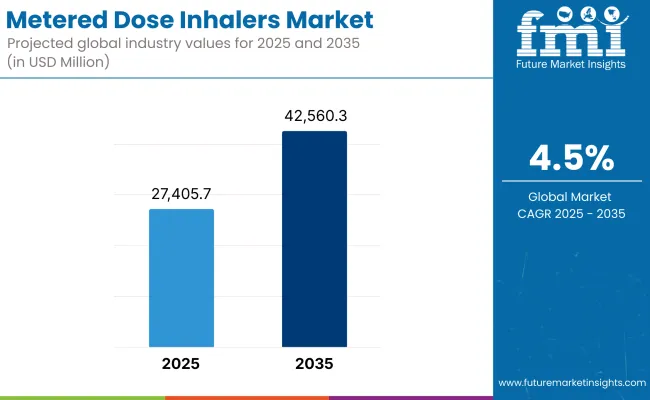

In the coming years the metered dose inhalers market is expected to reach USD 27,405.7 million by 2025 and is expected to steadily grow at a CAGR of 4.5% to reach USD 42,560.3 million by 2035. In 2024, metered dose inhalers generated roughly USD 26,322.9 million in revenues.

MDI market includes portable drug delivery devices that deliver a specific amount of drug to lungs. These devices are often used to treat respiratory diseases like asthma and chronic obstructive pulmonary disease (COPD).

The metered dose inhalers market is expected to grow at a significant rate in coming period of time owing to several factors. This is being driven in part by the increasing global burden of respiratory diseases. The rising infiltration of environmental pollutants, urbanization, regional prevalence of tobacco smoking, and burning biomass, the emergence of chronic respiratory disorders that require chronic inhalation therapy has been also noticed.

Moreover, since MDIs administer drugs into the lungs directly, enabling quicker drug action and lesser systemic side effects, healthcare providers worldwide still suggest MDIs as a first-line treatment.

In addition to that, the advancements in inhaler technology is also enhancing the market growth. New innovations like dose counters, breath-actuated for inhalers with integration to digital tracking platforms that are improving patient adherence and treatment outcomes. The changing paradigm of home-based management of chronic illnesses has also made MDIs attractive with their ease of use and cost-effectiveness. With increasing awareness, and diagnosis rates worldwide, the demand for MDIs is likely to expand further.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 27,405.7 million |

| Industry Value (2035F) | USD 42,560.3 million |

| CAGR (%) | 4.5% |

The Metered Dose Inhalers (MDI) market had been growing at a steady pace between 2020 to 2024 due to various determinants. This growth can be attributed to rise of respiratory diseases like asthma and chronic obstructive pulmonary disease (COPD). In response, healthcare professionals and patients turned to MDIs, prescription-based inhalers used to treat these ailments, due to the rising pollution levels and urbanization, among other factors, which have led to an increase in these respiratory conditions.

The COVID-19 pandemic also highlighted the importance of respiratory health, as many are now motivated for better awareness and management of respiratory conditions. During this time, the trend toward home-based care accelerated, with patients and healthcare providers embracing MDIs for their portability, ease of use and the quick relief of respiratory symptoms.

MDIs provided a convenient dosaging option for patients with chronic respiratory disease in recent years shifted their use to non-traditional clinical settings (e.g. home healthcare).Market growth was also facilitated by technological advancements. Technological innovations like breath-actuated inhalers and devices with dose counters improved user experience and adherence to treatment regimens. Furthermore, this led to the production of greener propellants addressing environmental concerns related to conventional inhalers, drawing in line with global sustainability initiatives.

North America held the top revenues share in the metered dose inhalers industry due to advanced healthcare infrastructure, a high rate of diagnosis of respiratory conditions, and the early adoption for advanced drug delivery technologies. Key Pharmaceutical Manufacturers Straddled this Domain with Strong Presence, guaranteeing Product Availability & Continuation of Innovation. The consistent demand further showed by high awareness amongst patients and healthcare professionals about asthma and COPD treatment options.

This lead to an expedited uptake of digital inhalers with dose tracking and adherence monitoring, as remote patient management came into play during the pandemic. Wide use in both the inpatient and homecare settings was also driven by positive reimbursement systems and access to prescription therapies.

The increase was also driven by a rise in health-conscious activities and the growing presence of environmental allergens. Halted progress turned into momentum for the industry after regulatory support for low-emission inhalers encouraged a shift toward eco-friendly formulations.

Moreover, European health care systems were already involved in the integration of both dose-monitored and breath-actuated inhalers earlier by promoting the more patient-friendly devices. Scores of regional pharmaceutical firms invested in local production and research to meet rising domestic demand.

While regulatory processes continued to be rigorous, they also facilitated safer and more effective product launches. Accessibility among rural and urban populations was additionally bolstered by the high prevalence of specialist clinics, distributor channels, and cross-border collaborations.

Campaigns led by the government on public health and early respiratory care made patients more compliant. Furthermore, the European healthcare systems strongly encouraged the implementation of inhalers with a breath-actuated mechanism and dose monitoring to enhance adherence to treatment.

Local pharmaceutical companies made investments into localized manufacturing and research to meet the rising domestic demand. Although regulatory procedures were strict, they also promoted safer and efficient product launches. Monitor and thus the strong presence of specialist clinics, wide mix of distribution channels and cross-border partnerships.

The Asia Pacific region is shaping up to be a fast-growing force in the inhaler landscape. The rising urban air pollution, exposure to industry, and smoking-related illnesses combined with the demand for respiratory solutions immensely.

Increasing healthcare expenditure and better accessibility to medical facilities in developing countries, especially China, India, and Southeast Asia, attracted several growth avenues for the adoption of inhalers. Domestic manufacturers developed massive capacity, and foreign companies invested in domestic production and distribution through local partnerships.

Programs focused on disease awareness and education by various health authorities and non-governmental organizations also played a role in better disease management, increasing acceptance for MDIs.

Additionally, the increased trend of self-medication and consumer tendency to seek smaller and easy-to-use treatment options due to portability options propelled the sales via retail pharmacy and e-commerce sites. Such regional topography was also supported through low manufacturing costs that would spur price competitiveness and make the technology accessible to various socio-economic classes.

Improper Inhaler Technique among Patients is Set to be the Key Barrier in the Metered Dose Inhalers Market

Despite consistent growth in demand, the metered dose inhalers (MDI) industry presents several significant barriers that ensure its untapped potential. One of the major barriers is the incorrect use of inhalers by patients. MDIs need to be actuated and inhaled at the same time, so many users - particularly the elderly and young children - have difficulty using them properly. Thus, this leads to less than optimal therapy effect by leading to the adverse health effects wherein treatment is discontinued leading to decline in sales over-time as well as loss of trust in the product class.

Another key hurdle is environmental regulation of propellants. Traditional MDIs commonly use hydrofluoroalkane (HFA) propellants, which are being questioned due to their effect on climate change. Regulatory agencies increasingly want greener alternatives, but developing propellants that are environmentally friendly requires considerable research and investment.

Not only does this extend product development cycles, but it also raises production costs which are a significant burden, especially on smaller or regional manufacturers, creating disparities in competitive position.

Cost is still a major limitation too, especially in low- and middle-income areas. MDIs are known as critical dependencies in a chronic respiratory patient but affordability poses a challenge particularly in areas where there is minimal insurance coverage. Large device uptake is hindered by patients seeking alternative therapies or postponing treatment due to pricing limitations.

Development of New Product Pipeline, Spurring Innovation in Device Formulation and Packaging is Creating Opportunities in the Market

A remarkable opportunity in metered dose inhalers (MDI) market is growing focus on environmentally sustainable propellants. Regulatory pressure is mounting for allergy and asthma inhalers that use hydrofluoroalkane (HFA) as a propellant because of their negative environmental effects, and manufacturers have investigated replacing them with low global warming potential (GWP) propellants, such as HFO-1234ze.

This transition is developing a new product pipeline, hence promoting innovation in device formulation and packaging. Now they can repackage different product offerings without compromising on therapeutic efficacy, extending their life in eco-savvy commercial markets.

And as the industry places more and more emphasis on patient-centered design, particularly for older and pediatric patients, another opportunity arises. Molecular delivery inhalers (MDIs) will be developed with more sophisticated actuation mechanisms, built-in dose counters, and more ergonomic features to minimize user error and improve compliance. This improves patient outcomes and drives adoption in age groups where coordination or dexterity may be an issue.

In addition, the increased integration of digital health provides an opportunity for MDIs, integrated with smart sensors that monitor usage of doses and integrate with mobile apps for adherence to medication. Connected with special devices, these tools are pioneering the remote monitoring of chronic respiratory conditions, including asthma and COPD, thus augmenting their potential for protracted management of disease. This reflects the increasing demand forat-home care and telehealth, creating a new layer of value in MDI offerings.

From 2020 to 2024, as patient behavior evolved, pharmaceutical delivery systems advanced, and public health efforts were adopted, the landscape of metered dose inhalers (MDI) underwent a gradual transformation. The first part of the period saw a much greater focus on respiratory health, and the second part itself saw many people becoming proactive about getting preventative care. In response, manufacturers launched improved inhaler formats with better usability, including soft mist devices and lower-resistance valves.

From 2025 through 2035, the industry may witness a more strategic and technology-based evolution of its operations. Inhalers are expected to evolve to become more integrated with digital technologies that provide real-time feedback, dosage tracking, and remote monitoring. Such functionality would serve to both boost treatment adherence as well as facilitate communication between the patient and the provider. In the coming decade, the transition towards low-GWP propellants and sustainable packaging solutions will usher in a generation of environmentally friendly inhalers.

As urban populations in these nations swell, we expect to see burgeoning demand, and new regional manufacturing plants and tailored therapeutic formulations. At the same time, policy frameworks will continue to adapt, toward patient safety, emission control, and affordability. A leap from reactive to proactive The industry will transform from reactive to proactive with better clinical guidelines and greater availability of early detection.

Shifts in the Metered Dose Inhalers Market from 2020 to 2024 and Future Trends 2025 to 2035

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Concentration on product stability, inhaler maneuverability agreement, and propellant compliance. |

| Technological Advancements | Development of dose counters and breath-actuated features for improved usability. |

| Consumer Demand | Nasal steroid inhalers become the most popular home-use inhalers as respiratory awareness increases and post-COVID-19 home use of inhalers rises. |

| Market Growth Drivers | People were adopting it for increased diagnosis rates, urban pollution, and healthcare access. |

| Sustainability | Research into green propellants was the first step to reducing environmental impact. |

| Supply Chain Dynamics | Manufacturing was localized to address regional demand and reduce disruption. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Tighter emission limits and push for low-GWP of inhalers will redefine approval pathways. |

| Technological Advancements | Digital Health Tool and AI-based Inhalation Tracking Integration Will Take Off |

| Consumer Demand | The focus will turn to intelligent, connected and environmentally sustainable inhalers. |

| Market Growth Drivers | Long-term growth drivers include preventive care, digital therapeutics, and aging population. |

| Sustainability | Inhalers with sustainable materials and propellants will become the industry standard. |

| Supply Chain Dynamics | Strategy will be dominated by flexible, automated supply chains and regional manufacturing hubs. |

Market Outlook

A strong insurance marketplace fosters pharmaceutical innovation, and that, plus millions of individuals living with chronic lung disorders, like asthma and COPD, has positioned the United States at the center of the inhalation therapy market in the world. The country’s healthcare policy encourages upfront and maintenance therapies, a factor that has helped support demand for metered dose inhalers. The meteoric increase in telehealth and home-based treatment since the pandemic also facilitated the spread of inhalers in nonclinical settings.

USA manufacturers have also developed digitally-enabled inhalers that include dose tracking and feedback systems. Moreover, the regulatory drive for faster approvals of next-gen devices has provided an accommodating backdrop for the technology to grow. The personalization of respiratory care combined with the latest findings highlighting the increasing burden of allergies both in adults and children alike have significantly enabled sustained inhaler adherence across varied respiratory patient demographics.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

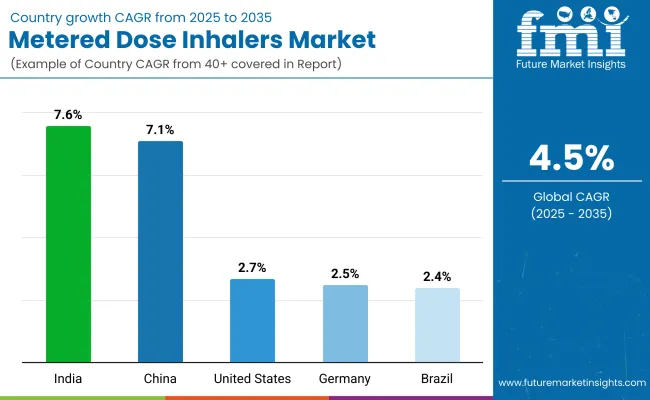

| United States | 2.7% |

Market Outlook

The inhaler industry in Germany has seen steady growth on account of its well-organized healthcare organization system, patient compliance programmer, and government initiatives for greener alternatives for inhalers. Improvement in therapy efficacy through robust coordination between physicians and patients and training on an adequate inhalation technique has enhanced persistence with the therapy.

High ambition Germany’s shift toward low-emission inhalers has also been faster as its green parties push for environmental sustainability, with many domestic and regional producers developing more environmentally friendly propellant technologies. Tactical Therapeutic Education was performed regularly on every product used in Germany and it was undertaken by Pharmacists.

And the country’s strong reimbursement framework also promotes accessibility across insurance types increasing uptake. Germany’s older population also provides a significant foundation of chronic respiratory disease sufferers who need prolonged inhalation support.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.5% |

Market Outlook

Inhalation therapies market in China has even been considered fast-growing segment of overall market in recent years witnessing a growing trend owing to deteriorating urban air quality in China and rising prevalence of respiratory diseases.

Respiratory health was also prioritized by the government on the public health agenda, which significantly improved diagnostic capabilities and access to treatment. Increasing income levels and better awareness about healthcare have prompted a larger segment of consumers to seek modern therapy alternatives such as portable inhalers.

Multiple domestic manufacturers began expanding production capacity, leading to improved affordability and penetration in rural and semi-urban areas for end customers. The accessibility of all these has also been enhanced by public hospital associations with private players. China has changed this expectation; retail and e-commerce channels are the fastest growing source of inhalers in the country, ensuring hundreds of million users have access to inhalers without the need for hospital-centric models.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.1% |

Market Outlook

Due to growing awareness campaigns by the public and increased physician outreach in semi-urban and rural areas, India’s inhaler usage landscape is undergoing massive transformation. Historically, MDIs were used less than they could be due to patient stigma and a poor understanding of respiratory therapies, but this is changing as MDIs gain greater acceptance, particularly as government programs encourage their use of asthma and COPD. Indian pharma companies have also expanded their respiratory portfolio and introduced economically viable inhalers to facilitate massive deployment.

Furthermore, partnerships between public health entities and medical schools have improved the education around inhalation, which is essential in improving treatment outcomes. In India, unlike in many Western countries, pricing sensitivity continues to be a fundamental driver, which drives local innovation centered around affordability and bulk distribution through primary health centers.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.6% |

Market Outlook

The inhalation therapy industry in Brazil grew out of targeted public health measures aimed at no communicable diseases and access to respiratory care. Urban populations in cities including São Paulo and Rio de Janeiro are exposed to high levels of air pollution, worsening asthma and other chronic respiratory diseases. Programs subsidized by the government and national health campaigns have increased both awareness and access to inhalers.

Since then, domestic companies have also bolstered their supply chains and collaborated with hospitals close to home to maintain a better availability of products. Brazil also receives a boost from a relatively high pharmacy-led consultation rate, whereby pharmacists recommend and show how to use inhalers properly. In particular, seasonal climate shifts in southern states create periodic demand spikes, and that reality is bolstering the relevance of MDIs for both preventive and reactive care.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 2.4% |

Preventive Inhalers Gaining Stronghold through Chronic Disease Management

Preventive inhalers are undoubtedly a leader in the respiratory drug delivery world due to their vital role in long-term disease management. Following is typically used in controlling chronic lung diseases like asthma and COPD, where long-term-use can minimize the risk of exacerbations and hospital admissions. They include corticosteroids or long-acting bronchodilators intended to reduce inflammation and maintain an open airway, so they’re critical for daily use.

Their importance has been rising alongside a shift in healthcare providers toward preventive rather than symptomatic care, especially in older patients and those living with multiple chronic conditions. Several countries advise these inhalers as first-line maintenance therapy in clinical guidelines, reinforcing their adoption.

In urban and semi-urban healthcare settings, however, regular monitoring and guided treatment plans, particularly in primary care, have contributed to and re-established their use. Also, in fact patients have been incentivized to maintain consistent preventive inhalation routines, to prevent long-term sequelae.

Reliever Inhalers Preferred for Rapid Symptom Control in Acute Scenarios

Reliever inhalers account for a large market share owing to its importance in controlling sudden and acute symptoms of respiratory system. These inhalers provide rapid relief by relaxing the muscles around the airways, so they’re the first medication for asthma attacks or sudden breathing trouble.

They act quickly, making them critical in emergency situations, especially for patients with mild and intermittent conditions who may not need daily preventive therapy. They are commonly prescribed in outpatient settings and stowed away by patients for take-with-you use.

They are widely available via pharmacies and general practitioners, which accounts for their popularity among patients who manage symptoms without professional medical oversight. Moreover, school and workplace policies commonly suggest or require reliever inhalers for people with known respiratory diseases. As such, along with the pressing need for immediate therapeutic response, these factors create a sustained case for reliever inhalers and their integral position within the personal and clinical respiratory strategy of diverse end-user populations.

Homecare Settings Driving Demand through Convenience and Self-Management

The homecare segment is expected to be the largest revenue-generating segment based on the increasing preference for self-administered respiratory therapies in home settings among patients. The increasing prevalence of chronic respiratory diseases, particularly in the elderly and patients with limited mobility, makes home-based inhalation therapy a viable alternative to repeated hospital visits. Telemedicine and digital health support have encouraged further home monitoring of symptoms, allowing patients to take control of their treatment schedules.

Instructional materials and remote consultation provide sufficient comfort for metered dose inhalers to be utilized without in-person oversight. Additionally, homecare can significantly lower healthcare costs for both patients and providers, making it a financially viable option.

Clinical outcomes have demonstrated positive impacts as treatment adherence is enhanced in an environment that promotes comfort and low-pressure. MDIs are also more accessible for home use with the availability of retail pharmacies, automatic refill programs, and delivery services. All of these trends further reinforce the need for homecare to be the predominant enabler of inhaler utilization.

Hospital Settings Sustaining Relevance through Acute and Intensive Care Needs

Hospitals retain a significant proportion of inhaler usage, since patients with acute respiratory failure or postoperative status are a key population. In acute care settings like emergency departments and ICUs, metered dose inhalers are commonly the first line of treatment for rapid stabilization. Hospitals also care for patients with acute exacerbations of a tenuous or poorly controlled chronic condition who require supervised administration of bronchodilators or combination inhalers.

In addition, hospital-based healthcare professionals perform accurate dosing assessments and educational instruction in inhaler delivery, thus augmenting appropriate use at discharge. You have a lot of hospitals and chain pharmacies that have different formulations in stock that sometimes you cannot find in retail channels.

Moreover, surgeries to the lungs or involving anesthesia may require temporary inhaler assistance during recovery from the procedure. These multidimensional clinical scenarios guarantee that hospitals will always be an important distribution and administration point for metered dose inhalers.

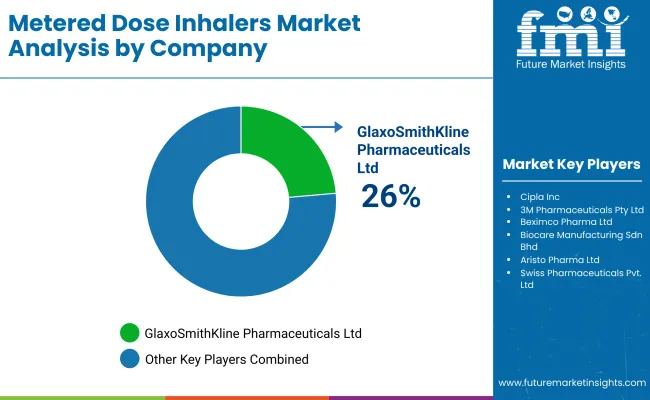

The metered dose inhalers industry is characterized as moderately fragmented with the presence of a mixed number of global pulmonology manufacturing entities as well as regional players in the supply ecosystem. Companies compete on product innovation (types and delivery mechanisms), pricing, inhaler design, and environmental sustainability. This growing demand and development seems to be at the forefront recently due to the incorporation of digital technology and user-centric designs into inhalers.

Differentiation of product formulation has also been encouraged by regulatory pressures for greener propellants. New players are emerging with lower-cost alternatives, while incumbents defend through established penetration and clinical support in a fragmented market. In the big picture, competition is getting tougher thanks to technological and regulatory changes.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| GlaxoSmithKline Pharmaceuticals Ltd. | 26%-27% |

| Cipla Inc. | 21%-22% |

| 3M Pharmaceuticals Pty Ltd. | 11%-12% |

| Beximco Pharma Ltd. | 7%-8% |

| Other Companies (combined) | 32%-33% |

| Company Name | Key Company Offerings and Activities (2025) |

|---|---|

| GlaxoSmithKline Pharmaceuticals Ltd. | The company has a large respiratory portfolio with combination therapies and has recently doubled down on green inhalers, with clinical development of low-emission propellant devices. |

| Cipla Inc. | Cipla is an affordable manufacturer of inhalation therapies and also has been aggressive in introducing digital adherence programs in North America to enhance patient outcomes, including smart inhaler platforms and mobile-based adherence monitoring. |

| 3M Pharmaceuticals Pty Ltd. | With components for inhalation delivery, 3M has developed proprietary actuator and valve systems that can help support dose consistency and compatibility with evolving propellant technologies. |

| Beximco Pharma Ltd. | Beximco already has established itself as the leading player for scale MDIs in South Asia by rapidly scaling local production of MDIs and working closely with healthcare systems to provide them with essential inhalers for public respiratory health programs. |

Key Company Insights

GlaxoSmithKline Pharmaceuticals Ltd. (26-27%)

The team is committed to continuing to grow its specialty medicines portfolio and providing innovative respiratory therapies backed by ongoing research and development. While, it is strengthening its growth in developing nations via alliances and local production to target healthcare demand in various regions.

Cipla Inc. (21-22%)

Within North America, Cipla is focused on cementing its proposed position in the generics market with launch of complex respiratory products. The company is also using its expertise in patient adherence and outcomes through digital health platforms, which aligns with its patient commitment as the best company.

3M Pharmaceuticals Pty Ltd. (11-12%)

3M is using extensive material science expertise to create new inhalation drug delivery systems that enable enhanced drug deposition and patient compliance. They are also designing inhalers to be more environmentally friendly and sustainable.

Beximco Pharma Ltd. (9-10%)

Regulatory approvals in new markets and expanded export capabilities are helping Beximco to expand its global footprint. It is also investing in high-tech manufacturing facilities, increasing its production efficiency and international quality standards.

Other Key Players (32-33% Combined)

A number of other companies are major contributors to the metered dose inhalers market through innovative technologies and increased distribution networks. They include:

With the growing demand, firms are focusing on expansion, accelerating research and development activities, regulatory clearances, and strategic partnerships to reinforce their market positions and enhance surgical outcomes.

Preventive Inhale, Reliever Inhaler and Long-Acting Bronchodilators Inhaler

Homecare, Hospitals and Clinics

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

The overall market size for metered dose inhalers market was USD 27,405.7 million in 2025.

The metered dose inhalers market is expected to reach USD 42,560.3 million in 2035.

The increasing incidence of chronic respiratory conditions, Innovations in inhaler technology and growing awareness about respiratory health and the importance of early diagnosis.

The top key players that drives the development of metered dose inhalers market are GlaxoSmithKline Pharmaceuticals Ltd., Cipla Inc., 3M Pharmaceuticals Pty Ltd., Beximco Pharma Ltd. and Midascare Pharmaceuticals Pvt. Ltd.

Preventive Inhale, is by type leading segment in metered dose inhalers market is expected to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End-User, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-User, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End-User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-User, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-User, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-User, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-User, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-User, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-User, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-User, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-User, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-User, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-User, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-User, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-User, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-User, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End-User, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-User, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-User, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-User, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metered Dose Squeeze Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Dose Monitoring Devices Market - Growth & Demand 2025 to 2035

Unit Dose Tubes Market Size and Share Forecast Outlook 2025 to 2035

Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Oral Dose Packaging Market Trends & Growth Forecast 2025 to 2035

Unit Dose Manufacturing Market Trends – Growth & Industry Outlook 2024-2034

Unit-Dose Respiratory Medications Market

Multi Dose Drug Vial Adapters Market Size and Share Forecast Outlook 2025 to 2035

Single Dose Detergent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Dose Radiotherapy Services Market – Growth & Forecast 2025 to 2035

Leading Providers & Market Share in Single Dose Pouches Industry

Single Dose Radiotherapy Market

Single Dose Sachet Market

Contract Dose Manufacturing Market

Radiation Dose Optimisation Software Market Size and Share Forecast Outlook 2025 to 2035

Snap Single Dose Dispensers Market Size and Share Forecast Outlook 2025 to 2035

Pharmaceutical Unit Dose Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Pharmaceutical Unit Dose Packaging Providers

Child Resistant Single Dose Pouches Market Size and Share Forecast Outlook 2025 to 2035

Smart Inhalers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA