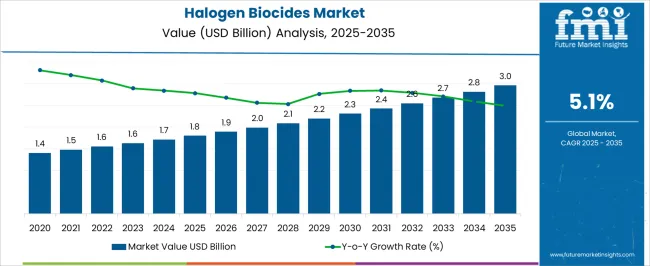

The halogen biocides market is projected to grow from USD 1.8 billion in 2025 to USD 3 billion by 2035, reflecting a CAGR of 5.1%. Over the ten-year period, the market is expected to witness steady expansion, with annual increments from USD 1.8 billion in 2025 to USD 3 billion in 2035. This growth is being driven by rising industrial and commercial demand for water treatment, disinfection, and preservation applications where halogen biocides are widely utilized.

Market performance is influenced by regulatory compliance, chemical efficacy, and cost-effectiveness, which are being increasingly recognized by end-users seeking reliable microbial control solutions. During this decade, the halogen biocides market is anticipated to capture value through consistent adoption across diverse sectors, including municipal water treatment, cooling systems, and pulp and paper processing. The gradual rise in market size indicates that production efficiency, supply chain management, and chemical standardization are being leveraged to enhance product availability and operational reliability. Investors and manufacturers are positioned to benefit from predictable growth patterns, while incremental gains are being observed in emerging industrial regions.

| Metric | Value |

|---|---|

| Halogen Biocides Market Estimated Value in (2025 E) | USD 1.8 billion |

| Halogen Biocides Market Forecast Value in (2035 F) | USD 3.0 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The halogen biocides market is estimated to hold a notable proportion within its parent markets, representing approximately 12-14% of the water treatment chemicals market, around 10-11% of the industrial biocides market, close to 8-9% of the disinfectants and sanitizers market, about 6-7% of the specialty chemicals market, and roughly 4-5% of the agricultural chemicals market. Collectively, the cumulative share across these parent segments is observed in the range of 40-46%, reflecting a significant presence of halogen biocides across industrial, agricultural, and water treatment applications.

The market has been influenced by the growing demand for effective microbial control and chemical treatments, where product efficacy, stability, and regulatory compliance are highly prioritized. Adoption is guided by procurement decisions focused on formulation compatibility, dosage efficiency, and operational safety across diverse applications. Market participants have emphasized high-purity compounds, controlled release formulations, and consistent performance to ensure reliability and maintain microbial control in water systems, industrial processes, and agricultural settings.

As a result, the halogen biocides market has not only captured a substantial share within water treatment and industrial biocide segments but has also impacted disinfectants, specialty chemicals, and agricultural chemicals markets, highlighting its strategic role in ensuring effective microbial management, chemical safety, and operational consistency across multiple sectors.

The halogen biocides market is witnessing significant growth, supported by the increasing demand for effective microbial control across industrial, municipal, and commercial applications. The proven efficacy of halogen compounds in eliminating bacteria, viruses, and algae is driving their adoption in water treatment, industrial cleaning, and surface disinfection processes. Regulatory support for maintaining hygienic water standards in municipal and industrial infrastructure is further contributing to market expansion.

In particular, the role of halogen biocides in ensuring safe potable water and treating wastewater is gaining importance as global urbanization and industrialization accelerate. Continuous product innovation, including the development of stabilized halogen formulations with extended effectiveness, is enhancing performance in complex environments. As industries seek biocides that offer high reactivity, low cost, and ease of application, halogen-based solutions are emerging as preferred options.

Increasing attention to environmental compliance and operational efficiency is also encouraging end users to adopt halogen biocides that meet both regulatory and performance expectations. With rising investments in sanitation infrastructure and water treatment technologies, the market is expected to experience steady and resilient growth across key sectors globally.

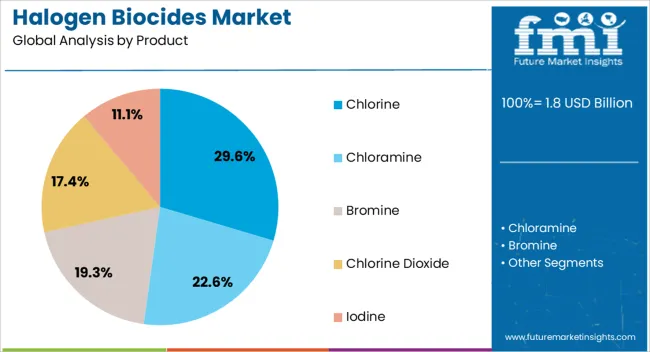

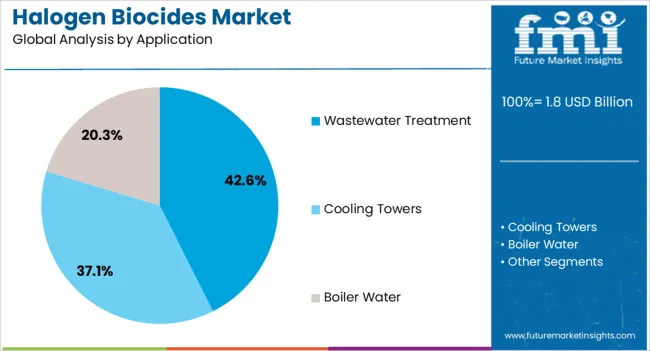

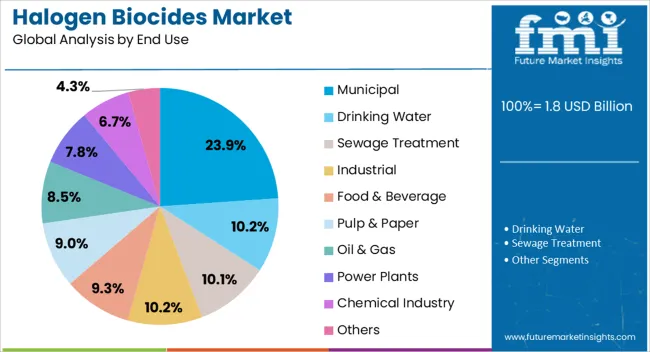

The halogen biocides market is segmented by product, application, end use, and geographic regions. By product, halogen biocides market is divided into Chlorine, Chloramine, Bromine, Chlorine Dioxide, and Iodine. In terms of application, halogen biocides market is classified into Wastewater Treatment, Cooling Towers, and Boiler Water. Based on end use, halogen biocides market is segmented into Municipal, Drinking Water, Sewage Treatment, Industrial, Food & Beverage, Pulp & Paper, Oil & Gas, Power Plants, Chemical Industry, and Others. Regionally, the halogen biocides industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The chlorine segment is projected to account for 29.6% of the halogen biocides market revenue share in 2025, making it the leading product type. Its leadership is attributed to chlorine's high biocidal efficacy, broad-spectrum antimicrobial activity, and cost-effectiveness in large-scale disinfection operations. Widely available and easily applied in both liquid and gas forms, chlorine is used extensively in water treatment plants, industrial cooling systems, and sanitation processes.

Its ability to rapidly oxidize and eliminate microbial contaminants has established it as a critical solution in maintaining public health and industrial hygiene. The segment is benefiting from its compatibility with existing disinfection infrastructure, minimizing the need for capital-intensive upgrades. Continued demand from municipal and industrial sectors for dependable and affordable water treatment chemicals is reinforcing the chlorine segment’s dominance.

Additionally, innovations in chlorine delivery systems and controlled dosing technologies are improving safety and efficiency, ensuring sustained usage in regulated environments. With growing focus on scalable and fast-acting biocidal agents, chlorine remains the most trusted and widely adopted product in the halogen biocides market.

The wastewater treatment segment is anticipated to hold 42.6% of the halogen biocides market revenue share in 2025, making it the largest application segment. This leadership is being driven by the increasing need for microbial control in industrial and municipal wastewater before discharge or reuse. The effectiveness of halogen biocides, particularly chlorine and bromine compounds, in neutralizing a wide range of pathogens is making them indispensable in wastewater treatment processes.

Regulatory mandates for safe effluent disposal and environmental protection are contributing to the growing reliance on chemical biocides to achieve compliance. Rising urban population and industrial activity are increasing wastewater volumes, further expanding the application base for halogen-based treatments. Biocides used in this segment offer fast-acting disinfection, low residual effects, and broad-spectrum control, which are essential for achieving consistent water quality.

Advances in dosing and monitoring systems are enabling more precise application of halogen biocides, reducing overuse while ensuring effectiveness. As sustainability goals align with public health concerns, wastewater treatment is expected to remain a high-priority area of application, securing this segment's dominant position.

The municipal segment is projected to account for 23.9% of the halogen biocides market revenue share in 2025, establishing it as the leading end-use category. This leadership is being supported by growing investments in public water treatment infrastructure and the increasing need for maintaining safe drinking water and sanitation services. Halogen biocides, particularly chlorine-based solutions, are widely used in municipal settings to disinfect drinking water, wastewater, and recreational water systems.

The segment is benefiting from the widespread integration of chemical disinfection into regulatory frameworks aimed at preventing waterborne diseases and ensuring public health. Continuous upgrades to aging municipal infrastructure in both developed and emerging economies are reinforcing the use of proven and cost-effective disinfection agents.

Moreover, increasing population density in urban areas is placing higher demands on municipal water treatment facilities, accelerating the adoption of reliable biocidal solutions. The segment's growth is further strengthened by awareness programs promoting clean water access and by technological improvements in storage, dosing, and safety systems that simplify the use of halogen biocides in public applications.

The halogen biocides market is being driven by industrial water treatment and sanitation needs, with emerging opportunities in healthcare and household applications. Trends focus on automated dosing, safety protocols, and precise monitoring, while regulatory and environmental challenges require strict compliance and careful handling. Despite potential constraints, market growth is expected to remain strong as industries and consumers prioritize effective microbial control, operational efficiency, and hygiene standards. Adoption is being reinforced by versatility, reliability, and performance consistency across diverse applications, ensuring continued relevance and expansion in global markets.

The demand for halogen biocides is being propelled by their extensive use in industrial water treatment and sanitation processes. Cooling towers, boilers, and wastewater management systems rely on halogen-based compounds to control microbial growth and ensure operational efficiency. The chemical’s efficacy in controlling algae, bacteria, and fungi is increasingly being recognized in municipal water treatment facilities, food processing plants, and pulp and paper industries. Rising emphasis on maintaining hygiene standards and avoiding system corrosion has reinforced the preference for halogen biocides over alternative antimicrobial solutions. Consequently, industrial sectors are actively integrating these biocides into routine operations to maintain safety, efficiency, and long-term reliability, ensuring a stable and growing demand trajectory.

Opportunities in the halogen biocides market are being unlocked by their expanded use in healthcare and household settings. Disinfectants, antiseptics, and cleaning agents in hospitals and clinics are increasingly incorporating halogen compounds for their broad-spectrum antimicrobial action. Consumer products such as surface cleaners, hand sanitizers, and water purifiers are also adopting halogen-based ingredients to meet rising hygiene expectations. Companies are exploring formulations that offer enhanced stability, longer shelf life, and compatibility with diverse applications. This diversification beyond industrial water treatment positions halogen biocides as versatile agents for infection control, creating new revenue streams and reinforcing market relevance across multiple sectors.

Market trends indicate that automated dosing systems and improved safety protocols are shaping halogen biocide adoption. Industrial facilities are increasingly relying on precise dosing equipment to optimize chemical usage and reduce operational risks. Enhanced monitoring systems are being integrated to maintain consistent biocide concentration, preventing microbial resistance and ensuring regulatory compliance. Safety measures, such as protective handling procedures and training programs, are being emphasized to mitigate exposure risks. The trend towards automated and controlled application methods reflects the market’s movement towards efficiency, safety, and accountability, demonstrating that operational precision is becoming a central driver in halogen biocide utilization.

Challenges in the halogen biocides market arise from stringent regulatory frameworks and environmental considerations. Usage limits, permissible discharge levels, and handling requirements vary across regions, creating compliance complexity for manufacturers and end-users. Overexposure or improper disposal of halogen compounds can result in environmental contamination and health hazards, compelling strict adherence to safety standards. Competitive pressure from non-halogen antimicrobial solutions adds further market strain. Companies are required to invest in safety infrastructure, monitoring systems, and staff training to overcome these challenges, making regulatory alignment and responsible management essential factors in sustaining market growth and acceptance.

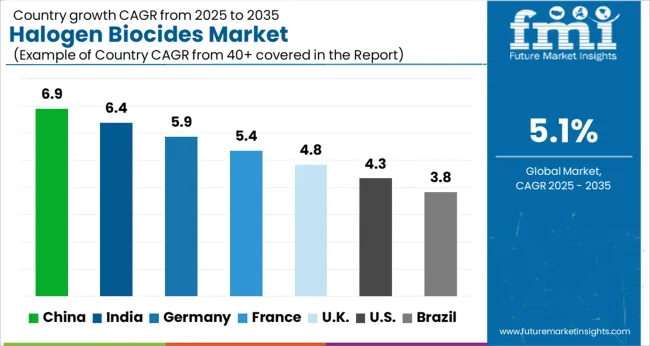

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global halogen biocides market is projected to grow at a CAGR of 5.1% from 2025 to 2035. China leads with a growth rate of 6.9%, followed by India at 6.4%, and Germany at 5.9%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. Expansion is driven by increasing demand for water treatment, industrial sanitation, and antimicrobial applications across multiple sectors. Emerging markets like China and India benefit from rapid industrialization, growing healthcare infrastructure, and rising urban water treatment initiatives. Mature markets such as Germany, UK, and USA focus on regulatory compliance, technological advancements in biocide formulations, and adoption of eco-efficient antimicrobial solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The halogen biocides market in China is projected to grow at a CAGR of 6.9% due to rapid industrialization and urbanization, which drive demand for safe water treatment and industrial sanitation solutions. Municipal water projects, chemical manufacturing plants, and power generation facilities require halogen biocides to maintain operational efficiency and comply with microbial safety standards. The pharmaceutical sector’s growth further adds to the adoption of halogen biocides for disinfection and microbial control. Rising awareness about waterborne diseases and government regulations emphasizing environmental and public health standards are increasing demand. Continuous investments in research for high-performance, eco-efficient halogen-based biocides are also boosting adoption. Moreover, industrial cooling systems and wastewater management applications contribute to steady market expansion across China.

The halogen biocides market in India is anticipated to grow at a CAGR of 6.4% as industrial and municipal water treatment demand rises. Rapid expansion in the chemical, pharmaceutical, and food processing sectors is driving biocide consumption for microbial control. Government initiatives to improve access to safe drinking water, coupled with rising urban infrastructure development, further stimulate market growth. Industrial cooling systems, wastewater management, and food manufacturing processes increasingly rely on halogen biocides to maintain sanitation and regulatory compliance. Continuous investments in high-performance formulations and eco-friendly solutions are expanding the market footprint. Additionally, rising awareness about waterborne diseases and hygiene standards is fueling adoption across healthcare and industrial sectors. The market’s steady expansion is supported by India’s growing industrial base and increasing infrastructure projects.

The halogen biocides market in Germany is expected to grow at a CAGR of 5.9%, driven by industrial and municipal water treatment requirements across chemical plants, energy facilities, and pharmaceutical industries. Regulatory frameworks enforcing strict environmental and microbial safety standards are key drivers of market adoption. Germany’s mature industrial base emphasizes the use of eco-efficient and high-performance biocides to reduce operational risk and comply with environmental regulations. Industrial cooling systems, wastewater treatment plants, and food processing sectors increasingly incorporate halogen biocides for microbial control. Market growth is further supported by rising demand for advanced biocide formulations, improving efficacy while minimizing environmental impact. Continuous technological advancements and heightened awareness of sanitation standards continue to boost adoption across diverse industrial and commercial applications.

The halogen biocides market in the UK is projected to grow at a CAGR of 4.8%, with industrial water treatment, municipal sanitation, and healthcare applications driving expansion. Regulatory frameworks focusing on water safety, microbial control, and environmental protection encourage the adoption of halogen biocides. Industrial facilities such as cooling towers, chemical processing plants, and wastewater treatment plants rely heavily on these biocides for effective microbial management. The market also benefits from growing awareness about hygiene, waterborne diseases, and eco-efficient chemical usage. Demand in the food processing sector for microbial safety adds another dimension to adoption. With a mature industrial and healthcare sector, the UK emphasizes high-performance, safe, and environmentally responsible biocide solutions. Market growth is further reinforced by investments in research and development to improve formulation efficiency and compliance with environmental standards.

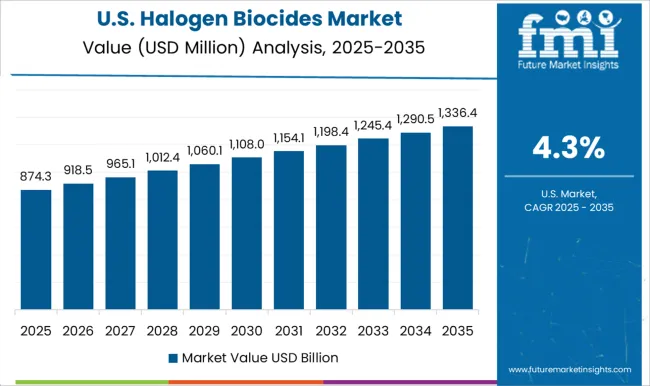

The halogen biocides market in the USA is expected to grow at a CAGR of 4.3%, fueled by increasing industrial, municipal, and healthcare sector demands for microbial control. Water treatment facilities, cooling systems, chemical manufacturing, and food processing industries are major consumers of halogen biocides. Regulatory standards focusing on environmental safety, water quality, and microbial contamination drive adoption of advanced formulations. Rising awareness about sanitation, public health safety, and eco-efficient biocides further supports market growth. Investments in innovative and high-performance biocides, along with technological improvements in industrial water treatment systems, continue to strengthen adoption across key sectors. The USA market reflects steady growth as industries seek solutions that balance operational efficiency, safety compliance, and environmental responsibility.

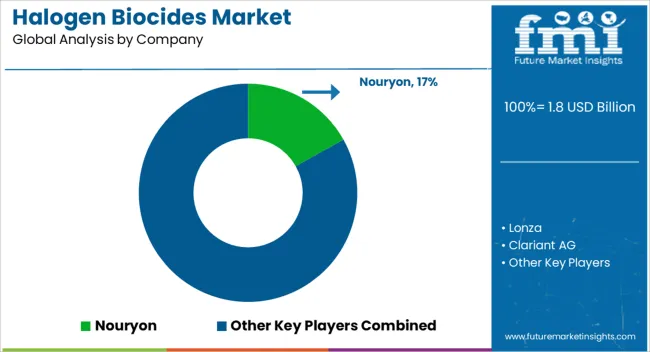

The halogen biocides market is driven by growing demand for water treatment, industrial disinfection, and preservation solutions across multiple sectors. Leading companies such as Nouryon, Lonza, and Clariant AG focus on high-purity halogen-based products that ensure effective microbial control while adhering to stringent regulatory standards. Firms like SUEZ and Albemarle Corporation emphasize innovative formulations and customized solutions for municipal and industrial water applications. DuPont, BASF, and Evonik Industries leverage extensive R&D and global distribution networks to enhance product performance and market reach. Market brochures highlight product specifications, applications, and compliance certifications, providing stakeholders with critical information on safety, efficacy, and environmental considerations. Meanwhile, companies such as Kemira and Solvay target niche segments including pulp and paper, cooling towers, and oilfield operations, underscoring the versatility of halogen biocides in preventing biofouling and microbial contamination.

Competition in the halogen biocides market is shaped by product innovation, regulatory adherence, and operational efficiency. Key players aim to differentiate through high-stability formulations, broader application compatibility, and environmentally responsible manufacturing practices. Brochures from these companies emphasize their technical expertise, process reliability, and commitment to sustainable solutions, reinforcing trust among industrial clients. Strategic collaborations, regional expansions, and targeted marketing initiatives further enhance competitiveness. The market landscape reflects a balance between product efficacy, regulatory compliance, and service excellence, driving adoption across water treatment, industrial cleaning, and preservation industries globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Product | Chlorine, Chloramine, Bromine, Chlorine Dioxide, and Iodine |

| Application | Wastewater Treatment, Cooling Towers, and Boiler Water |

| End Use | Municipal, Drinking Water, Sewage Treatment, Industrial, Food & Beverage, Pulp & Paper, Oil & Gas, Power Plants, Chemical Industry, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nouryon, Lonza, Clariant AG, SUEZ, Albemarle Corporation, DuPont, BASF, Evonik Industries, Kemira, and Solvay |

| Additional Attributes | Dollar sales by biocide type (chlorine-based, bromine-based, iodine-based) and application (water treatment, industrial cooling, pulp & paper, oil & gas) are key metrics. Trends include rising demand for microbial control solutions, growth in industrial water management, and increasing adoption of eco-friendly and efficient disinfection methods. Regional adoption, regulatory compliance, and technological advancements are driving market growth. |

The global halogen biocides market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the halogen biocides market is projected to reach USD 3.0 billion by 2035.

The halogen biocides market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in halogen biocides market are chlorine, chloramine, bromine, chlorine dioxide and iodine.

In terms of application, wastewater treatment segment to command 42.6% share in the halogen biocides market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Non-Halogenated Flame Retardants Market- Growth & Demand 2025 to 2035

Biocides Market- Size, Share, and Forecast 2025 to 2035

Metal Biocides Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA