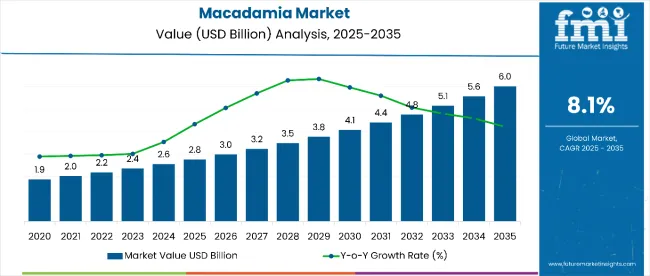

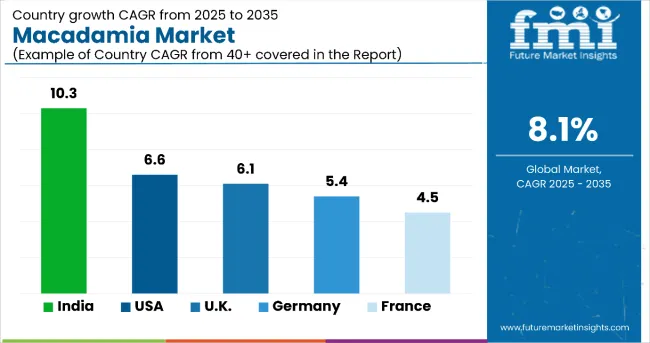

The macadamia market is expected to grow from USD 2.76 billion in 2025 to USD 6.0 billion by 2035, reflecting a CAGR of 8.1% throughout the forecast period. The United States is positioned as the most lucrative market globally. India is expected to register the fastest growth with a CAGR of 10.3% between 2025 and 2035.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 2.76 billion |

| Projected Global Industry Value (2035F) | USD 6.0 billion |

| Value-based CAGR (2025 to 2035) | 8.1% |

Macadamia market expansion is expected to be sustained through diversified application development. The integration of the food and beverage industry is anticipated to accelerate substantially. The adoption of the cosmetic and pharmaceutical sector is projected to increase significantly. Premium product positioning is expected to be strengthened by manufacturers. Sustainable farming practices are anticipated to be prioritized for market differentiation. Geographic expansion strategies are expected to be implemented by major players.

Advancements in processing technology are projected to enhance product quality standards. Supply chain optimization is anticipated to improve market accessibility globally. Consumer education initiatives are expected to consistently drive demand growth. Innovation in product development is projected to create new market opportunities. Regulatory frameworks are expected to support the certification of organic and sustainable products. Market consolidation is anticipated among smaller players seeking to gain competitive advantages.

India is expected to be the fastest-growing market for macadamia, with a projected CAGR of 10.3%. In-shell macadamias will dominate the product type segment, accounting for approximately 55% of the market share. Oil is projected to be the fastest-growing form, with a CAGR of 12.3% during the forecast period. The overall macadamia market is anticipated to grow at a compound annual growth rate (CAGR) of 8.1% from 2025 to 2035.

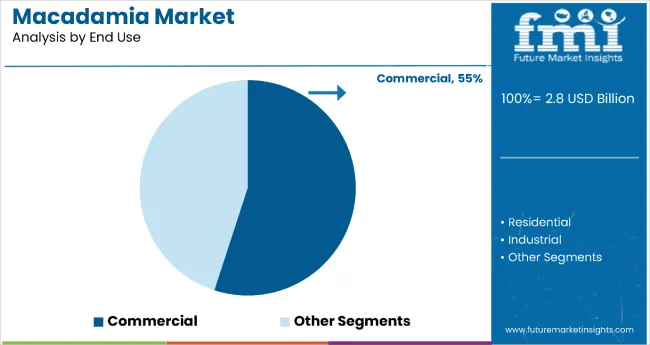

The commercial segment holds the dominant position with 55% of the market share in the end use category within the macadamia market. This leadership is driven by the extensive utilization of macadamia nuts and macadamia-based ingredients across the food and beverage industry, including snack manufacturing, confectionery production, bakery applications, and premium dessert formulations. Commercial end users benefit from macadamia's unique buttery flavor profile, high nutritional value, and premium positioning that enables product differentiation and justifies higher price points in processed food offerings.

The segment's dominance is reinforced by the growing demand from food processing companies that incorporate macadamia into value-added products such as nut butters, chocolate products, baked goods, and gourmet snacks. Commercial applications also extend to the pharmaceutical and cosmetics industries, where macadamia oil's beneficial properties are utilized in skincare formulations and health supplements. As consumer preference for premium, healthy ingredients continues to grow and food manufacturers seek to develop innovative products with clean-label credentials, the commercial segment is positioned to maintain its market leadership through continued investment in product development and supply chain optimization.

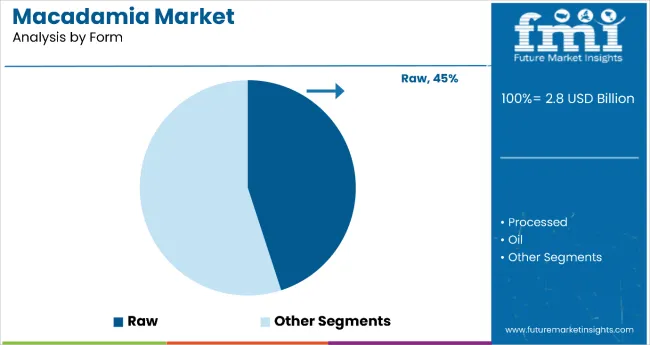

Raw macadamia nuts hold a significant position with 45% of the market share in the form category within the macadamia market. This substantial market share reflects consumer preference for unprocessed, natural macadamia nuts that retain their full nutritional benefits and authentic flavor characteristics. Raw macadamias are particularly favored by health-conscious consumers who prioritize whole foods and minimal processing in their dietary choices, as well as by culinary professionals and food manufacturers who require versatile ingredients for various applications.

The segment's strong performance is driven by the growing awareness of macadamia nuts' exceptional nutritional profile, including their high content of monounsaturated fats, palmitoleic acid, and essential minerals that support cardiovascular health and metabolic function. Raw macadamias serve as both a premium snacking option and a versatile ingredient for home cooking, baking, and food preparation applications. As the health and wellness trend continues to gain momentum globally and consumers increasingly seek natural, minimally processed food options, the raw segment is expected to maintain its substantial market share through continued emphasis on quality, freshness, and nutritional integrity.

The growing demand for plant-based and vegan products is driving increased consumption of macadamia nuts.

The growth in the market for plant-based and vegan goods has greatly contributed to the increased consumption of macadamias. Consumers are increasingly adopting plant-based diets and seeking nutrient-rich alternatives to animal-derived products.

Macadamias fit the bill. They are rich in monounsaturated fats, protein, fiber, and various essential vitamins and minerals, making them a complementary choice for a well-balanced and nutritious diet. Macadamias lend themselves beautifully to various vegan recipes, including a whole range, from savory dishes and snacks to dairy-free desserts and beverages.

Among the macro trends is the growing phenomenon of macadamia milk, which has gained ground as a dairy alternative. Macadamia milk has a creamy texture and a rich, buttery flavor, and is therefore popular among consumers who prefer plant-based milks. It is also free of lactose and cholesterol, making it suitable for those with dietary restrictions or health concerns. The market for macadamia milk has seen an exponential increase in consumption, with many brands entering the fray with macadamia-based products to meet the growing demand.

Furthermore, an increasing proportion of macadamia nuts is now being incorporated into plant-based snacks and confectionery products. This unique flavor and texture make them great for incorporation into energy bars, nut butters, and vegan chocolates. With the rise of health-conscious consumers, there has come an increased demand for macadamias, which serve as a natural and wholesome alternative to chemically based, highly processed ingredients.

Consumers are increasingly seeking organic and sustainably sourced macadamias.

It reflects a tendency towards healthful and green eating habits in its entirety. Consumer demand for organic and sustainably sourced macadamias increases. These macadamias are grown organically by avoiding synthetic pesticides, fertilizers, and genetically modified organisms. This makes them an essentially natural choice for those who are health-oriented and have considered their well-being.

This trend is largely attributed to the increasing awareness over time of the health risks associated with the chemical residues remaining on conventionally grown food. With such practices, macadamias are nutritionally intact, pure, and wholesome, appealing quite well to health-conscious consumers. These macadamias are also very key to the now greenly aware consumers. Indeed, with sustainable agriculture practices, soil health, biodiversity, and water conservation serve to sustain the environment for future generations.

More and more consumers are becoming aware of the environmental impact of their food choices, and they are willing to purchase products that align with their values of sustainability in sourcing from nature. Macadamia producers who practice this excellence will want their consumers to know that they are cutting down their carbon footprint by conserving natural resources and supporting local communities.

This scoop will resonate well with eco-conscious consumers. Traceability and transparency are crucial factors for consumers when determining their preference for organic and sustainably sourced macadamias. They keep asking where their food comes from and how it is grown, and they appreciate brands that provide clear information on their sourcing and production processes. Thus, this earns many brands a trophy of trust and loyalty among consumers who increasingly prioritize those brands that match their values.

The cosmetic industry is incorporating more macadamia oil in skincare products.

Macadamia oil has been widely recognized as a global benefit in the field of cosmetics. In fact, you can find it incorporated into many skincare products. Macadamia oil contains a high amount of essential fatty acids, including oleic, linoleic, and palmitoleic acids, which closely mimic the natural oils of the human skin's surface. Its unique structure offers excellent moisturization, simple replenishment, and maintenance of the natural barrier in a person's skin, ensuring that no loss of moisture occurs in the skin.

Most of its weightlessness and non-greasy qualities make it easy for all skin types, including those prone to acne, to absorb. Macadamia oil contains all the antioxidants in organic tocopherols and tocotrienols, which are forms of vitamin E. These antioxidants can counteract the effects of free radicals, lower inflammation levels, and help in the replication or turnover of healthy skin cells. Squalene, a natural antioxidant and emollient, is also present and enhances the anti-aging properties of macadamia oil by improving skin elasticity and smoothing out fine lines.

It is the need of the hour to incorporate macadamia oil into all types of skin care preparations that the cosmetic industry produces, such as moisturizers, serums, lotions, and cleansers. It has one of the moods for skin feeding and rejuvenation in the majority of cosmetic forms for both premium and regular products.

Growing consumer preferences for 100% pure, natural alkaloids in human skincare products have created demand for macadamia oil, aligning with the thriving demand for clean and environmentally friendly beauty products.

New flavor combinations and gourmet products featuring macadamias are being developed.

The culinary surge of late has given rise to an avalanche of new flavor pairings and gourmet products, with macadamia at the helm. The flavor and texture of macadamia nuts create a fascination for their use by chefs and food innovators in an ever-burgeoning series of experimental and thrilling culinary creations.

The light, buttery flavor of macadamias pairs incredibly well with both sweet and savory ingredients, making them a wonderful addition to a wide range of dishes and products. In the gourmet food arena, one can find delectables including macadamias infused with exotic spices, chocolate, and artisanal cheeses that attract highly discerning palates.

A big trend is the introduction of macadamias into high-end confectionery and dessert products. Chocolatiers have been crafting fancy chocolate bars, truffles, and pralines with macadamias, often in combination with sea salt, caramel, or tropical fruits to heighten the nut's own natural richness, creating a heavenly balance of flavors that delights the tongue with varying textures. Furthermore, the gourmet ice cream and gelato producers have included macadamias in their recipe for some gusto as these creamy, rich treats marvel with the lovely creaminess of the nut.

In the savory world, macadamias are taking culinary innovation into new realms of gourmet business catering to contemporary tastes. The chefs have utilized macadamias in sauces, pestos, and dressings to impart some flavor depth and luxurious mouthfeel.

The crunchy properties of the nut lend themselves perfectly in dusting overpriced salads, grain bowls, and roasted vegetables. Macadamia is even being included in plant-based meat alternatives, where high-fat content and buttery smooth texture replicate much of the mouthfeel of traditional meat products.

The following table shows the estimated growth rates of the three significant geographies' sales. USA and Germany are set to exhibit high consumption, recording CAGRs of 6.6% and 5.4% respectively, through 2035.

| Country | CAGR 2025 to 2035 |

|---|---|

| USA | 6.6% |

| Germany | 5.4% |

| India | 10.3% |

Growing further, the premium and gourmet food sector in the USA gives ample support to the macadamia market. While in America, macadamias became a much-prized ingredient due to their rich, buttery flavor, paired with a great nutritional profile, presenting high-quality, indulgent food experiences.

The popularity of gourmet products further gave impetus to the development of various specialized macadamia cherished delights-artisan chocolates, nut butters of the highest order, and fancy snacks. Making it easier for consumers to reach these upscale products, driven by the growth of specialty food stores, mall-type gourmet markets, and online vendors, the plant-based and health-conscious diet trends only add more fuel to the fire by focusing on nutrient density.

This event, therefore, remains another challenge that enhances the expansion of the premium and gourmet food sector as a force for the growth of the macadamia market in the USA, thereby presenting great options that are both luxurious and nutritional for consumers to fulfill their palate dreams.

The German consumer preference for organic and sustainably sourced products has greatly influenced the macadamia market. As market consumers become increasingly aware of their environmental footprint and the ethical implications of their purchases, they are turning more toward products that align with their value systems.

Organic macadamia nuts grown in a sustainable farming practice beautifully complement this need. This ensures their natural goodness free from synthetic pesticides and fertilizers and makes a healthier choice for consumers. Sustainable farming methods prioritize soil health, biodiversity, and water conservation, attracting eco-conscious clientele.

This developing trend has created a shift toward transparency for macadamia growers and a traceable supply chain that helps assert their commitment towards sustainable and ethical sourcing. Thus, the demand for organic and sustainably sourced macadamias in Germany continues to grow, driven by consumers who are increasingly concerned about health, sustainability, and ethical production.

The macadamia market in India has great pent-up potential due to the expanding food processing and hotel industries. The increasing development of these sectors has necessitated the surging requirement for high-quality and exquisite ingredients to meet the rising demand of the consumers' palates.

Macadamias find their way into many food products-snacks, desserts, gourmet dishes, etc.- through the growing demand created by their rich flavor and nutritional attributes. The hotels, restaurants, and cafes of the hospitality sector, which also thrive on the novelty and luxury impression of macadamias in their food, seek to provide an indulgent culinary experience with their guests.

These changing trends in India are bolstered by increased disposable income and changing food preferences, which are leading Indian consumers toward healthier and more exotic alternatives. Hence, growing these industries would also open up doors for the macadamia market in India, throwing more light on the versatility and prestige of the nut for the premium segment.

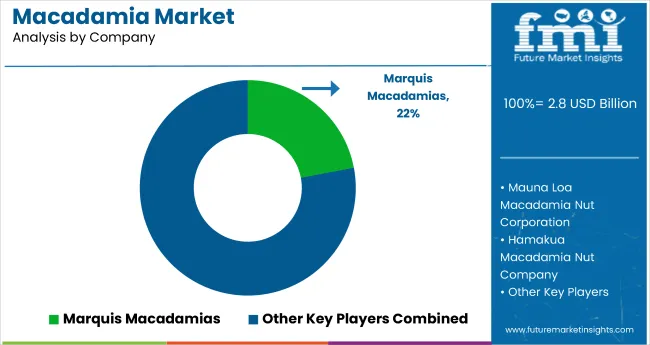

Both established producers and growing niche players drive the macadamia market. Leading manufacturers include Macadamia Processing Company (MPC), Green Farms Macadamias, Mauna Loa Macadamia Nut Corporation, Hamakua Macadamia Nut Company, and Marquis Macadamias. These firms dominate global supply chains through vertically integrated operations, sustainable farming practices, and innovative value-added products.

MPC and Green Farms lead in Australia with extensive grower networks and global exports. Mauna Loa and Hamakua are Hawaii-based leaders emphasizing flavored and packaged nuts for retail. Marquis Macadamias offers large-scale processing capabilities and maintains a global footprint. Other contributors, such as Wondaree Macadamias, Nutworks Australia, and Suncoast Gold Macadamias, strengthen the supply base through regional expertise and specialty offerings.

As per Product Type, the industry has been categorized into In-shell and Kernel.

As per Form, the industry has been categorized into Raw, Processed, and Oil.

As per End Use, the industry has been categorized into Residential, Commercial, and Industrial.

As per Sales Channel, the industry has been categorized into Direct Sales / B2B and Indirect Sales / B2C.

As per Nature, the industry has been categorized into Organic and Conventional.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and Middle East & Africa.

The industry is projected to grow at a CAGR of 8.1% during the forecast period.

By 2035, the market is estimated to reach USD 6.0 billion in sales value.

The USA is expected to dominate global consumption.

Leading manufacturers include Macadamia Processing Company (MPC), Green Farms Macadamias, Mauna Loa Macadamia Nut Corporation, and Hamakua Macadamia Nut Company.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Macadamia Milk Market Analysis by Flavor, Product Type, and Sales Channel Through 2025 to 2035

Macadamia Butter Market Analysis by Nature, Form, Application, Distribution Channel, and Region through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA