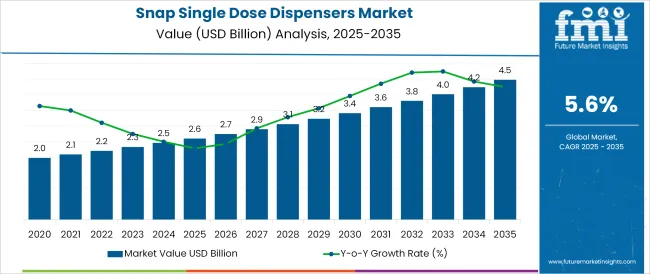

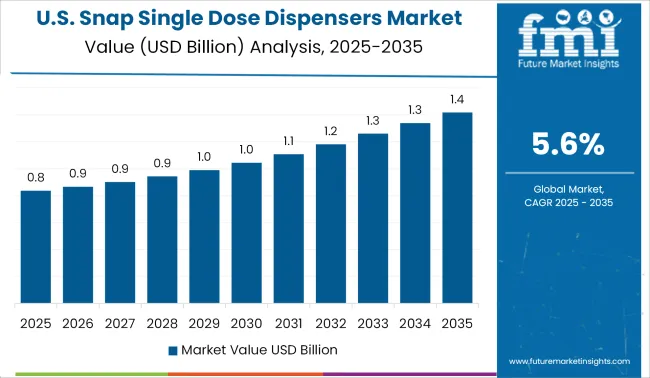

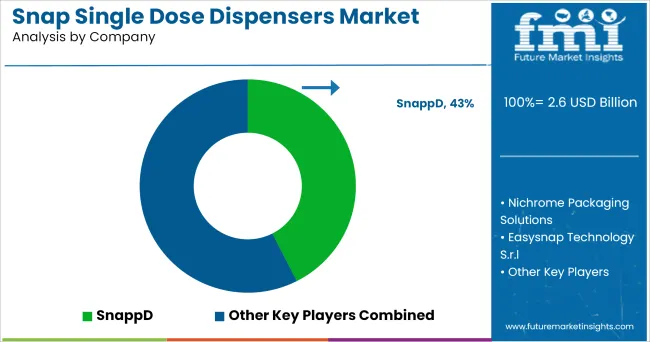

The Snap Single Dose Dispensers Market is estimated to be valued at USD 2.6 billion in 2025 and is projected to reach USD 4.5 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

The snap single‑dose dispensers market has been propelled by growing emphasis on precision, hygiene, and portability in dosing systems. Rising demand for controlled dispensing across diverse sectors such as personal care, pharmaceuticals, and food & beverages has intensified preference for single-use formats that reduce contamination risk.

Materials engineering advancements-particularly in barrier coatings and tamper-evident seals-have bolstered dispenser reliability and user confidence. Sustainability considerations are fostering innovations in lightweight, recyclable plastic substrates, aligning with global packaging mandates. Furthermore, improvements in dispensing mechanisms, such as leak-proof snaps and easy-open designs, are enhancing end-user convenience.

As consumer expectations evolve and regulations around product safety tighten, the outlook remains optimistic: manufacturers and brands capable of introducing customizable, high-integrity single‑dose solutions will likely capture growing share across multiple application segments.

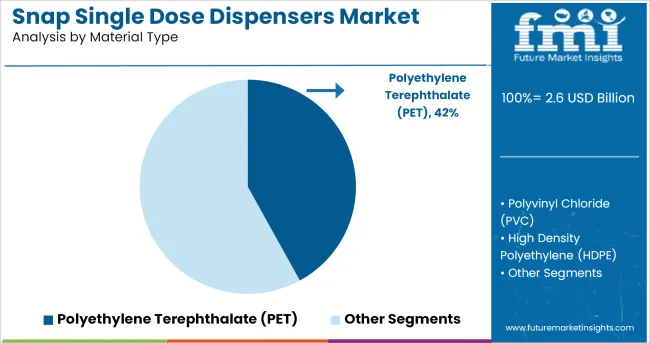

It is observed that the polyethylene terephthalate (PET) material type accounts for 42% of market revenue, establishing it as the leading material. This position is supported by PET’s strong barrier properties, lightweight profile, and recyclability, which align with both regulatory requirements and brand sustainability goals.

PET’s compatibility with thermoforming and injection moulding has enabled cost-efficient mass production of disposable dose units with consistent quality. Enhanced clarity offered by PET materials has further contributed to improved product visibility and consumer trust. Additionally, existing infrastructure for PET recycling has minimized environmental concerns and supported circular‑economy frameworks within packaging operations.

Collectively, these factors have reinforced PET’s dominance in snap single‑dose dispensers, making it the benchmark choice for material robustness, consumer appeal, and regulatory alignment.

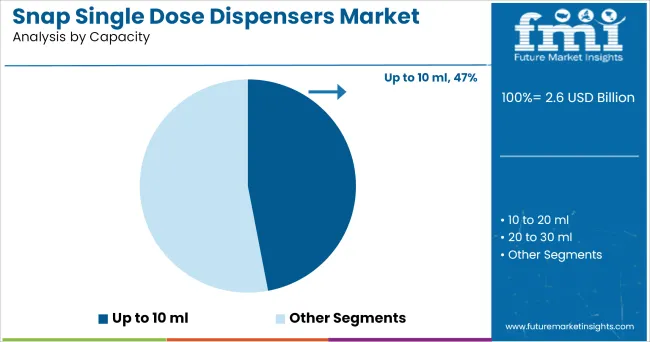

It has been noted that the up to 10 ml capacity segment holds 47.0% of the market, making it the most prominent sizing category. This segment is favoured due to its suitability for single-use applications in controlled dispensing scenarios, including medication, personal care treatments, and small-scale food samples.

The volume range supports precision and dosage accuracy, while preserving portability for on-the-go consumption. Manufacturing efficiencies have been realised through standardized tooling and reduced material usage, contributing to cost-effectiveness.

In addition, the format aligns with regulatory and hygiene demands, as smaller dosage units minimise contamination risks and support waste reduction efforts. As a consequence, the up to 10 ml capacity has emerged as the market standard, balancing consumer convenience, regulatory adherence, and production efficiency.

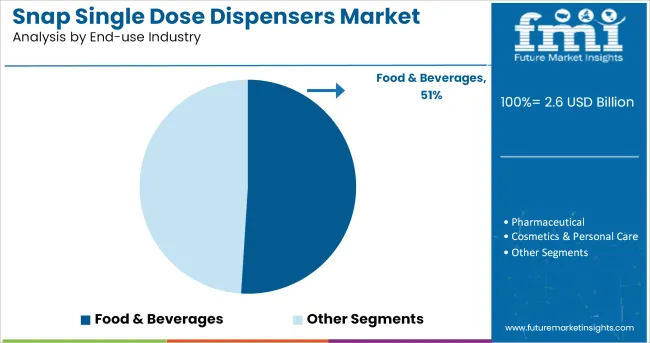

It is observed that the food & beverages vertical accounts for 51.0% of market revenue, positioning it as the leading end‑use industry. This share is supported by the sector’s need for hygienic, single-use dispensing of concentrates, flavorings, dietary supplements, and condiments.

The format has been favoured due to its precise dosing, extended shelf life, and strong tamper‑evident features, which match both regulatory requirements and consumer safety expectations. Moreover, demand for on-the-go and personalized consumption experiences-such as flavor dosing at table or individual supplement servings-has driven adoption.

The facility of integrating branding and nutritional information via compact PET dispensers has further enhanced product appeal at point of sale. Consequently, the food & beverages industry has emerged as the primary growth driver, leveraging these dispensers for product differentiation, safety assurance, and consumer engagement.

Lightweight and innovative packaging have has been a strong trend in the cosmetics and pharmaceutical packaging. Snap single dose dispensers provides easy one hand opening, convenience, and complete dispensing of the contents. Hence, these are preferred solution of packaging for majority of the cosmetic manufacturers.

Snap single dose dispensers contains correct quantity of doses so safe and easy to use for the consumers. These are considered as environment sustainable solutions by reducing excess product waste. Moreover, these are easy to deliver and distribute for the cosmetic manufacturers. These factors projected to drive the growth in demand over the coming years.

Over recent years, beauty and personal care industry is witnessing remunerative growth in developed and developing countries across the globe. To cater the increasing consumer demand many small scale cosmetic manufacturers are emerging. This, in turn, is resulting in increasing consumption of snap single dose dispensers.

Moreover, snap single dose dispensers do not allow air inside and ensures to maintain properties and integrity of the product. These can replace the conventional packaging solutions such as small bottles & tubes, small cups, portion pack containers with improved durability and safety with minimal wastage.

Subsequently, cosmetic manufacturers across the globe are inclining towards implementation of snap single dose dispensers.

Snap single dose dispensers are suitable to be used in food industry for syrups, ketchup, honey, melted cheese, etc. In addition have applications in cosmetics industry for shampoo, liquid soaps, hair conditioners, hair dyes, liquid detergents, cosmetic creams and lotions, moisturizers, etc. The rapid growth in cosmetic and food industry investments are compelling the increased consumption over the coming years.

These are also used in the packaging of pharmaceutical products such as ointments, medicated gels, liquid medications, etc. Manufacturers are investing in research & development for new materials in order to provide improved resistance to the reactions for these products. They are also focusing on recyclable dispensers in order to curtail environmental impact.

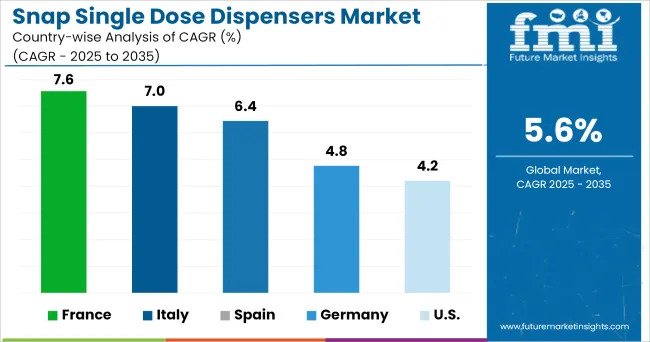

USA is projected to hold leading share in the global market, owing to increasing investments in pharmaceuticals and cosmetic packaging coupled with technological advancements. The prevalence of large number of manufacturers in the USA is paving the way for market growth in the region.

Presence of world-class healthcare infrastructure coupled with dominance some of the biggest and oldest pharmaceutical companies in the world in the countries such as Germany, UK, Italy, etc. is expected to augment the market growth in the Europe over the forecast period.

The regional market is thus expected to grow with substantial growth rate owing to the rising prominence of beauty and cosmetic products on the back of increasing retail sales as well as increasing number of new entrants in the cosmetic manufacturing.

Some of the leading manufacturers and suppliers include

Leading manufacturers are focused on expansion of their manufacturing facilities along with sales and distribution network in emerging markets across the globe. Also, continuing efforts are being made to further establish long term contracts with the end users. Manufacturers are also focusing developing recyclable products in order to minimize ecological impact.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global snap single dose dispensers market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the snap single dose dispensers market is projected to reach USD 4.5 billion by 2035.

The snap single dose dispensers market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in snap single dose dispensers market are polyethylene terephthalate (pet), polyvinyl chloride (pvc), high density polyethylene (hdpe) and others.

In terms of capacity, up to 10 ml segment to command 47.0% share in the snap single dose dispensers market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Dose Detergent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Dose Radiotherapy Services Market – Growth & Forecast 2025 to 2035

Leading Providers & Market Share in Single Dose Pouches Industry

Single Dose Radiotherapy Market

Single Dose Sachet Market

Child Resistant Single Dose Pouches Market Size and Share Forecast Outlook 2025 to 2035

Single Air Chamber Hydro-pneumatic Suspension Market Forecast and Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Machine Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Spot Welder Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Recloser Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Conventional Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA