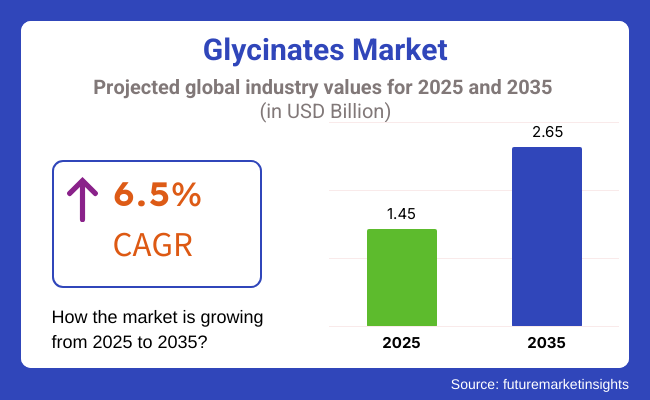

The glycinates market is estimated to be worth USD 1.45 billion in 2025 and is projected to reach a value of USD 2.65 billion by 2035, expanding at a CAGR of 6.5% over the assessment period of 2025 to 2035.

The industry is showing a stable increase due to the growing requirement in the food, pharmaceutical, and animal nutrition sectors. They are the chelated minerals produced when binding glycine by the magnesium, calcium, zinc, and iron are included together with necessary minerals. These are widely used for their high absorption and bioavailability properties.

The increasing emphasis on health and wellness is also a significant driver behind the industry progress. The industry is expected to mainly grow through the accelerated use of them in dietary supplements and functional foods. Consumers are looking for mineral-fortified products that have a better absorption and bioavailability compared to the usual mineral salts.

They are widely used in multivitamins, sports nutrition, and fortified beverages to support bone health, muscle function, and overall well-being. Beside this the animal feed industry is again a central factor in this expansion. They are being utilized in livestock and pet nutrition to help enhance mineral absorption, boost growth rate, and improve the immune system.

This situation is coupled with the increasing worries about animal health and production and consequently the demand for the chelated minerals in the feed formulations is going up in the poultry, swine, and aquaculture areas.

Regarding the technical aspects, the production of them has been made more stable and effective due to the new technologies in chelation processes and fortifications of minerals, which are basically the reasons they are now a number one producer's choice.

Also, the industry's growth potential is boosted by the increasing health and environmentally conscious consumer trends which in turn demand the sourcing of natural and non-GMO mineral products, thus enlarging the industry.

Nonetheless, the industry is confronted with challenges like the changing raw material prices and the tough regulatory frameworks concerning mineral supplements. Adhering to safety and labelling criteria in distinct regions entails more difficulties for the manufacturers. The widespread availability of alternative mineral sources may also affect the use of them in certain applications.

However, in these complications, there are broader scopes for creating business. Users' quest for personalized nutrition and targeted supplementation is, without a doubt, the foremost driver behind more advancements happening. The increasing awareness of the common deficiency of minerals and the resulting negative impact of health issues is also generating new avenues for the industry in the pharmaceutical and nutraceutical sectors. As these sectors keep their focus on highly usable and applicable contents, glycinates is bound to function excellently through the years.

The world industry is growing steadily due to the rising demand for bioavailable mineral supplements in various industries. Glycinates, which have high absorption rates and low gastrointestinal side effects, are extensively used in food fortification, pharmaceuticals, animal nutrition, and personal care products.

In the food and beverage industry, they are incorporated into fortified foods and nutritional supplements to stimulate mineral nutrition, particularly iron, zinc, and magnesium glycinates. Pharmaceutical companies utilize them in nutraceuticals to enhance bone health, muscle function, and metabolism. Animal nutrition industry is subjected to growing use due to glycinates, which can increase feeding efficiency as well as the health of the animals.

Additionally, the cosmetic industry is producing cosmetic formulations in the form of glycinates due to its skin-conditioning nature. Due to greater awareness of clean-label ingredients and sustainably sourced supplies, companies are producing organic, plant-based options as a response to changing consumer trends.

The table below is a comparative assessment of variation in CAGR based on six months tempering for base year (2024) and current year (2025) in the industry. So, this analysis drives the trends with overall industry performance to give better picture of annual growth trend and revenue realization pattern over the year to stakeholder.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.2% |

| H2 (2024 to 2034) | 6.3% |

| H1 (2025 to 2035) | 6.4% |

| H2 (2025 to 2035) | 6.6% |

Above half-yearly demand industry potential in between 2025 to 2035 has been segmented in terms of CAGR for the industry for standardization of data. The industry will flourish in H1 2024 with a CAGR of 6.2%, and it is estimated to rise to 6.3% in H2. Elevation of CAGR for the first half is 6.4% (H1) and continues to maintain an upward trajectory for second half at 6.6% (H2) in 2025.

From 2020 to 2024, the industry grew steadily owing to increased consumption of nutritional supplements, animal feeds, and cosmetics. Due to their bioavailability and improved level of absorption, they gained acceptance within the food as well as pharma industry in terms of fortification.

In animal nutrition, glycinates was a pathfinder in providing enhanced availability of vital minerals such as magnesium, zinc, and copper and thereby furthering animal productivity and health. Growing interest in health and well-being also induced food supplement ingestion of them due to the desire of individuals for better nutrient assimilation and overall well-being.

But production costs and limited raw materials restricted industry growth to some extent. Between 2025 and 2035, the industry will experience growth at a faster pace fueled by developments in chelation technology and consumer demand for clean-label and organic products. Demand for fortified functional foods and beverages will increase, driving the demand for high-quality mineral supplements.

Feed additive innovations will target enhanced stability and bioavailability of them to improve animal growth rates and immunity. Also, the personal care industry will embrace them due to their skin-conditioning ability and encourage their incorporation in skincare and cosmetic products. Environmental-friendly production methods and support from regulatory authorities for bioavailable supplements will also enhance industry opportunities.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing applications of glycinates in animal feed for enhanced nutrient absorption. | Sophisticated chelation technology for enhanced bioavailability and stability. |

| Increased consumer interest in functional foods and dietary supplements. | Increased consumer interest in clean-label and organic mineral supplements. |

| Obstacles in the form of high production cost and supply chain disruptions. | Increased productivity of production and sustainable sourcing practices. |

| Glycinates in cosmetics and personal care for skin conditioning benefits. | Increased usage in skincare and cosmetics. |

| Increased regulatory interest in fortification and bioavailability of nutrients. | The support of bioavailable supplements and green manufacturing. |

The food and feed add the processes insect stringent regulatory requirements, thus, highlighting the compliance challenges. Manufacturers must prepare the prescriptions of the adherence to the health and safety regulations, secure the necessary certificates as well as the sustainability of the transparency of the products the companies cope with are necessary to make consumers trust them and the industry tolerate them.

On one hand, supply chain disruptions such as the unavailability of raw materials, costlier transportation, and geopolitical trade barriers affect the stability of the production and the pricing. The reliance on magnesium, zinc, and calcium metal sources as intestines in the industry, which increases the industry's susceptibility to external factors.

To counter such risks, enterprises should prioritize the diversification of suppliers, as well as, focus on the sustainability of their sourcing through environmentally sound behaviours. Transition in the consumer's buying sense from synthetic to organic and plant-based supplements has emerged a fierce task for traditional glycinates made from the chemical process.

The desire for natural ingredients and the avoidance of genetically modified organisms mineral chelates cause a rise in competition. The challenge for companies is to come up with clean-label, highly bioavailable formulations that will keep them abreast of the shifting industry trends.

The increasing rivalry from the other mineral supplements; in the form of amino acid chelates and organic trace minerals, has led to the pressure on both pricing and product differentiation. In order to maintain competitiveness, companies are advised to concentrate on their research and development, formulating and supply pure high-grade materials that can be used in different fields, for example, animal health care and functional nutrition.

Economic uncertainties, currency fluctuations, and the altering of trade policies have their effects on the growth of the industry. In order to reap the benefits for a long term, the companies ought to boost the efficiency of the production process, penetrate into the developing markets, and join forces with the pharmaceutical, food, and feed industries to create cutting-edge glycinate products that go well across a variety of industry applications.

Rising Global Demand for Magnesium Glycinate in Nutraceuticals and Wellness

| Segment | Value Share (2025) |

|---|---|

| Magnesium glycinate (Type) | 51.6% |

The magnesium glycinate segment in 2025 accounts for the maximum share of 51.6% in the type basis of the Industry. This dominance is fuelled by the increasing use of bioavailable magnesium supplements to combat stress, facilitate muscle recovery, and support cardiovascular health. Magnesium glycinate is readily absorbed in the body, which is why it is commonly used in dietary supplements and functional foods.

Magnesium glycinate, available from companies including Albion Minerals (Balchem), BASF, and Innophos, is used in insomnia, anxiety, and athletic performance formulations. The growing awareness of health and rising cases of magnesium deficiency interactively grow the industry.

Calcium Glycinate: which holds a significant 14% of the industry share and is used in bone health supplements, fortified dairy and pharmaceutical preparations. It also has a higher bioavailability than many calcium salts, making it suitable for people with osteoporosis and calcium absorption problems. Calcium glycinate is used by manufacturers such as Glanbia Nutritional's and Nutreco in animal feed and nutraceutical applications, delivering improved mineral absorption to livestock, as well as humans.

As consumers become more aware of mineral deficiencies and the concept of functional nutrition, the industry for glycinate-based minerals with their high bioavailability is likely to expand. This will keep the glycinate industry evolving and adapting through technology owing to the increasingly popular sports nutrition, dietary supplements, and fortified food sectors.

Growing Market share for Glycinates in Pharmaceutical and Nutraceutical

| Segment | Value Share (2025) |

|---|---|

| Pharmaceutical and Nutraceutical (Application) | 68.6% |

In 2025, the industry is segmented by application, with pharmaceutical/nutraceutical dominating at 68.6%. This is mainly attributable to the rising demand for highly bioavailable mineral supplements in dietary supplements, functional foods, and pharmaceuticals.

Magnesium glycinate, a high-absorption form of magnesium with good gastrointestinal tolerance, is a popular supplement to support muscle function, stress relief, and cardiovascular health. Glycinate-based formulations are tactically offered by companies, including Balchem (Albion Minerals), BASF, and Innophos, for development into multivitamins, sleep aids, and sports nutrition supplements.

Likewise, calcium glycinate in bone health supplements to treat osteoporosis and other types of diseases. The growth of the industry is further supported by the rising trend of nutraceutical innovations and personalized nutrition.

The Animal Feed segment holds 12.5% of the industry share, driven by the need for highly absorbable mineral supplements in livestock nutrition. Properties of glycinates that enhance growth rates, immune system function, and reproductive health in poultry, swine, and cattle.

Glycinates for improved mineral absorption and decreased regurgitation leading to sustainability in animal husbandry are offered, among others, by Nutreco and Novus International. Because of an increasing focus on feed efficiency and animal care, they are quickly being adopted over inorganic minerals in the livestock sector.

Growing consumer awareness about mineral deficiencies, gut health, and nourishing the body sustainably, would help drive the industry for pharmaceuticals & nutraceutical sectors, and for the animal feed industry, drums of bioavailable and non-compromising solutions will be adopted.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.8% |

| UK | 4.9% |

| France | 4.7% |

| Germany | 5.1% |

| Italy | 4.5% |

| South Korea | 5.3% |

| Japan | 4.8% |

| China | 6.2% |

| Australia | 4.6% |

| New Zealand | 4.4% |

The USA industry is anticipated to register a CAGR of 5.8% over the forecast period of 2025 to 2035, driven by increasing demand for mineral-fortified functional foods and nutraceuticals among consumers. The increasing prevalence of osteoporosis, cardiovascular diseases, and immune-related disorders is fueling demand for highly bioavailable chelated minerals such as magnesium, zinc, and calcium glycinates.

USA industry leaders like Nature's Bounty and NOW Foods are launching new, clean-label mineral supplements that are popular with health-conscious consumers. Increased interest in personal nutrition, encouraged by advanced biotechnology, has also solidified the industry position.

The growth of e-commerce channels and direct-to-consumer models is expanding exposure to premium glycinate-based supplements and mass adoption. In addition, rigorous FDA regulation of dietary supplements is compelling companies towards evidence-based products, ensuring product efficacy and consumer trust. The USA also leads environmentally friendly chelation technology research and development, compelling repeated product innovation within the industry.

The UK industry will expand at a 4.9% CAGR from 2025 to 2035 due to the increasing trend for organic and clean-label dietary supplements. There is a trend in the UK where consumers are seeking plant-based and allergen-free supplements, and this is also enhancing the uptake of glycinate-based minerals in vegan-friendly supplements.

Holland & Barrett and MyProtein are some of the players capitalizing on this trend by introducing glycinate-enriched vitamins and sports nutrition products. In addition, the UK's highly regulated environment under the Food Standards Agency (FSA) encourages the application of bioavailable and safe forms of minerals in food and pharmaceutical use.

An increasing population of older adults and consciousness of bone and joint-related ailments also drive demand for calcium and magnesium glycinates. Ethical and sustainable ingredient sourcing is also gaining prominence in the nation, forcing businesses to develop green options for human and animal nutrition.

The French industry will develop at 4.7% CAGR from 2025 to 2035 in response to the increased demand for premium quality pharmaceuticals and diet supplements. Increased demand for premium quality evidence-based mineral supplements with PiLeJe and Nutergia as trendsetter companies in the industry for chelated minerals is fueling demand in France.

France's well-established pharmaceutical industry is also fueling the application of them in pharmaceuticals. France's nutritional regulation on sustainable food solutions and clean-label ingredients promotes movement in the industry towards organic and bioavailable minerals.

In addition, expansion in the dairy industry and fortified infant nutrition are driving the use of them in specialty foods. The developments in biotechnology and pharmaceuticals in the country are projected to increase the industry opportunity further.

The German industry will expand during 2025 to 2035 at a CAGR of 5.1%, driven primarily by increasing demand from the livestock and poultry industries for sustainable animal nutrition products. Stringent EU regulations in Germany for the use of feed additives force the adoption of organic and chelated minerals to promote animal growth and health.

Evonik and BASF are prominent companies heavily investing in emerging glycinate-based feed products to improve nutrient uptake and minimize environmental impact. Germany's interest in green and antibiotic-free animal nutrition is spurring further investment in them and other feed additives. In addition, the strong research climate for agricultural biotechnology is setting the stage for more advanced chelation technologies with high efficiency and sustainability in the feed industry.

Italy's industry will grow at a CAGR of 4.5% over the forecast period on account of increasing demand for functional foods and nutraceuticals. Italian consumers look for quality science-formulated supplements, and hence products like Solgar Italia and Specchiasol provide innovative chelated mineral products. Also driving industry growth is the shift towards the Mediterranean diet with functional foods.

Additionally, the Italian pharmaceutical sector is integrating them into bone health and cardiovascular supplements. The nation's focus on higher standards of safety and efficacy in regulations ensures the continuous utilization of top-quality glycinate-based supplements. Rising demand for organic and plant-based nutrition also supports product diversification.

The South Korean industry is anticipated to expand at a CAGR of 5.3% during 2025 to 2035, led by the fast-expanding functional food and dietary supplement industries. South Korean consumers are highly interested in skin care, immune system support, and anti-aging supplements, and these are propelling the use of them in beauty and wellness products.

Players like Amorepacific and CJ CheilJedang are adding chelated minerals to nutraceutical and functional beverage products. In addition, the country's well-developed biotechnology sector is spearheading research on the production of glycinate as a drug and food use. The government in Korea's encouragement of the local production of supplements and favorable regulatory policies for scientifically validated formulas also work in favor of industry growth.

Japan's industry is likely to grow at a 4.8% CAGR from 2025 to 2035, driven by Japan's health-conscious emphasis on healthy aging and functional nutrition. High-mineral content mineral supplements supporting cognitive function, bone health, and cardiovascular health are popular among Japanese consumers, and consequently, there is a high demand for glycinate products. Fancl and Yakult Honsha are leading chelated mineral product innovations.

The nation's developed pharmaceutical and nutraceutical industries are incorporating them into prescription and over-the-counter drugs. The government's emphasis on preventive healthcare and stringent quality standards contribute further to industry growth, with consumers repeatedly taking bioavailable minerals.

China's industry is expected to grow at 6.2% CAGR between 2025 to 2035, driven by China's increasing pharmaceutical industry and increased application of chelated minerals in drugs. China's booming premium healthcare industry and aging population with growing years of aging have fueled the application of glycinate in clinical nutrition and medicines. Domestic brands like BY-HEALTH and Amway China rely on science-based, high-quality mineral supplements.

Additionally, state subsidies in favor of domestic manufacturing of drugs and biotechnology R&D have seen increased investments into glycinate studies. Growth in the middle class with improved disposable income is also growing demand for premium therapeutic supplements.

The Australian industry is expected to register a CAGR of 4.6% during 2025 to 2035, driven by the rising demand for fortified functional foods and dietary supplements. Australian consumers require clean-label and organic foods, and therefore brands like Blackmores and Swisse have incorporated them in high-end supplement lines.

The country's well-regulated food and pharmaceutical industries guarantee the application of bioavailable minerals in pharmaceutical and nutraceutical applications. In addition, increasing investments in sustainable animal nutrition and feed fortification fuel the high demand for them in animal health applications.

New Zealand's industry is projected to register 4.4% CAGR growth over the forecast period with the increasing dairy and functional foods industry. There is an encouragement of organic and natural nutrition in New Zealand, in line with the higher use of chelated minerals in fortified baby food and milk. Nutricia and Fonterra are some firms that apply them to enhance nutritional compounds.

Additionally, New Zealand's livestock sector is using glycinate-based feed products to enhance animal health and performance. The country's regulatory interest in sustainable agriculture promotes the growth of the industry.

The industry is booming because it caters to needs across various industries-pharmaceuticals, nutraceuticals, animal feed, and personal care. The most considerable determinants for this growth are increased awareness concerning mineral bioavailability, consumer trends gravitating toward health-consciousness, and the changeover from conventional to chelated mineral supplements.

Industry players such as BASF SE, Solvay S.A., Ajinomoto, Clariant, and Balchem Corporation are blocking out specific initiatives directed at developing new products, sustainable sources, and advanced chelation technologies to increase absorption efficiency. BASF SE is accordingly investing in high-purity mineral glycinates intended for functional foods, while Solvay S.A. is augmenting its portfolio with eco-friendly and high-solubility formulations.

The demand for fortified animal nutrition has increased; dietary supplements are consumed more frequently, and strict regulatory frameworks promote high-quality chelated minerals. All these changes in the industry have led to global production capacity expansions, optimization of supply chains, and forming partnerships to improve their position in the industry by companies.

This intensification of competition will encourage key strategies such as targeting emerging markets, developing customized formulations, and leveraging e-commerce for direct-to-consumer sales in the health and wellness segments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 18-22% |

| Solvay S.A. | 14-18% |

| Ajinomoto Co., Inc. | 10-14% |

| Balchem Corporation | 8-12% |

| Clariant AG | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Market Focus |

|---|---|

| BASF SE | Top manufacturer of high purity glycinates for pharmaceutical, animal feed, and food fortification use. Emphasizes sustainability and innovative chelation technology. |

| Solvay S.A. | Provides custom glycinates for industrial and healthcare use, investing in research and development and tailored formulation options. |

| Ajinomoto Co., Inc. | Emphasizes bioavailable amino acid chelates, targeting nutraceuticals and functional foods. Very strong focus on scientific study and efficacy research. |

| Balchem Corporation | Excels at encapsulated glycinates for feed and food use, with stability and controlled release formulations. |

| Clariant AG | Delivers high-performance chelated minerals, serving the cosmetics, health care, as well as animal nutrition markets with top-of-the-line products. |

Key Company Insights

BASF SE (18% - 22%)

An industry leader in high-quality glycinates with advanced chelation processes and sustainable sourcing of its ingredients.

Solvay S.A. (14%-18%)

Further bolsters competitiveness through customized glycinates and technical innovation in industrial applications.

Ajinomoto Co., Inc. (10-14%)

It utilizes amino acid knowledge to improve bioavailability in dietary supplements and functional food products.

Balchem Corporation (8-12%)

It is the leader in microencapsulation technology that optimizes the stability and controlled delivery of nutrients.

Clariant AG (6-10%)

The leading supplier of premium glycinates includes clean-label solutions in personal care and health care applications.

By type, the industry is categorized into magnesium glycinate, calcium glycinate, zinc glycinate, iron glycinate, copper glycinate, manganese glycinate, and sodium glycinate.

By form, the industry is segmented into dry and liquid.

By application, the industry includes animal feed, pharmaceutical/nutraceutical, food & beverage, and cosmetics & personal care.

By region, industry analysis has been carried out in key countries across North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic countries, Russia & Belarus, and the Middle East & Africa.

The industry is expected to generate USD 1.45 billion in revenue by 2025.

The industry is projected to reach USD 2.65 billion by 2035, growing at a CAGR of 6.5%.

Key players include BASF SE, Solvay S.A., Ajinomoto Co., Inc., Balchem Corporation, Clariant AG, Pancosma SA, Jost Chemical Co., Albion Minerals, Shijiazhuang Donghua Jinlong Chemical Co., and Novotech Nutraceuticals.

North America and Europe, driven by rising demand for high-quality animal nutrition, fortified food products, and increasing awareness of mineral deficiencies in human health.

Magnesium glycinates dominate due to their superior bioavailability, growing use in dietary supplements, and applications in stress management and muscle health.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Form, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Form, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (MT) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Form, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (MT) Forecast by Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 40: Asia Pacific Market Volume (MT) Forecast by Form, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: MEA Market Volume (MT) Forecast by Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 48: MEA Market Volume (MT) Forecast by Form, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Form, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Form, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 90: Europe Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 93: Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Europe Market Attractiveness by Form, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 114: Asia Pacific Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: MEA Market Volume (MT) Analysis by Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 138: MEA Market Volume (MT) Analysis by Form, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 141: MEA Market Attractiveness by Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Application, 2023 to 2033

Figure 143: MEA Market Attractiveness by Form, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA