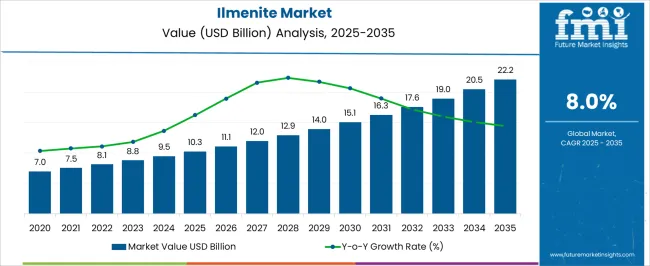

The global ilmenite market is projected to reach USD 22.2 billion by 2035 from an estimated USD 10.3 billion in 2025, growing at a CAGR of 8.0% during the forecast period. Market saturation is gradually emerging in mature regions, where large-scale extraction and established supply chains have fulfilled base industrial demand, particularly in titanium dioxide pigment production. Growth momentum remains strong in emerging economies, driven by expanding construction, automotive, and aerospace sectors that require titanium-based pigments, welding electrodes, and specialized alloys.

Demand for high-grade synthetic rutile from ilmenite processing is anticipated to accelerate, supporting revenue expansion. Competitive pressures are shaping strategies around beneficiation technologies, mining efficiency, and logistical optimization, ensuring supply meets industrial consumption. Environmental regulations on mining and processing activities are influencing capacity utilization and investment patterns. Technological improvements in smelting and mineral separation have increased yield efficiency, allowing producers to cater to higher-volume applications in pigment, metallurgical, and chemical sectors. As industrial diversification progresses, the market may experience incremental saturation in traditional applications while emerging end uses in 3D printing, aerospace alloys, and specialty ceramics create new growth pockets. Strategic expansions, joint ventures, and regional partnerships are anticipated to optimize global distribution and market penetration.

| Metric | Value |

|---|---|

| Ilmenite Market Estimated Value in (2025 E) | USD 10.3 billion |

| Ilmenite Market Forecast Value in (2035 F) | USD 22.2 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The ilmenite market is strongly influenced by five interconnected parent markets, each contributing differently to overall demand and growth. The titanium dioxide (TiO₂) pigment market holds the largest share at 40%, driven by the need for white pigments in paints, coatings, plastics, paper, and cosmetics, where brightness, opacity, and durability are critical. The welding electrodes and metallurgy market contributes 25%, with ilmenite used in fluxes, titanium alloys, and metal refining to enhance strength, corrosion resistance, and performance in industrial applications.

The chemical and ceramic industries account for 15%, as ilmenite serves as a raw material for titanium-based chemicals, catalysts, and advanced ceramics. The aerospace and automotive sectors hold a 12% share, fueled by demand for titanium alloys in lightweight components, corrosion-resistant parts, and high-performance structural applications. The emerging specialty applications market represents 8%, including additive manufacturing, 3D printing, and functional materials that utilize processed ilmenite or synthetic rutile. TiO₂ pigment, welding/metallurgy, and chemical/ceramic applications account for 80% of overall demand, highlighting that industrial coatings, metal production, and chemical synthesis remain the primary growth drivers, while aerospace and specialty applications provide additional avenues for market expansion globally.

The ilmenite market is experiencing steady growth due to the rising demand for titanium-based products in a variety of industrial applications. Increasing use of titanium dioxide as a pigment in paints, plastics, and paper is a key driver, supported by expansion in construction, automotive, and packaging sectors.

Technological improvements in mineral processing and beneficiation are enabling higher recovery rates and better quality output, making ilmenite extraction more efficient and commercially viable. Global urbanization and infrastructure development are also fuelling consumption, particularly in emerging economies.

Additionally, sustainable mining practices and strategic investments in value-added titanium products are expanding market opportunities. The outlook remains positive as industries increasingly depend on titanium dioxide for its brightness, opacity, and durability, ensuring continued demand for ilmenite across diverse applications.

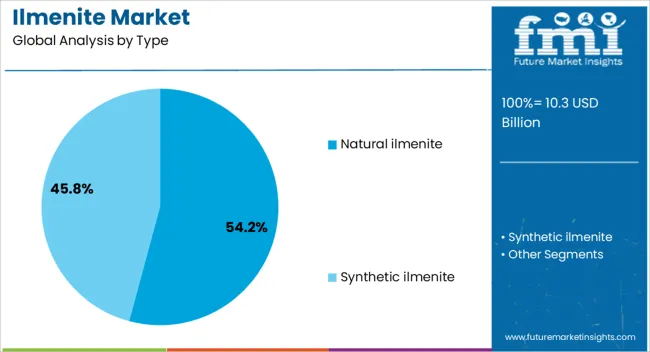

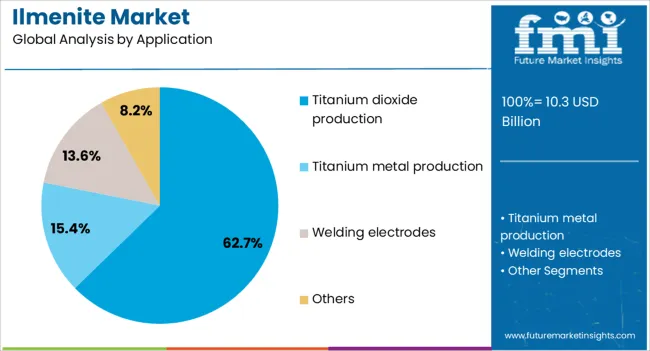

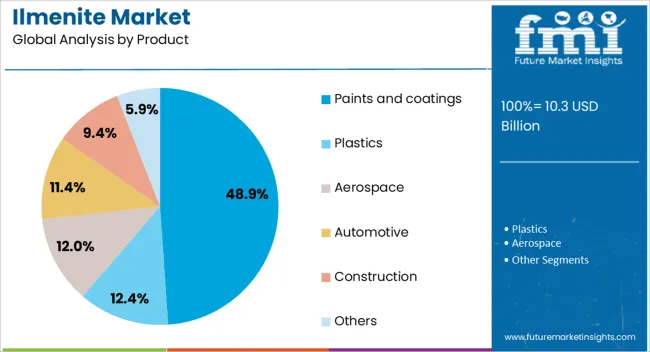

The ilmenite market is segmented by type, application, product, and geographic regions. By type, ilmenite market is divided into Natural ilmenite and Synthetic ilmenite. In terms of application, ilmenite market is classified into Titanium dioxide production, Titanium metal production, Welding electrodes, and Others. Based on product, ilmenite market is segmented into Paints and coatings, Plastics, Aerospace, Automotive, Construction, and Others. Regionally, the ilmenite industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The natural ilmenite segment is projected to account for 54.20% of total market revenue by 2025 within the type category, establishing it as the leading segment. This dominance is driven by its abundant availability, cost-effectiveness, and suitability for direct use in titanium dioxide production without extensive processing.

The segment benefits from well-established supply chains and efficient mining operations in major producing countries.

The ability to meet large-scale industrial demand with consistent quality has further reinforced the strong position of natural ilmenite in the market.

The titanium dioxide production segment is expected to represent 62.70% of total market revenue by 2025 within the application category, making it the most significant area of demand. This growth is driven by the extensive use of titanium dioxide as a pigment in paints, plastics, paper, and other industrial products.

Its superior opacity, whiteness, and UV resistance make it indispensable in multiple end-use industries.

The expansion of construction and automotive sectors, alongside the rise of sustainable coatings, has reinforced demand for titanium dioxide, thereby increasing the consumption of ilmenite as its primary feedstock.

The paints and coatings segment is projected to capture 48.90% of total market revenue by 2025 within the product category, positioning it as the leading product-based application. This is supported by robust demand in infrastructure development, automotive manufacturing, and decorative finishes.

Titanium dioxide derived from ilmenite offers exceptional brightness, color stability, and protective qualities, making it a preferred choice in high-performance coatings.

The shift toward eco-friendly and long-lasting paints is also driving growth, with manufacturers increasingly using titanium dioxide to meet both functional and aesthetic requirements.

TiO₂ pigments, metallurgy, and chemical applications drive the majority of ilmenite demand. Emerging specialty applications provide incremental growth opportunities and diversify the market globally.

The titanium dioxide (TiO₂) pigment segment drives significant growth in the ilmenite market, as paints, coatings, plastics, paper, and cosmetic industries require high-quality white pigments. Ilmenite is a primary feedstock for TiO₂ production due to its high titanium content and cost-effectiveness compared to synthetic alternatives. Rising construction, automotive, and consumer goods production fuels pigment demand, particularly in emerging economies. Manufacturers are optimizing ilmenite beneficiation and smelting processes to improve pigment yield and quality. Water and energy-efficient processing technologies are being increasingly adopted to enhance output while meeting environmental regulations.

Ilmenite plays a critical role in welding electrodes, titanium alloys, and metallurgical processes, contributing substantially to market demand. The flux and alloying properties of ilmenite enhance corrosion resistance, mechanical strength, and durability in steel and non-ferrous metals. Expanding industrial manufacturing, metal fabrication, and automotive production support higher consumption of metallurgical-grade ilmenite. Suppliers focus on high-grade ilmenite with controlled impurity levels to improve alloy performance and welding quality. Regional industrial hubs in Asia-Pacific, North America, and Europe maintain strong adoption, while continuous improvements in smelting efficiency ensure stable supply for growing end-use requirements. Metallurgical applications are expected to maintain a consistent share of total ilmenite consumption globally.

Ilmenite serves as a raw material for titanium-based chemicals, catalysts, and advanced ceramics, contributing to diversified industrial demand. The chemical industry uses ilmenite in the production of titanium tetrachloride, titanium sulfate, and pigment intermediates, supporting applications in paints, plastics, and specialty chemicals. Ceramics leverage titanium-rich ilmenite for high-strength, heat-resistant, and electrically functional products. Demand growth is further supported by emerging specialty chemicals and functional materials requiring precise mineral composition. Manufacturers are investing in beneficiation and synthetic rutile production to meet quality and consistency requirements. Together, chemical and ceramic applications form a crucial segment, ensuring steady revenue streams and adoption in industrial markets worldwide.

Emerging applications in aerospace, automotive, additive manufacturing, and 3D printing are creating incremental demand for high-purity ilmenite and synthetic rutile. Lightweight titanium alloys for aerospace components and corrosion-resistant parts in automotive sectors expand consumption. Specialty material manufacturers are exploring high-grade ilmenite for functional ceramics and advanced alloys. Companies focus on strategic mining expansions, joint ventures, and regional partnerships to secure raw material supply and optimize logistics. R&D in beneficiation and smelting ensures consistent quality and higher yields.

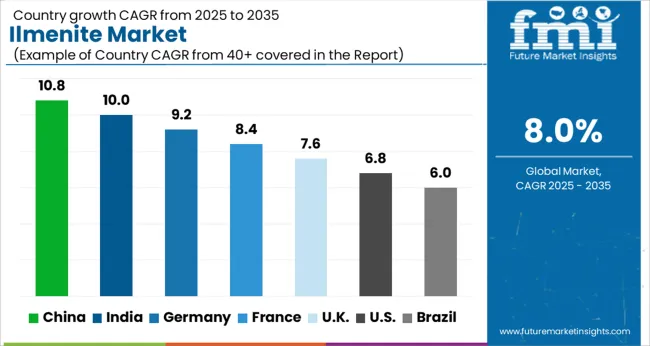

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

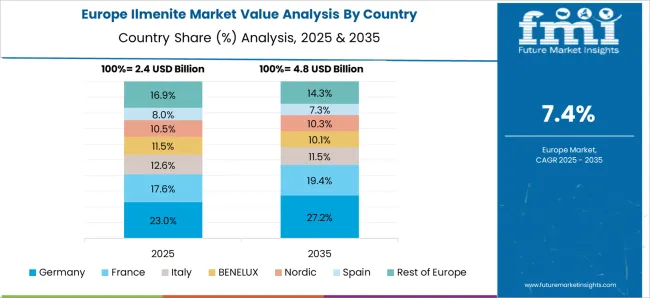

The global ilmenite market is projected to grow at a CAGR of 8.0% from 2025 to 2035. China leads at 10.8%, followed by India at 10.0%, Germany at 9.2%, the UK at 7.6%, and the USA at 6.8%. Growth is driven by rising titanium dioxide production for paints, coatings, plastics, and paper, alongside expanding demand in welding, metallurgy, chemicals, and ceramics. High-grade ilmenite and synthetic rutile are increasingly adopted for specialty applications in aerospace, automotive, and additive manufacturing. Mining efficiency, beneficiation technologies, and regional production expansions are supporting supply to meet growing global consumption. Asia-Pacific shows rapid expansion due to industrialization and manufacturing, while Europe and North America emphasize quality, environmental compliance, and high-performance alloy applications. The analysis includes over 40+ countries, with the leading markets detailed below.

The ilmenite market in China is projected to grow at a CAGR of 10.8% from 2025 to 2035, supported by rapid industrialization, infrastructure development, and expanding automotive and construction sectors. Titanium dioxide (TiO₂) production, the primary end-use of ilmenite, is increasing for paints, coatings, plastics, and paper applications. Domestic mining and beneficiation operations are scaling up to supply high-grade ilmenite and synthetic rutile for both local and export markets. Manufacturers are investing in advanced smelting and separation technologies to improve yield and quality. Demand is further fueled by aerospace, welding, and specialty ceramic applications. Strategic partnerships and regional expansions ensure raw material supply for growing TiO₂ and alloy production.

The ilmenite market in India is expected to grow at a CAGR of 10.0% from 2025 to 2035, driven by rising TiO₂ pigment production, industrial growth, and expanding automotive and construction sectors. Local ilmenite mines are being developed to meet demand for pigment-grade and metallurgical-grade feedstock. Processing facilities are increasingly focusing on producing synthetic rutile and high-purity ilmenite for specialty applications. Industrial demand for welding electrodes, titanium alloys, and chemical intermediates further supports market growth. Partnerships with international suppliers and technology adoption in beneficiation enhance product quality. Emerging applications in 3D printing, aerospace, and specialty chemicals are creating incremental opportunities.

The ilmenite market in Germany is projected to grow at a CAGR of 9.2% from 2025 to 2035, supported by automotive production, industrial coatings, and specialty chemical demand. TiO₂ pigment production for paints, plastics, and paper forms the largest consumption segment. German manufacturers emphasize high-quality, low-impurity ilmenite and synthetic rutile to meet strict regulatory and performance standards. Industrial applications in welding, metallurgy, and chemical synthesis maintain steady adoption. Strategic collaborations with mining companies and R&D in beneficiation processes ensure a reliable supply chain. Growth is also supported by aerospace, ceramics, and emerging high-performance material applications requiring titanium-based feedstock.

The ilmenite market in the UK is anticipated to grow at a CAGR of 7.6% from 2025 to 2035, driven by TiO₂ pigment production, metallurgical applications, and chemical industry demand. Domestic and imported ilmenite supplies are processed to produce high-purity feedstock for paints, coatings, plastics, and specialty chemicals. Welding electrodes and titanium alloys also contribute to industrial consumption. Manufacturers focus on beneficiation and smelting technologies to maintain consistent quality and yield. Strategic partnerships with international suppliers ensure raw material availability. Emerging aerospace, automotive, and functional material applications are expected to create incremental opportunities for high-performance ilmenite.

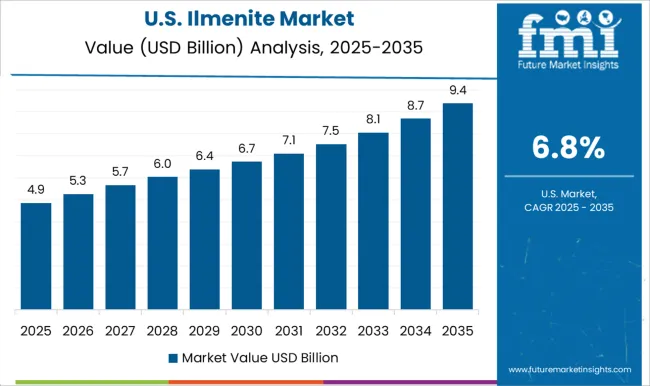

The ilmenite market in the USA is projected to grow at a CAGR of 6.8% from 2025 to 2035, led by TiO₂ pigment production for paints, plastics, coatings, and paper. Industrial applications in welding, metallurgical alloys, and chemical intermediates sustain steady demand. Manufacturers focus on high-purity ilmenite and synthetic rutile production to meet strict quality and environmental standards. Strategic capacity expansions, technology adoption in beneficiation, and partnerships with domestic and international suppliers support supply reliability. Emerging applications in aerospace, automotive, and specialty materials create incremental growth opportunities. Regional consumption patterns favor high-performance, low-impurity ilmenite for industrial and specialty applications.

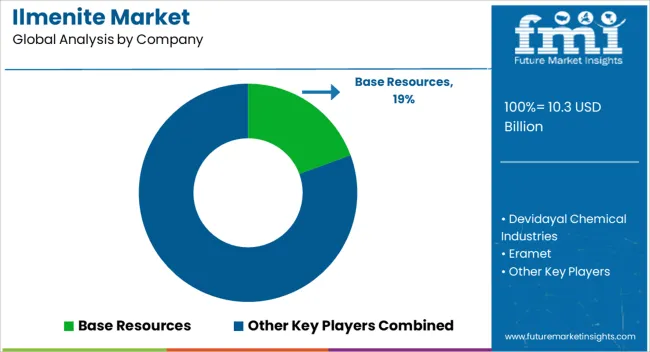

Competition in the ilmenite market is shaped by ore quality, titanium content, and beneficiation efficiency. Base Resources leads with high-grade ilmenite production, optimized mining operations, and global distribution networks serving TiO₂ pigment, metallurgical, and chemical industries. Iluka Resources competes with diversified mineral portfolios, including zircon and rutile, emphasizing high-purity feedstock, beneficiation technologies, and long-term supply contracts.

Kenmare Resources differentiates through large-scale mining projects, cost-efficient extraction, and consistent delivery to pigment and alloy producers. Tronox Holdings focuses on integrated mining and TiO₂ processing, offering reliability and performance for industrial applications. Specialized and regional players, including Devidayal Chemical Industries, Eramet, GMA Garnet, Mineral Commodities, Peekay Agencies, Rio Tinto, Salgo Minerals, Sierra Rutile Limited, The Kerala Minerals and Metals, Trimex Sands, and V.V. Mineral, compete through niche ores, regional supply networks, and tailored solutions for pigment, welding, and specialty chemical markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.3 Billion |

| Type | Natural ilmenite and Synthetic ilmenite |

| Application | Titanium dioxide production, Titanium metal production, Welding electrodes, and Others |

| Product | Paints and coatings, Plastics, Aerospace, Automotive, Construction, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Base Resources, Devidayal Chemical Industries, Eramet, GMA Garnet, Iluka Resources, Kenmare Resources, Mineral Commodities, Peekay Agencies, Rio Tinto, Salgo Minerals, Sierra Rutile Limited, The Kerala Minerals and Metals, Trimex Sands, Tronox Holdings, and V.V. Mineral |

| Additional Attributes | Dollar sales by product type (ilmenite, synthetic rutile, slag), share by end-use segment (TiO₂ pigments, welding/metallurgy, chemicals, ceramics, aerospace), regional demand trends, ore grade quality, beneficiation efficiency, supply chain reliability, emerging specialty applications. |

The global ilmenite market is estimated to be valued at USD 10.3 billion in 2025.

The market size for the ilmenite market is projected to reach USD 22.2 billion by 2035.

The ilmenite market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in ilmenite market are natural ilmenite and synthetic ilmenite.

In terms of application, titanium dioxide production segment to command 62.7% share in the ilmenite market in 2025.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA